- All Self-Study Programs

- Premium Package

- Basic Package

- Private Equity Masterclass

- VC Term Sheets & Cap Tables

- Sell-Side Equity Research (ERC © )

- Buy-Side Financial Modeling

- Real Estate Financial Modeling

- REIT Modeling

- FP&A Modeling (CFPAM ™ )

- Project Finance Modeling

- Bank & FIG Modeling

- Oil & Gas Modeling

- Biotech Sum of the Parts Valuation

- The Impact of Tax Reform on Financial Modeling

- Corporate Restructuring

- The 13-Week Cash Flow Model

- Accounting Crash Course

- Advanced Accounting

- Crash Course in Bonds

- Analyzing Financial Reports

- Interpreting Non-GAAP Reports

- Fixed Income Markets (FIMC © )

- Equities Markets Certification (EMC © )

- ESG Investing

- Excel Crash Course

- PowerPoint Crash Course

- Ultimate Excel VBA Course

- Investment Banking "Soft Skills"

- Networking & Behavioral Interview

- 1000 Investment Banking Interview Questions

- Virtual Boot Camps

- 1:1 Coaching

- Corporate Training

- University Training

- Free Content

- Support/Contact Us

- About Wall Street Prep

Capital Structure

Step-by-Step Guide to Understanding Capital Structure (Debt and Equity Mix)

Learn Online Now

What is Capital Structure?

The Capital Structure is the mixture of debt, preferred stock, and common equity used by a company to fund its operations and purchase assets.

Often referred to as the “capitalization”, the capital structure of a company is determined by management’s discretionary decisions pertaining to how to fund operations and the purchase of fixed assets, or capital expenditures (Capex).

- The capital structure refers to the percentage of common equity, preferred stock, and debt utilized by a corporation to finance its operating activities and acquire fixed assets (PP&E).

- The formula to calculate a company’s capital structure is: Common Equity Weight (%) + Debt Weight (%) + Preferred Stock Weight (%)

- In theory, the optimal capital structure balances the trade-off between the benefits of debt (“interest tax shield”) and the risk of insolvency, i.e. financial distress.

- The weighted average cost of capital (WACC) is minimized, while the implied firm valuation is maximized at the optimal capital structure.

Table of Contents

How Does the Capital Structure Work?

What are the full–form capital structure components, how to analyze capital structure (debt-equity mix), capital structure formula, what factors affect capital structure, how to optimize capital structure (debt–equity ratio), why does the capital structure matter, capital structure calculator, 1. capitalization assumptions, 2. capital structure example (all-equity firm), 3. capital structure example (50/50 debt to equity firm).

The capital structure is the allocation of debt, preferred stock , and common stock by a company used to finance working capital needs and acquire fixed assets (PP&E).

In short, the capital structure is the mixture of debt and equity that firms utilize to finance their near-term and long-term growth strategies.

For most companies that reach a certain size, raising outside capital is frequently a necessity to reach the next stage of growth and to continue their efforts to expand their operations.

Using the proceeds from debt and equity issuances, a company can finance operations, day-to-day working capital needs, capital expenditures ( Capex ), business acquisitions, and more.

Corporations can choose to raise outside capital in the form of either debt or equity.

- Debt → The capital borrowed from creditors as part of a contractual agreement, where the borrower agrees to pay interest and return the original principal on the date of maturity.

- Common Equity → The capital provided from investors in the company in exchange for partial ownership in future earnings and assets of the company.

- Preferred Stock → The capital provided by investors with priority over common equity but lower priority than all debt instruments, with features that blend debt and equity (i.e. “hybrid” securities).

Debt financing is generally perceived as a “cheaper” source of financing than equity, which can be attributed to taxes, among other factors. Unlike dividends , interest payments are tax-deductible, creating a so-called “interest tax shield” as a company’s taxable income (and the amount of taxes due) is lowered.

By opting to raise debt capital, existing shareholders’ control of the firm’s ownership is also protected, unless there is the option for the debt to be converted into equity (i.e. convertible debt).

The lower the percentage of total funding contributed by equity investors, the more credit risk that the lenders must bear – all else being equal.

If the return on investment (ROI) on the debt offsets (and earns more) than the cost of interest and principal repayment, then the company’s decision to risk the shareholders’ equity paid off.

The downside to debt, however, is the required interest expense on loans and bonds, as well as mandatory amortization payments on loans. The latter is far more common for senior debt lenders such as corporate banks, as these risk-averse lenders prioritizing capital preservation are likely to include such provisions in the agreement.

Senior debt is often called senior secured debt, as there can be covenants attached to the loan agreement – albeit restrictive covenants are no longer the norm in the current credit environment.

The formula to determine a company’s capital structure, expressed in percentage form, is as follows.

- Common Equity Weight (%) = Common Equity ÷ Total Capitalization

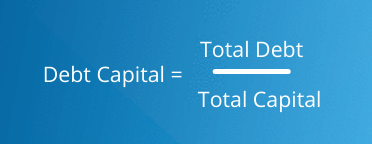

- Debt Weight (%) = Total Debt ÷ Total Capitalization

- Preferred Stock Weight (%) = Preferred Stock ÷ Total Capitalization

Combined, the resulting percentage contribution per capital source must equal 1.0, or 100%.

Early-stage companies rarely carry any debt on their balance sheet, as finding an interested lender is challenging given their risk profiles.

In contrast, if a borrower is a mature, established company with a track record of historical profitability and low cyclicality, lenders are far more likely to negotiate with them and offer favorable lending terms.

Consequently, a company’s stage in its life cycle, along with its cash flow profile to support the debt on its balance sheet, dictates the most suitable capital structure.

Established, mature companies are able to obtain debt at cheaper pricing rates, contrary to early-stage companies.

The corporate borrower must repay the remaining principal in full at the end of the debt’s maturity – in addition to the interest expense payments during the life of the loan.

The maturity date stated on a lending agreement illustrates how debt represents a finite financing source, unlike common equity, which is perpetual in theory.

If the company fails to repay the principal at maturity, the borrower is now in technical default because it has breached the contractual obligation to repay the lender on time.

Hence, companies with highly leveraged capital structures relative to their free cash flow profile (FCFs) can reasonably handle frequently end up becoming insolvent and filing for bankruptcy.

In such cases, the unsustainable capital structure makes financial restructuring necessary, where the debtor attempts to “right-size” its balance sheet by reducing the debt burden – as negotiated with creditors either out-of-court or in-court.

Most companies seek an “optimal” capital structure, in which the total valuation of the company is maximized while the cost of capital is minimized.

With that said, the objective of most companies is to balance the trade-offs among the benefits of debt (e.g. reduced taxes) and the risk of taking on too much leverage.

The required rate of return, or the cost of capital, is the minimum rate of return a company must earn to meet the hurdle rate of return demanded by the capital providers.

The cost of capital accounts for the weight of each funding source in the company’s total capitalization (and each component’s separate costs).

- Debt ➝ Cost of Debt (kd)

- Common Equity ➝ Cost of Equity (ke)

- Preferred Stock ➝ Cost of Preferred Stock (kp)

The expected future cash flows must be discounted using the proper discount rate – i.e. the cost of capital – for each source of capital.

In effect, the lower the cost of capital (i.e. the “blended” discount rate), the greater the present value (PV) of the firm’s future free cash flows will be.

Leverage ratios can measure a company’s level of reliance on debt to finance assets and determine if the operating cash flows of the company generated by its asset base are sufficient to service interest expense and other financial obligations.

- Debt to Assets Ratio = Total Debt ÷ Total Assets

- Debt to Equity Ratio (D/E) = Total Debt ÷ Total Equity

- Times Interest Earned (TIE) Ratio = EBIT ÷ Fixed Charges

- Fixed Charge Coverage Ratio = (EBIT + Leases) ÷ (Interest Expense Charges + Leases)

If debt begins to comprise a greater proportion of the capital structure, the weighted average cost of capital (WACC) initially declines due to the tax-deductibility of interest (i.e. the “interest tax shield”).

The cost of debt is lower than the cost of equity because of interest expense – i.e. the cost of borrowing debt – is tax-deductible, whereas dividends to shareholders are not.

The WACC continues to decrease until the optimal capital structure is reached, where the WACC is the lowest (and at this point, the firm is at “peak valuation”).

Beyond this threshold, the potential for financial distress offsets the tax benefits of leverage, causing the risk to all company stakeholders to rise.

Thus, debt issuances impact not only the cost of debt but also the cost of equity because the company’s credit risk increases as the debt burden increases – which is particularly concerning for equity holders, who are placed at the bottom of the capital structure.

Common equity represents the lowest priority claim under a liquidation scenario (and are the least likely to recover funds in the case of bankruptcy).

While shareholders are partial owners of the company, on paper, management has no obligation to issue them dividends, so share price appreciation can often be the only source of income.

However, the share price (and capital gain) upside belongs entirely to equity holders, whereas lenders receive only a fixed amount via interest and principal amortization .

We’ll now move to a modeling exercise, which you can access by filling out the form below.

Excel Template | File Download Form

By submitting this form, you consent to receive email from Wall Street Prep and agree to our terms of use and privacy policy.

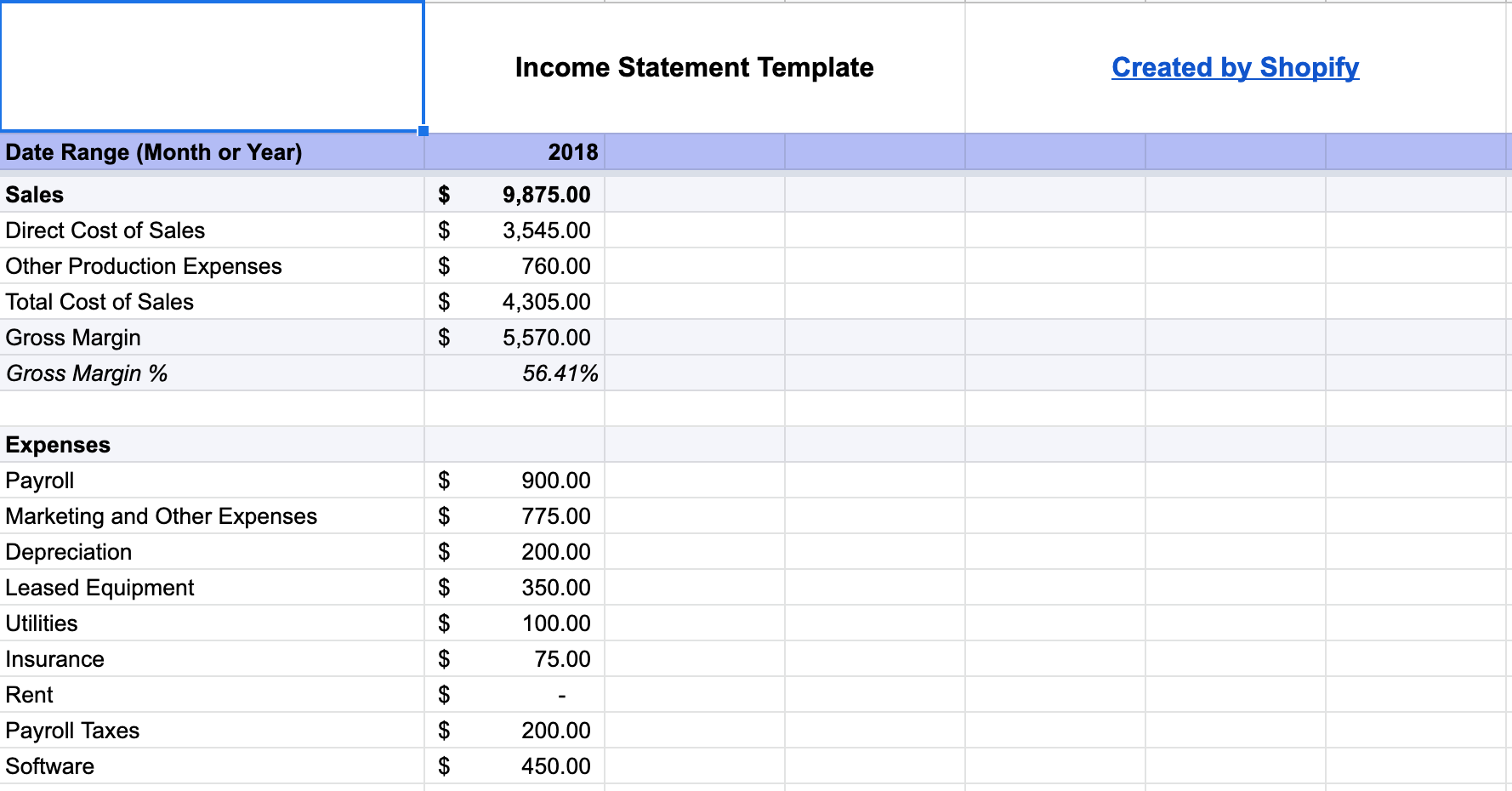

In our illustrative training tutorial in Excel, we’ll compare the same company under two different capital structures.

The company’s total capitalization in both cases is $1 billion, but the major distinction is where the funding came from.

- Scenario A → All-Equity Firm (No Debt)

- Scenario B → 50/50 Debt-to-Equity Firm

In Scenario A, the company is funded entirely by equity, whereas in the second scenario, the company’s funding is split equally between equity and debt.

We’ll assume the company’s EBIT is $200 million in both cases, the interest rate on debt is 6%, and the applicable tax rate is 25%.

- Operating Income (EBIT) = $200 million

- Interest Rate (%) = 6.0%

- Tax Rate (%) = 25.0%

The taxable income is equivalent to EBIT for the all-equity firm, since there is no tax-deductible interest.

Therefore, the tax expense is $50 million, which results in net income of $150 million.

Since there are no required payments to debt holders, all the net income could hypothetically be distributed to equity holders as dividends, share buybacks, or kept in retained earnings to reinvest in the company’s operations.

Next, for our company with the 50/50 capital structure, the interest expense comes out to $30 million, which directly reduces taxable income.

Given the 25% tax rate, the tax incurred is $7 million less than in the all-equity scenario, representing the interest tax shield .

In the final step, we can see that net income is lower for the company under the capital structure with debt.

Yet, the total distribution of funds is $8 million higher for the company with debt than the all-equity company because of the additional amount that flowed to debt holders rather than being taxed.

The capital structure should be adjusted to meet a company’s near-term and long-term objectives.

Therefore, the optimal capital structure fluctuates depending on a company’s life-cycle, free cash flow profile (FCF), and prevailing market conditions.

Everything You Need To Master Financial Modeling

Enroll in The Premium Package: Learn Financial Statement Modeling, DCF, M&A, LBO and Comps. The same training program used at top investment banks.

- Google+

- 100+ Excel Financial Modeling Shortcuts You Need to Know

- The Ultimate Guide to Financial Modeling Best Practices and Conventions

- What is Investment Banking?

- Essential Reading for your Investment Banking Interview

We're sending the requested files to your email now. If you don't receive the email, be sure to check your spam folder before requesting the files again.

Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO.

The Wall Street Prep Quicklesson Series

7 Free Financial Modeling Lessons

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts.

Capital Structure

Updated July 12, 2023

What is Capital Structure?

Capital structure refers to the mix of debt and equity a company uses to finance its business operations and growth. Debt can be raised through bank loans, bond issues, or commercial papers, while equity can come from common stock, preferred stock, or retained earnings.

Usually, a company’s capital structure is expressed as a debt-to-equity ratio or debt-to-capital ratio.

Start Your Free Investment Banking Course

Download Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

Some key features of a suitable capital structure for a company are as follows:

- Flexibility: It provides flexibility in terms of financing options so that the finance manager can alter the debt-equity mix based on the needs of the hour. For instance, a growing company might employ higher debt, while a mature company would rely more on equity .

- Profitability: A sound capital structure can be leveraged to improve profitability, translating into higher earnings per share. An optimum capital structure can result in maximum leverage at a minimum cost.

- Solvency: Excessive debt or very high leverage can threaten a company’s solvency and credit rating. The portion of debt in a capital structure should be limited to the extent the company can comfortably service.

- Conservatism: The company should be conservative and ensure it does not exceed its debt capacity. Any debt entails principal repayment and periodic interest payment that depends on future cash flows . If the future cash flows are inadequate for debt servicing, it can result in legal insolvency.

- Control: An increase in leverage means a higher amount of debt that might lead to business owners relinquishing control of the company in the case of inability to repay. Hence, the capital structure should be such that it does not lead to a loss of control in the company.

Examples of Capital Structure (With Excel Template)

Below are various examples:

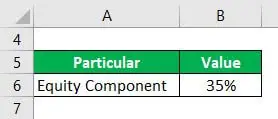

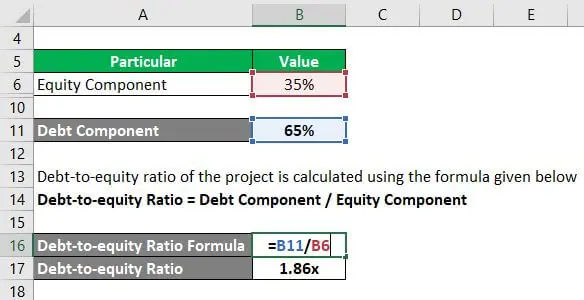

Let us assume that a company plans to invest in an expansion project. The project will be financed 35% through equity infusion, and the remaining funding will occur through bank loans. Determine the debt-to-equity ratio of the project based on the given information:

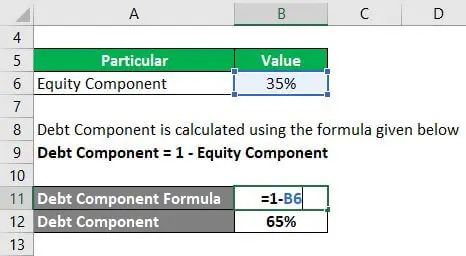

One calculates the Debt Component using the formula given below:

Debt Component = 1 – Equity Component

- Debt Component = 1 – 35%

- Debt Component = 65%

One calculates the debt-to-equity ratio of the project using the formula given below.

Debt-to-equity Ratio = Debt Component / Equity Component

- Debt-to-equity Ratio = 65% / 35%

- Debt-to-equity Ratio = 1.86x

Hence, the debt-to-equity ratio of the project is 1.86x.

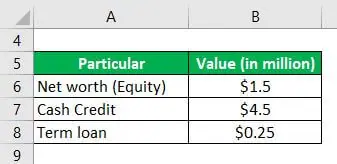

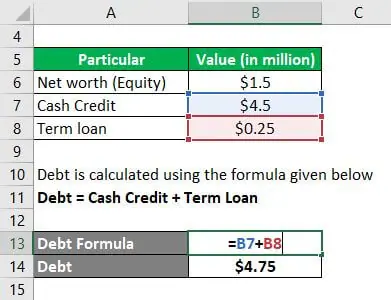

Let us take the example of a company engaged in a trading business. The company has an outstanding cash credit of $4.5 million, a term loan of $0.25 million, and a tangible net worth of $1.5 million. Determine the company’s debt-to-equity ratio based on the given information.

One calculates the Debt using the formula given below:

Debt = Cash Credit + Term Loan

- Debt = $4.5 million + $0.25 million

- Debt = $4.75 million

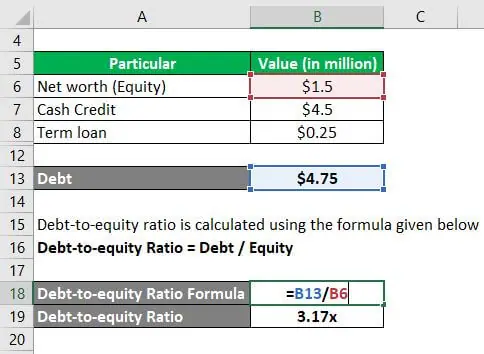

One calculates the debt-to-equity ratio using the formula given below:

Debt-to-equity Ratio = Debt / Equity

- Debt-to-equity ratio = $4.75 million / $1.5 million

- Debt-to-equity ratio = 3.17x

Hence, the company’s debt-to-equity ratio is 3.17x.

Types of Capital Structure

Companies fund their business operations by either issuing debt or equity. Based on the mix of debt and equity, the capital structure can be broadly classified into three major categories – highly leveraged, lowly leveraged, and optimal.

- Highly leveraged: Companies increase their leverage through increased debt funding to improve profit margins. However, this creates the obligation to pay back lenders, which can worsen the woes of a struggling business.

- Lowly leveraged: Companies issue more equity and give up some ownership. In this way, they can fund business requirements and avoid the liability of paying back lenders.

- Optimal: One achieves optimal capital structure when companies can achieve the perfect mix of debt and equity financing that results in maximum company value at the minimum cost of capital.

The factors that play a key role in determining a company’s capital structure are as follows:

- Cost of capital: This is the cost of capital raised from different fund sources. The interest rate is the cost of capital for debt, while the rate of return is the cost of equity.

- Degree of control: The different types of shareholders and their voting rights influence a company’s capital structure. Typically, equity shareholders enjoy more rights than preference shareholders or debenture shareholders.

- Government policies: The rules and policies introduced by the government impact corporate decisions pertaining to the structure.

It is a crucial factor in determining a company’s overall stability. Some of its important aspects are:

- A company with a sound capital structure typically enjoys a higher valuation in the investor community.

- An optimal structure ensures the efficient use of available funds, avoiding over or undercapitalization issues.

- Companies can use appropriate capital structures to boost profits, resulting in higher shareholder returns.

Key Takeaways

Some of the key takeaways of the article are:

- A company’s capital structure shows how it finances its business growth.

- A sound structure provides flexibility in financing options and boosts shareholders’ returns by improving profitability.

- The debt-to-equity ratio is a commonly used indicator of capital structure and is useful for determining a company’s borrowing capacity.

Capital structure is a crucial financial aspect for any company, as it determines the proportion of debt or equity in its fund sources. Achieving the optimal capital structure is vital for a company, as it helps maximize shareholders’ capital while minimizing the overall cost of capital. Thus, it is evident that capital structure plays a significant role in a company’s financial stability and growth.

Recommended Articles

Here are some further related articles for expanding understanding:

- Overcapitalization

- Capitalization Ratio

- Return on Invested Capital

- Structured Note

*Please provide your correct email id. Login details for this Free course will be emailed to you

By signing up, you agree to our Terms of Use and Privacy Policy .

Download Capital Structure Excel Template

Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

Forgot Password?

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. By closing this banner, scrolling this page, clicking a link or continuing to browse otherwise, you agree to our Privacy Policy

Explore 1000+ varieties of Mock tests View more

Submit Next Question

🚀 Limited Time Offer! - 🎁 ENROLL NOW

- Capital Structure

- Modigliani and Miller Theories

- Business Risk

- Degree of Financial Leverage

Capital structure refers to the relative proportion of common stock, preferred stock and debt in a a company's total capital employed. It is normally expressed as a percentage of market value of each component of capital to the sum of the market values of all components of capital.

Capital structure is a statement of the way in which a company's assets are financed. Analysis of capital structure is relevant to understanding the level of risk which a business has. Modigliani and Miller proposed that capital structure is irrelevant when there are no taxes and that 100% debt is the optimal capital structure when there are taxes. However, recent studies suggest that cost of debt falls with increase in the proportion of debt but it leads to an offsetting increase in cost of equity (due to higher distress costs associated with higher debt levels). The optimal structure is where the weighted average cost of capital is lowest and that is anywhere between 100% debt and 100% equity.

Calculation

| % of Equity = | Market Value of Equity |

| Market Value of Equity + Market Value of Debt |

| % of Debt = | Market Value of Debt |

| Market Value of Equity + Market Value of Debt |

If market values are not available, the percentages are calculated based on book values.

Capital structure is also expressed by debt to total assets ratio. Percentage of equity and percentage of debt can also be calculated if we know the financial leverage ratio or debt to equity ratio of the business.

Example 1: Delta Airlines has a recent market capitalization of $9.79 billion whiles the value of the company i.e. the enterprise value is $19.74 billion. The percentage of equity in the company's structure is 49.6% ($9.79 billion/$19.74 billion). The percentage of debt in the capital is 51.4% (1 minus percentage of equity).

Example 2: Calculation of capital structure from financial leverage ratio : Oceanic Airlines has a financial leverage ratio of 2.5. Find its capital structure.

Financial leverage ratio = Total Assets (A) ÷ Total Equity (E) = 2.5

Total Assets (A) ÷ (Total Assets (A) − Total Liabilities (L)) = 2.5

A = 2.5 × (A − L) A = 2.5 A − 2.5 L 2.5 L = 2.5 A − A 2.5 L = 1.5 A L/A% = 1.5/2.5 = 60%

Percentage of debt in the capital structure of Oceanic Airlines is 60% which gives us a percentage of equity of 40%.

In the same way we can find capital structure as percentage of equity and percentage of debt from debt to equity ratio .

by Obaidullah Jan, ACA, CFA and last modified on May 21, 2019

Related Topics

- Cost of Equity

- Cost of Debt

- Cost of Capital

- Market Capitalization

- Debt-to-Equity Ratio to Debt Ratio

- Equity Multiplier

- Debt-to-Capital Ratio

All Chapters in Finance

- Time Value of Money

- Capital Budgeting Process

- Stock Valuation

- Risk and Return

- Exchange Rates

- Real Estate

- Financial Ratios

- Excel PV Function

- Corporate Finance

- Business Valuation

- Performance Measurement

- Primary & Secondary Market

Current Chapter

XPLAIND.com is a free educational website; of students, by students, and for students. You are welcome to learn a range of topics from accounting, economics, finance and more. We hope you like the work that has been done, and if you have any suggestions, your feedback is highly valuable. Let's connect!

Copyright © 2010-2024 XPLAIND.com

Capital Structure for Startups

by Sarath | April 15, 2021 | Capital structure , Debt Capital , Equity Capital

You must have heard the term “capital structure” at least once in your life, especially if your family or friends have businesses. For people who are investment analysts, professional investors , or corporate officers, this concept is essential.

This article will tell you about capital structure, the types of capital , and why a sound capital structure is essential for startups .

All you need to know about Capital Structure

Capital structure is an essential part of a company. It helps the organisation run smoothly and lowers financial burden . Without a strong capital structure, the company is at risk down the road. Having an ideal capital structure is important for startups.

What is a capital structure?

Startups have to finance their operations in order to attain growth, which can be done by structuring the combination of debt and equity in a way that suits the business. This structure of finance is called the capital structure. They have to choose their approach from all the different available options. They can create equity through common or preferred stock , and/or debt (long & short-term) as loans and bonds . The route they choose will depend on the product they offer and the industry they are in.

There are trade-offs when the business uses debt or equity to finance the operations. Depending on the industry, the management will have to decide the amount to use and balance both to find a point of equilibrium suitable for their company.

Why is capital structure important for a startup?

Capital structure is an essential factor that contributes to the stability of the company. Startups need to have a good capital structure as this will determine if they will s urvive the initial stages . Other factors that also show this importance are:

- A startup with a good capital structure will draw investors

- The business will be efficient as all the funds and resources will be effectively used, preventing under or overcapitalization .

- As per the startup’s situation, the company will have the flexibility of changing its debt capital .

- Having a proper capital structure minimizes the overall cost of capital while maximizing the shareholder’s capital.

- In the form of higher returns to the shareholders , an effective capital structure will increase their profit .

- If your startup has a sound capital structure, the chances of share prices increasing are high , leading to an overall higher business valuation .

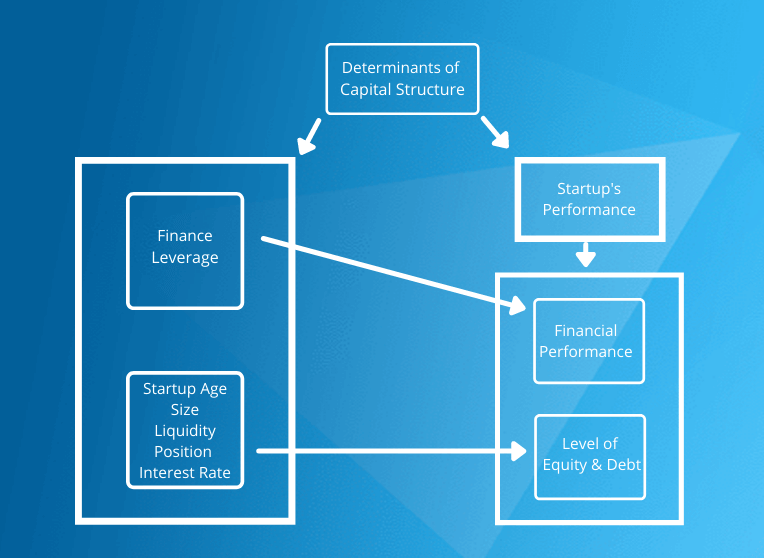

Factors determining capital structure

There are many factors that affect and influence the capital structure of a startup. This is why it’s necessary to focus on the important factors, including:

- Control – The shareholders type will determine the degree of control. If the startup has more equity shareholders than preference shareholders, they will have control and higher voting rights .

- Government Policies – It is important as a startup to stay informed on all the policies that the government has set, as it influences your capital structure choice. If there are significant changes in the fiscal and monetary policies, you may have to change your capital structure choice.

- Cost of Capital – Startups raise capital for its operations, and there are costs to do so. These costs that they incur is called the cost of capital . A company should generate enough revenue to negate this cost, and the growth can be sufficiently funded. One way of reducing the cost of capital is by balancing the debt and equity to get an optimal capital structure.

- Trading on Equity – To increase returns, startups borrow new funds using more equity as the source . When the rate of interest the startup pays on debt is less than the rate of return on the total capital or when the rate of interest is higher than the return, they choose to trade on equity.

Types of Capital Structure

The plan by which a business finances its assets by combining debt and equity optimally is called a capital structure. A business sources funds from various areas to finance its operations, some of them are retained earnings, equity shares, long-term loans, preference shares, and others. Startups have to make a crucial decision and choose the type of source they want to use to raise their capital. Choosing the right type of capital structure will show the strength of the business and also the cost of capital.

The types of capital structures have been explained below.

Equity Capital

In exchange for common or preferred stock , equity capital is the funds received from investors. Equity is the core of the business, and you can further add debt to this for more funding. The moment an investor invests in this, their investment is at risk. The reason for this is that in a scenario where the firm is liquidated , the company will settle the creditors’ claims before the business pays the shareholders.

Irrespective of the risks, investors put their money into equity for many more reasons. Investing in equity shares gives the investor a degree of control in the business. Through this, they can make sure that the company is efficient, generating sufficient funds , and can pay dividends to the shareholders.

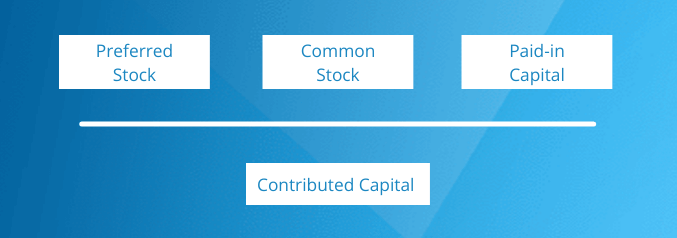

From a valuation perspective, equity capital is considered the total amount given back to the investor after all liabilities are settled in the case of a liquidated company. In the balance sheet, the par value of stocks sold, retained earnings, offsetting amount of the treasury stock, and the additional paid-in capital are components of the equity capital according to an accounting perspective. Equity capital is of two types :

#1 Contributed Capital

The total amount of money initially invested into the company by the owners and from shareholders as a cost for ownership is known as contributed capital. In other words, it is a part of the total equity recorded by the company. The contributed capital can be in the shareholders’ equity section as a separate account.

Contributed Capital can further be divided into two parts: the regular stock account and the additional paid-in capital account . Here the regular stock account records the par value of a share sold. In the additional paid-in account, all excess payments are recorded. These accounts are created to record the amounts for legal purposes and do not provide any extra information. This is because investors look at the company’s total equity rather than the single amount given in these accounts.

The common entry written down when an investor buys shares from a company is to debit the cash account and credit the contributed capital account . Other transactions also involve contributed capital, such as receiving liability for stock and stock for fixed assets.

#2 Retained Earnings

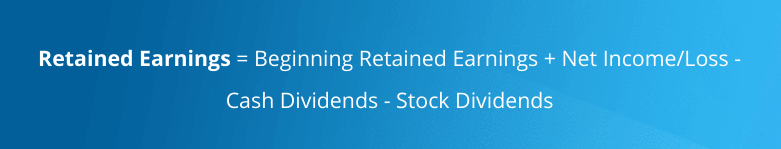

Retained earnings is a part of the profit earned that the business keeps separately, for use to grow the business. In other words, it is the profits less dividends and any distributions paid to shareholders . This amount is always adjusted when an entry affects the revenue or expenses in the company accounts. If a company has a considerable amount in the retained earnings account, it means that they are financially strong. The formula to calculate retained earnings (RE) is: retained earnings at the beginning + net profit/loss – Dividends.

Debt capital

Debt capital is the type of capital the company raises by taking loans . This loan is also known as growth capital and is paid back at a future date. Debt capital is different from share or equity capital. This is because the lender does not become part owner in the company; they are just creditors. Normally, the creditor is entitled to a fixed interest rate on the loan annually, known as the coupon rate . In some cases, the loan is repaid depending on the company’s monthly revenue; this scenario is similar to revenue-based financing.

Equity holders, unlike debt holders, have rights in the company. But debt ranks higher than equity when it comes to annual repayment. Similarly, if a company is liquidated, the debt is paid off in full before the shareholders get repaid.

Note: In a startups capital structure, these loans are often in the form of convertible notes , like SAFE notes or KISS notes . They have a principal amount, may contain interest terms , and can convert to equity later on .

What is the optimal capital structure for a startup?

The ideal balance between debt and equity that results in a low WACC ( weighted average cost of capital) is known as the optimal capital structure. The definition does not reflect the same in practice as companies have their own aspect of what they think represents the optimal capital structure. The reason every company has a different perspective also comes down to the industry they are in.

For example , a company in the petroleum industry will not find it suitable to have a high debt ratio as they deal in products with high liquidity. The ideal ratio should be 1:1 . Whereas for a business in the banking industry, it is ideal to have a high debt ratio as they borrow capital to lend it to customers. Even though creditors charge financial institutions high interests, banks charge customers high-interest rates to counter it and earn profits.

Capital structure vs Financial structure

Capital structure is the long-term funds that are sourced by the business. In the balance sheet, it comes under the non-current liabilities and shareholders’ funds . The capital structure includes long-term borrowings, equity capital, debentures, preference shares, retained earnings, and others.

The financial structure is the plan through which company assets are financed . Financial structure is a more extensive concept than capital structure. It represents the entire liabilities and equity side of the balance sheet.

| Capital Structure | Financial Structure |

|---|---|

| Capital structure is the of funds raised by the company. | The plan by which the and are financed is the financial structure. |

| It includes , , , , and others. | Financial structure includes the , , , , , and others. |

| It is shown under and . | Financial structure includes the capital structure. It is the entire and . |

When you compare the capital structure vs financial structure , the main difference is that the financial structure includes the capital structure.

Interested to Optimize your Company’s Capital Structure?

Startups have a hard time dealing with the hurdles that come their way during the first couple of years. It is essential that they find their optimal point. Finding the ideal capital structure will depend on various factors such as the industry of the business and the owners’ willingness to give up control of the company. Setting a strong and optimal capital structure allows the company to secure healthy finances.

One tool that can help is Eqvista . It is an advanced equity management tool that helps owners and investors track all financial information about the company’s capital and financial structure. The Eqvista platform also has other features, like our financial modeling in our Waterfall and Round Modeling Analysis, to help you make better financial decisions. Contact us today for more information to get started!

- 409a Valuation

- Angel Investors

- Business Valuation

- Employee Stock Option

- FAST Agreement

- Financial Modeling

- Issue Shares

- Venture Capital Firms

Popular posts

Simple equity management by eqvista.

Interested in knowing more about our services or have any questions ?

CREATE YOUR CAP TABLE IN UNDER 2 MINUTES, FOR FREE!

Interested in issuing & managing shares.

If you want to start issuing and managing shares, Try out our Eqvista App , it is free and all online!

How to Determine a Company's Capital Structure

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on April 14, 2023

Fact Checked

Why Trust Finance Strategists?

Table of Contents

When deciding on the capital structure of a company, the promoters will have to decide the proportion of capital to be raised by the issue of shares and debentures .

It should be noted that shareholders are paid dividends out of profit , and so they bear the risk involved in carrying out the business activities.

According to Gertenberg, the capital structure (or financial structure) of a company refers to the make-up of its capitalization.

In a broader sense, capital structure includes all long-term funds, including share capital , debentures , bonds , loans, and reserves. Interest is paid on funds raised through loans irrespective of profit or loss.

Capital Structure: Definition

Funds obtained through shares and loans have their own plus and minus points.

Psychologically speaking, investors who desire a regular source of income typically invest their funds in debentures and loans. By contrast, adventurous investors tend to invest their funds in shares.

Companies, in order to capitalize themselves, seek to derive benefits from the psychology of both shareholders and debenture holders.

The company is said to be high-geared if a large part of its capital is raised through the issue of securities that carry a fixed rate of interest and dividends.

The company is said to be low-geared if it is not required to pay interest and dividends at a fixed rate.

Suppose a company raises $1,500,000 by issuing shares and $1,000,000 by issuing debentures. By the above-mentioned definition, the company is said to be low-geared.

In this way, share capital obtained by issuing equity and preference shares , loans raised by issuing debentures, bonds, and loans, and retained earnings constitute the company's capital structure.

Factors Determining Capital Structure

The following factors should be considered when determining the capital structure of a business enterprise:

1. Nature of the business: If the enterprise is a risky one, it should raise its funds by issuing shares.

For example, manufacturing enterprises, where the degree of risk is considerable, secure capital by issuing of shares.

Trading concerns, which are inherently less risky than manufacturing companies, should obtain their funds by issuing debentures or receiving loans.

A financially sound business should raise its funds by issuing debentures. This is because such enterprises pay dividends at higher rates than the interest rate, and so issuing debentures is the most efficient option.

2. Purpose for which the finance is required: When funds are required to purchase fixed assets (or for unproductive purposes), funds must be raised by issuing of shares.

To meet working capital requirements, funds may also be raised through loans. If the purpose is to generate productive funds, the funds should be raised through borrowings.

3. Trading on equity: Trading on equity means borrowing funds at reasonable rates with the help of share capital.

The policy of trading on equity may be adopted only by those business enterprises satisfying the following requirements:

- The company should be reputed and established (e.g., a blue-chip company)

- The company should earn at rates higher than the interest rate prevailing in the capital market

- The company should have stable and regular earnings, thereby enabling it to pay interest on loans out of its earnings

- The company's cash inflows must be assured

- The company must have sufficient fixed assets to offer in the form of security

4. Intention to retain control of the company: When the existing management wants to retain control over the company, it should obtain funds through loans. Issuing shares will mean granting voting rights to outsiders and losing control.

5. Cost of raising funds: Issuing equity shares is costlier than issuing preference shares and debentures. The company should compare the respective costs and make a suitable decision.

6. Period for which funds are required: Sometimes, funds are needed for the short- or medium-term, in which case borrowing through loans and debentures should be preferred.

When funds are required for a longer period as a permanent investment , equity shares should be issued.

7. Nature and attitude of investors: When investors are adventurous, equity shares should be issued, whereas if investors are cautious, debentures or preference shares should be issued.

When raising funds, the preferences and attitudes of investors should be taken into consideration. Ideally, the company should issue whatever its potential investors will willingly subscribe for.

8. Business cycle: If the business cycle is in a period of depression, investors will not be interested in subscribing to equity shares. In a boom period in the money market, investors are more likely to take risks and, consequently, invest in shares.

9. Statutory provisions: Legal requirements must be honored (e.g., banking companies can issue equity shares only).

Difference Between Capitalization and Capital Structure

| Capitalization, in a narrow sense, is the sum total of capital raised through shares, debentures, bonds, loans, and retained earnings. | Capital structure is the make-up of the company's capitalization (i.e., shares, debentures, bonds, loans, etc.). | |

| Capitalization, in a broader sense, refers to the determination of the total needs of capital, its structure, and the arrangement of funds. It includes capital structure in itself. | Capital structure, in a broader sense, is an aspect of capitalization. It determines the ratio in which the total capital in the company is contributed by different sources. | |

| Capitalization is classified as either over-capitalization or . | Capital structure is either high-geared or low-geared. | |

| Capitalization is mainly influenced by the internal requirements of the enterprise. | Capital structure is mainly influenced by external forces, including market conditions, investor psychology, and government policies. |

How to Determine a Company's Capital Structure FAQs

What is a capital structure.

The capital structure of a company is the make-up of its total capitalization (i.e., shares, Debentures, bonds, loans, etc.) and their respective proportions.

What are the factors that influence capital structure?

The following factors should be considered when determining the capital structure of a business enterprise: - Nature of the business - Purpose for which the finance is required - Trading on equity - Intention to retain control of the company - Cost of raising funds - Period for which funds are required - Nature and attitude of investors - Business cycle - Statutory provisions - Government taxation policy

What is capitalization?

Capitalization, in a narrow sense, refers to the sum total of funds raised by a company through its shares, Debentures, bonds, loans, and Retained Earnings.

What are the factors that determine capitalization?

The following factors should be considered when determining the capitalization of a business enterprise: - Market condition - Investor’s risk-taking attitude - Investor’s preference for different sources of funds - The extent to which funds are required by the business - Business cycle - Government taxation policy

What are the differences between capitalization and capital structure?

Capitalization, in a broader sense, refers to the total needs of capital, its sources, and arrangements. On the other hand, capital structure refers to the proportion of funds contributed by different sources.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Our Services

- Financial Advisor

- Estate Planning Lawyer

- Insurance Broker

- Mortgage Broker

- Retirement Planning

- Tax Services

- Wealth Management

Ask a Financial Professional Any Question

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

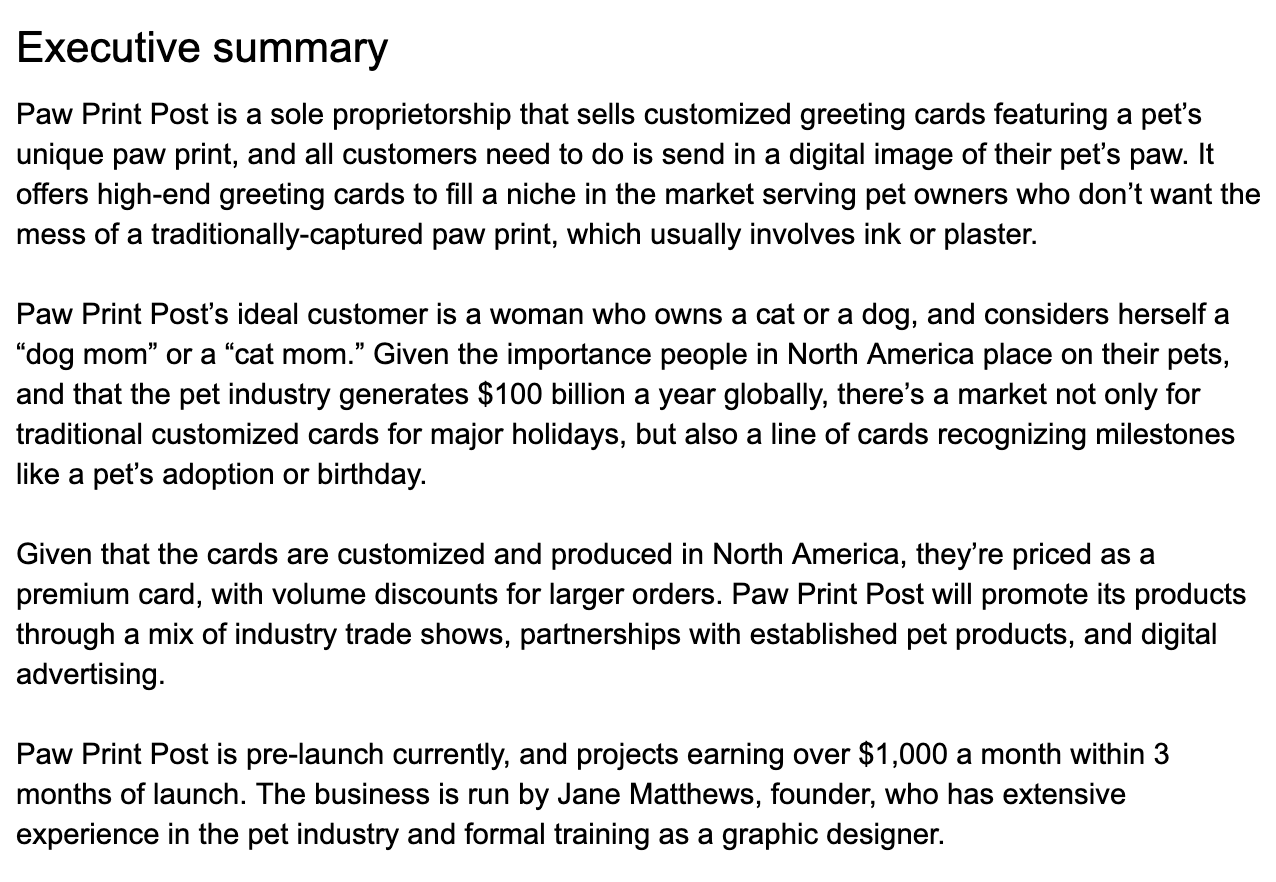

How to Write a Business Plan: Your Step-by-Step Guide

So, you’ve got an idea and you want to start a business —great! Before you do anything else, like seek funding or build out a team, you'll need to know how to write a business plan. This plan will serve as the foundation of your company while also giving investors and future employees a clear idea of your purpose.

Below, Lauren Cobello, Founder and CEO of Leverage with Media PR , gives her best advice on how to make a business plan for your company.

Build your dream business with the help of a high-paying job—browse open jobs on The Muse »

What is a business plan, and when do you need one?

According to Cobello, a business plan is a document that contains the mission of the business and a brief overview of it, as well as the objectives, strategies, and financial plans of the founder. A business plan comes into play very early on in the process of starting a company—more or less before you do anything else.

“You should start a company with a business plan in mind—especially if you plan to get funding for the company,” Cobello says. “You’re going to need it.”

Whether that funding comes from a loan, an investor, or crowdsourcing, a business plan is imperative to secure the capital, says the U.S. Small Business Administration . Anyone who’s considering giving you money is going to want to review your business plan before doing so. That means before you head into any meeting, make sure you have physical copies of your business plan to share.

Different types of business plans

The four main types of business plans are:

Startup Business Plans

Internal business plans, strategic business plans, one-page business plans.

Let's break down each one:

If you're wondering how to write a business plan for a startup, Cobello has advice for you. Startup business plans are the most common type, she says, and they are a critical tool for new business ventures that want funding. A startup is defined as a company that’s in its first stages of operations, founded by an entrepreneur who has a product or service idea.

Most startups begin with very little money, so they need a strong business plan to convince family, friends, banks, and/or venture capitalists to invest in the new company.

Internal business plans “are for internal use only,” says Cobello. This kind of document is not public-facing, only company-facing, and it contains an outline of the company’s business strategy, financial goals and budgets, and performance data.

Internal business plans aren’t used to secure funding, but rather to set goals and get everyone working there tracking towards them.

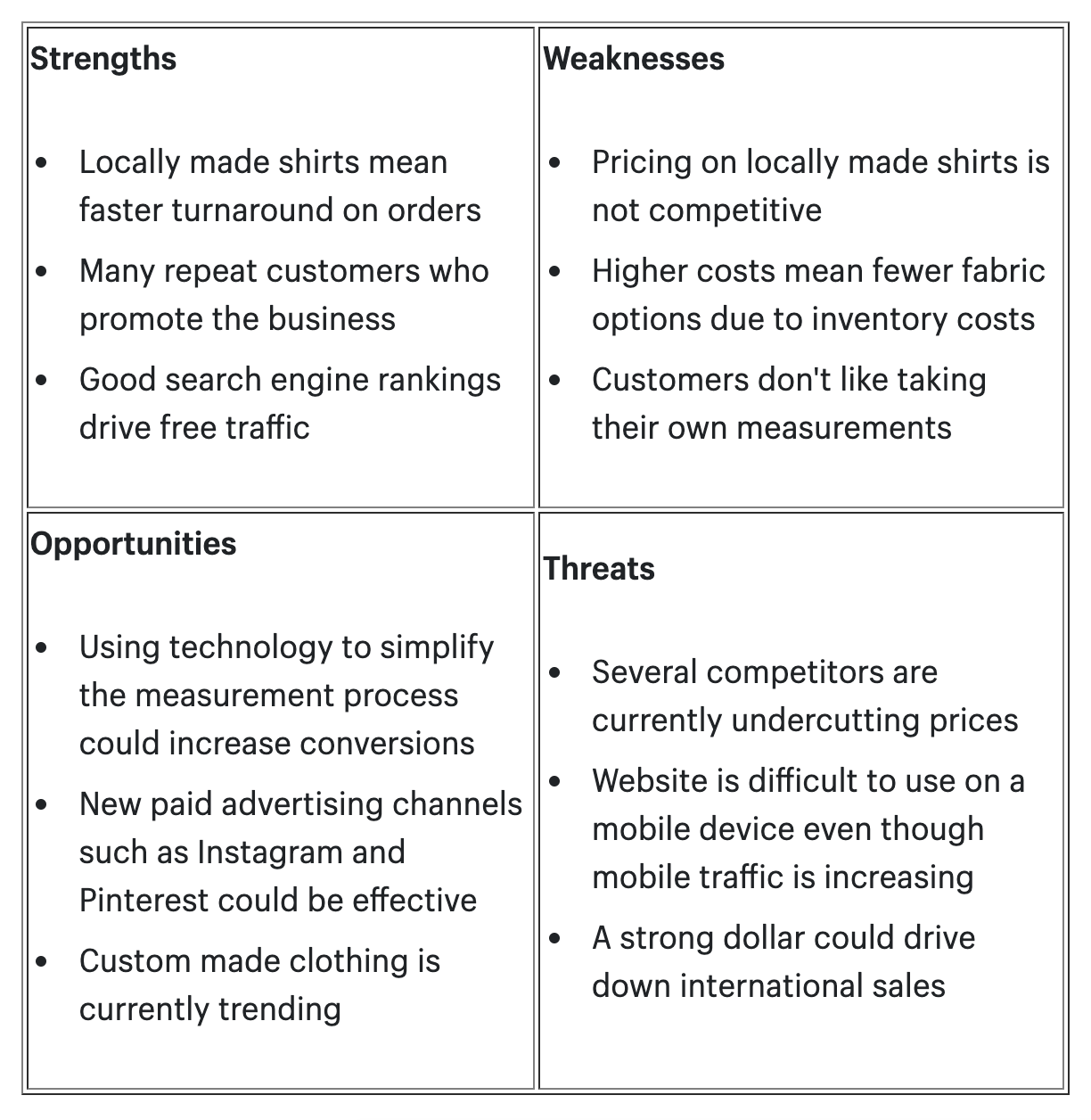

As the name implies, strategic business plans are geared more towards strategy and they include an assessment of the current business landscape, notes Jérôme Côté, a Business Advisor at BDC Advisory Services .

Unlike a traditional business plan, Cobello adds, strategic plans include a SWOT analysis (which stands for strengths, weaknesses, opportunities, and threats) and an in-depth action plan for the next six to 12 months. Strategic plans are action-based and take into account the state of the company and the industry in which it exists.

Although a typical business plan falls between 15 to 30 pages, some companies opt for the much shorter One-Page Business Plan. A one-page business plan is a simplified version of the larger business plan, and it focuses on the problem your product or service is solving, the solution (your product), and your business model (how you’ll make money).

A one-page plan is hyper-direct and easy to read, making it an effective tool for businesses of all sizes, at any stage.

How to create a business plan in 7 steps

Every business plan is different, and the steps you take to complete yours will depend on what type and format you choose. That said, if you need a place to start and appreciate a roadmap, here’s what Cobello recommends:

1. Conduct your research

Before writing your business plan, you’ll want to do a thorough investigation of what’s out there. Who will be the competitors for your product or service? Who is included in the target market? What industry trends are you capitalizing on, or rebuking? You want to figure out where you sit in the market and what your company’s value propositions are. What makes you different—and better?

2. Define your purpose for the business plan

The purpose of your business plan will determine which kind of plan you choose to create. Are you trying to drum up funding, or get the company employees focused on specific goals? (For the former, you’d want a startup business plan, while an internal plan would satisfy the latter.) Also, consider your audience. An investment firm that sees hundreds of potential business plans a day may prefer to see a one-pager upfront and, if they’re interested, a longer plan later.

3. Write your company description

Every business plan needs a company description—aka a summary of the company’s purpose, what they do/offer, and what makes it unique. Company descriptions should be clear and concise, avoiding the use of jargon, Cobello says. Ideally, descriptions should be a few paragraphs at most.

4. Explain and show how the company will make money

A business plan should be centered around the company’s goals, and it should clearly explain how the company will generate revenue. To do this, Cobello recommends using actual numbers and details, as opposed to just projections.

For instance, if the company is already making money, show how much and at what cost (e.g. what was the net profit). If it hasn’t generated revenue yet, outline the plan for how it will—including what the product/service will cost to produce and how much it will cost the consumer.

5. Outline your marketing strategy

How will you promote the business? Through what channels will you be promoting it? How are you going to reach and appeal to your target market? The more specific and thorough you can be with your plans here, the better, Cobello says.

6. Explain how you’ll spend your funding

What will you do with the money you raise? What are the first steps you plan to take? As a founder, you want to instill confidence in your investors and show them that the instant you receive their money, you’ll be taking smart actions that grow the company.

7. Include supporting documents

Creating a business plan is in some ways akin to building a legal case, but for your business. “You want to tell a story, and to be as thorough as possible, while keeping your plan succinct, clear, interesting, and visually appealing,” Cobello says. “Supporting documents could include financial projects, a competitive analysis of the market you’re entering into, and even any licenses, patents, or permits you’ve secured.”

A business plan is an individualized document—it’s ultimately up to you what information to include and what story you tell. But above all, Cobello says, your business plan should have a clear focus and goal in mind, because everything else will build off this cornerstone.

“Many people don’t realize how important business plans are for the health of their company,” she says. “Set aside time to make this a priority for your business, and make sure to keep it updated as you grow.”

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

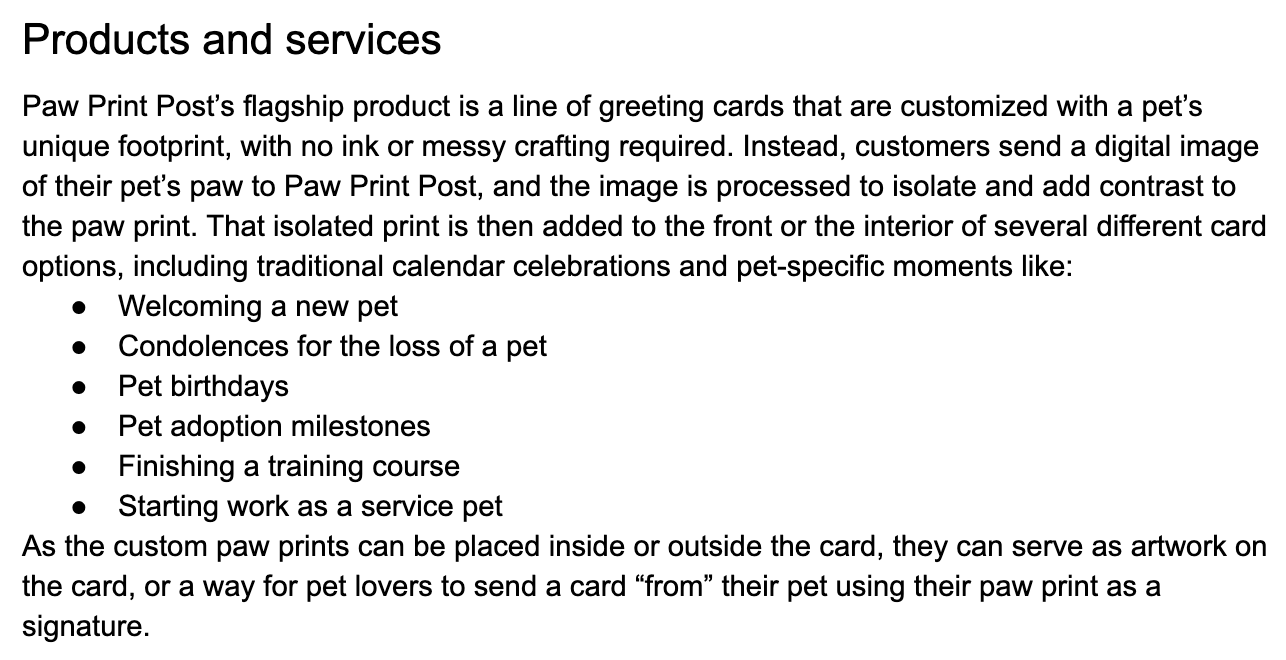

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

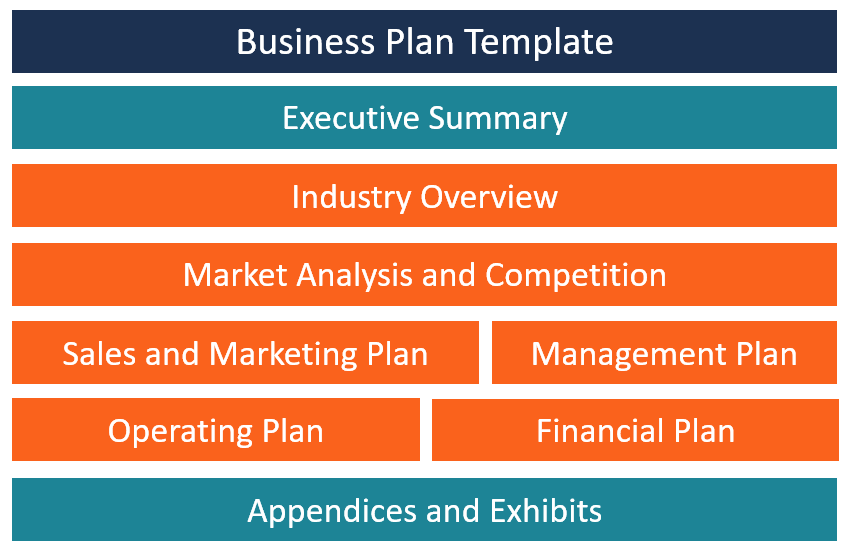

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure

- Three Financial Statements

- Business Model Canvas Examples

- See all management & strategy resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

Making capital structure support strategy

CFOs invariably ask themselves two related questions when managing their balance sheets: should they return excess cash to shareholders or invest it and should they finance new projects by adding debt or drawing on equity? Indeed, achieving the right capital structure the composition of debt and equity that a company uses to finance its operations and strategic investments has long vexed academics and practitioners alike. 1 1. Franco Modigliani and Merton Miller, “The cost of capital, corporate finance, and the theory of investment,” American Economic Review, June 1958, Number 48, pp. 261–97. Some focus on the theoretical tax benefit of debt, since interest expenses are often tax deductible. More recently, executives of public companies have wondered if they, like some private equity firms, should use debt to increase their returns. Meanwhile, many companies are holding substantial amounts of cash and deliberating on what to do with it.

The issue is more nuanced than some pundits suggest. In theory, it may be possible to reduce capital structure to a financial calculation to get the most tax benefits by favoring debt, for example, or to boost earnings per share superficially through share buybacks. The result, however, may not be consistent with a company’s business strategy, particularly if executives add too much debt. 2 2. There is also some potential for too little debt, though the consequences aren’t as dire. In the 1990s, for example, many telecommunications companies financed the acquisition of third-generation (3G) licenses entirely with debt, instead of with equity or some combination of debt and equity, and they found their strategic options constrained when the market fell.

Indeed, the potential harm to a company’s operations and business strategy from a bad capital structure is greater than the potential benefits from tax and financial leverage. Instead of relying on capital structure to create value on its own, companies should try to make it work hand in hand with their business strategy, by striking a balance between the discipline and tax savings that debt can deliver and the greater flexibility of equity. In the end, most industrial companies can create more value by making their operations more efficient than they can with clever financing. 3 3. Richard Dobbs and Werner Rehm, “ The value of share buybacks ,” McKinsey on Finance , Number 16, Summer 2005, pp. 16–20.

Capital structure’s long-term impact

Capital structure affects a company’s overall value through its impact on operating cash flows and the cost of capital. Since the interest expense on debt is tax deductible in most countries, a company can reduce its after-tax cost of capital by increasing debt relative to equity, thereby directly increasing its intrinsic value. While finance textbooks often show how the tax benefits of debt have a wide-ranging impact on value, they often use too low a discount rate for those benefits. In practice, the impact is much less significant for large investment-grade companies (which have a small relevant range of capital structures). Overall, the value of tax benefits is quite small over the relevant levels of interest coverage (Exhibit 1). For a typical investment-grade company, the change in value over the range of interest coverage is less than 5 percent.

Tax benefits of debt are often negligible.

The effect of debt on cash flow is less direct but more significant. Carrying some debt increases a company’s intrinsic value because debt imposes discipline; a company must make regular interest and principal payments, so it is less likely to pursue frivolous investments or acquisitions that don’t create value. Having too much debt, however, can reduce a company’s intrinsic value by limiting its flexibility to make value-creating investments of all kinds, including capital expenditures, acquisitions, and, just as important, investments in intangibles such as business building, R&D, and sales and marketing.

Managing capital structure thus becomes a balancing act. In our view, the trade-off a company makes between financial flexibility and fiscal discipline is the most important consideration in determining its capital structure and far outweighs any tax benefits, which are negligible for most large companies unless they have extremely low debt. 4 4. At extremely low levels of debt, companies can create greater value by increasing debt to more typical levels.

Mature companies with stable and predictable cash flows as well as limited investment opportunities should include more debt in their capital structure, since the discipline that debt often brings outweighs the need for flexibility. Companies that face high uncertainty because of vigorous growth or the cyclical nature of their industries should carry less debt, so that they have enough flexibility to take advantage of investment opportunities or to deal with negative events.

Not that a company’s underlying capital structure never creates intrinsic value; sometimes it does. When executives have good reason to believe that a company’s shares are under- or overvalued, for example, they might change the company’s underlying capital structure to create value either by buying back undervalued shares or by using overvalued shares instead of cash to pay for acquisitions. Other examples can be found in cyclical industries, such as commodity chemicals, where investment spending typically follows profits. Companies invest in new manufacturing capacity when their profits are high and they have cash. 5 5. Thomas Augat, Eric Bartels, and Florian Budde, “Multiple choice for the chemical industry,” The McKinsey Quarterly , 2003 Number 3, pp. 126–36. Unfortunately, the chemical industry’s historical pattern has been that all players invest at the same time, which leads to excess capacity when all of the plants come on line simultaneously. Over the cycle, a company could earn substantially more than its competitors if it developed a countercyclical strategic capital structure and maintained less debt than might otherwise be optimal. During bad times, it would then have the ability to make investments when its competitors couldn’t.

A practical framework for developing capital structure

A company can’t develop its capital structure without understanding its future revenues and investment requirements. Once those prerequisites are in place, it can begin to consider changing its capital structure in ways that support the broader strategy. A systematic approach can pull together steps that many companies already take, along with some more novel ones.

The case of one global consumer product business is illustrative. Growth at this company we’ll call it Consumerco has been modest. Excluding the effect of acquisitions and currency movements, its revenues have grown by about 5 percent a year over the past five years. Acquisitions added a further 7 percent annually, and the operating profit margin has been stable at around 14 percent. Traditionally, Consumerco held little debt: until 2001, its debt to enterprise value was less than 10 percent. In recent years, however, the company increased its debt levels to around 25 percent of its total enterprise value in order to pay for acquisitions. Once they were complete, management had to decide whether to use the company’s cash flows, over the next several years, to restore its previous low levels of debt or to return cash to its shareholders and hold debt stable at the higher level. The company’s decision-making process included the following steps.

Estimate the financing deficit or surplus.

Set a target credit rating., develop a target debt level over the business cycle., forecasting the financing debt or surplus.

In the example of Consumerco, executives used a simple downside scenario relative to the base case to adjust for the uncertainty of future cash flows. A more sophisticated approach might be useful in some industries such as commodities, where future cash flows could be modeled using stochastic-simulation techniques to estimate the probability of financial distress at the various debt levels illustrated in Exhibit 3.

Modeling future cash flows with stochastic simulation

The final step in this approach is to determine how the company should move to the target capital structure. This transition involves deciding on the appropriate mix of new borrowing, debt repayment, dividends, share repurchases, and share issuances over the ensuing years.

A company with a surplus of funds, such as Consumerco, would return cash to shareholders either as dividends or share repurchases. Even in the downside scenario, Consumerco will generate €1.7 billion of cash above its target EBITA-to-interest-expense ratio.

For one approach to distributing those funds to shareholders, consider the dividend policy of Consumerco. Given its modest growth and strong cash flow, its dividend payout ratio is currently low. The company could easily raise that ratio to 45 percent of earnings, from 30 percent. Increasing the regular dividend sends the stock market a strong signal that Consumerco thinks it can pay the higher dividend comfortably. The remaining €1.3 billion would then typically be returned to shareholders through share repurchases over the next several years. Because of liquidity issues in the stock market, Consumerco might be able to repurchase only about 1 billion, but it could consider issuing a one-time dividend for the remainder.