We earn commissions if you shop through the links below. Read more

Repo Business

Back to All Business Ideas

Turning Repossession into Profits: Start Your Repo Business

Written by: Carolyn Young

Carolyn Young is a business writer who focuses on entrepreneurial concepts and the business formation. She has over 25 years of experience in business roles, and has authored several entrepreneurship textbooks.

Edited by: David Lepeska

David has been writing and learning about business, finance and globalization for a quarter-century, starting with a small New York consulting firm in the 1990s.

Published on March 25, 2022 Updated on July 21, 2024

Investment range

$4,750 - $9,500

Revenue potential

$65,000 - $325,000 p.a.

Time to build

1 – 3 months

Profit potential

$52,000 - $97,500 p.a.

Industry trend

Consider these crucial factors when launching your repo business:

- Licenses — Many states require a repossession license or permit to operate legally. Check with your state’s regulatory agency for specific requirements.

- State and federal laws : Stay informed about federal, state, and local laws regulating the repossession industry, including the Fair Debt Collection Practices Act (FDCPA) .

- Vehicles — Invest in reliable tow trucks and recovery vehicles suited for various types of repossessions.

- Services — Decide on the types of repossession services you will offer, such as vehicle repossession, equipment repossession, boat repossession, or real estate foreclosure assistance.

- Repossession tools — Equip your team with tools like GPS tracking devices, lockout kits, and camera systems.

- Register your business — A limited liability company (LLC) is the best legal structure for new businesses because it is fast and simple. Form your business immediately using ZenBusiness LLC formation service or hire one of the best LLC services on the market.

- Legal business aspects — Register for taxes, open a business bank account, and get an EIN .

- Partnerships — Build relationships with local law enforcement, towing companies, and financial institutions to enhance your services.

- Repossession software — Use repossession software to manage assignments, track progress, and maintain detailed records.

Interactive Checklist at your fingertips—begin your repo business today!

You May Also Wonder:

Is a repo business profitable?

Yes, a repo business can be profitable. You can earn a lot and your ongoing expenses are low. If you prove yourself to be reliable, you’ll get repeat business from the banks and lenders you work with.

How do I find repo clients?

To find repo clients, network with banks, lending institutions, credit unions, and auto dealerships that may require repossession services. Attend industry events, join professional associations, and build relationships with key contacts in the financial and lending industry.

Is repo a safe job?

Repo work can come with inherent risks and challenges, and it is important to prioritize safety in this line of work. While every repossession job may differ, there is potential for encountering difficult or confrontational individuals.

How do banks use repo?

Banks may use repossession businesses as a means to recover collateral when borrowers default on their loans. When a borrower fails to make payments on a financed asset, such as a car or property, the bank may contract with a repossession business to locate and repossess the asset.

How can I handle the documentation and paperwork involved in the repossession process?

Handling the documentation and paperwork involved in the repossession process requires organization and attention to detail. Establish a standardized process for documenting each repossession, including detailed reports, photographs, and inventory of repossessed assets. Ensure compliance with legal requirements and maintain accurate records of repossession notices, contracts, and communications with clients and debtors.

Step 1: Decide if the Business Is Right for You

Pros and cons.

Starting a repo business has pros and cons to consider before decided if it’s right for you.

- Good Money – Make $200 to $300 per repossessed item

- Flexibility – Work as much or as little as you want

- High Demand – Banks and lenders always need repo services

- Danger – People will not be happy to see you

- Licensing – States have various licensing requirements

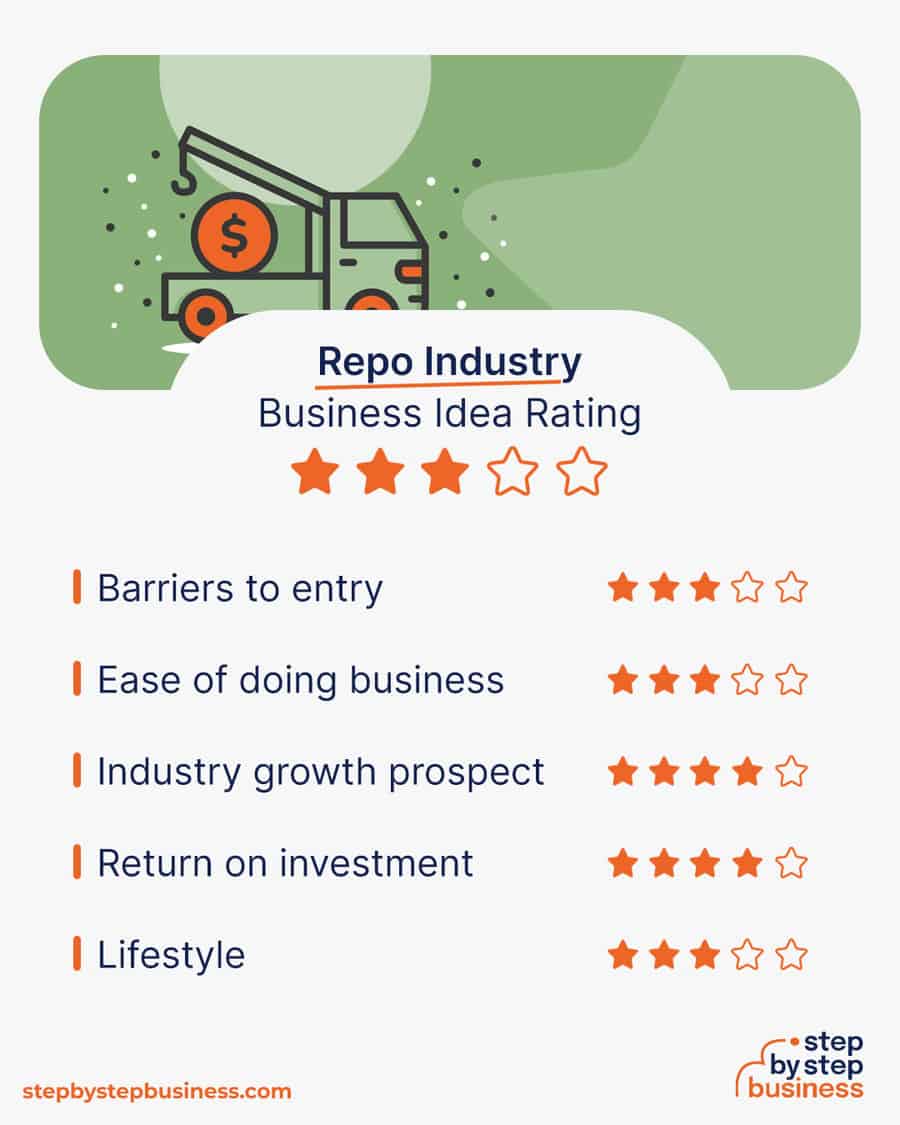

Repo industry trends

Industry size and growth.

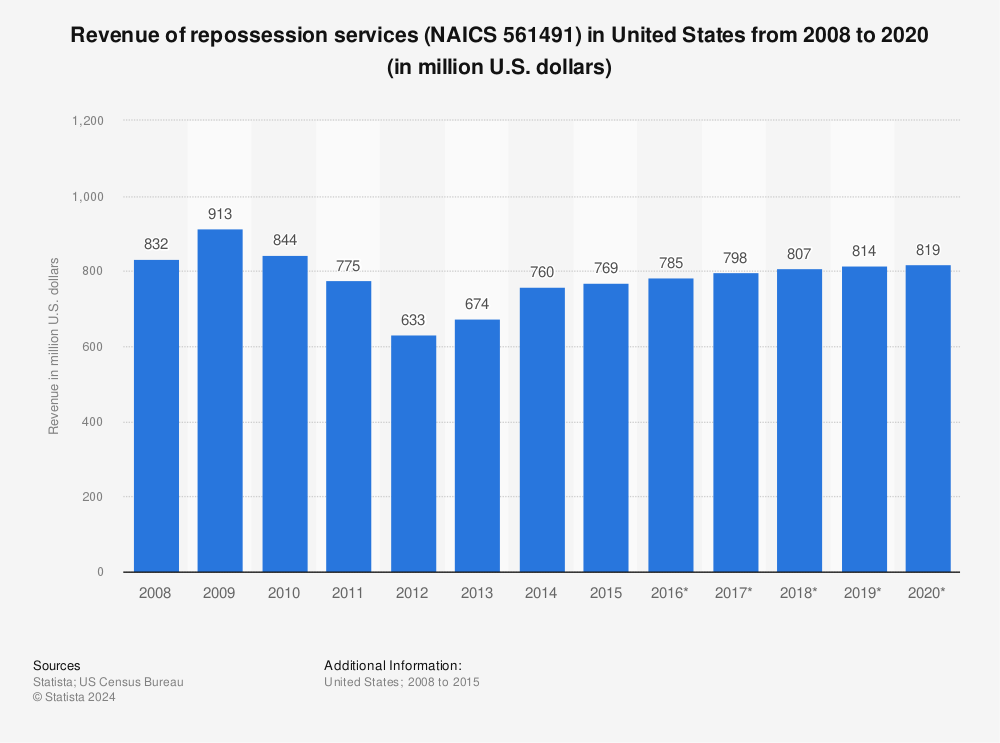

- Industry size and past growth – The US repossession industry was worth $2 billion in 2021 after 4% annual growth the previous five years.(( https://www.ibisworld.com/united-states/market-research-reports/repossession-services-industry/ ))

- Growth forecast – The US repo industry is expected to grow steadily for the next five years.

- Number of businesses – In 2021, 10,065 repossession businesses were operating in the US.

- Number of people employed – In 2021, the US repossession industry employed 18,234 people.

Trends and challenges

Trends in the repo industry include:

- The financial difficulties faced by many during the pandemic are driving up repo demand, particularly as economic relief comes to an end.

- Sharp demand for used cars is driving up the value of repossessed cars, making lenders more likely to repossess to recover their money.

Challenges in the repo industry include:

- Danger is a constant problem for repo workers. Car owners, for instance, often mistake the repo person for a thief and try to stop them by violent means.

- For repo businesses, economic recovery at any given time is bad news for business.

How much does it cost to start a repo business?

Startup costs for a repo business range from $4,500 – $9,500. The main costs are a down payment on a tow truck and a website. You’ll also need to meet the licensing requirements of your state.

In some states, you’ll just need a commercial driver’s license (CDL), while in others you’ll need a repossession license. To get a repo license, states require a certain number of educational hours and some repo experience. Check with your state for specific requirements. You’ll also need to check local repossession business laws.

| Start-up Costs | Ballpark Range | Average |

|---|---|---|

| Setting up a business name and corporation | $150 - $200 | $175 |

| Business licenses and permits | $100 - $300 | $200 |

| Insurance | $100-$300 | $200 |

| Business cards and brochures | $200 - $300 | $250 |

| Website setup | $1,000 - $3,000 | $2,000 |

| Tow truck down payment | $3,000 - $5,000 | $4,000 |

| Repossession and CDL licensing | $200 - $400 | $300 |

| Total | $4,750 - $9,500 | $7,125 |

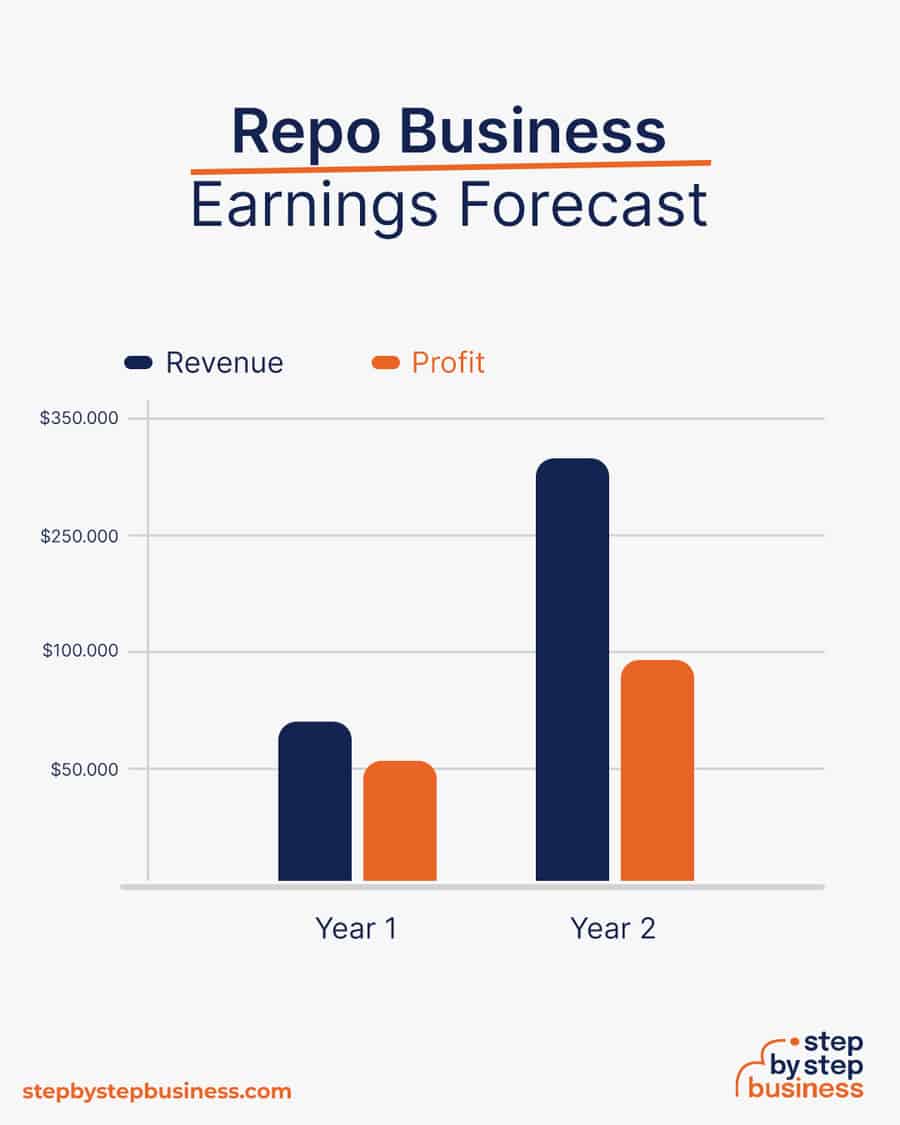

How much can you earn from a repo business?

The average price to repo a car is about $200, and larger, more valuable items can cost more. If you have to track down the person and the items, you can add fees of about $25 per hour. These calculations will assume an average per-repo price of $250. Your profit margin should be about 80%.

In your first year or two, you could work from home and repo five items per week, bringing in $65,000 in annual revenue. This would mean $52,000 in profit, assuming that 80% margin. As you get repeat customers, you could do 25 items per week. At this stage, you’d rent a commercial space and hire staff, reducing your profit margin to around 30%. With annual revenue of $325,000, you’d make a tidy profit of $97,500.

What barriers to entry are there?

There are a few barriers to entry for a repo business. Your biggest challenges will be:

- The licensing requirements of the state

- Connecting with the banks and lenders who will be your clients

Related Business Ideas

How to Launch Your Own Profitable Car Hauling Business

How to Start a Hot Shot Trucking Business in 13 Steps

How to Start a Box Truck Business in 13 Steps

Step 2: hone your idea.

Now that you know what’s involved in starting a repo business, it’s a good idea to hone your concept in preparation to enter a competitive market.

Market research will give you the upper hand, even if you’re already positive that you have a perfect product or service. Conducting market research is important, because it can help you understand your customers better, who your competitors are, and your business landscape.

Why? Identify an opportunity

Research repo businesses in your area to examine their services, price points, and customer reviews. You’re looking for a market gap to fill. For instance, maybe the local market is missing a repo business that focuses on trucks, boats, or furniture and appliances, or a repo business that offers investigative services to locate buyers.

You might consider targeting a niche market by specializing in a certain aspect of your industry, such as repo for car dealers.

This could jumpstart your word-of-mouth marketing and attract clients right away.

What? Determine your services

In addition to repossession services, you could offer investigation services. Since you’ll have a tow truck, you could also offer tow truck services when you don’t have repo work. You’d be a combination repo/tow truck business, which would bring in more revenue.

To learn more about tow truck services, read this Step By Step article on how to start a towing business .

How much should you charge for repo services?

The average price for a repo is $200 plus $25 an hour for investigative services. When you’re working by yourself, your ongoing costs will be limited to your tow truck payment, fuel, and insurance. You should aim for a profit margin of 80%.

Once you know your costs, you can use this Step By Step profit margin calculator to determine your mark-up and final price points. Remember, the prices you use at launch should be subject to change if warranted by the market.

Who? Identify your target market

Your target market will be banks, lenders, and retailers that do their own financing. You can find them on LinkedIn, but your best bet is to call them directly. You can find them on Google or Yelp.

Where? Choose your business premises

In the early stages, you may want to run your business from home to keep costs low. But as your business grows, you’ll likely need to hire workers for various roles and may need to rent out an office. You can find commercial space to rent in our area on sites such as Craigslist , Crexi , and Instant Offices .

When choosing a commercial space, you may want to follow these rules of thumb:

- Central location accessible via public transport

- Ventilated and spacious, with good natural light

- Flexible lease that can be extended as your business grows

- Ready-to-use space with no major renovations or repairs needed

Step 3: Brainstorm a Repo Company Name

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- Name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords, such as “repo” or “repossession”, boosts SEO

- Name should allow for expansion, for ex: “Elite Repo Group” over “RV Repo Pros”

- A location-based name can help establish a strong connection with your local community and help with the SEO but might hinder future expansion

Once you’ve got a list of potential names, visit the website of the US Patent and Trademark Office to make sure they are available for registration and check the availability of related domain names using our Domain Name Search tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Find a Domain

Powered by GoDaddy.com

Finally, make your choice among the names that pass this screening and go ahead with domain registration and social media account creation. Your business name is one of the key differentiators that sets your business apart. Once you pick your company name, and start with the branding, it is hard to change the business name. Therefore, it’s important to carefully consider your choice before you start a business entity.

Step 4: Create a Repo Business Plan

Here are the key components of a business plan:

- Executive Summary: Provide a concise overview of your repossession (repo) business, highlighting your service model, target market, and competitive edge.

- Business Overview: Outline the primary function of your repo business, focusing on asset recovery services for financial institutions and private lenders.

- Product and Services: Describe the specific types of repossession services you offer, such as vehicles, equipment, or property recovery.

- Market Analysis: Assess the demand for repossession services within the regions you plan to operate and the prevailing economic conditions influencing the market.

- Competitive Analysis: Evaluate other repo companies in the area, identifying your business’s unique approach or services that will provide an advantage.

- Sales and Marketing: Explain your strategy for building relationships with lenders and marketing your services to potential clients.

- Management Team: Highlight the qualifications and experience of your management team, emphasizing expertise in legal procedures and asset recovery.

- Operations Plan: Detail your operational procedures for repossession, including client agreements, asset location, and recovery methods.

- Financial Plan: Outline your startup costs, pricing model, and financial projections, considering the average number of repossessions and operating expenses.

- Appendix: Include any supporting documentation, such as licenses, contracts, insurance policies, or partnership agreements that underpin your business plan.

If you’ve never created a business plan, it can be an intimidating task. You might consider hiring a business plan specialist to create a top-notch business plan for you.

Step 5: Register Your Business

Registering your business is an absolutely crucial step — it’s the prerequisite to paying taxes, raising capital, opening a bank account, and other guideposts on the road to getting a business up and running.

Plus, registration is exciting because it makes the entire process official. Once it’s complete, you’ll have your own business!

Choose where to register your company

Your business location is important because it can affect taxes, legal requirements, and revenue. Most people will register their business in the state where they live, but if you’re planning to expand, you might consider looking elsewhere, as some states could offer real advantages when it comes to repossession businesses.

If you’re willing to move, you could really maximize your business! Keep in mind, it’s relatively easy to transfer your business to another state.

Choose your business structure

Business entities come in several varieties, each with its pros and cons. The legal structure you choose for your repo business will shape your taxes, personal liability, and business registration requirements, so choose wisely.

Here are the main options:

- Sole Proprietorship – The most common structure for small businesses makes no legal distinction between company and owner. All income goes to the owner, who’s also liable for any debts, losses, or liabilities incurred by the business. The owner pays taxes on business income on his or her personal tax return.

- General Partnership – Similar to a sole proprietorship, but for two or more people. Again, owners keep the profits and are liable for losses. The partners pay taxes on their share of business income on their personal tax returns.

- Limited Liability Company (LLC) – Combines the characteristics of corporations with those of sole proprietorships or partnerships. Again, the owners are not personally liable for debts.

- C Corp – Under this structure, the business is a distinct legal entity and the owner or owners are not personally liable for its debts. Owners take profits through shareholder dividends, rather than directly. The corporation pays taxes, and owners pay taxes on their dividends, which is sometimes referred to as double taxation.

- S Corp – An S-Corporation refers to the tax classification of the business but is not a business entity. An S-Corp can be either a corporation or an LLC , which just need to elect to be an S-Corp for tax status. In an S-Corp, income is passed through directly to shareholders, who pay taxes on their share of business income on their personal tax returns.

We recommend that new business owners choose LLC as it offers liability protection and pass-through taxation while being simpler to form than a corporation. You can form an LLC in as little as five minutes using an online LLC formation service. They will check that your business name is available before filing, submit your articles of organization , and answer any questions you might have.

Form Your LLC

Choose Your State

We recommend ZenBusiness as the Best LLC Service for 2024

Step 6: Register for Taxes

The final step before you’re able to pay taxes is getting an Employer Identification Number , or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business will operate in a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

The IRS website also offers a tax-payers checklist , and taxes can be filed online.

It is important to consult an accountant or other professional to help you with your taxes to ensure you’re completing them correctly.

Step 7: Fund your Business

Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan .

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Friends and Family: Reach out to friends and family to provide a business loan or investment in your concept. It’s a good idea to have legal advice when doing so because SEC regulations apply.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings or the sale of property or other assets.

Bank and SBA loans are probably the best option, other than friends and family, for funding a repo business.

Step 8: Apply for Repo Business Licenses and Permits

Starting a repo business requires obtaining a number of licenses and permits from local, state, and federal governments.

In some states, you’ll just need a commercial driver’s license (CDL), and in others, you’ll need a repossession license. To get a repo license, states will require a certain number of educational hours, and some require repo experience. Check with your state for specific requirements. You’ll also need to check local repossession business laws.

Federal regulations, licenses, and permits associated with starting your business include doing business as (DBA), health licenses and permits from the Occupational Safety and Health Administration ( OSHA ), trademarks, copyrights, patents, and other intellectual properties, as well as industry-specific licenses and permits.

You may also need state-level and local county or city-based licenses and permits. The license requirements and how to obtain them vary, so check the websites of your state, city, and county governments or contact the appropriate person to learn more.

You could also check this SBA guide for your state’s requirements, but we recommend using MyCorporation’s Business License Compliance Package . They will research the exact forms you need for your business and state and provide them to ensure you’re fully compliant.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

Step 9: Open a Business Bank Account

Before you start making money, you’ll need a place to keep it, and that requires opening a bank account .

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you’re running your repo business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer accounts tailored for businesses — just inquire at your preferred bank to learn about their rates and features.

Banks vary in terms of offerings, so it’s a good idea to examine your options and select the best plan for you. Once you choose your bank, bring in your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and other legal documents and open your new account.

Step 10: Get Business Insurance

Business insurance is an area that often gets overlooked yet it can be vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of the above insurance types.

Step 11: Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

Being an entrepreneur often means wearing many hats, from marketing to sales to accounting, which can be overwhelming. Fortunately, many websites and digital tools are available to help simplify many business tasks.

You may want to use industry-specific software, such as Smart Repo , Tracers , or Repo Systems to manage your contracts, invoicing, and payments.

- Popular web-based accounting programs for smaller businesses include Quickbooks , Freshbooks , and Xero .

- If you’re unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Here are some powerful marketing strategies for your future business:

- Local Partnerships: Collaborate with local auto repair shops, towing companies, and financial institutions to establish referral partnerships, increasing your reach within the community.

- Targeted Direct Mail Campaigns: Utilize direct mail to reach out to car dealerships, banks, and credit unions in your area, emphasizing your expertise in efficient and secure vehicle repossessions.

- Community Events and Sponsorships: Participate in or sponsor local events and community gatherings to raise awareness about your Repo Business, fostering trust and recognition among potential clients.

- Educational Seminars: Host seminars or webinars to educate financial institutions and car dealerships about the repossession process, showcasing your expertise and building credibility.

- Social Media Engagement: Leverage social media platforms to share success stories, industry insights, and engage with your audience, creating a human connection and building trust in your services.

- Discounts and Promotions: Offer special promotions or discounts to financial institutions for bulk services or to clients who refer others, encouraging loyalty and word-of-mouth referrals.

- Vehicle Recovery Success Stories: Showcase real-life success stories on your website and marketing materials to highlight your track record and instill confidence in your ability to recover vehicles efficiently.

- Specialized Marketing Collateral: Design informative brochures and business cards emphasizing your specialized skills, making it easy for potential clients to understand the unique value your Repo Business brings.

- Online Reviews and Testimonials: Encourage satisfied clients to leave positive reviews on online platforms, enhancing your online reputation and serving as social proof for your business’s reliability.

- GPS Technology Integration: Highlight the use of advanced GPS technology in your repossession process in marketing materials, emphasizing your commitment to efficient and precise vehicle recovery.

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism. They are unlikely to find your website, however, unless you follow Search Engine Optimization ( SEO ) practices. These are steps that help pages rank higher in the results of top search engines like Google.

You can create your own website using services like WordPress , Wix , or Squarespace . This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

Focus on USPs

Unique selling propositions, or USPs, are the characteristics of a product or service that sets it apart from the competition. Customers today are inundated with buying options, so you’ll have a real advantage if they are able to quickly grasp how your repo business meets their needs or wishes. It’s wise to do all you can to ensure your USPs stand out on your website and in your marketing and promotional materials, stimulating buyer desire.

Global pizza chain Domino’s is renowned for its USP: “Hot pizza in 30 minutes or less, guaranteed.” Signature USPs for your repo business could be:

- Professional repo services to recover your loan money fast

- Truck repossessions – we can handle the load

- We track down valuables quickly to return your money to you

You may not like to network or use personal connections for business gain. But your personal and professional networks likely offer considerable untapped business potential. Maybe that Facebook friend you met in college is now running a repo business, or a LinkedIn contact of yours is connected to dozens of potential clients. Maybe your cousin or neighbor has been working in repo for years and can offer invaluable insight and industry connections.

The possibilities are endless, so it’s a good idea to review your personal and professional networks and reach out to those with possible links to or interest in repossession. You’ll probably generate new customers or find companies with which you could establish a partnership.

Step 12: Build Your Team

If you’re starting out small from a home office, you may not need any employees. But as your business grows, you will likely need workers to fill various roles. Potential positions for a repo business include:

- Repo Drivers – repo vehicles and other items

- General Manager – scheduling, accounting

- Marketing Lead – SEO strategies, social media

At some point, you may need to hire all of these positions or simply a few, depending on the size and needs of your business. You might also hire multiple workers for a single role or a single worker for multiple roles, again depending on need.

Free-of-charge methods to recruit employees include posting ads on popular platforms such as LinkedIn, Facebook, or Jobs.com. You might also consider a premium recruitment option, such as advertising on Indeed , Glassdoor , or ZipRecruiter . Further, if you have the resources, you could consider hiring a recruitment agency to help you find talent.

Step 13: Run a Repo Business – Start Making Money!

If you want a business that might offer a little excitement, a repo business may be just the ticket. Auto repossession and other large item repossession is a large industry, worth $2 billion and counting. You can make a good living, have some flexibility, and run your business from home for a small investment. You’ll have to jump through a few licensing hoops and get a tow truck, but it will pay off in the end.

Now that you understand the business, you’re ready to get on the road to launching your new repo company!

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

- Decide if the Business Is Right for You

- Hone Your Idea

- Brainstorm a Repo Company Name

- Create a Repo Business Plan

- Register Your Business

- Register for Taxes

- Fund your Business

- Apply for Repo Business Licenses and Permits

- Open a Business Bank Account

- Get Business Insurance

- Prepare to Launch

- Build Your Team

- Run a Repo Business - Start Making Money!

Subscribe to Our Newsletter

Featured resources.

16 Best Truck Business Ideas for Steady Income

David Lepeska

Published on December 4, 2022

Do you own a truck, or are thinking about buying one, and wondering whether it could help you launch a successful business? You’ve come to the ...

57 In-Demand Service Business Ideas You Can Launch Today

Published on December 1, 2022

The services sector is undoubtedly the biggest economic sector in the US as it accounts for nearly 70% of the country’s gross domestic product. It ...

26 Profitable Automobile/Car Business Ideas

Esther Strauss

Published on July 21, 2022

From car washing to limo services, there are countless lucrative business opportunities related to cars. If you’re looking for a business ideathat ...

No thanks, I don't want to stay up to date on industry trends and news.

Please choose a language.

Lift and Tow

Lift and Tow is the Original Inventor of the Truly Hidden Wheel Lift.

How to Start Your Own Repo Business

When it comes to loans, the returns are spotty. For every loan borrower who fulfills his or her payments promptly, there is a borrower who falls behind on payments. The borrower will often fall so far behind that payback becomes impossible. Regardless of whether or not the issue comes down to circumstances beyond the borrower’s control, a debt is a debt, and a contract is a contract . Simply put, you can’t own a product you didn’t pay for with your money.

In such cases, someone must step in and repossess the item that does not belong to the borrower. Enter the repo man—the guy who reclaims the unrepaid investment and hands it over to the lender, who resells the item to recoup the original money.

Table of Contents

How to become a repo man, how to repossess a vehicle, how to handle personal belongings after a repo, beware of temperamental borrowers.

Get My Wheel Lift

The repossession industry is challenging and often profitable because the role of the repo man is tough. You have to be the aggressive, go-getter type of person to succeed in this line of work. A lot of borrowers who have failed to pay off items are in dire financial situations, and you cannot be swayed emotionally when you confront such individuals.

To put it bluntly, the repo man’s job is not for the average person. As such, most lenders prefer to hire third parties to handle such tasks.

And the market for this line of work has been growing in recent years and looks like it will continue to grow. IBIS World reported a 4.2% industry growth for repossession services in the United States from 2016 to 2021. Several factors have influenced this growth, including a strengthening economy and extra confidence in buyers to take out loans to acquire new vehicles. You can expect the repo industry to grow into 2025, so the time is ripe for you to get a piece of the action.

To be a repo man, you also need to be a self-determined self-starter with the initiative to spend hours researching information on borrowers. In some cases, it will only be through persistence that you’ll manage to locate the borrowers in question, so having effective people skills are a plus.

Check the Repo Laws in Your Area

Due to the lucrative nature of the repo industry, anyone with the nerve for this type of work can start a repo business. You don’t even need to have experience to enter into this line of work. However, you do need to have an understanding of how repo laws work within your state. In order to learn how to start a repo company, you first have to comply with all relevant regulations.

Each state has its own interpretation of fair and just repossession. Given the highly litigious nature of lender/borrower fallouts, you must be careful not to break any laws when you involve yourself in these situations.

Regardless of your state, it could take considerable time to acquaint yourself with the complex layers of repossession law. Schedule a meeting with a state employee to discuss the law that will apply to your business. The state worker should help you understand how to operate your business within the law which is a critical step to learning how to become a repo man.

Test the Waters as a Freelancer

As with any industry, you should only commit to a career in repossession with a concrete idea of whether the role will suit your personality and lifestyle. Therefore, before you invest in a repo business startup, enter into the field as a freelancer. This way, you’ll be able to get more of a feel for this line of work and determine if you should become a repo man.

Get Your Finances in Order

Once you’re ready to start your own repo business, you must put out some capital upfront. This means having your finances together before you begin creating your legal business is crucial. Here are some of the items you’ll need:

- A tow truck, if you don’t already have one

- An office space

- Business name

- Business license

- Driver’s License

- Insurance and bonding

- Extra money to cover unexpected startup costs and employee salaries

We recommend having enough money on hand to cover six months’ worth of operating costs. This may seem like a lot of money, but having it can provide peace of mind and ensure you have enough capital for your new business to get up and running.

Set up an Office and Establish Fees

To work as a repo officer, you’ll first need office space to take orders. The space you lease must include a storage yard big enough to accommodate your towing equipment.

You may also be wondering, How much does a repo man make? You’ll also need to establish a service fee to know this for your business. For repo work, the going rate is between $200 and $300.

In cases where you are asked to track down a missing borrower, you will want to charge extra. You’ll need to discuss any additional fees with the clients who ask you to locate delinquent, hard-to-reach borrowers. A typical repossession company will have these charges pre-determined so people know what to expect.

Promote Yourself

You’ll need to hustle to become a successful repo man and establish lasting relationships with clients and potential clients. You can make these connections through auto dealers, trade unions and other associations that occasionally align with the repo industry. You can market yourself online and through brochures, which you could distribute at trade shows.

Send advertisements via email and snail mail to the various entities that could get you clients, such as car dealerships, loan companies, banks and auto rental companies. In preparation for the onslaught of phone calls, set up a telephone database to input the contact information of interested parties.

Get a Business Name and License

Select a name for your company and file a Doing Business As, or DBA, with your state. The name could be direct or vague regarding the focus of your business, but it should be something memorable. As with any self-run business, you’ll need to get a business license, which typically costs between $50 and $60. You’ll also need to renew your license every 12 months.

Create a Repo Business Plan

Draft a business plan that accounts for your marketing and budgetary needs. Draw up a list of all the supplies necessary to operate as a repossession officer. Two of the essential things for any repossession business to have are a flatbed trailer and a semi-truck, which make it possible to tow away large vehicles. Additional crucial components include vehicle attachments, such as a winch or a boom arm.

Include within your budget earmarks for yard space, insurance and a place of operation. If you eventually plan to hire additional offers, determine how much of your budget to earmark for their payroll. To best present your company’s aims to potential clients, write up your business’s mission statement. When searching for how to become a repo man, your repo business plan is a great place to start.

Ensure That Your Driver’s License Permits You to Operate Hauling Vehicles

Part of the legal clearance for operating as a repo officer will include the parameters of your driver’s license. Does your current license permit you to drive semi-trucks with hauling attachments? If not, you must upgrade your driver classification to account for your new profession. If in doubt, you can find all information about this topic — and learn about whether you need to take additional tests — at your local DMV. You will also want to look into how to get a repossession license in your state.

If you hire a team of repo officers, you will also need to ensure that they each have the necessary licenses to operate the types of vehicles that come with this territory.

Buy/Lease Towing Equipment and Apply Company Name/Logo

Now that you have the office space and proper licensing, it’s time to either buy or lease the towing equipment. With your company name determined and a logo designed, have the name and logo painted onto the equipment, along with your URL and contact information.

Get Property/Equipment Insurance and Bonding

To keep yourself safe in an accident, purchase an insurance plan to cover the property with which you do business. Also, purchase a liability policy covering the heavy equipment you’ll be using on the job. Some states require bonding. Check the website for your state government to see whether this will apply to your business.

For banks or lenders to consider you a viable repossession agent, you must have a million-dollar liability policy, which could cost between $1k and $5k per month, depending on your location and insurance history.

Hire Your Team

Whether or not you hire a team of drivers, you will likely need to hire staff to help you around the office. As the clients pour in, you will need to have a secretary to field the calls and file papers as you head out to haul vehicles.

As an alternative to hiring an in-house dispatch fleet, consider hiring independent contractors who rent or lease their hauling vehicles. This way, you can save on vehicle leasing and insurance costs. If you do go this route, make sure that each independent contractor that works for your company is qualified with the proper license classification and insurance.

Get Business Cards/Promo Flyers Made

Have business cards and flyers made for your business. Hire a graphic designer in your local area for the graphics and logo. You can find a graphic designer on your local Craigslist under the “services” section, which will typically feature ads from several seasoned or newly graduated designers looking for work. Rates are generally lower with young designers fresh out of college, eager to begin their careers and build their resumes.

When you discuss the card idea with your designer, decide on something that stands out yet looks professional and appropriate for a repossession business. Make sure that your cards list all relevant contact info in legible type.

Create a Business Website

When everything is set up and running, you’ll need to create a website for your business. Purchase a URL—yourbusinessname.com—and choose a web host. If you are wondering which host to select, click the YouTube topic and watch a few comparison videos on the available options. With the right tools, website design is relatively easy.

Alternatively, hire a web designer to develop your business website. Once again, web designers are easy to find on Craigslist under the “services” section, where young designers are eager for work. Ensure you include the costs of hiring a web designer in your budget.

A critical part of learning how to become a repo man is learning about the repossession process . Vehicle repossession can be a short or long process, depending in part on whether or not the delinquent borrower chooses to be cooperative. In cases where the borrower tries to evade you, it then becomes a matter of how long it takes to pinpoint the whereabouts of the vehicle in question.

Once you verify its location, the repossession of a vehicle primarily consists of the following steps:

- Drive to the location to impound the vehicle.

- Return to your office with the vehicle in tow.

- Run an inventory on the personal possessions left inside the vehicle.

- Assess the condition of the vehicle and write a report.

- Contact the authorities to inform them of the repossession.

- Send an invoice to the lender.

Granted, sometimes it can take months to get to the first of these steps if the borrower goes off the grid for a time. The job duties of a repo agent can vary, but they usually follow the same requirements

After you repossess a vehicle from a delinquent borrower, the party in question is still entitled to the personal belongings they left inside. As you inspect the vehicle, you’ll need to remove any possessions that belong to the borrower. Should the borrower come into your office to reclaim his or her belongings, you’ll need to be present at that time.

Possessions are a thorny issue in the repo business because some delinquent borrowers look for holes in this area. In some cases, a borrower will claim in court that the possessions were stolen when, in fact, the borrower was contacted with a place and time to recollect them. In other cases, a borrower will reclaim his or her possessions but several months later claim that they were stolen by the repo man despite having signed a release form.

It takes a hard-nosed individual to succeed in the repossession business. The majority of delinquent borrowers are not only in dire situations, but some are also psychologically unstable. One expert who has worked as both a prison security supervisor and a repo man observes that unstable characters are encountered just as frequently, if not more often, in the latter profession.

Most people accept the fact that to own and keep a vehicle, you must either buy it with your own money or take out a loan and repay the amount in full. In many cases, delinquent borrowers will convince themselves what they want to believe — that you can have and keep something regardless of whether you can afford it, as long as you want it badly enough. People with this frame of mind are often difficult to level with, and they can become belligerent when confronted with the truth.

When you go to repossess a vehicle, you must prepare for the possibility that the borrower will be uncooperative and possibly combative. As such, you must have the conviction to press on with the job in spite of potential adversity if you wish to be a repo man.

Buy Repo Equipment from Lift and Tow

When people need repo wheel lift equipment , they’ll often buy new towing vehicles, but you can save money by converting a semi-truck with add-on towing equipment. At Lift and Tow, we’ve provided lifting equipment to the repo industry since 1999. To learn more about our Underbody Wheel Lift , Self-Loading Wheel Lift or Super Series , contact us online or call us at 717-496-0839.

Call Us 717-496-0839

10680 B Cumberland Highway Orrstown PA 17244 Sitemap

View Terms and Conditions

Have a Question?

- Business Ideas

- Registered Agents

How to Start a Repo Business in 14 Steps (In-Depth Guide)

Updated: April 3, 2024

BusinessGuru.co is reader-supported. When you buy through links on my site, we may earn an affiliate commission. Learn more

The U.S. Repossession industry is a $1.1 billion market and continues to grow. Over the next five years, the market is set to expand, making this a great time for newcomers to get involved in the repo industry. While anyone can start a repo business, it takes research, dedication, and funding to get started and be successful as a repossession agent.

With more people struggling financially, many are unable to keep up with car payments, leading to a rise in repossessions. This creates ample opportunity for those looking to get into the repo business.

This guide will help you learn how to start repo business building. Topics include market research, competitive analysis, registering an EIN, getting the right licensure like a commercial driver’s license, sourcing equipment from car dealerships , and more.

1. Conduct Repo Market Research

Market research is essential to building a thorough business plan for any new business. In a repo business, it offers insight into local competitors, where to apply for your repossession license, trends in services and products, pricing guides, and more.

Some details you’ll learn through market research for your own repo business include:

- Most repo companies operate locally and regionally, though some national ones have upwards of 7 million vehicles under management.

- A growing auto financing market means ample business for repo companies and agents.

- The breakeven point for a local operation is roughly 30 repossessions per month, as experienced agents can complete 2-3 nightly.

- At an average $350 per vehicle fee, this equals around $10,500 monthly revenue.

- Deducting operating costs and agent payroll, a single-agent business could generate $5,000+ monthly profits.

- Urban areas see more volume, though competition can be intense.

- Individual contractors keep 100% of fees but sacrifice benefits, while larger agencies offer stability but take a cut.

- Newbies should expect only $25,000-$50,000 until building a clientele.

A lean solo repo operation can generate a comfortable living, while more scaled agencies present a stronger profit upside. Through strong execution and sales, six figures are realistic. Just be ready to work odd hours while carefully managing costs.

2. Analyze the Competition

When launching a repo company, sizing up local competitors is crucial to strategizing your positioning and go-to-market plan. This analysis should evaluate both existing brick-and-mortar agencies as well as their digital footprint.

Some ways to get to know your repossession business competitors include:

- Identify major players through online directories and resources.

- Search listings by proximity to compile a competitor list, then visit websites and social channels to gather intel.

- Evaluate services, features, assets (trucks, equipment), and areas of specialty like luxury repos.

- Estimate market share based on fleet sizes. This quantifies what share is still up for grabs.

- Digital presence shows how findable and appealing brands are.

- Google competitors and geo-variations to see search visibility, plus keywords they rank for.

- Check online reviews on sites like Facebook as a proxy for reputation.

- Sign up for email lists to analyze messaging.

- Higher web visibility and positive community sentiment signal stronger positioning. New entrants should identify gaps where competitors fall short digitally.

Local filings like business registrations may surface added details like founding year, corporate structure, leadership, and locations. Newer startups signal an opening for other fresh entrants.

Use these insights to position competitively. If incumbents falter on client-friendly tech, highlight digital conveniences. Spotty coverage means expansion opportunities. Shoddy reputations allow for delivering a higher-caliber experience. Base your strategy on objective competitor findings.

3. Costs to Start a Repo Business

Getting a repo company up and running entails both substantial one-time startup costs as well as ongoing operational expenses. Expect an initial $50,000 to $100,000 investment depending on scale, along with roughly $15,000 to $25,000 in monthly recurring costs.

Start-up Costs

Before completing your first repo job, laying the proper operational foundations requires sinking cash into assets, licensing, professional services, and working capital. Key startup costs include:

- Incorporation Fees: Forming an LLC for liability purposes rings up around $800 when including state registration, drafting operating agreements, and publishing notices.

- Office Lease: A small retail space or commercial warehouse suits most local repossession agencies’ needs for storing impounded vehicles. Allow $2,500 per month for a basic space in many markets.

- Furnishings & Supplies: Outfitting your office with desks, filing cabinets, computers, and repo management software will likely require around $15,000 upfront.

- Towing Trucks & Equipment: Expect to spend $50,000+ per heavy-duty tow truck with lift gates, not including customizations like dual wheels for added stability and payload capacity. Assume 1 truck per agent.

- Licensing & Insurance: States require specific licenses like California’s $1,500 Vehicle Repossession Agency License. Liability policies providing necessary protection start at around $2,500 annually.

- Cash Reserves: Having robust operating capital prevents struggling with overhead costs before revenue stabilizes. Set aside at least 3 months’ worth of operating expenses – so around $45,000+ for our 1-truck operation example.

Solo agents can start more leanly with just their tow rig and administrative tools, while mid-size agencies should budget $75,000+ for proper facilities, multiple trucks, and ample working capital.

Ongoing Costs

Once opened for business, delivering smooth repo operations and maintaining profitability means managing key monthly expenses:

- Facilities Overhead: Assuming that the $2,500 office lease is above, plan another $700 monthly for utilities, repairs, maintenance, and other landlord pass-thru costs.

- Tow Truck Costs: From fuel to maintenance to custom hideaway lights, operating industrial-grade trucks capable of lifting 2+ ton vehicles costs approx. [$1,500 per rig] spend about $1,500 per month per tow truck on gas, maintenance, repairs, and insurance payments.).

- Software & Admin Tools: Specialized repossession management systems optimize dispatching and inventory tracking but add another $1000 to monthly spending.

- Insurance: Expect to fork over $600 monthly to properly insure the business including liability, commercial auto, and worker’s compensation for employees.

- Payroll: Experienced repo agents command at least $40,000+ annually, equating to around $3,500 per employee monthly – our example above staffed 1 agent.

4. Form a Legal Business Entity

Entrepreneurs launching a new repossession agency face an important early decision – formally structuring the legal business entity. The optimal choice balances personal liability protection, tax implications, and ease of management as the company grows.

Sole Proprietorship

Sole proprietorships represent the simplest and most common initial structure – you directly own the business as an individual. However major liability risk exists as no legal separation shields personal assets like your home if the company faces lawsuits or bankruptcy. Taxes are straightforward with pass-through treatment but may hit higher personal income tax rates.

Partnership

General or limited partnerships allow sharing ownership with multiple partners, easing capital raising. However, they still expose personal assets to substantial risk as partners retain direct liability for debts and legal actions against the partnership. The lack of liability protections compared to LLCs makes partnerships poorly matched for hazardous repo work as well.

Corporation

Forming a C corporation or S corporation creates a distinct legal entity insulating owners from liability claims. However, the significant legal paperwork and mandatory formalities like shareholder meetings add overhead costs and administrative hassles better suited to large enterprises. State regulations also poorly accommodate the nomadic nature of repo work across regions.

Limited Liability Company (LLC)

For starting repo agents, limiting legal liability while retaining operational simplicity points clearly to forming an LLC. As separate legal entities under state statute, repo LLCs shield members’ assets like houses, cars, or bank accounts from court judgments related to the business.

Taxes use simpler pass-through treatment like partnerships avoiding double taxation, unlike corporations. Different classes of ownership interest better accommodate bringing on investors or employee-partners, facilitating growth. And meeting formalities are minimal versus s-corps.

5. Register Your Business For Taxes

Once your repo company is legally formed, crucial next steps include registering for federal and state tax purposes. This establishes your ability to operate legally, bill clients, and hire employees. Let’s walk through what’s required.

First, head to IRS.gov to obtain your federal Employer Identification Number (EIN). This unique 9-digit identifier acts like your business’s social security number establishing tax and banking abilities.

The EIN application process only takes a few minutes online:

- Navigate to the EIN Assistant and select “View Additional Types” including LLCs.

- Choose reason code 11 for “Started a New Business” under “Other” on the dropdown menu.

- Work through the short application with basic information like name, address, and responsible party. Double-check for accuracy.

- After submitting, your EIN will display immediately. Print this page for your records.

Completing this free and simple registration legitimizes your repo agency as a registered business in the eyes of the IRS, partners, and clients.

You must also formally register for a state seller’s permit for collecting and remitting sales tax in locations where you operate. Expect under $100 in initial state filing fees. Any physical repossession services are taxable.

6. Setup Your Accounting

Handling repossessions brings enough operational headaches without inviting IRS trouble. That’s why properly structuring your agency’s finances and accounting proves so important from day one. Follow key best practices like implementing integrated software, working with an accountant, and rigorously separating expenses.

Accounting Software

As an industry dealing in significant tangible assets like vehicles, careful bookkeeping and tracking ensure you capture available tax deductions on tow trucks, fuel, equipment maintenance, and other operating costs. However, manually logging expenses risks missing write-offs. That’s where software like QuickBooks generates major value.

Hire an Accountant

Retaining a provider exclusively handling small business clients proves pivotal for optimal tax preparation. Expect fees between $200-500 annually for basic filing, though more complex partnerships may spend $5,000+. Value emerges from identifying every possible deduction and credit to legally minimize tax obligations.

Open a Business Bank Account

Avoid common pitfalls like mingling personal and business finances. Keeping dedicated checking/credit accounts simplifies separating expenses come filing time. Understand card limits derive from your agency’s financials, not your credit score.

7. Obtain Licenses and Permits

Beyond basic corporate formation, repo agencies must obtain specific state and federal clearances allowing legal operation. Find federal license information through the U.S. Small Business Administration . The SBA also offers a local search tool for state and city requirements.

Local repossession business laws may require a specific business license or repo license for your new company. For example, California issues Vehicle Repossession Agency Licenses starting at $400 with renewals over $230 biennially.

Typical requirements include passing background checks, meeting bond/insurance minimums, and paying accompanying fees. State police also run fingerprints verifying applicants don’t have recent criminal records that might raise integrity concerns around collateral recovery.

Check regulations to determine if individual agents must also carry approved credentials when operating in the field away from home office oversight. Renew license documentation on time to continue practicing uninterrupted.

Since repossessing vehicles involves towing across public roads, the federal Department of Transportation also imposes clearance requirements under the Motor Carrier Act.

You’ll need USDOT Numbers displayed on all commercial vehicles plus CDL-licensed drivers . Some states waive CDLs for certain lighter GVWR vehicles – understand exactly which trucks fall under DOT rules to stay compliant.

8. Get Business Insurance

Operating in the high-risk repossession industry leaves business owners navigating a potential minefield of hazards from tragic accidents to disgruntled vehicle owners. Without adequate insurance backing, a single incident could spell financial and legal ruin for your uninsured agency.

Some common business insurance products include:

- General Liability Insurance: This foundational policy insulates against third-party losses like medical bills from customer injuries on your premises or damage to their property while towing. It also covers associated legal claim expenses. Limits often reach $1 million total and cost around $1,200 annually for a single location.

- Commercial Auto Insurance: Given high collision and turnover risks for repossession trucking demanding late-night highway transport and loading/unloading of vehicles, secure robust commercial policies on all company rigs. Bare minimum premiums still run $1,800 annually but provide the necessary protection.

- Workers Compensation: Required in nearly every state, this covers lost wages, medical bills, and rehabilitation costs if a driver or support staffer gets injured executing their duties whether it’s a tow scene assault or severe strain from a vehicle recovery. Plus it preempts them suing your business directly. Expect $40+ monthly premiums per unique employee factoring in role risk exposure.

- Umbrella Liability: For additional buffer given the hazard potential in repo work, supplemental umbrella policies add millions more coverage protecting your personal and business assets if a court judgment exceeds primary liability limits. These cost-effective policies start around $500 annually per $1 million in added protection but drive major peace of mind against financial risk.

9. Create an Office Space

While much of a repo company’s critical work stays on the road recovering vehicles, maintaining some formal office space provides key benefits. Use it to securely store paperwork, conduct sales calls, manage staff, and temporarily hold repossessed asset inventory. Weigh several real estate alternatives based on cost and functionality factors:

Home Office

Converting an extra bedroom or basement area offers convenience for solo entrepreneurs. Expect minimal explicit costs beyond dedicated desk and storage solutions running a few thousand dollars. However home resale values may take a minor hit. It still offers substantial autonomy given no lease commitments. Provides limited customer/asset hosting capacity, however.

Coworking Space

For collaborative camaraderie and networking with fellow entrepreneurs, coworking spaces like WeWork offer short-term desk rentals for around $300 monthly. Add small private office rentals from $650 for sales calls/meetings. Great for flexibility but secure inventory storage needs likely require upgrading to conventional office rental.

Commercial Office

For mid-size repo outfits housing multiple agents spread across units like document processing teams and sales staff supporting recovery crews, multistory commercial spaces offer abundant capacities for under $10 per square foot. Locate facilities near secured impound lots rather than heavy retail density. Gives control to build-out amenities like evidence rooms or customer service areas facilitating operations.

10. Source Your Equipment

Launching a properly equipped repo operation means investing in specialized rigs and gear for safely transporting repossessed vehicles. Evaluate options for acquiring these assets new or used, along with more capital-friendly rental alternatives.

The gold standard remains all-new purpose-built repo trucks and attachments allowing flawless legal compliance and reliable performance even under extreme workloads. Brands like NRC offer customizable cab chassis starting around $50,000 supporting add-ons like:

- Wheel Lifts ($15,000+) – Secure vehicle frames during transport

- Slides ($4,000+) – Load inoperable vehicles

- Tow Dollies ($10,000+) – Flat tow 4 wheels down cars

While expensive, buying new provides warranty support plus modern feature sets like GPS tracking assisting in asset recovery. Finance newer models to conserve capital for those with strong credit.

Buying Used

Scour classifieds like Craigslist and industry forums for quality secondhand trucks costing 40% less than new without the customization advantages. Perform thorough mechanical inspections before purchasing to confirm roadworthiness, suspension, transmission, and electrical components see punishing use requiring ongoing maintenance in repo applications.

For flexible access to properly equipped rigs without six-figure capital costs, rental options exist but command premium pricing between $700-$1,500 weekly. Compare costs of longer-term commitments against buying. Key caveat – operators must already possess insurance and proper operating licensing to meet agreements. Short-term but not budget-friendly.

Custom leasing programs through dealers like Trimor offer competitive rates to purchase rigs over longer 3-5-year terms. Requires strong business credit history. Down payments are still demanded upfront. Offers path towards ownership without large lump sum payments that direct purchase options require.

11. Establish Your Brand Assets

Distinguishing your repossession company amidst a crowded industry starts with nurturing instant name recognition. Implement essential branding elements conveying quality and reliability when engaging with lenders, debtors, and other consumer groups.

Getting a Business Phone Number

Ditch personal cell numbers prone to ignoring unknown calls. Services like RingCentral provide customizable toll-free and local pro numbers from $30 monthly. Forward calls automatically to any staffer’s devices untethering agents from desks.

Creating Logos and Branding

Build distinctive visual identity cueing security and reliability through cohesive logos, truck wraps employing a limited color palette, and complementary letterhead/uniform aesthetics. Services like Looka provide custom design options starting at $20 harnessing AI for quick professional iterations.

Business Cards and Signage

Back your trucks up with professionally printed materials like 10¢ standard cards from Vistaprint establishing legitimacy for sales discussions and onsite interactions. Window cling signage and ID lanyards enhance authority in managing tense vehicle seizures.

Purchasing Domain Names

Anchor online visibility to your distinctive brand name via a matching .com domain from registrars like Namecheap for $9 annually. Convey professionalism and aid discovery by lenders searching locally online.

Building Websites

Either utilize website builders like Wix with customizable templates and hosting for $10 monthly or hire niche repo site developers on Fiverr for $200 delivering custom-coded functionality. Promote capabilities and client testimonials building trust while lead capturing.

12. Join Associations and Groups

Navigating the highly competitive collateral recovery trade requires building mutually beneficial relationships with lienholders and other key industry players. Seek out these invaluable networking opportunities:

Local Associations

Major state groups like the Repo Alliance organize regular local meetings, seminars, and conferences connecting repossession agents regionally for idea exchange and peer support. Annual dues run a few hundred dollars but open doors to contractor jobs plus mentorship opportunities accelerating practical learning.

Local Meetups

Sales-driven repo events hosted throughout the year in most states offer hands-on training across topical areas like compliance plus access to role models and innovators pushing the industry forward. Find nearby offerings through aggregators like Meetup and checkout equipment vendors displaying the latest tow truck and gadget breakthroughs.

Facebook Communities

For 24/7 idea exchange from the masses, industry-specific Facebook groups like Small Business Supporters (USA-based) enable crowd-sourced guidance on everything from recommended gear and documentation tips to workshop promotions and job openings. Lean on thousands of fellow reclamation veterans in these digital sanctuaries to accelerate success.

13. How to Market a Repo Business

Gaining a share in the competitive collateral recovery market relies heavily on vigorous promotion to connect with new lender partners. Balance digital approaches with selected offline tactics maximizing awareness of your reliable services and rapid response across regions.

Leverage Existing Networks

Seed success through current spheres of influence like professional connections made locally plus friends and family open to spreading positive experiences using your services and securing their assets.

Request 5-star online reviews on platforms like Facebook and Google highlighting reliability. Referral rewards like branded shop swag or reduced 10% friend fees keep the unity flowing. Nothing fuels conversion like word-of-mouth from those who already trust you.

Digital Marketing

- Launch Google Ads campaigns with geo-targeted keywords like “repo company [city]” driving searches to your website capture forms.

- Publish helpful repo process explainers on sites like Medium drawing organic traffic.

- Run retargeted Facebook and Instagram video ads demonstrating recovery capabilities following customized pre-sale audiences.

- Contact vehicle finance publications about contributing repo guest articles putting your name before industry influencers.

- Start an email newsletter providing security tips for nurturing lender relationships and referral pipelines.

Traditional Marketing

- Print glossy brochures with brand summaries and client wins for in-person sales meetings.

- Advertise late-night AM radio ads blanketing recovering regions when repossession agents drive routes.

- List with B2B directories like Yelp building visibility among finance company searchers.

- Host free regional seminars on asset protection securing speaking slots touting expertise.

- Sponsor relevant trade groups aligning with peer verticals in automotive and finance.

The most effective marketing mixers synergize online and offline channels with networking efficiently will multiply your agency’s visibility and trust signals. Let me know if you need any other repo promotion pointers!

14. Focus on the Customer

In the reputation-dependent collateral recovery industry, how you treat both lenders and debtors proves pivotal in determining referral rates and retention. Make providing an excellent customer experience a top strategic priority right from the start.

Some ways to improve customer focus within your repossession business include:

- Respond quickly to new service inquiries with custom quotes within 24 hours, vastly outpacing the multi-day lags of slower competitors.

- During actual repo operations, instruct agents to carefully explain legal protocols if challenged by emotional vehicle owners, defusing tensions by emphasizing options around retrieving essential medications or documents.

- Follow up within 48 hours of assignments to ensure both creditors and debtors that repossessions occurred properly.

- Address any outstanding pickup coordination issues if vehicles require alternate transportation.

- Foster relationships with every point of contact when working with asset finance partners, whether front desk staff or executives.

- Thoughtful gestures like periodic coffee meetings demonstrate commitment beyond per-job transactions.

- Encourage happy clients and consumers to post online reviews or provide website testimonials, and consider small incentives like $100 credits on future projects.

Delivering such personalized, compassionate support compounds into loyalty, retention, and critically important referrals. Outcare the competition across each customer interaction to shape a reputation for superior service enabling sustainable repo business growth.

You Might Also Like

March 1, 2024

0 comments

How to Start an ATV Rental Business in 14 Steps (In-Depth Guide)

The ATV rental industry has seen impressive growth over the last decade. It is ...

How to Start a Driving School in 14 Steps (In-Depth Guide)

The need for professional drivers isn’t going away anytime soon. The US trucking industry ...

How to Start a Car Restoration Business in 14 Steps (In-Depth Guide)

Classic car restoration is big business, with the global automotive restoration industry reaching $5.5 ...

How to Start an Auto Repair Shop in 14 Steps (In-Depth Guide)

The auto repair industry in the United States reached $188.13 billion in 2024 and ...

Check Out Our Latest Articles

How to start a dog clothing business in 14 steps (in-depth guide), how to start a vintage clothing business in 14 steps (in-depth guide), how to start a bamboo clothing business in 14 steps (in-depth guide), how to start a garage cleaning business in 14 steps (in-depth guide).

Create Your Corporation

How to Start a Successful Repo Business: A Comprehensive Guide

Learn how to start a profitable repossession business. This comprehensive guide covers licensing, equipment, hiring, marketing and more to launch your own successful repo company.

Have you ever thought about starting your own repossession business? The repo industry can be very lucrative, but it also comes with risks and challenges. As the operator of a repo company, your job is to recover vehicles and other assets on behalf of lenders when borrowers default on their loans. It's not an easy job, but for the right person with the right skills and temperament, running a repo business can be a pathway to financial freedom and being your own boss. If you're up for the challenge and want to learn how to start a successful repo business, you've come to the right place. This comprehensive guide will walk you through all the essential steps, from obtaining the proper licensing and insurance to recruiting experienced agents and building relationships with lenders. We'll also share tips for staying safe on the job, using the latest technology to boost productivity, and scaling your business over time.

The Repo Business Landscape

The repo industry serves a wide range of lenders, from small local banks and credit unions to large national lending institutions. As a repo business owner, your target audience will be these lenders. You'll market your services to them as a way to recover assets from delinquent borrowers in an efficient and cost-effective manner. The repo market itself is quite broad. It includes the recovery of vehicles (the most common), heavy equipment, aircraft, watercraft, and commercial equipment. Most repo companies specialize in a particular market segment, at least when first starting out. For example, you may focus exclusively on repossessing cars and trucks for auto lenders in your local area. Over time, as your business grows, you can expand into other markets and work with lenders on a regional or national basis. While some large repo companies do operate on a national scale, most repo businesses are local or regional enterprises. They build their success through establishing close working relationships with lenders in their target market and developing a reputation for fast, reliable service at competitive rates. The key is finding the right balance between being big enough to get steady work from major lenders yet small enough to provide the personal service that both lenders and debtors expect.

Your Service Offering

As a repo business owner, your core service is recovering assets on behalf of lenders when borrowers default on their loans. However, not all repo companies are the same. To stand out, focus on building a reputation for: •Speed and efficiency. The faster you can recover an asset, the lower the loss for the lender. Use technology like GPS tracking and monitoring software to quickly locate targets. •Professionalism and courtesy. While repo work can be confrontational, treat all parties with respect. Avoid unnecessary aggression or force. Your agents should be professionally trained and dress in uniforms. •Compliance and transparency. Follow all laws regarding repossession and storage of assets. Provide detailed reports and documentation to lenders on the status of their accounts. •Competitive rates. Offer lenders affordable, straightforward pricing based on factors like the type of asset, location, and difficulty. Discount rates for high-volume lenders. To deliver your service, you'll need a team of experienced agents, a secured vehicle storage facility, tow trucks, and administrative staff. Market your business directly to lenders through sales calls, mailers, and your website. Be prepared to do some educating, as some lenders may not fully understand how the repo process works and your role in it. Developing strong relationships with lenders and delivering on your promises will build up your reputation and lead to more work over time through word-of-mouth and repeat business.

The Economics of a Repo Business