The Leading Source of Insights On Business Model Strategy & Tech Business Models

S-Curve In Business And Why It Matters

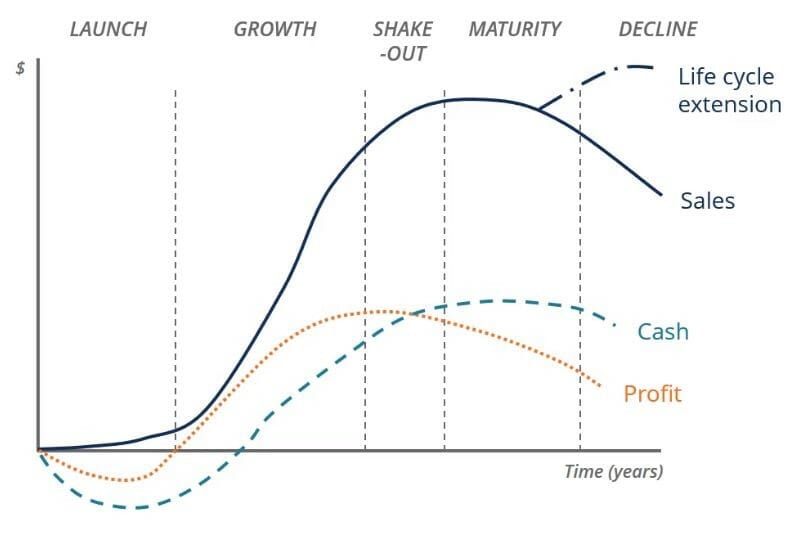

The S-Curve of Business illustrates how old ways of doing business mature and then become superseded by newer ways. The S-Curve itself is based on a mathematical concept called the Sigmoidal curve. In the context of business, the curve graphically depicts how an organization grows over a typical life cycle.

| An , also known as a sigmoid curve, is a graphical representation of the adoption or growth of a new technology, product, or innovation over time. It is called an S-Curve due to its characteristic shape, resembling the letter “S,” which typically starts slowly, accelerates, and then levels off as it reaches maturity. The S-Curve is widely used in various fields, including technology adoption, project management, and product life cycles. | |

| : The S-Curve typically consists of three phases: 1. : The initial stage where adoption or growth is slow as the innovation gains traction and awareness. 2. : The period of rapid adoption or growth as the innovation gains momentum and attracts a larger user or customer base. 3. : The stage where adoption or growth levels off as the market becomes saturated, and the innovation becomes a standard or mature offering. – : S-Curves are commonly used to analyze and predict the adoption of new technologies, the growth of industries, and the progress of projects. | |

| – : The adoption of smartphones is a classic example of an S-Curve. Initially, only early adopters used smartphones, but as technology improved and prices decreased, adoption accelerated, and smartphones became ubiquitous. – : In product management, S-Curves are used to track the sales and growth of a product from its launch to market saturation. – : S-Curves are used to monitor the progress of projects, showing how resources are allocated over time. | |

| – : S-Curves provide a valuable tool for predicting the future adoption or growth of technologies, products, or innovations based on historical data and patterns. – : In project management, S-Curves help allocate resources effectively over the course of a project, ensuring that resources are not underutilized or overutilized. – : Businesses can use S-Curves to make informed decisions about when to invest in new technologies or enter emerging markets. | |

| – : S-Curves assume a continuous and predictable adoption or growth pattern, which may not always hold true in rapidly changing markets. – : External factors, such as economic conditions, competition, and regulatory changes, can influence the shape and trajectory of S-Curves. – : S-Curves may not account for market saturation, where growth eventually slows down as the market reaches its maximum potential. | |

| The adoption of electric vehicles (EVs) provides a contemporary example of an S-Curve. Initially, EVs had a slow adoption rate due to limited charging infrastructure and high costs. However, as battery technology improved, prices decreased, and charging networks expanded, the growth of EV adoption accelerated, following an S-Curve pattern. |

Table of Contents

Understanding the S-Curve of Business

A key argument of the curve is that sooner or later, most businesses will reach a period of stagnation – no matter how successful they were in the past.

At the point of stagnation, the business reaches an inflection point.

At this point, it will be forced to innovate to grow and remain competitive.

For executives, understanding where their business lies along the S-Curve is crucial.

If the business has already reached an inflection point – also referred to as a “stall point” – it has less than a 10% chance of fully recovering.

In the next section, we’ll discuss these terms at various points of the life cycle in more detail.

The stages of the S-Curve life cycle

Initially, start-up companies begin at the bottom of the curve with a product or service they are taking to market.

If they are lucky, their offering gains traction – albeit very slowly at first and then gradually quickening as more consumers become aware.

This is the first inflection point, where sales and revenue increase rapidly after an initial period of stagnation or low growth .

While growth will continue for some time, a host of internal or external factors will eventually cause growth to decrease and then taper off.

These factors include:

- Market saturation.

- The rising influence of a competitor.

- Emerging technology that is more profitable.

- A change in leadership resulting in poor management.

Here, the business encounters the second inflection point. At this point, a critical decision must be made.

For the growth curve to start anew and begin trending upward, the business must innovate and ride the wave of technological advancement.

Ultimately, a business at the second inflection point that then tries to innovate is already too late.

Inflection points must be identified before they occur so that businesses have adequate time to develop new products that have a high chance for success.

How do businesses commonly reach stall points?

External factors

Most businesses will find it hard to maintain growth during recessions since consumers are spending less.

When state or federal laws are enacted to regulate or ban certain products or services, businesses must have the ability to pivot quickly.

This is particularly prevalent in technology where trends shift quickly.

Examples of companies unknowingly reaching inflection points because of technology include Nokia, Blackberry, Xerox, and Kodak.

Internal factors

Dilution of focus.

Many start-ups have visionary leaders whose sole intent is to serve their customers well.

But when companies become larger, focus and effort can become diluted – particularly as management becomes more convoluted.

Talent shortage

For whatever reason, some companies are hindered in their growth because they cannot source the required talent to make it happen.

Examples of S-Curve

Population growth of a country.

As a country’s population grows, the growth rate typically builds momentum slowly.

Yet it accelerates during the middle of the S-curve while leveling off as the population reaches its maximum capacity.

The adoption of a new technology

When a new technology is introduced, it might take time before this technology becomes adopted by the masses.

In the initial stage of the technology adoption curve , its path it’s very steep. Yet when it does take off, it does that very quickly.

Thus, here the slowly then suddenly saying works exceptionally well.

As the adoption rate increases rapidly, thus enabling technology to reach the masses, it eventually reaches a plateau as the technology won’t have any more market penetration.

An example is how smartphones took off and how today, they have become a saturated market, as there are billions of smartphones across the world.

The evolution of a market

Take the example of the iPhone; when it was launched, it didn’t pick up right on.

Indeed, Apple first launched the iPhone in 2007, and only when by 2008, when Apple launched the App Store in combination with the iPhone, the store worked as a jet engine for the iPhone to take off very quickly.

Yet, Apple’s iPhone success was built on the premise that the smartphone market had already been developed by other players like BlackBerry.

Thus, Apple wasn’t a first mover, but when it did enter the market, it took off very quickly.

Key takeaways

- The S-Curve of Business allows a company to determine where it is on a typical growth life cycle, and adjust its strategies accordingly.

- The S-Curve of Business life cycle consists of two inflection points. The second is the most critical, as it signifies that a business has reached a growth ceiling.

- Inflection points are caused by a variety of factors relating to the economy, consumer trends, and talent shortages. Whatever the cause, managers must identify them ahead of time and develop strategies to maintain growth .

Key Highlights:

- S-Curve of Business Overview: The S-Curve of Business illustrates the typical life cycle of a business, showing how old methods become obsolete and new ones emerge. It’s based on the sigmoidal curve and emphasizes the need for innovation to maintain growth .

- Businesses reach a point of stagnation and inflection, forcing them to innovate to remain competitive.

- Knowing where a business is along the S-Curve is crucial, as recovery after an inflection point becomes unlikely.

- The life cycle consists of initial slow growth , rapid growth after the first inflection point, stagnation, and the need for innovation .

- External Factors: Economic downturns, regulatory changes, and shifting trends.

- Internal Factors: Focus dilution, talent shortages, and mismanagement.

- Population Growth: Population growth in a country starts slowly, accelerates, and levels off.

- Technology Adoption: New technology takes time to gain momentum, accelerates, and saturates the market.

- Market Evolution: The example of smartphones, where the iPhone took off rapidly due to market development by other players.

- The S-Curve helps businesses understand their position in the growth life cycle.

- Inflection points are crucial, and innovation is required to overcome stagnation.

- Factors causing inflection points can be internal or external, and managers must anticipate them to ensure sustained growth .

Case Studies

| Technology/Industry | Description | Application of S-Curve | Examples and Impact |

|---|---|---|---|

| Mobile Phones | The evolution of mobile phone technology. | Early adoption and gradual growth, followed by rapid adoption as technology matures and becomes widely accessible. | The transition from basic cell phones to smartphones (e.g., iPhone) followed an S-curve, with exponential growth in adoption once smartphones became mainstream. |

| Electric Vehicles (EVs) | The development and adoption of electric vehicles. | Slow initial adoption, followed by a period of accelerated growth as EV technology improves, charging infrastructure expands, and consumer demand increases. | Companies like Tesla played a significant role in driving the adoption of electric vehicles, resulting in exponential growth in the EV market. |

| Internet Usage | The growth of internet usage and connectivity. | Initial slow growth as internet infrastructure is established, followed by rapid adoption as more people and businesses come online. | The expansion of the internet in the late 1990s and early 2000s led to an S-curve of adoption, transforming how people communicate, work, and access information. |

| Renewable Energy | The deployment of renewable energy sources. | Gradual adoption of solar, wind, and other renewable technologies, followed by an exponential increase in capacity as costs decrease and environmental awareness grows. | As the cost of solar panels and wind turbines has decreased, there has been a significant uptick in the adoption of renewable energy sources worldwide. |

| Artificial Intelligence (AI) | The development and use of AI technologies. | Initial stages of research and experimentation, followed by rapid growth in AI applications as algorithms improve, data availability increases, and industries embrace AI. | Industries like healthcare, finance, and autonomous vehicles are experiencing an S-curve in AI adoption, with the technology becoming integral to their operations. |

| 3D Printing | The evolution and utilization of 3D printing. | Early stages of experimentation and prototyping, followed by wider adoption in manufacturing, healthcare, and aerospace as the technology matures. | 3D printing is following an S-curve, with expanding applications in various industries, including custom manufacturing, prosthetics, and aerospace components. |

| Biotechnology | The advancement and application of biotechnology. | Incremental progress in understanding biology and genetics, leading to exponential growth in medical treatments, genetic engineering, and pharmaceuticals. | Advances in biotechnology have led to breakthroughs in gene therapy, precision medicine, and CRISPR-Cas9 gene editing, following an S-curve of innovation. |

| Blockchain Technology | The development and adoption of blockchain technology. | Early exploration and experimentation, followed by rapid growth in blockchain applications in finance, supply chain, and beyond. | Blockchain is at the initial stages of an S-curve, with ongoing developments in decentralized finance (DeFi), non-fungible tokens (NFTs), and supply chain traceability. |

Read Next: Business Model Innovation , Business Models .

Related Innovation Frameworks

Business Engineering

Business Model Innovation

Innovation Theory

Types of Innovation

Continuous Innovation

Disruptive Innovation

Business Competition

Technological Modeling

Diffusion of Innovation

Frugal Innovation

Constructive Disruption

Growth Matrix

Innovation Funnel

Idea Generation

Design Thinking

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

- INNOVATION LABS

Buckley Barlow

The S Curve of Business: The Key Levers to Sustaining Momentum for Your Brand

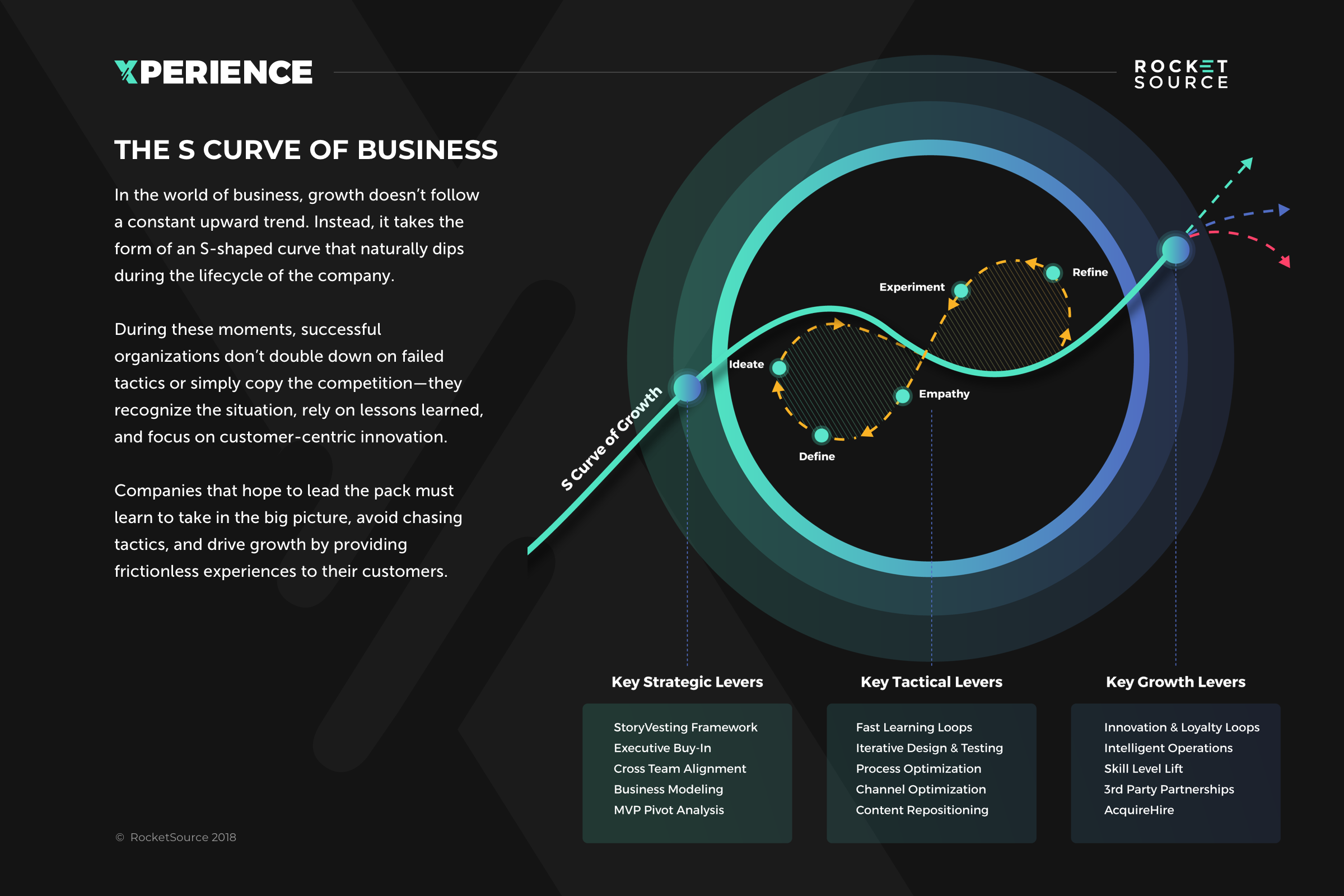

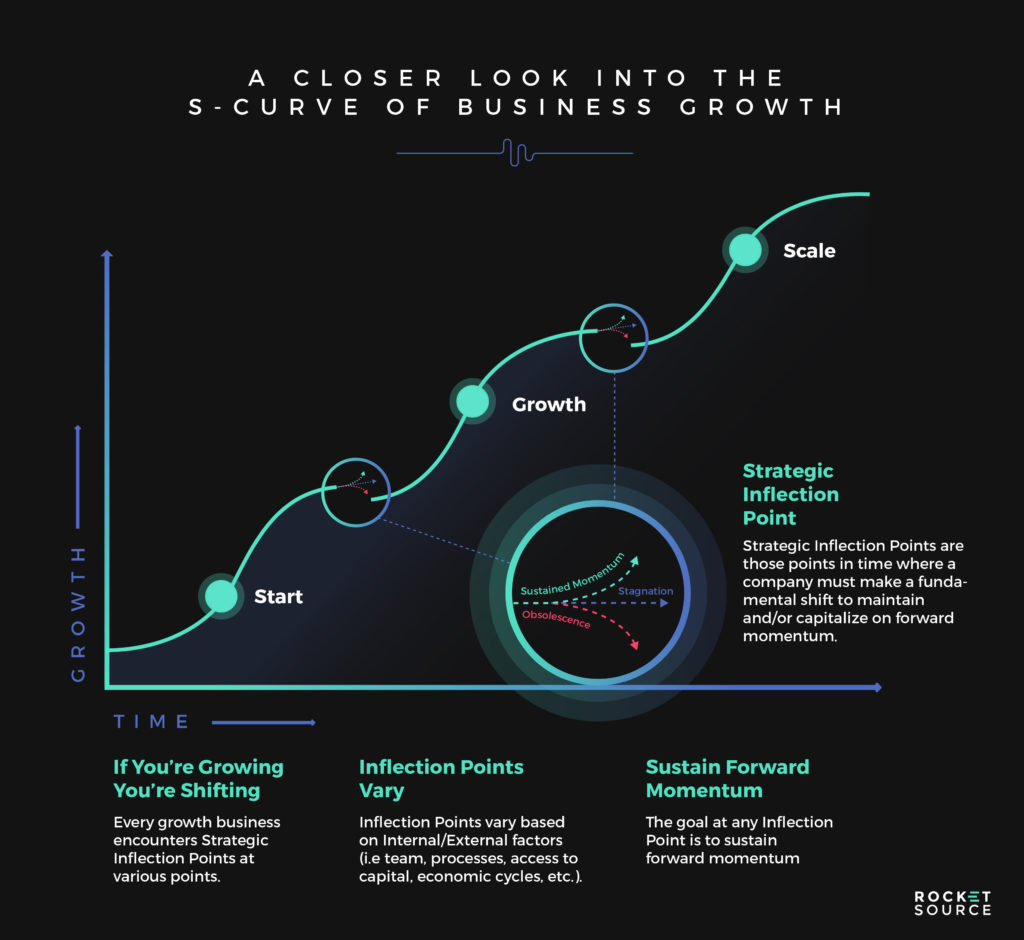

The best strategists, the best innovators, and the best growth leaders have this one-two-three combo punch in common: Impeccable timing , flawless execution and sustainable momentum . It’s the perfect alignment of knowing what, when and how to strike. And nowhere is this more important and evident than in the thick of navigating the S Curve of Business.

Every company—regardless of business type or business model (i.e. product, SaaS, service, media, etc.)—will go through a highly predictable cycle of growth and maturity called the S Curve of Business. Oftentimes, you’ll hear or see it called the S Curve of Innovation or the S Curve of Growth and in the interest of your time and reading pleasure, I will interchange these terms quite liberally in this post.

Let’s Dive Into the S Curve of Business

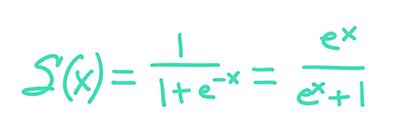

The Wikipedia definition of the S Curve of Business —where the S stands for sigmoid—is a bit convoluted. If you strip its definition down to its most basic level, the S Curve of most things is a mathematical model (also known as the logistic curve) which describes the growth of one variable in terms of another variable over time. For those so inclined, here’s the sigmoid function formula:

Simple in definition, easy to see in a rear-view mirror but successfully navigating this S curve is extremely difficult to master for any leading innovator or growth architect and that’s simply due to the fact that somewhere along your business lifecycle, there will always be someone (or many) smarter, more creative, more tapped into the current market, more unethical and so on… than you and your team.

In my opinion, one of the fundamental truths of business is that success isn’t a zero-sum game. The pie is always big enough for newcomers to come in and get their own slice based on specialization, price point, or other differentiating factors.

That said, it’s also true that there are only so many top spots for things like global market share , fastest-growing companies , and best companies to work for .

When you’re charged with leading a company to new heights, watching direct competitors overtake you in key areas can be daunting. Frustrating, even. After all, you’ve got a pretty good system in place—you have a hard-working team, you know your market, you have a product that sells well, and you get stellar feedback from your customer base.

So how can you be falling behind? What do they have that you don’t?

That frustration you may be feeling is understandable, and not nearly as unusual as you might think. Plenty of companies either never break through or lose their edge over time. Remember Pan American World Airways? Kodak? Xerox? Blackberry? Yahoo? All of these companies were very successful at some point, but now in hindsight, serve as cautionary tales. What were they missing? Why are they shadows of their former selves, or why did they disappear entirely?

The simple answer is they stopped growing. But at least for a time, growth wasn’t a problem for these brands. The problem they had was maintaining a high level of momentum . That’s the all-too-obvious, but elusive, key to successful and continuous growth.

Growth: A Practical Assessment

When people start talking about growth, it’s often in very clinical terms—data, charts, percentages. Of course, these are useful for providing a synopsis, but they’re only the footnotes of the story when it comes to success.

Maintaining your momentum starts with a mindset, not a mathematical formula.

The word “growth” itself sometimes feels overused to the point of abstraction. It’s obviously a good thing, but defining it in concrete terms generally boils down to year-over-year revenue.

And plenty of companies—like the ones mentioned above—have enjoyed huge market shares and massive profits. They had real growth —that is, right up until they didn’t.

As we’ve seen time and again, impressive growth in the short term may be achievable, but sustaining that momentum without facing moments where growth stalls simply doesn’t happen. The market fluctuates. Competitors make adjustments to stay relevant and target your customers. Your groundbreaking product just isn’t as impressive and unique as it used to be. The acquisition strategy failed to materialize. You get it. There are a lot of moving pieces but the foundation to growth is knowing how to navigate the S Curve of Business and knowing when you need to jump to that next S curve.

The truth is, every company eventually runs into problems that affect growth. What separates leading companies from laggards is how they handle those moments.

A company that can sustain its momentum will not only continue to grow, but also be more resistant to business failure.

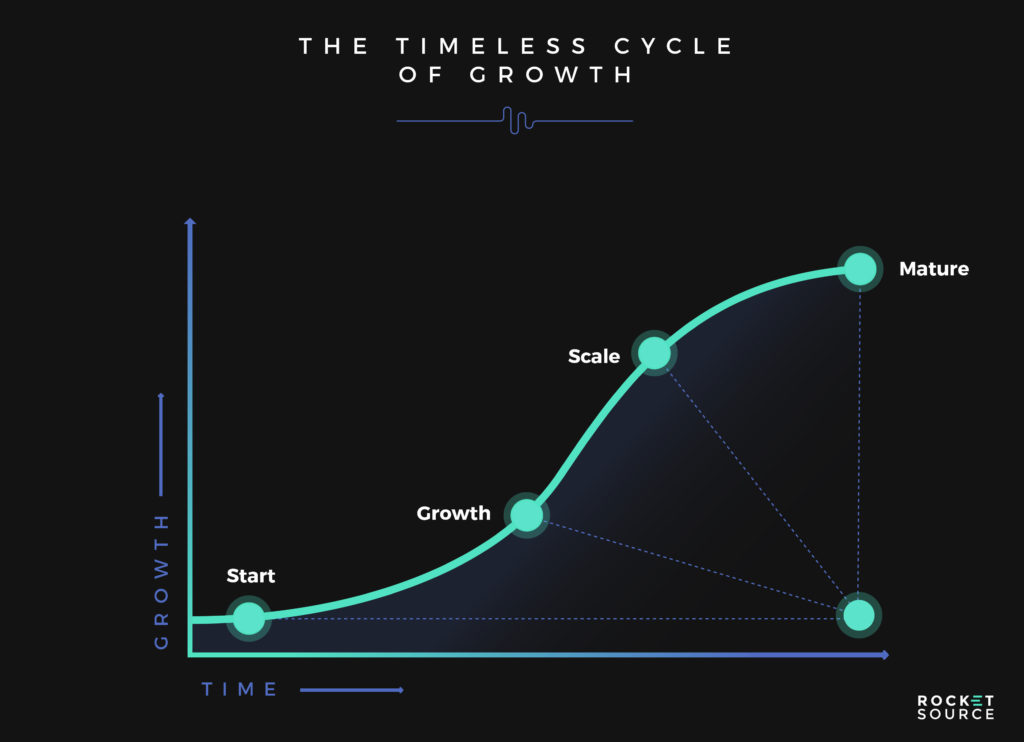

What Growth Really Looks Like

In order to adopt the right mindset for sustaining momentum, you should get a feel for the big picture of growth.

Once you get past the initial upswing, the life cycle of a successful company takes on the form of a sigmoid, or S curve. The S shape represents growth over time—starting out slowly, picking up speed during rapid growth, then tapering off as growth slows.

If you don’t know what to look for when analyzing your growth, this tapering can be very alarming. Revenue is suddenly and unexpectedly leveling out into a plateau, and the knee-jerk response often leads to panic and bad decision making.

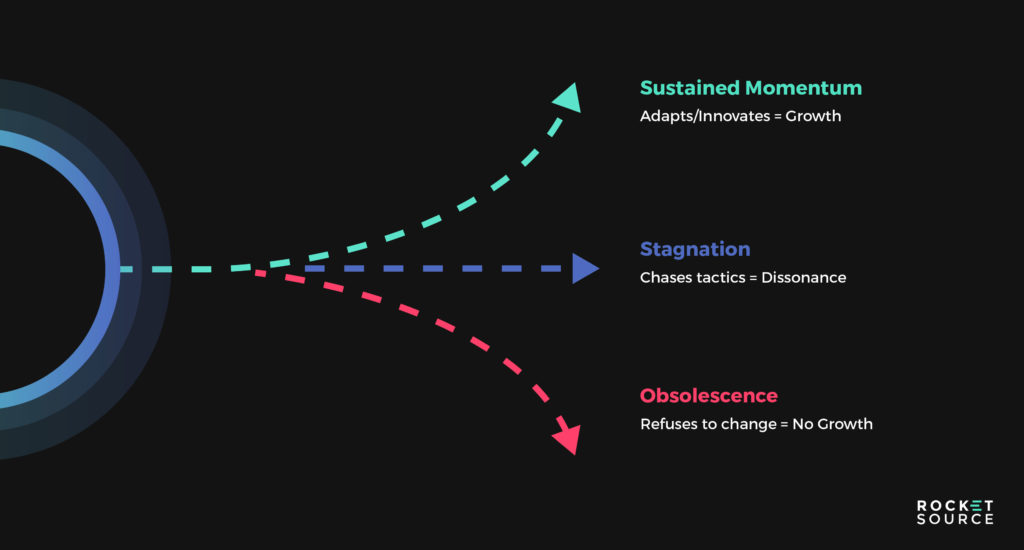

When you can identify how this S curve works in your business, then you know you don’t have to panic when growth (ultimately momentum) begins to taper off. Instead, you can recognize that tapering for what it truly is: a strategic inflection point .

Strategic Inflection Points on the S Curve of Business

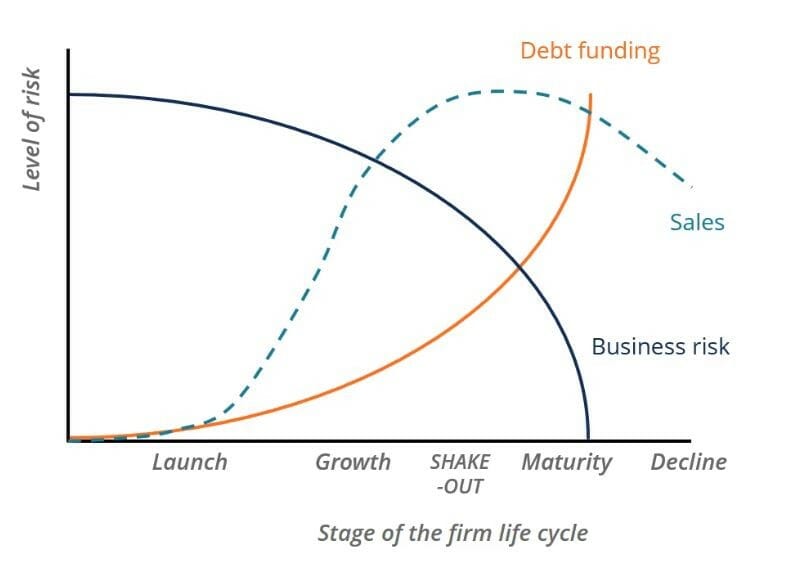

Strategic inflection points —also known to many an MBA student as stall points , downturns, turning points, etc.—are an inevitability for companies that experience growth. These are moments where changes must be made in order to maintain growth.

When things are going well, it’s easy to get comfortable and complacent. If it isn’t broke don’t fix it and all that. On a personal and professional level, most of us have the tendency to put off what’s needed until circumstances demand it.

View inflection points as your circumstances making demands, and what they demand is a fundamental shift in your company.

So what causes an inflection point, exactly? It could be a competitor releasing a superior product at a lower price point. There’s a drop in interest of your core product. Your advertising isn’t hitting the right audience. Maybe there’s a recession.

Regardless of the source, inflection points are a natural consequence of growth and the free market. Sooner or later, every organization will encounter internal and external factors that affect revenue creation and momentum.

Recognizing Inflection Points

Failure to recognize and act on a strategic inflection point can be detrimental to the life cycle of a company . Floundering in the face of an inflection point not only squanders the opportunity to promote strategic development, but it also fails to resolve a significant need. In order to be prepared for the strategic inflection points, make sure you know how to recognize them.

The appearance of an inflection point doesn’t necessarily speak to a massive crisis, but to an important decision for your business. In other words, what happens at that strategic inflection point depends entirely on how the company responds .

Contributing Factors to Inflection Points

The variables that can affect growth are too numerous to count, but there are some commonalities where an initial surge of success can lead to stalling. These can be divided into external and internal categories. The following lists are by no means exhaustive but can give a good idea of what leads to a strategic inflection point.

External Factors

- Economy. On a local, regional, national, or global level, even healthy businesses are hard-pressed to thrive during a recession and consumers are spending less.

- Finance. Financial institutions are part of every transaction, and control everything from interest rates and credit to consumer loans. The stability of every business, to some degree, relies on the solvency of these organizations.

- Infrastructure. Construction, housing development, and zoning laws can impact businesses that rely on physical locations to improve operations or attract customers and talent.

- Politics. Changes in local, state, or federal laws and regulations can have a huge effect on a business when a core product or service becomes regulated or illegal.

- Trends. Even companies that spend considerable time and money on positioning can suddenly find themselves on the wrong side of public opinion or a movement.

Internal Factors

- Lack of ownership and vested mentality. Founders and founding members of a company usually have a strong sense of ownership and responsibility when it comes to taking risks and achieving results. But when companies grow and begin to add more and more layers of management, the focus on customers and the core business becomes more blurred.

- Talent shortage. Successful companies which experience short-term growth often encounter issues with scaling teams quickly enough to keep up with growth. Revenue growth is realistic only when enough talent and skill exist to support and augment the organization.

- Founder’s ceiling. The passion and drive of a successful founder are invaluable to a new company, but may not be sufficient to carry it through every stage of development. Founders often attempt to apply methods that have worked in the past on a much larger scale and can introduce unnecessary organizational bottlenecks by staying involved in most, or all, company decisions.

- Voice of the customer goes unheard. Small organizations with few customers react quickly to their demands. As growth sets in and the gap between leadership and frontline employees widens (often by hiring managers with no experience in customer service), innovations that address the needs of the customer are not prioritized.

- Innovation timing . Complex problems must be planned, shaped and molded around the ideal market segment. Unfortunately, most larger organizations are focused on driving incremental growth via perfecting processes and departmental lift, and major disruptors are simply holding on for dear life as growth seems exponential. Now don’t get me wrong, every business stage has its own set of unique challenges at $1mm, $10mm, $100mm…but without a customer-centric, data-driven innovation looping strategy in place, companies may start to stagnate or face obsolescence.

Keeping the S Curve of Business Going

When facing a strategic inflection point, there are a few ways an organization will respond. This response determines whether growth returns, the business stagnates, or losses occur.

Sustained momentum is only possible when the business is structured for adapting and innovating. As I had mentioned above, being content to keep up with the competition leads to stagnation . And refusing to respond is a recipe for obsolescence and failure.

Building and Sustaining Momentum With a Growth Framework

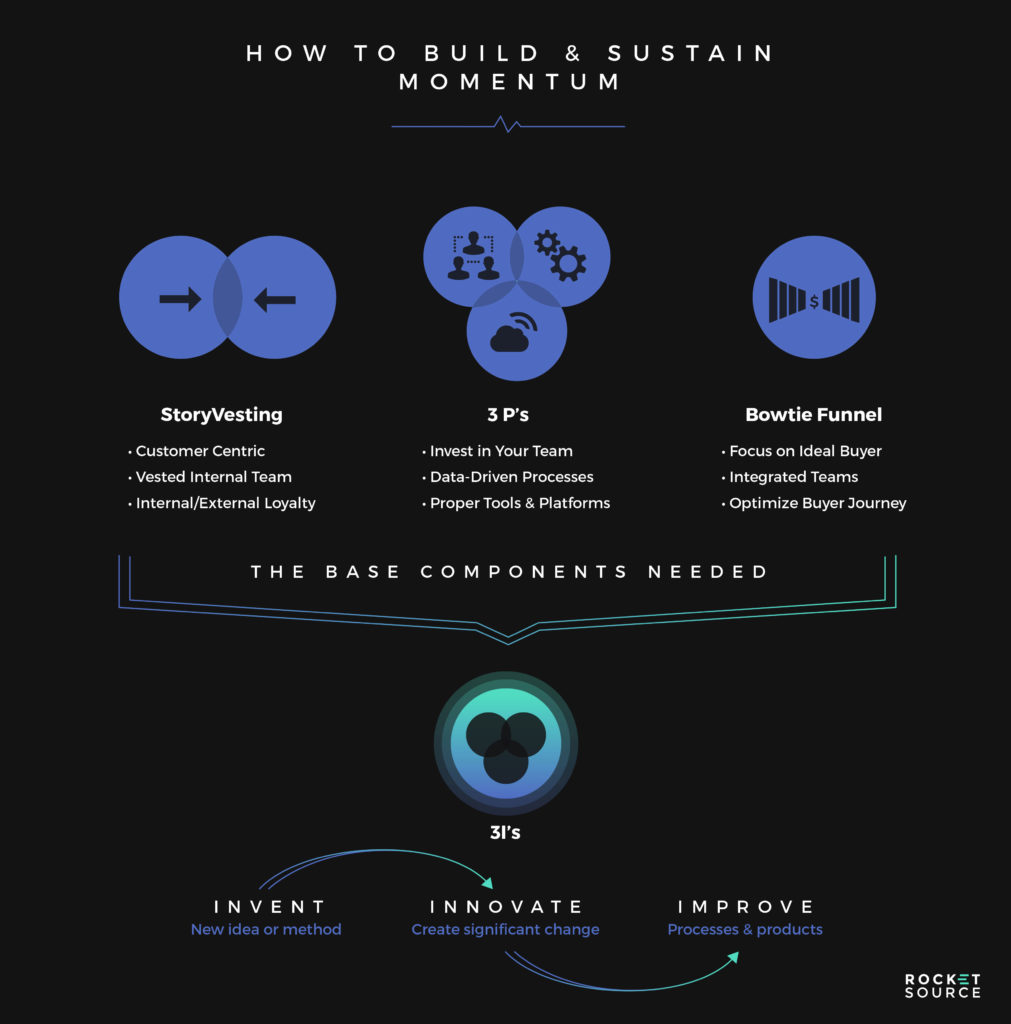

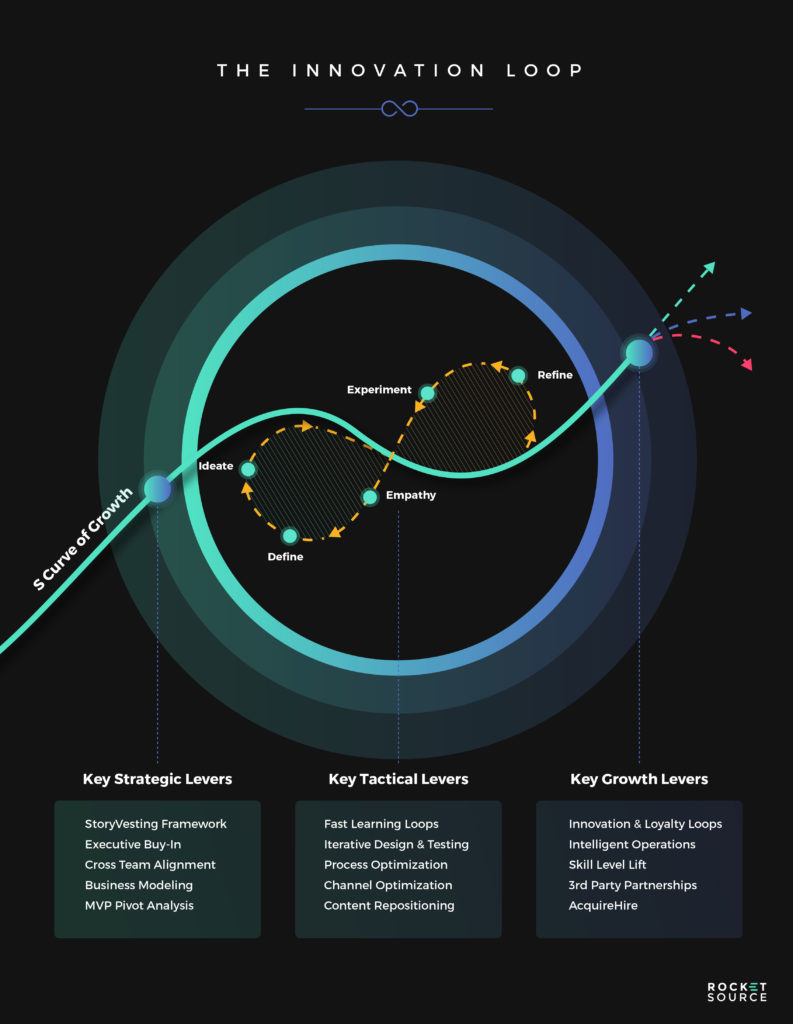

If you recognize the inflection point for what it is, you can navigate it successfully—but only if your basic structure is prepared to support growth. In other words, you need a deep understanding of the guidelines successful companies follow for building a solid business growth framework . By way of example, StoryVesting and the Innovation Loop are just two frameworks out of many available to tackle the challenge of sustaining momentum at various stages of the S Curve of Business Growth.

I know it’s easy to throw out buzzwords like innovate and optimize in a fancy graphic, but there’s a good reason they are brought up so frequently—businesses that don’t innovate or optimize are either on the downturn or at risk of disruption from forward-thinking competitors.

Accomplishing that fundamental shift required at an inflection point isn’t as simple as it sounds. There’s no single solution you can use to navigate every inflection point successfully. But there are important components that will lead you to develop what we call the three Is of growth.

Base Components

To build a strong growth framework, start with working knowledge of StoryVesting, the 3 Ps, and the bowtie funnel. StoryVesting is a proprietary, end-to-end system for improving customer experience and promoting growth by aligning a company’s core purpose and structure with the needs of its customers.

In order for a company to constantly grow, there are several relationships that have to be maintained:

- Customers to the brand

- Company to the customer

- Employees to the company

- Company to the employees

StoryVesting lays out a detailed methodology for building these relationships in a long-term manner and also addresses the 3 Ps , the essential building blocks of a business — people (employees and partners) with a growth mindset , processes that have been refined and optimized, and platforms that enable you to deliver the best possible customer experience.

The importance of your people—the employees that work on your products, support your customers, and maintain and implement processes—cannot be overstated. The right people can take an idea and turn it into a profitable business while the wrong people will drive a successful business into the ground.

Where traditional sales/marketing funnels end with an exchange of money, the bowtie funnel incorporates active feedback loops that serve to carry your ideal customer from prospect to brand advocacy, continually optimized based on the data-driven insights and information you gain as you work to improve the total customer experience.

The Three Is

At times, the needs of the customer are so unique that invention is required. Coming up with something entirely new that meets your ideal customers’ most pressing demands.

But inventing something new isn’t something you can just rush into. If you’ve done your work with StoryVesting, and have processes in place to get qualitative and quantitative feedback, you should have a very good idea of what your next big thing should be.

Before you start dedicating engineers to building it, do your due diligence. Discover the features or qualities your customers actually want, not what the loudest voices insist on. Find out if this new product should replace an old offering, or if they should be sold together (we’re looking at you, New Coke).

To improve , assess what you already offer to your users and enhance some aspect of it—make it easier to use, more affordable, better, faster, etc. Align the teams you have in a more agile, functional way that complements the needs of your customers in direct, meaningful ways.

Innovation prompts large changes by introducing new methods, ideas, or products. Innovation goes beyond “thinking outside the box” or weekly brainstorming sessions—it’s a methodology unto itself that requires a specific set of skills and disciplines.

The Innovation Loop

During a strategic inflection point, there are key pieces of the research and discovery phase that should not be overlooked.

- Refine the ideas you have, propose theories, and settle on the next course of action. This shouldn’t play out as a “design by committee” situation where everyone in an organization has a say—take a page from Stora Enso’s playbook, which reinvented itself by establishing a dedicated, interdepartmental transformation team to tackle their most pressing challenges.

- Experiment on the high-priority items that surface. Use available data to determine what are the true, deal-breaking pain points for your customers versus the nice-to-haves.

Show your customers that you genuinely care, all the way from when they call in with a complaint, to how you shape your product to fit their needs.

- Define the changes that will be made based on your testing and findings. Determine the scope and impact of what you’ll be doing, how it rolls out, and what you expect the results to be.

- Ideate throughout the entire process. Make small yet important adjustments to your impending rollout, and track the revolutionary ideas that could be used in future projects.

Leveraging Data on the S Curve of Business

I always say that big data is meaningless without proper data visualization. Every data-driven leader needs quantifiable metrics to inform real-time decision-making. And yet, if you’re still messing around with Excel spreadsheet tables and graphs to tell your story, you’re probably missing the bigger picture of what your team really needs in order to sustain momentum for any initiative.

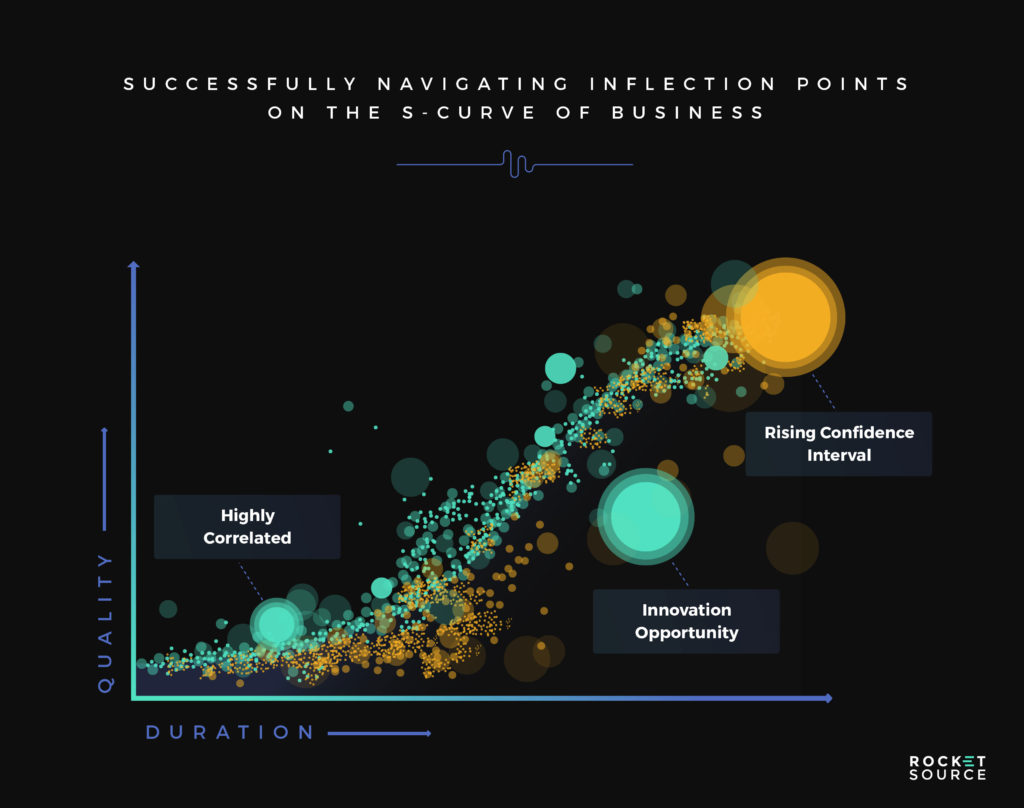

For example, in the S Curve of Business (or S Curve of Growth) infographic, I used a scatter plot output from a simple regression analysis as an example to showcase where a company may start to stall out, again otherwise seen as the strategic inflection point. In this type of data visualization, I can pinpoint where outliers can be found for innovation loops (larger circles) or how certain outcomes need to be supported with an increased budget (larger circles close to the S curve line). I know that I’m oversimplifying the complex, but I didn’t want to turn this post into a lesson on regressions, cause/correlation, and a slew of other analytical methods.

Using a modified scatter plot like this, you will have to massage the data (and data viz) and analytical framework to achieve the kind of data visualization you’ll need to tell your story. That’s where the creative side of data science comes into play. Forget what you learned at MBA school, start thinking like Van Gogh and carve out the masterpieces which can be incorporated into your ongoing internal dashboards.

At RocketSource, for example, we constantly think about the outcome of the data science effort, especially when we’re building a growth strategy at the strategic inflection point. Meaning that while aggregation, mining, and modelling data are core to the “science” behind forecasting and showing tangible internal rate of return (IRR) or return on investment (ROI), it’s how that data can be interpreted and understood to make actionable decisions at every layer of an organization.

How Zappos Started Strong and Sustains Momentum

Image courtesy of Zappos.

In 1999, Zappos started with a crazy idea of selling shoes online. Early on, the company’s CEO, Tony Hsieh, insisted on going to extremes for customers and running a customer-led culture .

That’s easy for anyone to say, but when it comes down to it, most companies don’t live up to this promise. It’s usually lip service. It would be easy for any company to simply print “Powered by Service” on every delivery box (as Zappos does) but never go the extra mile to accommodate the customer.

But Zappos held tight to the vision and knew that customers can distinguish empty platitudes from a mindset that permeates the entire company.

We're excited to feature an audio soundbite from @zappos in our newest post about the #SCurveofBusiness and how to sustain momentum through innovation.

James Green, Customer Service Manager

Hitting the Ground Running

First, Zappos invented (vs. the word “pioneered”) a new model that would provide free shipping, free returns, and a 24/7 call center that valued customer relationships over efficiency. The gamble was that bringing the store to the customer’s home—along with a superior customer experience—would lead to more sales.

The sad truth is that in many organizations, that sort of proposal might get you laughed out of the room. But not only did this approach work with customers, it set a new standard for retail operations. They got the customers they were looking for and kept them—word of mouth spread fast, and a strong majority of their sales are from repeat customers.

And for me, personally, I couldn’t imagine ever shopping for shoes the way I had before. I was hooked!!! (And so was everyone else who tried it thanks to my relentless word-of-mouth advertising.) When a brand speaks to exactly what you want and need—as it did for me—that particular brand and cognitive association deepens to the point that it’s like prying Steve’s wife loose from Bunco game night! That is until the brand really screws up repeatedly or no longer stays relevant to the changing wants/needs of the customer. Then it’s game on for every competitor who has been patiently nipping at that pole position.

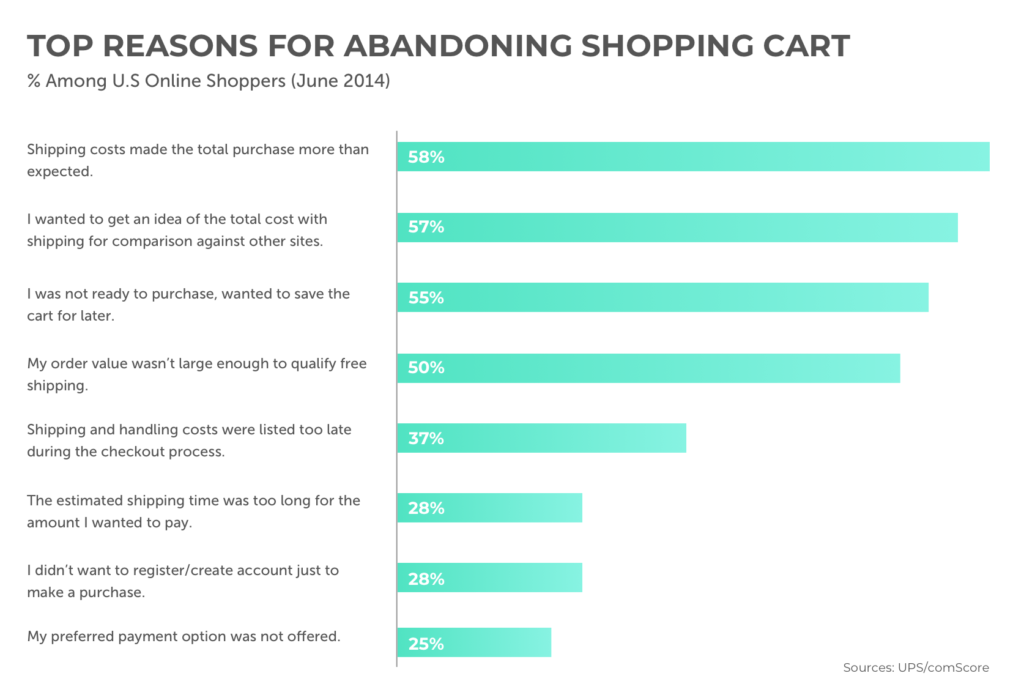

And, as it turns out, this wasn’t such a gamble at all. Online shopping cart abandonment rates generally hover around 60-70%, and statistics indicate that shipping costs have a lot to do with that.

But free shipping both ways was just part of the Zappos strategy. The company is so committed to the idea of a customer-centric culture that applicants are highly vetted—sometimes over several months—to ensure that they connect with the company goals and culture. During onboarding, new hires are paid their full salary, and one week in, are given “The Offer”—a $1,000 bonus plus the time worked—to quit. They put real money on the line to make sure the team is passionate about service.

Staying in the Game

After getting started in the right direction, Zappos went to great lengths to improve their operations. They had established a reputation for excellent service and knew there were ways to make it even better.

They moved away from drop shipping to an outsourced warehouse and shipping company, then brought it all in-house to provide better service.

As an e-commerce company, we should have considered warehousing to be our core competency from the beginning. Trusting that a third party would care about our customers as much as we did was one of our biggest mistakes. If we hadn’t reacted quickly by starting our own warehouse operation, that mistake would eventually have destroyed Zappos. – Tony Hsieh

At a time where most companies tend to avoid phone calls and apply scripts and time limits to their call centers, Zappos leadership made the decision to relocate the Zappos HQ from San Francisco to Las Vegas—a location with a hospitality-minded, 24-hour culture that would attract top-tier phone support talent.

We put our phone number at the top of every single page of our website because we actually want to talk to our customers. We staff our call center 24/7. We don’t have scripts because we want our reps to let their true personalities shine during every phone call. We don’t hold reps accountable for call times. And we don’t upsell—a practice that usually just annoys people. We care only whether the rep goes above and beyond for every customer. – Tony Hsieh

Ongoing Evolution

Not content to rest on their laurels, Zappos continues to innovate .

Starting with a strong vision (and like-minded employees) was just the beginning. Zappos has implemented many programs that go above and beyond to reinforce the company’s values, build employee engagement and improve productivity:

- A dedicated team trains employees in each of the company’s ten core values .

- Most employees are expected to spend their first three to four weeks answering phones in the call center, learning how to address customer needs and concerns.

- Raises are given based on results from skills tests, not knowing the right person or relative performance metrics.

- Zollars (Zappos dollars), is a form of currency awarded to employees in order to purchase company swag, donate to charity, etc.

The result is vested employees—individuals working together as a whole to fulfill the mission of the company. People who love what they’re doing, and are advocates for the company’s mission. Employees whose legendary customer service extends to sending flowers to a customer, buying out-of-stock shoes from another store, or overnighting a free pair of shoes to a best man.

The Results

The impact of Zappos on the retail world has been massive. Some of the ideas created by the company have been passively adopted by other companies, such as offering money to new hires to quit—something Apple now does, as an incredible company in its own right that we’ll talk about later.

But this concept of building a company so committed to service that every single employee is chosen based on their attitude and ultimate fit with the vision and team—was revolutionary. Revolutionary enough that Amazon bought the company in 2009, the largest acquisition Amazon had made up until that point.

The side effect of Zappos’ free shipping alone has set a new benchmark in retail that has pushed smaller retailers to compete . The entire retail industry has been forced to pivot and react based on consumer expectations and behavior that now prefer low or no additional shipping costs.

Their laser focus on customer service has insulated them from competitors matching their strategy of offering free shipping both ways. The first of the company’s ten core values is to “Deliver WOW Through Service”—a radical idea at the time, has since become the logical one.

The rules of retail are changing, due to forward-thinking companies like Zappos and empowered consumers.

How Apple Drives Their S Curve

When Apple burst onto the scene in 1984 with the original Macintosh, it was an invention that completely changed the way people thought about computers. And for a time, the company enjoyed growth that you might easily have mistaken for hockey stick growth. And then that growth tapered off, and the company began the first of what would be many downward spirals.

Coming Back

That story, of course, ultimately has a happy ending—at least for now. Like a phoenix rising from the ashes, Apple came back, again and again, to create multiple billion-dollar business units . The iPod wasn’t the first portable MP3 player on the scene—but the invention of the scroll wheel coupled with the iTunes software completely transformed the way we listened to and purchased digital music.

The later innovation of the iPod touch and the iPhone paved the way for the App Store—which paved the way for an entire new industry of app developers.

Not content to rest on their laurels, Apple continued to make iterative improvements to iTunes based on user feedback and ultimately created a sophisticated multimedia content manager, e-commerce platform, and hardware synchronization manager.

Is every innovation a winner? Of course not. Is every invention the iPhone? No. But because Apple responds to strategic inflection points by inventing, innovating, and improving in conjunction with one another , they remain relevant. And let’s not forget how many times Apple relied on outside partnerships to gain that competitive edge. The company, by any measure, is the poster child for turning stall points into strategic inflection points along the S Curve of Business Growth .

The Secret Sauce

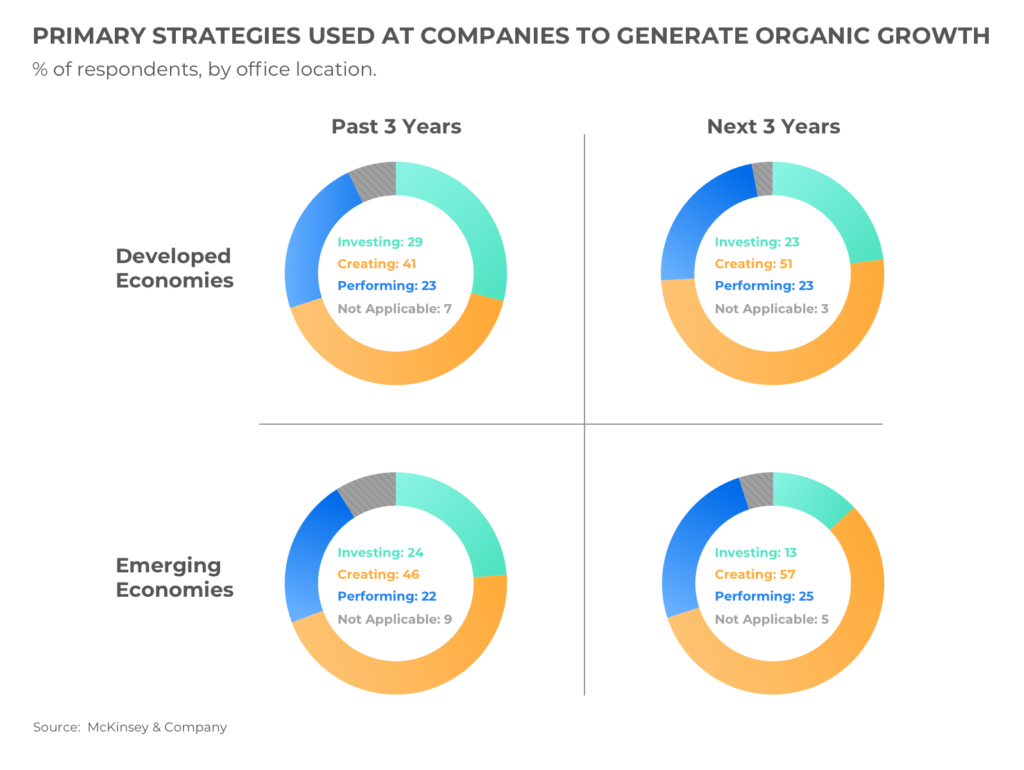

Apple excels during inflection points because they adapt in more than one way . See, as effective as any of the 3 Is can be alone, using a combination of methods increases the chances of producing high growth. As McKinsey points out in their article:

Most companies pursue just one of these strategies as their primary source of organic growth . But the executives reporting above-market growth… are more likely than others to say they are pursuing a diversified approach to growth.

Failure to Act

It’s well known that panic is the parent of bad decision-making. And inflection points tend to cause high levels of panic and require making difficult decisions . Without the knowledge necessary to handle inflection points calmly, panic can lead to companies falling into a number of strategic pitfalls. One of these pitfalls is the inability to make a decision , and it can be caused by several possible factors:

- Lack of recognition. More often than not, the failure to respond is rooted in the failure to recognize an inflection point in the first place.

- Panic paralysis. Whether caused by a fundamental misunderstanding of what’s happening in their growth, or an overarching fear of misstepping, the inability to keep a clear head can completely deter any productive call to action.

- Old Habits. Falling into the same patterns that have gotten you through in the past feels safe, but it’s in no way an actual progression for your company. No one makes progress while looping back on themselves.

No matter the underlying reason, a business failing to act at a critical inflection point not only robs them of an opportunity to evolve, but also derails the path to long-term continued growth.

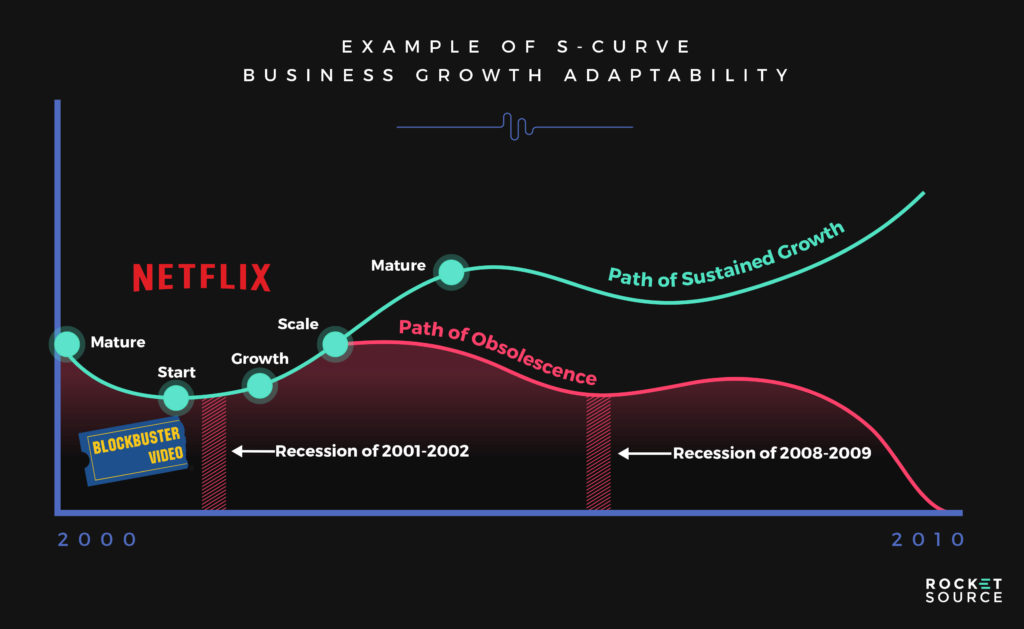

Blockbuster Video Couldn’t Sustain its Growth

Blockbuster is a sad reminder of how established, dominant businesses can trip up at inflection points. In fact, the odds are usually stacked against incumbents in some key ways. Success is a double-edged sword, and as a company grows it loses some of the dynamic flexibility it had as a startup. It no longer has reason to consistently reassess their process and approach, they become more cautious in their actions, and they’re more likely to revert to tactics they’ve already used in the past. So in some ways, avoiding the three common pitfalls of inaction becomes harder and harder the more a business grows.

In 2004, video rental chain Blockbuster employed over 60,000 workers across 9,000 stores. Not only did Blockbuster dominate the video rental market, in 2000 it was confident enough to pass on the opportunity to buy the tiny upstart Netflix—which seemed headed for dot.com destruction.

Yet that same confidence kept Blockbuster from assessing one of their biggest weaknesses, which was that their main source of income came from penalizing customers . The practice of charging late fees was a huge flea in the ointment of customer experience: one that Blockbuster relied upon, but Netflix maneuvered around handily.

On top of it all came the pivotal moment, the strategic inflection point, when increased broadband speeds made streaming media possible. Netflix was aware of the developing circumstances and could adapt. Blockbuster didn’t react to Netflix gaining traction until it was well past too late, and they were already behind.

Even after realizing Netflix was growing as a competitor, Blockbuster was too married to their retail model to make a shift fundamental enough to keep up with them. Through paralysis, ignorance, and dedication to old habits, Blockbuster failed to change and doomed themselves to the path of stagnation. And stagnation for a business is just a drawn-out death sentence.

When the CEO of Blockbuster was asked why he didn’t chase Netflix for an acquisition, he replied, “Neither RedBox nor Netflix are even on the radar screen in terms of competition.”

Ironically, when I was helping RedBox innovate on their initial outdoor media and marketing strategy, I was delivering blow after blow to Blockbuster’s core business. —Buckley Barlow (@BuckleyBarlow)

Impacts and Negative Action

As destructive as a lack of action can be to a business, not all action is good action. In fact, according to Donald Sull’s article on why good companies go bad , the problem is often “not an inability to take action, but an inability to take appropriate action.”

There are numerous examples of businesses that doom themselves to obsolescence because they took actions that were ineffective, or even made the situation worse.

Chasing Channels and Tactics is Detrimental to Real Growth

When revenues stall, many companies fumble after anything that will get some cash in the door. But if you give in to panic, and start playing the short game, you’re already putting yourself behind the competition. Growth is about the long term. It’s not about the quick revenue blips that come from chasing the next big thing, because then you’ll never be the one who innovates the next big thing.

For example, if you were one of the first people on Pinterest, you probably saw a nice revenue spike, maybe even a large one which gave you the major traction you needed to launch into more sustained growth. But once everyone else was also on Pinterest, you likely saw that growth taper off. You assume (wrongly) that the channel is oversaturated, and it’d be easier to try again in a more convenient channel.

Many companies in this frame of mind began frantically trying to get themselves on “the next Pinterest”—the New! Improved! Infomercial-type channel. And maybe they managed to ride the next wave for another revenue blip. Maybe, when viewed close up, that blip can even look like a hockey stick , driving revenues and users ever upwards.

But the result of prematurely leaving markets can actually be quite harmful.

For one thing, choosing to chase the small game wastes time you could be spending laying the framework for much more lasting growth. And when you chase tactics without a strategic plan in place, you will eventually hit a wall, or end up in a field you have no business being in. Best case scenario, you end up with your hand half in a lot of different cookie jars, instead of one beautifully built investment.

Instead of flailing after a bunch of new solutions, there’s a better opportunity to take a closer look at the growth you gained from Pinterest. When that growth starts leveling out, improve your existing processes, and build iterative improvements to your product. Focus on the innovations that move you forward, and the inventions that propel you ahead of the competition. So if you plunged into Pinterest and saw growth within your own business, don’t leave it to chase after the next channel. Instead pause, tweak, refine and sustain momentum on Pinterest. In other words, do what Apple does, and milk every channel, every product, for all it’s worth.

You can then strategically leverage your Pinterest growth by engaging users, finding out what they want, and tweaking your product or service offering accordingly. Keep that entrepreneurial product/market fit in mind constantly, and think about how you can turn your Pinterest followers into brand ambassadors who can attract a new wave of users. In the end, you can reduce overall churn and reap a myriad of other benefits just by giving your existing channels a little TLC.

Now maybe at the very beginning of this process, you looked at Pinterest and decided it wasn’t the right channel for you in the first place. If you weren’t sure, you could consult an outsourced Pinterest expert like Anna Bennett to determine whether this is actually a viable and sustainable growth strategy for your brand .

How to Innovate Without Risking it All

It may sound like I’m giving you more don’t s than do s, but the sad truth is that there is no “one size fits all” fix for inflection points, and even the most commonly used solutions can go very wrong. For example, misplaced invention or unnecessary improvements will introduce more problems than solutions. Instead of attempting to keep the S curve of business moving upward, companies easily start chasing short-term solutions that may provide a small bump but don’t contribute in the long run.

Something I’ve seen all too often is innovation initiatives that fail to do anything new or unique. Businesses often try to “innovate” by adopting strategies or features already offered by their competitors. In reality, adding on features that your competitors launched previously means you’re keeping up, not breaking new ground. And, as we saw with companies like Zappos, innovation at its best will completely switch up how the game is played—and your competitors will be forced to play by your new rules.

Strategic Growth Planning

Now, you might be getting the impression that innovating or expanding into new channels will be a huge mistake that will drive your business into the ground. That isn’t the case.

In fact, I’m a big believer in new channels and new tactics when they are used in connection with an overall plan that accounts for the difference between strategy and tactics . A good, solid game plan can make a difference between making a huge mistake and your next business breakthrough. Much like how the recognition of your business’ S curve can mediate any panic about growth, being able to recognize where your choices fit into a larger plan for your business can allow smart decision making—even while handling riskier maneuvers like exploring new channels.

After all, there are times when it’s smart and absolutely necessary to explore outside channels, like when a business’s primary channel is experiencing a lack of growth. This is where exploring new channels and “out of the box” innovations can be the key to the next uptick in your S Curve of Business growth.

So innovating and channel exploration are both examples where choices should be made within a larger structure. This structure helps make the innovation process less risky, but there are key steps that can be taken to instill true innovation in an organization.

Acting During Inflection Points Also Means Re acting

No decision should be made within the microcosm of your own business—everything needs to take into account the surrounding environment to have a chance at progress.

Beware of External Factors that Threaten Growth

It’s important to pay attention to the surroundings affecting your business, especially because revenue stalls are often related to external factors. Maybe the product/market fit for your locally-based semi-luxury product was absolutely perfect a month ago, but last week the major employer in your city laid off 900 workers, and the local economy has tanked.

Do you slash your prices? Expand into new markets where the landscape is brighter? Revamp your offering to be more closely aligned with current consumer needs, or rebrand your company as a luxury solution and target only the wealthy?

Here’s what you don’t do: You don’t ignore the evidence in front of you. You don’t refuse to see where events in the world are having an impact on your business. You don’t willfully block out external factors and plunge ahead as if nothing has changed, because not only will external factors sometime result in strategic inflection points, but they’ll also affect how effective your business choices will be in spurning on growth.

The case studies already used in this blog post double as examples of external factors playing a role in the failure of a business. For example, Blockbuster failed to respond to shifts in the market (improved internet infrastructure and preference for direct-to-home delivery model) which allowed competitors to gain traction on them.

How you should respond to external factors depends, of course, on what exactly those factors are. What’s critical and constant, however, is that you follow Margaret Heffernan’s advice on decision-making and act strategically, based on the knowledge that you are facing an inflection point .

Firestone Faced a Storm of External Threats

In the 1970s, Firestone Tires had been experiencing an extended period of uninterrupted growth. The company had a strong sense of values and a clear path to success. They were well known for their focus on growing a network of vested employees and clients. They set up an efficient production system devoted to meeting high tire demands, and they had a larger strategic plan guiding their actions.

Foundationally, Firestone was doing everything right.

But when Michelin introduced the radial tire to the U.S. market, Firestone was suddenly playing catch-up. This new product was safer, lasted longer, and cost less than traditional tires. And when huge automakers like Ford committed to all new cars having radials, the need for change was even more clear.

Firestone was aware of the coming changes and poured money into this new development. The company invested over $400 million in a new plant, and several existing factories were converted to radial production.

So they took action, and had a solid growth foundation—why isn’t this a success story?

Because, despite the response being swift, it was not effective. While they invested substantially in a new standard, the production processes stayed the same and produced inferior results—they kept the same habits while trying to retool the core product. On top of that, obsolete factories were kept in high production, which added operating costs and ignored the external factors at work.

By 1979, the company was renting space to store unsold tires and eventually sold to Bridgestone in 1988.

Identifying Threats to Growth

Not all the factors affecting growth will be external. When the threat to sustainable growth comes from within your company, it can sometimes be extremely difficult to identify. If you’ve been part of a culture that’s working hard to maintain the status quo, it’s not easy to recognize when you’re stuck in a rut. And upsetting that status quo can be terrifying—particularly if the business is generally running smoothly and there’s no real push for change.

In this situation, you need buy-in before you can enact change . You cannot simply issue a mandate and expect everyone in the company to suddenly be on board because you said so. Instead, you will need to put in time to understand the underlying need for the change, and skill up your team to prepare them to actively participate instead of resist those changes.

You may discover that some of your employees simply cannot get on board—and at that point, you’ll have some tough decisions to make. Bear in mind that employees who are not growth-minded will not be able to contribute effectively, and may even actively work to disrupt change. It all ties back to maintaining that solid growth framework.

Apply Customer Retention Principles to Your Internal Team

When you know which employees are committed to growth and driving that business S curve upward, which employees can embrace the growth mindset and bring the innovation, invention, and improvement needed for sustainable growth, you need to do everything in your power to keep those employees on board.

Obviously, this starts with paying your employees what they’re worth, but it doesn’t end there. You also need to make sure your employees understand the company’s overall growth plan—and how their daily tasks fit into that plan. Don’t just tell your web designer that the entire site needs to be redone. Explain why, and show him how his contribution directly affects the bottom line. At the end of the day, as Kathryn Minshew succinctly points out, employees care a lot about their relationships at work .

A smart customer retention strategy ensures that your offering is orders of magnitude better than the competition’s so that your customers never even consider leaving. Apply the same strategy to your employees: offer them training that appeals to their personal and professional growth curves while making them more valuable to the company. Demonstrate a path to success with increasing responsibilities—and commensurate compensation packages—over time. Survey your employees—just as you survey your customers—to find out what they really want, and give it to them.

Create Frictionless Experiences to Drive Sustainable Growth

When you want to improve growth and retain the customers you already have, you must ensure that your entire marketing funnel—from attracting potential customers through onboarding, all the way through turning customers into advocates—is frictionless. In fact, Christoph Janz even recommends hiding any complexities that might be involved until the user is more comfortable and committed to the product.

If you’re not a Software as a Service (SaaS) company, you might be tempted to think that the concept of frictionless onboarding isn’t relevant to you. Think again.

The customer experience—the entire customer experience—must be nothing short of sublime. Remember how it felt the first time you picked up an iPhone and you knew exactly what to do because there was only one button? You want your user to feel that way all the time. They should never have to stop and think, “Hang on, where’s that thing I wanted to click?” Hide the complexities. The iPhone has them, but they’re definitely not the first thing you see.

From the very first contact you have with your users, the experience should be frictionless. Nothing should slow them down. And once you have those customers, hold them close. Follow Brian Balfour’s excellent advice to increase the lifetime value (LTV) of your customers.

Frictionless onboarding is for everyone—not just SaaS companies.

Your Path to Sustainable Growth

Can every company see sustainable growth in perpetuity? Probably not—but what’s stopping you from trying?

Most companies—no matter their size—can transform into digital leaders by starting from the foundation of the growth framework and supplementing that with the right training and education for employees and partners.

The key levers to staying on the s curve of business stem from a customer-centric, collaborative mindset that touches every part of the business. As long as you continue to encourage innovation on a company-wide scale and to challenge the status quo at every inflection point, you can navigate inflection points successfully and achieve long-term, sustainable growth.

The S Curve of Business: A Recap

Mistakes made in the clutches of panic can lead to a company’s total demise and can be prevented absolutely by a framework of knowledge about sustainable growth.

Every business is sure to face a strategic inflection point—that moment where the previous momentum is showing signs of slowing down or the lack of momentum is causing brand disconnect, or even churn. Solving for the complex is a core part of RocketSource’s DNA and raison d’etre. We’re here to help you navigate those critical moments in your business to help propel you to that next level.

Understanding what sustainable growth looks like is the first step. Once you understand the S curve of growth and how strategic inflection points affect growth, you’re better equipped to confront the natural pattern of growth. You can prepare psychologically for the time when growth stalls, and you can more objectively navigate each strategic inflection point. Regardless of your industry, putting in the time to uncover and fix your growth roadblocks is always the best place to start. Once you know what’s in your way, you can then figure out how to pull the right levers to drive sustainable growth.

Customer Experience (CX) Terms

- 360° Degree View of the Customer

- Barlow Bands

- Behavioral Triggers

- Bow Tie Funnel

- Brick-to-Click

- Business Impact Analysis (BIA)

- Cognitive Computing

- Cohort Analytics

- Content Mapping

- Conversational User Guidance

- Customer Data Profile

- Customer Experience (CX)

- Customer Friction

- Customer Insights Map

- Customer Journey

- Customer Journey Mapping

- Customer Satisfaction (CSAT)

- Customized Ratios

- CX Intelligence

- CX Led Growth

- Data as a Product (DaaP)

- Data as a Service (DaaS)

- Data Culture

- Data Driven

- Data Engineering

- Data Fabric

- Data Governance

- Data Humanization

- Data Hygiene

- Data Looping

- Data Mapping

- Data Mining

- Data Modeling

- Data Monetization

- Data Visualization

- Data Warehouse

- Data-Centric

- Descriptive Analytics

- Diagnostic Analytics

- Digital Asset Management (DAM)

- Digital Transformation

- Dirty Data In Dirty Data Out

- Embedded Intelligence

- Empathy Mapping

- Employee Data Profile

- Employee Experience (EX)

- EX to CX Data Mapping

- EX to CX Mapping

- Experience Management (XM)

- Gap Analysis

- Generative AI

- Human-Centered Design (HCD)

- Journey Analytics

- Machine Learning (ML)

- Managed Agile Services on Demand

- Modified Hoshin

- North Star Metric

- Pathway to Purchase

- Predictive Analytics

- Product-Market Fit Mapping

- Real Time Design Looping

- Revenue Acceleration

- S Curve of Growth

- Stack Impact Analysis

- StoryVesting

- Table Stakes Testing

- The 3 P’s

- User Experience (UX)

- User Insights Map

- User Interface (UI)

- Voice of the Customer (VoC)

- Voice of the Employee (VoE)

- World Cloud Generator Sentiment Mining

- X Analytics

Company Growth Strategy: 7 Key Steps for Business Growth & Expansion

Published: May 01, 2024

A concrete business growth strategy is more than a marketing effort. It’s a crucial cog in your business machine. Without one, you’re at the mercy of a fickle consumer base and market fluctuations.

So, how do you plan to grow?

If you’re unsure about the steps needed to craft an effective growth strategy, we’ve got you covered.

Table of Contents

Why You Need a Business Growth Plan

Business growth, types of business growth, business growth strategy, types of business growth strategies, product growth strategy, how to grow a company successfully, growth strategy examples.

We know the why is important — so why do we think building a business growth plan is so crucial, even for established businesses? There are so many reasons, but here are three that apply to almost all businesses at some point:

- Funding. Functionally, most businesses are always on the lookout for investors, and you’ll have an advantage if you can present a solid growth plan to convince them. Most expect it.

- Insurance. Growth creates financial padding, like a forcefield to protect your business when unexpected issues crop up. The economic upheaval for brick-and-mortar businesses in 2020 is a perfect example.

- Credibility and creditability. For brand new businesses, getting a loan and making sure you can pay back your bank is at the top of the priority list. There’s no real profit until that debt is managed. Having a growth plan will not only help you secure a business loan, it will be there to refer to so you’ll know what to do to continue making your payments.

Business growth is a stage where an organization experiences unprecedented and sustained increases in market reach and profit avenues. This can happen when a company increases revenue, produces more products or services, or expands its customer base.

For the majority of businesses, growth is the main objective. With that in mind, business decisions are often made based on what would contribute to the company’s continued growth and overall success. There are several methods that can facilitate growth which we’ll explain more about below.

.png)

Free Strategic Planning Template

Access a business strategic planning template to grow your business.

- Sales and Revenue Growth

- Growth of Customer Base

- Expansion into New Regions

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

As a business owner, you’ll have several avenues for growth. Business growth can be broken down into the following categories:

With organic growth, a company expands through its own operations using its own internal resources. This is in contrast to having to seek out external resources to facilitate growth.

An example of organic growth is making production more efficient so you can produce more within a shorter time frame, which leads to increased sales. A perk of using organic growth is that it relies on self-sufficiency and avoids taking on debt. Additionally, the increased revenue created from organic growth can help fund more strategic growth methods later on. We’ll explain that below.

Example : Organic growth could be putting some of your revenue aside to purchase a second machine — doubling your production without debt. This increases your ability to take more and/or larger orders. In this way, you create more revenue to invest in a third machine or fund another growth strategy.

2. Strategic

Strategic growth involves developing initiatives that will help your business grow long-term. An example of strategic growth could be coming up with a new product or developing a market strategy to target a new audience.

Unlike organic growth, these initiatives often require a significant amount of resources and funding. Businesses often take an organic approach first in hopes that their efforts will generate enough capital to invest in future strategic growth initiatives.

Pro tip: Strategic growth can be a major endeavor depending on the size of your business. Be prepared to learn a lot, work hard at it, and see slow development. For quicker results, hire someone who knows a lot to work hard at it. Another option is to spend the money on a user-friendly platform that you or an employee can manage. Strategic growth is easily a full-time job for anyone, if not for a team of professionals.

3. Internal

An internal growth strategy seeks to optimize internal business processes to increase revenue. Similar to organic growth, this strategy relies on companies using their own internal resources. Internal growth strategy is all about using existing resources in the most purposeful way possible.

Example: Internal growth could be cutting wasteful spending and running a leaner operation by automating sales with AI , or some of its functions instead of hiring more employees. Internal growth can be more challenging because it forces companies to look at how their processes can be improved and made more efficient rather than focusing on external factors like entering new markets to facilitate growth.

4. Mergers, Partnerships, Acquisitions

Although riskier than the other growth types, mergers, partnerships, and acquisitions can come with high rewards. There’s strength in numbers. A well-executed merger, partnership, or acquisition can help your business break into a new market. You can also expand your customer base or increase the products and services you offer.

A growth strategy is a plan that companies make to expand their business in a specific aspect, such as yearly revenue, number of customers, or number of products. Specific growth strategies can include adding new locations, investing in customer acquisition, or expanding a product line.

A company’s industry and target market influence which growth strategies it will choose. Strategize, consider the available options, and build some into your business plan. Depending on the kind of company you’re building, your growth strategy might include aspects like:

- Adding new locations.

- Investing in customer acquisition.

- Franchising opportunities.

- Product line expansions.

- Selling products online across multiple platforms.

Pro tip: Your particular industry and target market will influence your decisions, but it’s almost universally true that new customer acquisition will play a sizable role.

That said, there are different types of overarching growth strategies you can adopt before making a specific choice, such as adding new locations. Let’s take a look.

There are several general growth strategies that your organization can pursue. Some strategies may work in tandem. For instance, a customer growth and market growth strategy will usually go hand-in-hand.

Revenue Growth Strategy

A revenue growth strategy is an organization’s plan to increase revenue over a time period, such as year-over-year. Businesses pursuing a revenue growth strategy may monitor cash flow , leverage sales forecasting reports , analyze current market trends, diminish customer acquisition costs , and pursue strategic partnerships with other businesses to improve the bottom line.

Specific revenue growth tactics may include:

- Investing in sales training programs to boost close rates.

- Leveraging technology to improve sales forecasting reports.

- Using lower-cost marketing strategies to lower customer acquisition costs.

- Continuing to train customer service reps to increase customer retention.

- Partnering with another company to promote your products and services.

Pro tip: Revenue for the sake of personal income is often important at the start of a business (to pay the bills) and end of a business (as an enticement while selling the company). But while you look to the future with your company running, it’s wise to use revenue growth toward continued overall business growth.

Customer Growth Strategy

A customer growth strategy is an organization’s plan to boost new customer acquisitions over a time period, such as month-over-month. Businesses pursuing a customer growth strategy may be more open to making large strategic investments, as long as the investments lead to greater customer acquisitions.

For this strategy, you may track customer churn rates , calculate customer lifetime value (CLV), and leverage pricing strategies to attract more customers. You might also spend more on marketing, sales, and CX , with new customer sign-ups as the north star metric.

Specific customer growth tactics may include:

- Investing in your marketing and sales organization’s headcount.

- Increasing advertising and marketing spend.

- Opening new locations in a promising market you’ve not yet reached.

- Adding new product lines and services.

- Adopting a discount or freemium pricing strategy .

- Tracking metrics such as churn rates, CLV, and monthly recurring revenue (MRR).

Pro tip: Remember that it’s about people. Market research tools such as trend monitoring can help keep you aware of what your target audiences are genuinely interested in. This way, you can meet them where they are and get those customer sign-ups.

Marketing Growth Strategy

A marketing growth strategy — which is related, but not the same as, a market development strategy — is an organization’s plan to increase its total addressable market (TAM) and increase existing market share.

Businesses pursuing a marketing growth strategy will research different verticals, customer types, audiences, regions, and more to measure the viability of a market expansion.

Specific marketing growth tactics may include:

- Rebranding the business to appeal to a new audience.

- Launching new products to appeal to buyers in a different market.

- Opening new locations in other regions.

- Adopting a different marketing strategy, e.g., local marketing or event marketing , to appeal to different markets.

- Becoming a franchisor so that individual business owners can buy franchises from you.

Pro tip: The idea here is to get a bigger slice of the pie by growing into already established markets. It differs from market development in that market development discovers or creates new markets instead of finding some space in existing ones. Most businesses are not trying to reinvent the wheel. They’re just getting a spot at the car show.

A product growth strategy is an organization’s plan to increase product usage and sign-ups or expand product lines.

This type of growth strategy requires a significant investment into the organization’s product and engineering team (at SaaS organizations). In the retail industry, a product growth strategy may look like partnering with new manufacturers to expand your product catalog.

Specific tactics may include:

- Adding new features and benefits to existing products.

- Adopting a freemium pricing strategy.

- Adding new products to the existing product line.

- Partnering with new manufacturers and providers.

- Expanding into new markets and verticals to increase product adoption.

Not sure what all of this can look like for your business? Here are some actionable tactics for achieving growth.

- Use a growth strategy template.

- Choose your targeted area of growth.

- Conduct market and industry research.

- Set growth goals.

- Plan your course of action.

- Determine your growth tools and requirements.

- Execute your plan.

1. Use a growth strategy template [Free Tool] .

5. Plan your course of action.

Next, outline how you’ll achieve your growth goals with a detailed growth strategy. Again, we suggest writing out a detailed growth strategy plan to gain the understanding and buy-in of your team.

Don't forget to share this post!

Related articles.

What is a Sales Funnel? (& What You Should Make Instead)

Outcome-Based Selling: An Overview + Practical Tips

The Ins & Outs of Cold Emailing That Delivers Results

![business growth curve model What Is Cross-Selling? Intro, Steps, and Pro Tips [+Data]](https://knowledge.hubspot.com/hubfs/ft-cross-selling.webp)

What Is Cross-Selling? Intro, Steps, and Pro Tips [+Data]

9 Bad Sales Habits (& How to Break Them In 2024), According to Sales Leaders

![business growth curve model 22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]](https://www.hubspot.com/hubfs/Best-Sales-Strategies-1.png)

22 Best Sales Strategies, Plans, & Initiatives for Success [Templates]

9 Key Social Selling Tips, According to Experts

![business growth curve model 7 Social Selling Trends to Leverage This Year [New Data]](https://www.hubspot.com/hubfs/social%20selling%20trends.png)

7 Social Selling Trends to Leverage This Year [New Data]

![business growth curve model How Do Buyers Prefer to Interact With Sales Reps? [New Data]](https://www.hubspot.com/hubfs/person%20phone%20or%20online%20sales%20FI.png)

How Do Buyers Prefer to Interact With Sales Reps? [New Data]

![business growth curve model 7 Sales Tips You Need to Know For 2024 [Expert Insights]](https://www.hubspot.com/hubfs/Sales%20Tips%202024%20FI.png)

7 Sales Tips You Need to Know For 2024 [Expert Insights]

Plan your business's growth strategy with this free template.

Powerful and easy-to-use sales software that drives productivity, enables customer connection, and supports growing sales orgs

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

When Your Business Needs a Second Growth Engine

- James Allen

Traditionally, the most reliable way for a firm to find its next wave of growth was to apply the capabilities of its core business in an adjacent market. But recently a new pattern has begun to emerge. More firms are learning the art of building large second cores—what Bain’s Zook and Allen call engine twos. Given that in the past five years, 60% of big public companies have seen their growth stall out or stagnate—often because of technological disruption—finding an engine two has become increasingly imperative.

What does it entail? Successful engine twos have four factors in common: They target markets where the profit pool is sizable and growing or shifting, as Amazon’s cloud computing business did. They have a differentiated competitive advantage, which is often built up through acquisitions, as happened at Disney+. They adopt entrepreneurial approaches, like Bradesco’s digital unit, Next, and leverage the scale and assets of the original core, as the industrial cleaning company Ecolab’s new water-purification business did.

In combination these four elements magnify one another’s effects, often creating businesses that have much greater potential than firms’ original cores.

Here’s how to build one.

Idea in Brief

The opportunity.

While new technologies continue to upend industries and shorten the lives of corporations, there has never been a better time for companies to search for new growth engines.

How to Tap It

Half of successful “engine two” businesses are found by entering a fast-growing adjacency, as Ecolab, a provider of industrial cleaning products and services, did when it moved into the industrial water purification business. About a third are next-generation versions of the core business—like Netflix’s move from DVD rentals to streaming. The rest involve building or buying a business totally separate from the core.

Keys to Success

Companies need to identify markets with expanding profit pools, ensure that their offerings are differentiated, and instill an entrepreneurial mindset in the new business while harnessing the skills and assets of the original engine of growth.