With our proven track record of excellence, we are confident that we are the perfect choice for businesses seeking for optimal performance and sustainable growth.

- Reasons to work with us

- Meet Our Leadership Team

- Why Outsource to Vietnam?

- Case Studies

Stay up-to-date with the latest news, industry trends, and valuable insights shared by our experts.

- BPO Trends & Updates

- Events and Podcasts

- Newsletters

We are a Vietnam-based diverse, qualified and dedicated team that works to help clients in North America, Canada, Australia, and Asia-Pacific expand their global footprints.

- Innovaturer’s Activities

Guide to Developing a Personnel Plan

- May 12, 2023

- BPO Insights

- Finance and Accounting Services , Financial Analysis & Financial Planning

Table of Contents

A people plan is an essential component of your business strategy and Financial Planning . In addition to assisting you in budgeting for current and prospective employees, your personnel strategy allows you to consider who to hire and when to hire them.

What is a Personnel Plan?

A Personnel Plan is a document that details an organization’s staffing needs, goals, and workforce management practices. It is an essential component of human resource management and serves as a road map for employee recruitment, selection, training, development, retention, and management.

A Personnel Plan is an essential component of any start-up or entrepreneur’s business plan . It will aid you in your financial predictions, allowing you to anticipate the best periods to hire and expand.

When presenting for funding to angel investors or venture capitalists , they will want to see why your team is uniquely equipped to grow and scale your firm, as well as your hiring strategy.

Investors will be interested in learning:

- What positions do you require?

- When do you intend to fill them?

- How much will it cost to assemble the team you require?

What should you put in your Personnel Plan section?

The people who execute the work—your team—are both the most expensive and most important asset for many startups and small businesses . It stands to reason that hiring the appropriate individual at the right moment can have a big impact on your company’s ability to accomplish milestones and goals, not to mention cash flow.

A healthy Personnel Plan includes strategic thinking about human resources, such as whether to expand roles, and salary levels, and whether to hire full-time or on a contract basis.

So, whether you’re looking for investment or not, developing a people plan and forecast is an important aspect of business planning and strategic planning for your company’s long-term success. Look at the 9 critical phases of developing an investor-ready Personnel Plan .

What is the composition of your management team?

Typically, the “team” portion of your business plan will include an overview of the main jobs in your organization as well as the backgrounds of the people who will fill those critical responsibilities. You will highlight each of your company’s executive positions before speaking more broadly about other departments and teams.

Keep it brief .

You do not need to submit whole resumes for each team member; a brief overview of why each person is qualified for the position is sufficient. Describe each individual’s talents and expertise, as well as what they will do for the company.

Highlight your team’s strengths . How do they bolster your group’s strength? What is their special knowledge and experience in your (or a related) industry? If your market research uncovered a fantastic opportunity, why are you the best team to capitalize on it?

This part helps potential investors understand why each team member is critical to the company’s success. It serves as the rationale for their wage and ownership stake in the company if they are part owners.

How is the organizational structure defined?

Your company’s organizational structure is typically portrayed as an “org chart” that indicates who reports to whom and who is accountable for what.

However, you do not need to construct a graphic org chart; simply defining your organization in the text is sufficient . Simply demonstrate that your organization has a well-defined structure.

Is authority divided fairly among the team members? Do you have the resources to do all of the tasks required to expand your business?

You should also explain the many teams that your organization will have in the future . Sales, customer service, product development, marketing, production, and so on are examples.

You don’t have to hire all of these employees right away. Consider this section to be an outline of what you intend to do with your firm in the future.

Compile a list of your advisors, consultants, and board members

External advisers, board members, and even consultants can play an important role in determining a corporate strategy for some organizations. These individuals may even temporarily fill crucial positions as your company grows. You should include a list of these individuals in your Personnel Plan if this is the case. Give a brief background on each main advisor that outlines the value they give, just like you would for your management team.

You don’t have to include your advisors if they don’t play essential roles or aren’t critical to your achievement. However, i nclude anyone who adds significant value to the organization through advice, contacts, or operational skills.

Explain the gaps

It’s normal for your team to have gaps, especially if you’re a startup . You may not yet have identified all of the “right” team members, or you may not yet have the cash to hire for critical roles. That’s OK.

The trick is to recognize that you do have gaps on your team—this is how you determine who to employ and when to hire them . Furthermore, it is far better to describe and recognize team deficiencies than to pretend that you have all of the critical responsibilities that you require. Explain where your organization is weak and how you intend to address the issue as you develop in your business strategy.

Although it may be tempting to conceal potential weaknesses from investors, they will see right through you. It is far preferable to be open and honest about where you have management gaps and your Personnel Strategy to remedy those gaps. You want them to know you’ve identified and planned for dangers.

You should also bear in mind that your Personnel Plan may wear many hats in the early days of a company, but specialization will occur as the company expands.

For example, the CEO may initially also be the VP of Sales. However, the job of VP of Sales should eventually be filled by a specialist to take on that task. Include modifications like these in your personnel plan to show investors that you understand how your company will expand and scale.

What are your personnel requirements?

Outline the company’s personnel requirements, including the number and types of people required to run the business successfully . The credentials and skills required for each post should also be included.

Here you may identify your team’s shortcomings and vulnerabilities , ensuring that you have a competent grasp of the roles and duties that will be crucial to the business in the future – even if they are not currently in existence. Investors are ready to highlight “perfect” people strategies, so you should embrace the fact that you have recognized staffing hazards.

For example, your head of customer service may also be your head of sales, but these two responsibilities will need to be split in the future.

How will recruitment and training be carried out?

This section should explain how the company intends to recruit and train personnel, including any training programs or on-the-job training.

What are the remuneration and benefits?

Outline the salary and benefits packages that will be provided to employees, including salaries, bonuses, health insurance, retirement plans, and any other perks or incentives.

Describe your Human Resources policies

Explain the company’s policies on topics such as employee performance reviews, disciplinary procedures, and termination procedures.

Estimate your personnel costs

Most Personnel Plans should include a personnel table to anticipate labor costs . Here are some expenses to keep in mind when forecasting.

Labor costs, both direct and indirect

You should include both direct expenses, which are often salary, and indirect expenses, which include:

- Paid vacation

- Insurance and healthcare

- Payroll expenses

As well as any extra fees you incur for each employee in addition to their compensation. Here’s an example of a personnel prediction:

Employee-related expenses and the burden rate

The indirect costs of staff are known by various names . Still, Innovature BPO will refer to it as a “burden rate” or “employee-related expenses”, as it is an expense in addition to direct wages and salary . Payroll taxes, worker’s compensation insurance, health insurance, and other benefits and taxes are common examples of these costs.

Don’t worry about calculating the correct burden rate for company planning objectives. Estimate it instead as a proportion of total monthly compensation. A range of 15% to 25% is normally appropriate, but it depends on the type of benefits you intend to provide.

Individuals and groups of individuals can both be listed in your Personnel Plan . You should certainly mention key people and other highly paid employees but put other departments or groups of people together. For example, you may include your management team but then group departments such as marketing, customer service, and manufacturing together.

Then factor in your employee costs for benefits and insurance. In the example personnel table above, this is referred to as “Employee-Related Expenses.”

The whole quantity of your salary and personnel load will then be included as an item in your profit and loss prediction. Assume you’re using HR management software to create a Personnel Prediction. This software explains where you’ll see personnel costs on your cash flow statement, profit and loss (income statement), and balance sheet.

Is it necessary to Personnel Plan in a company strategy if you have no employees?

Even if you don’t currently have any employees, having a Personnel Plan is useful to your firm in the long run.

You may find it difficult to scale your firm or respond to changes in your sector or market if you do not have a Personnel Plan . For example, if you need to hire someone immediately to fill a key function, you may not know where to begin or what qualifications to search for.

Developing a Personnel Plan can also assist you in clarifying your company’s aims and objectives. You can better prioritize and focus on the critical tasks that must be completed by establishing the roles and responsibilities required to fulfill those goals.

As a result, even if you don’t currently have any employees, it’s a good idea to build a Personnel Plan to help you prepare for future growth and ensure that you have the correct team in place to support your business objectives.

Is there an easy approach to forecasting a Personnel Plan?

Personnel Plan is a time-consuming process that necessitates careful consideration of what needs to happen in your company and where you want it to go. Typically, this necessitates a lengthy process of spreadsheets and mathematics to determine who needs to work with you and at what expense.

A financial modeling tool can ensure that this component of your business strategy, along with other critical components, is easily constructed, requiring only a few data entries to be entered throughout the software. Currently, on the market, there are quite a few tools to support Personnel plans and personnel management . Let’s enjoy!

Personnel Plan is an important aspect of the business planning process because it forces you to consider what needs to be done in your company and who will do it. Take the time to work through this section of your financial plan, and you’ll have a lot better idea of what it will take to make your firm a success.

- What is Financial Analysis of a company and Financial Analysis Outsourcing Process you need to know

- What is Financial Planning for a business, and how to outsource Financial Planning?

- Mastering the Income Statement: A Beginner’s Guide to Financial Analysis

- The Role of Balance Sheet in Financial Analysis: Why It Matters

- Comparing the Financial Statements: Income Statement vs Balance Sheet

- A Beginner’s Guide to Cash Flow Statement: Examples and Explanation

- Understanding the Statement of Shareholder Equity: Key Concepts and Examples

- Risk Mitigation: Preparing for the Unexpected

- From Data to Insights: How to Build Accurate Sales Forecasts

- How Innovation Tools Change Financial Modeling for Strategic Success?

Are you ready to take your business to the next level?

- AWARDS & CERTIFICATES

- OUR SERVICES

- +84 28 2221 5580

- +1 201 862 8668

- +84 91 870 5429

- [email protected]

- Ree Tower, 9 Doan Van Bo, District 4, HCMC, Vietnam

- 15R, Avenir Building, Archbishop Reyes Ave Lahug, Cebu City, Philippines

- 5900 Balcones Drive #10422 Austin, Texas 78731

© Copyright by INNOVATURE BPO | All Rights Reserved.

Limited Time Offer:

Save Up to 25% on LivePlan today

0 results have been found for “”

Return to blog home

How to Create an Investor-Ready Personnel Plan and Forecast Employee Costs

Posted march 22, 2021 by noah parsons.

A personnel plan is a critical part of your business plan and financial forecast . In addition to helping you budget for current and future employees, your personnel plan enables you to think through who you should hire and when you should hire them.

If you’re pitching to angel investors or venture capitalists for funding, they will want to see why your team is uniquely suited to grow and scale your business, as well as your hiring plan.

Investors will want to know:

- What positions do you need to fill?

- When you plan on filling them?

- How much it’s going to cost to build the team you need??

What to include in the personnel section of your business plan

For many startups and small businesses, the people who do the work—your team—are both the most costly and most valuable asset. It makes sense that hiring the right person at the right time can have a significant impact on your ability to meet your company’s milestones and goals , not to mention your cash flow .

Thinking strategically about human resources — when to add positions, compensation levels, and whether to hire full-time or on a contract basis are all pieces of a healthy personnel plan.

So, whether you’re seeking investment or not, building a personnel plan and forecast is an essential part of business planning and strategic planning for the long-term viability of your company. Let’s dive right in and look at the five key steps to build an investor-ready personnel plan.

1. Describe your team

In the “team” section of your business plan, you will typically include an overview of the key positions in your company and the background of the people who will be in those critical roles. Usually, you’ll highlight each of the management positions in your company and then speak more generally about other departments and teams.

You don’t need to include full resumes for each team member—a quick summary of why each person is qualified to do the job is enough. Describe each person’s skills and experience and what they will be doing for the company.

Emphasize your team’s strengths. How do they make your team stronger? What specific expertise and experience do they have in your (or a related) industry? Assuming your market research identified a great opportunity, why are you the right team to capitalize on it?

For potential investors, this section helps qualify why each team member is necessary for the success of the business. It acts as a justification for their salary and equity share if they are part owners of the company.

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

2. Describe your organizational structure

The organizational structure of your company is frequently represented as an “org chart” that shows who reports to whom and who is responsible for what.

You don’t have to create a visual org chart, though—describing your organization in the text is just fine. Just make sure to show that you have a clear structure for your company.

Is authority adequately distributed among the team? Do you have the resources to get everything done that you need to grow your company?

You’ll also want to mention the various teams your company is going to have in the future. These might include sales, customer service, product development, marketing, manufacturing, and so on.

You don’t need to plan on hiring all of these people right away. Think of this section as an outline of what you plan to do in the future with your company.

3. Explain the gaps

It’s alright to have gaps on your team, especially if you’re a startup. You may not have identified all the “right” team members yet, or you may not have the funds available yet to hire for essential roles . That’s okay.

The key is to know that you do have gaps on your team—this is how you figure out who you need to hire and when you need to hire them. Also, it’s much better to define and identify weaknesses in your team than to pretend that you have all the key roles that you need. In your business plan , explain where your organization is weak and what your plans are to correct the problem as you grow.

It might be tempting to hide your potential weaknesses from investors, but they’ll see through that right away. It’s much better to be open and honest about where you have management gaps and your plans to solve those problems. You want them to know you have identified and made plans to mitigate risks .

You also need to keep in mind that employees might wear a lot of hats in the early days of a company, but that specialization will happen as the company grows.

For example, initially, the CEO might also be the VP of Sales. But, eventually, the VP of Sales role should be filled by a specialist to take on that responsibility. Include these types of changes in your personnel plan to explain to investors that you understand how your company is going to grow and scale.

4. List your advisors, consultants, and board members

For some companies, external advisors, board members , and even consultants can play a crucial role in setting business strategy. These people might even fill key positions temporarily as your company grows. If this is the case, you’ll want to list these people in your business plan. Like your management team, provide a brief background on each principal advisor that explains the value they provide.

If your advisors don’t hold key roles or are not critical to your success, you don’t necessarily have to list them. But, do list anyone that is adding substantial value to the company by providing advice, connections, or operational expertise.

5. Forecast your personnel costs

Most business plans should include a personnel table to forecast the expense of your employees. Here are the expenses you’ll need to be aware of when forecasting.

Direct and indirect labor expenses

You’ll want to include both direct expenses , which usually comprise salaries, as well as indirect expenses which include:

- Paid time off

- Healthcare and insurance

- Payroll costs

As well as any other costs you incur for each employee beyond their salary. Here’s an example of what a personnel forecast can look like using LivePlan .

Burden rate and employee-related expenses

There are different names for the indirect expenses of personnel. Still, I like to call it “burden rate” or “employee-related expenses,” which is an expense over and above the direct wages and salaries. These expenses typically include payroll taxes, worker’s compensation insurance, health insurance, and other benefits and taxes.

For business planning purposes, don’t stress about coming up with the exact figure for the burden rate. Instead, estimate it using a percentage of total monthly salaries. Somewhere between 15 percent and 25 percent usually makes sense, but it depends on what kind of benefits you plan on offering.

In your personnel plan, you can list both individual people as well as groups of people. You’ll probably want to list out key people and other highly paid employees, but group together other departments or groups of people. For example, you might list out your management team, but then group together departments like Marketing, Customer Service, and Manufacturing.

Then, add in your personnel burden to cover benefits and insurance. In the example personnel table above, this is called “Employee-Related Expenses.”

You’ll then take the total number of your salaries plus personnel burden and include this in your profit and loss forecast as an expense. Suppose you’re using LivePlan to build your personnel forecast. In that case, this how-to article on entering personnel shows where you’ll see personnel costs appear on your cash flow statement, profit and loss (income statement), and your balance sheet.

Do you need a personnel plan if you have no employees?

If you are a sole proprietor and don’t have employees, you should still include your own salary as part of the business plan. Make sure to include your salary as an expense in your Profit & Loss Statement . Even if you, the business owner, don’t take the salary, so you can keep the cash in your business, you’ll want to record what you should have been paid.

In the case of a sole proprietor, you probably don’t need a full table for the personnel plan, like in the example above. But, when you do start planning to hire a team, you should use the format I’ve described here.

Personnel planning is a valuable part of the business planning process because it forces you to think about what needs to get done in your business and who’s going to do it. Take the time to work through this part of your financial forecast, and you’ll have a much better sense of what it’s going to take to make your business successful.

*Editors Note: This article was initially written in 2019 and updated for 2021.

Like this post? Share with a friend!

Noah Parsons

Posted in business plan writing, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

- Business Planning

- Cash Flow Forecasting

- Scenario Planning

- Financial Reporting

- Financial Planning & Analysis

- For Enterprises

- For Franchises

- Case Studies

- Partnerships

- Software Integrations

- Templates & Downloads

How to Create a Personnel Plan for Investors

What is a personnel plan?

A personnel plan is a document that outlines an organization’s staffing needs, goals, and strategies for managing its workforce.

It is a key component of human resource management and provides a roadmap for the recruitment, selection, training, development, retention, and management of employees.

A personnel plan is critical within the business plan you would have created as a start-up or entrepreneur. It will help you in your financial forecasting, anticipating the right times to hire and expand.

What to include in the personnel section of your business plan

The personnel section of a business plan should include information about the management team and staff that will be involved in operating the business. The people who do the work are the most important asset, which of course comes with a cost. Understanding when to hire, when to think about human resources, and when to grow your business at the right time can be enormously important in meeting business objectives, setting yourself up for success with great personal benchmarks.

Building out a personnel plan within your business plan is going to be essential in planning for the long term success of your business. Forecasting this data can be the best way to ensure longevity.

Who is your management team?

This should include a brief introduction to the key members of the management team, including their backgrounds, experience, and relevant skills. It’s important to highlight their qualifications and how they will contribute to the success of the business.

This can be brief and doesn’t require a full resume for each member of the team. A simple explanation detailing qualifications and relevant experience applicable within the company is all that’s required.

What is the organizational structure?

This section should provide an overview of the organizational structure of the company, including who will be in charge of each department or functional area, as well as any outside consultants or advisors who will be involved.

In line with forecasting, you will want to illustrate the future of your company and who will be included. As you develop, you can anticipate your team growing from a just few employees into staff across multiple sectors, such as customer service, marketing, and support.

What are your staffing needs?

Outline the staffing needs of the business, including the number and types of employees needed to run the business successfully. This should also include the qualifications and skills required for each position.

Here you can identify the weaknesses and risks across your team, ensuring that you have a capable understanding of the roles and responsibilities that are important to the business in the future – though they may not be in place right now. Investors are quick to highlight “perfect” personnel plans, so you will want to embrace that you have identified risks in staffing.

As an example, your head of customer support may also be your head of sales, but in time these two roles will need to be separated.

What will recruitment and training look like?

This section should detail how the company plans to recruit and train employees, including any training programs or on-the-job training that will be provided.

What will the compensations and benefits be?

Outline the compensation and benefits packages that will be offered to employees, including salaries, bonuses, health benefits, retirement plans, and any other perks or incentives.

Outline the Human Resources policies

Detail the company’s policies on issues such as employee performance reviews , disciplinary procedures, and termination policies.

Does a business plan need personnel planning if I have no staff?

Even if you don’t have any employees right now, having a personnel plan is beneficial for your business in the long term.

Without a personnel plan, you may find it challenging to scale your business or adapt to changes in your industry or market. For example, if you suddenly need to hire someone to fill a critical role, you may not know where to start or what qualifications you should look for.

Creating a personnel plan can also help you to clarify your business goals and objectives. By determining the roles and responsibilities required to meet those goals, you can better prioritize and focus on the essential tasks that need to be done.

Therefore, even if you don’t have any employees currently, it’s still a good idea to develop a personnel plan to help you prepare for future growth and ensure that you have the right team in place to support your business objectives.

Is there an easy way to forecast a personnel plan?

Personnel planning is a long process as it requires dedicated thought as to what needs to happen in your business and where you want to take it. Typically, this require a lengthy process of spreadsheets and equations to figure out exactly who needs to be working with you, and at what cost.

Business planning software can ensure that this part of your business plan, alongside other key components, is created with ease – simply needing a few data entries to be entered throughout the software.

Related articles

- SWOT Analysis For Startups

- How to Start Your Business Plan Online for Free

- A quick guide to setting up and running your business

- How to easily forecast your startup’s cash flow

Get started with Brixx

The Secrets of a Great Personnel Plan

Investing in human resources (HR) is a key element of healthy personnel planning and strategy. A hallmark of effective leadership is efficient HR which means hiring employees in a cost-effective manner and mostly when needed. Your business plan should always include an informative and up-to-date personnel plan section to provide direction for the company and help entrepreneurs stay focused.

At the heart of every business owner is the desire to excel. The best way to excel is to define your plans and proceed with purpose. Your business plan comprises a business description , a competition analysis, a marketing plan, a personnel section, the HR section and key financial information.

The personnel plan is designed to help company owners put their plans into action. It helps to clarify objectives for the current and forthcoming year. Thus, a good understanding of personnel plan and how to implement it in your business is vital.

What is a personnel plan?

A personnel plan is a vital part of every company plan and financial forecast, which aids future and current budgeting and defines the type of employee to hire and when to hire such employees.

When you are seeking funding, venture capitalists and angel investors will want a breakdown of your team. Who are they? What talents and skills do they bring to the table? What is your hiring plan for the first year, second year, and so on? How will your team drive business growth and success?

All this information will include the positions you will need employees for, the period in which the management intends to fill the plan, and the financial implications of the implementation of the plan. Just as you would assess if your business is financially feasible , you’ll need to apply this same sentiment when hiring employees.

The personnel plan represents a consolidated strategy for hiring the best people for all company positions, while keeping an eye on future expansion.

Michael E. Gerber, the author of The E-Myth Revisited, posited that an effective personnel plan designed as an efficient workplace game will help employers prime employees for organizational goals while creating job satisfaction. This means that an effective hiring process is vital to an efficient process of personnel planning.

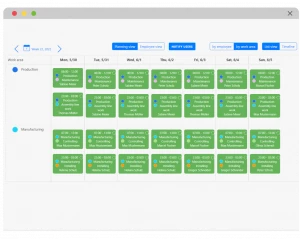

The majority of employers find personnel planning difficult especially those whose staff work in shifts. Organizational challenges like these can easily be taken care of with TimeTrack Duty Roster which helps employers create a suitable overview of their workforce and personalize shifts according to any number of criteria, including their location and skills.

Features of the TimeTrack Duty Roster

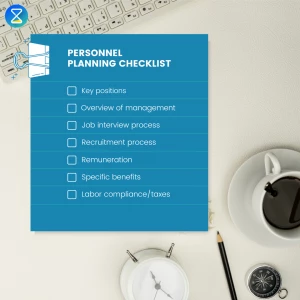

Key elements of a personnel plan

Each company’s needs may differ, but in general, these are common elements that should form part of every personnel plan.

Job description

- Clearly explained requirements of the various job functions. Use easy-to-understand language and phrases.

Organizational chart and type of hiring

- The chart of the organization should show who works for whom and provide a good overview of the overall management and employee structure of the company.

- The plan should be clear on whether employees are independent contractors or receive salaries. This is essential for labor compliance issues and the workers’ tax.

Remuneration (salary amount and assumptions)

- Details of hourly or yearly payments are defined, including relevant assumptions that comprise estimates of salary increases over time. You also need to account for company benefits, including health insurance. This may be a percentage of salary costs employers pay to staff.

Time of recruitment

- The hiring of employees is often done over time and staggered. Thus, your plan must include details about when an employee will start and the end date for temporary staff.

Incorporate key personnel into the business plan

Employees are the most valuable assets any company can have. This means that hiring the right person should always be a key priority for every company. Your staff will have a significant impact on revenue, customer experience/satisfaction and the success of the company.

Incorporating the personnel section into your business plan is an important part of strategic planning for long-term viability. The information below serves as guide on how to implement a personnel plan in your business.

Team dynamics

This presents an overview of all the key positions in your business and the backgrounds of staff in their critical roles and departments. Add the total number of staff and their experiences. Emphasize the strengths of individuals and how to upskill where necessary. A great team is typically the fulcrum of business success because they have the responsibility of and possess the ability to translate policies into business success.

Organizational structure

The structure of your company is represented in the company’s organizational chart, which shows the hierarchy of duties and management. Is authority finely distributed and are the various company teams properly mentioned? This includes customer service, product development, marketing, manufacturing and sales.

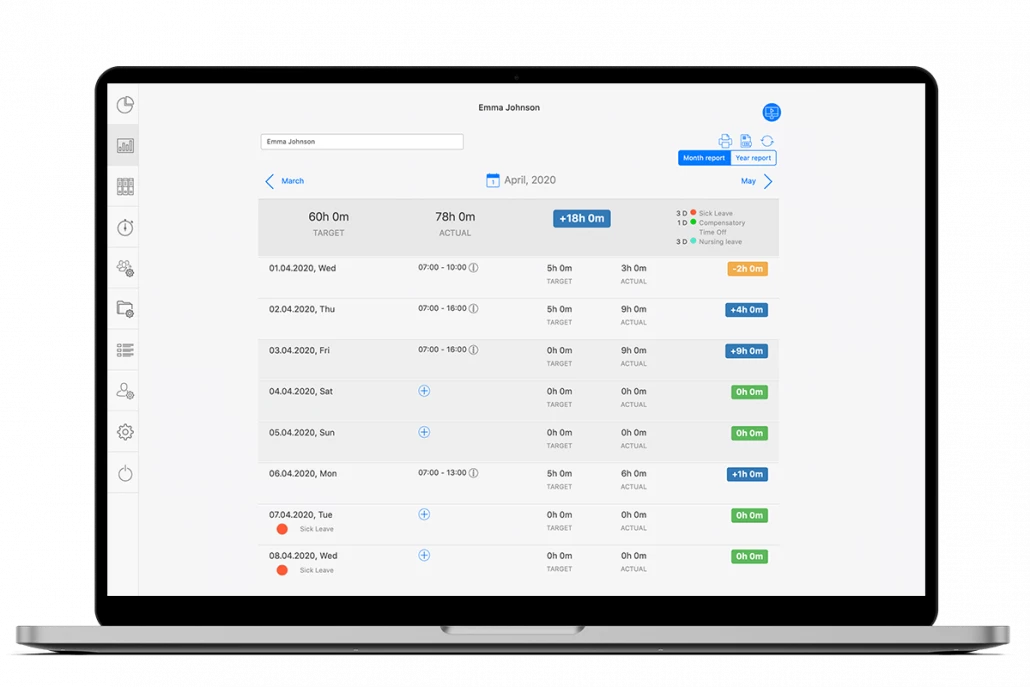

When planning the company’s organizational details, you will need a strategy to manage absences and leave. TimeTrack Leave Management feature helps you to finetune these details so you can easily (and quickly!) oversee employee absences, vacation time and keep track of working hours for compliance management.

TimeTrack Leave Management

Gaps and stumbling blocks

While it may be difficult to identify gaps in your team, chances are that if you look closely, you will observe a section of your company in need of quality talent. You need to figure out how to fill this gap. Don’t hide the weakness of your team from potential investors. Always remember that specialization will evolve as the company grows.

Where advisors, board members and consultants are applicable to your company, list them. Where they will fill key positions as the business grows, you need to list them and provide background on the value they provide.

The fine print

Every personnel plan needs to include a section addressing employment benefits , rights and conditions, especially for managers. Design your company’s management personnel plan and include a table of staff expenses, including both direct and indirect labor expenses, a burden rate and employee-related expenses, while adding payroll tax, workers’ compensation, salaries and health insurance.

Checklist for personnel planning

Personnel improvement

Improving conditions for personnel involve the identification of gaps, developing and implementing action plans and taking follow-up actions. Managers should develop a performance improvement plan before taking disciplinary action against employees.

Identify skills or performance gaps

A gap analysis is designed to help you identify potential and current issues and is an essential part of the personnel process. Incorporate characteristics of human resource planning into your business planning.

Provide proof of a skills gap or underperformance of the workforce using a consistent format across all employment cadres. Design your format, including employee information and a description of performance discrepancies using expected and actual performance criteria.

Have a face-to-face meeting with your employees to share observed issues or concerns and gain insights into causal factors of underperformance. Use your documentation to share insights on performance challenges. Let the affected employees know they have committed specific policy infractions. Focus only on the outcomes of behaviors to help affected staff understand how their behaviors affect company success.

Develop action plans

Establish specific and measurable improvement goals for your workforce. Avoid generalizations and focus on key goals. Setting bit-sized goals is an effective way of working while monitoring task on time .

Provide detailed resources, including advanced tools that can help employees improve. This also means providing the management with essential tools that will help with the efficient oversight of the workforce.

Create a timeline for achieving performance improvement goals. This will help keep the staff on track towards achieving expectations. Don’t forget to identify metrics for measuring progress. Be specific about what you want employees to achieve and define the intended consequences in the event of failure to complete performance improvement plan. Be specific about actions you will take whether or not targets are met.

Schedule regular appointments to review the performance improvement plan with your employees and implement their feedback.

Incorporating a personnel plan into your business strategy is a key factor for efficient planning. To maximize the opportunity presented by personnel planning, use any of the effective and reliable TimeTrack planning and absence management software tools.

I am a researcher, writer, and self-published author. Over the last 9 years, I have dedicated my time to delivering unique content to startups and non-governmental organizations and have covered several topics, including wellness, technology, and entrepreneurship. I am now passionate about how time efficiency affects productivity, business performance, and profitability.

Time Tracking

- Absence Management Software

- Clock In System

- Time Attendance System

- Auto Scheduling

- Duty Roster

- Shift Planning

- Appointment Planning

- Task Planning

- Info Center

- Timesheet Templates

- Rota Templates

- Promotional Program

- Affiliate Program

- Success Stories

How to Write the Management Team Section of a Business Plan + Examples

Written by Dave Lavinsky

Over the last 20+ years, we’ve written business plans for over 4,000 companies and hundreds of thousands of others have used the best business plan template and our other business planning materials.

From this vast experience, we’ve gained valuable insights on how to write a business plan effectively , specifically in the management section.

What is a Management Team Business Plan?

A management team business plan is a section in a comprehensive business plan that introduces and highlights the key members of the company’s management team. This part provides essential details about the individuals responsible for leading and running the business, including their backgrounds, skills, and experience.

It’s crucial for potential investors and stakeholders to evaluate the management team’s competence and qualifications, as a strong team can instill confidence in the company’s ability to succeed.

Why is the Management Team Section of a Business Plan Important?

Your management team plan has 3 goals:

- To prove to you that you have the right team to execute on the opportunity you have defined, and if not, to identify who you must hire to round out your current team

- To convince lenders and investors (e.g., angel investors, venture capitalists) to fund your company (if needed)

- To document how your Board (if applicable) can best help your team succeed

What to Include in Your Management Team Section

There are two key elements to include in your management team business plan as follows:

Management Team Members

For each key member of your team, document their name, title, and background.

Their backgrounds are most important in telling you and investors they are qualified to execute. Describe what positions each member has held in the past and what they accomplished in those positions. For example, if your VP of Sales was formerly the VP of Sales for another company in which they grew sales from zero to $10 million, that would be an important and compelling accomplishment to document.

Importantly, try to relate your team members’ past job experience with what you need them to accomplish at your company. For example, if a former high school principal was on your team, you could state that their vast experience working with both teenagers and their parents will help them succeed in their current position (particularly if the current position required them to work with both customer segments).

This is true for a management team for a small business, a medium-sized or large business.

Management Team Gaps

In this section, detail if your management team currently has any gaps or missing individuals. Not having a complete team at the time you develop your business plan. But, you must show your plan to complete your team.

As such, describe what positions are missing and who will fill the positions. For example, if you know you need to hire a VP of Marketing, state this. Further, state the job description of this person. For example, you might say that this hire will have 10 years of experience managing a marketing team, establishing new accounts, working with social media marketing, have startup experience, etc.

To give you a “checklist” of the employees you might want to include in your Management Team Members and/or Gaps sections, below are the most common management titles at a growing startup (note that many are specific to tech startups):

- Founder, CEO, and/or President

- Chief Operating Officer

- Chief Financial Officer

- VP of Sales

- VP of Marketing

- VP of Web Development and/or Engineering

- UX Designer/Manager

- Product Manager

- Digital Marketing Manager

- Business Development Manager

- Account Management/Customer Service Manager

- Sales Managers/Sales Staff

- Board Members

If you have a Board of Directors or Board of Advisors, you would include the bios of the members of your board in this section.

A Board of Directors is a paid group of individuals who help guide your company. Typically startups do not have such a board until they raise VC funding.

If your company is not at this stage, consider forming a Board of Advisors. Such a board is ideal particularly if your team is missing expertise and/or experience in certain areas. An advisory board includes 2 to 8 individuals who act as mentors to your business. Usually, you meet with them monthly or quarterly and they help answer questions and provide strategic guidance. You typically do not pay advisory board members with cash, but offering them options in your company is a best practice as it allows you to attract better board members and better motivate them.

Management Team Business Plan Example

Below are examples of how to include your management section in your business plan.

Key Team Members

Jim Smith, Founder & CEO

Jim has 15 years of experience in online software development, having co-founded two previous successful online businesses. His first company specialized in developing workflow automation software for government agencies and was sold to a public company in 2003. Jim’s second company developed a mobile app for parents to manage their children’s activities, which was sold to a large public company in 2014. Jim has a B.S. in computer science from MIT and an M.B.A from the University of Chicago

Bill Jones, COO

Bill has 20 years of sales and business development experience from working with several startups that he helped grow into large businesses. He has a B.S. in mechanical engineering from M.I.T., where he also played Division I lacrosse for four years.

We currently have no gaps in our management team, but we plan to expand our team by hiring a Vice President of Marketing to be responsible for all digital marketing efforts.

Vance Williamson, Founder & CEO

Prior to founding GoDoIt, Vance was the CIO of a major corporation with more than 100 retail locations. He oversaw all IT initiatives including software development, sales technology, mobile apps for customers and employees, security systems, customer databases/CRM platforms, etc. He has a B.S in computer science and an MBA in operations management from UCLA.

We currently have two gaps in our Management Team:

A VP of Sales with 10 years of experience managing sales teams, overseeing sales processes, working with manufacturers, establishing new accounts, working with digital marketing/advertising agencies to build brand awareness, etc.

In addition, we need to hire a VP of Marketing with experience creating online marketing campaigns that attract new customers to our site.

How to Finish Your Business Plan in 1 Day!

Don’t you wish there was a faster, easier way to finish your business plan?

With Growthink’s Ultimate Business Plan Template you can finish your plan in just 8 hours or less!

Click here to finish your business plan today.

OR, Let Us Develop Your Plan For You

Since 1999, Growthink has developed business plans for thousands of companies who have gone on to achieve tremendous success.

Click here to see how Growthink’s professional business plan consulting services can create your business plan for you.

Other Resources for Writing Your Business Plan

- How to Write an Executive Summary

- How to Expertly Write the Company Description in Your Business Plan

- How to Write the Market Analysis Section of a Business Plan

- The Customer Analysis Section of Your Business Plan

- Completing the Competitive Analysis Section of Your Business Plan

- Financial Assumptions and Your Business Plan

- How to Create Financial Projections for Your Business Plan

- Everything You Need to Know about the Business Plan Appendix

- Business Plan Conclusion: Summary & Recap

Other Helpful Business Plan Articles & Templates

How Do You Draft the Personnel Section of the Business Plan? The Personnel Section of a Business Plan Explained.

One of the key sections of a Business Plan is the section that describes the plan to grow or scale the business. This often involves hiring staff and staff often represent the single largest ongoing expense that a company will have. As such, it is important to plan exactly who will be hired, how much they will be paid and when staff will join the team.

What Should a Personnel Plan Look Like?

The personnel section of a Business Plan should contain the following components.

- Job Descriptions – The job descriptions should provide the reader with enough detail so that they understand the job function of prospective hires

- Organizational Chart – An organizational chart show who will work for who and allows a reader to get an overview of the overall management and staffing structure of the company.

- Type of Hire – Staff can either be salaried employees or independent contractors. It is important to distinguish between these two types of workers for tax and other labor compliance issues.

- Salary Amount – Details of either yearly or hourly pay should be included.

- Salary Assumptions – common assumptions include an estimate of raises over time (eg. 5%) and a burden rate assigned to cover company benefits like health insurance (eg. 20% of salary costs)

- When Hires Will Take Place – Staff are usually hired over a period of time and staggered. As such, it is helpful to include detail surrounding when a particular employee will start. If you will have temporary staff of contractors, you should also specify when the employment will end.

What Do the Numbers Look Like?

The sample chart below is an example of the financial section of a business plan. It is for illustrative purposes only and each plan is unique and requires tailoring to meet the specific needs of the company.

| FY2015 | FY2016 | FY2017 | FY2018 | FY2019 | |

| Coder | $0 | $48,000 | $50,400 | $52,920 | $55,572 |

| Sales – 2 Sales Staff | $0 | $48,000 | $50,400 | $52,920 | $55,566 |

| Sales Manager | $0 | $0 | $24,000 | $25,200 | $26,460 |

| Marketing Head | $0 | $0 | $0 | $24,000 | $25,200 |

| Distribution Manager | $0 | $0 | $0 | $0 | $24,000 |

| Founder 1 – Founder Founder | $91,667 | $105,000 | $110,250 | $115,763 | $121,551 |

| Founder 2 | $0 | $100,000 | $105,000 | $110,250 | $115,763 |

| Founder 3 | $0 | $100,000 | $105,000 | $110,250 | $115,763 |

| Total | $91,667 | $401,000 | $445,050 | $491,303 | $539,875 |

What Should the Explanation of a Personnel Plan Look Like?

The detail below is a summary of some of the possible explanation that could be included in a Personnel Plan for the above data. The description is an excerpt of possible language that could be used.

The company will start out utilizing the three founders and salaries have been allocated for each founder at $100,000 per year. Founder 1 will start taking a salary in FY2015 while the other two founders will start taking a salary in FY2016. Founders will also take dividends as issued by the Board of Directors.

The budget contemplates hiring 2 employees in the sales area in fiscal 2016 and one software engineer . Until that time, one of the founders who specializes in application development (Hellen Bussiere), will work on developing the tech side of the business. In addition, the plan includes hiring 1 sales person a year after that. Sales people will make approx.. $25,000 per year. In year 4, the application will be completed and we will hire a marketing head to promote the product. The marketing head will make $24,000 a year and will be a part time position. In year 5, a distribution manager will be hired and he/she will also be part time and make $24,000 per year.

Full job descriptions are included in Section A.2 of the plan.

The total number of employees at the end of year 5 is 9 people (including the founders). This is a modest estimate and may increase significantly if more users sign up.

All salaries include a raise estimated at 5% per year. 20% of salary costs have been included for benefits such as health care and 401K matching.

Scott Legal, P.C. regularly prepares business plans for E-2 visas , L-1 Visas and EB-5 visas . We welcome the opportunity to assist you.

To find out more about business plan drafting, click here .

FREE Visa Resources

Click on the buttons below in order to claim your free Visa Guide ( E-1, E-2, TN, EB-5, H-1B, L-1, PERM, NIW, EB-1, O-1, E-3 ), sign up for our free Webinar , join our Facebook Group , or watch our videos .

Set up a Visa or Green Card Consultation

For a dedicated one-on-one consultation with one of our lawyers, click on the button below to schedule your consultation.

This website and blog constitutes attorney advertising. Do not consider anything in this website or blog legal advice and nothing in this website constitutes an attorney-client relationship being formed. Set up a one-hour consultation with us before acting on anything you read here. Past results are no guarantee of future results and prior results do not imply or predict future results. Each case is different and must be judged on its own merits.

About The Blog

Scott Legal, P.C. keeps up to date on the issues related to the practice areas we specialize in. We also regularly publish articles in this blog so that we can share that information with you. Please feel free to contact us and ask us any questions you have about our posts. Also, please feel free to comment in the comment section and/or share the posts with friends and family on Facebook, Twitter and Linkedin.

Search Articles by Topic

- Business Entity Set-Up 11

- Raising Capital in the U.S. 6

- Business Plans 11

- COVID-19 152

- Immigration Law Changes & New Law 91

- White House & President Immigration News 19

- Questions & Answers 70

- Uncategorized 23

- Approvals 886

- Canadian Immigration 32

- Deportation & Humanitarian Immigration 194

- E-1 Visa 69

- E-2 Visa 349

- EB-5 Visa 113

- Extraordinary Ability 75

- Family Immigration 161

- H-1B and E-3 Visa 230

- Immigration Litigation 5

- International Entrepreneur Rule 11

- Investor Visas 262

- L-1 Visa 100

- National Interest Waiver 131

- Spanish Articles 14

- Visa Waivers 9

Similar Posts

Do i need a business plan for a national interest waiver, what makes a good e-2 business plan considerations for immigration business plans, do i need a business plan for an e-1 visa if an e-1 business plan is not required, why should i submit one should i prepare and e-1 business plan, leave a reply cancel reply.

You must be logged in to post a comment.

Copyright © 2023 Scott Legal, P.C. Immigration and Business Law Counsel for Investors & Entrepreneurs | 2 Park Avenue, Floor 20, NY, NY 10016 | (212) 223-2964 Attorney Advertising | Disclaimer | Terms of Use & Privacy Policy

- Our Approvals and Wins

- Why Choose Us

- International Entrepreneur Rule

- E-2 Investor Visa

- E-1 Trader Visa

- EB-5 Investor

- National Interest Waiver EB-2

- B-1 Business Visa

- Waiver – Green Cards

- Waivers – Visa

- Green Card Through Family

- Removal and Deportation Defense

- Asylum & Refugee Relief

- Citizenship & Naturalization

- Immigration Litigation

- Business Plan Drafting

- Entrepreneurial

- New Business Entity Set Up

- Business Litigation Support

- Schedule A Consultation

Privacy Overview

- Search Search Please fill out this field.

- Building Your Business

- Becoming an Owner

- Business Plans

How To Write the Management Section of a Business Plan

Susan Ward wrote about small businesses for The Balance for 18 years. She has run an IT consulting firm and designed and presented courses on how to promote small businesses.

:max_bytes(150000):strip_icc():format(webp)/SusanWardLaptop2crop1-57aa62eb5f9b58974a12bac9.jpg)

Ownership Structure

Internal management team, external management resources, human resources, frequently asked questions (faqs).

When developing a business plan , the 'management section' describes your management team, staff, resources, and how your business ownership is structured. This section should not only describe who's on your management team but how each person's skill set will contribute to your bottom line. In this article, we will detail exactly how to compose and best highlight your management team.

Key Takeaways

- The management section of a business plan helps show how your management team and company are structured.

- The first section shows the ownership structure, which might be a sole proprietorship, partnership, or corporation.

- The internal management section shows the department heads, including sales, marketing, administration, and production.

- The external management resources help back up your internal management and include an advisory board and consultants.

- The human resources section contains staffing requirements—part-time or full-time—skills needed for employees and the costs.

This section outlines the legal structure of your business. It may only be a single sentence if your business is a sole proprietorship. If your business is a partnership or a corporation, it can be longer. You want to be sure you explain who holds what percentage of ownership in the company.

The internal management section should describe the business management categories relevant to your business, identify who will have responsibility for each category, and then include a short profile highlighting each person's skills.

The primary business categories of sales, marketing , administration, and production usually work for many small businesses. If your business has employees, you will also need a human resources section. You may also find that your company needs additional management categories to fit your unique circumstances.

It's not necessary to have a different person in charge of each category; some key management people often fill more than one role. Identify the key managers in your business and explain what functions and experience each team member will serve. You may wish to present this as an organizational chart in your business plan, although the list format is also appropriate.

Along with this section, you should include the complete resumés of each management team member (including your own). Follow this with an explanation of how each member will be compensated and their benefits package, and describe any profit-sharing plans that may apply.

If there are any contracts that relate directly to your management team members, such as work contracts or non-competition agreements, you should include them in an Appendix to your business plan.

While external management resources are often overlooked when writing a business plan , using these resources effectively can make the difference between the success or failure of your managers. Think of these external resources as your internal management team's backup. They give your business credibility and an additional pool of expertise.

Advisory Board

An Advisory Board can increase consumer and investor confidence, attract talented employees by showing a commitment to company growth and bring a diversity of contributions. If you choose to have an Advisory Board , list all the board members in this section, and include a bio and all relevant specializations. If you choose your board members carefully, the group can compensate for the niche forms of expertise that your internal managers lack.

When selecting your board members, look for people who are genuinely interested in seeing your business do well and have the patience and time to provide sound advice.

Recently retired executives or managers, other successful entrepreneurs, and/or vendors would be good choices for an Advisory Board.

Professional Services

Professional Services should also be highlighted in the external management resources section. Describe all the external professional advisors that your business will use, such as accountants, bankers, lawyers, IT consultants, business consultants, and/or business coaches. These professionals provide a web of advice and support outside your internal management team that can be invaluable in making management decisions and your new business a success .

The last point you should address in the management section of your business plan is your human resources needs. The trick to writing about human resources is to be specific. To simply write, "We'll need more people once we get up and running," isn't sufficient. Follow this list:

- Detail how many employees your business will need at each stage and what they will cost.

- Describe exactly how your business's human resources needs can be met. Will it be best to have employees, or should you operate with contract workers or freelancers ? Do you need full-time or part-time staff or a mix of both?

- Outline your staffing requirements, including a description of the specific skills that the people working for you will need to possess.

- Calculate your labor costs. Decide the number of employees you will need and how many customers each employee can serve. For example, if it takes one employee to serve 150 customers, and you forecast 1,500 customers in your first year, your business will need 10 employees.

- Determine how much each employee will receive and total the salary cost for all your employees.

- Add to this the cost of Workers' Compensation Insurance (mandatory for most businesses) and the cost of any other employee benefits, such as company-sponsored medical and dental plans.

After you've listed the points above, describe how you will find the staff your business needs and how you will train them. Your description of staff recruitment should explain whether or not sufficient local labor is available and how you will recruit staff.

When you're writing about staff training, you'll want to include as many specifics as possible. What specific training will your staff undergo? What ongoing training opportunities will you provide your employees?

Even if the plan for your business is to start as a sole proprietorship, you should include a section on potential human resources demands as a way to demonstrate that you've thought about the staffing your business may require as it grows.

Business plans are about the future and the hypothetical challenges and successes that await. It's worth visualizing and documenting the details of your business so that the materials and network around your dream can begin to take shape.

What is the management section of a business plan?

The 'management section' describes your management team, staff, resources, and how your business ownership is structured.

What are the 5 sections of a business plan?

A business plan provides a road map showing your company's goals and how you'll achieve them. The five sections of a business plan are as follows:

- The market analysis outlines the demand for your product or service.

- The competitive analysis section shows your competition's strengths and weaknesses and your strategy for gaining market share.

- The management plan outlines your ownership structure, the management team, and staffing requirements.

- The operating plan details your business location and the facilities, equipment, and supplies needed to operate.

- The financial plan shows the map to financial success and the sources of funding, such as bank loans or investors.

SCORE. " Why Small Businesses Should Consider Workers’ Comp Insurance ."

Management Blog

Management practices based on the time span research of elliott jaques., how to write a personnel plan.

From the Ask Tom mailbag –

Question: As our company looks to its annual planning meeting, I have been asked to prepare a personnel plan for my department. I have never thought about it before. When we get busy, I hire someone.

Response: Many companies are faced with increasing volume, more revenue, more customers, more transactions, more inventory, in short, more work. And that’s the place to start. Define the work.

Start by defining the output, its quality standard, how much and where it ends up (the market).

- Steps required to create the output.

- Oversight required to implement the output, monitoring pace of output, quality of output, quantity of output related to target.

- Systems required to create consistency of output, predictability of output, to determine necessary resources. This would include not only the core systems (functions), but also the supporting systems (functions) necessary to create the output.

- Oversight required to implement all the systems together at the same time, optimized and integrated.

In the list above, I have described four different levels of work, each requiring a different level of problem solving and a different level of decision making.

Your department may only require three levels or two levels of work. It depends on your company business model, and whether your department is a core function in that business model, or a supporting function. Your personnel plan starts by defining the work.

Share this:

Leave a reply cancel reply.

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Notify me of follow-up comments by email.

Notify me of new posts by email.

This site uses Akismet to reduce spam. Learn how your comment data is processed .

How to Write a Business Plan: Step-by-Step Guide + Examples

Noah Parsons

24 min. read

Updated May 7, 2024

Writing a business plan doesn’t have to be complicated.

In this step-by-step guide, you’ll learn how to write a business plan that’s detailed enough to impress bankers and potential investors, while giving you the tools to start, run, and grow a successful business.

- The basics of business planning

If you’re reading this guide, then you already know why you need a business plan .

You understand that planning helps you:

- Raise money

- Grow strategically

- Keep your business on the right track

As you start to write your plan, it’s useful to zoom out and remember what a business plan is .

At its core, a business plan is an overview of the products and services you sell, and the customers that you sell to. It explains your business strategy: how you’re going to build and grow your business, what your marketing strategy is, and who your competitors are.

Most business plans also include financial forecasts for the future. These set sales goals, budget for expenses, and predict profits and cash flow.

A good business plan is much more than just a document that you write once and forget about. It’s also a guide that helps you outline and achieve your goals.

After completing your plan, you can use it as a management tool to track your progress toward your goals. Updating and adjusting your forecasts and budgets as you go is one of the most important steps you can take to run a healthier, smarter business.

We’ll dive into how to use your plan later in this article.

There are many different types of plans , but we’ll go over the most common type here, which includes everything you need for an investor-ready plan. However, if you’re just starting out and are looking for something simpler—I recommend starting with a one-page business plan . It’s faster and easier to create.

It’s also the perfect place to start if you’re just figuring out your idea, or need a simple strategic plan to use inside your business.

Dig deeper : How to write a one-page business plan

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- What to include in your business plan

Executive summary

The executive summary is an overview of your business and your plans. It comes first in your plan and is ideally just one to two pages. Most people write it last because it’s a summary of the complete business plan.

Ideally, the executive summary can act as a stand-alone document that covers the highlights of your detailed plan.

In fact, it’s common for investors to ask only for the executive summary when evaluating your business. If they like what they see in the executive summary, they’ll often follow up with a request for a complete plan, a pitch presentation , or more in-depth financial forecasts .

Your executive summary should include:

- A summary of the problem you are solving

- A description of your product or service

- An overview of your target market

- A brief description of your team

- A summary of your financials

- Your funding requirements (if you are raising money)

Dig Deeper: How to write an effective executive summary

Products and services description

This is where you describe exactly what you’re selling, and how it solves a problem for your target market. The best way to organize this part of your plan is to start by describing the problem that exists for your customers. After that, you can describe how you plan to solve that problem with your product or service.

This is usually called a problem and solution statement .

To truly showcase the value of your products and services, you need to craft a compelling narrative around your offerings. How will your product or service transform your customers’ lives or jobs? A strong narrative will draw in your readers.

This is also the part of the business plan to discuss any competitive advantages you may have, like specific intellectual property or patents that protect your product. If you have any initial sales, contracts, or other evidence that your product or service is likely to sell, include that information as well. It will show that your idea has traction , which can help convince readers that your plan has a high chance of success.

Market analysis

Your target market is a description of the type of people that you plan to sell to. You might even have multiple target markets, depending on your business.

A market analysis is the part of your plan where you bring together all of the information you know about your target market. Basically, it’s a thorough description of who your customers are and why they need what you’re selling. You’ll also include information about the growth of your market and your industry .

Try to be as specific as possible when you describe your market.

Include information such as age, income level, and location—these are what’s called “demographics.” If you can, also describe your market’s interests and habits as they relate to your business—these are “psychographics.”

Related: Target market examples

Essentially, you want to include any knowledge you have about your customers that is relevant to how your product or service is right for them. With a solid target market, it will be easier to create a sales and marketing plan that will reach your customers. That’s because you know who they are, what they like to do, and the best ways to reach them.

Next, provide any additional information you have about your market.

What is the size of your market ? Is the market growing or shrinking? Ideally, you’ll want to demonstrate that your market is growing over time, and also explain how your business is positioned to take advantage of any expected changes in your industry.

Dig Deeper: Learn how to write a market analysis

Competitive analysis

Part of defining your business opportunity is determining what your competitive advantage is. To do this effectively, you need to know as much about your competitors as your target customers.

Every business has some form of competition. If you don’t think you have competitors, then explore what alternatives there are in the market for your product or service.

For example: In the early years of cars, their main competition was horses. For social media, the early competition was reading books, watching TV, and talking on the phone.

A good competitive analysis fully lays out the competitive landscape and then explains how your business is different. Maybe your products are better made, or cheaper, or your customer service is superior. Maybe your competitive advantage is your location – a wide variety of factors can ultimately give you an advantage.

Dig Deeper: How to write a competitive analysis for your business plan

Marketing and sales plan

The marketing and sales plan covers how you will position your product or service in the market, the marketing channels and messaging you will use, and your sales tactics.

The best place to start with a marketing plan is with a positioning statement .

This explains how your business fits into the overall market, and how you will explain the advantages of your product or service to customers. You’ll use the information from your competitive analysis to help you with your positioning.

For example: You might position your company as the premium, most expensive but the highest quality option in the market. Or your positioning might focus on being locally owned and that shoppers support the local economy by buying your products.

Once you understand your positioning, you’ll bring this together with the information about your target market to create your marketing strategy .

This is how you plan to communicate your message to potential customers. Depending on who your customers are and how they purchase products like yours, you might use many different strategies, from social media advertising to creating a podcast. Your marketing plan is all about how your customers discover who you are and why they should consider your products and services.

While your marketing plan is about reaching your customers—your sales plan will describe the actual sales process once a customer has decided that they’re interested in what you have to offer.

If your business requires salespeople and a long sales process, describe that in this section. If your customers can “self-serve” and just make purchases quickly on your website, describe that process.

A good sales plan picks up where your marketing plan leaves off. The marketing plan brings customers in the door and the sales plan is how you close the deal.

Together, these specific plans paint a picture of how you will connect with your target audience, and how you will turn them into paying customers.

Dig deeper: What to include in your sales and marketing plan

Business operations

The operations section describes the necessary requirements for your business to run smoothly. It’s where you talk about how your business works and what day-to-day operations look like.

Depending on how your business is structured, your operations plan may include elements of the business like:

- Supply chain management

- Manufacturing processes

- Equipment and technology

- Distribution

Some businesses distribute their products and reach their customers through large retailers like Amazon.com, Walmart, Target, and grocery store chains.

These businesses should review how this part of their business works. The plan should discuss the logistics and costs of getting products onto store shelves and any potential hurdles the business may have to overcome.

If your business is much simpler than this, that’s OK. This section of your business plan can be either extremely short or more detailed, depending on the type of business you are building.

For businesses selling services, such as physical therapy or online software, you can use this section to describe the technology you’ll leverage, what goes into your service, and who you will partner with to deliver your services.

Dig Deeper: Learn how to write the operations chapter of your plan

Key milestones and metrics

Although it’s not required to complete your business plan, mapping out key business milestones and the metrics can be incredibly useful for measuring your success.

Good milestones clearly lay out the parameters of the task and set expectations for their execution. You’ll want to include:

- A description of each task

- The proposed due date

- Who is responsible for each task

If you have a budget, you can include projected costs to hit each milestone. You don’t need extensive project planning in this section—just list key milestones you want to hit and when you plan to hit them. This is your overall business roadmap.

Possible milestones might be:

- Website launch date

- Store or office opening date

- First significant sales

- Break even date

- Business licenses and approvals

You should also discuss the key numbers you will track to determine your success. Some common metrics worth tracking include:

- Conversion rates

- Customer acquisition costs

- Profit per customer

- Repeat purchases

It’s perfectly fine to start with just a few metrics and grow the number you are tracking over time. You also may find that some metrics simply aren’t relevant to your business and can narrow down what you’re tracking.

Dig Deeper: How to use milestones in your business plan

Organization and management team

Investors don’t just look for great ideas—they want to find great teams. Use this chapter to describe your current team and who you need to hire . You should also provide a quick overview of your location and history if you’re already up and running.

Briefly highlight the relevant experiences of each key team member in the company. It’s important to make the case for why yours is the right team to turn an idea into a reality.

Do they have the right industry experience and background? Have members of the team had entrepreneurial successes before?

If you still need to hire key team members, that’s OK. Just note those gaps in this section.

Your company overview should also include a summary of your company’s current business structure . The most common business structures include:

- Sole proprietor

- Partnership

Be sure to provide an overview of how the business is owned as well. Does each business partner own an equal portion of the business? How is ownership divided?

Potential lenders and investors will want to know the structure of the business before they will consider a loan or investment.

Dig Deeper: How to write about your company structure and team

Financial plan

Last, but certainly not least, is your financial plan chapter.

Entrepreneurs often find this section the most daunting. But, business financials for most startups are less complicated than you think, and a business degree is certainly not required to build a solid financial forecast.

A typical financial forecast in a business plan includes the following:

- Sales forecast : An estimate of the sales expected over a given period. You’ll break down your forecast into the key revenue streams that you expect to have.