Flexible Benefits

Healthcare reform, search form.

Benefits Buzz

Group Health Plans: Owners, Non-Employees & Domestic Partners

Ask the Expert

Stay Connected

- Health Insurance

- Medicare Plans

- Life Insurance

- Health Savings Accounts

- Ancillary/Voluntary Plans

- Wrap Document Services

- Flexible Spending Accounts

- Federal COBRA

- Health Reimbursement Arrangements

- Compliance dashboard

- Non-Discrimination Testing

- Premium Only Plans

- Commuter Benefits

Individuals

- Press Releases

Affiliations

Headquarters, field office.

5050 Quorum Drive, Suite 700, Dallas, TX 75254 Phone: 866-472-0883 Fax: 214-292-8832

Individuals & Employers

Sales & Service: 866-472-5351

General Agency: Sales & Quotes: 888-353-9178 Service: 866-472-5352

Flex Plans: Sales & Service: 888-345-7990

Login/Register

© Flexible Benefit Service LLC. All Rights Reserved. Site Map | Privacy Policy | Terms of Use

| You might be using an unsupported or outdated browser. To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website. |

- Health Insurance

What Is Group Health Insurance & How Does it Work?

Updated: Feb 27, 2024, 6:19am

Nearly 50% of insured Americans receive health insurance coverage through group plans provided by employers, according to 2019 Census data. However, many of them may not have thought much about how exactly this group health insurance works.

Group health insurance provides many benefits, but when your insurance plan is tied directly to your employment, you risk a sudden loss of health coverage should your job situation change. In 2017, 22% of uninsured Americans reported losing their health insurance due to job loss or change in employment status.

Whether you recently started a new job and want to learn more about how your new group coverage works, you already have group coverage and want to know more about it, or you just lost or quit your job and worry you’ve lost health insurance coverage, this guide can help you understand the ins and outs of group health insurance.

What Is Group Health Insurance and How Does It Work?

Group health insurance—sometimes called employer-based coverage—is a type of health insurance plan offered by an employer of a member organization. Members of a group health insurance plan usually receive coverage at a lower cost because the risk to the insurer is distributed across multiple members.

Under the Affordable Care Act (ACA), businesses with 50 or more full-time employees must provide health insurance to full-time employees and dependents under the age of 26 or pay a fee. Insurers are also required to provide group coverage to organizations with as few as two employees. Some states allow self-employed individuals to qualify for group coverage plans as well.

Group health insurance plans are selected and purchased by companies or organizations and then offered to employees. In most states, a group insurance plan is required to have a 70% participation rate, though some states’ minimum rate is higher or lower.

Benefits of Group Health Insurance Plans

Group health insurance policies have a number of advantages and benefits over individual plans. Many employers provide supplemental health plans, which include dental coverage, vision coverage and pharmacy coverage, either separately or as a bundle.

The main benefit group plans offer is lower premiums. According to 2018 research conducted by eHealth, a private online marketplace for health insurance, the average premium cost per individual in a group health insurance plan was $409 a month compared to $440 for an individual plan. In the same study, small group health plans had an average deductible of $3,140 a year compared to $4,578 for individual plans.

Additionally, family members and dependents can be added to group plans at an additional cost to members, which can assist families with sole providers or whose alternative or individual health plan options carry significantly higher prices.

Group health insurance plans provide numerous tax benefits to both the employer and employee. The money employers pay towards monthly premiums is tax-deductible, and employees’ premium payments can be made pre-tax, which may reduce their total taxable income.

Some smaller businesses may also qualify for the small business health care tax credit . The small business health care tax credit benefits an employer with fewer than 25 full-time employees who pays average wages of less than $50,000 a year, offers a qualified health plan through the Small Business Health Options Program (SHOP) Marketplace and pays at least 50% of the cost of health care coverage for each employee (but not for family or dependents).

Who Can Sign Up for Group Health Insurance?

To be eligible for group health insurance, an employee must be on payroll and the employer must pay payroll taxes. Individuals usually not eligible for group coverage include independent contractors, retirees and seasonal or temporary employees. Employees who are on unpaid leave are often ineligible for group coverage until they return to work.

Generally, group health insurance coverage must also be offered to an employee’s spouse and dependent children until age 26, though employers may choose to expand the age definition for child dependents. Employers may also opt to extend health benefits to unmarried partners of the same or opposite sex, and that coverage must mirror the coverage extended to spouses on the same plan.

How to Enroll in Group Health Insurance

To enroll in a group health care plan provided by your employer, ask about the deadline for enrollment once hired. If you miss this deadline, you might have to wait until the annual open enrollment period to join. Some employers may have waiting periods of up to 90 days before new employee health insurance kicks in. You won’t have to pay premiums during this time, but you won’t have access to any health care coverage, either.

Some group health insurance plans offer different tiers of coverage or supplemental coverage like dental, vision and/or pharmacy. During open enrollment periods, you can make decisions about these insurance choices your employer provides, as well as add or remove any dependents. If a major life event like marriage, the birth of a child or a spouse’s loss of employment changes your circumstances, you may be able to enroll these new dependents in your group health insurance plan outside the open enrollment period.

Where to Find Group Health Insurance Plans

The most common way to get group health insurance coverage is through an employer. If your employer doesn’t offer health insurance due to the small size of the company or if you’re unsatisfied with your employer’s coverage options, look into coverage through a membership organization. If you belong to a membership organization offering a group health plan, such as AARP, the National Association of Female Executives, the Writer’s Guild of America or the Freelancers Union, you may be able to get health insurance coverage through your membership.

Be wary of plans offered by some membership organizations, as many offer a “health services discount” plan, which may save you money on prescriptions but isn’t a true health insurance plan.

Featured Small Business Health Insurance Partners

UnitedHealthcare

1.3 million

On UnitedHealthcare's Website

Blue Cross Blue Shield

1.7 million

On Healthcare.com's Website

1.2 million

Group Health Insurance for the Self-Employed

Approximately 25.7 million small businesses in 2017 were considered “nonemployers,” or businesses with no paid employees, according to a 2020 report from the U.S. Small Business Administration Office of Advocacy. If your business doesn’t have any employees, you’re considered a small group of one.

Even though you’re self-employed, you may be able to buy group health insurance for your company in certain states. Check with your state’s insurance department to determine whether your state allows group policies to be sold to groups of one.

What to Do If You Lose Your Group Health Benefits

If you lose your job, you may also lose your employer-sponsored group health insurance. You and your dependents may be able to keep this coverage through what’s called continuation coverage.

In 1985, Congress passed the Consolidated Omnibus Budget Reconciliation Act (COBRA), which allows employees who lose their jobs to buy group health coverage for themselves or for their families for a limited amount of time. Under COBRA, the same group insurance plan with the same benefits must be made available to the terminated worker; however, the former employee must pay the full cost—including whatever the employer has previously covered—of the plan.

Continuation coverage is often much more expensive than an individual health insurance plan, so consider the price, benefits and network of providers carefully before making the choice to keep your coverage through continuation coverage temporarily instead of moving to an individual plan.

Featured Health Insurance Partners

Offers plans in all 50 states and Washington, D.C.

About 1.2 million

About 1.7 million

About 1.5 million

- Health Insurance Coverage of the Total Population . KFF. Accessed 9/17/2021.

- 27+ Affordable Care Act Statistics and facts . Policy Advice. Accessed 9/17/2021.

- What is the Average Cost of Small Business Health Insurance? eHealth. Accessed 9/17/2021.

- 2020 Small Business Profile . U.S. Small Business Administration Office of Advocacy. Accessed 9/17/2021.

- Group Health Plan . HealthCare.gov. Accessed 9/17/2021.

- What constitutes a group for health insurance? People Keep. Accessed 9/17/2021.

- Health Insurance During Employment . Legal Aid at Work. Accessed 9/17/2021.

- Offer SHOP health insurance . HealthCare.gov. Accessed 9/17/2021.

- Employer Health Insurance Versus Individual Plans . Medical Mutual. Accessed 9/17/2021.

- Small Business Health Care Tax Credit and the SHOP Marketplace . Internal Revenue Service. Accessed 9/17/2021.

- Eligible Employees and Dependents . Health Coverage Guide by Small Business Majority. Accessed 9/17/2021.

- Health Insurance Guide . California Department of Insurance. Accessed 9/17/2021.

- Available Through Professional and Trade Organizations . The Hartford. Accessed 9/17/2021.

- The Best Way to Buy Group Health Insurance for Self-Employed Workers . HealthMarkets. Accessed 9/17/2021.

- Health Insurance After Employment: COBRA . Legal Aid at Work. Accessed 9/17/2021.

- Best Affordable Health Insurance

- Best Dental Insurance

- Best Disability Insurance

- Best Health Insurance

- Best Health Insurance For College Students

- Best Health Insurance for Retirees

- Best Health Insurance for Young Adults

- Best Mental Health Insurance

- Best Short-Term Health Insurance

- Best Small Business Health Insurance

- Best Vision Insurance

- Compare Health Insurance Quotes

- Cost Of Health Insurance

- Cost Of Obamacare

- Does Insurance Cover Ambulance Rides?

- How Long Can You Stay On Your Parent’s Health Insurance?

- How Much Does An Urgent Care Visit Cost?

- How Much Does It Cost To Have A Baby?

- How To Get Health Insurance?

- How To Get Health Insurance Without A Job?

- What Happens If You Don’t Have Health Insurance?

- What Is Private Health Insurance?

Navigating Health Insurance As A Self-Employed Worker: 3 Things You Need To Know

No-Deductible Health Insurance: What Is It And How Does It Work?

Top Benefits Of A Health Insurance Plan In 2024

What’s The Difference Between A Deductible vs. Out-of-Pocket Maximum?

Best Health Insurance Companies Of July 2024

Best Short-Term Health Insurance Companies Of 2024

Chauncey grew up on a farm in rural northern California. At 18 he ran away and saw the world with a backpack and a credit card, discovering that the true value of any point or mile is the experience it facilitates. He remains most at home on a tractor, but has learned that opportunity is where he finds it and discomfort is more interesting than complacency.

Alena is a professional writer, editor and manager with a lifelong passion for helping others live well. Before coming to Forbes Health, Alena worked as a digital media consultant for both B2B and B2C health-focused companies for several years, building content strategies and leaning into the world of e-commerce. She is also a newly minted functional medicine certified health coach.

Mitigate misclassification risk with coverage up to USD 500,000 | Learn more

- Log In Sign Up Book a Demo

How to provide health insurance for non-employees

Things to consider around health benefits for non-employees.

PUBLISHED ON

May 12, 2022

One of the top benefits a company can offer its employees is health insurance coverage . This gives workers access to a group policy, which often allows them to secure more affordable and comprehensive coverage than they could on their own.

But what if you want to provide health insurance for non-employees, such as contractors?

While your options may be limited, there are ways to provide health insurance to non-employees. Through careful consideration of the details, you can provide contractors with a high-level benefit that will strengthen your relationship.

Before we go any further, remember this: you’re under no legal obligation to offer health insurance to individual contractors. This is a decision your company can make at its own discretion.

The best path forward is to offer contractors the same health insurance as your employees. This makes it easier to manage payroll and benefits , thus reducing the risk of error and saving you time.

If you opt to offer contract medical insurance, there are four points to keep in mind:

1. Employers can offer the same group plan

As noted above, you can offer contractors the same group plan as your part and full-time employees. You don’t have to select a different plan for contractors to access.

2. The contractor may need to declare it as taxable income

Urge your contractors to discuss the tax implications of receiving health insurance from your company. They may need to declare any employer contribution as taxable income.

3. Employers don’t have to pay any portion of the premium

There’s no requirement for employers to pay any portion of the premiums for contractors. You can do this if you want, but it’s not an obligation. That holds true even if you pay some or all of the premium for your employees.

4. Contractors may be able to deduct the premium paid

Contractors may be able to deduct any premiums paid from their income. This can help reduce the impact of the cost at tax time.

Want to see the Oyster platform in action? Book a demo and we promise to show you all the features that’ll make your People Ops team go whoa .

Is health insurance for non-employees a good idea.

There’s no right or wrong answer to this question, as the situation varies from company to company and contractor to contractor. If you’re on the fence, here are some benefits of offering health insurance coverage to “1099 employees.”

- Health insurance can help retain contractors. One of the primary disadvantages of working as a contractor is a lack of access to benefits such as medical coverage. You can help contractors by giving them access to your group policy.

- It can save you money. The more people you have on your group policy — especially if you add younger, healthier contractors — the better chance there is of reducing premiums for your entire team.

- It can help you qualify: For instance, if you’re the only employee at your company, you may need to add contractors to qualify for group health insurance.

Questions to ask and answer

As you inch closer to making a final decision, answering these questions can help you proceed with confidence:

- How many contractors do you work with?

- Do you generally maintain long-term relationships with your contractors?

- Can you afford to pay a portion of contractor health insurance premiums?

- Do you know if some or all of your contractors are interested in buying coverage through your group plan?

- Does it make sense to search for a different health insurance provider before allowing contractors to join?

Answering these questions provides insight into your situation so that you can make a more informed decision.

Oyster is here to help

Deciding for or against health insurance for non-employees is easier said than done. For that reason, you want to gather as much information and professional guidance as possible. And that’s where Oyster can help.

Oyster Health makes it simple and affordable to offer health insurance to team members in more than 180 countries. You’re not limited to offering coverage to contractors and employees in your home country.

By working directly with various health insurance carriers, Oyster can provide you with multiple quotes to help you make the right decision for your team and your company financials.

About Oyster

Oyster is a global employment platform designed to enable visionary HR leaders to find, hire, pay, manage, develop and take care of a thriving global workforce. It lets growing companies give valued international team members the experience they deserve, without the usual headaches and expense.

Oyster enables hiring anywhere in the world with reliable, compliant payroll, and great local benefits and perks. Try Oyster out with a free demo!

.webp)

Table of Contents

Related terms, additional resources.

Do employers have to offer health insurance?

Are you required to provide healthcare to your team?

Health insurance for foreign nationals

How to provide health insurance to foreign nationals.

What’s the difference between public and private health insurance?

Understanding different types of insurance for employees.

How much is health insurance for 1099 workers?

Must-knows about insurance for independent contractors.

What countries offer free health care?

Find out which countries have universal health care.

What are the most common employee benefits?

Find out what the 10 most common employee benefits are.

.webp)

How to add 1099 and global contractors to your company’s benefits plan

Learn about the benefits your company can offer contractors.

.webp)

What is an employer-sponsored health plan?

Learn how it supports employee well-being

Get A Demo of Oyster

A call from one of our Oyster experts

A full overview of Oyster's tools and features

The best available price to fit your company needs

- Updated Terms of Use

- New Privacy Policy

- Your Privacy Choices

- Closed Captioning Policy

Quotes displayed in real-time or delayed by at least 15 minutes. Market data provided by Factset . Powered and implemented by FactSet Digital Solutions . Legal Statement .

This material may not be published, broadcast, rewritten, or redistributed. ©2024 FOX News Network, LLC. All rights reserved. FAQ - New Privacy Policy

How to Get Group Health Insurance Without an Employer

Just because you are self employed or don’t work for a company that offers group health insurance, that doesn’t mean you can’t get it.

Depending on the state you live in, there are ways to get group health insurance through associations and membership organizations.

Unlike individual health insurance plans that include an underwriting process that requires a health exam and have a high turn down right, with group health insurance, the chances of getting coverage declined are minimal and the coverage includes all the major benefits. Group coverage also tends to have much smaller deductibles than individual health care.

With group insurance “the benefits tend to be richer,” says Carrie McLean, a licensed insurance agent for eHealthInsurance.com . “You might have a smaller deductible and unlimited doctor visits.”

Group Coverage for One or Two

Although not widespread, according to eHealthInsurance.com some states, including Massachusetts, Washington, New York, Florida and Colorado allow groups of one to be eligible for group health insurance.

California and New Jersey allow two-person businesses to buy group insurance for one person, if one employee has group insurance from another source, like a spouse’s employer. In order to be eligible for group insurance in any state, recipients have to have documentation that they have a business.

Let’s say you run a cleaning service but the only other person on the payroll is your wife. If you live in a state that allows groups of two to get group health insurance then you would be eligible. Both of you have to actively work in the business and both must be on the payroll, according to Craig Lordigyan, an agent and managing partner at The Lordigyan Insurance Agency.

Associations and Membership Organization Coverage

If you don’t live in a state that offers group health insurance to small groups then you may be able to get the insurance by joining an association or membership organization.

In general, an association or membership organization is a group created to support the interests of people in a specific industry or trade.

For instance, The Gasoline Retailers Association provides group benefits for repair shops. So if you worked as a mechanic in a repair shop that has only two employees, that shop could offer you group coverage, says Lordigyan.

AARP also offers group health insurance. According to AARP, its Essential Premier Health Insurance Plan is similar to the health insurance plans offered by many companies to employees. Membership fees to join AARP cost $63 for five years, $43 for three years and $16 for one year.

Associations have strict criteria to be eligible to join, but if you are in a field or trade that has an association that provides group health insurance, it can be a way to get better coverage.

Before you go out and join an association, McLean advises to make sure there’s more to joining than the health insurance. According to McLean, with some membership groups, health insurance is secondary for the group. Not to mention you’ll have to pay membership fees.

“Make sure you are getting coverage the way you want to,” she says.

- Search Search Please fill out this field.

- Group Health Insurance Plan

How Group Health Insurance Works

History of group health insurance.

- Benefits of Group Health Insurance

Insurance Options for Uninsured Individuals

Example of group health insurance, the bottom line.

- Health Insurance

- Definitions A - M

Group Health Insurance: What It Is, How It Works, Benefits

Julia Kagan is a financial/consumer journalist and former senior editor, personal finance, of Investopedia.

:max_bytes(150000):strip_icc():format(webp)/Julia_Kagan_BW_web_ready-4-4e918378cc90496d84ee23642957234b.jpg)

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas' experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

:max_bytes(150000):strip_icc():format(webp)/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

- Health Insurance: Definition, How It Works

- What Is Group Health Insurance? CURRENT ARTICLE

- Is Health Insurance Mandatory?

- What is the Affordable Care Act?

- ACA Marketplace Plan Types

- Private Health Insurance

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Point-of-Service Plan

- High Deductible Health Plan (HDHP)

- Coinsurance vs. Copays

- Copay vs. Deductible

- Preexisting Condition

- Paying for Preexisting Conditions

- How Much is Health Insurance?

- Cutting Your Costs for Marketplace Health Insurance

- What Does Health Insurance Not Cover?

- How to Apply for Financial Assistance to Pay for Health Insurance

- Health Insurance Premium

- How is my Health Insurance Premium Calculated?

- Are Health Insurance Premiums Tax Deductible?

- Health Insurance Deductible

- Out-Of-Pocket Expenses Explained

- Out-of-Pocket Maximum Explained

- How to Get Health Insurance

- Best Health Insurance Companies

- Aetna vs. Cigna

- Healthcare Cost-Cutting Cautions

- Critical Illness Insurance

What Is a Group Health Insurance Plan?

Group Insurance health plans provide coverage to a group of members, usually comprised of company employees or members of an organization. Group health members usually receive insurance at a reduced cost because the insurer’s risk is spread across a group of policyholders. There are plans such as these in both the U.S. and Canada .

Key Takeaways

- Group members receive insurance at a reduced cost because the insurer’s risk is spread across a group of policyholders.

- Plans usually require at least 70% participation in the plan to be valid.

- Premiums are split between the organization and its members, and coverage may be extended to members' families and/or other dependents for an extra cost.

- Employers can enjoy favorable tax benefits for offering group health insurance to their employees.

Group health insurance plans are purchased by companies and organizations and then offered to their members or employees. Plans can only be purchased by groups, which means individuals cannot purchase coverage through these plans. Plans usually require at least 70% participation in the plan to be valid. Because of the many differences—insurers, plan types, costs, and terms and conditions—between plans, no two are ever the same.

Group plans cannot be purchased by individuals and typically require at least 70% participation by group members.

Once the organization chooses a plan, group members are given the option to accept or decline coverage. In certain areas, plans may come in tiers, where insured parties have the option of taking basic coverage or advanced insurance with add-ons. The premiums are split between the organization and its members based on the plan. Health insurance coverage may also be extended to the immediate family and/or other dependents of group members for an extra cost.

The cost of group health insurance is usually much lower than individual plans because the risk is spread across a higher number of people. Simply put, this type of insurance is cheaper and more affordable than individual plans available on the market because more people buy into the plan.

The earliest known example of group coverage for health services dates to 1798, when Congress established the U.S. Marine Hospital for Navy seamen. Participation was compulsory, with deductions coming from salaries. Other examples include the mining, lumber, and railroad industries in the late 1800s, which had a vested interest in ensuring the health of its workers.

Montgomery Ward is credited with establishing the nation’s first group health insurance policy in 1910. The policy did not reimburse workers for medical expenses, but provided cash payments to workers equal to half their wages in the event of injury or illness.

The progressive political movement of the early 1900s led to several proposals to establish compulsory national health insurance. However, these proposals failed to counter opposition from doctors, who objected to uniform fee structures; labor groups, which felt their power would be weakened; and insurance companies, which feared encroachment on their business.

Employer-sponsored group health insurance grew rapidly in the 1940s as a way for employers to get around wage controls set during World War II. In 1943, the War Labor Board introduced wage caps but did not include insurance premiums as part of the cap. As such, employers were free to offer health insurance to attract and retain workers, resulting in a tripling of health insurance coverage by the end of the war.

But this failed to address the needs of retirees and other non-working adults. Federal efforts to provide coverage to those groups led to the Social Security Amendments of 1965, which laid the foundation for Medicare and Medicaid .

Benefits of a Group Health Insurance Plan

The primary advantage of a group plan is that it spreads risk across a pool of insured individuals. This benefits the group members by keeping premiums low, and insurers can better manage risk when they have a clearer idea of who they are covering. Insurers can exert even greater control over costs through health maintenance organizations (HMOs), in which providers contract with insurers to provide care to members.

The HMO model tends to keep costs low, at the cost of restrictions on the flexibility of care afforded to individuals. Preferred provider organizations (PPOs) offer the patient a greater choice of doctors and easier access to specialists but tend to charge higher premiums than HMOs.

The percent of the U.S. population covered by employer-provided group health insurance in 2021.

The vast majority of group health insurance plans are employer-sponsored benefit plans. It is possible, however, to purchase group coverage through an association or other organizations. Examples of such plans include those offered by the American Association of Retired Persons (AARP), the Freelancers Union, and wholesale membership clubs.

Not everyone is covered by a group health insurance plan. For many decades, these uninsured people were forced to bear the cost of healthcare on their own. But that has changed.

Government-sponsored health plans are an option for those left out of employer-sponsored group health insurance. The Affordable Care Act (ACA) adopted in 2010 created a marketplace for health insurance that provides coverage to 16.3 million people as of the 2022-2023 open enrollment season.

After the passage of the ACA, taxpayers were required to show they had health insurance coverage or qualified for an exemption, or else they were required to pay a penalty described as a “shared responsibility payment.” This mandated payment was eliminated with the passage of the Tax Cuts and Jobs Act beginning in the 2019 tax year.

United Healthcare, a division of UnitedHealth Group (UHC), is one of the nation's largest health insurers. It offers a buffet of group health insurance options for all types of businesses. Include are medical plans and specialty, supplemental plans, such as dental, vision, and pharmacy.

United Healthcare offers plans under the federally-sponsored Small Business Health Options (SHOP) program, a provision of the Affordable Care Act. In most states, employers must have 50 or fewer full-time employees, although some states allow for as many as 100 employees. Businesses that pay at least 50% of the insurance premium qualify for a 50% tax credit.

Midsize businesses, with between 51 and 2,999 employees, have various options available, including bundles. Large businesses, with 3,000 or more employees, qualify as national accounts, which have more services and healthcare features, including the ability to customize plan offerings.

What Is a Group Health Plan?

Group health plans are employer- or group-sponsored plans that provide healthcare to members and their families. The most common type of group health plan is group health insurance, which is health insurance extended to members, such as employees of a company or members of an organization.

What Is a Group Health Cooperative?

A group health cooperative, also known as mutual insurance, is a health insurance plan owned by the insured members . Insurance is offered at a reduced cost, and what they collect from members is based on claims paid. The cost of care is spread out across the insured population.

How Many Employees Do You Need to Qualify for Group Health Insurance?

Many group health insurers offer plans to companies with one or more employees. The type of plans available, however, may vary according to the size of the business . For example, United Healthcare provides various plans for small businesses with 1-50 employees , midsize businesses with 51-2,999, and large employers with 3,000 or more employees.

What Are Group Health Insurance Benefits?

Group health insurance plans offer medical coverage to members of an organization or employees of a company. They may also provide supplemental health plans—such as dental, vision, and pharmacy—separately or as a bundle. Risk is spread across the insured population, which allows the insurer to charge low premiums. And members enjoy low-cost insurance, which protects them from unexpected costs arising from medical events.

How Much Does Group Health Insurance Cost?

The average group health insurance policy costs roughly $7,400 annually for an individual, with the employee paying 17% of the premium. For family coverage, the average cost was about $21,000 per year, with the employee paying 27% of the premium.

Group health insurance plans are one of the most affordable types of health insurance plans available. Because risk is spread among insured persons, premiums are considerably lower than traditional individual health insurance plans. This is possible because the insurer assumes less risk as more people participate in the plan. For employees who ordinarily would not be able to afford individual health insurance, it is an attractive benefit.

U.S. Bureau of Labor Statistics, Monthly Labor Review. “ The Development and Growth of Employer-Provided Health Insurance ,” Pages 3-4.

Marilyn J. Field and Harold T. Shapiro. “ Employment and Health Benefits: A Connection at Risk ,” Chapter 2.

National Archives. “ Medicare and Medicaid Act (1965) .”

Kaiser Family Foundation. " Health Insurance Coverage for the Total Population ."

U.S. Department of Health and Human Services. “ Biden-Harris Administration Announces Record-Breaking 16.3 Million People Signed Up for Health Care Coverage in ACA Marketplaces During 2022-2023 Open Enrollment Season .”

Internal Revenue Service. “ Individual Shared Responsibility Provision .”

United HealthCare Services. “ Small Business Health Options Program (SHOP) .”

Kaiser Family Foundation. “ 2020 Employer Health Benefits Survey .”

:max_bytes(150000):strip_icc():format(webp)/WhatIsIndemnityHealthInsurance-f5548176a8474b95a2d3b08aeb760ba3.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

Are You Covered Under A Group Health Plan?

A “Group Health Plan” (GHP) is health insurance offered by an employer, union or association to its members while they are still working. GHP coverage is based on current employment . Employers with 20 or more employees are required by law to offer current workers and their spouses who are age 65 (or older) the same GHP health benefits that are provided to younger employees.

Examples of health insurance policies that are GHPs based on current employment .

- Small or large employer-sponsored plans for its current employees,

- Self-insured plans,

- Employee organizational plans (i.e., union plans or hours banks),

- National health plans in foreign countries.

- Do not include:

- Plans that only cover self-employed individuals,

- Consolidated Omnibus Budget Reconciliation Act (COBRA) coverage,

- Retiree coverage,

- Continued coverage based on severance pay,

- Health savings accounts,

- Veterans Affairs (VA) coverage.

If your GHP is based on current employment, you may not need Medicare Part B when you turn 65. You may get a “Special Enrollment Period” (SEP) to sign up for Part B later without a penalty after the employment or group health plan coverage ends. If you qualify, you can sign up for Part B anytime while you’re covered by an employer or union group health plan (GHP) based on current employment , or you can enroll in Medicare Part B anytime within 8 months after the employment ends or the GHP coverage ends (whichever happens first).

If you would like to learn more, there is additional information on our " Special Enrollment Period " page.

- What if I have health care protection from other plans?

- Will I get Medicare if I live outside the United States? If you are not sure how to answer these questions and you would like to learn more, read our “Medicare” booklet or talk to your personnel office.

An official website of the United States government

Here's how you know

Official websites use .gov A .gov website belongs to an official government organization in the United States.

Secure .gov websites use HTTPS A lock ( ) or https:// means you've safely connected to the .gov website. Share sensitive information only on official, secure websites.

Exploring coverage options for small businesses

Health insurance for businesses, group health insurance coverage.

- Learn more about purchasing insurance through SHOP

- See SHOP plans and prices

- How the Affordable Care Act (ACA) affects small businesses

Health reimbursement arrangements

- Qualified small employers

- Individual coverage, such as Marketplace plans

- Additional health benefits (when offered with a traditional group plan)

Health Savings Accounts and other tax-favored health plans

A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. By using untaxed dollars in a Health Savings Account (HSA) to pay for deductibles, copayments, coinsurance, and some other expenses, you may be able to lower your overall health care costs. HSA funds generally may not be used to pay premiums.

Refer to glossary for more details.

Health Reimbursement Arrangements (HRAs) are employer-funded group health plans from which employees are reimbursed tax-free for qualified medical expenses up to a fixed dollar amount per year. Unused amounts may be rolled over to be used in subsequent years. The employer funds and owns the arrangement. Health Reimbursement Arrangements are sometimes called Health Reimbursement Accounts.

What can we help you find?

Since you asked: can an employer offer health insurance to its board’s directors.

By Maureen Gammon , Anu Gogna , Benjamin Lupin and Kathleen Rosenow | December 21, 2022

Employers often have questions on practical considerations related to healthcare, retirement and other employee benefit regulations. In this “Since you asked” feature, we discuss the provision of health insurance to board members and their dependents.

Can our company provide benefits under our group health plan to members of the company’s board of directors who are not employees? We would like to provide coverage for retention and recruiting purposes.

Possibly, but various compliance concerns need to be addressed.

Multiple Employer Welfare Arrangement considerations

Covering non-employees (whether directors, board members or owners) under a company's benefit programs is likely to raise compliance concerns (assuming the written plan eligibility rules allow non-employees to enroll in coverage). For one, it is unclear whether a Multiple Employer Welfare Arrangement (MEWA) is created when health or other welfare benefits are provided to non-employee directors.

- A MEWA is defined as an employee welfare benefit plan providing benefits to the employees of two or more employers (including one or more self-employed individuals). If the board of directors consists of members who are not current employees of the company, this would technically classify the benefit plan as a MEWA, as the non-employees would be considered self-employed individuals.

- From a federal reporting standpoint, MEWAs are generally required to file an annual report with the federal government (Form M-1); however, the plan may qualify for an exemption to filing the annual Form M-1. More specifically, a group health plan is exempt if less than 1% of participants are non-employee directors, and the plan would not be a MEWA “but for” coverage of non-employee directors. This does not mean that the arrangement is not a MEWA but only that no Form M-1 filing is required.

- MEWAs do not qualify for ERISA preemption from a state regulatory perspective, so the plan potentially would be subject to state laws specifically regulating MEWAs, including any filing and licensing requirements similar to rules imposed on insurers licensed to operate in the state. For example, California law requires self-funded MEWAs to obtain a certificate of compliance from the Department of Insurance in order to operate within the state. But under California law, the Department of Insurance ceased providing such certificates in 1995, effectively preventing the formation of any new MEWAs. In addition, since state law would likely apply, state mandated benefit rules may apply to the arrangement (e.g., requiring the plan to cover medical procedures it would not otherwise cover).

Tax considerations

Generally, the coverage for the non-employee director cannot be pre-tax under the cafeteria plan rules, although there is a special rule for certain "dual status" individuals (i.e., directors who are also employees).

- If non-employees are permitted to participate in employer-sponsored benefits, they cannot participate on a tax-favored basis in the same way as employees.

- Under the general rule, directors who are not employees of the company (“outside directors”) cannot participate in the company's cafeteria plan. This is the case whether or not the directors receive fees for their services as directors. The 2007 proposed cafeteria plan regulations expressly provide that the term “employee” does not include a “self-employed individual.” The regulations list examples of self-employed individuals: a sole proprietor, a partner in a partnership, and a director serving on a corporation's board of directors who does not otherwise provide services to the corporation as an employee. Contributions made by non-employees should be made on an after-tax basis, and contributions made by the employer should be treated as additional taxable compensation.

- The regulations also provide a special rule for certain “dual status” individuals. Under the dual status rule, an individual who is an employee and provides services to his or her employer as a director or independent contractor (e.g., an individual who is both an employee and a director of a C corporation) is eligible to participate in the employer’s cafeteria plan, although solely in his or her capacity as an employee. For example, assume one of the company's employees also serves on the company's board of directors. Her annual compensation as an employee of the company is $80,000; she also receives $5,000 in directors' fees each year. She can participate in the company's cafeteria plan in her capacity as an employee and can elect to make salary reductions from her employee compensation for benefits under the plan; however, she cannot elect to reduce her directors' fees for benefits under the plan. Note that if the company is an S corporation, the dual-status rule will not apply to any employee-directors who are also shareholders owning more than 2% of company stock at any time during a year.

- In addition, directors who are not employees cannot participate in a health reimbursement arrangement or health flexible spending account. Note: Non-employees may make contributions to health savings accounts (HSAs) as long as they are otherwise eligible (i.e., enrolled in a qualifying high-deductible health plan, have no other disqualifying coverage and cannot be claimed as a tax dependent). Any contributions made by the non-employee to an HSA should be made on an after-tax basis, which then may qualify for an above-the-line deduction on his or her individual tax return (Form 1040).

- Companies offering coverage to directors and their dependents under their group health plan need to make sure they (or their third-party administrators) have the ability to do so on an after-tax basis.

- MEWA considerations must be discussed with legal counsel, as such an arrangement may need to be registered in various states (assuming it is permitted by state law).

- A possible alternative for directors would be the company paying taxable cash (with or without a gross-up) and helping them find individual health insurance coverage.

Related Solutions

MyCompass Login Document Center

Employee Benefit Guidance & Compliance Solutions

Is offering health coverage to Non-Employees risky?

A frequent Compliance Corner question asks whether employers can include independent contractors in their health plans or other benefits. When dealing with contractors or temporary employees, many think they are not eligible for their health plans or other benefits such as COBRA or FFCRA. The answer to this question is more complicated than one might think. So, is offering health coverage to non-employees risky?

Most benefit experts advise against including independent contractors or other non-employees such as 1099 employees, non-employee directors, or leased employees on employer’s benefit plans.

Here are three (3) reasons why this may be inadvisable:

- Treating an independent contractor as an employee may undermine an employer’s assertion that the individual is not an employee. The DOL and the IRS , as well as their state counterparts, have aggressive programs to uncover worker misclassification . By offering a non-employee employee benefit, an employer’s assertion to these regulators challenging whether an individual is really an employee is weakened. Moreover, if some non-employees gain benefits while others do not, an independent contractor excluded from a plan may sue for benefits exposing an employer to potential penalties.

- Covering individuals who are not employees on the health plan may result in the creation of a multiple employer welfare arrangement or MEWA. The intent to create a MEWA is irrelevant. MEWAs have IRS reporting requirements such as Form M-1. If the plan is self-funded there may be further complications with state laws that prohibit self-insured MEWAs

- Tax issues also come into play. For example, an independent contractor is not eligible for a Section 125 plan. Employer contributions to coverage may also be taxable.

Complicating this decision is that some insurance carriers will allow independent contractors to be included in an employer’s health plan. But, compliance is the employer’s responsibility, not the insurance carrier’s.

The best answer to whether non-employees can be offered coverage is that employers who wish to evaluate or pursue covering non-employees should consult their legal and benefits advisors.

An insurance broker that is exciting? We bet you never heard that before! Believe it or not, our firm is often described as a fun and exciting place to work by our employees and carrier partners.

Over the years, our founders noticed that employees who enjoy coming to work every day, are much more productive and much better suited to represent our company. If you are going to entrust us to handle both employer and employee questions , wouldn’t you want to interact with someone who is pleasant and frequently smiles?

We truly have a unique culture at PF Compass . Our culture is shaped by our Core Values: Respect, Honesty, Commitment, and Enthusiasm. Employees at PF Compass are dedicated to these values and take many steps to prove it. Whether it’s developing knowledge by participating in educational seminars or simply reading today’s news, our staff help to continually grow the company while making us better than the competition.

if i am a 1099 employee and a certain employer says they can put me on the company medical benefit plan, what do i need to know?

December 15, 2022

I’m also interested in the answer

June 28, 2024

There is no quick and easy answer to this. It can be a complex issue, but here is all the information you need to know:

IRS Guidelines: The IRS has strict rules distinguishing between employees and independent contractors. Offering employee benefits like health insurance to 1099 workers can blur these lines and potentially reclassify the worker as an employee.

ERISA Compliance: The Employee Retirement Income Security Act (ERISA) generally governs employer-sponsored health plans and does not cover independent contractors.

Insurance Carrier Policies: Most insurance carriers do not allow 1099 contractors to be included in group health plans. They typically restrict coverage to W-2 employees to maintain compliance with state and federal regulations.

Tax Implications: If the IRS reclassifies your status from independent contractor to employee due to receiving employee benefits, it could result in back taxes, penalties, and interest for both you and the employer.

Legal Risks: Employers face legal risks if they are found to be improperly classifying workers to avoid taxes or other regulatory requirements.

July 3, 2024

Post a Reply Cancel reply

Your email address will not be published. Required fields are marked *

- Healthcare Compliance

- Employee Education & Communication

- Benefits Admin Technology

- Account Management

- HRA Administration

- Our Purpose

- Shawn Kennedy

- Amy Gibriano

- Maribel Higgins

- Brandi Bowers

- Jared Koplik

- Valerie Harrs

- Perry Koplik

- Brian Honan

- Patty Davala

- Anthony Bruno

- Maggie Johnson

- Hilary Boff

- Mick Smoothey

- Our Culture

- Non-Profits

- HR Professionals

- Business Executives

- Our Clients

- Life Insurance

- Executive Reimbursement Plans

- Voluntary Benefits

- Time To Upgrade!

© 2015 PF Compass

Pin It on Pinterest

- StumbleUpon

SCHEDULE A PLAN REVIEW

Fill Out Our Contact Form:

All Services Healthcare Compliance Employee Education & Communication Benefits Admin Technology Account Management COBRA HRA Administration Other

- Providing world class service and value for employee benefit group plans since 1987

- 800-903-6066

How to Determine Which Employees are Eligible for Group Coverage and What it Covers

Once you’ve made the decision to offer group health insurance to your employees—either to satisfy a mandate or to boost your competitiveness in attracting talent, it’s time to start shopping. About half of the total US population is covered by group health insurance through employers , so you’re in good company. You should put together a benefits policy early on that identifies in writing who is—and is not eligible for group coverage.

While you may have control over certain eligibility decisions, proceed with caution. Your benefits policies should be designed to promote fairness. Any indication of bias or favoritism can land your company in hot water.

Which Employees are Eligible for Group Health Insurance?

An employer may choose to cover any employee on their payroll, but most choose to restrict these benefits to full-time employees that have met certain criteria like completion of a probationary period. However, if an employer offers insurance benefits to one full-time employee, they must offer the same benefits to all full-time employees.

The IRS defines a full-time employee as anyone who works an average of 30 hours or more per week. This is the definition that the Affordable Care Act will use so employers who are subject to mandated insurance coverage should align their benefits policies to this definition of a full-time employee.

Who is Not Eligible for Group Health Insurance?

Your company may employ a variety of different types of people. Not everyone fits the definition of a full-time employee, even if they meet the hourly requirement. Let’s take a look:

- Employees covered under a collective bargaining agreement may not be eligible for your group health insurance policy, particularly if their agreement provides coverage through a different plan.

- Independent contractors or freelancers that may perform work for your company are not eligible to participate in your group health plan.

- Retired or former employees are not eligible.

- Temporary employees or those who have not yet completed any probationary periods required by corporate policies may not be eligible.

- Non-employee directors or consultants are not eligible.

- Part-time employees who work less than 30 hours per week may not be eligible based on your company benefits policy.

What are Dependents and How do you Determine Eligibility?

In addition to your full-time employees, group coverage eligibility typically extends to their dependents (or immediate family members) with some caveats. A company generally must offer dependent eligibility in order to satisfy ACA . However, some smaller companies may not be able to secure low enough rates to make dependent coverage feasible. Here’s a closer look at the ins and outs:

The biological and adopted children of an eligible employee should be covered through age 26, according to the ACA. However, employers have some freedom in defining a dependent child to include stepchildren without requiring adoption or to extend the age beyond 26.

Spouse or Domestic Partners

The legal married spouse should be considered eligible in most cases. However, some states may not recognize same-sex marriages and in some cases, employers use an alternative insurance clause to deter spousal coverage.

- Domestic Partner: A long-term living arrangement with another adult without a legal marriage. Employers may choose to extend spousal eligibility to domestic partners. Policies should be specific, indicating whether this applies to same-sex domestic partners, opposite-sex domestic partners, or both.

- Alternative Coverage Clause: If a spouse or domestic partner is employed full-time and has access to reasonably-priced insurance through that employer, they may not be eligible for coverage as a spouse on your plan.

What Group Health Insurance Covers

Group health insurance is intended to cover eligible medical expenses for the employees of an organization and their dependents. Coverage limits vary by policy, but a typical group health insurance policy covers:

- Primary Care Visits

- Specialty Care Visits

- Urgent Care

- Emergency Care

- Hospitalization

- Surgical Interventions

- Diagnostics

- Preventative Care

- Maternity Care

- Mental Health Care

These policies don’t pay the full cost of these services . Instead, each policy defines a deductible, co-pay, and co-insurance amount that splits cost between the insured and the insurer.

- Deductible: The amount that the insured pays before the plan kicks in.

- Co-Pay: A fixed amount that the insured pays for designated services.

- Co-Insurance: The percentage of expenses that the insured pays after the deductible is met.

Additionally, some plans offer supplemental coverage for other services like dental care, vision, and prescriptions. If not, the employer usually secures supplemental coverage through other providers in order to offer a complete benefits package to their employees.

The Takeaway on Group Insurance Eligibility

The bottom line is that group health insurance is typically reserved for regular, full-time employees and their dependents. Any coverage extended to part-time workers or non-traditional dependents is solely at the discretion of the employer. The only requirement is that the employer must provide the same options to all employees that meet the same criteria. This coverage, which is mandated by the ACA in most cases, covers typical medical expenses for doctors visits and required care.

Written by Todd Taylor

Todd Taylor oversees most of the marketing and client administration for the agency with help of an incredible team. Todd is a seasoned benefits insurance broker with over 35 years of industry experience. As the Founder and CEO of Taylor Benefits Insurance Agency, Inc., he provides strategic consultations and high-quality support to ensure his clients’ competitive position in the market.

What Are Your Insurance Needs?

Featured Testimonial

Todd Taylor with Taylor Benefits gives our small business the kind of personal service we need. Insurance benefits are important to our employees and Todd helps us find a balance between benefits and value. Todd responds immediately to my phone calls & e-mails. He has even gotten in touch with me on a Sunday when we were in need of coverage answers immediately. We are very pleased with the hands-on service Todd and his staff provide.”

- Ken and Linda Orvick, Orvick Management Group, Inc.

Recent Post

- Murfreesboro Large Group Health Insurance Plans

- Springfield Large Group Health Insurance Plans

- Oceanside Large Group Health Insurance Plans

- Fort Collins Large Group Health Insurance Plans

- Lancaster Large Group Health Insurance Plans

- Self Employed

- Pension Plan

- Affordable Care Act

- Peoples also ask

- retirement benefits

- Employee Benefits

- Insurance claims

- good insurance companies

- Insurance claims process

- Mental Health Insurance

- Group health insurance

- Employee insurance

- employee insurance rates

- Uncategorized

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

We’re ready to help! Call today: 800-903-6066

- Core and Group Health

- Voluntary Benefits

- Consumer Driven Health Care

- Health Care Reform

- Benefits Sales Strategies

- Broker Innovation Lab

- Practice Management

- Employer-Paid

- Employee-Paid

- HR Regulation

- HR Technology

- Cost-Containment

- Employee Participation

- Defined contribution

- Advisor Sales Strategies

- Retirement Regulation

- Advisor Technology

- Retirement Trends

- Defined Benefits

- Investment Instruments

- LUMINARIES Website

- LUMINARIES Coverage

- Advisor of the Year Website

- Advisor of the Year Coverage

- Benefits Leads

- 401(k) Leads

- Career Center

- Special Reports

- BROKER EXPO

- Instant Insights

- Expert Perspectives

- Editorial Calendar

Resource Center

- Newsletters

- Podcast Center

- Asset & Logo Licensing

NOT FOR REPRINT

Page Printed from: benefitspro.com/2021/04/02/4-characteristics-of-non-group-health-insurance-enrollees/?slreturn=20240709154810

Instant Insights /

4 characteristics of non-group health insurance enrollees.

Based on what we know about existing individual-market shoppers, will the expanded ACA subsidies have a major impact on enrollment?

The Biden administration recently announced that it would be extending the special open enrollment period for health insurance coverage on the federal exchanges through August. As of early March, more than 200,000 people had taken advantage of the extended opportunity to purchase health insurance, and legislators hoped to entice even more with expanded subsidies included in the American Rescue Plan.

Complete your profile to continue reading and get FREE access to BenefitsPRO, part of your ALM digital membership.

Your access to unlimited BenefitsPRO content isn’t changing. Once you are an ALM digital member, you’ll receive:

- Critical BenefitsPRO information including cutting edge post-reform success strategies, access to educational webcasts and videos, resources from industry leaders, and informative Newsletters.

- Exclusive discounts on ALM, BenefitsPRO magazine and BenefitsPRO.com events

- Access to other award-winning ALM websites including ThinkAdvisor.com and Law.com

Already have an account? Sign In

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected] . For more information visit Asset & Logo Licensing.

Trending Stories

1 health care price transparency tools increase prices ask economists, 2 chevron overturned: how federal agencies' loss of power impacts health care and benefits, 3 experts debate: should scotus have overruled the chevron doctrine , 4 employers, take note: financial wellness benefits employees really want, 5 house republican aims to revive association health plan regulations, recommended stories, questions congressional budget office is asking about adding a benefit to medicare.

By Allison Bell | July 09, 2024

Your clients often have to decide whether adding a new benefit is worth it. Here's some of what Medicare managers consider.

Health care cost containment: filtering out the waste

By Mark Galvin | July 09, 2024

Policies implemented over the past three years empower fiduciaries to scrutinize and manage health care costs and regain control of the unsustainable cost burden weighing on employers and employees.

Health disparities exist in every state: Stark racial divide in premature deaths

By Scott Wooldridge | July 09, 2024

Massachusetts, Minnesota, and Connecticut stand out for their relatively high performance for all ethnic groups, yet these states have considerable health disparities between white and nonwhite residents, says a new report.

Infographic

Sponsored by ArmadaCare

The True Cost of Cutting Healthcare Coverage

Degrading healthcare coverage to control benefit costs can have huge ripple effects and drive-up costs in other areas. This infographic looks at the many consequences that you and your clients need to know.

Browse More Resources ›

Sponsored by Redirect Health

A Complete Broker's Guide to Self-Funded Plans

This guide provides brokers with essential insights and practical advice on implementing and managing self-funded plans to help employers save on healthcare costs while maintaining high-quality care for employees.

Sponsored by New Benefits

Return on Wellness: A Modern Perspective on Employee Benefits

It’s time to redefine employee benefits by shifting the focus from Return on Investment (ROI) to Return on Wellness (ROW). This guide outlines why prioritizing overall employee well-being results in a multitude of rewards, from increased productivity to reduced healthcare costs.

BenefitsPRO

Don’t miss crucial news and insights you need to navigate the shifting employee benefits industry. Join BenefitsPRO.com now!

- Unlimited access to BenefitsPRO.com - your roadmap to thriving in a disrupted environment

- Exclusive discounts on BenefitsPRO.com and ALM events

Already have an account? Sign In Now

Health Insurance for Non-Profits

There’s a reason we count more non-profits as clients than any other sector.

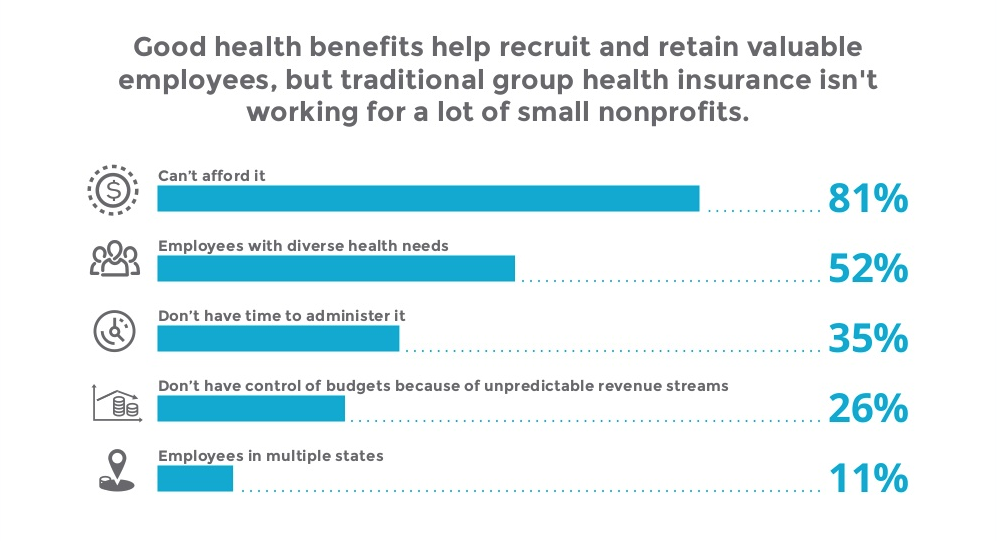

Health Insurance for Nonprofits: An In-depth Look at Options

Nonprofit organizations face distinct challenges when it comes to providing health benefits for their employees. Balancing the need to deliver value to their teams while maintaining financial sustainability requires innovative solutions. In this guide, we will explore the dynamic landscape of health coverage for nonprofits and highlight the advantages of Health Reimbursement Arrangements ( HRAs ), including Individual Coverage HRAs ( ICHRAs ) and Qualified Small Employer HRAs ( QSEHRAs ).

We will address the pain points nonprofits often experience, such as limited budgets and low salaries, and discuss strategies to overcome these challenges while ensuring effective stewardship of funds.

Join us as we navigate the world of health benefits for nonprofits and uncover how HRAs can be a game-changer in achieving a sustainable balance between mission-driven impact and employee well-being.

Harnessing the Power of HRAs: Supporting Employee Well-Being and Financial Sustainability in Nonprofits

According to a recent study conducted by the Urban Institute, approximately 20% of nonprofit workers in the United States lack access to employer-sponsored health insurance.

This highlights the importance of exploring innovative solutions that can help bridge this gap and support the well-being of nonprofit employees.

One such solution gaining traction is Health Reimbursement Arrangements (HRAs). HRAs offer flexibility and cost control, allowing nonprofits to allocate their limited resources efficiently while attracting and retaining top talent.

In a report published by the Society for Human Resource Management (SHRM), it was found that nonprofits with comprehensive employee benefits, including health coverage, experience higher employee satisfaction and increased productivity. This demonstrates the importance of investing in employee well-being and the positive impact it can have on nonprofit mission success.

These statistics and real-world examples underscore the significance of exploring innovative approaches to health benefits in the nonprofit sector. HRAs provide a strategic tool for nonprofits to deliver valuable health coverage, overcome budgetary constraints, and attract and retain talented individuals dedicated to advancing their organization's mission.

Join us as we delve into the world of health benefits for nonprofits, examining the advantages of HRAs and how they can help nonprofits strike a balance between financial sustainability, honoring the mission, and prioritizing employee well-being.

Nonprofits: Balancing Mission, Stewardship, and Limited Resources

As nonprofits, the core focus is undoubtedly on advancing the mission and making a positive impact. However, it's essential to acknowledge the challenges that come with limited budgets, typically low salaries, and the need to be good stewards of the funds raised or received through grants. In this section, we'll delve into these pain points and discuss strategies for nonprofits to navigate these challenges effectively.

Putting Dollars Towards the Mission, Not Overhead

Nonprofits understand the significance of directing funds towards their mission rather than overhead expenses. It's crucial to optimize the allocation of resources to ensure maximum impact. However, certain operational costs, such as employee benefits, cannot be overlooked. Health benefits, in particular, play a vital role in attracting and retaining top talent, which is essential for nonprofit success. Striking the right balance between minimizing overhead and providing competitive health benefits becomes a crucial consideration.

Being Good Stewards of Funds

Nonprofits have a responsibility to be good stewards of the funds they raise or receive through grants. Donors and grantors want to see their contributions utilized wisely and effectively. This means carefully evaluating expenditures and making strategic decisions. While it may be tempting to minimize costs across the board, it's essential to remember that investing in employee benefits, including health coverage, is an investment in the organization's long-term sustainability and success.

Navigating Nonprofit Pain Points

Limited budgets and typically low salaries present challenges for nonprofits in various ways. One of the most significant pain points is attracting and retaining talented individuals who can contribute to the organization's mission. Nonprofits often compete with for-profit entities that can offer more substantial compensation packages. As a result, finding and retaining skilled employees can be an ongoing struggle. Limited budgets can make it challenging to offer competitive benefits, further adding to the difficulty of attracting and retaining top talent.

Strategies for Success

While the pain points may seem daunting, there are strategies nonprofits can employ to overcome these challenges and thrive:

- Strategic Budgeting: Prioritize spending on areas that have the most significant impact on your mission. This may involve finding cost-effective solutions for overhead expenses while ensuring essential employee benefits, such as health coverage, are not compromised.

- Creative Compensation Packages: Consider alternative forms of compensation, such as flexible work arrangements, professional development opportunities, or unique non-monetary perks that align with your employees' values and interests. This approach can help offset the limitations of low salary budgets.

- Maximizing Health Benefit Value: Partner with benefit providers who understand the unique needs of nonprofits and offer cost-effective solutions without compromising quality. Platforms like Take Command Health can help nonprofits navigate the complexities of health benefits, providing tailored options that fit within limited budgets.

- Highlighting the Mission: Emphasize the impact and purpose of the organization's work when recruiting and engaging employees. Nonprofits often attract individuals who are passionate about making a difference, and leveraging that sense of purpose can help compensate for lower salary offerings.

By employing these strategies and prioritizing the effective utilization of resources, nonprofits can overcome the pain points associated with limited budgets, low salaries, and the need for stewardship.

By providing competitive health benefits while being mindful of costs, nonprofits can attract and retain talented individuals who share their vision and contribute to the organization's mission-driven success.

Addressing the Unique Health Benefit Challenges in Nonprofits with HRAs, ICHRAs, and QSEHRAs

Nonprofit organizations, with their distinctive mission and structural frameworks, often confront unique challenges when it comes to delivering health benefits to their employees. As these organizations strive to maximize their resources towards mission-centric activities, they are often in search of efficient, cost-effective solutions to provide robust health benefits.

Health benefits are a crucial part of the compensation package for employees, and their importance cannot be understated. However, given the unique financial and structural nuances of nonprofits, traditional group health insurance plans may not always be the most feasible or efficient way to provide these benefits.

Enter HRAs – this category of employer-funded plans allows organizations to reimburse employees for out-of-pocket medical expenses and individual health insurance premiums on a tax-advantaged basis. Within the HRA universe, two specific types – the Individual Coverage HRA ( ICHRA ) and the Qualified Small Employer HRA ( QSEHRA ) – have emerged as particularly valuable tools for nonprofits.

ICHRA and QSEHRA allow nonprofits to control costs while maintaining a high level of care for their employees. ICHRAs offer flexibility and scalability, making them a suitable choice for larger organizations, while QSEHRAs offer simplicity and cost-effectiveness, making them an attractive option for smaller nonprofits.

Exploring Health Reimbursement Arrangements (HRAs)

Health benefits are a key factor in recruiting and retaining top-tier talent in any organization, including nonprofits. But traditional health insurance plans may not always be the most cost-effective or flexible solution for these organizations. HRAs are a unique tool that could potentially transform the way nonprofits approach health benefits.

The most important thing about HRAs like QSEHRA or QSEHRA is that they allows nonprofits to reimburse employees tax-free for individual health insurance premiums and medical expenses.

This is a big deal because nonprofits can now get the same favorable tax treatment as big company group health plans but with a lot less hassle.

HRAs enable nonprofits to adopt a strategy called "defined contribution" which is much simpler than hassling with a one-size-fits all group plan and is proven to be much more efficient, affordable, and predictable.

Nonprofits can now give their employees a fixed dollar amount each month, say $200, and each employee can then shop for the plan that fits his or her needs the best.

Sally can choose a Blue Cross plan for her doctor, Roger can get Aetna to cover his prescription, and Betty can stay on her husband's group plan.

Gone are the days of comparing quotes from each insurance company or the headache of trying to get everyone what they want without breaking the budget!

And employees end up happier too.

What are HRAs?

Health Reimbursement Arrangements, or HRAs, are employer-funded health benefit plans that reimburse employees for out-of-pocket medical expenses, as well as premiums for individual health insurance policies. HRAs are not health insurance plans themselves; rather, they are a means for employers, including nonprofits, to help their employees pay for healthcare costs.

The Advantages of HRAs for Nonprofits

HRAs serve as a robust solution for nonprofits navigating the complex landscape of health benefits.

- Cost Control : One of the most significant challenges nonprofits face is budget predictability, particularly concerning healthcare costs. HRAs offer a solution to this issue by allowing nonprofits to determine how much they will contribute to each employee's HRA account each year. This fixed contribution model enables nonprofits to budget their healthcare expenses accurately and efficiently. The ability to control healthcare costs without compromising the quality of benefits offered to employees is an appealing feature of HRAs for nonprofits.

- Flexibility: Another strength of HRAs lies in their flexibility. They allow nonprofits to design a health benefit plan that aligns with their resources and the specific needs of their employees. HRAs can reimburse a broad spectrum of medical expenses, including doctor visits, prescription medications, and even health insurance premiums. This flexibility means that nonprofits can provide a health benefits package that truly supports the wellbeing of their employees.

- Tax Efficiency: Lastly, the tax advantages offered by HRAs cannot be understated. The reimbursements provided through an HRA are typically tax-deductible for the nonprofit, reducing their overall tax liability. Additionally, these reimbursements are received tax-free by the employees, thereby enhancing the value of their health benefits. This dual tax efficiency creates a win-win scenario for both the nonprofit and its employees.

Limitations of HRAs for Nonprofits

Despite their advantages, HRAs do come with certain limitations:

- Complexity: HRAs come with rules and regulations that can seem daunting. The complexity of understanding, implementing, and managing these plans may appear as a hurdle to some nonprofits. However, with Take Command, this challenge is effectively mitigated. Our platform simplifies the setup, administration, and compliance of HRAs, making these health benefits solutions accessible and manageable for nonprofits, regardless of their size or resources.

- Limited Scope: While HRAs provide a substantial contribution to health coverage, they might not cover all health expenses. Employees may need to complement their HRA with an individual health insurance policy. With Take Command’s personalized support and user-friendly platform make it easier for employees to navigate the health insurance marketplace and find a plan that complements their HRA benefits.

Leveraging HRAs' cost-efficiency, flexibility, and tax benefits, nonprofits can build a robust health benefits strategy. With Take Command’s expert guidance, nonprofits can effectively manage HRAs, aligning their health benefits with their mission, ensuring employee wellness, and financial sustainability.

Which HRA is right for you?

Case study: qsehra success in nonprofits - new britain roots.

New Britain ROOTS, a small nonprofit based in Connecticut, promotes food security and empowered eating choices through local advocacy and education initiatives. With a small team and limited funding, the organization faced a significant challenge: providing affordable health benefits for their staff.

Executive Director, Joey Listro, found himself up against the costly reality of group health insurance plans. As a growing organization, they knew they needed a competitive benefits package to attract and retain talent. But how could they achieve this without overstretching their budget?

The Quest for an Affordable Solution

Upon exploring various options, Joey stumbled upon the QSEHRA. As the only full-time staff member, traditional employer plans were prohibitively expensive, costing nearly five times more than a QSEHRA.

But the unfamiliarity of QSEHRA presented its own hurdles. Joey's board of directors had never heard of it and were unsure about its legality. As a non-profit, the board needed to approve the QSEHRA, meaning Joey had to provide accurate information to get everyone on the same page.

Enter Take Command

That's where Take Command stepped in, offering guidance and educational resources about QSEHRA. With this support, Joey was able to clarify the benefits of QSEHRA to his board, gaining their approval to move forward with the setup.

Take Command’s team continued to assist Joey throughout the setup process, providing a simple, user-friendly platform for managing the QSEHRA. As a result, New Britain ROOTS successfully implemented their QSEHRA in January, currently reimbursing premiums only.

Joey shares, "The setup was quick and simple, and reporting and reimbursements are easy as well."

The Impact of QSEHRA