Your 10 Step Guide to Building a Real Estate Investing Business Plan

Real estate empires grow from a blueprint, not last-minute hunches. This guide outlines how to create a real estate investing business plan to help you navigate market dynamics, seek funding, and add to your team so that you can successfully grow your business.

Let’s be honest, the idea of drafting a formal real estate investing business plan probably doesn’t excite you. After all, you got into real estate investing to scout deals and transform properties, not write novels full of financial projections.

But experienced investors know a solid plan spells the difference between profitability and major headaches. It forces clarity on direction and feasibility before you sink hundreds of thousands into property purchases and rehabs.

Think of your business plan as a blueprint for success tailored to your unique investment goals and market conditions. Whether you currently own a few rentals or are launching a full-fledged development firm, a plan guides decisions, aligns partners, and demonstrates viability to secure financing.

So how do you build one effectively without needless complexity? What key strategy areas require your focus? Let’s explore components that set you up for growth while avoiding common first-timer pitfalls. With realistic planning as your foundation, your investing journey can start smooth and stay the course.

What is a real estate investing business plan?

At its core, a real estate investment business plan is simply a strategic guide outlining your intended real estate approach. It defines target markets, preferred project types based on expertise, capital sources, growth strategy, key operational procedures, and other investment specifics tailored to your situation.

View your plan as an evolving document rather than a rigid static rulebook collecting dust. It should provide goalposts and guardrails as markets shift over time and new opportunities appear. You'll be able to refer back to the plan to confirm that these new opportunities align with proven tactics that yield predictable returns.

Detailed upfront planning provides a sound foundation for confident direction. It protects stakeholders by identifying potential pitfalls and mitigation strategies before costly surprises trip up the stability of your real estate business.

So, it's worth it to take the time and develop a customized plan aligned to your niche, resources, and risk tolerance. While initially tedious, the practice of putting together your strategic real estate business plan ultimately provides clarity and confidence moving forward.

Importance of having a business plan

Now that we’ve defined what a business plan is, let’s explore why having one matters — especially if you want to grow a successful real estate investment company.

Have you considered what originally attracted you to investing in properties? Whether it was rehabbing flips, acquiring rentals, or simply a lucrative hobby, your motivations and ideal path can get lost in the daily distractions of life. That’s where an intentional business plan provides clarity and conviction moving forward.

Reasons every real estate investor should prioritize planning are:

- Goals and vision : You might be wanting to quit your day job and focus on real estate full time, or you might simply want to generate some extra income on the side. Either way, a business plan forces you to define what success looks like for you.

- Due diligence : Creating a plan forces you to research the real estate markets you want to invest in — analyzing sales, rents, permits, zoning, demographics, and growth projections. This helps you objectively identify high-potential neighborhoods and properties rather than relying on hearsay or intuition.

- Funding and financing : Lenders and potential investors will want to review your business plan to evaluate the viability and profitability of your real estate investment business before offering any financing . A complete plan builds credibility and confidence with stakeholders.

- Guide decision-making : It's easy to get distracted by the latest real estate seminar or shiny new construction techniques. But sticking to the parameters and strategies laid out in your plan prevents you from making hasty changes or going down rabbit holes.

- Identify potential risks : There are always things that can unexpectedly go wrong: what if interest rates spike and make your loans unaffordable, or your best tenants move out and unreliable folks move in? Brainstorming these scenarios in advance allows you to minimize risks and have contingency plans.

- Systemize operations : As you grow, how will you scale operations? A business plan helps you identify areas that will require attention as your business evolves, like creating maintenance checklists for rentals, standardizing lease agreements , or automating accounting procedures.

- Build the right team : Your business plan provides guidance on the team you'll need for your business. Know if you require a real estate agent to help you find deals or a property manager to handle tenant complaints at 2 AM.

- Track progress : Your plan helps you compare things like actual rehab costs, rental occupancy rates, cash flow, etc. to your initial projections and determine whether you're on track. You can then make adjustments as needed.

- Maintain strategy : As you scale your operations with new hires or partnerships, you'll want to maintain direction in alignment with your original business plan. For example, if you are considering new verticals like commercial real estate, does evaluation criteria match your proven risk metrics and return hurdles? A real estate business plan keeps everyone focused on the same goals as your business grows.

What to include in a real estate investment business plan

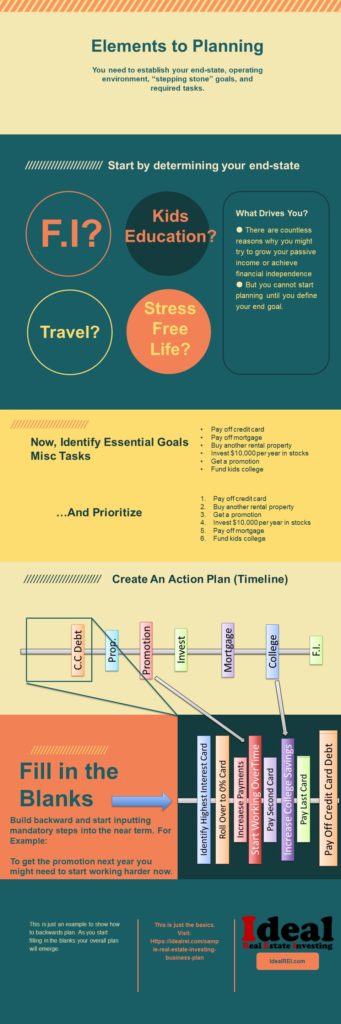

A good real estate investing business plan covers everything from business goals to financing strategy. Here are the ten key elements you should include:

1. Executive summary

The executive summary provides a high-level overview of your real estate investment business plan. It briefly describes your company mission, objectives, competitive advantages, growth strategies, team strengths, and financial outlook.

Think of it as the elevator pitch for your business plan, and write it last after you have completed the full plan. Limit it to 1-2 pages at most.

Make your executive summary compelling and motivate investors or lenders to learn more. Be sure to also summarize your past successes and experiences to build credibility.

2. Company description

The company description section provides background details on your real estate investment company. Keep this section brief, but use it to legitimize your business and team.

- Business model : Explain your core business model and investment strategies. Will you primarily flip properties, buy and hold rentals, conduct wholesale deals, or use another approach?

- Company history and achievements : Provide a brief timeline of your company's history, including its formation, past projects, key milestones, and achievements.

- Legal business structure : Identify your corporate structure, such as LLC , S-Corp , C-Corp, or sole proprietorship.

- Office location : Provide your company's office address, which lends you credibility. If you are initially working from home, consider establishing a local PO Box or virtual address.

- Founders and key team members : Introduce your founders and key team members. Highlight relevant real estate, finance, management expertise, and credentials.

- Past projects : Provide an overview of any successful prior real estate projects your company or founders have executed.

- Competitive advantages : Explain unique resources, systems, or other strengths that give your company an edge over competitors. These could be proprietary analytic models, contractor relationships, deal access, or specialized expertise.

- Technologies and tools : Discuss technologies, software programs, or tools your company uses to streamline processes and optimize operations.

3. Market analysis

The market analysis section validates whether your real estate investment strategy makes sense in a given area.

Conduct detailed research from multiple sources to create realistic real estate investment market projections and identify potentially profitable opportunities.

Outline why certain neighborhoods, property types, or price points pique your interest more than others.

Your market analysis should dig deep into factors like:

- Local sales and rental price trends : Analyze pricing history and current trends for both sales and rents. Look at different property types, sizes, and neighborhoods.

- Housing inventory and demand analysis : Research the balance of supply and demand and how that impacts prices. Is the market undersupplied or oversupplied?

- Market growth projections : Review forecasts from real estate analysts on expected market growth or decline in coming years. Incorporate these projections into your analysis.

- Competitor analysis : Identify other real estate investors actively acquiring or managing properties in your target areas. Look at their business models and strategies.

- Target neighborhood and property analysis : Provide an in-depth analysis of your chosen neighborhoods and target property types. Outline positive attributes, risks, and opportunities.

- Demographic analysis : Analyze the demographics of potential tenants or homebuyers for your target properties. Factors like income, age, and family size impact demand.

- Local construction and renovation costs : Research materials and labor costs for accurate budgets and understand the permitting process and timelines.

- Regional economic outlook : Factor in projections for job growth, new employers, infrastructure projects, and how they may impact the real estate market.

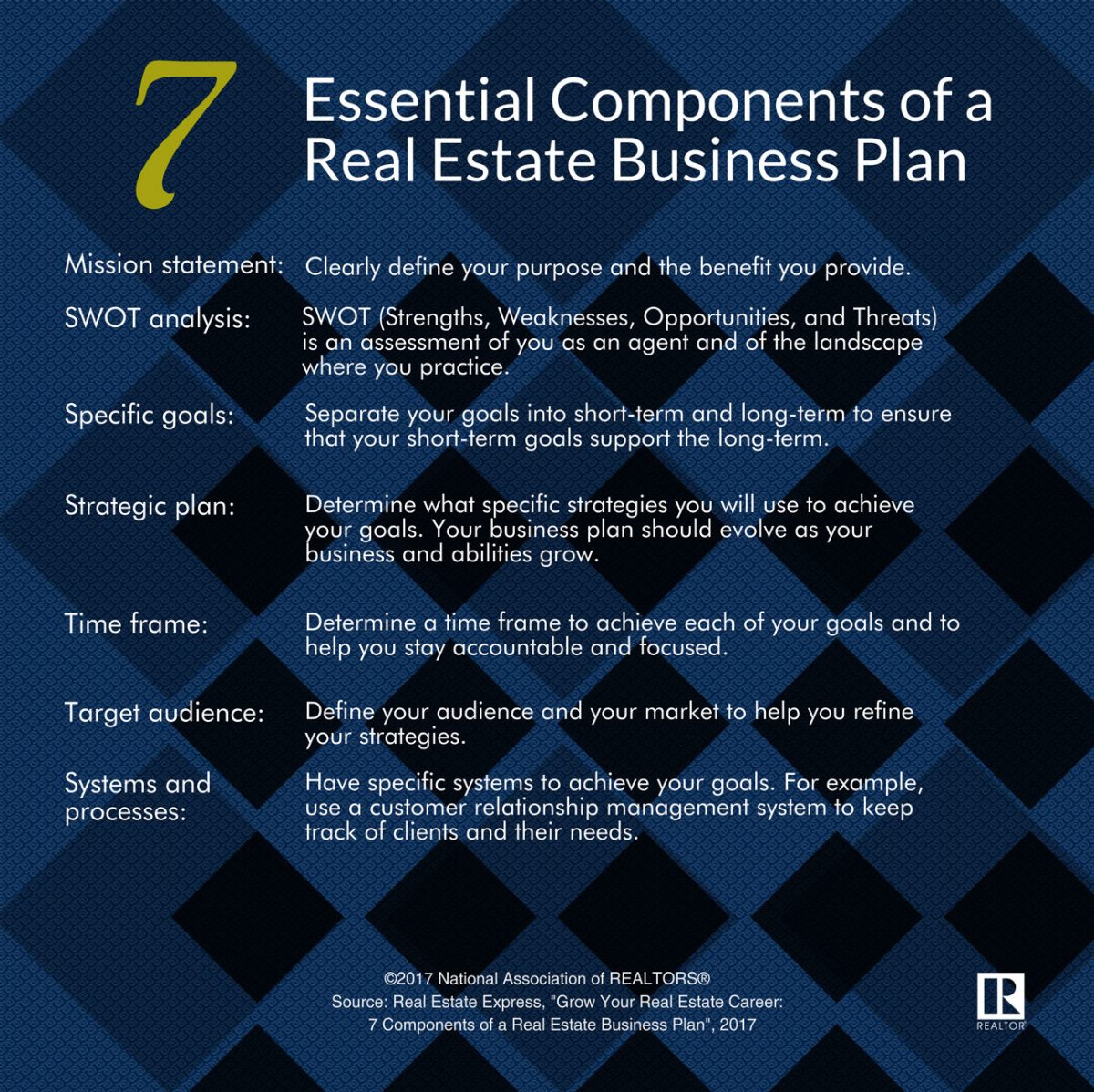

4. SWOT analysis

SWOT stands for strengths, weaknesses, opportunities and threats. Conducting a SWOT analysis means stepping back from day-to-day business to assess your broader position and path from a strategic lens.

Internal strengths for your real estate investment business may include an experienced team skilled in major rehab projects, strong contractor relationships, or access to private lending capital. Weaknesses might be limited staff for handling tenant maintenance issues across a growing rental portfolio or only having a small number of referral partners for deal flow.

External opportunities can come from accelerating population growth and development in your target market, new zoning favorable to multifamily housing, or record-low mortgage interest rates. Threats could be rising material prices that hurt your flip margins, laws imposing restrictions on non-primary residence owners, or an oversupply of new luxury rentals, allowing tenants to be choosy.

The SWOT analysis highlights strengths to double down on and risks to mitigate in the real estate market.

5. Financial projections

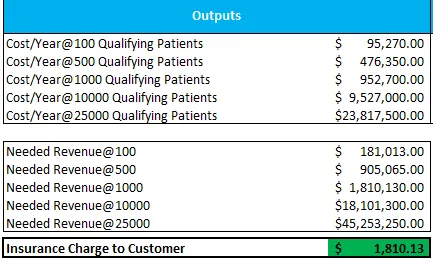

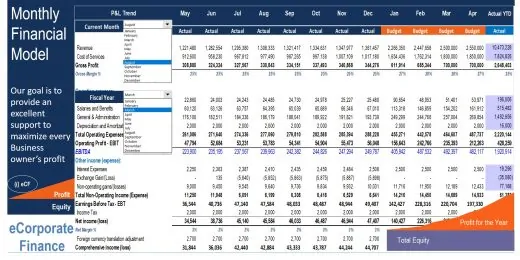

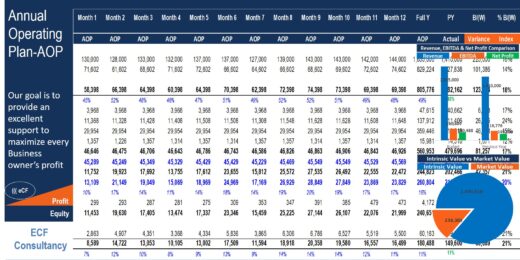

The financial plan helps for both internal preparation and attracting investors. For real estate companies, the financial plan section should cover:

- Startup costs : Include the expected startup costs involved to start your investment project, such as getting licenses and permits or paying for legal fees.

- Profit and loss forecasts : Create projected profit and loss statements that outline what you think your revenues and expenses will be over the next 3-5 years.

- Cash flow projections : Put together projected cash flow statements that show expected cash flow for each month.

- Return on investment projections : Project your company's expected ROI over time under the different investment scenarios.

- Funding requirements : Based on your forecasts, detail exactly how much capital you will need to start and operate your business until it is profitable. Specify whether you plan to use debt or equity financing.

6. Investment strategy

The investment strategy outlines your niche — will you focus on flipping, buying rentals, commercial properties, or a blend? Define any geographic targets like certain cities or zip codes backed by your research on growth potential.

Specify your criteria for ideal investment properties based on your goals. Decide which factors — age, size, layout, condition, or price point — matter most to you.

You can also use this section to explain how you plan to find deals, whether that's by scouting listed properties, attending foreclosure auctions, or networking to create off-market opportunities.

Clearly conveying your approach allows lenders and potential private investors to grasp your niche, planned pursuits, and process for finding deals. Having a strong strategy that summarizes how you locate, evaluate and capture deals matching your investing thesis can increase lender and private investor confidence in your ability to execute.

7. Marketing plan

Real estate marketing can’t just be an afterthought; it helps attract profitable deals, financing, and tenants to your business, making it a necessary component of your business plan to prioritize.

Components of your marketing plan can include:

- Networking: Actively networking at local real estate meetups puts you directly in front of promising off-market opportunities and partnerships with motivated sellers, lenders and contractors in your community.

- Social media: Consistently nurturing your social media presence can also pay off to help you find opportunities or potential investors.

- Direct marketing: Never underestimate old school direct marketing — sending postcards to addresses with outdated “We Buy Houses” signs or calling the For Sale by Owners numbers from public listings can help you reach motivated sellers.

- Listings management: Note that marketing does not end once you own property. To keep rental vacancies filled, leverage listing sites that can publish your units to a wide audience of prospective tenants.

8. Operations plan

Without systems, real estate investors struggle through renovations plagued by cost overruns, shoddy contractors who never call back, and frustrating tenants who always pay late . The operations component of your plan should consider aspects like:

- Renovations: Ever lined up a contractor who juggles too many clients and leaves your projects languishing? Create standardized processes for accurate scoping, vetting subs, enforcing deadlines contractually, and maintaining contingency funds.

- Business technologies: As your portfolio grows, tasks like tracking income, expenses , assets, and communicating with tenants can quickly overwhelm. Identify technologies early on that help centralize details to avoid getting swamped. Look into property management platforms that automate listings, tenant screening , digitized lease agreements, maintenance work order flows, and communications.

- Insurance: Tenants or contractors can sometimes damage assets. Discuss landlord insurance policies to protect you against lawsuits, natural disasters, and major property repairs as you scale up.

9. Team structure

If you plan to grow your team beyond just yourself or a few partners, your business plan should outline your organization's key roles and responsibilities. This helps you consider what positions you may need to fill as your company scales.

- Partners or co-founders: These are the main decision-makers and equity holders. Outline their background, skills, and the value they bring.

- Property manager: This person handles day-to-day management of properties, tenants and maintenance issues.

- Bookkeeper: You may need daily help managing bank accounts, invoices, taxes, and financial reporting.

- Contractors and project managers : You'll need trusted renovations, repairs, and landscaping contractors. Dedicated project managers help oversee large jobs.

- Leasing agents : As you grow and add more properties, leasing agents handle showings, applications, and signing new tenants.

- Real estate attorneys : Real estate investing requires proper legal filings and compliance. Attorneys can help you manage this risk.

10. Exit strategies

Every wise investor plans their exit strategy upfront before acquiring a property. Will you aim to flip the asset quickly or retain it as a rental long-term? What factors determine ideal timing and the right profit margin for you to walk away?

Build flexibility into your strategy, as markets move in unpredictable ways. Especially with flips, have contingency plans if your listing gets lowballs or no offers. Be willing to rent short-term, refinance and hold if possible, convert to condos, or just patiently wait until the market changes. Having reserves and backup options allows you to avoid a distress sale.

Also include plans for strategies after a property sale, like a 1031 exchange to defer capital gains taxes and reinvest in another property. You may want to use sale proceeds to reduce or clear outstanding debts, enhancing cash flow and financial standing.

Tips for your real estate business plan

Now that you know what to include, consider the following four tips to help your real estate investment business plan stand out.

1. Be detailed and specific

Resist the urge to gloss over details as you put together your plan. Drill down on the specifics for parameters like:

- Target purchase and rehab costs.

- Timelines for completing projects.

- Minimum profit margins.

- Maximum allowable vacancy rates .

- Minimum cash reserves.

2. Refine and update regularly

Markets change, so don't create your business plan and file it away. Review your plan regularly to see how market conditions and your actual results compare to projections.

Make adjustments as needed. Tweak your approach if your rehabs are going over budget or your properties aren't selling as quickly as expected.

Aim to update your full plan annually at a minimum. Even if your overall strategy remains consistent, refresh the details around market factors, financials, tactics, risks, and projections.

3. Seek expert feedback

Before implementing your new real estate investment business plan, seek feedback from advisors who can identify potential issues or weaknesses.

Ask experienced real estate investors in your area to review your plan and provide constructive input. It's also a good idea to share your plan and numbers with your CPA and legal counsel as well.

4. Keep it simple

While specificity is good, don't over complicate your business plan to the point where it becomes difficult to follow. You want to inform readers without confusing them.

The goal is for stakeholders, such as co-investors, lenders, and partners, to easily digest your plan and understand it after a quick skim. Make it easy for readers to grasp your reasons behind focusing on a given area or project type based on market conditions and opportunity.

A property investment business plan fit to your goals

After finally finishing your business plan, you’re probably eager to dive into tangible investments rather than tweaking spreadsheets. But in the real estate industry, even experienced investors periodically step back and update strategies.

Approach your business plan as a living document that evolves as the market shifts, as you create new partnerships, or when you need to make changes in strategy. Set reminders to revisit quarterly and confirm your activities of today still align with the vision from day one.

Solid planning is proven to improve outcomes in dynamic industries like real estate investing. Though preparation isn’t glamorous, it pays dividends. Thoughtfully constructing your playbook puts the odds of executing successfully in your favor.

With a solid blueprint backed by your research, you’re now ready to capture the best real estate investment opportunities.

Business plan real estate investor FAQs

How do i stay flexible and adapt my business plan to changes in the market.

To stay flexible, review your real estate investing business plan regularly and update it based on changes in market conditions, trends, and opportunities. If things change in the market, find ways to adapt your strategy. This can include your goals, target market, financing, and even your exit plans.

How do I know if my real estate investing business plan is effective?

You'll know your business plan is effective if you're meeting the key objectives and metrics you outlined. Let's say your plan called for you to purchase a certain number of properties and achieve a specific cash flow or rate of return. If you're falling short, you can use the plan to course-correct.

Are there any specific software or tools for creating a real estate investing business plan?

Azibo is a helpful software tool for creating real estate investing business plans. This comprehensive platform has templates and tools to build out key sections of your plan. Its robust accounting and financial capabilities help construct accurate statements and projections.

Incorporating Azibo's online rent collection allows you to model cash flows. By centralizing lease documents , accounting, and portfolio management, Azibo streamlines the process of putting together a strategically sound real estate business plan.

Important Note: This post is for informational and educational purposes only. It should not be taken as legal, accounting, or tax advice, nor should it be used as a substitute for such services. Always consult your own legal, accounting, or tax counsel before taking any action based on this information.

Nichole co-founded Gateway Private Equity Group, with a history of investments in single-family and multi-family properties, and now a specialization in hotel real estate investments. She is also the creator of NicsGuide.com, a blog dedicated to real estate investing.

Other related articles

Whether you’re a property owner, renter, property manager, or real estate agent, gain valuable insights, advice, and updates by joining our newsletter.

Latest posts

How to find off-market properties: 13 winning methods.

How do you get the best deal on a rental property? This article presents 13 ways to find off-market properties. You'll find practical ways to uncover these deals so you can grow your real estate portfolio without relying on public listings.

Should I Sell or Rent My House? Making the Right Choice

Deciding whether to sell or rent out your house isn't a simple choice, but it's a great chance to evaluate how best to use your property to boost your finances. Here, we cover reasons for both options, and if you lean towards becoming a landlord, we've got you covered with key steps to turn your home into a successful rental.

New Customizable Late Fees: Ethically Enforcing Timely Rent Payments

Azibo introduces customizable late fees, giving property owners the flexibility to set fees that suit their needs while maintaining transparency and fairness for tenants. This new feature helps manage late payments effectively, promoting timely rent payments and positive tenant relationships.

How to Write a Real Estate Investment Business Plan: Complete Guide

- Tweet Share Share

Last updated on December 19, 2023

Building an investing business without a real estate investment business plan is sort of like riding a bike without handlebars.

You might be able to do it… but why would you?

It’s far easier and more practical to set out on your venture with a business plan that outlines things like your lead-flow, where you’ll find funding, and which market(s) you’ll operate.

Plus, according to Entrepreneur, having a business plan increases your chances of growth by 30%.

Download Now: Free marketing plan video and a downloadable guide

So don’t skip this critical first step.

Here’s how to do it.

Real Estate Investment Business Plan Guide

In this article we’re going to discuss:

- What is a real estate investment business plan?

- Create your mission and vision

- Run market analysis

- Choose your business model(s)

- Determine your business goals

- Find funding / Cash buyers

- Identify lead-flow source

- Gather property analysis information

- Create your brand

- Set growth milestones

- Plan to Delegate

What is a Real Estate Investment Business Plan and Why Does it Matter?

A real estate investment business plan is a document that outlines your goals, your vision, and your plan for growing the business .

It should detail the real estate business model you’re going to pursue, your chosen method for lead-gen, how you’ll find funding, and how you plan to close deals.

The kit and caboodle.

It shouldn’t be overly complicated.

Whether this real estate investment business plan is only for your personal use or to present to someone else, simplicity is best. Be thorough, be clear, but don’t over-explain what you’re going to do.

As far as why you should have a business plan, consider that it gives you a 30% better chance of growing your business.

Also, consider that setting out without a plan would be like — full of unexpected twists and turns — is that something you want to do?

Probably not.

It’s worth taking a few days or weeks to put together a business plan, even if it’s just for your own sake. By the time you’re complete, you’ll have greater confidence in the business you’re setting out to build.

And an entrepreneur’s confidence is everything.

How to Create Your Real Estate Investment Business Plan

Now we get into the nitty-gritty.

How do you create your real estate investment business plan? Here are the 10 steps!

1. Create Your Mission & Vision

This can be considered your “summary” section. You might not think that you need a mission statement or vision for your real estate business.

And you don’t.

We know a lot of real estate investors (many of our members, in fact) don’t have a clear mission or vision that they’ve outlined — and they’re successful regardless.

But if you’re just getting started…

Then we think it’s a worthwhile use of your time.

Because if you don’t know why you’re going to build your real estate investing business, if you don’t see what purpose it serves on a personal and professional level, then it’s not going to be very exciting to you.

You can either use this time to create a mission for your business… or a mission statement for you as it relates to growing your business (depending on your goals).

For instance…

- Our mission is to create affordable house opportunities in the Roseburg, Oregon community.

- Our mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Or you could go a more personal route…

- My mission is to create a business that supports my family.

- My mission is to build a company that gives me more time for what matters most to me.

Or you could do both…

- My mission is to create a business that supports my family, and my business’ mission is to provide homeowners with an exceptional experience when selling their properties for cash.

Either way, it’s good to think about this before getting started.

Because if you know why you’re going to build your business — and if, ideally, that reason resonates with you — then you’ll be more excited and determined to work hard toward your goals.

It is also an excellent opportunity to outline the core values you’ll adhere to within your business as Brian Rockwell does on his website …

With this information in hand, you’re ready to move on to the next step.

2. Run Competitive Market Analysis

Which market are you going to operate in?

That might be an easy question to answer — if you’re just going to operate in the town where you live, fair enough.

But it’s worth keeping in mind that today’s technology has made it possible to become a real estate investor in any market from pretty much any location (remotely).

So if the market you’re in is lacking in opportunity, then you might consider investing elsewhere.

How do you know which market to choose?

Here are the 10 top real estate markets for investors, according to our own Carrot member data of over 7000 accounts, based on lead volume…

- Atlanta, GA

- Houston, TX

- Chicago, IL

- Charlotte, NC

- New York, NY

- Los Angeles, CA

- Orlando, FL

- Philadelphia, PA

- Phoenix, AZ

And here are the top 20 states…

- North Carolina

- Pennsylvania

- Oregon

That’ll give you some ideas.

But what makes a market good or bad for real estate investors? Here are some metrics to pay attention to when you’re doing your research.

- Median Home Value — This will tell you how much the average home sells for in the market, which will impact whether you’ll be willing to operate there. Because obviously, you want to play with numbers that feel reasonable to you.

- Median Home Value Increase Year Over Year — Ideally, you want to invest in a market where homes are appreciating every year. And a positive increase in this metric is a good sign that the properties you invest in will continue to increase in value.

- Occupied Housing Rate — A high housing occupancy rate means it’s easy to find tenants, and there’s a healthy demand for housing. That’s a good sign.

- Median Rent — This is the average cost of rent in the market and will give you a good idea of how much you’ll be able to charge on any rentals you own.

- Median Rent Increase Year Over Year — If you’re going to buy rentals, it’s a good sign if rental costs increase every year.

- Population Growth — When the population grows, it creates demand for housing, both rentals and on the MLS. That’s a good sign for a real estate investor.

- Job Growth — Job growth is a sign of a healthy economy and indicates that you’ll have an easier time capitalizing on your real estate investments.

Fortunately, all of this research is super easy to do on Google.

You can just type in the market and the metric in Google and you’ll get meaningful results.

Thank god for technology.

Want more freedom & impact?

From Mindset to Marketing, join our CEO as he unlocks the best stories, tactics, and strategies from America’s top investors and agents on the CarrotCast . If you want to grow your business, you need to check it out!

3. Choose Your Business Model(s)

There’s not just one real estate business model .

There are many.

And the market you’re in — as well as your business goals — will determine which business model you choose.

Here’s a brief overview of each…

- Wholesaling — Is a prevalent business model in the real estate world. Wholesalers find deals and flip them to other cash buyers for an assignment fee, typically somewhere between $5,000 to $10,000. It’s low risk and requires little capital upfront (you can get started with as little as $2,000).

- Wholetailing — Wholetailing is a mix between wholesaling and house flipping. A wholetailer will find a deal, do some very minor repairs (if any), and sell the house on the MLS themselves. It results in large profits with far less work. But wholetail deals are hard to come by.

- BRRRR — This stands for Buy, Rehab, Rent, Refinance, Repeat. It’s a long-term process for buying and holding rental properties. It’s a great way to build net worth and create generational wealth.

- Flipping — House flipping is the most popularized real estate investing method. It consists of purchasing distressed properties, fixing them up, and selling them at a good profit on the MLS, often making upwards of $100,000 per deal. However, this method involves much more risk than the other methods and each deal takes a lot longer to complete.

If you’re just getting started, then we recommend choosing just one business model and doing that until you’ve mastered it.

Down the road, you will likely want to use multiple business models.

We know the most successful real estate investors are wholesalers, wholesalers, flippers, and they own some rental properties.

That allows them to make the most of every opportunity that comes their way.

But again… to start, just choose one.

4. Determine Your Business Goals

At this point, you should have a pretty clear idea of why you’re going to build your real estate investing business.

Are you going to build it because you want to make an impact in your community? Because you want more financial freedom? Because you want more time freedom?

All of the above?

Whatever the case, now it’s time to set some goals related to your mission for the business.

Remember the SMART acronym for goal setting…

Start by thinking about how much money you’d like to make per month — this should be the first income threshold that you’re excited to hit.

Let’s pretend you said $10,000 per month.

Okay, now take a look at your business model. How many properties do you need to have cash-flowing to hit that number? How many deals do you have to do per month? How many flips?

Try to be as realistic with your numbers as possible.

Here are some baselines to consider for the different business models at the $10k/month threshold…

- Wholesaling – 2-3 Deals Per Month

- Wholetailing – 2-3 Deals Per Month

- BRRRR – $1 Million in Assets

- Flipping – 1-2 Flips Per Year

Now you have a general idea of the results you’ll need to hit your first income threshold.

But we haven’t talked about overhead costs.

How much will you need to spend to get those results?

Your answer to that question will be influenced by the market analysis you already did. But it’s pretty standard for the price of finding a deal to hover around $2,000 for a real estate investor (if you’re doing your own advertising).

So now you’re spending $2,000 per deal, or whatever your specific number is. That’s going to have an impact on how much money you’re making. So now we can adjust your goals to be more realistic for hitting that $10k per month marker…

- Wholesaling – 4-5 Deals Per Month

- Wholetailing – 4-5 Deals Per Month

- BRRRR – $1.5 Million in Assets

- Flipping – 2-3 Flips Per Year

The idea here is to figure out how many deals you’ll have to do per month to hit your income goals.

Then work that back into figuring out how much you’ll need to spend every month to realistically and predictably hit your goals.

At $2k per deal and intending to hit $10k/month, here’s what your deal-finding costs might look like…

- Wholesaling – 4-5 Deals Per Month – $8k-$10k/month

- Wholetailing – 4-5 Deals Per Month – $8k-$10k/month

- BRRRR – $1.5 Million in Assets – $6k-$8k/month

- Flipping – 2-3 Flips Per Year – $4k-$6k/month

That should give you a baseline.

How do those numbers look?

If they feel too high for you right now, lower your initial goal — you want to make your first goal something that you know you can accomplish.

Then, as you gain experience, you can increase your goals and make more money down the road.

Free Real Estate Marketing Plan Template

Take our short survey to find out where you struggle most with your online marketing strategy. Generate your free marketing plan video and downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market:

Download your marketing plan template here.

5. Find Funding / Cash Buyers

Are you going to fund your own deals or find private investors ? Or maybe you’re going to get a business loan from a bank?

If you’re just starting as a wholesaler or wholetailer, then it’s recommended funding your own first few deals — that should only cost $2,000 to $5,000… and why overcomplicate things in the beginning when you’re still trying to learn the ropes?

However, as a wholesaler or wholetailer, you’ll still need to find some cash buyers.

Here’s a great video that’ll teach you how to do that…

To consistently grow your cash buyer list (which is an important part of the wholesaling and wholestailing business model), we also recommend creating a buyer website like this…

Learn more about creating your cash buyer website with Carrot over here .

To scale, you might seek out other sources of funding.

Here are some options…

- Bank Loan — Getting a loan from a bank might be the most straightforward strategy if you’re just getting started. But keep in mind that the requirements for a loan on an investment property will be more stringent than the requirements were for your primary residence mortgage. And the interest rate will likely be higher as well. For that reason, you might seek out some of the other options.

- Hard Money — Hard money loans come from companies that specifically serve real estate investors. They are easier and faster to secure than a bank loan and hard money lenders typically base their approval of the loan on the quality of the investment property rather than the investor’s financial standing.

- Private Money — Whereas a hard money loan comes from a company; a private money loan comes from an individual with a good chunk of capital they’re looking to invest. That could be a friend, family member, coworker, and acquaintance. Interest rates and terms on these loans are typically very flexible and the interest rate is usually quite good. Private money is an excellent option for real estate investors looking to scale their business.

But before you seek out funding from those sources, get clear on what exactly you’re going to use those funds for.

Finding funding is even more critical. In fact — if you’re flipping properties or using the BRRRR method.

(It’s a key part of the BRRRR method)

You’ll likely want to use hard money or private money to fund your deals as you grow your business.

But how do you find and secure those loans?

Hard money lenders are easy to find — just Google for hard money lenders in your area and call the companies that pop up to get more details.

Private money (which usually has more favorable terms than hard money) is a bit trickier to find but not at all impossible.

To find private money lenders, you can…

- Tell Friends & Family — This should be the first thing you do. Tell everyone you can about the business you’re building and the returns you can offer investors. Then ask them if they know anyone who might be interested in investing.

- Network — After you’ve exhausted all your friends and family, make a point of getting to know people everywhere you go. The easiest way to do this is to wear branded clothing so people ask about what you do. Talk to people at coffee shops, grocery stores, movie theaters, and anywhere else that you frequent. You never know who you might meet.

- Attend Foreclosure Auctions — Foreclosure auctions are jam-packed with people who have cash-on-hand to buy properties. These people might also be interested in investing in your real estate endeavors. Or they might know where to find private money. Either way, it’s in your interest to build relationships with these people. Attend foreclosure auctions and bring some business cards.

Here are some tips on finding private money lenders…

6. Identify Lead-Flow Source

Now let’s talk about how you will generate a consistent flow of motivated leads for your business.

Because no matter which of the business models you’ve chosen… you’re going to need to find motivated sellers.

And you’re going to need to find those people every single month.

There are essentially two parts to a successful lead generation strategy for real estate investing business.

Both pieces are critical…

- The Short Term — We call this “hamster-wheel marketing” because it requires you to keep working and spending money to generate leads. Examples include Facebook ads, direct mail, bandit signs, cold calling, driving for dollars, and other tit-for-tat strategies that will burn you out if you’re not careful.

- The Long Term — We call this “evergreen marketing” because it requires an upfront investment… but that investment pays off for years and years to come. Examples include increasing brand awareness for your business in your target market(s) and improving your website’s SEO , so that motivated sellers find you .

Short-term tactics are critical when you’re first starting — in fact, they are likely going to be your only source of leads for at least the first few months.

Here are some more details on the most popular and effective methods…

- Tax default mailing lists

- Vacant house lists

- Expired listing lists

- Pre-foreclosure lists

- Out-of-state landlord lists

- Cold Calling — This might be more uncomfortable than stubbing your toe on a piece of furniture, but it can still be effective for finding motivated sellers. We have an article all about colding calling — it even has scripts for you to use.

- Facebook Ads — Facebook ads is another excellent method for generating leads so long as you have a high-converting website to send them to . If you don’t, get yourself a Carrot website . Each Carrot site is built to convert. Here are some more details about running successful ads on Facebook for your real estate investing business.

- Google Ads — Google Ads is one of the most popular platforms for real estate professionals needing to provide quick results with a minimal to high investment depending on markets.

But over time, the goal is to invest in more long-term evergreen marketing tactics so that you can get off the hamster wheel and build a more sustainable business.

Check out the video below to learn more about the critical distinction between short-term and long-term marketing.

At Carrot, we’ve created an online marketing system that makes generating leads super easy and simple for real estate investors.

And it’s 100% evergreen.

Here’s an example of one of our members’ websites that converts like crazy…

Try our free Marketing Plan Generator here.

7. Gather Property Analysis Information

We just talked about how you can generate leads.

But once someone calls you, once you’re checking out a property… How will you know if the property is a good fit for your chosen business model?

After all, not every property will be a fit.

First, ask the following questions when the seller calls…

- What is the address of the house you want to sell?

- How many bedrooms, bathrooms does it have?

- Does it have a garage, basement, or pool?

- If you were going to list it with a Realtor, what repairs and/or updating would you say would be needed?

- How much is owed on the house?

- Do you have an asking price in mind?

- Is the house behind on payments?

- If I come out and look at the property and make you a cash offer to buy it ‘As-Is’ and close as soon as you want, what would be the least you would be willing to take?

That will provide you with a lot of critical information about what you’re dealing with.

Next, once you’re off the phone, do a bit of due diligence and look at what nearby properties of similar size have sold for in the last 90 days or so — that should give you a ballpark idea for the after-repair value of the property.

If you decide that the property sounds promising, you’ll want to walk through it and take pictures of anything and everything that’ll need to be repaired.

Back at the office, estimate the cost of those repairs — here’s a great resource from REISift that’ll help you estimate rehab costs .

You’ll need to go through this entire process regardless of your business model so that you understand your max offer on the property.

So how do you calculate your max offer?

Use the 75% rule — check out this video from Ryan Dossey…

With that, you’ll know how much to pay for the property, how much to spend on repairs, and how much it’ll sell for.

The more you streamline this part of the process, the better.

8. Create Your Brand

Building a company is one thing.

Building an easily recognizable brand and known to be reputable in your marketplace is quite another.

But that’s an integral part of the process. Consider some of these statistics…

- Using a signature color can increase brand recognition by 80 percent.

- It takes about 50 milliseconds (0.05 seconds) for people to form an opinion about your website.

- Consistent presentation of a brand has seen to increase revenue by 33 percent.

- 66 percent of consumers think transparency is one of the most attractive qualities in a brand.

When it comes to building a real estate investing brand, your goals are to…

- Establish Rapport

- Create Easy Recognizability

- Dominate The Conversation

The first step in this process is building an online presence – that means creating a high-converting website (i.e., one that systematically turns visitors into leads by capturing their contact information), running advertisements, and ranking in Google for important keywords.

That’s what we can help you with at Carrot .

Out of the box, our website templates are built to convert visitors into leads – and you can customize them however you want with your branding materials…

You’ll even receive immediate text notifications when someone signs up to be a lead so that you can contact them right away (speed is the name of the game!).

Having a high-converting website is ground zero for brand-building success. If you don’t have a website that systematically converts visitors into leads, then every dollar you spend on advertising is going to be wasted.

So that’s where we start.

Once you’ve got your website up and running, then – if you’re on our Content Pro or Advanced Marketer plan – we’ll provide you with blog posts every single month that are written to rank in Google for high-value keywords relevant to your specific market …

You just upload, make some minor tweaks, and publish – and the more you publish, the more traffic you’ll drive.

To help you become a true authority in your market, we also have the following tools…

- Keyword Ranking Tracker

- SEO Tool For Optimizing All Pages

- Text Notifications For Leads

- World-Class Support

- Campaign Tracking Links

- Coaching Calls

We want to make generating leads as easy as possible for you… so you can focus on closing deals and growing your business.

You can try us here risk-free for 30 days.

If you get yourself a Carrot website, that’ll take care of the “Dominate The Conversation” part of the branding process.

But what about these parts?

Super easy.

Establishing rapport is simply a matter of putting testimonials and case studies on your website. The more of these you have, the more people will trust your brand when they arrive on your website for the first time.

As for creating an easily recognizable brand, create a simple branding package…

- Brand Colors

And then be consistent across all platforms. Use the same colors, font, logo, and brand name on everything – online and offline.

That’ll make it feel like you’re everywhere – which is what you want.

So there you go.

That’s how you create a brand identity as a real estate investor. You’ll know you’ve done it right if people are coming to you out of nowhere – because a friend of a friend told them about you.

And if you want a brand that dominates your market without all of the footwork, we’ve got just the thing – it’s called the Authority Leader Plan … and we’ll do everything for you.

9. Set Growth Milestones

Okay – let’s pretend that you’ve taken all of the steps above.

You’ve got yourself a functioning business and brand with funding, you’ve got consistent lead-flow, and you’re even closing some deals.

Now what?

Well… you want to grow, of course!

You don’t just want to do one deal per month… you want to do three, five, or even ten deals per month.

You want to make more money, increase your net worth, grow your business, and have a significant impact.

How do you do that?

First, you set new goals and milestones for your business’ growth – how many deals do you want to be doing per month in 6 months? In a year?

Then break those goals down by quarter – and turn them into actionable to-dos.

For example, if you’re currently doing one deal per month and you want to be doing five deals per month by the end of Q2, here’s what your goals might look like…

- Send 10,000 Mailers Per Month

- Spend $5,000 on Facebook Ads Per Month

- Hire Salesperson To Answer Phone

- Hire Acquisition Manager

- Create Workflow Process

Or maybe it’ll look a bit different. Make your to-dos as realistic as possible so that if you do those things … you’re virtually guaranteed to hit your goals.

After all, what’s the point of having goals if you’re not going to hit them?

All in all…

Set milestone goals to grow your business, turn those into to-dos and break them down by quarter. The next and final step of your real estate investment business plan might be even more important…

10. Plan To Delegate

At some point, every real estate investor has to come to terms with a straightforward fact…

You can’t build the business of your dreams on your own . You need to delegate .

You’ve got to partner with other people, build critical relationships, hire people, manage people, create systems and processes to streamline your team’s workflow, and lots more.

One of the most important areas that deserve a highlight is your client communications and satisfaction. Consider setting up a robust cloud contact center software to manage all the communications that will lead to long-term partnerships.

Building a business isn’t so much about hustling and bustling as it is about putting the right pieces in the right place.

How do you scale your business?

The answer is quite simple: you do the same things you’re doing now… but at scale – that means hiring people, training people, and creating clean-cut systems.

That’s how you grow your business.

Automate, delegate, and step outside of your business as much as possible to build a real estate investment company that serves you rather than enslaves you.

Final Thoughts on Real Estate Investment Business Plan

What more is there?

You know how to create a mission and vision statement, run market analysis, choose an REI business model, set goals, find funding, generate leads, analyze properties, create a brand, set long-term growth milestones, and delegate.

All that’s left is action.

And reach out anytime with questions – we’re always here to help!

Featured Resource

Free Real Estate Marketing Plan

Generate your free marketing plan video and a downloadable guide to increase lead generation and conversion, gain momentum, and stand out in your market!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Sum of 5 + 9 *

- Property Management 101

- Property Law

- Join Our Network

How to Create a Real Estate Investment Business Plan for Residential Rental Properties (Free Template)

Ready to unlock the potential of real estate investment and build your financial future? Whether you’re an experienced investor or just starting out , crafting a well-thought-out business plan is critical if you're to succeed in the world of residential rental properties.

This article will guide you through the essential steps, considerations, and components of creating a real estate investment business plan. Plus, we've got a valuable free template to make your journey even more manageable.

Why You Need a Business Plan for Real Estate Investment

Crafting an effective real estate investment business plan is about more than paperwork; it's about turning your aspirations into achievements.

Creating a formalized business plan for your real estate investment venture is tantamount to success. It forces you—the investor—to organize your thoughts, feelings, goals, and ideas moving forward in the business in a single, powerful document.

Remember, this is a living document meant to be flexible as your business grows or changes tactics over the years. It keeps you on target, helps expand your business, and keeps your financial goals on track.

It’s also a helpful document for potential investors, creditors, and partners to peruse before pursuing a business venture with you.

And speaking of collaborators, finding sample real estate investment business plans or a template to download to get you started is a good idea. But before diving into that, let's look at a few general considerations that will shape your plan.

General Considerations for a Real Estate Investment Business Plan

Before you start actually writing your business plan, there are a few general considerations to keep in mind:

- The Why. When you start any new venture, it’s good to know you’ve got the strength to realize your goals, even when things get tricky. Defining why you’re embarking upon this real estate investment journey is necessary if you want to reach your destination. Why do you want to invest in real estate? To create financial independence? To serve the community? To provide for your family? Everyone’s “why” is unique to them. As such, your underlying motivation should be the starting point of creating a business plan. Everything follows from this origin.

- Financial Goals. Next, it’s wise to consider your financial goals. What are you hoping to accomplish financially? This is a business, and having defined financial goals will help keep your real estate investments trending in the right direction.

- Timeline. When do you want to achieve all this? Are you taking this business from now until retirement or looking to flip a few houses before the decade closes? Having a general timeline in mind when planning means you’ll be realistic about what goals you can accomplish.

- Real Estate Investment Strategy. There are countless ways to jumpstart your real estate investments. Doing a bit of research to discover which real estate investment strategies best suit your financial goals and desired timeline will ensure your business plan is realistic moving forward.

These considerations form the foundation of your real estate investment business plan. But how do you piece it together and create a comprehensive, winning document?

Spoiler alert: Property managers can be your secret weapon in crafting an airtight plan and guiding you through your investment journey.

But first, let's explore the essential components of your business plan and how a property manager can make the process smoother.

Essential Components of a Business Plan for Real Estate Investment

A well-thought-out business plan for real estate investment should help you secure the financing and partnerships needed to bring your dream to fruition.

To do this, it must include the following components:

- Executive Summary: a bird’s eye view. The first section of a business plan is like an abstract for a research paper. Here, you’ll introduce the plan and give an overview of what comes later in the document.

- Define your team. Who are you bringing on this journey? What are their qualifications? This section can attract new investors and partners by touting the team's accomplishments.

- Outline marketing strategy. A business plan won’t succeed without a marketing strategy to connect with potential clients, in this case, future tenants. Your real estate business plan must include understanding the need for top-quality marketing and a method to market your business successfully. Will you run social media ads? Rent local billboard space?

- Demonstrate initiative and a willingness to learn. Include a section to show that you know this industry, have researched the competition, and are aware of local real estate market trends and areas for growth. This will communicate to potential investors you’re willing to put in the elbow grease it takes to succeed long-term in this business.

- Describe the “What”. What services will you offer? What type of properties will you invest in? What are the next steps to your plan moving forward?

As you dive deeper into your real estate investment journey, remember that the strength of every property manager relationship reflects the property owner's dedication.

How to Create a Residential Real Estate Business Plan Quickly

If you're looking to create a residential real estate business plan quickly, here are a few must-have tips to get you started:

- Define: Mission. Vision. Values. A business is only as strong as its “big three” pillars: the mission, vision, and values. Begin your business plan by defining what the purpose of your business is (its mission), your plan to bring this mission to life (vision), and the values that will guide your actions when the going gets tough. Careful consideration of these will give you clarity when finding team members to build your business later on. You need people who click with what your business stands for.

- Identify short and long-term goals. A real estate business is only as successful as it prepares to be. Remember the adage: if you fail to plan, you plan to fail. Spending time identifying short (3-12 months out) and long (1-5 years in the future) term goals gives you and your team ways to mark the journey to success with well-defined milestones.

- Figure out the finances. How will you fund your business? There are many ways to find capital to bring your real estate business plan to life, but you may have to get creative. And you’ll need to stay organized and on task to bring your financial goals to fruition.

- Find the perfect property manager. The quickest way to accomplish this magnificent business plan you’re creating? Hire a property manager to help you skip the grunt work. But while finding the right manager for your business isn’t easy—you’ll need to research and interview several property managers before you get a feel for what’s best for you—the road will be much less bumpy with a solid business plan in hand.

How a Property Manager Can Help You Create a Real Estate Investment Business Plan

A property manager can help you create a real estate investment business plan in five important ways.

- Provide you with insights into the local real estate market.

- Help you identify and evaluate potential investment properties.

- Help you develop a marketing strategy to attract tenants.

- Help you manage your finances and keep track of your expenses.

- Provide you with guidance and support throughout the investment process.

When you enter property manager interviews armed with a robust business plan, you demonstrate your commitment and pave the way for a successful partnership.

Ultimately, creating the ideal business plan for real estate investment begins with you. Every property manager relationship is only as strong as the drive of the property owner.

Download APM’s free sample real estate investment business plan template to get started.

Get the latest property management trends delivered right to your inbox.

Find A Property Manager

- Single-Family Property Management

- Multifamily Property Management

- Apartment Property Management

- Condo Property Management

- Homeowners' Association (HOA) Property Management

- Commercial Property Management

For Property Owners

For property managers.

- Resource Center

- My Client Center

We use essential cookies to make Venngage work. By clicking “Accept All Cookies”, you agree to the storing of cookies on your device to enhance site navigation, analyze site usage, and assist in our marketing efforts.

Manage Cookies

Cookies and similar technologies collect certain information about how you’re using our website. Some of them are essential, and without them you wouldn’t be able to use Venngage. But others are optional, and you get to choose whether we use them or not.

Strictly Necessary Cookies

These cookies are always on, as they’re essential for making Venngage work, and making it safe. Without these cookies, services you’ve asked for can’t be provided.

Show cookie providers

- Google Login

Functionality Cookies

These cookies help us provide enhanced functionality and personalisation, and remember your settings. They may be set by us or by third party providers.

Performance Cookies

These cookies help us analyze how many people are using Venngage, where they come from and how they're using it. If you opt out of these cookies, we can’t get feedback to make Venngage better for you and all our users.

- Google Analytics

Targeting Cookies

These cookies are set by our advertising partners to track your activity and show you relevant Venngage ads on other sites as you browse the internet.

- Google Tag Manager

- Infographics

- Daily Infographics

- Popular Templates

- Accessibility

- Graphic Design

- Graphs and Charts

- Data Visualization

- Human Resources

- Beginner Guides

Blog Business 5 Real Estate Business Plan Examples & How to Create One?

5 Real Estate Business Plan Examples & How to Create One?

Written by: Danesh Ramuthi Nov 28, 2023

Crafting a business plan is essential for any business and the real estate sector is no exception. In real estate, a comprehensive business plan serves as a roadmap, delineating a clear path towards business growth.

It guides owners, agents and brokers through various critical aspects such as identifying target markets, devising effective marketing strategies, planning finances and managing client relationships.

For real estate businesses, a well-written plan is crucial in attracting potential investors, showcasing the company’s mission statement, business model and long-term income goals.

So, how can you write one?

Leveraging tools like Venngage Business Plan Make r with their Business Plan Templates to create your own real estate business plan can be transformative.

They offer a lot of real estate business plan examples and templates, streamlining the process of crafting a comprehensive plan.

Click to jump ahead:

- 5 real estate business plan examples

How to write a real estate business plan?

- Wrapping Up

5 Real estate business plan examples

As I have said before, a well-crafted business plan is a key to success. Whether you’re a seasoned agent or just starting out, examples of effective real estate business plans can offer invaluable insights.

These examples showcase a range of strategies and approaches tailored to various aspects of the real estate market. They serve as guides to structuring a plan that addresses key components like market analysis, marketing strategies, financial planning and client management, ensuring a solid foundation for any real estate venture.

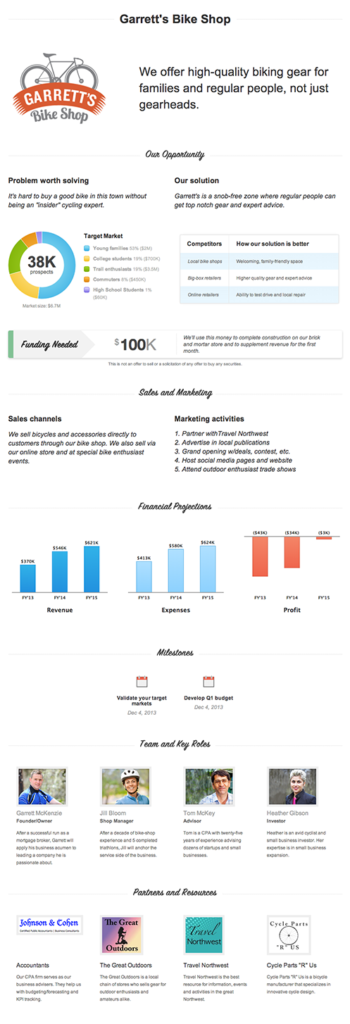

Real estate business plan example

There are various elements in a real estate business plan that must be integrated. Incorporating these elements into a real estate business plan ensures a comprehensive approach to launching and growing a successful real estate business.

What are they?

- Executive summary: The executive summary is a concise overview of the real estate business plan. It highlights the mission statement, outlines the business goals and provides a snapshot of the overall strategy.

- Company overview: An overview on the history and structure of the real estate business. It includes the company’s mission and vision statements, information about the founding team and the legal structure of the business.

- Service: Here, the business plan details the specific services offered by the real estate agency. This could range from residential property sales and leasing to commercial real estate services. The section should clearly articulate how these services meet the needs of the target client and how they stand out from competitors.

- Strategies: A very crucial part of the plan outlines the strategies for achieving business goals. It covers marketing strategies to generate leads, pricing strategies for services, and tactics for effective client relationship management. Strategies for navigating market shifts, identifying key market trends and leveraging online resources for property listings and real estate listing presentations to help with lead generation are also included.

- Financial plan: The financial plan is a comprehensive section detailing the financial projections of the business. It includes income statements, cash flow statements, break-even analysis and financial goals. Besides, a financial plan section also outlines how resources will be allocated to different areas of the business and the approach to managing the financial aspects of the real estate market, such as average sales price and housing market trends.

Read Also: 7 Best Business Plan Software for 2023

Real estate investment business plan example

A real estate investment business plan is a comprehensive blueprint that outlines the goals and strategies of a real estate investment venture. It serves as a roadmap, ensuring that all facets of real estate investment are meticulously considered.

Creating a business plan for real estate investment is a critical step for any investor, regardless of their experience level Typically, these plans span one to five years, offering a detailed strategy for future company objectives and the steps required to achieve them.

Key components:

- Executive summary: Snapshot of the business, outlining its mission statement, target market, and core strategies. It should be compelling enough to attract potential investors and partners.

- Market analysis: A thorough analysis of the real estate market, including current trends, average sales prices and potential market shifts.

- Financial projections: Detailed financial plans, including income statements, cash flow analysis, and break-even analysis.

- Strategy & implementation: Outlines how the business plans to achieve its goals. This includes marketing efforts to generate leads, pricing strategies and client relationship management techniques.

- Legal structure & resource allocation: Details the legal structure of the business and how resources will be allocated across various operations, including property acquisitions, renovations and management.

Real estate agent business plan example

A real estate agent business plan is a strategic document that outlines the operations and goals of a real estate agent or agency. It is a crucial tool for communicating with potential lenders, partners or shareholders about the nature of the business and its potential for profitability.

A well-crafted real estate agent business plan will include

- Where you are today: A clear understanding of your current position in the market, including strengths, weaknesses and market standing.

- Where you aim to be: Sets specific, measurable goals for future growth, whether it’s expanding the client base, entering new markets or increasing sales.

- How can you get there: Outlines the strategies and action plans to achieve these goals, including marketing campaigns, client acquisition strategies and business development initiatives.

- Measuring your performance: Defines the key performance indicators (KPIs) and metrics to assess progress towards the set goals, such as sales figures, client satisfaction rates and market share.

- Course correction: Establishes a process for regular review and adjustment of the plan, ensuring flexibility to adapt to market changes, shifts in client needs and other external factors.

For real estate agents, a comprehensive business plan is not just a roadmap to success; it is a dynamic tool that keeps them accountable and adaptable to market changes.

Realtor business plan example

A realtor business plan is a comprehensive document that outlines the strategic direction and goals of a real estate business. It’s an essential tool for realtors looking to either launch or expand their business in the competitive real estate market. The plan typically includes details about the company’s mission, objectives, target market and strategies for achieving its goals.

Benefits of a realtor business plan and applications:

- For launching or expanding businesses: The plan helps real estate agents to structure their approach to entering new markets or growing in existing ones, providing a clear path to follow.

- Securing loans and investments: A well-drafted business plan is crucial for securing financing for real estate projects, such as purchasing new properties or renovating existing ones.

- Guideline for goal achievement: The plan serves as a guideline to stay on track with sales and profitability goals, allowing realtors to make informed decisions and adjust strategies as needed.

- Valuable for real estate investors: Investors can use the template to evaluate potential real estate businesses and properties for purchase, ensuring they align with their investment goals.

- Improving business performance: By filling out a realtor business plan template , realtors can gain insights into the strengths and weaknesses of their business, using this information to enhance profitability and operational efficiency.

A realtor business plan is more than just a document; it’s a roadmap for success in the real estate industry.

Writing a real estate business plan is a comprehensive process that involves several key steps. Here’s a detailed guide to help you craft an effective business plan :

- Tell your story : Start with a self-evaluation. Define who you are as a real estate agent, why you are in this business and what you do. Develop your mission statement, vision statement and an executive summary.

- Analyze your target real estate market : Focus on local market trends rather than national or state-wide levels. Examine general trends, market opportunities, saturations, and local competition. This step requires thorough research into the real estate market you plan to operate in.

- Identify your target client : After understanding your market, identify the niche you aim to serve and the type of clients you want to target. Create a client persona that reflects their specific needs and concerns.

- Conduct a SWOT analysis : Analyze your business’s Strengths, Weaknesses, Opportunities and Threats. This should reflect a combination of personal attributes and external market conditions.

- Establish your SMART goals : Set specific, measurable, attainable, realistic and timely goals. These goals could be financial, expansion-related or based on other business metrics.

- Create your financial plan : Account for all operating expenses, including marketing and lead generation costs. Calculate the number of transactions needed to meet your financial goals. Remember to separate personal and business finances.

- Revisit your business plan to monitor & evaluate : Treat your business plan as a living document. Plan periodic reviews (quarterly, semi-annually or annually) to check if your strategies are advancing you toward your goals.

- Defining your mission & vision : Include a clear mission and vision statement. Describe your business type, location, founding principles and what sets you apart from competitors.

- Creating a marketing plan : Develop a marketing plan that addresses the product, price, place and promotion of your services. Determine your pricing strategy, promotional methods and marketing channels.

- Forming a team : Ensure the cooperation of colleagues, supervisors and supervisees involved in your plan. Clarify their roles and how their participation will be evaluated.

Related: 15+ Business Plan Examples to Win Your Next Round of Funding

Wrapping up

The journey to a successful real estate venture is intricately linked to the quality and depth of your business plan. From understanding the nuances of the real estate market to setting strategic goals, a well-crafted business plan acts as the backbone of any thriving real estate business. Whether you’re developing a general real estate business plan, focusing on investment, working as an agent, or operating as a realtor, each plan type serves its unique purpose and addresses specific aspects of the real estate world.

The examples and insights provided in this article serve as a guide to help you navigate the complexities of the real estate industry. Remember, a real estate business plan is not a static document but a dynamic blueprint that evolves with your business and the ever-changing market trends.

Crafting a strategic real estate business plan is a crucial step towards achieving your business goals. So, start shaping your vision today with Venngage.

Explore venngage business plan maker & our business plan templates and begin your journey to a successful real estate business now!

Discover popular designs

Infographic maker

Brochure maker

White paper online

Newsletter creator

Flyer maker

Timeline maker

Letterhead maker

Mind map maker

Ebook maker

Now answering calls 24/7

Lead Intake Done For You

Professionally Trained, U.S. Based, Live Call Answering For Real Estate Professionals.

Listen to Actual Conversions with Call Porter representatives.

Featured In:

Trusted by Hundreds of Investors & Agents

Here’s what some of our clients have to say about us…

The World’s Only Real Estate-Specific Answering Service.

Call Porter is the world’s only, US based, live answering service & lead management system built exclusively for real estate investors—Buy and sell more property without being glued to the phone.

Built By Investors, For Investors

Frustrated with low-quality call services, CP was created by investors with real estate processes in mind. All our scripts, systems, and staff are expertly trained in all aspects of real estate and work exclusively with real estate investors.

Your Own Personal Phone Rep

We only hire and train English-fluent, US residents—No more language barriers and miscommunication. Also, your leads are exclusively linked to you . So when our agents answer, they answer in your company name.

Professional Appointment Setting

Call porter allows you to:, close more deals.

Ramp up your deal flow by focusing on marketing and buying, not phone intake. With Call Porter, you can easily take 50, 75, even 100 calls per week without spending an extra minute on the phone yourself.

Save Hours Of Time

The Call Porter team screens, qualifies, and schedules appointments with sellers who’re ready to sell, so you can stop wasting your time with bad-leads .

Save Thousands of $$$

A personal assistant handling inbound calls can cost at least $1,600 per month (not to mention the months you’ll waste training them). Call Porter costs a fraction of this and our staff are expertly trained in all aspects of real estate investing .

Enjoy More Freedom

You created a business for freedom, not a job. Stop spending hours on the phone qualifying and persuading your leads—Call Porter handles all this for you… and they do it well!

Ready To Grow?

Let us handle all your inbound calls so you can focus on investing, closing deals ,and growing your business.

Born from incompetent phone reps...

Call Porter was born because of terrible call services that don’t know real estate or intake. It was created by 7-figure portfolio holder and wholesaler, Ryan Dossey, and call center veteran Justin Dossey…

Before Call Porter, Ryan used almost every service on the block and even hired international VA’s that were “cheaper”. But instead, he found that he was losing leads by the day . On top of that, he had wasted hours trying to re-coup the lost leads, wasting appointment blocks on tire-kickers (booked by incompetent phone reps), and dealing with confused and irate sellers. He decided to end all that headache and create his own answering service. He envisioned a call center with amazing answering agents, trained in REI, screening, and booking quality appointments ( and doing it better than investors themselves ).

So, he teamed up with his brother Justin Dossey, a 15-year veteran of call center operations, and former director of customer service for the largest extended warranty company in the country. Because international agents created more confusion than anything else, they decided to go local to eliminate language barriers. Then, they created a solid hiring process that finds go-getters and natural talent. Then, they created a bonafide script and selling system that Ryan and his acquisition manager created to give the best results while getting as many quality appointments as possible. The results were stellar.

Now, they ( and 300+ users ) sit back, turn on their marketing, and watch their appointment calendar fill up every week with no other hassles.

Built Exclusively For Real Estate Professionals

Copyright © 2023 All Rights Reserved

Site by Paul W Stern

Real Estate Investing Business Plan

Ready to dive into the world of real estate investing? Embarking on this journey can be exciting and profitable, but it’s essential to be well-prepared and have a solid business plan in place. This comprehensive guide will walk you through the crucial steps of crafting your real estate investing business plan, from defining your investment goals to assembling a skilled team. Set yourself up for success and turn your real estate dreams into reality.

Key Takeaways

- Real estate investing requires a comprehensive business plan to optimize decision-making and utilize resources.