The New Equation

Executive leadership hub - What’s important to the C-suite?

Tech Effect

Shared success benefits

Loading Results

No Match Found

PwC and Oracle Alliance

Modernizing financial services organizations in today’s race for competitiveness

- 5 minute read

- November 14, 2023

Tapan Nagori

Principal, Financial Services Oracle Leader, PwC US

Three large global companies share lessons learned from their transformational cloud journeys

The clock is ticking for financial services enterprises worldwide. As of 2023, most of them have not moved their financial platforms to the cloud , while industry-leading enterprises see cloud implementations as one of the keys to innovation, attracting new talent and creating a pathway to better reporting. Important drivers for this pressing transition include the need to standardize business processes, enhance data integration, improve efficiencies and comply with regulatory demands.

This shift to the cloud presents an opportunity to help take businesses forward. Pursuing changes with cloud transformation can help enhance their long-term viability, particularly when it comes to embedding new technologies into a business model, entering new markets and digitally transforming existing products, according to PwC’s August 2023 Pulse Survey . But, as the study indicates, technological transformation is also one of financial services’ biggest pain points.

Many industry-leading organizations are becoming cloud-powered and reaping digitization’s rewards in the form of better decision-making, reduced expenses and faster development of new products.

During Oracle CloudWorld in Las Vegas in September 2023, I spoke with three leaders from large financial services organizations about why and how they rolled out transformative programs to migrate their operations to Oracle Cloud. They shared their different approaches and the lessons they learned along the way:

1. The big bang approach

Over the last six years, PwC has helped a global financial technology company that works in over 150 countries to accomplish an ambitious goal: to migrate to the cloud using a big bang approach. In 2016, migrating to the cloud was considered a bold move. Imagine doing so across the suite of applications, at a full-on pace.

At the time, the company had completed its first public company acquisition and was already operating on the Oracle on-prem suite. The acquisition forced the company’s leadership to make a decision to either stay on-premise or take the plunge and go to the cloud. They decided to migrate entirely, which can be described as “the big bang approach.” With help from PwC’s industry-specific professionals, the company went live with general ledger, accounts payable, accounts receivable and project management across a dozen countries. Their secret for success was team spirit. Each country had a stake in the process. To help make the transition possible, they enabled teams in over 150 countries to have ownership in the transformation.

Today, six years into their transformative journey into doing business in the cloud, they can breathe easier and be assured that the company went the right direction. As a result of the team engagement, the company now has a highly competent user community invested in the future of the applications and in rolling out enhancements.

2. The phased strategy

One of the world’s largest custody asset banks (with almost $2 trillion in assets under management) was already on global platforms when the time came to replace over 150 outdated consolidation systems and general ledgers in over 30 countries. The goal was to scale and reach better functionality across territories. Phasing the systems out region by region didn’t make sense because the company would have to use two – maybe three – general ledgers at a time. To help prevent the inefficiencies of duplicate systems, they decided to implement each module in a phased approach.

The process took two and a half years, by which point the organization had achieved scalability and greater functionality, and had modernized its financial reporting processes. The phased approach required an extended timeframe, but the result was successful. Today, thanks to the Oracle Cloud platform they implemented one phase at a time, they are able to produce daily balance sheets about consolidated companies and closing the business in four business days.

3. Committing to data efficiency through a transformational program

As customers realize almost daily, data is at the heart of every cloud transformation. This was particularly important for a bank and insurance company that PwC assisted in their cloud journey starting in 2019. At the time, the firm faced big challenges, including extensive closing time for critical reports. The leadership team needed a faster, more effective way to gain access to key data to drive decisions.

By simplifying the scope and improving the reporting strategy through conformity, standardization and application rationalization with Oracle Cloud, the organization is now able to close reports in four days. And by making it possible for senior management to access critical reports within a short timeframe, the cloud transformation significantly improved their financial reporting, allowing for standardization and better data integration.

The lesson they learned revolves around the reporting strategy and in the change management plan. A clear and solid reporting strategy enabled the firm to focus on what was needed, and a continuous attention to change management allowed them to not only upskill their workforce but also to unleash engagement. For the success of the cloud implementation, it was critical to have the right system integrator collaborator and engage with Oracle early on.

One destination

From selection and implementation to providing managed services, Oracle can help deliver streamlined processes, greatly reducing manual activities and helping improve controls. Learning from previous successful Oracle Cloud transitions can help your organization feel more confident about the industry-leading practices across financial services — from banks, insurance and asset wealth management leaders — that can help deliver smooth cloud transition adoptions.

Contact us to learn how PwC can help you get the most out of your cloud investment.

{{filterContent.facetedTitle}}

Playback of this video is not currently available

{{item.publishDate}}

{{item.title}}

{{item.text}}

© 2017 - 2024 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms, each of which is a separate legal entity. Please see www.pwc.com/structure for further details.

- Data Privacy Framework

- Cookie info

- Terms and conditions

- Site provider

- Your Privacy Choices

- Innovative Prompts

- Strategies Packs

- Skills Packs

- SOPs Toolkits

- Business Ideas

- Super Guides

- Innovation Report

- Canvas Examples

- Presentations

- Spreadsheets

- Discounted Bundles

- Search for:

No products in the cart.

Return to shop

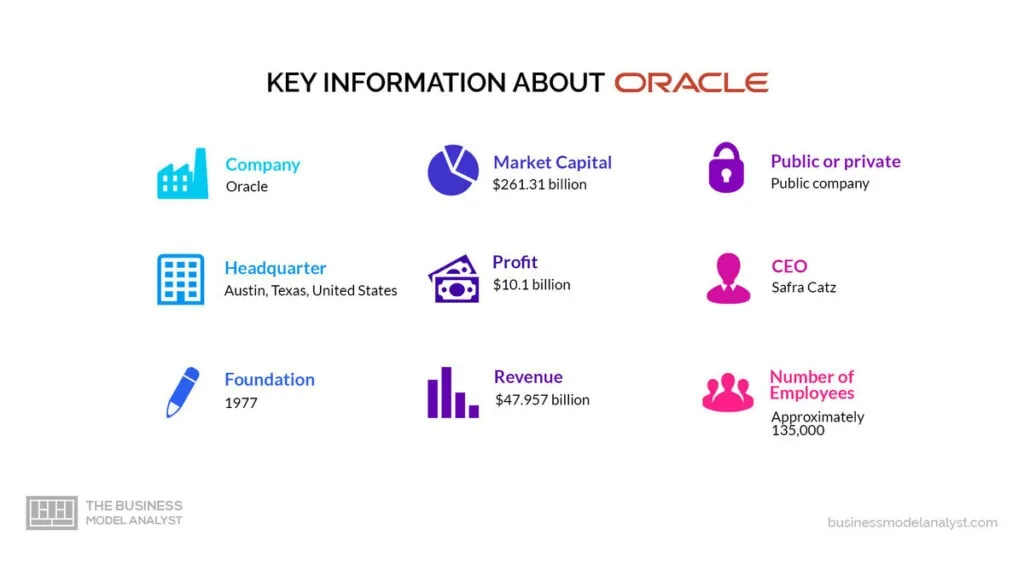

Oracle Business Model

The Oracle business model is focused on selling its software, cloud services, and hardware products to businesses and organizations. The company operates under a mixed business model, combining elements of subscription-based and traditional sales-based business models. At the core of Oracle’s business model is its customer segmentation strategy. Oracle has identified and targeted specific market segments with unique needs and requirements. By segmenting the market, Oracle can tailor its products and services to meet the particular needs of each customer segment, providing them with personalized solutions.

In addition to customer segmentation, Oracle has a clear value proposition. The company offers a wide range of products and services designed to meet the needs of businesses of all sizes. Oracle’s value proposition centers on providing its customers with high-quality and secure technology solutions to help them achieve their business objectives.

A brief history of Oracle

Oracle was founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates. Ellison. In the company’s early days, Oracle focused on developing and selling relational database management systems (RDBMS) for midrange computers. The company’s first product, Oracle Version 2, was released in 1979. Oracle Version 3, released in 1983, was the first commercially available RDBMS to support SQL, the standard language for accessing and manipulating data in a relational database.

Throughout the 1980s, Oracle continued to grow and expand its product offerings. The company introduced new database products, such as Oracle Rdb for Digital Equipment Corporation’s VMS operating system and Oracle SQL/DS for IBM mainframe computers. Oracle also began to develop application software, such as Oracle Financials and Oracle Manufacturing.

In the 1990s, Oracle continued expanding its product offerings and global reach. The company introduced Oracle7, the first database to support distributed computing, in 1992. Oracle also launched Oracle Applications, a suite of business software products, in 1990. The company expanded its international presence, opening offices in Europe, Asia, and Latin America. In recent years, Oracle has shifted its focus to cloud computing. The company offers a range of cloud services, including software-as-a-service (SaaS), platform-as-a-service (PaaS), and infrastructure-as-a-service (IaaS) offerings.

Who Owns Oracle

According to the company’s recent proxy statement, Larry Ellison, one of the co-founders of Oracle, owns approximately 1.1 billion Oracle shares, representing about 27% of the company’s outstanding shares. This makes him the largest individual shareholder of Oracle. However, institutional investors like The Vanguard Group, BlackRock, and State Street still own a significant portion of the company’s shares, so they also have a say in the company’s decisions and direction.

Oracle Mission Statement

Oracle’s mission statement is “to help people see data in new ways, discover insights, and unlock endless possibilities.”

How Oracle works

Oracle works by providing its customers with customized technology solutions that help them address their unique challenges and improve their business performance. Oracle does the following to offer solutions to its customers:

Collaborates with Customers

Oracle collaborates with its customers to understand their unique business needs and challenges. By doing this, Oracle can develop tailored technology solutions that address these challenges and help its customers improve their business performance. This collaboration may involve consultations, data analysis, and testing.

Delivers customized Technology solutions

Oracle provides customized technology solutions to its customers based on their specific business requirements. These solutions can be either software, hardware, or a combination. For instance, Oracle’s flagship database software is a powerful tool that helps businesses store and manage their data.

Offers a Variety of Products

Oracle offers a variety of products that cater to different business needs. These products are designed to help businesses improve their productivity, efficiency, and overall performance. Some of Oracle’s products include its database software, ERP software, CRM software, cloud-based services, and more.

How Oracle makes money

Oracle generates revenue from the following:

- Software licenses

Oracle sells software licenses for its various products, such as its database, enterprise resource planning (ERP), and customer relationship management (CRM) software. Customers can purchase perpetual licenses, which allow them to use the software indefinitely, or term licenses, which provide access to the software for a specific period.

Cloud services Fees

Oracle offers a range of cloud-based services, including infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). These services provide customers with access to computing resources, software applications, and other tools which they can use to run their businesses more efficiently. Customers pay for these services on a subscription basis, which provides recurring revenue for Oracle.

- Maintenance and support services fees

Oracle provides maintenance and support services to its customers, including software updates, technical support, and training. Customers typically pay an annual fee for these services, which can be a significant source of recurring revenue for Oracle.

- Hardware sales

In addition to its software offerings, Oracle also sells hardware products, such as servers, storage systems, and networking equipment. These products support the company’s software offerings, and customers can purchase them either as standalone products or as part of a larger solution.

- Consulting services fees

Oracle offers consulting services to help customers implement its software and hardware products effectively. These services can include everything from design and planning to implementation and training. Customers pay for these services on a project basis, which can be a lucrative source of revenue for Oracle.

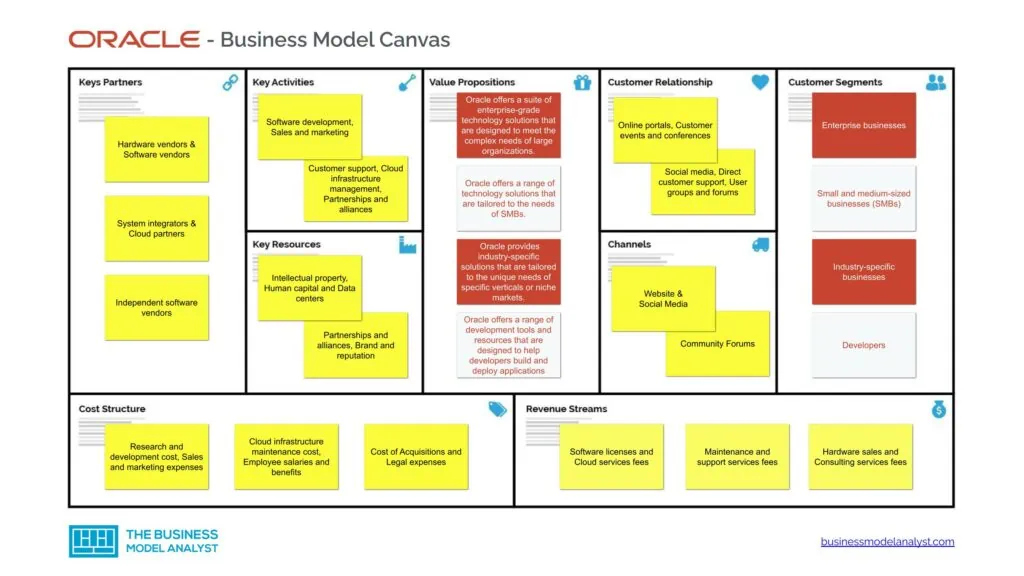

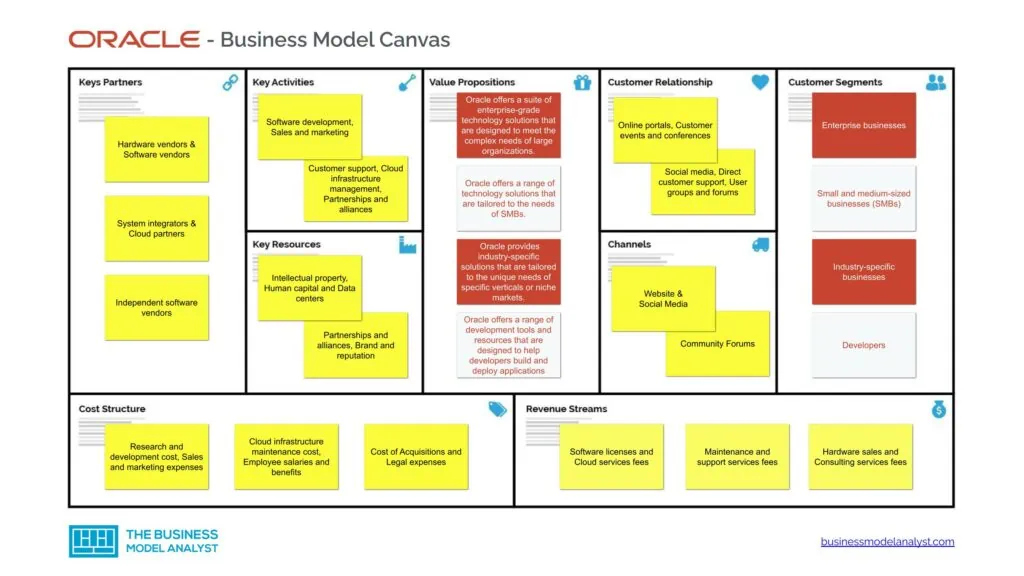

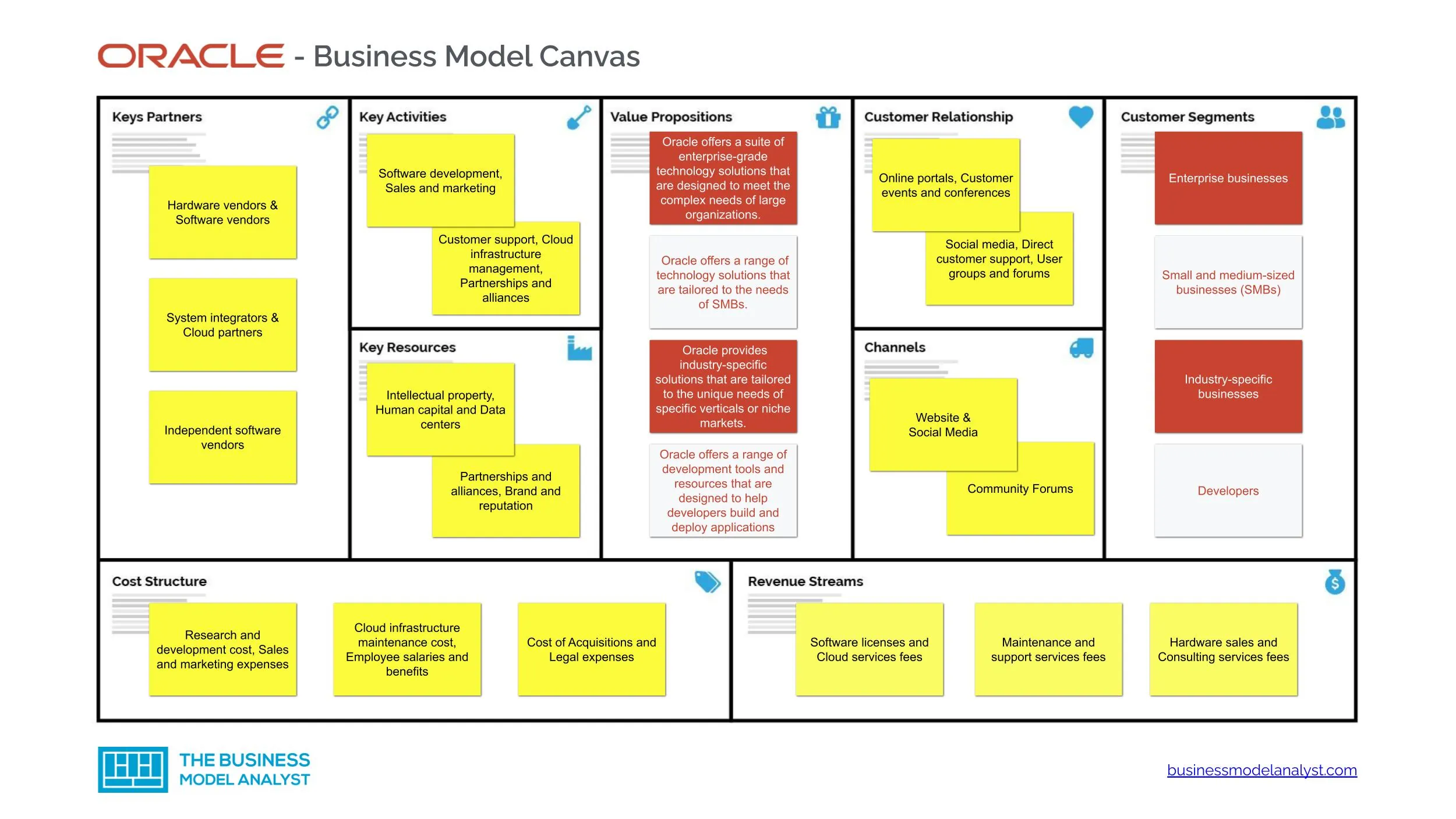

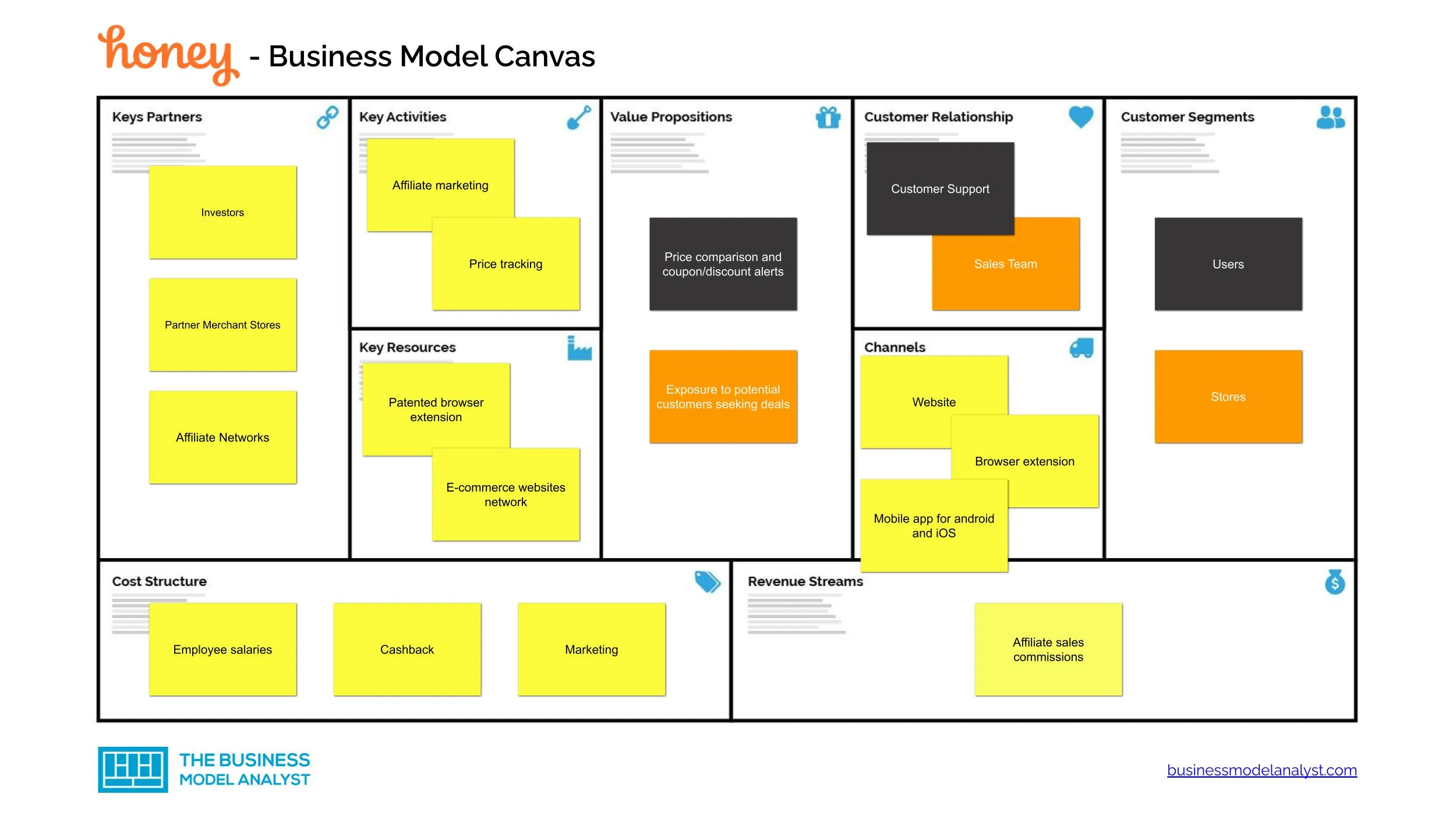

Oracle Business Model Canvas

Let’s take a look at the Oracle Business Model Canvas below:

Download FREE!

To download Oracle Business Model Canvas today just enter your email address!

Oracle Customer Segments

Oracle’s customer segments consist of:

- Enterprise businesses : Enterprise businesses are large organizations with complex IT needs. These businesses typically require robust technology solutions to manage their operations, and often have multiple locations and business units. Examples of enterprise businesses include multinational corporations, financial institutions, and government agencies;

- Small and medium-sized businesses (SMBs) : Small and medium-sized businesses (SMBs) are companies with fewer than 500 employees. These businesses typically have more limited IT resources and require more streamlined technology solutions to manage their operations. Examples of SMBs include local retailers, healthcare providers, and professional services firms;

- Industry-specific businesses : Industry-specific businesses are companies that operate within a particular vertical or niche market. These businesses have unique technology needs that are tailored to their specific industry, such as healthcare, retail, or hospitality;

- Developers : Developers are individuals or teams responsible for building software applications or customizing existing software to meet specific business needs. Oracle provides a range of development tools and resources to help developers build and deploy applications on its platforms, such as Oracle Cloud Infrastructure and Oracle Database.

Oracle Value Propositions

Oracle’s value propositions consist of:

- For enterprise businesses : Oracle offers a suite of enterprise-grade technology solutions that are designed to meet the complex needs of large organizations. These solutions include enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management software. Oracle’s value proposition to enterprise businesses provides scalability, reliability, security, and performance, as well as a deep understanding of the needs of large organizations;

- For small and medium-sized businesses (SMBs ): Oracle offers a range of technology solutions that are tailored to the needs of SMBs, including cloud-based software-as-a-service (SaaS) applications, hardware, and infrastructure solutions. Oracle’s value proposition to SMBs includes affordability, ease of use, and scalability, as well as the ability to integrate with existing IT infrastructure;

- For industry-specific businesses : Oracle provides industry-specific solutions that are tailored to the unique needs of specific verticals or niche markets. For example, Oracle offers healthcare-specific solutions, such as electronic medical records (EMR) software, that are designed to meet the needs of healthcare providers. Oracle’s value proposition to industry-specific businesses includes deep domain expertise, a tailored approach, and the ability to address unique business challenges;

- For Developers : Oracle offers a range of development tools and resources that are designed to help developers build and deploy applications on its platforms, such as Oracle Cloud Infrastructure and Oracle Database. Oracle’s value proposition to developers includes easy-to-use development tools, extensive documentation and resources, and a broad ecosystem of partners and developers who can provide support and guidance.

Oracle Channels

Oracle’s channels consist of:

- Social Media

- Community Forums

Oracle Customer Relationships

Oracle’s customer relationships consist of:

- Online portals

- Customer events and conferences

- Social media

- Direct customer support

- User groups and forums

Oracle Revenue Streams

Oracle’s revenue streams consist of:

- Cloud services fees

Oracle Key Resources

Oracle’s key resources consist of:

- Intellectual property

- Human capital

- Data centers

- Partnerships and alliances

- Brand and reputation

Oracle Key Activities

Oracle’s key activities consist of:

- Software development

- Sales and marketing

- Customer support

- Cloud infrastructure management

Oracle Key Partners

Oracle’s key partners consist of:

- Hardware vendors

- Software vendors

- System integrators

- Cloud partners

- Independent software vendors

Oracle Cost Structure

Oracle’s cost structure consists of:

- Research and development cost

- Sales and marketing expenses

- Cloud infrastructure maintenance cost

- Employee salaries and benefits

- Cost of Acquisitions

- Legal expenses

Oracle Competitors

- Microsoft : Microsoft is a multinational technology company that develops and licenses a wide range of software products, including operating systems, productivity applications, and cloud services. The company was founded in 1975 and is headquartered in Redmond, Washington. Microsoft competes with Oracle in several areas, including database management systems, cloud computing, and enterprise software;

- IBM : IBM is a global technology company that provides hardware, software, and consulting services to businesses and governments. The company was founded in 1911 and is headquartered in Armonk, New York. IBM competes with Oracle in several areas, including database management systems, cloud computing, and enterprise software;

- SAP : SAP is a multinational software company that develops enterprise software applications for managing business operations and customer relations. The company was founded in 1972 and is headquartered in Walldorf, Germany. SAP competes with Oracle in several areas, including enterprise resource planning (ERP), customer relationship management (CRM), and supply chain management;

- Salesforce : Salesforce is a cloud-based software company that provides customer relationship management (CRM) and other enterprise software solutions. The company was founded in 1999 and is headquartered in San Francisco, California. Salesforce competes with Oracle in the CRM market;

- Amazon Web Services (AWS) : AWS is a subsidiary of Amazon that provides cloud computing services to businesses and individuals. The company was founded in 2006 and is headquartered in Seattle, Washington. AWS competes with Oracle in the cloud computing market.

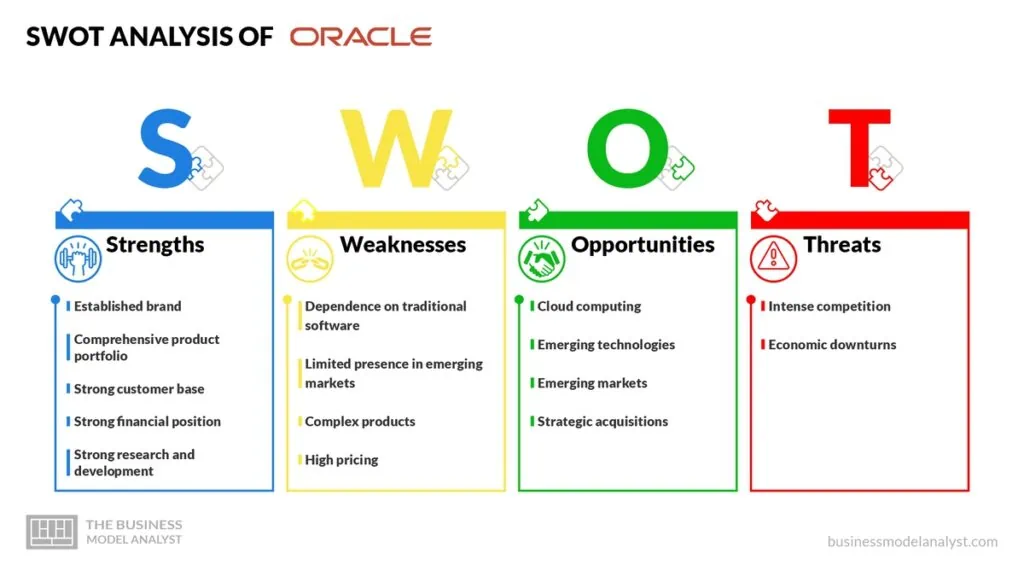

Oracle SWOT Analysis

Below, there is a detailed SWOT analysis of Oracle:

Oracle Strengths

- Established brand : Oracle is a well-known and established brand in the technology industry, with a strong reputation for quality and reliability. Its reputation is an important strength for Oracle, as it helps to establish trust with customers and creates a positive image for the company. A strong brand can also help to attract new customers and retain existing ones;

- Comprehensive product portfolio : Oracle offers a wide range of products and services, including enterprise software, cloud computing, and hardware. The comprehensive portfolio helps the company meet the diverse needs of customers and creates cross-selling opportunities. Additionally, an extensive product portfolio can help to reduce the risk of revenue loss due to changes in market demand for specific products;

- Strong customer base : Oracle has a large and diverse customer base, including large enterprises and government organizations. A solid customer base is a necessary strength, as it helps the company generate significant revenue and reduces its dependence on any one industry or customer group;

- Strong financial position : Oracle has a robust financial situation, with a high level of cash reserves and strong revenue growth in recent years. Its strong financial position provides the company with the resources needed to invest in research and development, expand its product portfolio, and pursue strategic acquisitions;

- Strong research and development : Oracle invests heavily in research and development, which helps it develop new products and stay ahead of competitors. This is an important strength, as it allows the company to innovate and create products that meet evolving customer needs.

Oracle Weaknesses

- Dependence on traditional software : Oracle’s traditional software products, such as its database software, continue to generate the majority of its revenue. Such dependence leaves the company vulnerable to market shifts and disruptive technologies that may reduce demand for these products;

- Limited presence in emerging markets : Oracle has a limited presence in emerging markets, which limits its growth opportunities in these regions. This is a weakness, as emerging markets represent significant growth opportunities for technology companies;

- Complex products : Some of Oracle’s products require significant expertise to implement and use. This complexity may make them less attractive to some customers, who may prefer more straightforward and user-friendly products;

- High pricing : Oracle’s products and services are often priced at a premium compared to competitors. High pricing may make them less attractive to price-sensitive customers, who may opt for cheaper alternatives.

Oracle Opportunities

- Cloud computing : Oracle has the opportunity to expand its cloud computing offerings and capture a larger share of the growing cloud market. This is a significant opportunity as the demand for cloud services continues to grow;

- Emerging technologies : Oracle has the opportunity to invest in and develop emerging technologies such as artificial intelligence, blockchain, and the Internet of Things. This opportunity could help the company stay ahead of competitors and meet evolving customer needs;

- Emerging markets : Oracle has the opportunity to expand its presence in emerging markets, which represent significant growth opportunities. Leveraging this opportunity could help the company reduce its dependence on mature markets and create new revenue streams;

- Strategic acquisitions : Oracle has the opportunity to acquire strategic companies and technologies that could complement its existing product portfolio and expand its capabilities. Strategic acquisitions could help the company enter new markets, create new products, and increase its revenue.

Oracle Threats

- Intense competition : Oracle faces intense competition from other technology companies, including Amazon, Microsoft, and Google. Such competition could limit its market share and revenue growth, as customers have more options;

- Economic downturns : Economic downturns could reduce demand for Oracle’s products and services, particularly in industries such as finance and government, which are major customers.

Oracle’s business model is a dynamic and effective approach to selling software, cloud services, and hardware products to businesses and organizations. By combining elements of both subscription-based and traditional sales-based business models , Oracle has created a unique approach to delivering value to its customers.

Through customer segmentation and a clear value proposition , Oracle has maintained its position as a major player in the technology industry. Its diversified channels, revenue streams, key resources, and strategic partnerships have also contributed to its success.

Despite the intense competition in the industry, Oracle’s business model is well-equipped to continue providing innovative solutions to its customers and maintain its leadership in the industry for years to come.

Daniel Pereira

Related posts.

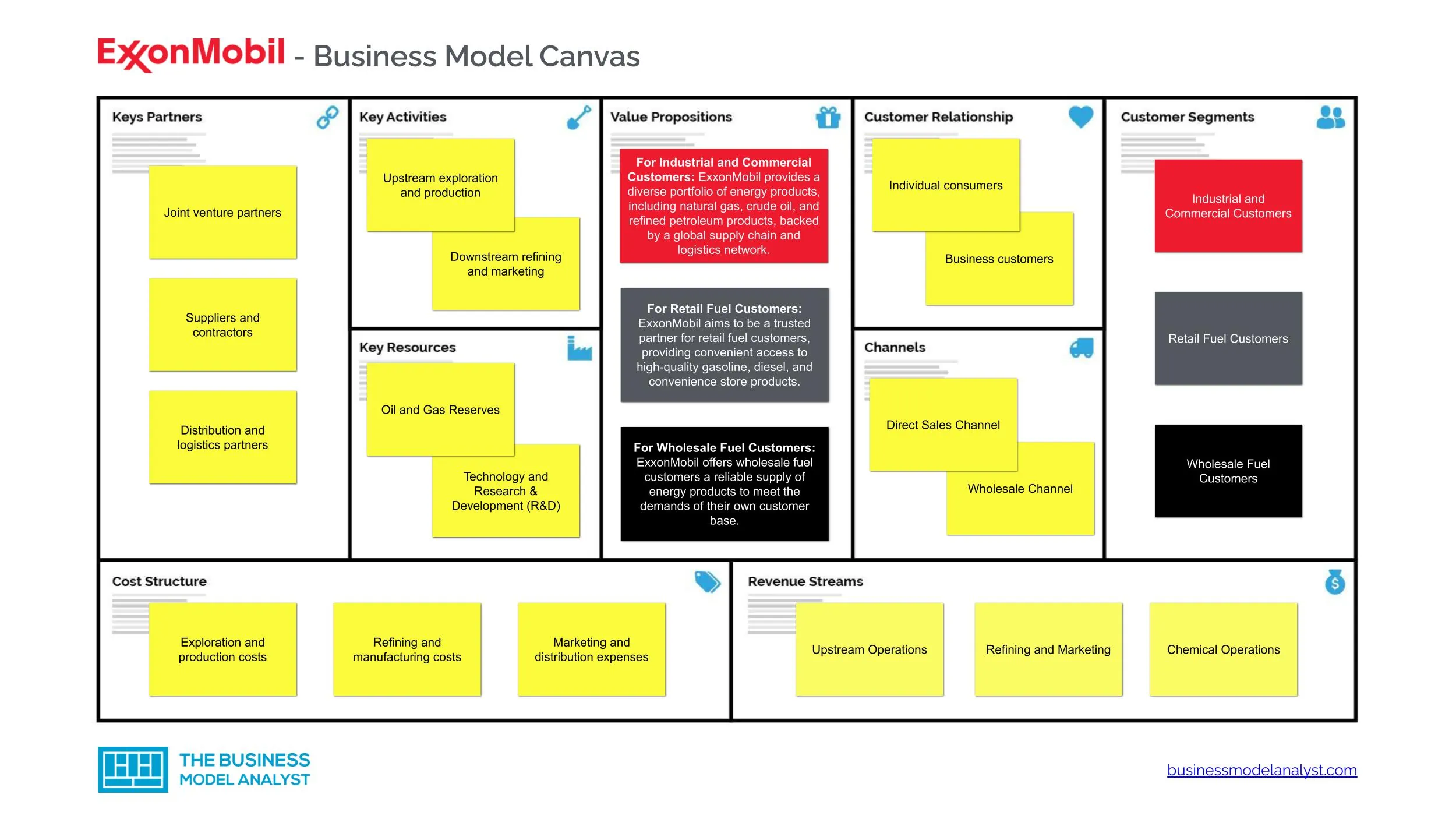

Exxonmobil Business Model

Operating in more than 60 countries, the ExxonMobil business model is centered around providing reliable [...]

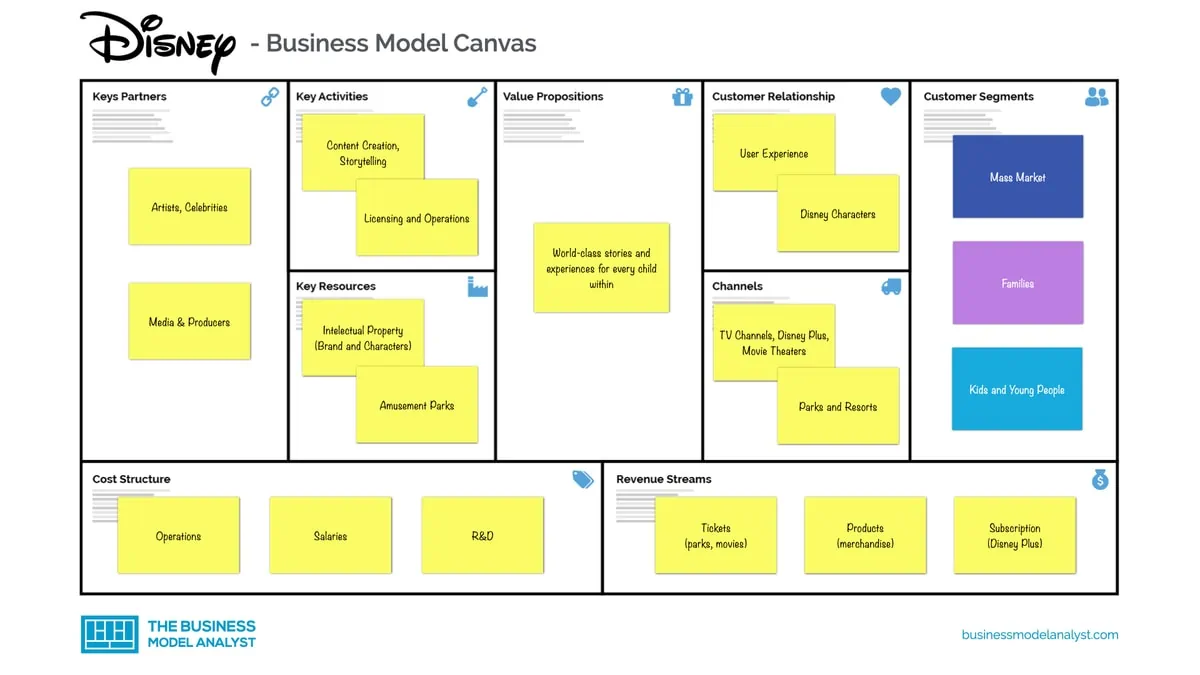

Disney Business Model

Ever since Disney business model created the cartoon character Mickey Mouse, the company has become [...]

Verizon Business Model

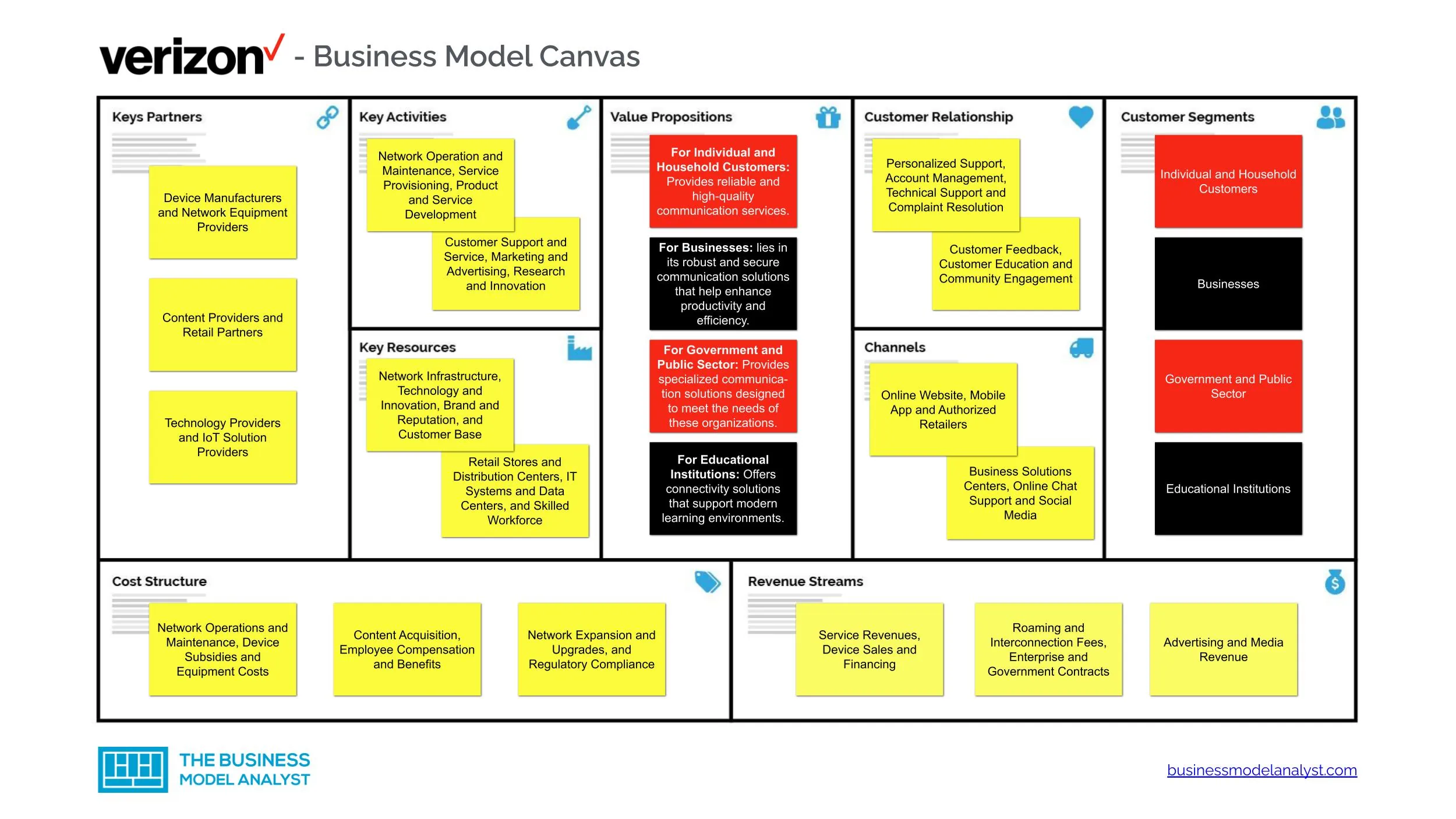

The Verizon business model revolves around providing a comprehensive suite of communication and technology solutions [...]

Tata Motors Business Model

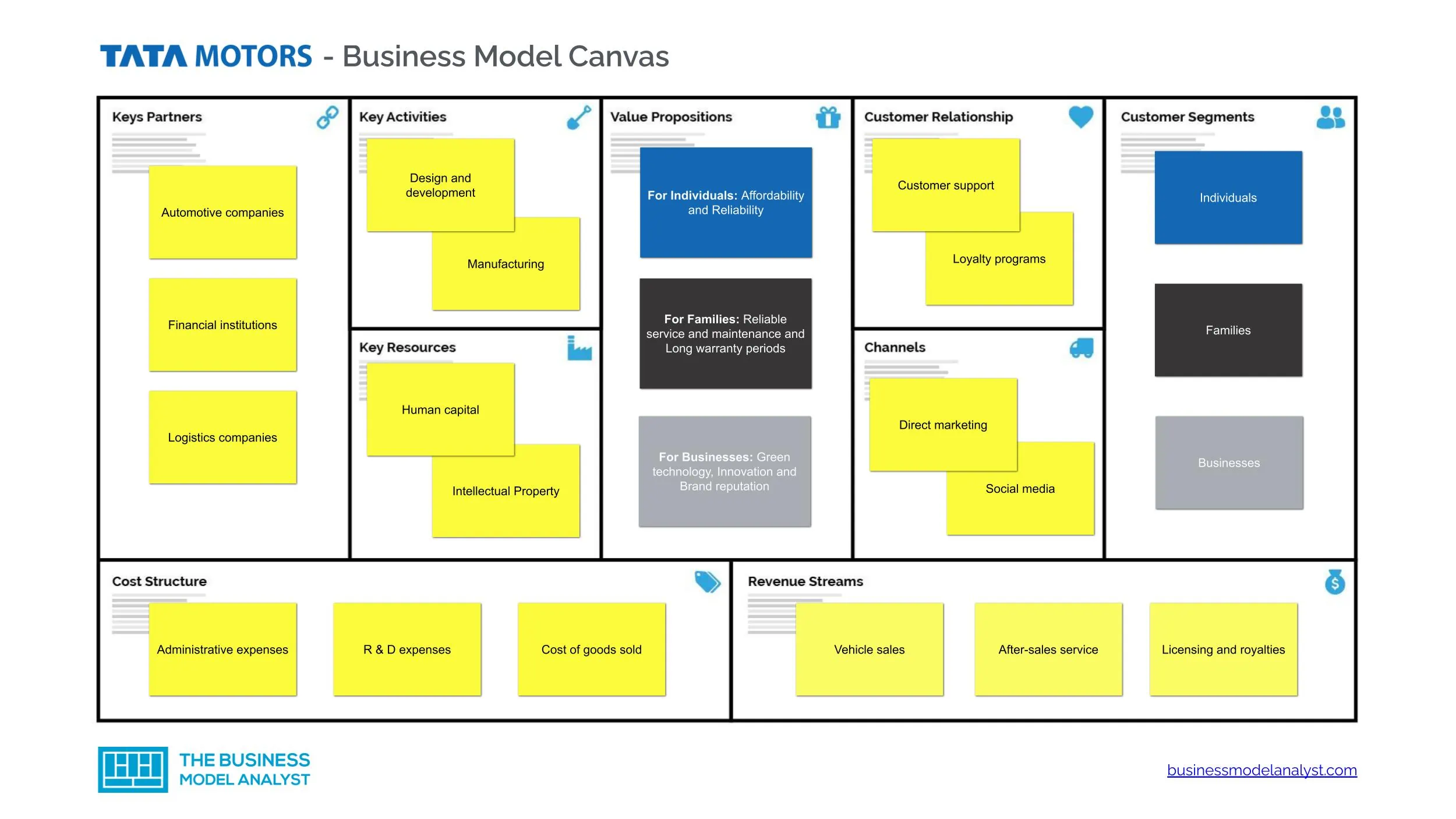

The Tata Motors business model is based on providing innovative automobiles for people worldwide on [...]

Abbvie Business Model

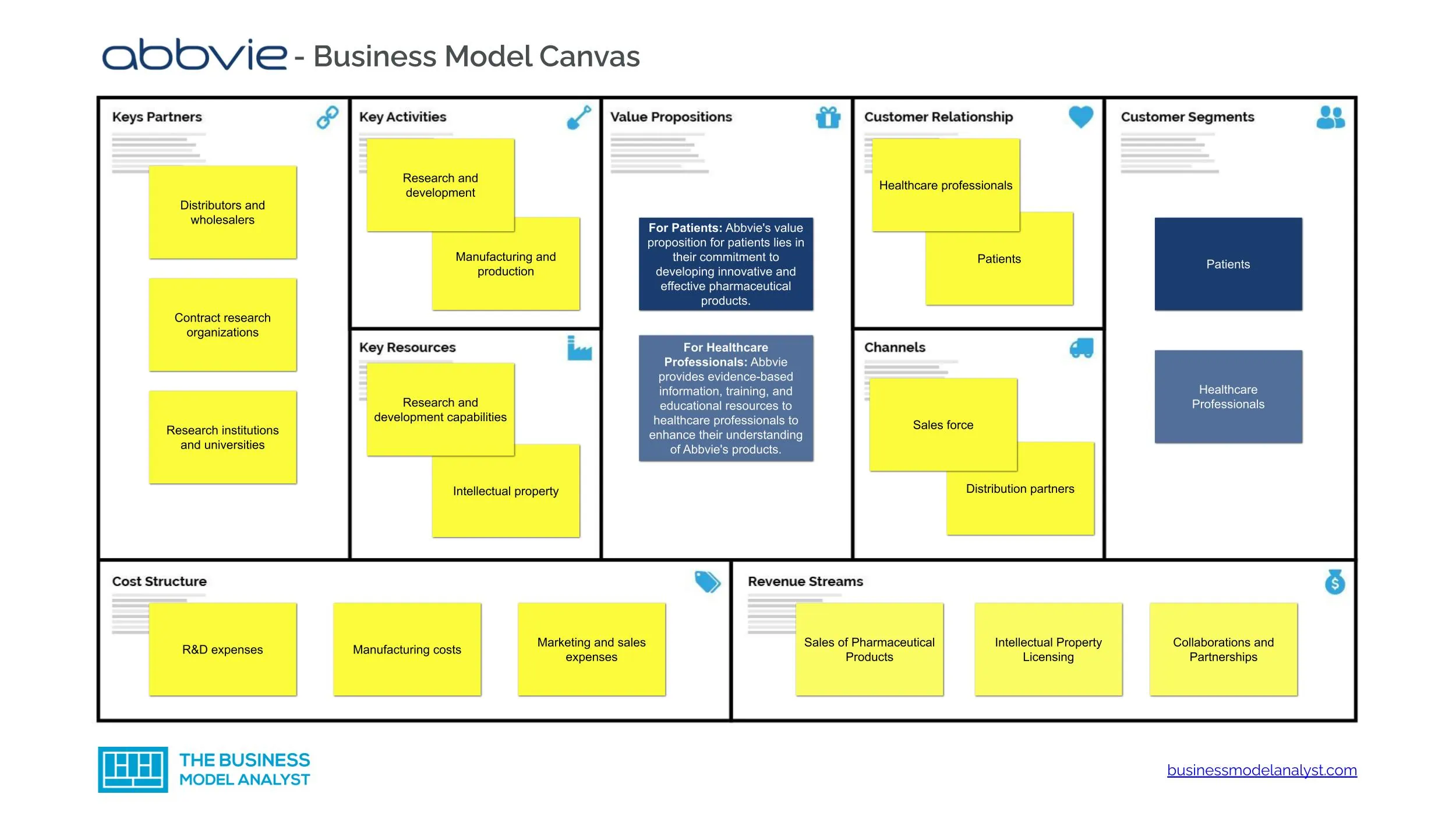

The Abbvie business model revolves around delivering innovative healthcare solutions to improve the lives of [...]

Whole Foods Business Model

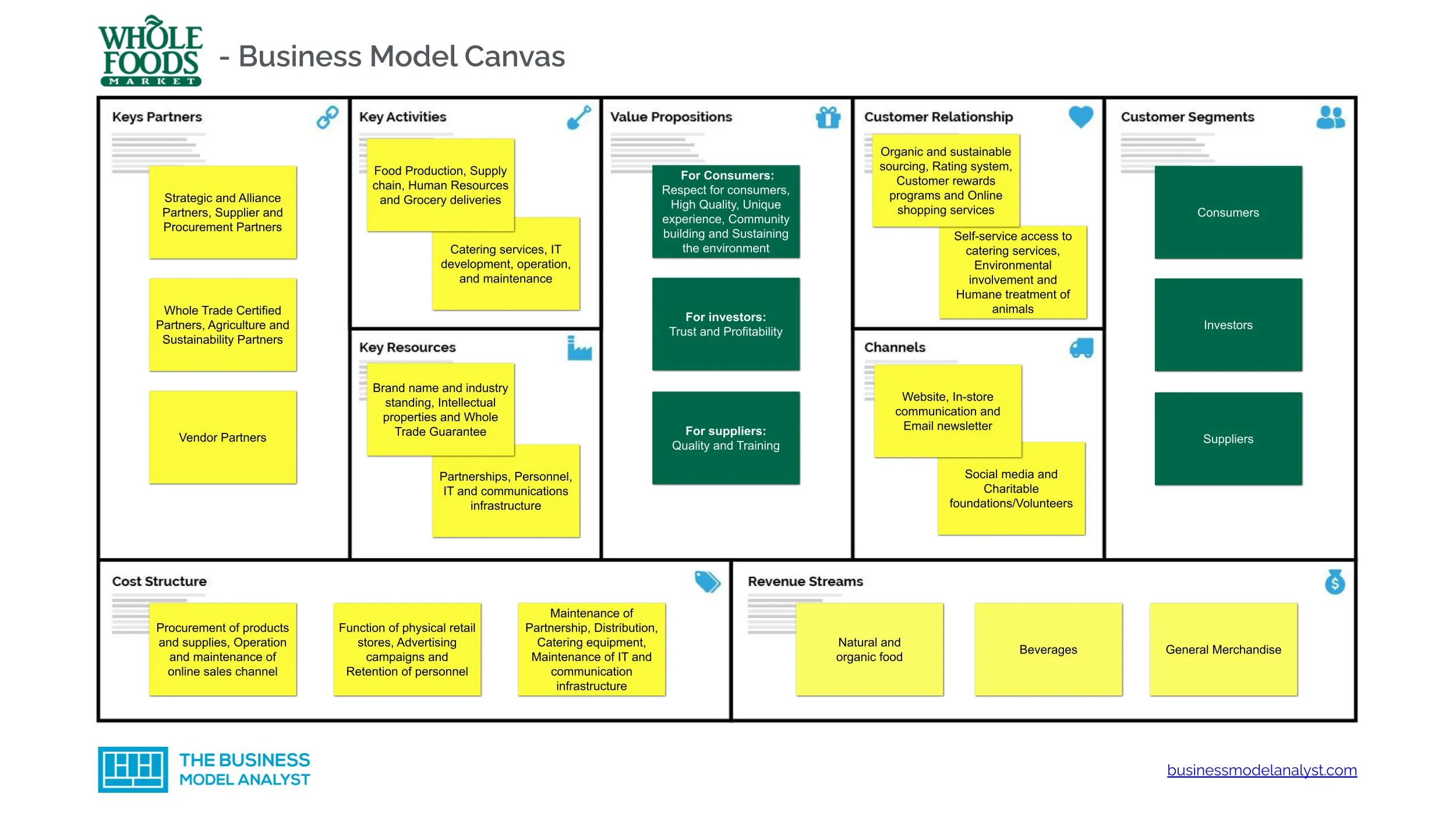

Headquartered in Austin, Texas, Whole Foods Market is the largest multinational chain of supermarkets that [...]

Honey Business Model

The Honey Business Model operates in the United States as a free browser extension app [...]

DoorDash Business Model

DoorDash is maybe the most popular meal-delivery service in the U.S. and has hundreds of [...]

RECEIVE OUR UPDATES

Username or email address *

Password *

Remember me Log in

Lost your password?

The Leading Source of Insights On Business Model Strategy & Tech Business Models

How Does Oracle Make Money? The Oracle Business Model In A Nutshell

Oracle is a behemoth software company founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates. The company followed the on-premise software model but mostly successfully transitioned to the cloud model . In fact, by 2022, cloud services represented most of its revenues. Indeed its lineup of software products comprises MySQL, Java, Middleware, Oracle Linux, and many others.

| Business Model Element | Analysis | Implications | Examples |

|---|---|---|---|

| Value Proposition | Oracle’s value proposition centers on providing comprehensive and integrated cloud-based software and hardware solutions to businesses. It offers scalable and customizable products that help organizations manage their data, optimize business processes, and achieve digital transformation. | Offers advanced technology solutions that enhance business efficiency, productivity, and competitiveness. Provides flexibility and scalability for tailored solutions. Attracts enterprises seeking digital transformation. | – Oracle Cloud Infrastructure (OCI) offers cloud services, including computing, storage, and networking, to organizations seeking scalable and secure cloud solutions. – Oracle Database provides database management software to enterprises for data storage and retrieval. |

| Customer Segments | Oracle serves a wide range of customer segments, including enterprises, governments, and organizations across various industries such as finance, healthcare, retail, and manufacturing. Its solutions cater to both small and large businesses, including Fortune 500 companies. | Addresses the diverse needs of enterprises across industries. Offers solutions suitable for organizations of different sizes. Attracts a global and varied customer base. | – Oracle provides cloud solutions to financial institutions for secure data storage and analytics. – Large retail chains use Oracle Retail solutions for inventory management and customer engagement. |

| Distribution Strategy | Oracle distributes its products through a combination of direct sales, partnerships, resellers, and a strong online presence. The company also offers cloud-based solutions accessible via the Oracle Cloud platform. | Ensures broad accessibility to its products and services. Leverages a network of partners and resellers for extended reach. Provides cloud solutions for easy online access. | – Oracle collaborates with system integrators to implement and support its solutions for customers. – Customers can access Oracle Cloud services through the Oracle Cloud platform’s online portal. |

| Revenue Streams | Oracle generates revenue from various sources, including software licensing, subscription-based cloud services, hardware sales, consulting, and support services. Its cloud offerings provide recurring revenue, while hardware sales and services contribute to one-time revenue. | Diversifies income streams through software licensing, cloud subscriptions, hardware sales, and services. Recurring revenue from cloud services provides stability. Attracts customers seeking comprehensive solutions. | – Oracle generates revenue from the subscription fees paid by organizations for using Oracle Cloud services. – Sales of Oracle Database licenses to enterprises result in one-time revenue. |

| Marketing Strategy | Oracle’s marketing strategy involves targeted advertising, industry-specific campaigns, partnerships with technology leaders, and participation in industry events and conferences. It highlights its innovation, expertise, and customer success stories to attract businesses. | Utilizes industry-specific marketing to resonate with target audiences. Partners with technology leaders for credibility. Showcases customer success to build trust. Engages with customers at industry events. | – Oracle promotes its cloud solutions to healthcare providers, highlighting data security and compliance. – Participation in tech conferences and partnerships with industry leaders enhance Oracle’s visibility. |

| Organization Structure | Oracle operates as a global corporation with various divisions and business units, including Oracle Cloud, Oracle Applications, and Oracle Database. It has a decentralized organizational structure with a focus on product development, sales, and customer support. | Operates with a decentralized structure to focus on specific product areas. Employs a global workforce to cater to diverse markets. Emphasizes innovation in product development and maintains a strong sales force. | – Oracle Cloud division focuses on cloud solutions, while Oracle Applications offers business applications like ERP and HCM. – Sales teams across regions target specific customer segments, such as enterprises or government agencies. |

| Competitive Advantage | Oracle’s competitive advantage lies in its extensive portfolio of cloud-based solutions, database management, and enterprise software. It boasts a large customer base, global presence, strong partnerships, and a commitment to research and development. | Offers a wide range of technology solutions under one roof. Attracts businesses with its established reputation and industry partnerships. Invests in innovation and research to stay competitive in the rapidly evolving tech landscape. | – Oracle’s partnership with major cloud providers like Microsoft Azure strengthens its cloud offerings. – Ongoing R&D efforts result in advanced database technologies that maintain Oracle’s leadership. |

Table of Contents

Origin Story

Oracle is a multinational computer technology corporation founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates.

Originally known as Software Development Laboratories (SDL), Ellison, in particular, became inspired by a 1970 paper written by Edgar F. Codd on database management systems.

Thirteen years later, SDL became Oracle Systems Corporation – a name aligned with the flagship Oracle Database product .

Oracle had early success using the C programming language to implement its products.

Its products and services were expanded following the successful acquisitions of PeopleSoft, NetSuite, and BEA Systems.

The company now sells database software and technology, cloud -engineered systems, and enterprise software products.

Today Larry Ellison is worth over $100 billion, thanks to his stake in Oracle.

Glance At The Oracle Business Model

As the company highlights in its financials:

Oracle provides products and services that address enterprise information technology (IT) environments. Our products and services include applications and infrastructure offerings that are delivered worldwide through a variety of flexible and interoperable IT deployment models. These models include on‑premise deployments, cloud ‑based deployments, and hybrid deployments (an approach that combines both on-premise and cloud ‑based deployment) such as our Oracle Cloud at Customer offering (an instance of Oracle Cloud in a customer’s own data center). Accordingly, we offer choice and flexibility to our customers and facilitate the product , service and deployment combinations that best suit our customers’ needs . Through our worldwide sales force and Oracle Partner Network, we sell to customers all over the world including businesses of many sizes, government agencies, educational institutions and resellers.

Oracle, therefore, is a behemoth whose software business ranges across the old and the new way (from on-premise to cloud and a hybrid between the two).

Oracle’s three primary lines of business comprise:

- Cloud and license : representing 83% of the company’s total revenues for 2020. This operating segment sells and delivers a broad spectrum of applications and infrastructure technologies through our cloud and license offerings.

- Hardware : it represented 9% of the company’s revenue in 2020 and it provides a broad selection of hardware products including Oracle Engineered System.

- And services : which represented 8% of the company’s revenue in 2020, primarily focused on helping customers and partners to use at the best the suite of Oracle products.

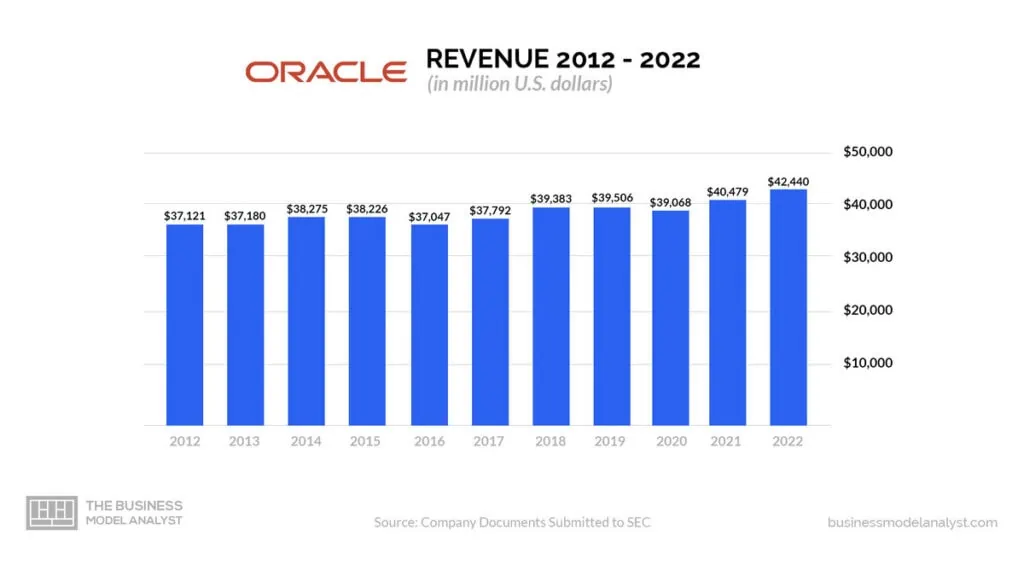

Oracle revenue generation

Oracle makes money by designing, manufacturing, and selling hardware and software products.

More specifically, revenue comes from software subscriptions, license, hardware, and service fees.

Through its numerous acquisitions, it also offers extensive complimentary services in consulting, hosting, financing, and training.

Ultimately, Oracle sells enterprise -level technology to large enterprises.

Let’s take a look at some of the major products and services.

Oracle Cloud Infrastructure

Oracle Cloud Infrastructure (OCI) delivers high-performance, on-premise computing power for cloud-native and enterprise IT workloads. Some of the more notable organizations utilizing OCI are Zoom, 7-Eleven, and FedEx.

Given that this is an enterprise solution, prices are available on request. Alternatively, a business can estimate its potential costs using a simple unit cost model .

Central to the Oracle software offering is their flagship product Oracle Database 19c.

This gives organizations cost-efficient access to the industry’s most reliable, scalable, and secure database technology.

Other on-premise products include:

- Middleware – a cloud platform for digital businesses.

- Oracle Linux – guiding leveraging Linux OS to deploy enterprise applications more rapidly.

- Engineered Systems – designed to integrate, test, and optimize software and hardware products.

- GraalVM – enabling interoperability between programming languages in a shared runtime.

- Analytics Server – for detailed customer analytics.

- Oracle Autonomous Database – a product allowing enterprises to reduce operating costs by 90% through an automated, machine learning database for full lifecycle management .

Prices are available by contacting an Oracle expert.

Oracle Hardware is a suite of scalable and engineered systems, storage, and servers. This hardware delivers many benefits to enterprises, including lower costs, better cloud integration, optimized performance, and more robust data.

Again, prices are available upon request. Current Oracle Hardware customers include Toyo, Halliburton, and Exelon.

Key takeaways

- Oracle is a multinational computer technology company for large enterprises. Co-founder Larry Ellison was inspired to create Oracle after reading a paper on database management systems.

- Oracle makes money by selling an extensive range of products and services to large enterprises. Acquisitions of related organizations also enable it to sell complementary services in hosting, training, and consulting.

- Oracle is best known for selling its database management system. It also sells cloud infrastructure and scalable systems, storage, and server hardware.

Key Highlights

- Origin and Evolution : Oracle was founded in 1977 by Larry Ellison, Bob Miner, and Ed Oates as Software Development Laboratories (SDL), which later became Oracle Systems Corporation. The company was inspired by Edgar F. Codd’s paper on database management systems. Over the years, Oracle expanded its product lineup through acquisitions of companies like PeopleSoft, NetSuite, and BEA Systems.

- Business Model : Oracle offers products and services addressing enterprise IT environments through various deployment models, including on-premise, cloud-based, and hybrid deployments. Its primary lines of business include cloud and licenses, hardware, and services.

- Revenue Generation : In 2022, Oracle generated significant revenue from cloud services (over 70%), followed by cloud and on-premise licenses, hardware, and services. The company’s revenue comes from software subscriptions, licenses, hardware sales, and service fees.

- Oracle Cloud Infrastructure (OCI) : High-performance cloud computing for enterprise workloads.

- Software : Flagship products like Oracle Database 19c, MySQL, Java, Middleware, Oracle Linux, and more.

- Hardware : Scalable and engineered systems, storage, and servers for enterprises.

- Larry Ellison’s Wealth : Co-founder Larry Ellison’s primary wealth comes from his ownership stake in Oracle, making him one of the wealthiest individuals globally.

- Revenue Breakdown : Oracle’s revenue is distributed among cloud and licenses, hardware, and services. Cloud and licenses constitute the majority of the revenue , with cloud services playing a significant role.

- Oracle Cloud Infrastructure : OCI offers high-performance computing for both cloud-native and enterprise IT workloads. Organizations like Zoom, 7-Eleven, and FedEx use OCI.

- Software Offerings : Oracle’s flagship product is Oracle Database 19c. The company also offers MySQL, Java, Middleware, Oracle Linux, Engineered Systems, GraalVM, Analytics Server, and Oracle Autonomous Database.

- Hardware Solutions : Oracle Hardware includes scalable and engineered systems, storage, and servers, providing enterprises with benefits such as cost savings, improved cloud integration, and optimized performance.

Business Model Explorers

Related visual stories.

Who Owns Oracle

Oracle Business Model

Oracle Revenue

Oracle Profits

Oracle Revenue Breakdown

Oracle Employees

Oracle Revenue Per Employee

More Resources

About The Author

Gennaro Cuofano

Discover more from fourweekmba.

Subscribe now to keep reading and get access to the full archive.

Type your email…

Continue reading

Organizational Models in Oracle Financials

This chapter covers the following topics:

Your Organization

The role of your legal entities, representing your organization in the system, organizational classifications in oracle financials, system entities, chart of accounts, a flexible model, cross organization reporting.

The Oracle E-Business Suite uses a variety of organizational constructs to capture corporate structures that exist in the real world. This chapter provides detailed information on the organizations you can set up in the Oracle E-Business Suite to represent your enterprise.

Oracle Financials can be implemented in multiple ways to reflect your real-world organization. Groups generally reflect a tension between their legal organization, management organization, and business divisions.

The Legal Organization

Our ability to buy and sell, own, and employ comes from our charter in the legal system. Commercial groups exist through corporate law. Units in the legal structure of a group are individual companies that share common ownership and control. In a public group, a company is owned by the public through shares sold on a stock market. In a private group, they are held by a privately held holding company. In other organizations, the legal entities are partnerships, funds, or government agencies.

A legally recognized entity can own and trade assets and employ people; while an entity without legal recognition cannot. When granted these privileges, legal entities are also assigned responsibilities to account for themselves to the public (statutory reporting and external reporting), comply with legislation and regulations, and pay income or profit and transaction taxes.

Most groups have many legal entities. They are created to facilitate legal compliance, segregate operations, optimize taxes, and for many other reasons. Legal entities establish your identity under the laws of each nation in which you operate, and provide vehicles for contractual relationships, compliance, and taxation.

The following diagram shows an archetypical group of companies operating various business and a standard functional organization.

A separate card represents each of a series of registered companies, that is, legal entities. The list of cards is the "Legal Axis".

Each company hosts parts or all of various subdivisions that management has made within its businesses. These are shown as vertical columns on each card. For example, a Group might have a separate company for each business in the United Kingdom, but have their Ireland company host all businesses in that country.

The subdivisions are linked across the cards so that a business can appear on some or all of the cards. For example, the chemical business might be operated by the Ireland, United Kingdom, and France companies. The list of business subdivisions is the "Business Axis".

Each company's card is also horizontally striped by functional groups, such as the sales team and the finance team. The functional list is the "Functional Axis".

The overall image suggests that information might, at a minimum, be tracked by company, business subdivision, and function in a group environment.

Business Divisions

Successfully managing multiple businesses requires that you segregate them by the rewards and risks involved in making them profitable. You divide your organization accordingly and assign management personnel to each division.

Although related to your legal structure, the business organizational hierarchies do not need to be reflected directly in the legal structure of the firm. The management entities and structure include divisions and subdivisions, lines of business, and other strategic business units, and include their own revenue and cost centers.

Functional Organizations

Straddling the legal and business organizations is an organization structured around people and their competencies: sales force, operations, plants, researchers, finance people, human resource management, information technologists, and management. The income statement often reflects their efforts and expenses directly. Organizations must manage and report revenues, cost of sales, and functional expenses such as Research and Development (R&D) and Selling, General, and Administrative Expense (SG&A).

Other Organizational Structures

Oracle Financials formally recognizes several other organizational structures, that will exist in your enterprise, in the data schema. You will have processing structures along different business flows:

Personnel reporting structures that may or may not correspond with the business hierarchy or legal or external reporting dictates.

Product driven structures in your production environment that may or may not correspond with your market and delivery structures.

Your legal entities, whether commercial registered companies or entities incorporated under laws other than company laws, play a pivotal role in your processing systems.

Compliance and Disclosure Requirements

Legal entities are formally the entities that actually enter into transactions. Individual legal entities own the assets of the enterprise, record sales and pay taxes on those sales, make purchases and incur expenses, and make other transactions.

All legal entities exist in particular legal jurisdictions, both national and regulatory, and must comply with the regulations of those jurisdictions. Legal entities have multiple compliance requirements placed on them, many of which define the form of the transactions into which that legal entity enters.

Many company statutes require that legal entities created in compliance with them publish specific and periodic disclosures. Annual or more frequent accounting reports, often referred to as "statutory accounts" and "external reporting," are required. These must be reported to specified national and regulatory authorities, for example the Securities and Exchange Commission (SEC) in the United States. Disclosure requirements are diverse. Local entities file locally using local regulations and currency, and through their holding company using parent Generally Accepted Accounting Principles (GAAP) and currency.

A given legal entity may or may not represent all or part of a management framework in its domain. For example, in a large country such as the United Kingdom or Germany, you might deploy individual companies to represent each business division, and you might control many companies in that country. In a smaller country, for example Austria, you might use a single legal entity to host all of your business divisions.

Legal entities have very specific relationships with shared service centers and with the ownership of the goods and transactions managed by such centers.

Organization Structures

Oracle Financials has powerful schemas of organization units that support your legal, management, and functional organization. They are designed to:

Ease the management of your worldwide shared service organization and facilitate sourcing at the optimal mix of employee cost, data flow, and management control.

Provide access control and security, excluding those without authority, and facilitating access across units for those who need it.

Administer compliance and segregate transactions and administrative rules by jurisdiction.

Provide attributes for reporting and identify business events according to the relevant business dimensions.

Organizations and Transactions

Oracle Financials enables you to categorize and classify your transactions to the level of granularity required to reflect each of these organizations. A single transaction can be categorized as follows:

On the Legal axis: By company or other legal entity, by groups of companies, and by establishment. Establishment is the presence of a legal entity in a jurisdiction for purposes such as payment of transaction taxes.

On the Management axis: Business classification by several management entities.

On the Functional axis: By nature of the transaction (for example, detailed accounts involved such as marketing or cost of sales). By people and cost centers involved.

By Other attributes.

The core task of Oracle Financials applications is to track the appropriate business and accounting attributes of a transaction.

Business attributes are tracked in the product modules and include such details as trading partner, subject matter, quantity, price, agent, employee, tax, addresses, dates, and so on. Accounting attributes are generated from that data by our subledger accounting engine and are recorded in detail in the subledger accounting tables and at your choice of summary level in General Ledger.

Two vehicles, system organization entities and the chart of accounts, are the cornerstones for securing transactions and modeling an enterprise in the Oracle E-Business Suite. The assembly of these building blocks to model your enterprise will define the representation of your business and your process flows in the applications suite.

In general, a system organization entity might represent any real organizational unit within a business. Depending on their classification, system entities deliver specific features and controls, such as access control and shared service administration, policy, legal or compliance administration, data storage, and employee administration. Oracle Financials provides names that reflect that functionality. In general, assigning a system entity to represent a real world entity with the same nomenclature is an effective choice.

By contrast, a chart of accounts representation of a real world entity is an identifier for analysis and accounting, with fewer features and control associated with it. Important entities, such as cost center and legal entity, can be represented by both a system entity and as a value in a chart of accounts section.

Several system entities are so closely tied to accounting entities that we automatically correlate them; others have looser associations so that you can tune the relationship to your actual organization.

The Oracle E-Business Suite includes the following important system entities:

Business Group and Departments

Government Reporting Legal Entity (GRLE)

Legal Entity

Operating Unit

Inventory Organization

Human Resources Organization

Each system entity is assigned to a classification that determines its functionality and indicates how you might want to deploy it.

Business Group and Department

Business groups.

The business group is an organization that is set up and configured in Oracle Human Resources. The business group is partitioned into separate files of Human Resources information and is used to administer Human Resources payroll and benefits for employees.

A business group is often related to country-specific legislation. It may correspond to your entire enterprise or to a major grouping such as a subsidiary or operating division. One business group is needed for each major employment jurisdiction. These jurisdictions roughly correspond to nations. If a group of nations unite together on employment laws, it is possible to implement a single business group for them.

A business group is the highest level classification in the organization hierarchy of the Oracle E-Business Suite. If your payroll tax and employment authorities permit it, you can group employees of different registered companies together for reporting. The result is a business group that can serve as an administrative and legislative organizing structure for personnel across legal entities.

Oracle provides configured business groups for a number of countries. These business groups are seeded with appropriate legislative data and rules. You can customize business rules that are subsequently stored under the business group for Human Resources applications such as Oracle Payroll.

Even if you do not have Oracle Human Resources in a given country or region, it is a good idea to set up a business group during implementation. A business group cannot be set up once your applications are live.

Government Reporting Legal Entity

Employees are employed by the system entity called "Government Reporting legal entity" or GRLE which represents the formal employer in the Human Resources Management System. Employees are assigned to departments.

A GRLE can represent a registered company or other registered legal entity: GRLEs are a particular type of system legal entity, and serve to connect your employees with the appropriate company or other entity in the legal world.

Departments

Oracle Human Resources further organizes employees into departments. You can create hierarchies of departments to roll up your employees into the management structure.

"Legal entity" in the Oracle system corresponds closely to "legal entity" or "company" in the legal world. You can store information about a registered company or other real world legal entity in the "legal entity". For example, you can store the registered address and director or officer names.

The legal entity administers transaction level rules in compliance with national laws.

A real world legal entity is a discrete legal personality characterized by the legal environment in which it operates.

In the real world, legal entities have the right to own property, the right to trade, and the responsibility to comply with appropriate laws. They also often have the responsibility to account for themselves (balance sheet, income statement, specified reports) to company regulators, taxation authorities, and owners according to rules specified in the relevant legislation.

The Oracle E-Business Suite reflects the real world for legal entities. The system legal entity is the first party on business transactions and is the transaction tax filer and payer. We recognize that for many groups, particularly in environments where the authorities allow you to treat many legal entities as one, you don't need or want to segment data or account separately for each entity that you have incorporated. Therefore, the system legal entity does not automatically account for itself.

Instead, we facilitate correlation of subledger activity with reporting legal structures by exploiting related system entities for operating units, ledgers, and company representation in the chart of accounts.

You can account for any real world legal entity separately if you need to do so;

You can account for a group of real world legal entities as if they were one when that fits your model;

And you can account for a part of a real world legal entity as if it were completely standalone when appropriate.

A system legal entity can account for its transactions in many ledgers, using different accounting conventions, or using different currencies.

Tip for Existing Oracle Financials User

You will find that a legal entity has more attributes in Release 12 and that a Legal Entity Configurator is provided. Tax calculation, intercompany processing, and bank ownership exploit legal entity attributes more assiduously than previously.

Establishment

A system legal entity is the transactor and taxpayer for each third party transaction. It holds tax registration data, such as identification numbers. An individual legal entity can have exposure to several tax authorities, and be registered with each. For example, a California-registered company might have "establishments" in California and in several other states.

Establishment is an entity that was not expressly called out in previous releases and is useful in resolving transaction tax situations.

Ledgers, Multiple Ledgers, Ledger Sets, Balancing Segments, and Subledgers

A fundamental concept in Oracle Applications is the "Ledger." The Ledger represents an accounting representation for an organization that is accountable in a self-contained way.

A ledger owner might be a legal entity, a group of companies in a common legal environment, a substantial operation within a legal entity but with legal entity attributes, or a foreign branch. Ledgers are also used to consolidate and manage reporting. In a pure implementation, "a legal entity accounts for itself in a ledger".

A ledger provides balanced ledger accounting for the accounting entity and serves as the repository of financial information. Consequently, it is the principal source of information for the analytical applications in the Oracle E-Business Suite.

Ledger balances have meaning - they assert that the balance:

on an account

at a given date

has a specific value in a particular currency and

is properly calculated.

This implies a consistent application of what we sometimes call "the 4 Cs": Chart of Accounts (COA), Calendar, Currency, and accounting Convention. The COA provides the account; Calendar the date; Currency the amount; and Convention the calculation.

Multiple Ledgers

Of course, you will need different currency and parent company GAAP representations of your overseas operations. One way to achieve this is to use multiple ledgers for an accounting entity.

An accounting entity can account for itself in ledgers that are prepared under different conventions with different charts of accounts, and value transactions in different currencies. One of the ledgers is the 'primary' ledger. The accounting for a subledger transaction can be set up so that multiple ledgers are populated according to different rules and in different currencies. You choose the appropriate accounting according to your needs.

When using a second ledger, you can elect to use an "all the detail” philosophy in which detailed transactions are posted to General Ledger. You might prefer to use a "just what matters" philosophy where only General Ledger balances are posted.

Ledger Sets

Ledgers can be grouped into "Ledger Sets". A Ledger Set is a collection of ledgers that you wish to manage as though they were one ledger. "Manage" includes reporting, opening and closing, running allocation calculations, and entries. For example:

You have 26 registered companies in Regmany. Regmany regulations require that each company maintains a distinct book of accounts. You set up a Ledger for each company and group them into a Ledger Set. Your finance staff can treat the collection as if they were one for all accounting activities, while the data remains distinct for each company.

You could create a Parent Currency and Parent GAAP ledger for each overseas operation. You can group all of them into a Parent View Ledger Set. Your corporate finance staff can treat them as one worldwide ledger for all accounting activities.

Ledger and Ledger Sets together replace Sets of Books. The data of a Set of Books is contained in a ledger. The management of the Set of Books (open and closing, reporting, allocating, and so on) is now at the Ledger Set level.

Multiple Ledgers is a new feature in Release 12.

Balancing Segment

Ledgers balance, that is, the sum of the debit and credit balances equal each other and you can prepare an income statement and balance sheet from them. Oracle Financials checks that imported data, subledger posting, and journal entries (adjustments) balance, in order to maintain this integrity. Ledgers in a Ledger Set also balance and are also used for financial reporting.

Within a ledger, you can nominate a segment of your chart of accounts to be a "balancing segment". The values (Balancing Segment Values or BSV) that you assign in that segment will represent entities in your organization for which you want to measure both income and wealth, that is, to prepare income statements and balance sheets, and to measure return on investment.

You might do this for divisions, plants, externally reportable segments, legal entities sharing a jurisdiction, and for other reasons.

Customers frequently combine entities into BSVs and report on groups of them. For example, if you want to track return on investment (ROI) on both "plants" and "divisions", you might create balancing segment values as shown in the following table.

| D01 | P100 | D01:P100 |

| D01 | P200 | D01:P200 |

| D02 | P100 | D02:P100 |

| D03 | P200 | D03:P200 |

During setup, you can specify whether a system legal entity uses a whole Ledger or balancing segments.

Ledgers and Subledgers

Oracle Financials reflects the traditional segregation between the general ledger and associated subledgers.

Detailed transaction information is captured in the subledgers and periodically posted (in summary or detail form) to the ledger. You post from subledger to general ledger in real time, without any grouped processing, or you can post on a schedule corresponding to your practice.

Operating Units

In the financial applications of Oracle's E-Business Suite, an Operating Unit (OU) is a system organization that:

Stores subledger data separately from the data associated with other OUs that support a particular ledger ("Partitions").

Administers subledger rules such as those associated with transaction types, sequencing schemes, and other sales tax or VAT regulations ("Complies").

Administers user access to the data for processing and reporting ("Secures").

Is not product specific and automatically links all subledger products that post to a specific ledger.

Applies to subledger business transaction and document data and associated data such as customer details. Subledger accounting data is not tagged with OU identification unless you elect to do so. General ledger data is not managed through OUs.

Multiple Organizations is the name we give to the functionality that surrounds OUs and it is exploited by all products as appropriate.

You can use OUs to store data on behalf of a Legal Entity. As compliance with transaction tax auditing legislation is built into transaction types and transaction types are stored by an OU, this is an effective way to manage transaction compliance. An OU with the type "Legal Entity" (OU/LE) is often used in conjunction with a Ledger to manage a real world legal entity's paperwork. All subledger products share the legal entity's OU and post to the Ledger.

The real world legal entity's compliance obligations are administered by:

OU on subledger transactions and

Ledger for balancing, closing, and reporting rules.

Depending on the nature of the regulation with which you must comply, various combinations of real world company and system legal entity, OU, and Ledger are possible. In a worldwide deployment, one would expect to see all combinations in place in different situations.

One legal entity accounts for itself in one Ledger storing subledger data in one OU. This is a normal setup for a country or region that closely regulates subledger data by legal entity.

Several legal entities account for themselves in one Ledger storing subledger data in one OU, and use the Chart of Accounts balancing segment to produce financial statements for each legal entity. This is a normal setup for a country or region that regulates a group of companies as a whole.

A legal entity or group of legal entities account for themselves in one Ledger storing subledger data in several OUs. This is a normal setup for a group doing business in highly regulated industries in a given country or region.

A part of a legal entity accounts for itself in a ledger using one or several OUs. This is a normal situation for a large corporation using several instances or Enterprise Resource Planning (ERP) systems.

System legal entities, Ledgers, and OUs are defined in relationship to one another. A legal entity accounts for itself in the Primary Ledger and optionally in other ledgers, and stores its subledger data in one or more OUs.

OUs are often identified with security. In the Oracle E-Business Suite, users are given access to the data they handle though "responsibilities". A responsibility is associated with a specific OU, or with several OUs - this is a feature called "Multiple Organizations Access Control". By securing subledger data in this way users can access and process transaction information only for the particular operating unit or set of operating units to which they have been granted access. They view only what they need and have authorization to view.

This is very fundamental security. The Oracle E-Business Suite incorporates many other security models specific to circumstances that match the usage and deployment requirement needs that you have for those circumstances, and integrate with Multiple Organizations Access Control to provide comprehensive and appropriate security.

OUs can be used to model autonomous organizational units that create financial transactions. You create, process, and report on subledger financial data within the context of an OU.

Use an OU when you need to keep the data of one organization distinct - at arms length - from the data of another organization. You might have the right to prevent a state's transaction tax auditor from viewing the transactions of a neighboring state; consider storing each state's transactions in separate OUs. This right often exists when the states are independent nations, but seldom when they are federated.

Use an OU when you need to comply with transaction tax law that is substantially different (more than just the tax rates) to similar laws in neighboring state. You can use product "transaction types" to create similar transactions that follow different documentation and processing practices.

Use an OU when you wish to keep data of an operation private from management of another operation. For example, within a financial institution division, you may want to keep the transactions and data of the lending operation separate from that of the brokerage operations.

OUs divide the subledger document data in Oracle Financials applications into distinct segments. Standard reports and processes run within OUs; and 'special' reports and processes run across them. You can deploy OUs to provide barriers that require special access, reporting, and processing to cross.

Subledger Accounting and Operating Units

While subledger transaction rules are governed by OU, subledger accounting rules are not OU dependent.

OUs store transaction types and rules that govern the transaction document such as invoices, and the business rules (for example, credit terms) that you want applied to those documents.

Subledger accounting rules are not stored by OU. They are stored centrally, but can refer to any data (including OU identifiers) associated with the transaction to derive the appropriate accounting.

Shared Services and Multiple Organizations Access Control

The setup of operating units provides a powerful security construct in the applications by creating a tight relationship between the functions a user can perform and the data that a user can process. This security model is appropriate in a business environment where local business units are solely responsible for managing all aspects of the finance and administration functions.

In a worldwide deployment, this tight relationship provides an internal control on inappropriate processing. For example, in traditional local operations, an invoice of one OU (a system representation of, perhaps, a company in a country) cannot be paid by a payment from another (a system representation of, perhaps, a different company in a different country). This would amount to tax fraud.

By contrast, in a Shared Service Center environment, processes that allow one company to perform services for others, with appropriate intercompany accounting, require that users access the data of different companies, each complying with different local requirements.

To accommodate shared services we use Multiple Organizations Access Control to expand the relationship between functions and data. A Responsibility can be associated with a single OU or with multiple OUs. You can isolate your data by OU for security and local level compliance and also enable certain users and processes to work across them. This is the core of our shared service architecture.

Consider an environment where the orders are taken in several different OUs each representing different registered companies. These OUs segregate the orders and data appropriately. However, all of these orders can be managed from a "shared service" order desk in an outsourcing environment through a single Responsibility.

Multiple Organizations Access Control is a new feature for Release 12.

Inventory Organizations

The Inventory Organization represents an organization for which you track inventory transactions and balances. These organizations might be manufacturing or distribution centers. Several modules and functions in the Oracle Manufacturing and Supply Chain Management suite secure information by Inventory Organization.

Inventory Organizations are associated with OUs. Each Inventory Organization has a parent OU and can serve other OUs.

Various functions in the Oracle E-Business Suite use this organization classification. For example, to activate the "Purchasing Receiving" function, your responsibility must have access to an organization that is classified as an Inventory Organization.

Through its parent Operating Unit, the Inventory Organization financially impacts the Ledger to which it rolls up. For example, requisition transactions or replenishment of supplies are created against an Inventory Organization, which then have a financial impact on the Ledger.

For the most part, we have discussed system entities (for example, Legal Entity, OU, Ledger) and their relationships with real world entities (for example, Company, Management Unit, Division) that you have in your organization. System entities are created though special setup screens and stored in tables.

We have discussed the "Balancing Segment" that is part of the chart of accounts rather than a stored system entity. The chart of accounts, your listing of account numbers, includes other segments that reflect your organization. You might have company codes, cost center codes, business organization codes, and other organization related codes, as well as non-organization codes such as natural accounts, product codes, or project codes.

The chart of accounts is a very flexible, almost free-form, combination of segments (as many as you like) of different lengths. You use these segments to flag transactions so that they are summarized in a meaningful way to your business. The chart is referred to as "flexfields", which is the underlying technology. The acronym "CCID" (Code Combination Identifier) or the term "Accounting Flexfield" refers to an individual combination of segment values, or a complete account number.

A specific chart of accounts (complete with values) is associated with each ledger and the same chart can be associated with many ledgers.

We specify only three segments, Natural Account, Balancing Segment, and Cost Center, as mandatory.

Cost Center

Cost Center is a focal point for a department's expenses. You might use the cost center to track "the Finance Department". In cases where labor is the most important element of expense, cost centers in your chart of accounts and the HR "Department" discussed earlier will refer to the same business unit in the real world. The Oracle E-Business Suite includes the ability to keep them synchronized. There are some important differences in the way you want them to behave.

When an employee leaves, you'd like HR to update the records immediately. But continuing expenses, if any, should be accounted for in the same cost center. If the employee was a manager, the resulting reorganization might not be reflected in the financial statements for some time.

Accordingly, the creation and maintenance of HR Departments and Ledger Cost Centers can be synchronized. However, we facilitate different update paths. Approval and expenses associated with employees are automatically associated with the cost center that relates to their HR department.

Many customers exploit naming conventions and ranges to facilitate the combination of individual cost centers in local companies into a worldwide view of similar cost centers. Ledger security includes a facility to control accounting access by ranges within chart of account segments that can be deployed usefully in this context.

Many customers also use cost centers, rather than natural accounts, to aggregate functional expense types such as "Research and Development" or "Finance".

We previously discussed Balancing Segment in the context of Ledgers and representations of Legal Entities. A Balancing Segment is a segment of the chart of account that forces balancing, meaning that the Ledger will calculate a receivable and payable between balancing segments for any entry that crosses them.

Example of 'Balancing'

My New York Division (01) ships to a California Division (03) customer. The entry as drafted is Credit 01-Sales, Debit 03, Receivables from Customer. The entry is posted as:

Credit 01, New York Sales

Debit 01, New York Receivable from 03, California

Credit 03, California Payable to 01, New York

Debit 03, Receivable from Customer

This facilitates the preparation of full balance sheet and income statements for each Balancing Segment value and makes them an excellent representation for any business unit for which you need to track balance sheets.

Our customers use balancing segments to identify registered companies that are accounted for together in a single ledger, divisions for which they wish to measure balance sheet data and return on investment, and externally reportable segments.

You can use a balancing segment value for each legal entity accounted for in a ledger: Companies 01, 02, and 03. Other than balancing, no additional functionality is attached to Balancing Segment, so using a Balancing Segment Value alone is recommended only in a federal environment that treats groups as one tax or statutory reporter or filer.

Natural Account

For many companies, natural account also has an organizational impact. Companies deploy the natural account in different ways. Some start "at the top" with their external reporting lines (for example, cash, revenue), expand the list to include their management reporting lines (different types of revenue), and then expand further to the level of granularity they wish. Others start "at the bottom" with detailed departmental expenditure types.

Companies that start with reporting lines often reach the point where "Finance Salaries", "Finance Benefits", and so on are natural accounts, and a report on all Finance accounts delivers the Finance expense. Those that start at the bottom often use "Salaries" and "Benefits" as the natural account and establish a list of cost centers to be the total finance.

When you are finished, you will have modeled your organization in the system using ledgers, ledger sets, and balancing segments to report your legal and management structure, and using different combinations of each as appropriate for statutory compliance and management needs.

You will have selected OUs to store and secure your data, reflecting transaction tax audit and filing needs that are mapped to your operating needs. You will also have selected accounting attributes through your chart of accounts, using natural accounts and cost centers together with other segments, to help you cut though the data to get to the heart of your operations.

In the earlier discussion for Your Organization , a diagram shows cards representing companies that are striped vertically by business subdivisions and horizontally by functional groups. The following diagram shows how some system entities can be mapped, often in alternate ways, to your organization. The system entities map to organizational characteristics as follows:

Legal Entities correspond to the company cards and keep their financial accounting in Ledgers within Ledger Sets.

Balancing Segments can represent both legal entities and business subdivisions.

Functional Groups map to Departments and Cost Centers in the system.

Natural Accounts classify the functional groups' activities.

Operating Units most often hold companies' data and can hold the data of different businesses at arms length from each other within a legal environment.

Using Oracle Human Resources with Oracle Financials

Just as legal entity and ledger structures furnish a strong degree of transactional control, business groups and department structures in Oracle Human Resources provide significant internal control in an enterprise.

In addition to direct relationships between headcount and spend rates, people and hierarchies are the primary means of authorization and security in an organization. For example, spending controls can be enforced by person and level in the hierarchy. Your internally controlled approval routing goes through a process that you can allow to default to the department hierarchy in Human Resources or to any other hierarchy that you create. Consider the following examples:

Purchase Approval Hierarchy: Purchase orders entered in Oracle Purchasing utilize workflow to route the purchase order for approval.

Journal Vouchers: Since journal vouchers can be unique in nature, their approval cannot be restricted to a hierarchy within a particular department. You can create workflow routing rules to personnel in a business group for the approval of journals in Oracle General Ledger.

Manual Invoices: Manual invoices use Oracle Approval Management Engine (AME) for approval. In turn, AME uses the Human Resources departmental hierarchy and spending authority at every level in the hierarchy to route the invoice.

Salary might be your primary expense. Oracle Human Resources breaks out salary by your departmental organizations. Broadly speaking, your Human Resources departments will map to Oracle General Ledger cost centers.

Note: The Oracle E-Business Suite comes with one predefined default business group. If you are implementing Oracle Financials without also implementing Oracle Human Resources, you can choose not to set up another business group.