- Search Search Please fill out this field.

What Is a Business Plan?

Understanding business plans, how to write a business plan, common elements of a business plan, the bottom line, business plan: what it is, what's included, and how to write one.

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

- How to Start a Business: A Comprehensive Guide and Essential Steps

- How to Do Market Research, Types, and Example

- Marketing Strategy: What It Is, How It Works, How To Create One

- Marketing in Business: Strategies and Types Explained

- What Is a Marketing Plan? Types and How to Write One

- Business Development: Definition, Strategies, Steps & Skills

- Business Plan: What It Is, What's Included, and How to Write One CURRENT ARTICLE

- Small Business Development Center (SBDC): Meaning, Types, Impact

- How to Write a Business Plan for a Loan

- Business Startup Costs: It’s in the Details

- Startup Capital Definition, Types, and Risks

- Bootstrapping Definition, Strategies, and Pros/Cons

- Crowdfunding: What It Is, How It Works, and Popular Websites

- Starting a Business with No Money: How to Begin

- A Comprehensive Guide to Establishing Business Credit

- Equity Financing: What It Is, How It Works, Pros and Cons

- Best Startup Business Loans

- Sole Proprietorship: What It Is, Pros & Cons, and Differences From an LLC

- Partnership: Definition, How It Works, Taxation, and Types

- What is an LLC? Limited Liability Company Structure and Benefits Defined

- Corporation: What It Is and How to Form One

- Starting a Small Business: Your Complete How-to Guide

- Starting an Online Business: A Step-by-Step Guide

- How to Start Your Own Bookkeeping Business: Essential Tips

- How to Start a Successful Dropshipping Business: A Comprehensive Guide

A business plan is a document that outlines a company's goals and the strategies to achieve them. It's valuable for both startups and established companies. For startups, a well-crafted business plan is crucial for attracting potential lenders and investors. Established businesses use business plans to stay on track and aligned with their growth objectives. This article will explain the key components of an effective business plan and guidance on how to write one.

Key Takeaways

- A business plan is a document detailing a company's business activities and strategies for achieving its goals.

- Startup companies use business plans to launch their venture and to attract outside investors.

- For established companies, a business plan helps keep the executive team focused on short- and long-term objectives.

- There's no single required format for a business plan, but certain key elements are essential for most companies.

Investopedia / Ryan Oakley

Any new business should have a business plan in place before beginning operations. Banks and venture capital firms often want to see a business plan before considering making a loan or providing capital to new businesses.

Even if a company doesn't need additional funding, having a business plan helps it stay focused on its goals. Research from the University of Oregon shows that businesses with a plan are significantly more likely to secure funding than those without one. Moreover, companies with a business plan grow 30% faster than those that don't plan. According to a Harvard Business Review article, entrepreneurs who write formal plans are 16% more likely to achieve viability than those who don't.

A business plan should ideally be reviewed and updated periodically to reflect achieved goals or changes in direction. An established business moving in a new direction might even create an entirely new plan.

There are numerous benefits to creating (and sticking to) a well-conceived business plan. It allows for careful consideration of ideas before significant investment, highlights potential obstacles to success, and provides a tool for seeking objective feedback from trusted outsiders. A business plan may also help ensure that a company’s executive team remains aligned on strategic action items and priorities.

While business plans vary widely, even among competitors in the same industry, they often share basic elements detailed below.

A well-crafted business plan is essential for attracting investors and guiding a company's strategic growth. It should address market needs and investor requirements and provide clear financial projections.

While there are any number of templates that you can use to write a business plan, it's best to try to avoid producing a generic-looking one. Let your plan reflect the unique personality of your business.

Many business plans use some combination of the sections below, with varying levels of detail, depending on the company.

The length of a business plan can vary greatly from business to business. Regardless, gathering the basic information into a 15- to 25-page document is best. Any additional crucial elements, such as patent applications, can be referenced in the main document and included as appendices.

Common elements in many business plans include:

- Executive summary : This section introduces the company and includes its mission statement along with relevant information about the company's leadership, employees, operations, and locations.

- Products and services : Describe the products and services the company offers or plans to introduce. Include details on pricing, product lifespan, and unique consumer benefits. Mention production and manufacturing processes, relevant patents , proprietary technology , and research and development (R&D) information.

- Market analysis : Explain the current state of the industry and the competition. Detail where the company fits in, the types of customers it plans to target, and how it plans to capture market share from competitors.

- Marketing strategy : Outline the company's plans to attract and retain customers, including anticipated advertising and marketing campaigns. Describe the distribution channels that will be used to deliver products or services to consumers.

- Financial plans and projections : Established businesses should include financial statements, balance sheets, and other relevant financial information. New businesses should provide financial targets and estimates for the first few years. This section may also include any funding requests.

Investors want to see a clear exit strategy, expected returns, and a timeline for cashing out. It's likely a good idea to provide five-year profitability forecasts and realistic financial estimates.

2 Types of Business Plans

Business plans can vary in format, often categorized into traditional and lean startup plans. According to the U.S. Small Business Administration (SBA) , the traditional business plan is the more common of the two.

- Traditional business plans : These are detailed and lengthy, requiring more effort to create but offering comprehensive information that can be persuasive to potential investors.

- Lean startup business plans : These are concise, sometimes just one page, and focus on key elements. While they save time, companies should be ready to provide additional details if requested by investors or lenders.

Why Do Business Plans Fail?

A business plan isn't a surefire recipe for success. The plan may have been unrealistic in its assumptions and projections. Markets and the economy might change in ways that couldn't have been foreseen. A competitor might introduce a revolutionary new product or service. All this calls for building flexibility into your plan, so you can pivot to a new course if needed.

How Often Should a Business Plan Be Updated?

How frequently a business plan needs to be revised will depend on its nature. Updating your business plan is crucial due to changes in external factors (market trends, competition, and regulations) and internal developments (like employee growth and new products). While a well-established business might want to review its plan once a year and make changes if necessary, a new or fast-growing business in a fiercely competitive market might want to revise it more often, such as quarterly.

What Does a Lean Startup Business Plan Include?

The lean startup business plan is ideal for quickly explaining a business, especially for new companies that don't have much information yet. Key sections may include a value proposition , major activities and advantages, resources (staff, intellectual property, and capital), partnerships, customer segments, and revenue sources.

A well-crafted business plan is crucial for any company, whether it's a startup looking for investment or an established business wanting to stay on course. It outlines goals and strategies, boosting a company's chances of securing funding and achieving growth.

As your business and the market change, update your business plan regularly. This keeps it relevant and aligned with your current goals and conditions. Think of your business plan as a living document that evolves with your company, not something carved in stone.

University of Oregon Department of Economics. " Evaluation of the Effectiveness of Business Planning Using Palo Alto's Business Plan Pro ." Eason Ding & Tim Hursey.

Bplans. " Do You Need a Business Plan? Scientific Research Says Yes ."

Harvard Business Review. " Research: Writing a Business Plan Makes Your Startup More Likely to Succeed ."

Harvard Business Review. " How to Write a Winning Business Plan ."

U.S. Small Business Administration. " Write Your Business Plan ."

SCORE. " When and Why Should You Review Your Business Plan? "

:max_bytes(150000):strip_icc():format(webp)/GettyImages-1456193345-2cc8ef3d583f42d8a80c8e631c0b0556.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What is a Business Plan? Definition, Tips, and Templates

Published: June 28, 2024

Years ago, I had an idea to launch a line of region-specific board games. I knew there was a market for games that celebrated local culture and heritage. I was so excited about the concept and couldn't wait to get started.

But my idea never took off. Why? Because I didn‘t have a plan. I lacked direction, missed opportunities, and ultimately, the venture never got off the ground.

And that’s exactly why a business plan is important. It cements your vision, gives you clarity, and outlines your next step.

In this post, I‘ll explain what a business plan is, the reasons why you’d need one, identify different types of business plans, and what you should include in yours.

Table of Contents

What is a business plan?

What is a business plan used for.

- Business Plan Template [Download Now]

Purposes of a Business Plan

What does a business plan need to include, types of business plans.

.webp)

Free Business Plan Template

The essential document for starting a business -- custom built for your needs.

- Outline your idea.

- Pitch to investors.

- Secure funding.

- Get to work!

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

A business plan is a comprehensive document that outlines a company's goals, strategies, and financial projections. It provides a detailed description of the business, including its products or services, target market, competitive landscape, and marketing and sales strategies. The plan also includes a financial section that forecasts revenue, expenses, and cash flow, as well as a funding request if the business is seeking investment.

The business plan is an undeniably critical component to getting any company off the ground. It's key to securing financing, documenting your business model, outlining your financial projections, and turning that nugget of a business idea into a reality.

The purpose of a business plan is three-fold: It summarizes the organization’s strategy in order to execute it long term, secures financing from investors, and helps forecast future business demands.

Business Plan Template [ Download Now ]

Don't forget to share this post!

Related articles.

18 of My Favorite Sample Business Plans & Examples For Your Inspiration

![various definitions of business plan 7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]](https://www.hubspot.com/hubfs/gantt-chart-1-20240625-3861486-1.webp)

7 Gantt Chart Examples You'll Want to Copy [+ 5 Steps to Make One]

![various definitions of business plan How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]](https://www.hubspot.com/hubfs/executive-summary-example_5.webp)

How to Write an Executive Summary Execs Can't Ignore [+ 5 Top Examples]

20 Free & Paid Small Business Tools for Any Budget

Maximizing Your Social Media Strategy: The Top Aggregator Tools to Use

The Content Aggregator Guide for 2024

![various definitions of business plan The 8 Best Free Flowchart Templates [+ Examples]](https://newinboundblog.hubspot.com/hubfs/flowchart%20templates.jpg)

The 8 Best Free Flowchart Templates [+ Examples]

16 Best Screen Recorders to Use for Collaboration

The 25 Best Google Chrome Extensions for SEO

Professional Invoice Design: 28 Samples & Templates to Inspire You

2 Essential Templates For Starting Your Business

Marketing software that helps you drive revenue, save time and resources, and measure and optimize your investments — all on one easy-to-use platform

- Customer Reviews

- Net 30 Account

- Wise Services

- Steps & Timeline

- Work at a Glance

- Market Research at a Glance

- Business Plan Writing Services

- Bank Business Plan

- Investor Business Plan

- Franchise Business Plan

- Cannabis Business Plan

- Strategic Business Plan

- Corporate Business Plan

- Merge and Acquisition Business Plan (M&A)

- Private Placement Memorandums (PPM)

- Sample Business Plans

- Professional Feasibility Study

- PowerPoint Presentations

- Pitch Deck Presentation Services

- Business Plan Printing

- Market Research

- L-1 Business Plan

- E-2 Business Plan

- EB-5 Business Plan

- EB-5 Regional Centers

- Immigration Attorneys

- Nonprofit Business Plan

- Exit Business Planning

- Business Planning

- Business Formation

- Business License

- Business Website

- Business Branding

- Business Bank Account

- Digital Marketing

- Business Funding Resources

- Small Business Loans

- Venture Capital

- Net 30 Apply

What is a business plan? Definition, Purpose, and Types

In the world of business, a well-thought-out plan is often the key to success. This plan, known as a business plan, is a comprehensive document that outlines a company’s goals, strategies , and financial projections. Whether you’re starting a new business or looking to expand an existing one, a business plan is an essential tool.

As a business plan writer and consultant , I’ve crafted over 15,000 plans for a diverse range of businesses. In this article, I’ll be sharing my wealth of experience about what a business plan is, its purpose, and the step-by-step process of creating one. By the end, you’ll have a thorough understanding of how to develop a robust business plan that can drive your business to success.

What is a business plan?

Purposes of a business plan, what are the essential components of a business plan, executive summary, business description or overview, product and price, competitive analysis, target market, marketing plan, financial plan, funding requirements, types of business plan, lean startup business plans, traditional business plans, how often should a business plan be reviewed and revised, what are the key elements of a lean startup business plan.

- What are some of the reasons why business plans don't succeed?

A business plan is a roadmap for your business. It outlines your goals, strategies, and how you plan to achieve them. It’s a living document that you can update as your business grows and changes.

Looking for someone to write a business plan?

Find professional business plan writers for your business success.

These are the following purpose of business plan:

- Attract investors and lenders: If you’re seeking funding for your business , a business plan is a must-have. Investors and lenders want to see that you have a clear plan for how you’ll use their money to grow your business and generate revenue.

- Get organized and stay on track: Writing a business plan forces you to think through all aspects of your business, from your target market to your marketing strategy. This can help you identify any potential challenges and opportunities early on, so you can develop a plan to address them.

- Make better decisions: A business plan can help you make better decisions about your business by providing you with a framework to evaluate different options. For example, if you’re considering launching a new product, your business plan can help you assess the potential market demand, costs, and profitability.

The executive summary is the most important part of your business plan, even though it’s the last one you’ll write. It’s the first section that potential investors or lenders will read, and it may be the only one they read. The executive summary sets the stage for the rest of the document by introducing your company’s mission or vision statement, value proposition, and long-term goals.

The business description section of your business plan should introduce your business to the reader in a compelling and concise way. It should include your business name, years in operation, key offerings, positioning statement, and core values (if applicable). You may also want to include a short history of your company.

In this section, the company should describe its products or services , including pricing, product lifespan, and unique benefits to the consumer. Other relevant information could include production and manufacturing processes, patents, and proprietary technology.

Every industry has competitors, even if your business is the first of its kind or has the majority of the market share. In the competitive analysis section of your business plan, you’ll objectively assess the industry landscape to understand your business’s competitive position. A SWOT analysis is a structured way to organize this section.

Your target market section explains the core customers of your business and why they are your ideal customers. It should include demographic, psychographic, behavioral, and geographic information about your target market.

Marketing plan describes how the company will attract and retain customers, including any planned advertising and marketing campaigns . It also describes how the company will distribute its products or services to consumers.

After outlining your goals, validating your business opportunity, and assessing the industry landscape, the team section of your business plan identifies who will be responsible for achieving your goals. Even if you don’t have your full team in place yet, investors will be impressed by your clear understanding of the roles that need to be filled.

In the financial plan section,established businesses should provide financial statements , balance sheets , and other financial data. New businesses should provide financial targets and estimates for the first few years, and may also request funding.

Since one goal of a business plan is to secure funding from investors , you should include the amount of funding you need, why you need it, and how long you need it for.

- Tip: Use bullet points and numbered lists to make your plan easy to read and scannable.

Access specialized business plan writing service now!

Business plans can come in many different formats, but they are often divided into two main types: traditional and lean startup. The U.S. Small Business Administration (SBA) says that the traditional business plan is the more common of the two.

Lean startup business plans are short (as short as one page) and focus on the most important elements. They are easy to create, but companies may need to provide more information if requested by investors or lenders.

Traditional business plans are longer and more detailed than lean startup business plans, which makes them more time-consuming to create but more persuasive to potential investors. Lean startup business plans are shorter and less detailed, but companies should be prepared to provide more information if requested.

Need Guidance with Your Business Plan?

Access 14 free business plan samples!

A business plan should be reviewed and revised at least annually, or more often if the business is experiencing significant changes. This is because the business landscape is constantly changing, and your business plan needs to reflect those changes in order to remain relevant and effective.

Here are some specific situations in which you should review and revise your business plan:

- You have launched a new product or service line.

- You have entered a new market.

- You have experienced significant changes in your customer base or competitive landscape.

- You have made changes to your management team or organizational structure.

- You have raised new funding.

A lean startup business plan is a short and simple way for a company to explain its business, especially if it is new and does not have a lot of information yet. It can include sections on the company’s value proposition, major activities and advantages, resources, partnerships, customer segments, and revenue sources.

What are some of the reasons why business plans don't succeed?

- Unrealistic assumptions: Business plans are often based on assumptions about the market, the competition, and the company’s own capabilities. If these assumptions are unrealistic, the plan is doomed to fail.

- Lack of focus: A good business plan should be focused on a specific goal and how the company will achieve it. If the plan is too broad or tries to do too much, it is unlikely to be successful.

- Poor execution: Even the best business plan is useless if it is not executed properly. This means having the right team in place, the necessary resources, and the ability to adapt to changing circumstances.

- Unforeseen challenges: Every business faces challenges that could not be predicted or planned for. These challenges can be anything from a natural disaster to a new competitor to a change in government regulations.

What are the benefits of having a business plan?

- It helps you to clarify your business goals and strategies.

- It can help you to attract investors and lenders.

- It can serve as a roadmap for your business as it grows and changes.

- It can help you to make better business decisions.

How to write a business plan?

There are many different ways to write a business plan, but most follow the same basic structure. Here is a step-by-step guide:

- Executive summary.

- Company description.

- Management and organization description.

- Financial projections.

How to write a business plan step by step?

Start with an executive summary, then describe your business, analyze the market, outline your products or services, detail your marketing and sales strategies, introduce your team, and provide financial projections.

Why do I need a business plan for my startup?

A business plan helps define your startup’s direction, attract investors, secure funding, and make informed decisions crucial for success.

What are the key components of a business plan?

Key components include an executive summary, business description, market analysis, products or services, marketing and sales strategy, management and team, financial projections, and funding requirements.

Can a business plan help secure funding for my business?

Yes, a well-crafted business plan demonstrates your business’s viability, the use of investment, and potential returns, making it a valuable tool for attracting investors and lenders.

Quick Links

- Investor Business Plans

- M&A Business Plan

- Private Placement

- Feasibility Study

- Hire a Business Plan Writer

- Business Valuation Calculator

- Business Plan Examples

- Real Estate Business Plan

- Business Plan Template

- Business Plan Pricing Guide

- Business Plan Makeover

- SBA Loans, Bank Funding & Business Credit

- Finding & Qualifying for Business Grants

- Leadership for the New Manager

- Content Marketing for Beginners

- All About Crowdfunding

- EB-5 Regional Centers, A Step-By-Step Guide

- Logo Designer

- Landing Page

- PPC Advertising

- Business Entity

- Business Licensing

- Virtual Assistant

- Business Phone

- Business Address

- E-1 Visa Business Plan

- EB1-A Visa Business Plan

- EB1-C Visa Business Plan

- EB2-NIW Business Plan

- H1B Visa Business Plan

- O1 Visa Business Plan

- Business Brokers

- Merger & Acquisition Advisors

- Franchisors

Proud Sponsor of

- 1-800-496-1056

- (613) 800-0227

- +44 (1549) 409190

- +61 (2) 72510077

Limited Time Offer:

Save Up to 25% on LivePlan today

0 results have been found for “”

Return to blog home

What Is a Business Plan? Definition and Planning Essentials Explained

Posted february 21, 2022 by kody wirth.

What is a business plan? It’s the roadmap for your business. The outline of your goals, objectives, and the steps you’ll take to get there. It describes the structure of your organization, how it operates, as well as the financial expectations and actual performance.

A business plan can help you explore ideas, successfully start a business, manage operations, and pursue growth. In short, a business plan is a lot of different things. It’s more than just a stack of paper and can be one of your most effective tools as a business owner.

Let’s explore the basics of business planning, the structure of a traditional plan, your planning options, and how you can use your plan to succeed.

What is a business plan?

A business plan is a document that explains how your business operates. It summarizes your business structure, objectives, milestones, and financial performance. Again, it’s a guide that helps you, and anyone else, better understand how your business will succeed.

Why do you need a business plan?

The primary purpose of a business plan is to help you understand the direction of your business and the steps it will take to get there. Having a solid business plan can help you grow up to 30% faster and according to our own 2021 Small Business research working on a business plan increases confidence regarding business health—even in the midst of a crisis.

These benefits are directly connected to how writing a business plan makes you more informed and better prepares you for entrepreneurship. It helps you reduce risk and avoid pursuing potentially poor ideas. You’ll also be able to more easily uncover your business’s potential. By regularly returning to your plan you can understand what parts of your strategy are working and those that are not.

That just scratches the surface for why having a plan is valuable. Check out our full write-up for fifteen more reasons why you need a business plan .

What can you do with your plan?

So what can you do with a business plan once you’ve created it? It can be all too easy to write a plan and just let it be. Here are just a few ways you can leverage your plan to benefit your business.

Test an idea

Writing a plan isn’t just for those that are ready to start a business. It’s just as valuable for those that have an idea and want to determine if it’s actually possible or not. By writing a plan to explore the validity of an idea, you are working through the process of understanding what it would take to be successful.

The market and competitive research alone can tell you a lot about your idea. Is the marketplace too crowded? Is the solution you have in mind not really needed? Add in the exploration of milestones, potential expenses, and the sales needed to attain profitability and you can paint a pretty clear picture of the potential of your business.

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Document your strategy and goals

For those starting or managing a business understanding where you’re going and how you’re going to get there are vital. Writing your plan helps you do that. It ensures that you are considering all aspects of your business, know what milestones you need to hit, and can effectively make adjustments if that doesn’t happen.

With a plan in place, you’ll have an idea of where you want your business to go as well as how you’ve performed in the past. This alone better prepares you to take on challenges, review what you’ve done before, and make the right adjustments.

Pursue funding

Even if you do not intend to pursue funding right away, having a business plan will prepare you for it. It will ensure that you have all of the information necessary to submit a loan application and pitch to investors. So, rather than scrambling to gather documentation and write a cohesive plan once it’s relevant, you can instead keep your plan up-to-date and attempt to attain funding. Just add a use of funds report to your financial plan and you’ll be ready to go.

The benefits of having a plan don’t stop there. You can then use your business plan to help you manage the funding you receive. You’ll not only be able to easily track and forecast how you’ll use your funds but easily report on how it’s been used.

Better manage your business

A solid business plan isn’t meant to be something you do once and forget about. Instead, it should be a useful tool that you can regularly use to analyze performance, make strategic decisions, and anticipate future scenarios. It’s a document that you should regularly update and adjust as you go to better fit the actual state of your business.

Doing so makes it easier to understand what’s working and what’s not. It helps you understand if you’re truly reaching your goals or if you need to make further adjustments. Having your plan in place makes that process quicker, more informative, and leaves you with far more time to actually spend running your business.

What should your business plan include?

The content and structure of your business plan should include anything that will help you use it effectively. That being said, there are some key elements that you should cover and that investors will expect to see.

Executive summary

The executive summary is a simple overview of your business and your overall plan. It should serve as a standalone document that provides enough detail for anyone—including yourself, team members, or investors—to fully understand your business strategy. Make sure to cover the problem you’re solving, a description of your product or service, your target market, organizational structure, a financial summary, and any necessary funding requirements.

This will be the first part of your plan but it’s easiest to write it after you’ve created your full plan.

Products & Services

When describing your products or services, you need to start by outlining the problem you’re solving and why what you offer is valuable. This is where you’ll also address current competition in the market and any competitive advantages your products or services bring to the table. Lastly, be sure to outline the steps or milestones that you’ll need to hit to successfully launch your business. If you’ve already hit some initial milestones, like taking pre-orders or early funding, be sure to include it here to further prove the validity of your business.

Market analysis

A market analysis is a qualitative and quantitative assessment of the current market you’re entering or competing in. It helps you understand the overall state and potential of the industry, who your ideal customers are, the positioning of your competition, and how you intend to position your own business. This helps you better explore the long-term trends of the market, what challenges to expect, and how you will need to initially introduce and even price your products or services.

Check out our full guide for how to conduct a market analysis in just four easy steps .

Marketing & sales

Here you detail how you intend to reach your target market. This includes your sales activities, general pricing plan, and the beginnings of your marketing strategy. If you have any branding elements, sample marketing campaigns, or messaging available—this is the place to add it.

Additionally, it may be wise to include a SWOT analysis that demonstrates your business or specific product/service position. This will showcase how you intend to leverage sales and marketing channels to deal with competitive threats and take advantage of any opportunities.

Check out our full write-up to learn how to create a cohesive marketing strategy for your business.

Organization & management

This section addresses the legal structure of your business, your current team, and any gaps that need to be filled. Depending on your business type and longevity, you’ll also need to include your location, ownership information, and business history. Basically, add any information that helps explain your organizational structure and how you operate. This section is particularly important for pitching to investors but should be included even if attempted funding is not in your immediate future.

Financial projections

Possibly the most important piece of your plan, your financials section is vital for showcasing the viability of your business. It also helps you establish a baseline to measure against and makes it easier to make ongoing strategic decisions as your business grows. This may seem complex on the surface, but it can be far easier than you think.

Focus on building solid forecasts, keep your categories simple, and lean on assumptions. You can always return to this section to add more details and refine your financial statements as you operate.

Here are the statements you should include in your financial plan:

- Sales and revenue projections

- Profit and loss statement

- Cash flow statement

- Balance sheet

The appendix is where you add additional detail, documentation, or extended notes that support the other sections of your plan. Don’t worry about adding this section at first and only add documentation that you think will be beneficial for anyone reading your plan.

Types of business plans explained

While all business plans cover similar categories, the style and function fully depend on how you intend to use your plan. So, to get the most out of your plan, it’s best to find a format that suits your needs. Here are a few common business plan types worth considering.

Traditional business plan

The tried-and-true traditional business plan is a formal document meant to be used for external purposes. Typically this is the type of plan you’ll need when applying for funding or pitching to investors. It can also be used when training or hiring employees, working with vendors, or any other situation where the full details of your business must be understood by another individual.

This type of business plan follows the outline above and can be anywhere from 10-50 pages depending on the amount of detail included, the complexity of your business, and what you include in your appendix. We recommend only starting with this business plan format if you plan to immediately pursue funding and already have a solid handle on your business information.

Business model canvas

The business model canvas is a one-page template designed to demystify the business planning process. It removes the need for a traditional, copy-heavy business plan, in favor of a single-page outline that can help you and outside parties better explore your business idea.

The structure ditches a linear structure in favor of a cell-based template. It encourages you to build connections between every element of your business. It’s faster to write out and update, and much easier for you, your team, and anyone else to visualize your business operations. This is really best for those exploring their business idea for the first time, but keep in mind that it can be difficult to actually validate your idea this way as well as adapt it into a full plan.

One-page business plan

The true middle ground between the business model canvas and a traditional business plan is the one-page business plan. This format is a simplified version of the traditional plan that focuses on the core aspects of your business. It basically serves as a beefed-up pitch document and can be finished as quickly as the business model canvas.

By starting with a one-page plan, you give yourself a minimal document to build from. You’ll typically stick with bullet points and single sentences making it much easier to elaborate or expand sections into a longer-form business plan. This plan type is useful for those exploring ideas, needing to validate their business model, or who need an internal plan to help them run and manage their business.

Now, the option that we here at LivePlan recommend is the Lean Plan . This is less of a specific document type and more of a methodology. It takes the simplicity and styling of the one-page business plan and turns it into a process for you to continuously plan, test, review, refine, and take action based on performance.

It holds all of the benefits of the single-page plan, including the potential to complete it in as little as 27-minutes . However, it’s even easier to convert into a full plan thanks to how heavily it’s tied to your financials. The overall goal of Lean Planning isn’t to just produce documents that you use once and shelve. Instead, the Lean Planning process helps you build a healthier company that thrives in times of growth and stable through times of crisis.

It’s faster, keeps your plan concise, and ensures that your plan is always up-to-date.

Try the LivePlan Method for Lean Business Planning

Now that you know the basics of business planning, it’s time to get started. Again we recommend leveraging a Lean Plan for a faster, easier, and far more useful planning process.

To get familiar with the Lean Plan format, you can download our free Lean Plan template . However, if you want to elevate your ability to create and use your lean plan even further, you may want to explore LivePlan.

It features step-by-step guidance that ensures you cover everything necessary while reducing the time spent on formatting and presenting. You’ll also gain access to financial forecasting tools that propel you through the process. Finally, it will transform your plan into a management tool that will help you easily compare your forecasts to your actual results.

Check out how LivePlan streamlines Lean Planning by downloading our Kickstart Your Business ebook .

Like this post? Share with a friend!

Posted in Business Plan Writing

Join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

Home > Business > Business Startup

How To Write a Business Plan

We are committed to sharing unbiased reviews. Some of the links on our site are from our partners who compensate us. Read our editorial guidelines and advertising disclosure .

Starting a business is a wild ride, and a solid business plan can be the key to keeping you on track. A business plan is essentially a roadmap for your business — outlining your goals, strategies, market analysis and financial projections. Not only will it guide your decision-making, a business plan can help you secure funding with a loan or from investors .

Writing a business plan can seem like a huge task, but taking it one step at a time can break the plan down into manageable milestones. Here is our step-by-step guide on how to write a business plan.

Table of contents

- Write your executive summary

- Do your market research homework

- Set your business goals and objectives

- Plan your business strategy

- Describe your product or service

- Crunch the numbers

- Finalize your business plan

By signing up I agree to the Terms of Use and Privacy Policy .

Step 1: Write your executive summary

Though this will be the first page of your business plan , we recommend you actually write the executive summary last. That’s because an executive summary highlights what’s to come in the business plan but in a more condensed fashion.

An executive summary gives stakeholders who are reading your business plan the key points quickly without having to comb through pages and pages. Be sure to cover each successive point in a concise manner, and include as much data as necessary to support your claims.

You’ll cover other things too, but answer these basic questions in your executive summary:

- Idea: What’s your business concept? What problem does your business solve? What are your business goals?

- Product: What’s your product/service and how is it different?

- Market: Who’s your audience? How will you reach customers?

- Finance: How much will your idea cost? And if you’re seeking funding, how much money do you need? How much do you expect to earn? If you’ve already started, where is your revenue at now?

Step 2: Do your market research homework

The next step in writing a business plan is to conduct market research . This involves gathering information about your target market (or customer persona), your competition, and the industry as a whole. You can use a variety of research methods such as surveys, focus groups, and online research to gather this information. Your method may be formal or more casual, just make sure that you’re getting good data back.

This research will help you to understand the needs of your target market and the potential demand for your product or service—essential aspects of starting and growing a successful business.

Step 3: Set your business goals and objectives

Once you’ve completed your market research, you can begin to define your business goals and objectives. What is the problem you want to solve? What’s your vision for the future? Where do you want to be in a year from now?

Use this step to decide what you want to achieve with your business, both in the short and long term. Try to set SMART goals—specific, measurable, achievable, relevant, and time-bound benchmarks—that will help you to stay focused and motivated as you build your business.

Step 4: Plan your business strategy

Your business strategy is how you plan to reach your goals and objectives. This includes details on positioning your product or service, marketing and sales strategies, operational plans, and the organizational structure of your small business.

Make sure to include key roles and responsibilities for each team member if you’re in a business entity with multiple people.

Step 5: Describe your product or service

In this section, get into the nitty-gritty of your product or service. Go into depth regarding the features, benefits, target market, and any patents or proprietary tech you have. Make sure to paint a clear picture of what sets your product apart from the competition—and don’t forget to highlight any customer benefits.

Step 6: Crunch the numbers

Financial analysis is an essential part of your business plan. If you’re already in business that includes your profit and loss statement , cash flow statement and balance sheet .

These financial projections will give investors and lenders an understanding of the financial health of your business and the potential return on investment.

You may want to work with a financial professional to ensure your financial projections are realistic and accurate.

Step 7: Finalize your business plan

Once you’ve completed everything, it's time to finalize your business plan. This involves reviewing and editing your plan to ensure that it is clear, concise, and easy to understand.

You should also have someone else review your plan to get a fresh perspective and identify any areas that may need improvement. You could even work with a free SCORE mentor on your business plan or use a SCORE business plan template for more detailed guidance.

Compare the Top Small-Business Banks

$0.00 | ||||||

$0.00 | ||||||

$0.00 | ||||||

$10.00 (waivable) | ||||||

$0.00 |

Data effective 1/10/23. At publishing time, rates, fees, and requirements are current but are subject to change. Offers may not be available in all areas.

The takeaway

Writing a business plan is an essential process for any forward-thinking entrepreneur or business owner. A business plan requires a lot of up-front research, planning, and attention to detail, but it’s worthwhile. Creating a comprehensive business plan can help you achieve your business goals and secure the funding you need.

Related content

- 5 Best Business Plan Software and Tools in 2023 for Your Small Business

- How to Get a Business License: What You Need to Know

- What Is a Cash Flow Statement?

Best Small Business Loans

5202 W Douglas Corrigan Way Salt Lake City, UT 84116

Accounting & Payroll

Point of Sale

Payment Processing

Inventory Management

Human Resources

Other Services

Best Inventory Management Software

Best Small Business Accounting Software

Best Payroll Software

Best Mobile Credit Card Readers

Best POS Systems

Best Tax Software

Stay updated on the latest products and services anytime anywhere.

By signing up, you agree to our Terms of Use and Privacy Policy .

Disclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. All information is subject to change. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. For the most accurate information, please ask your customer service representative. Clarify all fees and contract details before signing a contract or finalizing your purchase.

Our mission is to help consumers make informed purchase decisions. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links. This can affect which services appear on our site and where we rank them. Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. For more information, please see our Privacy Policy Page . |

© Business.org 2024 All Rights Reserved.

How to Write a Business Plan: Your Step-by-Step Guide

So, you’ve got an idea and you want to start a business —great! Before you do anything else, like seek funding or build out a team, you'll need to know how to write a business plan. This plan will serve as the foundation of your company while also giving investors and future employees a clear idea of your purpose.

Below, Lauren Cobello, Founder and CEO of Leverage with Media PR , gives her best advice on how to make a business plan for your company.

Build your dream business with the help of a high-paying job—browse open jobs on The Muse »

What is a business plan, and when do you need one?

According to Cobello, a business plan is a document that contains the mission of the business and a brief overview of it, as well as the objectives, strategies, and financial plans of the founder. A business plan comes into play very early on in the process of starting a company—more or less before you do anything else.

“You should start a company with a business plan in mind—especially if you plan to get funding for the company,” Cobello says. “You’re going to need it.”

Whether that funding comes from a loan, an investor, or crowdsourcing, a business plan is imperative to secure the capital, says the U.S. Small Business Administration . Anyone who’s considering giving you money is going to want to review your business plan before doing so. That means before you head into any meeting, make sure you have physical copies of your business plan to share.

Different types of business plans

The four main types of business plans are:

Startup Business Plans

Internal business plans, strategic business plans, one-page business plans.

Let's break down each one:

If you're wondering how to write a business plan for a startup, Cobello has advice for you. Startup business plans are the most common type, she says, and they are a critical tool for new business ventures that want funding. A startup is defined as a company that’s in its first stages of operations, founded by an entrepreneur who has a product or service idea.

Most startups begin with very little money, so they need a strong business plan to convince family, friends, banks, and/or venture capitalists to invest in the new company.

Internal business plans “are for internal use only,” says Cobello. This kind of document is not public-facing, only company-facing, and it contains an outline of the company’s business strategy, financial goals and budgets, and performance data.

Internal business plans aren’t used to secure funding, but rather to set goals and get everyone working there tracking towards them.

As the name implies, strategic business plans are geared more towards strategy and they include an assessment of the current business landscape, notes Jérôme Côté, a Business Advisor at BDC Advisory Services .

Unlike a traditional business plan, Cobello adds, strategic plans include a SWOT analysis (which stands for strengths, weaknesses, opportunities, and threats) and an in-depth action plan for the next six to 12 months. Strategic plans are action-based and take into account the state of the company and the industry in which it exists.

Although a typical business plan falls between 15 to 30 pages, some companies opt for the much shorter One-Page Business Plan. A one-page business plan is a simplified version of the larger business plan, and it focuses on the problem your product or service is solving, the solution (your product), and your business model (how you’ll make money).

A one-page plan is hyper-direct and easy to read, making it an effective tool for businesses of all sizes, at any stage.

How to create a business plan in 7 steps

Every business plan is different, and the steps you take to complete yours will depend on what type and format you choose. That said, if you need a place to start and appreciate a roadmap, here’s what Cobello recommends:

1. Conduct your research

Before writing your business plan, you’ll want to do a thorough investigation of what’s out there. Who will be the competitors for your product or service? Who is included in the target market? What industry trends are you capitalizing on, or rebuking? You want to figure out where you sit in the market and what your company’s value propositions are. What makes you different—and better?

2. Define your purpose for the business plan

The purpose of your business plan will determine which kind of plan you choose to create. Are you trying to drum up funding, or get the company employees focused on specific goals? (For the former, you’d want a startup business plan, while an internal plan would satisfy the latter.) Also, consider your audience. An investment firm that sees hundreds of potential business plans a day may prefer to see a one-pager upfront and, if they’re interested, a longer plan later.

3. Write your company description

Every business plan needs a company description—aka a summary of the company’s purpose, what they do/offer, and what makes it unique. Company descriptions should be clear and concise, avoiding the use of jargon, Cobello says. Ideally, descriptions should be a few paragraphs at most.

4. Explain and show how the company will make money

A business plan should be centered around the company’s goals, and it should clearly explain how the company will generate revenue. To do this, Cobello recommends using actual numbers and details, as opposed to just projections.

For instance, if the company is already making money, show how much and at what cost (e.g. what was the net profit). If it hasn’t generated revenue yet, outline the plan for how it will—including what the product/service will cost to produce and how much it will cost the consumer.

5. Outline your marketing strategy

How will you promote the business? Through what channels will you be promoting it? How are you going to reach and appeal to your target market? The more specific and thorough you can be with your plans here, the better, Cobello says.

6. Explain how you’ll spend your funding

What will you do with the money you raise? What are the first steps you plan to take? As a founder, you want to instill confidence in your investors and show them that the instant you receive their money, you’ll be taking smart actions that grow the company.

7. Include supporting documents

Creating a business plan is in some ways akin to building a legal case, but for your business. “You want to tell a story, and to be as thorough as possible, while keeping your plan succinct, clear, interesting, and visually appealing,” Cobello says. “Supporting documents could include financial projects, a competitive analysis of the market you’re entering into, and even any licenses, patents, or permits you’ve secured.”

A business plan is an individualized document—it’s ultimately up to you what information to include and what story you tell. But above all, Cobello says, your business plan should have a clear focus and goal in mind, because everything else will build off this cornerstone.

“Many people don’t realize how important business plans are for the health of their company,” she says. “Set aside time to make this a priority for your business, and make sure to keep it updated as you grow.”

7 Different Types of Business Plans Explained

11 min. read

Updated April 10, 2024

Business plans go by many names: Strategic plans, traditional plans , operational plans, feasibility plans, internal plans, growth plans, and more.

Different situations call for different types of plans.

But what makes each type of plan unique? And why should you consider one type over another?

In this article, we’ll uncover a quick process to find the right type of business plan, along with an overview of each option.

Let’s help you find the right planning format.

- What type of business plan do you need?

The short answer is… it depends.

Your current business stage, intended audience, and how you’ll use the plan will all impact what format works best.

Remember, just the act of planning will improve your chances of success . It’s important to land on an option that will support your needs. Don’t get too hung up on making the right choice and delay writing your plan.

So, how do you choose?

1. Know why you need a business plan

What are you creating a business plan for ? Are you pitching to potential investors? Applying for a loan? Trying to understand if your business idea is feasible?

You may need a business plan for one or multiple reasons. What you intend to do with it will inform what type of plan you need.

For example: A more robust and detailed plan may be necessary if you seek investment . But a shorter format could be more useful and less time-consuming if you’re just testing an idea.

2. Become familiar with your options

You don’t need to become a planning expert and understand every detail about every type of plan. You just need to know the basics:

- What makes this type of plan unique?

- What are its benefits?

- What are its drawbacks?

- Which types of businesses typically use it?

By taking the time to review, you’ll understand what you’re getting into and be more likely to complete your plan. Plus, you’ll come away with a document built with your use case(s) in mind—meaning you won’t have to restart to make it a valuable tool.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Start small and grow

When choosing a business plan format, a good tactic is to opt for a shorter option and build from there. You’ll save time and effort and still come away with a working business plan.

Plus, you’ll better understand what further planning you may need to do. And you won’t be starting from scratch.

Read More: How to identify the right type of plan for your business

Again, the type of business plan you need fully depends on your situation and use case. But running through this quick exercise will help you narrow down your options.

Now let’s look at the common business plan types you can choose from.

- Traditional business plan

The traditional (or standard) business plan is an in-depth document covering every aspect of your business. It’s the most common plan type you’ll come across.

A traditional business plan is broken up into 10 sections:

- Executive summary

- Description of products and services

- Market analysis

- Competitive analysis

- Marketing and sales plan

- Business operations

- Key milestones and metrics

- Organization and management team

- Financial plan

- Appendix

Why use this type of plan?

A traditional business plan is best for anyone approaching specific business planning events—such as presenting a business plan to a bank or investor for funding.

A traditional plan can also be useful if you need to add more details around specific business areas.

For example: You start as a solopreneur and don’t immediately need to define your team structure. But eventually you hit a threshold where you need more staff in order to keep growing. A great way to explore which roles you need and how they will function is by fleshing out the organization and management section .

That’s the unseen value of a more detailed plan like this. While you can follow the structure outlined above and create an in-depth plan ready for funding, you can also choose which sections to prioritize.

Read More: How to write a traditional business plan

- One-page plan

The one-page business plan is a simplified (but just as useful) version of a traditional business plan. It follows the same structure, but is far easier to create. It can even be used as a pitch document.

Here’s how you’ll organize information when using a one-page plan:

- Value proposition

- Market need

- Your solution

- Competition

- Target market

- Sales and marketing

- Budget and sales goals

- Team summary

- Key partners

- Funding needs

A one-page plan is faster and easier to assemble than a traditional plan. You can write a one-page plan in as little as 30 minutes .

You’ll still cover the crucial details found in a traditional plan, but in a more manageable format.

So, if you’re exploring a business idea for the first time or updating your strategy—a one-page plan is ideal. You can review and update your entire plan in just a few minutes.

Applying for a loan with this type of plan probably wouldn’t make sense. Lenders typically want to see a more detailed plan to accurately assess potential risk.

However, it is a great option to send to investors.

“Investors these days are much less likely to look at a detailed plan,” says Palo Alto Software COO Noah Parsons. “An executive summary or one-page plan, pitch presentation, and financials are all a VC is likely to look at.”

Creating a more detailed plan is as much about being prepared as anything else. If you don’t dig into everything a traditional plan covers, you’ll struggle to land your pitch .

If you don’t intend to seek funding, a one-page plan is often all you need. The key is regularly revisiting it to stay on top of your business.

Let’s explore two unique processes to help you do that:

Read More: How to write a one-page business plan

Lean planning process

Lean planning is a process that uses your one-page plan as a testing tool. The goal is to create a plan and immediately put it into action to see if your ideas actually work. You’ll typically be focusing on one (or all) of the following areas:

- Strategy – What you will do

- Tactics – How you will do it

- Business Model – How you make money

- Schedule – Who is responsible and when will it happen

Why use this process?

Lean planning is best for businesses that need to move fast, test assumptions, revise, and get moving again. It’s short and simple, and meant to get everyone on the same page as quickly as possible.

That’s why it’s so popular for startups. They don’t necessarily need a detailed plan, since they’re mostly focused on determining whether or not they have a viable business idea .

The only drawback is that this planning process is built primarily around early-stage businesses. It can be a useful tool for established businesses looking to test a strategy, but it may not be as helpful for ongoing management.

Read More: The fundamentals of lean planning

Growth planning

Growth planning is a financials-focused planning process designed to help you make quick and strategic decisions.

Again, it starts with a one-page plan outlining your strategy, tactics, business model, and schedule. The next step is to create a working financial forecast that includes projected sales, expenses, and cash flows.

From there, you run your business.

As you go, track your actual financial performance and carve out time to compare it to your forecasts . If you spot any differences, these discrepancies may indicate problems or opportunities that call for adjusting your current strategy.

Growth planning combines the simplicity of the one-page plan and the speed of lean planning, with the power of financial forecasting.

This makes the process useful for every business stage and even allows you to skip to the forecasting step if you already have a plan.

With growth planning, you’ll:

- Regularly revisit your financials

- Better understand how your business operates

- Make quick and confident decisions

This process focuses on growing your business. If diving into your financials isn’t a priority right now, that’s okay. Start with a one-page plan instead, and revisit growth planning when you’re ready.

Read More: How to write a growth-oriented business plan

- Internal plan

Sometimes you just need a business plan that works as an internal management tool.

Something to help you:

- Set business goals

- Provide a high-level overview of operations

- Prepare to create budgets and financial projections

You don’t need an overly long and detailed business plan for this. Just a document that is easy to create, useful for developing or revisiting your strategy, and able to get everyone up to speed.

The internal plan is a great option if you’re not planning to present your plan to anyone outside your business. Especially if you’re an up-and-running business that may have created a plan previously. You might just need something simple for day-to-day use.

Read More: 8 steps to write a useful internal business plan

- 5-year business plan

Some investors or stakeholders may request a long-term plan stretching up to five years. They typically want to understand your vision for the future and see your long-term goals or milestones.

To be honest, creating a detailed long-term business plan is typically a waste of time. There are a few exceptions:

- A long-term plan is specifically asked for

- You want to outline your long-term vision

- Real estate development

- Medical product manufacturing

- Transportation, automotive, aviation, or aerospace development

The reality is, you can’t predict what will happen in the next month, let alone the next one, three, or five years.

So, when creating a long-term plan, don’t dig too deep into the details. Focus on establishing long-term goals , annual growth targets, and aspirational milestones you’d like to hit.

Then supplement these with a more focused one-page plan that actually describes your current business, which you can use in your business right now.

Read More: How to write a five-year business plan

- Nonprofit business plan

A nonprofit business plan is not too different from a traditional plan. You should still cover all of the sections I listed above to help you build a sustainable business.

The main differences in a nonprofit plan are tied to funding and awareness. You need to account for:

- Fundraising sources and activities.

- Alliances and partnerships.

- Promotion and outreach strategies.

You also need to set goals, track performance, and demonstrate that you have the right team to run a fiscally healthy organization. You’re just not pursuing profits, you’re trying to fulfill a mission. But you cannot serve your community if your organization isn’t financially stable.

If you can use your business plan to show that you’re a well-organized nonprofit organization, you are more likely to attract donors and convince investors to provide funding.

Read More: How to write a nonprofit business plan

Resources to help write your business plan

Don’t get too hung up on the type of business plan you choose. Remember, you can always start small and expand if you need to.

To help you do that, I recommend downloading our free one-page business plan template . It’s especially useful if you’re exploring an idea and need a quick way to document how your business will operate.

If you know you’ll pursue funding, download our free traditional business plan template . It’s already in an SBA-lender-approved format and provides detailed instructions for each section. And if you want to explore other options, check out our roundup of the 8 best business plan templates you can download for free.

Lastly, check out our library of over 550 sample business plans if you need inspiration. These can provide specific insight into what you should focus on in a given industry.

Remember, just by deciding to write a business plan, you are increasing your likelihood of success. Pick a format and start writing!

Types of business plans FAQ

Which type of planning should be done for a business?

The type of planning fully depends on your business stage and how you intend to use the plan. Generally, whatever format you choose should help you outline your strategy, business model, tactics, and timeline.

How many types of business plans are there?

There are seven common types of business plans, including: traditional, one-page, lean, growth, internal, 5-year, and nonprofit plans.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- Plan writing resources

Related Articles

10 Min. Read

How to Write the Company Overview for a Business Plan

7 Min. Read

5 Consequences of Skipping a Business Plan

5 Min. Read

How to Write a Business Plan in Under an Hour

13 Min. Read

How to Write a Nonprofit Business Plan

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

Business Plan Example and Template

Learn how to create a business plan

What is a Business Plan?

A business plan is a document that contains the operational and financial plan of a business, and details how its objectives will be achieved. It serves as a road map for the business and can be used when pitching investors or financial institutions for debt or equity financing .

A business plan should follow a standard format and contain all the important business plan elements. Typically, it should present whatever information an investor or financial institution expects to see before providing financing to a business.

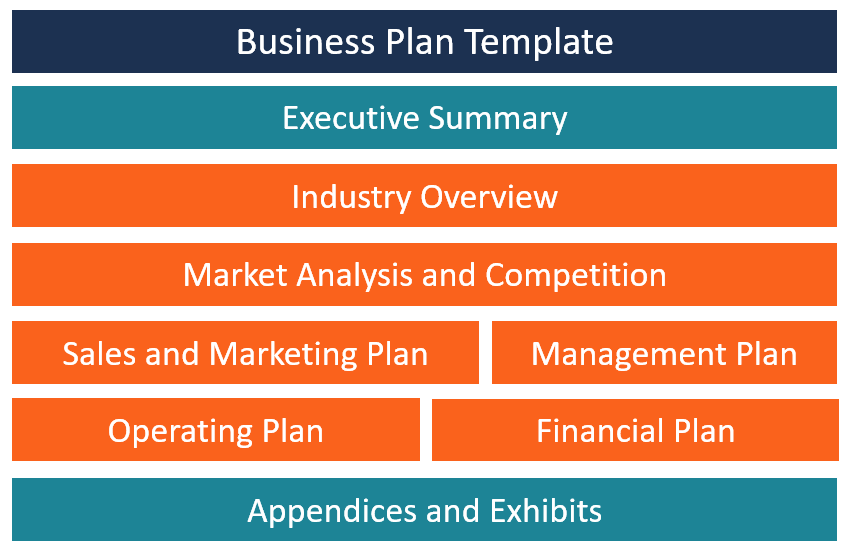

Contents of a Business Plan

A business plan should be structured in a way that it contains all the important information that investors are looking for. Here are the main sections of a business plan:

1. Title Page

The title page captures the legal information of the business, which includes the registered business name, physical address, phone number, email address, date, and the company logo.

2. Executive Summary

The executive summary is the most important section because it is the first section that investors and bankers see when they open the business plan. It provides a summary of the entire business plan. It should be written last to ensure that you don’t leave any details out. It must be short and to the point, and it should capture the reader’s attention. The executive summary should not exceed two pages.

3. Industry Overview

The industry overview section provides information about the specific industry that the business operates in. Some of the information provided in this section includes major competitors, industry trends, and estimated revenues. It also shows the company’s position in the industry and how it will compete in the market against other major players.

4. Market Analysis and Competition

The market analysis section details the target market for the company’s product offerings. This section confirms that the company understands the market and that it has already analyzed the existing market to determine that there is adequate demand to support its proposed business model.

Market analysis includes information about the target market’s demographics , geographical location, consumer behavior, and market needs. The company can present numbers and sources to give an overview of the target market size.

A business can choose to consolidate the market analysis and competition analysis into one section or present them as two separate sections.

5. Sales and Marketing Plan

The sales and marketing plan details how the company plans to sell its products to the target market. It attempts to present the business’s unique selling proposition and the channels it will use to sell its goods and services. It details the company’s advertising and promotion activities, pricing strategy, sales and distribution methods, and after-sales support.

6. Management Plan

The management plan provides an outline of the company’s legal structure, its management team, and internal and external human resource requirements. It should list the number of employees that will be needed and the remuneration to be paid to each of the employees.

Any external professionals, such as lawyers, valuers, architects, and consultants, that the company will need should also be included. If the company intends to use the business plan to source funding from investors, it should list the members of the executive team, as well as the members of the advisory board.

7. Operating Plan

The operating plan provides an overview of the company’s physical requirements, such as office space, machinery, labor, supplies, and inventory . For a business that requires custom warehouses and specialized equipment, the operating plan will be more detailed, as compared to, say, a home-based consulting business. If the business plan is for a manufacturing company, it will include information on raw material requirements and the supply chain.

8. Financial Plan

The financial plan is an important section that will often determine whether the business will obtain required financing from financial institutions, investors, or venture capitalists. It should demonstrate that the proposed business is viable and will return enough revenues to be able to meet its financial obligations. Some of the information contained in the financial plan includes a projected income statement , balance sheet, and cash flow.

9. Appendices and Exhibits

The appendices and exhibits part is the last section of a business plan. It includes any additional information that banks and investors may be interested in or that adds credibility to the business. Some of the information that may be included in the appendices section includes office/building plans, detailed market research , products/services offering information, marketing brochures, and credit histories of the promoters.

Business Plan Template

Here is a basic template that any business can use when developing its business plan:

Section 1: Executive Summary

- Present the company’s mission.

- Describe the company’s product and/or service offerings.

- Give a summary of the target market and its demographics.

- Summarize the industry competition and how the company will capture a share of the available market.

- Give a summary of the operational plan, such as inventory, office and labor, and equipment requirements.

Section 2: Industry Overview

- Describe the company’s position in the industry.

- Describe the existing competition and the major players in the industry.

- Provide information about the industry that the business will operate in, estimated revenues, industry trends, government influences, as well as the demographics of the target market.

Section 3: Market Analysis and Competition

- Define your target market, their needs, and their geographical location.

- Describe the size of the market, the units of the company’s products that potential customers may buy, and the market changes that may occur due to overall economic changes.

- Give an overview of the estimated sales volume vis-à-vis what competitors sell.

- Give a plan on how the company plans to combat the existing competition to gain and retain market share.

Section 4: Sales and Marketing Plan

- Describe the products that the company will offer for sale and its unique selling proposition.

- List the different advertising platforms that the business will use to get its message to customers.

- Describe how the business plans to price its products in a way that allows it to make a profit.

- Give details on how the company’s products will be distributed to the target market and the shipping method.

Section 5: Management Plan

- Describe the organizational structure of the company.

- List the owners of the company and their ownership percentages.

- List the key executives, their roles, and remuneration.

- List any internal and external professionals that the company plans to hire, and how they will be compensated.

- Include a list of the members of the advisory board, if available.

Section 6: Operating Plan

- Describe the location of the business, including office and warehouse requirements.

- Describe the labor requirement of the company. Outline the number of staff that the company needs, their roles, skills training needed, and employee tenures (full-time or part-time).

- Describe the manufacturing process, and the time it will take to produce one unit of a product.

- Describe the equipment and machinery requirements, and if the company will lease or purchase equipment and machinery, and the related costs that the company estimates it will incur.

- Provide a list of raw material requirements, how they will be sourced, and the main suppliers that will supply the required inputs.

Section 7: Financial Plan

- Describe the financial projections of the company, by including the projected income statement, projected cash flow statement, and the balance sheet projection.

Section 8: Appendices and Exhibits

- Quotes of building and machinery leases

- Proposed office and warehouse plan

- Market research and a summary of the target market

- Credit information of the owners

- List of product and/or services

Related Readings

Thank you for reading CFI’s guide to Business Plans. To keep learning and advancing your career, the following CFI resources will be helpful:

- Corporate Structure