- Assignment Clause

Get free proposals from vetted lawyers in our marketplace.

Contract Clauses

- Acceleration Clause

- Arbitration Clause

- Cancellation Clause

- Choice of Law Clause

- Confidentiality Clause

- Consideration Clause

- Definitions Clause

- Dispute Resolution Clause

- Entire Agreement Clause

- Escalation Clause

- Exclusivity Clause

- Exculpatory Clause

- Force Majeure Clause

- Governing Law Clause

- Indemnification Clause

- Indemnity Clause

- Insurance Clause

- Integration Clause

- Merger Clause

- Non-Competition Clause

- Non-Disparagement Clause

- Non-Exclusivity Clause

- Non-Solicitation Clause

- Privacy Clause

- Release Clause

- Severability Clause

- Subordination Clause

- Subrogation Clause

- Survival Clause

- Termination Clause

- Time of Essence Clause

Jump to Section

Assignment clause defined.

Assignment clauses are legally binding provisions in contracts that give a party the chance to engage in a transfer of ownership or assign their contractual obligations and rights to a different contracting party.

In other words, an assignment clause can reassign contracts to another party. They can commonly be seen in contracts related to business purchases.

Here’s an article about assignment clauses.

Assignment Clause Explained

Assignment contracts are helpful when you need to maintain an ongoing obligation regardless of ownership. Some agreements have limitations or prohibitions on assignments, while other parties can freely enter into them.

Here’s another article about assignment clauses.

Purpose of Assignment Clause

The purpose of assignment clauses is to establish the terms around transferring contractual obligations. The Uniform Commercial Code (UCC) permits the enforceability of assignment clauses.

Assignment Clause Examples

Examples of assignment clauses include:

- Example 1 . A business closing or a change of control occurs

- Example 2 . New services providers taking over existing customer contracts

- Example 3 . Unique real estate obligations transferring to a new property owner as a condition of sale

- Example 4 . Many mergers and acquisitions transactions, such as insurance companies taking over customer policies during a merger

Here’s an article about the different types of assignment clauses.

Assignment Clause Samples

Sample 1 – sales contract.

Assignment; Survival . Neither party shall assign all or any portion of the Contract without the other party’s prior written consent, which consent shall not be unreasonably withheld; provided, however, that either party may, without such consent, assign this Agreement, in whole or in part, in connection with the transfer or sale of all or substantially all of the assets or business of such Party relating to the product(s) to which this Agreement relates. The Contract shall bind and inure to the benefit of the successors and permitted assigns of the respective parties. Any assignment or transfer not in accordance with this Contract shall be void. In order that the parties may fully exercise their rights and perform their obligations arising under the Contract, any provisions of the Contract that are required to ensure such exercise or performance (including any obligation accrued as of the termination date) shall survive the termination of the Contract.

Reference :

Security Exchange Commission - Edgar Database, EX-10.29 3 dex1029.htm SALES CONTRACT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1492426/000119312510226984/dex1029.htm >.

Sample 2 – Purchase and Sale Agreement

Assignment . Purchaser shall not assign this Agreement or any interest therein to any Person, without the prior written consent of Seller, which consent may be withheld in Seller’s sole discretion. Notwithstanding the foregoing, upon prior written notice to Seller, Purchaser may designate any Affiliate as its nominee to receive title to the Property, or assign all of its right, title and interest in this Agreement to any Affiliate of Purchaser by providing written notice to Seller no later than five (5) Business Days prior to the Closing; provided, however, that (a) such Affiliate remains an Affiliate of Purchaser, (b) Purchaser shall not be released from any of its liabilities and obligations under this Agreement by reason of such designation or assignment, (c) such designation or assignment shall not be effective until Purchaser has provided Seller with a fully executed copy of such designation or assignment and assumption instrument, which shall (i) provide that Purchaser and such designee or assignee shall be jointly and severally liable for all liabilities and obligations of Purchaser under this Agreement, (ii) provide that Purchaser and its designee or assignee agree to pay any additional transfer tax as a result of such designation or assignment, (iii) include a representation and warranty in favor of Seller that all representations and warranties made by Purchaser in this Agreement are true and correct with respect to such designee or assignee as of the date of such designation or assignment, and will be true and correct as of the Closing, and (iv) otherwise be in form and substance satisfactory to Seller and (d) such Assignee is approved by Manager as an assignee of the Management Agreement under Article X of the Management Agreement. For purposes of this Section 16.4, “Affiliate” shall include any direct or indirect member or shareholder of the Person in question, in addition to any Person that would be deemed an Affiliate pursuant to the definition of “Affiliate” under Section 1.1 hereof and not by way of limitation of such definition.

Security Exchange Commission - Edgar Database, EX-10.8 3 dex108.htm PURCHASE AND SALE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1490985/000119312510160407/dex108.htm >.

Sample 3 – Share Purchase Agreement

Assignment . Neither this Agreement nor any right or obligation hereunder may be assigned by any Party without the prior written consent of the other Parties, and any attempted assignment without the required consents shall be void.

Security Exchange Commission - Edgar Database, EX-4.12 3 dex412.htm SHARE PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1329394/000119312507148404/dex412.htm >.

Sample 4 – Asset Purchase Agreement

Assignment . This Agreement and any of the rights, interests, or obligations incurred hereunder, in part or as a whole, at any time after the Closing, are freely assignable by Buyer. This Agreement and any of the rights, interests, or obligations incurred hereunder, in part or as a whole, are assignable by Seller only upon the prior written consent of Buyer, which consent shall not be unreasonably withheld. This Agreement will be binding upon, inure to the benefit of and be enforceable by the parties and their respective successors and permitted assigns.

Security Exchange Commission - Edgar Database, EX-2.1 2 dex21.htm ASSET PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1428669/000119312510013625/dex21.htm >.

Sample 5 – Asset Purchase Agreement

Assignment; Binding Effect; Severability

This Agreement may not be assigned by any party hereto without the other party’s written consent; provided, that Buyer may transfer or assign in whole or in part to one or more Buyer Designee its right to purchase all or a portion of the Purchased Assets, but no such transfer or assignment will relieve Buyer of its obligations hereunder. This Agreement shall be binding upon and inure to the benefit of and be enforceable by the successors, legal representatives and permitted assigns of each party hereto. The provisions of this Agreement are severable, and in the event that any one or more provisions are deemed illegal or unenforceable the remaining provisions shall remain in full force and effect unless the deletion of such provision shall cause this Agreement to become materially adverse to either party, in which event the parties shall use reasonable commercial efforts to arrive at an accommodation that best preserves for the parties the benefits and obligations of the offending provision.

Security Exchange Commission - Edgar Database, EX-2.4 2 dex24.htm ASSET PURCHASE AGREEMENT , Viewed May 10, 2021, < https://www.sec.gov/Archives/edgar/data/1002047/000119312511171858/dex24.htm >.

Common Contracts with Assignment Clauses

Common contracts with assignment clauses include:

- Real estate contracts

- Sales contract

- Asset purchase agreement

- Purchase and sale agreement

- Bill of sale

- Assignment and transaction financing agreement

Assignment Clause FAQs

Assignment clauses are powerful when used correctly. Check out the assignment clause FAQs below to learn more:

What is an assignment clause in real estate?

Assignment clauses in real estate transfer legal obligations from one owner to another party. They also allow house flippers to engage in a contract negotiation with a seller and then assign the real estate to the buyer while collecting a fee for their services. Real estate lawyers assist in the drafting of assignment clauses in real estate transactions.

What does no assignment clause mean?

No assignment clauses prohibit the transfer or assignment of contract obligations from one part to another.

What’s the purpose of the transfer and assignment clause in the purchase agreement?

The purpose of the transfer and assignment clause in the purchase agreement is to protect all involved parties’ rights and ensure that assignments are not to be unreasonably withheld. Contract lawyers can help you avoid legal mistakes when drafting your business contracts’ transfer and assignment clauses.

ContractsCounsel is not a law firm, and this post should not be considered and does not contain legal advice. To ensure the information and advice in this post are correct, sufficient, and appropriate for your situation, please consult a licensed attorney. Also, using or accessing ContractsCounsel's site does not create an attorney-client relationship between you and ContractsCounsel.

Meet some of our Lawyers

www.parachinilaw.com I represent a diverse mix in a vast array of specialties, including litigation, contracts, compliance, business and financial strategies, and emerging industries. Credit for this foundation of strength goes to those who taught me. Skilled professors and professionals fostered my powerful educational and professional background. Prior to law school, I earned dual Bachelor’s degrees in Business Administration & Accounting from Peru State College. I received a Master of Business Administration degree from Chadron State College. My ambitions did not stop there. While working full time as a Senior Accountant for the University of Missouri, Columbia, I achieved the lifelong goal of becoming a licensed Certified Public Accountant (CPA). Mizzo provided excellent opportunities and amazing experiences. Managing over $50M in government and private research funding was a gift. As a high ranking professional in the Department of Research, I was given priceless insight into the greatest scientific, journalistic, medical, and legal minds in the world. My passion for successful growth did not, and has not stopped. I graduated summa cum laude (top 3%) with a Doctorate in Law, emphasizing in urban, land use and environmental/toxic tort law from the University of Missouri, Kansas City. This success lead to invaluable experiences of serving as Hon. Brian C. Wimes' judicial clerk for the U.S. District Court for the W. D. of Missouri, as a staff editor/writer for UMKC Law Review, and as a litigation and transactional attorney with Lathrop GPM (fka Lathrop & Gage). My professional and personal network is expansive, with established relationships throughout the U.S. and overseas. Although I engage in legal practice all over the country, I maintain law licenses in Missouri, Kansas, and Nebraska. Federally, I hold licenses in the W.D. and E.D. of Missouri and the District of Nebraska. To offer extra value, efficiency, and options, I maintain a CPA license and am obtaining a real-estate brokerage license.

As a multilingual attorney, Rudy Cohen-Zardi holds multiple degrees from several institutions worldwide. He has gained experience in leading firms, including Eversheds Sutherland, LLP and Bank of China (NY). He is licensed to practice in New York. His practice focuses on bankruptcy, corporate, and contracts law.

I am a graduate from Wittenberg University and University of Illinois at Urbana-Champaign. I have been admitted to the Indiana bar since 2013. I have collaborated on several writing projects for the Indiana State Bar.

During my tenure as VP & Division General Counsel of PepsiCo Inc. in Chicago, I built upon my diverse career overseeing legal matters for both the domestic and international businesses of PepsiCo and The Quaker Oats Co. My extensive practice areas included M&A, contracts, competition, NDAs, regulatory compliance, consumer product & protection, environmental, patents, and advertising regulations. Throughout my professional journey, I navigated legal complexities associated with an eclectic range of products, spanning juices, sports drinks, cereals, snacks, needlepoint kits, canned goods, eyeglasses, men's suits, car seats and toys. For further information, see my LinkedIn: http://linkedin.com/in/karen-hunter-a700179

I am a business lawyer with 30+ years of experience, with a specialization in the life sciences industry. I have been general counsel at 5 different companies - both large and growing, as well as small and emerging. I have built legal teams and have extensive experience with Boards of Directors.

Greene Litigation Group, PLLC., specializes in Personal Injury, Criminal Defense, Contract Dispute, Wills & POAs, Irreconcilable Differences Divorce, Business Formation, Contract Drafting, and Landlord Tenant Law

Find the best lawyer for your project

Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

CONTRACT lawyers by city

- Atlanta Contract Lawyers

- Austin Contract Lawyers

- Boston Contract Lawyers

- Chicago Contract Lawyers

- Dallas Contract Lawyers

- Denver Contract Lawyers

- Fort Lauderdale Contract Lawyers

- Houston Contract Lawyers

- Las Vegas Contract Lawyers

- Los Angeles Contract Lawyers

- Memphis Contract Lawyers

- Miami Contract Lawyers

- New York Contract Lawyers

- Oklahoma City Contract Lawyers

- Orlando Contract Lawyers

- Philadelphia Contract Lawyers

- Phoenix Contract Lawyers

- Richmond Contract Lawyers

- Salt Lake City Contract Lawyers

- San Antonio Contract Lawyers

- San Diego Contract Lawyers

- San Francisco Contract Lawyers

- Seattle Contract Lawyers

- Tampa Contract Lawyers

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers. I submitted a bid that works best for my business and we went forward with the project.

I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control. Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations.

How It Works

Post Your Project

Get Free Bids to Compare

Hire Your Lawyer

Find lawyers and attorneys by city

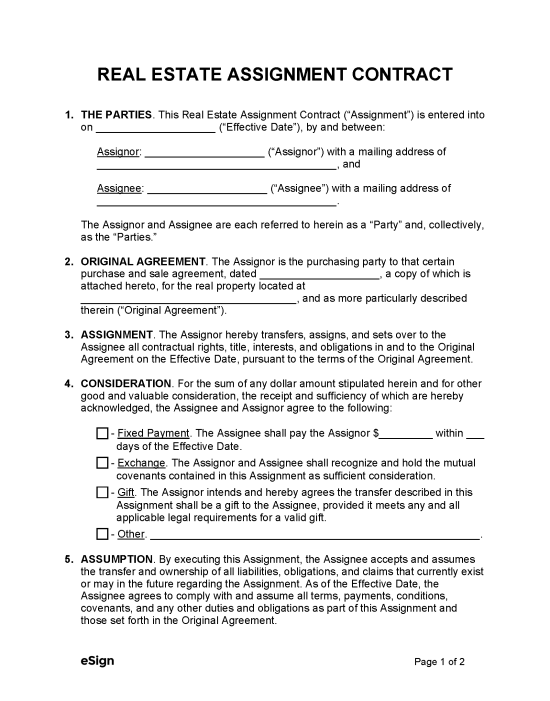

What Is An Assignment Of Contract In Real Estate?

An assignment of contract is when one party (the “assignor”) has a contract to which they have certain obligations, and transfers those contractual rights to another party (known as the “assignee”).

In real estate, assigning contracts is an effective strategy to achieve an extremely high return on investment (ROI) for as little capital and risk as possible.

Click below and jump to your section of choice on the assignment of the contract:

What Is An Assignment In Real Estate?

How does assignment of contract work, is it legal to assign a real estate contract, why use a real estate assignment contract, what is an assignment fee in real estate, how to assign a contract in real estate.

- Assignment Of Contract Template

Assignment of Contract vs. Double Closing

Assignment of contract: pros & cons, common misconceptions about assigning real estate contracts.

An assignment of contract in real estate is when the original party who has a piece of real estate transfers their contractual obligations to that of a new party.

Assigning real estate contracts is a common way to “flip” real estate without having to come out of your pocket with any capital. Utilizing a real estate assignment contract to profit is also known as wholesaling houses , flipping contracts, selling contracts, and real estate day trading.

What Is Assignment Of Contract In Real Estate?

The real estate assignment contract is also known as the assignment of purchase and sale agreement. This is a separate legal document from the original contract. The real estate assignment contract has the terms of the assignment, such as who is the assignor/assignee, when the payment is taking place, and real estate closing terms.

What Is An Assignment Clause In Real Estate?

A real estate assignment clause is a legally binding service that offers a contracting party the right to assign responsibility or transfer ownership to another contracting party of choice. Some contracts have a real estate contract assignment clause built into them. Below is an example:

“Assignment of Contract: The parties to this Contract mutually agree that it is binding upon them, their heirs, executors, administrators, personal representatives, successors, and assigns. All parties agree that this Contract is assignable to any party for a profit.”

It is also a common practice for the original buyer of a contract to put “and/or assigns” next to their name. In addition to the real estate assignment clause, “and/or assigns” will make it even more clear that the contract may be assigned.

The assignment of contract is a straightforward method where an investor transfers their rights in a property contract to a buyer, profiting from the difference between their purchase price and the selling price. Essentially, this process involves securing a property under contract and then assigning that contract to an end buyer. Below are 6 simple steps on how to assign a real estate contract:

- Find the right investment property for sale: Begin by researching and identifying potential properties that offer good investment returns, ideally below market value.

- Obtain the contract: Once you've found a suitable property, negotiate and enter into a purchase agreement with the seller, ensuring the contract allows for assignment.

- Submit the contract: Ensure all the details of the contract are accurate and submit it as per local regulations or to relevant parties such as title companies or attorneys.

- Discover an end buyer: Using your network or marketing strategies, identify an end buyer interested in purchasing the property.

- Assign the contract: Draft an assignment agreement, clearly transferring your rights in the initial contract to the end buyer, with a clear mention of the assignment fee.

- Get paid: Once the end buyer completes the purchase, you'll receive your assignment fee, marking a successful contract assignment.

Read Also: Wholesale Contracts In Real Estate (2024): FREE PDF & Template

The biggest reason to use a real estate assignment contract is you can profit from a piece of real estate by solely transferring your contract rights. This process is called “wholesaling,” and is a great way to flip real estate while lowering your risk and using as little money as possible .

Many people see the house flipping shows where investors buy, fix, and sell houses. This entire process can take months, and even longer than a year to effectively renovate and resell a property.

Additionally, when you buy a property there is always risk that comes with it. Most real estate investors raise money and invest other people’s money into their real estate deals in order to work on multiple projects at one time. When a fix & flipper borrows this capital, there is usually an interest rate along with it.

What this means is, that every day a fix & flipper has a house that they have bought and are renovating is another day that they will pay more interest on the money they’ve borrowed.

When a real estate assignment contract is used where the goal is to wholesale (“assignment of contract”) the property, then you virtually eliminate any risk. This is because you are assigning all contractual obligations to the new buyer of the property.

Yes, it is legal to assign real estate contracts. However, there are situations when assignments will not be enforced, such as:

- Solution: Get written consent from all parties.

- Solution: Modify the contract with the permission of all involved parties. If the parties involved are okay with it, then you can modify the contract from being non-assignable to assignable.

- Solution: Close the property and sell it after the restriction is over. Back out of the property if you have the appropriate contingencies.

All in all, it is legal to assign real estate contracts . In fact, all contracts are assignable by default, unless specifically stated otherwise within the agreement. As with anything having to do with contracts, it is extremely important to read the contract you will be signing with any seller of a property.

It’s recommended you use a real estate attorney to review the agreement you plan on using for your real estate deals to make sure it is worded correctly.

In real estate, an assignment fee is a crucial concept, especially for those involved in wholesaling properties. Essentially, an assignment fee is the monetary compensation that an assignor, or the original party in a real estate contract, receives when they transfer their equitable interest in that contract to a different party, known as the assignee.

This transactional process allows the assignor to profit without actually having to finalize the property's purchase. Often, this fee is a reflection of the difference between the price the assignor agreed to pay the original seller and the price they've negotiated with the assignee.

Commonly referred to as a "wholesale fee," it serves as the primary revenue stream for real estate wholesalers and is indicative of the value they bring to the table by connecting sellers with suitable buyers.

Real estate wholesalers get paid when a successful assignment of contract takes place. Their terms of getting paid are to be stated in the Assignment of Real Estate Purchase and Sale Agreement. It is important to note that everything is negotiable and no payment terms are set in stone unless agreed upon and signed in writing.

As a real estate wholesaler, you can get a deposit when the Assignment of Real Estate Purchase and Sale Agreement is signed. Then, when the transaction closes the wholesaler can receive the rest of the profit.

For example, if you are looking to get a $20,000 wholesale fee for a house, then you may take a 50% deposit of $10,000 when the contract is assigned. Then, receive the remaining 50% of $10,000 when the property closes.

Who Buys Real Estate Contracts?

The primary candidates for buying real estate contracts are real estate investors, a diverse group with varied intentions for the property. Among the most prominent are fix & flippers, investors who specialize in buying properties in less than optimal conditions, only to renovate and refurbish them with the sole aim of reselling at a profit.

By acquiring real estate contracts from wholesalers, these investors streamline the property acquisition process, ensuring they have a consistent inflow of properties to work on. In essence, this relationship underscores the symbiotic nature of the real estate ecosystem, where wholesalers identify and secure potential deals, only to pass them on to investors keen on executing the vision and reaping the returns.

If you're keen on diving into this lucrative venture, ensure you're equipped with the right tools. Start by downloading our FREE Wholesale Real Estate Contracts to set your foundation strong.

Once you have a property under contract, then it is time to locate a buyer for the real estate contract. Make sure the first thing you do is ask for an earnest cash deposit to ensure that your earnest money will be paid upfront. This clause protects you from any breach of contract between you and the assignee.

An assignment fee (“wholesale fee”) is then agreed upon between you and the buyer. You will then need to execute an Assignment of Real Estate Purchase and Sale agreement between you and the buyer.

As the assignor you are assigning all of your duties and obligations that you agreed upon in the original purchase and sale agreement with the seller of the property. This means that the buyer must purchase the property at the original agreed-upon price between you and the seller as stated in the original contract.

Just because the assignor of the contract is not the one purchasing the property doesn’t mean there isn’t additional work to be completed to ensure the deal gets closed. Once a buyer is found to sell the contract to, it is time to make sure the buyer follows through and closes on the deal.

This makes it important to have a great title company or real estate attorney to handle the closing. Whether you use a title company or attorney is dependent upon which state you are in. Some states have title companies handle the closing, and some states have attorneys handle it.

Read Also: Flipping Real Estate Contracts: A 6-Step Guide For Investors

Assignment of Contract Template

To give you a clearer perspective on its structure and contents, we provide an illustrative example of an assignment of a contract below:

The Assignment of Contract is not just a mere piece of paper, but a legally binding agreement that transfers the rights and obligations of one party to another.

As stated above, it allows the original party, typically the wholesaler, to pass on their position in a deal to an interested buyer, while receiving compensation in return. It's a mechanism that facilitates the smooth transition of interests, ensuring all parties' rights are protected and responsibilities are clearly laid out.

Here's another example of a real estate assignment contract PDF by The Judicial Title Insurance Company.

Beginner investors always tend to wonder whether a seller will have an issue with an assignment of rights taking place. It depends on the seller and your correspondence with them. If you communicate clearly, then this is typically not an issue.

This is because the seller has signed a legal and binding contract making them obligated to fulfill the terms of the contract. You have every right to perform an assignment of contract when everything has been done legally.

The majority of sellers you encounter will not have an issue with the assignment and having another party close on the transaction. Sellers are usually most concerned that 2 things take place:

- They receive the purchase price for the property that was originally agreed upon, and

- That the property closes on time at the date which was agreed upon.

Communicate clearly with the seller and fulfill the contract obligations, and you shouldn’t have an issue with assigning a real estate contract.

Double closing is when you close on the property (meaning you buy it), and then resell the property to the end buyer that you would have assigned the contract to originally and can take place when the seller has an issue with the assignment of contract.

The process of a double close is typically performed as soon as possible to reduce the risk to the wholesaler. If funds are needed to close on a property for this reason, then transactional funding is a great resource to use for any investor.

Transactional funding lenders lend real estate investors short-term capital for double-closing transactions.

Assignment contracts can be profitable and well structured, but with anything, you may face obstacles when closing on a home. Always remember to research before doing anything and pick the best option for you in this process. Below we will unpack some pros and cons of assignment contracts

Advantages Of Assignment Contracts

- Potential quick profit : This is usually the most eye-catching benefit of all in wholesaling and what lures people into starting their wholesaling journey. Who doesn’t want the ability to profit off a property without the haggling of purchasing the property?

- Assignment contract is cheaper than double-closing : An assignment contract has one closing cost, making this a cheaper option than double closing.

- Possible repeat business : If done effectively, you could potentially establish a positive relationship with a buyer to then repeat business with in the future. Being transparent is essential in this process so that all parties acknowledge that you are adding value to the deal, not just making a profit off of them.

- Networking : Assignors, who were once real estate investors, can increase their network through the different individuals they do transactions with. This can gain you access to different investment opportunities, and remember, you never know who you are talking to or who they have connections with.

Disadvantages Of Assignment Contracts

- Owner rights are off limits at this time : Above we touched upon how a wholesaler doesn’t purchase the actual property, but more so acts as a middleman between the seller and end buyer. This being the case, assignors aren’t allowed to do any renovation or repairs to the property, because they technically don’t own it yet.

- Visibility of the assignment fee : One of the main components that turns buyers off is the assignment fee that appears on the contract. This means that all parties can see what profit the obligee makes on the transaction. Some people are not willing to go through with that, especially if the obligor is unfamiliar with the wholesaling process.

- Limited time frame : Assignment contracts have a limited time frame that they need to be signed by, which can be seen as the closing date on the original contract. It may be a hassle to find a reliable buyer between the time the contract starts to the close of the contract.

- Final buyer financing may be hard to come by : The price that the assignor and seller agreed on will need to be paid by the end buyer. This typically means the property needs to be sold to an all-cash buyer (all-cash buyers are generally harder to find), because most lenders will not fund deals on assignment contracts.

- Properties are not always assignable : Real estate properties like HUD homes and REOs have anti-assignment clauses. This restricts wholesalers from partaking in the use of assignment contracts for their properties.

In general, there are a lot of misconceptions about assigning real estate contracts and wholesaling real estate. There’s a good chance you will encounter agents, brokers , attorneys, and others with little contract law or property law experience leading them to think that assigning real estate contracts is illegal.

Why would these real estate professionals think it’s illegal? Because they are unfamiliar with the concept and think you are an unlicensed individual acting as an agent.

It’s important to understand that you are the principal buyer of the transaction and you are selling the equitable interest in the contract to another buyer. You are not selling the actual property itself for a commission like a real estate agent does.

It’s wise to be cognizant that you will most likely come across people who think that an assignment of contract is illegal. In these situations you’ll have to educate them on how real estate assignment contracts work.

This is another reason why you want to have a great real estate attorney on your team who can explain the legality of assigning and wholesaling to anyone you’re working with.

Final Thoughts On The Assignment of Contract

The assignment of contract stands out as a game-changing strategy in the real estate investment arena. For those uninterested or unequipped for the buy, renovate, and flip routine, wholesaling via contract assignment emerges as an enticing alternative.

One of its paramount benefits is the minimal capital requirement coupled with a speedy transaction process. Thus, if you're seeking to harness the potential of such strategies and amplify your returns, our FREE training course is the perfect place to start. Delve deep into the intricacies of real estate and discover how to profit smartly and efficiently from your ventures.

Author: Alex Martinez

Founder & CEO at Real Estate Skills

Alex Martinez, the founder of Real Estate Skills, is known for his strong, practical expertise in real estate, starting from a beginner with no family connections in the industry to completing over 50 real estate deals, including wholesale and flips, within his first year.

He has dedicated his career to providing cutting-edge education and resources for real estate professionals. He emphasizes the importance of self-taught knowledge through mentors, books, and hands-on experience.

His journey from earning a modest income to becoming a successful real estate entrepreneur and educator showcases his expertise and dedication to the field.

Read Alex's Full Bio >>

Editor: Ryan Zomorodi

Co-Founder & Chief Operating Officer

Ryan Zomorodi, co-founder and COO of Real Estate Skills, leverages his experience from a diverse background in real estate investment, construction management, and entrepreneurship to provide comprehensive education in the real estate sector.

His expertise is rooted in hands-on experience, extensive industry knowledge, and a commitment to empowering others through education.

Ryan's journey reflects a blend of practical experience and entrepreneurial success, contributing to his role in developing a platform that educates and supports aspiring real estate professionals.

Access Our Brand-New Free Training

Learn how to consistently find real estate deals for wholesaling & house flipping.

We recommend Colibri Real Estate School for getting licensed. Click the button below to get started!

Browse Our Topics

→ Wholesale Real Estate

→ Flipping Houses

→ Real Estate Investing

→ Real Estate Business

→ Real Estate Software

→ Real Estate Marketing

→ Real Estate Terms

→ Real Estate Jobs

→ Real Estate Financing

→ Real Estate Markets

Unlock Our FREE Webinar Training

Founder & CEO of Real Estate Skills, Alex Martinez, reveals the systems and processes used to wholesale and flip houses without doing any marketing!

- Completely FREE training video .

- No prior experience is required to start.

- Begin investing with no cost for marketing.

- Learn to invest in any real estate market.

- Discover how you can close deals consistently .

Enter your information below to unlock the FREE webinar!

By providing my contact info, I give express written consent to Real Estate Skills to email, call, & send text messages for upcoming events & reminders. By opting in you agree to RealEstateSkills.com's Terms of Use and Privacy Policy .

Reviews & testimonials from students like you.

No matter where you start, you can become a successful real estate investor. Listen to these amazing stories from the students in our program!

Almost there!

Just enter your name & email below for real estate investing golden nuggets!

- Deals Funded

- Deals in Process

Testimonials

An assignment clause (AC) is an important part of many contracts, especially for real estate. In this article we discuss:

- What is an Assignment Clause? (with Example)

- Anti-Assignment Clauses (with Example)

- Non-Assignment Clauses

- Important Considerations

- How Assets America ® Can Help

Frequently Asked Questions

What is an assignment clause.

An AC is part of a contract governing the sale of a property and other transactions. It deals with questions regarding the assignment of the property in the purchase agreement. The thrust of the assignment clause is that the buyer can rent, lease, repair, sell, or assign the property.

To “assign” simply means to hand off the benefits and obligations of a contract from one party to another. In short, it’s the transfer of contractual rights.

In-Depth Definition

Explicitly, an AC expresses the liabilities surrounding the assignment from the assignor to the assignee. The real estate contract assignment clause can take on two different forms, depending on the contract author:

- The AC states that the assignor makes no representations or warranties about the property or the agreement. This makes the assignment “AS IS.”

- The assignee won’t hold the assignor at fault. It protects the assignor from damages, liabilities, costs, claims, or other expenses stemming from the agreement.

The contract’s assignment clause states the “buyer and/or assigns.” In this clause, “assigns” is a noun that means assignees. It refers to anyone you choose to receive your property rights.

The assignment provision establishes the fact that the buyer (who is the assignor) can assign the property to an assignee. Upon assignment, the assignee becomes the new buyer.

The AC conveys to the assignee both the AC’s property rights and the AC’s contract obligations. After an assignment, the assignor is out of the picture.

What is a Lease Assignment?

Assignment Clause Example

This is an example of a real estate contract assignment clause :

“The Buyer reserves the right to assign this contract in whole or in part to any third party without further notice to the Seller; said assignment not to relieve the Buyer from his or her obligation to complete the terms and conditions of this contract should be assigning default.”

Apply For Financing

Assignment provision.

An assignment provision is a separate clause that states the assignee’s acceptance of the contract assignment.

Assignment Provision Example

Here is an example of an assignment provision :

“Investor, as Assignee, hereby accepts the above and foregoing Assignment of Contract dated XXXX, XX, 20XX by and between Assignor and ____________________ (seller) and agrees to assume all of the obligations and perform all of the duties of Assignor under the Contract.”

Anti-Assignment Clauses & Non-Assignment Clauses

An anti-assignment clause prevents either party from assigning a contract without the permission of the other party. It typically does so by prohibiting payment for the assignment. A non-assignment clause is another name for an anti-assignment clause.

Anti-Assignment Clause Example

This is an anti-assignment clause example from the AIA Standard Form of Agreement:

” The Party 1 and Party 2, respectively, bind themselves, their partners, successors, assigns, and legal representatives to the other party to this Agreement and to the partners, successors, assigns, and legal representatives of such other party with respect to all covenants of this Agreement. Neither Party 1 nor Party 2 shall assign this Agreement without the written consent of the other.”

Important Considerations for Assignment Contracts

The presence of an AC triggers several important considerations.

Assignment Fee

In essence, the assignor is a broker that brings together a buyer and seller. As such, the assignor collects a fee for this service. Naturally, the assignor doesn’t incur the normal expenses of a buyer.

Rather, the new buyer assumes those expenses. In reality, the assignment fee replaces the fee the realtor or broker would charge in a normal transaction. Frequently, the assignment fee is less than a regular brokerage fee.

For example, compare a 2% assignment fee compared to a 6% brokerage fee. That’s a savings of $200,000 on a $5 million purchase price. Wholesalers are professionals who earn a living through assignments.

Frequently, the assignor will require that the assignee deposit the fee into escrow. Typically, the fee is not refundable, even if the assignee backs out of the deal after signing the assignment provision. In some cases, the assignee will fork over the fee directly to the assignor.

Assignor Intent

Just because the contract contains an AC does not obligate the buyer to assign the contract. The buyer remains the buyer unless it chooses to exercise the AC, at which point it becomes the assignor. It is up to the buyer to decide whether to go through with the purchase or assign the contract.

Nonetheless, the AC signals the seller of your possible intent to assign the purchase contract to someone else. For one thing, the seller might object if you try to assign the property without an AC.

You can have serious problems at closing if you show up with a surprise assignee. In fact, you could jeopardize the entire deal.

Another thing to consider is whether the buyer’s desire for an AC in the contract will frighten the seller. Perhaps the seller is very picky about the type of buyer to whom it will sell.

Or perhaps the seller has heard horror stories, real or fake, about assignments. Whatever the reason, the real estate contract assignment clause might put a possible deal in jeopardy.

Chain of Title

If you assign a property before the closing, you will not be in the chain of title. Obviously, this differs from the case in which you sell the property five minutes after buying it.

In the latter case, your name will appear in the chain of title twice, once as the buyer and again as the seller. In addition, the latter case would involve two sets of closing costs, whereas there would only one be for the assignment case. This includes back-to-back (or double) closings.

Enforceability

Assignment might not be enforceable in all situations, such as when:

- State law or public policy prohibits it.

- The contract prohibits it.

- The assignment significantly changes the expectations of the seller. Those expectations can include decreasing the value of the property or increasing the risk of default.

Also note that REO (real estate owned) properties, HUD properties, and listed properties usually don’t permit assignment contracts. An REO property is real estate owned by a bank after foreclosure. Typically, these require a 90-day period before a property can be resold.

How Assets America Can Help

The AC is a portion of a purchase agreement. When a purchase involves a commercial property requiring a loan of $10 million or greater, Assets America ® can arrange your financing.

We can finance wholesalers who decide to go through with a purchase. Alternatively, we can finance assignees as well. In either case, we offer expedient, professional financing and many supporting services. Contact us today for a confidential consultation.

What rights can you assign despite a contract clause expressly prohibiting assignment?

Normally, a prohibition against assignment does not curb the right to receive payments due. However, circumstances may cause the opposite outcome. Additionally, prohibition doesn’t prevent the right to money that the contract specifies is due.

What is the purpose of an assignment of rents clause in a deed of trust and who benefits?

The assignment of rents clause is a provision in a mortgage or deed of trust. It gives the lender the right to collect rents from mortgaged properties if the borrower defaults. All incomes and rents from a secured property flow to the lender and offset the outstanding debt. Clearly, this benefits the lender.

What is in assignment clause in a health insurance contract?

Commonly, health insurance policies contain assignment of benefits (AOB) clauses. These clauses allow the insurer to pay benefits directly to health care providers instead of the patient. In some cases, the provider has the patient sign an assignment agreement that accomplishes the same outcome. The provider submits the AOB agreement along with the insurance claim.

What does “assignment clause” mean for liability insurance?

The clause would allow the assignment of proceeds from a liability award payable to a third party. However, the insured must consent to the clause or else it isn’t binding. This restriction applies only before a loss. After a first party loss, the insurer’s consent no longer matters.

Related Articles

- Intercreditor Agreements – Everything You Need to Know

- Alienation Clause – Everything You Need to Know

- Loan Defeasance – Everything You Need to Know

- Cross Default – Complete Guide

Other Resources

- Adjustable Rate Mortgage

- Aircraft Financing Terms & Loan – Complete Guide

- Alienation Clause – Everything You Need to Know

- ARM Components

- ARV – After Repair Value – Everything You Need to Know

- Assignment Clause – Everything You Need to Know

- Average Daily Rate (ADR) Formula – Complete Guide

- Balloon Mortgages

- Blanket Mortgage

- Cap Rate Simplified for Commercial Real Estate (+ Calculator)

- Cash Coverage Ratio | Complete Guide + Calculator

- Cash Out Refinance on Investment Property – Complete Guide

- Closing Costs

- CMBS Loans: Guide to Commercial Mortgage-Backed Securities

- Commercial Adjustable Rate Loan Indexes

- Commercial Real Estate Appraisals – Everything You Need to Know

- Commercial Real Estate Syndication – Ultimate Success Guide

- Contingency Reserve – Everything You Need to Know

- CRE Loans – What Nobody Tells You About Commercial Lending

- Cross Default – Everything You Need to Know

- Debt Service Coverage Ratio

- Debt vs Equity Financing

- DIP Financing

- EBITDA Margin – Ultimate Guide

- Effective Gross Income (+ Calculator)

- Equity Kicker – Everything You Need to Know

- Fixed Rate Loans

- Full Service Gross Lease – Everything You Need to Know

- Gap Funding Commercial Real Estate – Pros & Cons

- Ground Lease – Everything You Need to Know (+ Calculator)

- Guide to Floor Area Ratio, Floor Space Index & Plot Ratio

- Hard Costs vs Soft Costs – Commercial Real Estate Guide

- Hard Money vs Soft Money Loans in Real Estate

- How Much to Borrow

- Hypothecation Agreements – Everything You Need to Know

- Industrial Gross Lease

- Intercreditor Agreements – Everything You Need to Know

- Interest Only Mortgage

- Lines of Business

- Loan Defeasance

- Loan Proceeds – Everything You Need To Know

- Loan to Cost Ratio

- Loss to Lease – Everything You Need to Know

- Market Links

- Master Lease Agreements

- Master Planned Communities

- Mergers & Acquisitions Seller Intake Questionnaire

- Mergers & Acquisitions Buyer Intake Questionnaire

- Mini Perm Loan – Complete Guide

- MIRR Guide | Modified Internal Rate of Return (+ Calculator)

- Modified Gross Lease – Everything You Need to Know

- Mortgage Programs

- Net Effective Rent (+ Calculator)

- Net Income and NOI

- Net Leases (Single, Double, Triple)

- Operating Expense Ratio – Ultimate Guide (+ Calculator)

- Pari Passu – Everything You Need to Know

- Partially Amortized Loan – Complete Guide

- Potential Gross Income – Everything You Need to Know

- Preferred Equity in Real Estate – Complete Investor’s Guide

- Preferred Shares – Everything You Need to Know

- Property Interest – Everything You Need to Know

- Recourse Loans – Complete Guide

- Restrictive Covenants – Everything You Need to Know

- Reverse 1031 Exchange – Everything You Need to Know

Ronny was a pleasure to work with and is extremely knowledgeable. His hard work was never ending until the job was done. They handled a complex lease and guided us through entire process, including the paperwork. Not to mention a below market lease rate and more than all the features we needed in a site. We later used Assets America for a unique equipment financing deal where once again Ronny and team exceeded our expectations and our timeline. Thank you to Assets America for your highly professional service!

Great experience with Assets America. Fast turn around. Had a lender in place in 30 minutes looking to do the deal. Totally amazing. Highly recommend them to anyone looking for financing. Ronny is fantastic. Give them a call if the deal makes sense they can get it funded. Referring all our clients.

Assets America guided us every step of the way in finding and leasing our large industrial building with attached offices. They handled all of the complex lease negotiations and contractual paperwork. Ultimately, we received exactly the space we needed along with a lower than market per square foot pricing, lease length and end of term options we requested. In addition to the real estate lease, Assets America utilized their decades-long financial expertise to negotiate fantastic rates and terms on our large and very unique multimillion dollar equipment purchase/lease. We were thankful for how promptly and consistently they kept us informed and up to date on each step of our journey. They were always available to answer each and every one of our questions. Overall, they provided my team with a fantastic and highly professional service!

Assets America was responsible for arranging financing for two of my multi million dollar commercial projects. At the time of financing, it was extremely difficult to obtain bank financing for commercial real estate. Not only was Assets America successful, they were able to obtain an interest rate lower than going rates. The company is very capable, I would recommend Assets America to any company requiring commercial financing.

Assets America was incredibly helpful and professional in assisting us in purchasing our property. It was great to have such knowledgeable and super-experienced, licensed pros in our corner, pros upon which we could fully rely. They helped and successfully guided us to beat out 9 other competing offers! They were excellent at communicating with us at all times and they were extremely responsive. Having them on our team meant that we could always receive truthful, timely and accurate answers to our questions. We would most definitely utilize their services again and again for all of our real estate needs.

Assets America is a great company to work with. No hassles. Recommend them to everyone. Professional, fast response time and definitely gets the job done.

Ronny at Assets America has been invaluable to us and definitely is tops in his field. Great experience. Would refer them to all our business associates.

We were very pleased with Assets America’s expertise and prompt response to our inquiry. They were very straight forward with us and helped a great deal. We referred them to all our business associates.

I’ve worked with this company for decades. They are reputable, knowledgeable, and ethical with proven results. I highly recommend them to anyone needing commercial financing.

Ronny was incredibly adept and responsive – top-notch professional who arranged impressive term sheets.

Assets America helped us survive a very difficult time and we most definitely give them 5 stars!

Ronny was very friendly and though we were unable to make something happen at the moment he gave me some direction to go.

My business partner and I were looking to purchase a retail shopping center in southern California. We sought out the services of Ronny, CFO of Assets America. Ronny found us several commercial properties which met our desired needs. We chose the property we liked best, and Ronny went to work. He negotiated very aggressively on our behalf. We came to terms with the Seller, entered into a purchase agreement and opened escrow. Additionally, we needed 80 percent financing on our multimillion-dollar purchase. Assets America also handled the commercial loan for us. They were our One-Stop-Shop. They obtained fantastic, low, fixed rate insurance money for us. So, Assets America handled both the sale and the loan for us and successfully closed our escrow within the time frame stated in the purchase agreement. Ronny did and performed exactly as he said he would. Ronny and his company are true professionals. In this day and age, it’s especially rare and wonderful to work with a person who actually does what he says he will do. We recommend them to anyone needing any type of commercial real estate transaction and we further highly recommend them for any type of commercial financing. They were diligent and forthright on both accounts and brought our deal to a successful closing.

Questionnaire

- Coaching Team

- Investor Tools

- Student Success

Real Estate Investing Strategies

- Real Estate Business

- Real Estate Markets

- Real Estate Financing

- REITs & Stock Investing

How To Navigate The Real Estate Assignment Contract

What is assignment of contract?

Assignment of contract vs double close

How to assign a contract

Assignment of contract pros and cons

Even the most left-brained, technical real estate practitioners may find themselves overwhelmed by the legal forms that have become synonymous with the investing industry. The assignment of contract strategy, in particular, has developed a confusing reputation for those unfamiliar with the concept of wholesaling. At the very least, there’s a good chance the “assignment of contract real estate” exit strategy sounds more like a foreign language to new investors than a viable means to an end.

A real estate assignment contract isn’t as complicated as many make it out to be, nor is it something to shy away from because of a lack of understanding. Instead, new investors need to learn how to assign a real estate contract as this particular exit strategy represents one of the best ways to break into the industry.

In this article, we will break down the elements of a real estate assignment contract, or a real estate wholesale contract, and provide strategies for how it can help investors further their careers. [ Thinking about investing in real estate? Register to attend a FREE online real estate class and learn how to get started investing in real estate. ]

What Is A Real Estate Assignment Contract?

A real estate assignment contract is a wholesale strategy used by real estate investors to facilitate the sale of a property between an owner and an end buyer. As its name suggests, contract assignment strategies will witness a subject property owner sign a contract with an investor that gives them the rights to buy the home. That’s an important distinction to make, as the contract only gives the investor the right to buy the home; they don’t actually follow through on a purchase. Once under contract, however, the investor retains the sole right to buy the home. That means they may then sell their rights to buy the house to another buyer. Therefore, when a wholesaler executes a contact assignment, they aren’t selling a house but rather their rights to buy a house. The end buyer will pay the wholesale a small assignment fee and buy the house from the original buyer.

The real estate assignment contract strategy is only as strong as the contracts used in the agreement. The language used in the respective contract is of the utmost importance and should clearly define what the investors and sellers expect out of the deal.

There are a couple of caveats to keep in mind when considering using sales contracts for real estate:

Contract prohibitions: Make sure the contract you have with the property seller does not have prohibitions for future assignments. This can create serious issues down the road. Make sure the contract is drafted by a lawyer that specializes in real estate assignment contract law.

Property-specific prohibitions: HUD homes (property obtained by the Department of Housing and Urban Development), real estate owned or REOs (foreclosed-upon property), and listed properties are not open to assignment contracts. REO properties, for example, have a 90-day period before being allowed to be resold.

What Is An Assignment Fee In Real Estate?

An assignment fee in real estate is the money a wholesaler can expect to receive from an end buyer when they sell them their rights to buy the subject property. In other words, the assignment fee serves as the monetary compensation awarded to the wholesaler for connecting the original seller with the end buyer.

Again, any contract used to disclose a wholesale deal should be completely transparent, and including the assignment fee is no exception. The terms of how an investor will be paid upon assigning a contract should, nonetheless, be spelled out in the contract itself.

The standard assignment fee is $5,000. However, every deal is different. Buyers differ on their needs and criteria for spending their money (e.g., rehabbing vs. buy-and-hold buyers). As with any negotiations , proper information is vital. Take the time to find out how much the property would realistically cost before and after repairs. Then, add your preferred assignment fee on top of it.

Traditionally, investors will receive a deposit when they sign the Assignment of Real Estate Purchase and Sale Agreement . The rest of the assignment fee will be paid out upon the deal closing.

Assignment Contract Vs Double Close

The real estate assignment contract strategy is just one of the two methods investors may use to wholesale a deal. In addition to assigning contracts, investors may also choose to double close. While both strategies are essentially variations of a wholesale deal, several differences must be noted.

A double closing, otherwise known as a back-to-back closing, will have investors actually purchase the home. However, instead of holding onto it, they will immediately sell the asset without rehabbing it. Double closings aren’t as traditional as fast as contract assignment, but they can be in the right situation. Double closings can also take as long as a few weeks. In the end, double closings aren’t all that different from a traditional buy and sell; they transpire over a meeter of weeks instead of months.

Assignment real estate strategies are usually the first option investors will want to consider, as they are slightly easier and less involved. That said, real estate assignment contract methods aren’t necessarily better; they are just different. The wholesale strategy an investor chooses is entirely dependent on their situation. For example, if a buyer cannot line up funding fast enough, they may need to initiate a double closing because they don’t have the capital to pay the acquisition costs and assignment fee. Meanwhile, select institutional lenders incorporate language against lending money in an assignment of contract scenario. Therefore, any subsequent wholesale will need to be an assignment of contract.

Double closings and contract assignments are simply two means of obtaining the same end. Neither is better than the other; they are meant to be used in different scenarios.

Flipping Real Estate Contracts

Those unfamiliar with the real estate contract assignment concept may know it as something else: flipping real estate contracts; if for nothing else, the two are one-in-the-same. Flipping real estate contracts is simply another way to refer to assigning a contract.

Is An Assignment Of Contract Legal?

Yes, an assignment of contract is legal when executed correctly. Wholesalers must follow local laws regulating the language of contracts, as some jurisdictions have more regulations than others. It is also becoming increasingly common to assign contracts to a legal entity or LLC rather than an individual, to prevent objections from the bank. Note that you will need written consent from all parties listed on the contract, and there cannot be any clauses present that violate the law. If you have any questions about the specific language to include in a contract, it’s always a good idea to consult a qualified real estate attorney.

When Will Assignments Not Be Enforced?

In certain cases, an assignment of contract will not be enforced. Most notably, if the contract violates the law or any local regulations it cannot be enforced. This is why it is always encouraged to understand real estate laws and policy as soon as you enter the industry. Further, working with a qualified attorney when crafting contracts can be beneficial.

It may seem obvious, but assignment contracts will not be enforced if the language is used incorrectly. If the language in a contract contradicts itself, or if the contract is not legally binding it cannot be enforced. Essentially if there is any anti-assignment language, this can void the contract. Finally, if the assignment violates what is included under the contract, for example by devaluing the item, the contract will likely not be enforced.

How To Assign A Real Estate Contract

A wholesaling investment strategy that utilizes assignment contracts has many advantages, one of them being a low barrier-to-entry for investors. However, despite its inherent profitability, there are a lot of investors that underestimate the process. While probably the easiest exit strategy in all of real estate investing, there are a number of steps that must be taken to ensure a timely and profitable contract assignment, not the least of which include:

Find the right property

Acquire a real estate contract template

Submit the contract

Assign the contract

Collect the fee

1. Find The Right Property

You need to prune your leads, whether from newspaper ads, online marketing, or direct mail marketing. Remember, you aren’t just looking for any seller: you need a motivated seller who will sell their property at a price that works with your investing strategy.

The difference between a regular seller and a motivated seller is the latter’s sense of urgency. A motivated seller wants their property sold now. Pick a seller who wants to be rid of their property in the quickest time possible. It could be because they’re moving out of state, or they want to buy another house in a different area ASAP. Or, they don’t want to live in that house anymore for personal reasons. The key is to know their motivation for selling and determine if that intent is enough to sell immediately.

With a better idea of who to buy from, wholesalers will have an easier time exercising one of several marketing strategies:

Direct Mail

Real Estate Meetings

Local Marketing

2. Acquire A Real Estate Contract Template

Real estate assignment contract templates are readily available online. Although it’s tempting to go the DIY route, it’s generally advisable to let a lawyer see it first. This way, you will have the comfort of knowing you are doing it right, and that you have counsel in case of any legal problems along the way.

One of the things proper wholesale real estate contracts add is the phrase “and/or assigns” next to your name. This clause will give you the authority to sell the property or assign the property to another buyer.

You do need to disclose this to the seller and explain the clause if needed. Assure them that they will still get the amount you both agreed upon, but it gives you deal flexibility down the road.

3. Submit The Contract

Depending on your state’s laws, you need to submit your real estate assignment contract to a title company, or a closing attorney, for a title search. These are independent parties that look into the history of a property, seeing that there are no liens attached to the title. They then sign off on the validity of the contract.

4. Assign The Contract

Finding your buyer, similar to finding a seller, requires proper segmentation. When searching for buyers, investors should exercise several avenues, including online marketing, listing websites, or networking groups. In the real estate industry, this process is called building a buyer’s list, and it is a crucial step to finding success in assigning contracts.

Once you have found a buyer (hopefully from your ever-growing buyer’s list), ensure your contract includes language that covers earnest money to be paid upfront. This grants you protection against a possible breach of contract. This also assures you that you will profit, whether the transaction closes or not, as earnest money is non-refundable. How much it is depends on you, as long as it is properly justified.

5. Collect The Fee

Your profit from a deal of this kind comes from both your assignment fee, as well as the difference between the agreed-upon value and how much you sell it to the buyer. If you and the seller decide you will buy the property for $75,000 and sell it for $80,000 to the buyer, you profit $5,000. The deal is closed once the buyer pays the full $80,000.

Assignment of Contract Pros

For many investors, the most attractive benefit of an assignment of contract is the ability to profit without ever purchasing a property. This is often what attracts people to start wholesaling, as it allows many to learn the ropes of real estate with relatively low stakes. An assignment fee can either be determined as a percentage of the purchase price or as a set amount determined by the wholesaler. A standard fee is around $5,000 per contract.

The profit potential is not the only positive associated with an assignment of contract. Investors also benefit from not being added to the title chain, which can greatly reduce the costs and timeline associated with a deal. This benefit can even transfer to the seller and end buyer, as they get to avoid paying a real estate agent fee by opting for an assignment of contract. Compared to a double close (another popular wholesaling strategy), investors can avoid two sets of closing costs. All of these pros can positively impact an investor’s bottom line, making this a highly desirable exit strategy.

Assignment of Contract Cons

Although there are numerous perks to an assignment of contract, there are a few downsides to be aware of before searching for your first wholesale deal. Namely, working with buyers and sellers who may not be familiar with wholesaling can be challenging. Investors need to be prepared to familiarize newcomers with the process and be ready to answer any questions. Occasionally, sellers will purposely not accept an assignment of contract situation. Investors should occasionally expect this, as to not get discouraged.

Another obstacle wholesalers may face when working with an assignment of contract is in cases where the end buyer wants to back out. This can happen if the buyer is not comfortable paying the assignment fee, or if they don’t have owner’s rights until the contract is fully assigned. The best way to protect yourself from situations like this is to form a reliable buyer’s list and be upfront with all of the information. It is always recommended to develop a solid contract as well.

Know that not all properties can be wholesaled, for example HUD houses. In these cases, there are often anti-assigned clauses preventing wholesalers from getting involved. Make sure you know how to identify these properties so you don’t waste your time. Keep in mind that while there are cons to this real estate exit strategy, the right preparation can help investors avoid any big challenges.

Assignment of Contract Template

If you decide to pursue a career wholesaling real estate, then you’ll want the tools that will make your life as easy as possible. The good news is that there are plenty of real estate tools and templates at your disposal so that you don’t have to reinvent the wheel! For instance, here is an assignment of contract template that you can use when you strike your first deal.

As with any part of the real estate investing trade, no single aspect will lead to success. However, understanding how a real estate assignment of contract works is vital for this business. When you comprehend the many layers of how contracts are assigned—and how wholesaling works from beginning to end—you’ll be a more informed, educated, and successful investor.

Click the banner below to take a 90-minute online training class and get started learning how to invest in today’s real estate market!

What is an STR in Real Estate?

Wholetailing: a guide for real estate investors, what is chain of title in real estate investing, what is a real estate fund of funds (fof), reits vs real estate: which is the better investment, multi-family vs. single-family property investments: a comprehensive guide.

Assignment of Contract – Assignable Contract Basics for Real Estate Investors

What is assignment of contract? Learn about this wholesaling strategy and why assignment agreements are the preferred solution for flipping real estate contracts.

Beginners to investing in real estate and wholesaling must navigate a complex landscape littered with confusing terms and strategies. One of the first concepts to understand before wholesaling is assignment of contract, also known as assignment of agreement or “flipping real estate contracts.”

An assignment contract is the most popular exit strategy for wholesalers, and it isn’t as complicated as it may seem. What does assignment of contract mean? How can it be used to get into wholesaling? Here’s what you need to know.

What Is Assignment of Contract?

How assignment of contract works in real estate wholesaling, what is an assignment fee in real estate, assignment of agreement pros & cons, assignable contract faqs.

- Transactly Saves Time. Learn How Now!

Assignment of real estate purchase and sale agreement, or simply assignment of agreement or contract, is a real estate wholesale strategy that facilitates a sale between the property owner and the end buyer.

This strategy is also known as flipping real estate contracts because that’s essentially how it works:

- The wholesaler finds a property that’s already discounted or represents a great deal and enters into a contract with the seller,

- The contract contains an assignment clause that allows the wholesaler to assign the contract to someone else (if they choose to!), then

- The wholesaler can assign the contract to another party and receive an assignment fee when the transaction closes.

Assignment of contract in real estate is a popular strategy for beginners in real estate investment because it requires very little or even no capital. As long as you can find an interested buyer, you do not need to come up with a large sum of money to buy and then resell the property – you are only selling your right to buy it .

An assignment contract passes along your purchase rights as well as your contract obligations. After the contract assignment, you are no longer involved in the transaction with no right to make claims or responsibilities to get the transaction to closing.

Until you assign contract to someone else, however, you are completely on the hook for all contract responsibilities and rights.

This means that you are in control of the deal until you decide to assign the contract, but if you aren’t able to get someone to take over the contract, you are legally obligated to follow through with the sale .

Assignment of Contract vs Double Closing

Double closing and assignment of agreement are the two main real estate wholesaling exit strategies. Unlike the double closing strategy, an assignment contract does not require the wholesaler to purchase the property.

Assignment of contract is usually the preferred option because it can be completed in hours and does not require you to fund the purchase . Double closings take twice as much work and require a great deal of coordination. They are also illegal in some states.

Ready to see how an assignment contract actually works? Even though it has a low barrier to entry for beginner investors, the challenges of completing an assignment of contract shouldn’t be underestimated. Here are the general steps involved in wholesaling.

Step #1. Find a seller/property

The process begins by finding a property that you think is a good deal or a good investment and entering into a purchase agreement with the seller. Of course, not just any property is suitable for this strategy. You need to find a motivated seller willing to accept an assignment agreement and a price that works with your strategy. Direct mail marketing, online marketing, and checking the county delinquent tax list are just a few possible lead generation strategies you can employ.

Step #2: Enter into an assignable contract

The contract with the seller will be almost the same as a standard purchase agreement except it will contain an assignment clause.

An important element in an assignable purchase contract is “ and/or assigns ” next to your name as the buyer . The term “assigns” is used here as a noun to refer to a potential assignee. This is a basic assignment clause authorizing you to transfer your position and rights in the contract to an assignee if you choose.

The contract must also follow local laws regulating contract language. In some jurisdictions, assignment of contract is not allowed. It’s becoming increasingly common for wholesalers to assign agreements to an LLC instead of an individual. In this case, the LLC would be under contract with the seller. This can potentially bypass lender objections and even anti-assignment clauses for distressed properties. Rather than assigning the contract to someone else, the investor can reassign their interest in the LLC through an “assignment of membership interest.”

Note: even the presence of an assignment clause can make some sellers nervous or unwilling to make a deal . The seller may be picky about whom they want to buy the property, or they may be suspicious or concerned about the concept of assigning a contract to an unknown third party who may or may not be able to complete the sale.

The assignment clause should always be disclosed and explained to the seller. If they are nervous, they can be assured that they will still get the agreed-upon amount.

Step #3. Submit the assignment contract for a title search

Once you are under contract, you must typically submit the contract to a title company to perform the title search. This ensures there are no liens attached to the property.

Step #4. Find an end buyer to assign the contract

Next is the most challenging step: finding a buyer who can fulfill the contract’s original terms including the closing date and purchase price.

Successful wholesalers build buyers lists and employ marketing campaigns, social media, and networking to find a good match for an assignable contract.

Once you locate an end buyer, your contract should include earnest money the buyer must pay upfront. This gives you some protection if the buyer breaches the contract and, potentially, causes you to breach your contract with the seller. With a non-refundable deposit, you can be sure your earnest money to the seller will be covered in a worst-case scenario.

You can see an assignment of contract example here between an assignor and assignee.

Step #5. Receive your assignment fee

The final step is receiving your assignment fee. This fee is your profit from the transaction, and it’s usually paid when the transaction closes.

The assignment fee is how the wholesaler makes money through an assignment contract. This fee is paid by the end buyer when they purchase the right to buy the property as compensation for being connected to the original seller. Assignment contracts should clearly spell out the assignment fee and how it will be paid.

An assignment fee in real estate replaces the broker or Realtor fee in a typical transaction as the assignor or investor is bringing together the seller and end buyer.

The standard real estate assignment fee is $5,000 . However, it varies by transaction and calculating the assignment fee may be higher or lower depending on whether the buyer is buying and holding the property or rehabbing and flipping.

The assignment fee is not always a flat amount. The difference between the agreed-upon price with the seller and the end buyer is the profit you stand to earn as the assignor. If you agreed to purchase the property for $150,000 from the seller and assign the contract to a buyer for $200,000, your assignment fee or profit would be $50,000.

In most cases, an investor receives a deposit when the Assignment of Purchase and Sale Agreement is signed with the rest paid at closing.

Be aware that assignment agreements can have a bad reputation . This is usually the case when the end buyer and seller are unsatisfied, realizing they could have sold higher or bought lower and essentially paid thousands to an investor who never even wanted to buy the property.

Opting for the standard, flat assignment fee is much more readily accepted by sellers and buyers as it’s comparable to a real estate agent’s commission or even much lower and the parties can avoid working with an agent.

Real estate investors enjoy many benefits of an assignment of contract: