What Is Absolute Advantage?

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on June 08, 2023

Are You Retirement Ready?

Table of contents, theory of absolute advantage.

Absolute advantage refers to how a company, country, or region produces a greater quantity of a product while maintaining the amount of time it takes to produce the product.

When there is absolute advantage, the same quantity of goods are produced using a lesser quantity of inputs than another company. This increases competition between companies, and can be advantageous for trade.

It is important to note that absolute advantage looks into the efficiency of production for a single product.

Define Absolute Advantage in Economics

If a company has a lower absolute advantage, it can produce products and services at a lower absolute cost per unit, which uses a small number of inputs, or possibly a more efficient process than another company that produces the same good or service.

The unit cost is a crucial measure to determine operational analysis of a company. Analyzing unit cost is an effective way to determine if the company is producing content efficiently.

The absolute advantage matters because it determines if a producer can provide goods or services in greater quantity for the same or lower cost than competing producers.

Additionally, absolute advantage is an effective basis for gains from trade between companies who produce different goods with different absolute advantages.

Specialization, division of labor, and trade with producers who have different absolute advantages leads to more gains than production in isolation. It is also related to comparative advantage , which opens up more widespread opportunities for gains from trade, as well as division of labor.

What Is the Origin of Absolute Advantage?

Adam Smith first developed the idea of absolute advantage in his book, "The Wealth of the Nations." He used this idea to demonstrate how countries that specialize in producing and exporting certain goods gain from trade with other countries.

In "Wealth of the Nations," Smith uses labor as the only input. Absolute advantage is determined by comparison of labor productiveness, so it is possible for a party to have no absolute advantage.

There are several good examples of this in the Chinese economy and the Canadian Economy. The Chinese economy exports low-cost manufactured goods, and takes advantage of their low unit labor costs.

The Canadian economy is rich in low cost land, and has an absolute advantage in agricultural production.

Absolute Advantage Example

Comparative advantage looks at the reduction of opportunity cost , which is the potential benefit gained by choosing to produce more of one product instead of producing the maximum amount of both products a country has absolute advantage in.

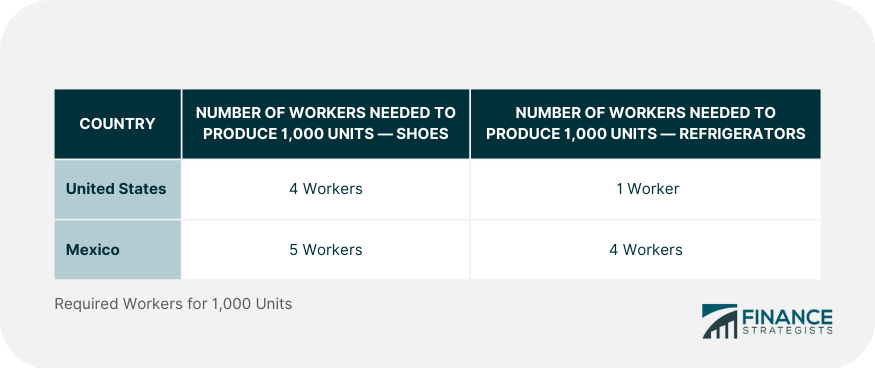

In the chart below, we see the United States has the absolute advantage in both refrigerators and shoes.

Absolute advantage examines the productivity of workers in each country, answering the question "how many inputs are needed to produce shoes in Mexico?"

Comparative advantage asks the question in a different way, instead focusing on the output it takes to produce goods in a country.

It identifies the good where the absolute advantage is relatively larger, or where the productivity disadvantage is smaller.

Comparative Advantages help countries consider possibilities for trade, and how to maximize production for profit .

In this situation, the United States has a higher comparative advantage of shoes over refrigerators (1 worker in the US versus 4 in Mexico), and Mexico has a higher comparative advantage of shoes (5 workers in Mexico versus 4 in the US).

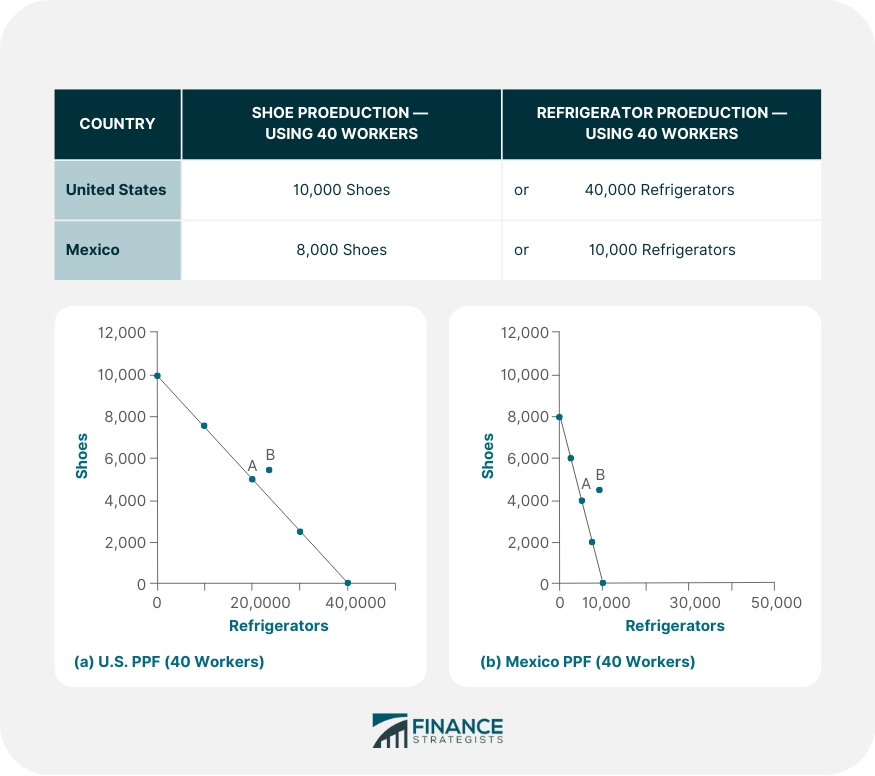

If both countries were to continue with their production rates, using 40 workers per good, the United States would produce 10,000 shoes and 40,000 refrigerators.

Mexico would produce 8,000 shoes, and 10,000 refrigerators, shown in the chart below.

If point A on each graph which is where countries start producing and consuming before trade. At this point, the United States produces 20,000 refrigerators and 5,000 pairs of shoes.

Mexico produces 4,000 pairs of shoes and 5,000 refrigerators, for a total of 9,000 shoes produced, and 25,000 refrigerators produced.

If each country were to transfer workers toward their area of comparative advantage, this would shift slightly.

If the US transferred six workers away from shoes to work on refrigerators, the shoe production decreases by 1,500 units (6/4 x 1,000), and refrigerator production increases by 6,000 (6/1 x 1,000).

If Mexico moves toward their area of comparative advantage, and transfers 10 workers to work on production of shoes, the production of refrigerators decreases by 2,500 (10/4 x 1,000), and production of shoes increases by 2,000 pairs (10/5 x 1,000).

This leads to a greater production of goods overall, as shown in the chart below.

This example shows that even though the United States has an absolute advantage in both goods, both countries can benefit from increased production in their area of comparative advantage. The United States will then export refrigerators, and import shoes.

Absolute Advantage FAQs

What is absolute advantage.

Absolute advantage refers to how a company, country, or region produces a greater quantity of a product while maintaining the same amount of time it takes to produce the product.

Why does Absolute Advantage matter?

Where did the concept of absolute advantage come from.

In his book, The Wealth of the Nations, Adam Smith used this idea to demonstrate how countries that specialize in producing and exporting certain goods gain from trade with other countries.

What does Absolute Advantage look for?

Absolute Advantage looks into the efficiency of production for a single product.

What are some Absolute Advantage examples for nations?

China enjoys a low-cost manufactured goods advantage due to low labor costs, while Canada's low land cost provides an agricultural production advantage.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Command Economy

- Cost-Push Inflation

- Demand-Pull Inflation

- Economic Outlook

- Free Market Economy

- GDP Per Capita

- Gross Domestic Product (GDP)

- Gross National Product (GNP)

- Hyperinflation

- Inferior Goods

- Knowledge Economy

- Liquidity Constraints

- Macro Environment

- Mixed Economy

- Monopolistic Competition

- Operation Twist

- Perfect Competition

- Producer Price Index (PPI)

- Purchase Annual Percentage Rate (APR)

- Real Gross Domestic Product (GDP)

- Trade Deficit

- What Does the 80/20 Rule Mean?

- Wholesale Price Index (WPI)

Ask a Financial Professional Any Question

Discover wealth management solutions near you, our recommended advisors.

Taylor Kovar, CFP®

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?

Just a Few More Details

We need just a bit more info from you to direct your question to the right person.

Tell Us More About Yourself

Is there any other context you can provide.

Pro tip: Professionals are more likely to answer questions when background and context is given. The more details you provide, the faster and more thorough reply you'll receive.

What is your age?

Are you married, do you own your home.

- Owned outright

- Owned with a mortgage

Do you have any children under 18?

- Yes, 3 or more

What is the approximate value of your cash savings and other investments?

- $50k - $250k

- $250k - $1m

Pro tip: A portfolio often becomes more complicated when it has more investable assets. Please answer this question to help us connect you with the right professional.

Would you prefer to work with a financial professional remotely or in-person?

- I would prefer remote (video call, etc.)

- I would prefer in-person

- I don't mind, either are fine

What's your zip code?

- I'm not in the U.S.

Submit to get your question answered.

A financial professional will be in touch to help you shortly.

Part 1: Tell Us More About Yourself

Do you own a business, which activity is most important to you during retirement.

- Giving back / charity

- Spending time with family and friends

- Pursuing hobbies

Part 2: Your Current Nest Egg

Part 3: confidence going into retirement, how comfortable are you with investing.

- Very comfortable

- Somewhat comfortable

- Not comfortable at all

How confident are you in your long term financial plan?

- Very confident

- Somewhat confident

- Not confident / I don't have a plan

What is your risk tolerance?

How much are you saving for retirement each month.

- None currently

- Minimal: $50 - $200

- Steady Saver: $200 - $500

- Serious Planner: $500 - $1,000

- Aggressive Saver: $1,000+

How much will you need each month during retirement?

- Bare Necessities: $1,500 - $2,500

- Moderate Comfort: $2,500 - $3,500

- Comfortable Lifestyle: $3,500 - $5,500

- Affluent Living: $5,500 - $8,000

- Luxury Lifestyle: $8,000+

Part 4: Getting Your Retirement Ready

What is your current financial priority.

- Getting out of debt

- Growing my wealth

- Protecting my wealth

Do you already work with a financial advisor?

Which of these is most important for your financial advisor to have.

- Tax planning expertise

- Investment management expertise

- Estate planning expertise

- None of the above

Where should we send your answer?

Submit to get your retirement-readiness report., get in touch with, great the financial professional will get back to you soon., where should we send the downloadable file, great hit “submit” and an advisor will send you the guide shortly., create a free account and ask any financial question, learn at your own pace with our free courses.

Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Started

To ensure one vote per person, please include the following info, great thank you for voting., get in touch, submit your info below and someone will get back to you shortly..

Absolute Advantage

The capacity of an economic agent to produce a larger quantity of a product than its competitors

What is Absolute Advantage?

In economics, absolute advantage refers to the capacity of any economic agent, either an individual or a group, to produce a larger quantity of a product than its competitors. Introduced by Scottish economist, Adam Smith , in his 1776 work, “An Inquiry into the Nature and Causes of the Wealth of Nations,” which described absolute advantage as a certain country’s intrinsic capability to produce more of a commodity than its global competitors.

Smith also used the concept of absolute advantage to explain gains from free trade in the international market. He theorized that countries’ absolute advantages in different commodities would help them gain simultaneously through exports and imports, making the unrestricted international trade even more important in the global economic framework.

Adam Smith’s Theory of Absolute Advantage

The mercantilist economic theory, which was widely followed between the 16 th and the 18 th century, came under a lot of criticism with the emergence of economists like John Locke and David Hume. Mercantilism advocated a national economic policy designed to maximize the nation’s trade and its gold and money reserves. Mercantilism gained influence due to the emergence of colonial powers such as Britain and Portugal, before Adam Smith, and later Daniel Ricardo, both staunch critics of the concept, came up with their own theories to counter mercantilism.

Smith was the first economist to bring up the concept of absolute advantage, and his arguments regarding the same supported his theories for a laissez-faire state. In “The Wealth of Nations”, Smith first points out that, through opportunity costs, regulations favoring one industry take away resources from another industry where they might have been more advantageously employed.

Secondly, he applies the opportunity cost principle to individuals in a society, using the particular example of a shoemaker not using the shoes he made himself because that would be a waste of his productive resources. Each individual thus specializes in the production of goods and services in which he or she has some sort of an advantage.

Thirdly, Smith applies the same principles of opportunity costs and specialization to international economic policy, and the principle of international trade. He explains that it is better to import goods from abroad where they can be manufactured more efficiently because it allows the importing country to put its resources into its own most productive and efficient industries. Smith thus emphasizes that a difference in technology between nations is the primary determinant of international trade flows around the globe.

Assumptions of the Absolute Advantage Theory

- Smith assumed that the costs of the commodities were computed by the relative amounts of labor required in their respective production processes.

- He assumed that labor was mobile within a country but immobile between countries.

- He took into consideration a two-country and two-commodity framework for his analysis.

- He implicitly assumed that any trade between the two countries considered would take place if each of the two countries had an absolutely lower cost in the production of one of the commodities.

Achieving an Absolute Advantage

An absolute advantage is achieved through low-cost production. In other words, it refers to an individual, company, or country that can produce at a lower marginal cost. Such an advantage is established when (compared to competitors):

- Fewer materials are used to produce a product

- Cheaper materials (thus a lower cost) are used to produce a product

- Fewer hours are needed to produce a product

- Cheaper workers are (in terms of hourly wage) used to produce a product

Advantages of an Advantage

Absolute cost advantage.

Absolute cost advantage results from the specialization of labor proposed by Smith in his theory. Specialization of labor, or division of labor, results in a significantly higher productivity per unit of labor, and in turn, a lower cost of production. Smith also used the concept of “Economies of Scale” to explain the lowering of production costs, as a higher output due to labor diversification would significantly reduce production costs.

Natural Advantage

A country should produce those goods that are naturally favoring its climatic environment. The type of goods produced would also depend on the availability of natural resources. The presence of lots of natural resources would significantly provide an advantage to such a country while producing the goods.

Acquired Advantage

Acquired advantage includes advantages in technology and level of skill development.

Absolute Advantage vs. Comparative Advantage

Absolute and comparative advantage are commonly misunderstood concepts. An absolute advantage looks at the financial costs of production, while a comparative advantage looks at the opportunity cost of production. The two terms are contrasted below:

The ability to produce more of a good or service while using fewer resources compared to a competing entity.

Comparative Advantage

The ability to produce a good or service at a lower opportunity cost.

Criticisms against Absolute Advantage

The Absolute Advantage Theory assumed that only bilateral trade could take place between nations and only in two commodities that are to be exchanged. Such an assumption was significantly challenged when the trade, as well as the needs of nations, started increasing. Thus, the theory did not take into account the multilateral trade that could take place between countries.

The Absolute Advantage Theory also assumed that free trade exists between nations. It did not take into account the protectionist measures that are adopted by countries. The protectionist measures included quantitative restrictions, technical barriers to trade, and restrictions on trade on account of environmental protection or public policy.

Ricardo later came up with his own criticisms of Adam Smith’s theory. Ricardo’s 1817 work, “On the Principles of Political Economy and Taxation,” introduced a theory that later attained fame as the theory of comparative advantage, which places opportunity cost at the focus of agents’ production decisions.

Related Reading

CFI is a global provider of the Financial Modeling & Valuation Analyst (FMVA)® certification program and several other courses for finance professionals. To help you advance your career, check out the additional CFI resources below:

- Economies of Scale

- Law of Supply

- Purchasing Power Parity

- Consumer Surplus Formula

- See all economics resources

Financial Analyst Certification

Become a certified Financial Modeling and Valuation Analyst (FMVA)® by completing CFI’s online financial modeling classes!

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

33.1 Absolute and Comparative Advantage

Learning objectives.

By the end of this section, you will be able to:

- Define absolute advantage, comparative advantage, and opportunity costs

- Explain the gains of trade created when a country specializes

The American statesman Benjamin Franklin (1706–1790) once wrote: “No nation was ever ruined by trade.” Many economists would express their attitudes toward international trade in an even more positive manner. The evidence that international trade confers overall benefits on economies is pretty strong. Trade has accompanied economic growth in the United States and around the world. Many of the national economies that have shown the most rapid growth in the last several decades—for example, Japan, South Korea, China, and India—have done so by dramatically orienting their economies toward international trade. There is no modern example of a country that has shut itself off from world trade and yet prospered. To understand the benefits of trade, or why we trade in the first place, we need to understand the concepts of comparative and absolute advantage.

In 1817, David Ricardo , a businessman, economist, and member of the British Parliament, wrote a treatise called On the Principles of Political Economy and Taxation . In this treatise, Ricardo argued that specialization and free trade benefit all trading partners, even those that may be relatively inefficient. To see what he meant, we must be able to distinguish between absolute and comparative advantage.

A country has an absolute advantage over another country in producing a good if it can produce more of that good. Absolute advantage can be the result of a country’s having more resources, having more productive resources, or its natural endowment. For example, extracting oil in Saudi Arabia is pretty much just a matter of “drilling a hole.” Producing oil in other countries can require considerable exploration and costly technologies for drilling and extraction—if they have any oil at all. The United States has some of the richest farmland in the world, making it easier to grow corn and wheat than in many other countries. Guatemala and Colombia have climates especially suited for growing coffee. Chile and Zambia have some of the world’s richest copper mines. As some have argued, “geography is destiny.” Chile will provide copper and Guatemala will produce coffee, and they will trade. When each country has a product others need and it can produce it with fewer resources in one country than in another, then it is easy to imagine all parties benefitting from trade. However, thinking about trade just in terms of geography and absolute advantage is incomplete. Trade really occurs because of comparative advantage.

Recall from the chapter Choice in a World of Scarcity that a country has a comparative advantage when it can produce a good at a lower cost in terms of other goods. The question each country or company should be asking when it trades is this: “What do we give up to produce this good?” It should be no surprise that the concept of comparative advantage is based on this idea of opportunity cost from Choice in a World of Scarcity . For example, if Zambia focuses its resources on producing copper, it cannot use its labor, land and financial resources to produce other goods such as corn. As a result, Zambia gives up the opportunity to produce corn. How do we quantify the cost in terms of other goods? Simplify the problem and assume that Zambia just needs labor to produce copper and corn. The companies that produce either copper or corn tell you that it takes two hours to mine a ton of copper and one hour to harvest a bushel of corn. This means the opportunity cost of producing a ton of copper is two bushels of corn. The next section develops absolute and comparative advantage in greater detail and relates them to trade.

Visit this website for a list of articles and podcasts pertaining to international trade topics.

A Numerical Example of Absolute and Comparative Advantage

Consider a hypothetical world with two countries, Saudi Arabia and the United States, and two products, oil and corn. Further assume that consumers in both countries desire both these goods. These goods are homogeneous, meaning that consumers/producers cannot differentiate between corn or oil from either country. There is only one resource available in both countries, labor hours. Saudi Arabia can produce oil with fewer resources, while the United States can produce corn with fewer resources. Table 33.1 illustrates the advantages of the two countries, expressed in terms of how many hours it takes to produce one unit of each good.

| Country | Oil (hours per barrel) | Corn (hours per bushel) |

|---|---|---|

| Saudi Arabia | 1 | 4 |

| United States | 2 | 1 |

In Table 33.1 , Saudi Arabia has an absolute advantage in producing oil because it only takes an hour to produce a barrel of oil compared to two hours in the United States. The United States has an absolute advantage in producing corn.

To simplify, let’s say that Saudi Arabia and the United States each have 100 worker hours (see Table 33.2 ). Figure 33.2 illustrates what each country is capable of producing on its own using a production possibility frontier (PPF) graph. Recall from Choice in a World of Scarcity that the production possibilities frontier shows the maximum amount that each country can produce given its limited resources, in this case workers, and its level of technology.

| Country | Oil Production using 100 worker hours (barrels) | Corn Production using 100 worker hours (bushels) | |

|---|---|---|---|

| Saudi Arabia | 100 | or | 25 |

| United States | 50 | or | 100 |

Arguably Saudi and U.S. consumers desire both oil and corn to live. Let’s say that before trade occurs, both countries produce and consume at point C or C'. Thus, before trade, the Saudi Arabian economy will devote 60 worker hours to produce oil, as Table 33.3 shows. Given the information in Table 33.1 , this choice implies that it produces/consumes 60 barrels of oil. With the remaining 40 worker hours, since it needs four hours to produce a bushel of corn, it can produce only 10 bushels. To be at point C', the U.S. economy devotes 40 worker hours to produce 20 barrels of oil and it can allocate the remaining worker hours to produce 60 bushels of corn.

| Country | Oil Production (barrels) | Corn Production (bushels) |

|---|---|---|

| Saudi Arabia (C) | 60 | 10 |

| United States (C') | 20 | 60 |

The slope of the production possibility frontier illustrates the opportunity cost of producing oil in terms of corn. Using all its resources, the United States can produce 50 barrels of oil or 100 bushels of corn; therefore, the opportunity cost of one barrel of oil is two bushels of corn—or the slope is 1/2. Thus, in the U.S. production possibility frontier graph, every increase in oil production of one barrel implies a decrease of two bushels of corn. Saudi Arabia can produce 100 barrels of oil or 25 bushels of corn. The opportunity cost of producing one barrel of oil is the loss of 1/4 of a bushel of corn that Saudi workers could otherwise have produced. In terms of corn, notice that Saudi Arabia gives up the least to produce a barrel of oil. Table 33.4 summarizes these calculations.

| Country | Opportunity cost of one unit — Oil (in terms of corn) | Opportunity cost of one unit — Corn (in terms of oil) |

|---|---|---|

| Saudi Arabia | ¼ | 4 |

| United States | 2 | ½ |

Again recall that we defined comparative advantage as the opportunity cost of producing goods. Since Saudi Arabia gives up the least to produce a barrel of oil, ( 1 4 1 4 < 2 2 in Table 33.4 ) it has a comparative advantage in oil production. The United States gives up the least to produce a bushel of corn, so it has a comparative advantage in corn production.

In this example, there is symmetry between absolute and comparative advantage. Saudi Arabia needs fewer worker hours to produce oil (absolute advantage, see Table 33.1 ), and also gives up the least in terms of other goods to produce oil (comparative advantage, see Table 33.4 ). Such symmetry is not always the case, as we will show after we have discussed gains from trade fully, but first, read the following Clear It Up feature to make sure you understand why the PPF line in the graphs is straight.

Clear It Up

Can a production possibility frontier be straight.

When you first met the production possibility frontier (PPF) in the chapter on Choice in a World of Scarcity we drew it with an outward-bending shape. This shape illustrated that as we transferred inputs from producing one good to another—like from education to health services—there were increasing opportunity costs. In the examples in this chapter, we draw the PPFs as straight lines, which means that opportunity costs are constant. When we transfer a marginal unit of labor away from growing corn and toward producing oil, the decline in the quantity of corn and the increase in the quantity of oil is always the same. In reality this is possible only if the contribution of additional workers to output did not change as the scale of production changed. The linear production possibilities frontier is a less realistic model, but a straight line simplifies calculations. It also illustrates economic themes like absolute and comparative advantage just as clearly.

Gains from Trade

Consider the trading positions of the United States and Saudi Arabia after they have specialized and traded. Before trade, Saudi Arabia produces/consumes 60 barrels of oil and 10 bushels of corn. The United States produces/consumes 20 barrels of oil and 60 bushels of corn. Given their current production levels, if the United States can trade an amount of corn fewer than 60 bushels and receive in exchange an amount of oil greater than 20 barrels, it will gain from trade . With trade, the United States can consume more of both goods than it did without specialization and trade. (Recall that the chapter Welcome to Economics! defined specialization as it applies to workers and firms. Economists also use specialization to describe the occurrence when a country shifts resources to focus on producing a good that offers comparative advantage.) Similarly, if Saudi Arabia can trade an amount of oil less than 60 barrels and receive in exchange an amount of corn greater than 10 bushels, it will have more of both goods than it did before specialization and trade. Table 33.5 illustrates the range of trades that would benefit both sides.

| The U.S. economy, after specialization, will benefit if it: | The Saudi Arabian economy, after specialization, will benefit if it: |

|---|---|

| Exports no more than 60 bushels of corn | Imports at least 10 bushels of corn |

| Imports at least 20 barrels of oil | Exports less than 60 barrels of oil |

The underlying reason why trade benefits both sides is rooted in the concept of opportunity cost, as the following Clear It Up feature explains. If Saudi Arabia wishes to expand domestic production of corn in a world without international trade, then based on its opportunity costs it must give up four barrels of oil for every one additional bushel of corn. If Saudi Arabia could find a way to give up less than four barrels of oil for an additional bushel of corn (or equivalently, to receive more than one bushel of corn for four barrels of oil), it would be better off.

What are the opportunity costs and gains from trade?

The range of trades that will benefit each country is based on the country’s opportunity cost of producing each good. The United States can produce 100 bushels of corn or 50 barrels of oil. For the United States, the opportunity cost of producing one barrel of oil is two bushels of corn. If we divide the numbers above by 50, we get the same ratio: one barrel of oil is equivalent to two bushels of corn, or (100/50 = 2 and 50/50 = 1). In a trade with Saudi Arabia, if the United States is going to give up 100 bushels of corn in exports, it must import at least 50 barrels of oil to be just as well off. Clearly, to gain from trade it needs to be able to gain more than a half barrel of oil for its bushel of corn—or why trade at all?

Recall that David Ricardo argued that if each country specializes in its comparative advantage, it will benefit from trade, and total global output will increase. How can we show gains from trade as a result of comparative advantage and specialization? Table 33.6 shows the output assuming that each country specializes in its comparative advantage and produces no other good. This is 100% specialization. Specialization leads to an increase in total world production. (Compare the total world production in Table 33.3 to that in Table 33.6 .)

| Country | Quantity produced after 100% specialization — Oil (barrels) | Quantity produced after 100% specialization — Corn (bushels) |

|---|---|---|

| Saudi Arabia | 100 | 0 |

| United States | 0 | 100 |

What if we did not have complete specialization, as in Table 33.6 ? Would there still be gains from trade? Consider another example, such as when the United States and Saudi Arabia start at C and C', respectively, as Figure 33.2 shows. Consider what occurs when trade is allowed and the United States exports 20 bushels of corn to Saudi Arabia in exchange for 20 barrels of oil.

Starting at point C, which shows Saudi oil production of 60, reduce Saudi oil domestic oil consumption by 20, since 20 is exported to the United States and exchanged for 20 units of corn. This enables Saudi to reach point D, where oil consumption is now 40 barrels and corn consumption has increased to 30 (see Figure 33.3 ). Notice that even without 100% specialization, if the “trading price,” in this case 20 barrels of oil for 20 bushels of corn, is greater than the country’s opportunity cost, the Saudis will gain from trade. Since the post-trade consumption point D is beyond its production possibility frontier, Saudi Arabia has gained from trade.

Visit this website for trade-related data visualizations.

As an Amazon Associate we earn from qualifying purchases.

This book may not be used in the training of large language models or otherwise be ingested into large language models or generative AI offerings without OpenStax's permission.

Want to cite, share, or modify this book? This book uses the Creative Commons Attribution License and you must attribute OpenStax.

Access for free at https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Authors: Steven A. Greenlaw, David Shapiro, Daniel MacDonald

- Publisher/website: OpenStax

- Book title: Principles of Economics 3e

- Publication date: Dec 14, 2022

- Location: Houston, Texas

- Book URL: https://openstax.org/books/principles-economics-3e/pages/1-introduction

- Section URL: https://openstax.org/books/principles-economics-3e/pages/33-1-absolute-and-comparative-advantage

© Jan 23, 2024 OpenStax. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution License . The OpenStax name, OpenStax logo, OpenStax book covers, OpenStax CNX name, and OpenStax CNX logo are not subject to the Creative Commons license and may not be reproduced without the prior and express written consent of Rice University.

Theory of Absolute Advantage

A country has an absolute advantage in the production of that good, which it can produce in greater quantity with the same quantity of resources than another country.

The Theory of Absolute Advantage is one of the earliest economic theories that explains the benefits of specialisation and international trade between countries. It was proposed by Adam Smith, the father of modern economics, in 1776 in his seminal work, "The Wealth of Nations." The theory of absolute advantage is based on the idea that countries can benefit from trade if they specialise in producing goods or services in which they have an absolute advantage over other countries.

The Purpose of the Theory of Absolute Advantage

The purpose of the theory of absolute advantage is to demonstrate the benefits of specialisation and international trade between countries. By specialising in the production of goods and services in which they have an absolute advantage, countries can increase their output through better resource allocation. This, in turn, can lead to economic growth and higher living standards.

Assumptions

The theory of absolute advantage is based on some assumptions, which are given below.

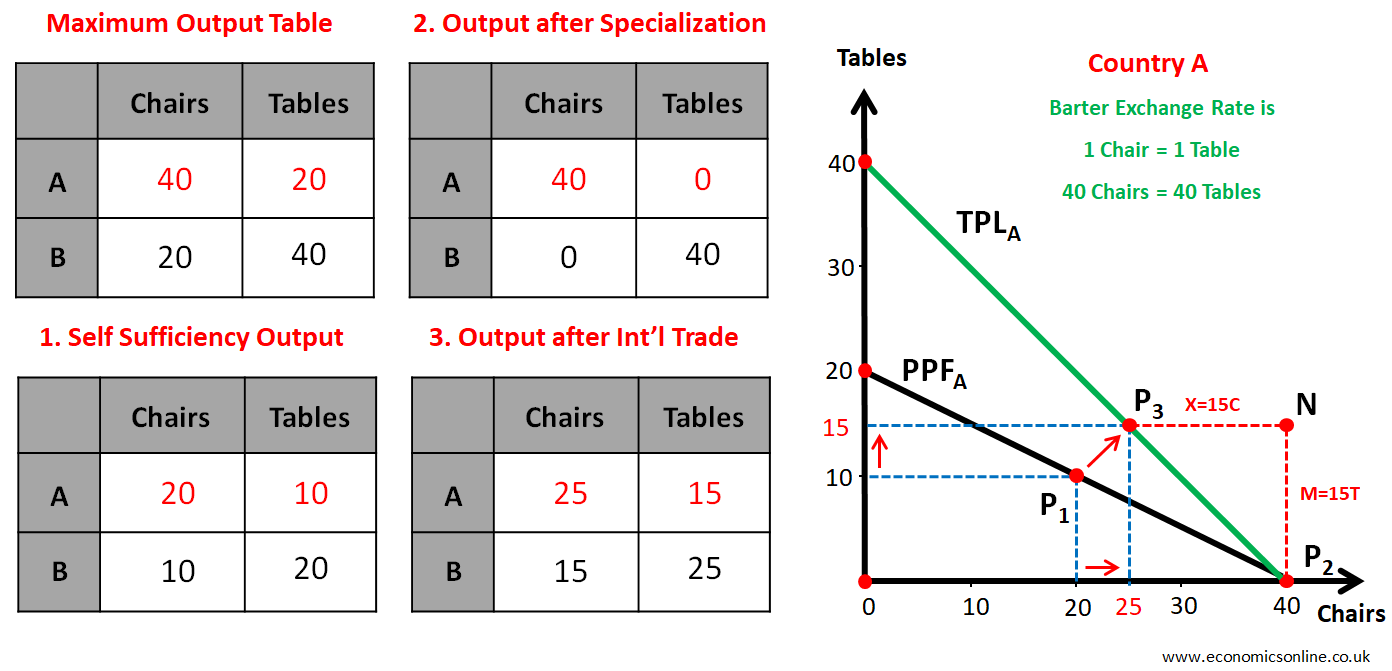

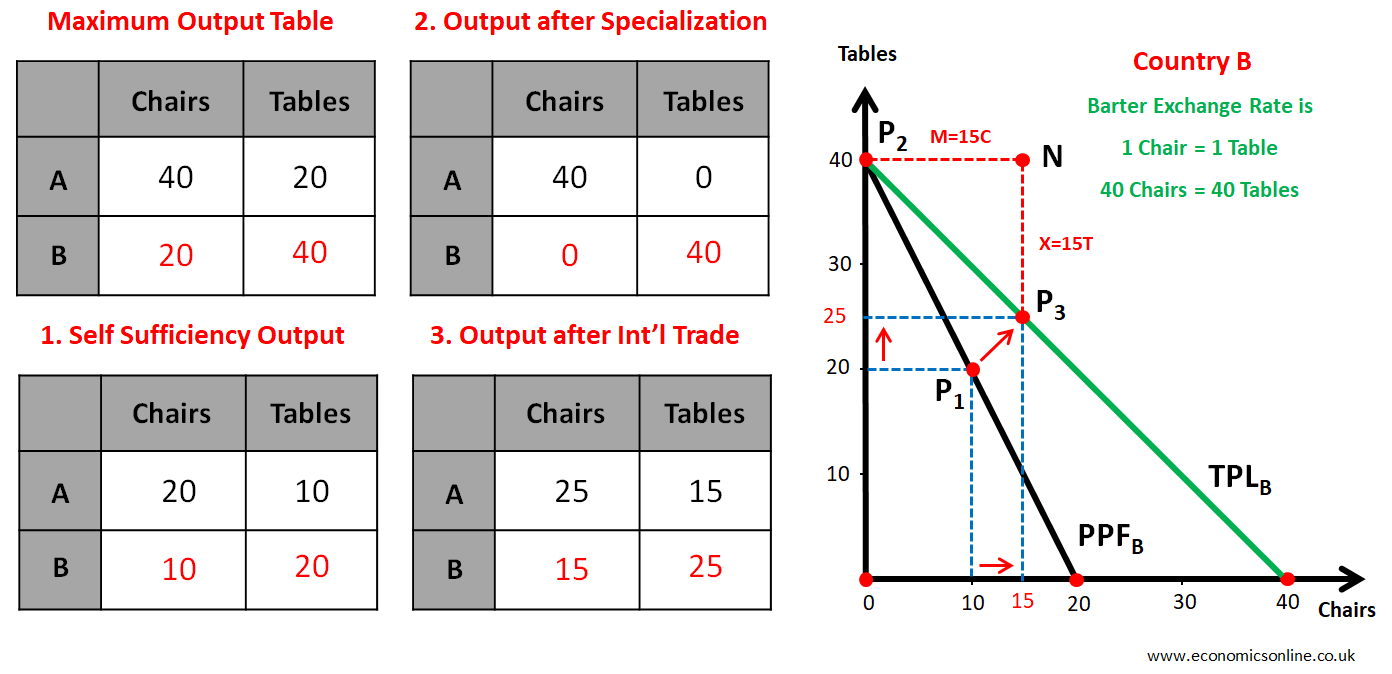

- There are only two countries in the world (Countries A and B).

- Both countries can only produce two goods. (Chairs and tables).

- The same resources are used to produce both goods.

- Both countries have different factor endowment in terms of the quality of their resources.

- Resources are homogeneous within a country. For example, all the workers in a country have the same skills, qualifications, productivity, and motivation.

- The factors of production or inputs (such as labor and capital) are not mobile between countries.

- There is constant opportunity cost. (We assume a straight-line production possibility frontier.)

- There is no transportation cost.

- There is free trade between trading countries. It means that there are no trade barriers for international trade.

- There is barter trade.

Data Example

Let’s use a data example to better understand the concept of absolute advantage.

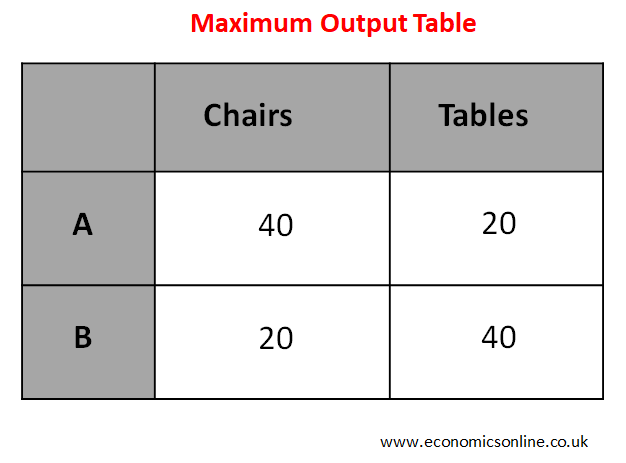

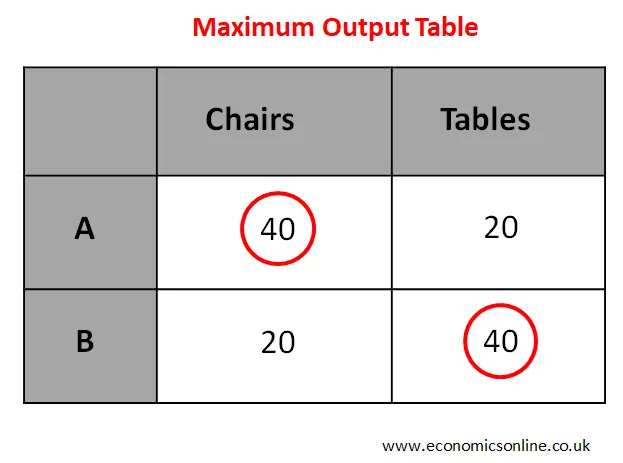

Consider the following maximum output table.

According to the above table, by using all the resources,

Country A can produce 40 chairs or 20 tables and country B can produce 20 chairs or 40 tables.

Suppose that each of the countries A and B has 10 workers. Then, In country A, 10 workers can produce 40 chairs or 20 tables and each worker can produce 4 chairs or 2 tables. While in country B, 10 workers can produce 20 chairs or 40 tables and each worker can produce 2 chairs or 4 tables.

Now let's consider different cases of resource allocation.

Case 1: Self-Sufficiency Output

Suppose that both countries are self-sufficient. Both countries produce chairs and tables according to their own needs. Suppose that both countries use half of their workers for the production of chairs and half for the production of tables. In country A, 5 workers will produce 20 chairs, and 5 workers will produce 10 tables. While in country B, 5 workers will produce 10 chairs, and 5 workers will produce 20 tables.

Following table shows self-sufficiency output in this scenario.

TWO is the total world output produced by both countries. For example, the total world output of chairs is 30 which is the sum of the outputs of country A (20) and country B (10).

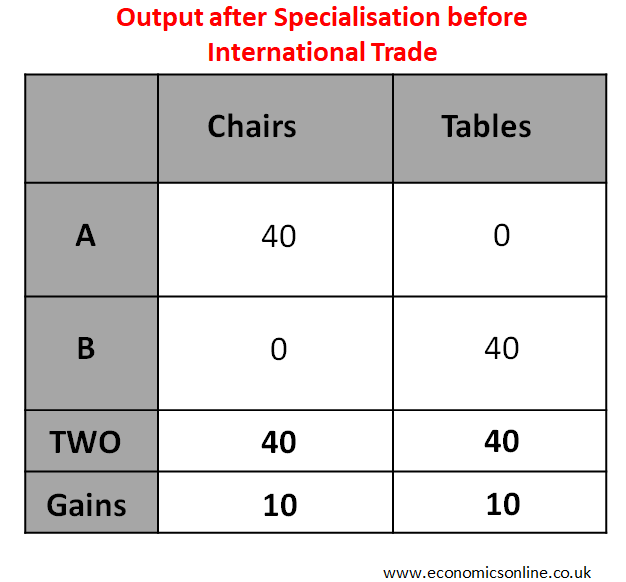

Case 2: Output after Specialisation before International Trade

The specialisation decision will be made on the basis of absolute advantage. The specialisation decision will be made by using the maximum output table.

Country A can produce more quantity of chairs; hence, country A has an absolute advantage in the production of chairs.

Country B can produce more quantity of tables; hence, country B has an absolute advantage in the production of tables.

Country A has an absolute advantage in the production of chairs. So, country A should specialise in the production of chairs.

Country B has an absolute advantage in the production of tables. So, country B should specialise in the production of tables.

The following table shows output after specialisation.

It can be noted from above two cases, that the total world output (TWO) is increased due to specialisation. But the problem is that country A does not have tables and country B does not have chairs. This problem can be solved through international trade.

Case 3: Output after Specialisation and International Trade

In order to do international trade, countries have to deciode the barter exchange rate.

The barter exchange rate is the rate at which one country’s goods can be exchanged with another country’s goods. It is also called the barter terms of trade. The following points are important.

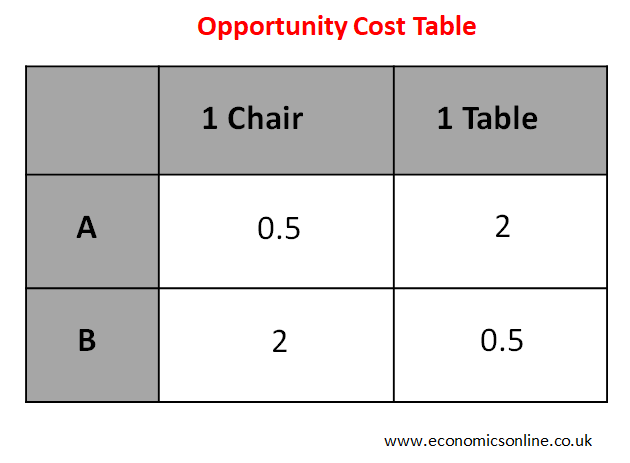

- The opportunity cost table is used to decide the barter exchange rate.

- The barter exchange rate must lie between opportunity cost ratios.

Here is the opportunity cost table.

For country A, the opportunity cost of making 1 chair = 0.5 tables

For country B, the opportunity cost of making 1 chair = 2 tables

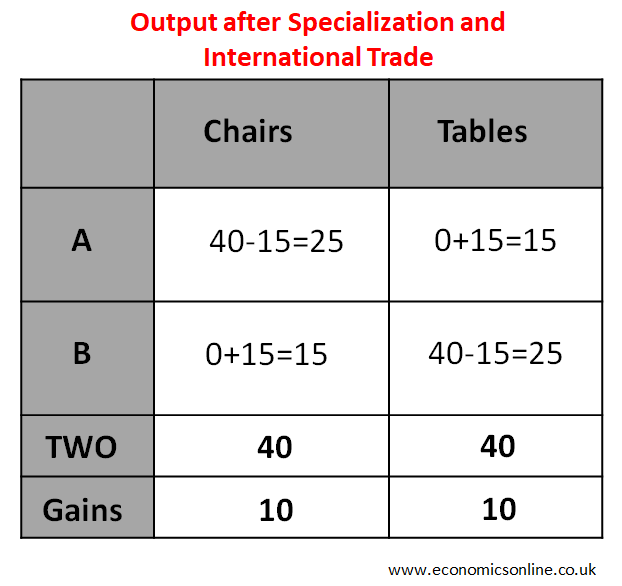

Let us take the barter exchange rate as 1 chair = 1 table

Suppose that country A has exported 15 chairs and imported 15 tables

The barter exchange rate is 1 chair = 1 table. So, 15 chairs = 15 tables

For country A, Exports =15 chairs and Imports =15 tables

For country B, Exports =15 tables and Imports =15 chairs

The output after international trade is shown in the table below.

Gains from Specialisation and International Trade

- Country A’s output is increased by 5 chairs and 5 tables.

- Country B’s output is increased by 5 chairs and 5 tables.

- Total world output is increased by 10 chairs and 10 tables.

Diagrams of the Theory of Absolute Advantage

Diagram for country a.

The following diagram shows all above cases of resource allocation in country A.

Point P 1 (20, 10) shows self-sufficiency output.

Point P 2 (40, 0) shows output after specialisation before international trade.

Barter exchange rate is 1 chair = 1 table. So, 40 chairs = 40 tables (This is used to draw the trade possibility line, TPL). And 15 chairs = 15 tables.

Point P 3 (25, 15) shows output after international trade.

For Country A , Exports = 15 Chairs Imports = 15 Tables

Country A's Gains from Specialisation and International Trade

- Country A’s output is increased by 5 chairs and 5 tables

- Country A’s output is above PPF, which shows a decrease in scarcity, an increase in output and economic growth.

Diagram for Country B

The following diagram shows all above cases of resource allocation in country B.

Point P 1 (10, 20) shows self-sufficiency output.

Point P 2 (0, 40) shows output after specialisation before international trade

Point P 3 (15, 25) shows output after international trade.

For Country B, Imports = 15 Chairs Exports = 15 Tables

Country B's Gains from Specialisation and International Trade

- Country B’s output is above PPF, which shows a decrease in scarcity.

Problem with the Theory of Absolute Advantage

It does not explain the possibility of specialisation and international trade if one country has an absolute advantage in both goods.

Limitations of the Theory of Absolute Advantage

While the theory of absolute advantage provides a useful framework for understanding the benefits of specialisation and international trade, it has several limitations, including:

The theory assumes that there are only two countries and two goods produced, and that all resources are homogeneous within a country, which is an unrealistic oversimplification of the real world.

The theory assumes that all factors of production are fixed and cannot be increased or decreased. In reality, factors of production are not fixed and can be increased or decreased through investment and innovation.

The theory does not account for the impact of government policies, such as subsidies and taxation, on trade.

The theory does not account for the impact of technological change on trade.

The theory assumes free trade without trade restrictions. In reality, there may be tariffs, quotas, and other trade restrictions between countries.

The theory assumes a constant opportunity cost, but in reality, the opportunity cost may not be constant, especially if resources are not homogeneous or if the production process becomes more complex.

The theory assumes barter trade, but in reality, most international trade is conducted through monetary exchange.

The theory assumes no transportation costs, which can have a significant impact on trade patterns.

Real-world Examples of the Theory of Absolute Advantage

Here are some real-world examples of the theory of absolute advantage in action:

Saudi Arabia and Oil Production

Saudi Arabia has an absolute advantage in oil production due to its abundant oil reserves and low cost of production. As a result, it specialises in oil production and exports oil to other countries that do not have an absolute advantage in oil production.

Japan and Electronics Manufacturing

Japan has an absolute advantage in electronics manufacturing due to its highly skilled workforce and advanced technology. As a result, it specialises in electronics manufacturing and exports electronic products to other countries.

China and Textile Production

China has an absolute advantage in textile production due to its low labour costs and large workforce. As a result, it specialises in textile production and exports textiles to other countries.

New Zealand and Agriculture

New Zealand has an absolute advantage in agriculture due to its favourable climate and abundant natural resources. As a result, it specialises in agriculture and exports agricultural products to other countries.

Zambia and Copper Production

Zambia has an absolute advantage in copper production due to its abundant copper reserves and low cost of production. As a result, it specialises in copper production and exports copper to other countries. In fact, copper is Zambia's main export, accounting for over 70% of the country's total export earnings.

These examples illustrate how countries can benefit from specialising in the production of goods in which they have an absolute advantage, and then trading with other countries to obtain goods in which they do not have an absolute advantage.

Theory of Absolute Advantage vs. Theory of Comparative Advantage

The theory of comparative advantage, developed by David Ricardo in the early 18th century, is another important economic theory that explains the benefits of international trade. The key differences between the theory of absolute advantage and the theory of comparative advantage are that the idea of absolute advantage focuses on productivity and efficiency, while the theory of comparative advantage focuses on opportunity costs. The theory of comparative advantage suggests that countries should specialise in producing goods and services for which they have a lower opportunity cost of production than other countries. This means that a country should produce the goods and services in which it is relatively more efficient, even if it is not absolutely efficient in producing them. Despite these differences, both Smith's theory of absolute advantage and Ricardo's theory of comparative advantage justify the benefits of specialisation and international trade.

In conclusion, the theory of absolute advantage provides a useful framework for understanding the benefits of international trade between countries. By specialising in the production of goods and services in which they have an absolute advantage, countries can increase their productivity and efficiency and reduce their production costs. However, the theory has several limitations and assumptions that must be considered, and it should be compared with other economic theories, such as the theory of comparative advantage, for a more complete understanding of the benefits of international trade.

The Impact of COVID-19 on Flight Cancellations and Compensation

How’s the UK Housing Market Faring in 2024?

- Search Search Please fill out this field.

Absolute Advantage

Comparative advantage, economic theory, the bottom line.

- Business Essentials

Absolute vs. Comparative Advantage: What’s the Difference?

:max_bytes(150000):strip_icc():format(webp)/troypic__troy_segal-5bfc2629c9e77c005142f6d9.jpg)

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate.

:max_bytes(150000):strip_icc():format(webp)/YariletPerez-d2289cb01c3c4f2aabf79ce6057e5078.jpg)

Absolute vs. Comparative Advantage: An Overview

Absolute and comparative advantage are two concepts in economics and international trade that influence how and why nations and businesses devote resources to producing particular goods and services.

Absolute advantage means one entity can manufacture a product at a higher quality and a faster rate for a greater profit than another competing business or country. Conversely, comparative advantage considers the opportunity costs when manufacturing multiple types of goods with limited resources.

Key Takeaways

- Absolute advantage and comparative advantage are two concepts in economics and international trade.

- Absolute advantage refers to the superiority of a country or business to produce a particular good.

- Comparative advantage introduces opportunity cost as a factor for analysis in choosing between production diversification.

The abilities of companies and nations to produce goods efficiently are the basis for absolute advantage . Absolute advantage is accomplished by creating the good or service at a lower absolute cost per unit using fewer inputs, or a more efficient process . Countries tend to avoid producing goods and services with little to no demand .

Absolute advantage is recognized with lower labor costs, access to a supply of resources, and a large pool of available capital. For example, Japan and Italy both produce automobiles. If Italy can manufacture higher quality sports cars with greater profit, then Italy is said to have an absolute advantage in that industry. On the other hand, Japan may devote limited resources and labor to electric cars or another industry to enjoy an absolute advantage rather than trying to compete with Italy's efficiency .

When a country or business has multiple resources to produce various goods and services rather than focus on just one product, it may look for a comparative advantage . Comparative advantage explains why companies, countries, or individuals benefit from trade. The opportunity cost of a given option is equal to the forfeited benefits achieved by choosing an available alternative in comparison.

Suppose China has the resources to produce smartphones and computers and can manufacture either 10 million computers or 10 million smartphones. If computers generate a higher profit , the opportunity cost is the difference in value lost from producing a smartphone rather than a computer. If China earns $100 for a computer and $50 for a smartphone, then the opportunity cost is $500 million. China will probably select computers because the chance of profit is higher.

Opportunity cost is the forgone benefit that would have been derived from an option other than the one chosen.

Scottish economist Adam Smith helped originate the concepts of absolute and comparative advantage in his book, The Wealth of Nations. Smith argued that countries should specialize in the goods they can produce most efficiently and trade for any products they can't produce as well.

Smith touted the marriage of specialization and international trade as they relate to absolute advantage. He suggested that England could produce more textiles per labor hour and Spain could produce more wine per labor hour, so England should export textiles and import wine, and Spain do the opposite.

Smith's theory assumes that the factors of production between countries don't change, there are no barriers to trade, and exports and imports are equal. British economist David Ricardo built on Smith's concepts by more broadly introducing comparative advantage in the early 19th century. He became well-known for his musings on comparative advantage. According to Ricardo, nations can benefit from trading even if one has an absolute advantage in producing everything.

Why Did the Economist Adam Smith Promote the Benefits of Trade?

Scottish economist Adam Smith is credited with developing the theories of absolute and creative advantage in his book, The Wealth of Nations. According to Smith, countries should focus on goods they can produce efficiently and use trade to acquire anything they can't make themselves. The mutual gain from trade forms the basis of Smith’s argument that specialization, the division of labor, and subsequent trade lead to prosperity for all.

What Is an Example of Absolute Advantage?

Saudi Arabia's oil reserves are abundant, giving it an absolute advantage. That's one reason it exports the commodity to other nations worldwide.

What Is the Benefit of Reaching Absolute Advantage in the Production of One Good?

The benefit of reaching absolute advantage when producing a single good or service is economics and profit. Making a product that others need and can't produce allows a company or country to initiate a trade relationship for goods and services it needs but can't produce. This will enable the company or country to profit from the specialized goods and import from the trading partner.

Scottish economist Adam Smith explained how countries can profit by only specializing in the goods and services they can produce and trade with others for products they can't make efficiently. The concept is often contrasted with comparative advantage in that countries produce goods and services not necessarily at a greater volume or quality at lower opportunity costs.

Project Gutenberg. " An Inquiry into the Nature and Causes of the Wealth of Nations ."

Adam Smith via Bibliomania. " The Wealth of Nations ."

Massachusetts Institute of Technology (MIT). " Ricardo's Difficult Idea ."

:max_bytes(150000):strip_icc():format(webp)/2048px-Porter_Value_Chain-78398cffb6364895b31c98549bf6f779.png)

- Terms of Service

- Editorial Policy

- Privacy Policy

Absolute Advantage – definition and examples

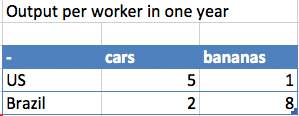

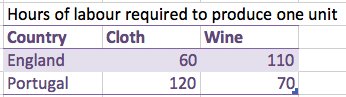

- Absolute advantage means that an economy can produce a greater total of goods for the same quantity of inputs.

- Absolute advantage means that fewer resources are needed to produce the same amount of goods and there will be lower costs than other economies.

Simple example of absolute advantage

- In this example, Brazil has an absolute advantage in producing bananas (8 to 1).

- The US has an absolute advantage in producing cars (5 to 2)

Absolute advantage and labour costs

This is a different way of showing absolute advantage. Rather than show the output, we show the hours of labour required. This reflects the effective cost of production.

- In the above case, England has an absolute advantage in producing cloth (only requires 60 hours compared to Portugal’s 120).

- Portugal has an absolute advantage in producing wine (only requires 70 hours compared to 110 hours in England)

Absolute advantage in everything

It is possible for an economy to have an absolute advantage in everything. Whilst, some countries may have no absolute advantage in any goods or services.

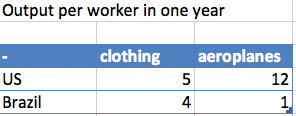

In the above case, the US has an absolute advantage in producing clothing (5 to 4) and also has an absolute advantage in producing aeroplanes. (12 to 1)

Absolute vs Comparative advantage

Absolute advantage is concerned with producing at a lower cost. Comparative advantage is concerned with producing at a lower opportunity cost (ie. relatively better at producing)

Having absolute advantage doesn’t necessarily mean an economy should produce that good. It is not advisable to try and produce everything. It is more helpful to consider comparative advantage .

Comparative advantage measures the opportunity cost of producing a good.

- If the US produces clothing, the opportunity cost is 12/5 = 2.4 aeroplanes foregone.

- If Brazil produces clothing, the opportunity cost is 1/4 = 0.25 aeroplanes foregone.

- Therefore, the US should specialise in producing aeroplanes. Brazil should specialise in producing clothing (even though it doesn’t have an absolute advantage)

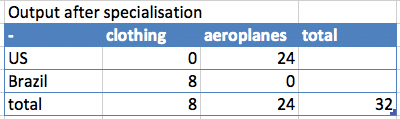

After specialisation

After specialisation, we assume countries are able to concentrate on doubling production because they produce only one good rather than two. Total output and economic welfare increases.

For example, one country may have an absolute advantage in many goods but it is better to focus on on goods where you have a relative advantage.

Absolute advantage in the workplace

- Susan can produce 11 cups of tea per hour and file 13 reports.

- Bob is a lazier worker and can only produce 10 cups of tea per hour and file 3 reports.

In this case, Susan has an absolute advantage in making cups of tea and filing reports.

- However, Susan should not try to do everything. She should specialise in compiling the reports, whilst Bob specialises in making cups of tea.

Notes about absolute advantage

- Absolute advantage can be hard to measure for many complicated goods because there are many different factor inputs.

- Comparative advantage

Published 12 November 2018, Tejvan Pettinger . www.economicshelp.org

13 thoughts on “Absolute Advantage – definition and examples”

Just a minor error, comparative advantage of aeroplanes in Brazil should be 1/4

Line – If Brazil produces clothing, the opportunity cost is 1/5 = 0.25 aeroplanes foregone.

yor comment is totaly wrong b/c comparative advantage is based on lower opportunity cost . countries with lower o.c is better off producing that good. i have degree in economics dear.

I have a degree* not I have degree. I don’t have a degree dear 😁

Sam, you are wrong please on the opportunity cost for Brazil it they decide to produce aeroplanes. The opportunity cost is not 1/4 but rather 4/1 = 4. This because they are forgoing producing 4 clothes only for one aeroplane. The O.C is therefore higher for them if they take this decision.

helpful but would like to know the defference btwn the comparative and absolute in detail

Thanks i got something new for ur presentation

LOL he’s is totally correct. Brazil has the comparative advantage is producing cloth,which the opprtunity cost of Cloth in brazil is lower than US

Thanks a lot… really helpful 🙏🙏🙏🙏🙏🙏

Tanks alot I’ve got everything for my presentation

Thanks a lot the document has really helped

I understood the lesson, I guess my students they are going to compliment me.

I very much enjoyed the notes, please keep publishing more for better clarification and details elaboration of the two subjects ( absolute and comparative advantage). I said this because on the context of relevance of absolute and comparative advantage is not detailed.

Wow I’m so thankful of you what a great lesson I learned from here I really appreciate you thanks for taking some absolutely advantage example.

Leave a comment Cancel reply

If you're seeing this message, it means we're having trouble loading external resources on our website.

If you're behind a web filter, please make sure that the domains *.kastatic.org and *.kasandbox.org are unblocked.

To log in and use all the features of Khan Academy, please enable JavaScript in your browser.

AP®︎/College Macroeconomics

Course: ap®︎/college macroeconomics > unit 1, comparative advantage, specialization, and gains from trade.

- Comparative advantage and absolute advantage

- Opportunity cost and comparative advantage using an output table

- Terms of trade and the gains from trade

- Input approach to determining comparative advantage

- When there aren't gains from trade

- Comparative advantage worked example

- Lesson summary: Comparative advantage and gains from trade

- Comparative advantage and the gains from trade

Want to join the conversation?

- Upvote Button navigates to signup page

- Downvote Button navigates to signup page

- Flag Button navigates to signup page

Video transcript

Agribusiness Management and Trade 3(3+0)

Lesson-37 absolute advantage theory of international trade.

37.1 INTRODUCTION

The exchange of goods across the national borders is termed as international trade. Countries differ widely in terms of the products and services traded. Countries rarely follow the trade structure of the other nations; rather they evolve their own product portfolios and trade patterns for exports and imports. Besides, nations have marked differences in their vulnerabilities to the upheavals in exogenous factors. There are various theories of international trade which are grouped in to classical and neo-classical theories. We will discuss only the classical theory of international trade. This lesson aims to discuss absolute advantage theory of international trade and the next lesson you are going to study the comparative advantage theory of international trade. This will provide a conceptual understanding of the fundamental principles of international trade and shifts in trade patterns.

37.2 THEORY OF MERCANTILISM

The theory of mercantilism attributes and measures the wealth of a nation by the size of its accumulated treasures. Accumulated wealth is traditionally measured in terms of gold, as earlier gold and silver were considered the currency of international trade. Mercantilists, therefore, suggested that the fundamental task of the national government is to acquire as much of gold and other precious metals as possible, through foreign trade. The only way in which this can be accomplished by a country is, when it is able to run perpetually favourable balance of trade for itself. i.e. by exporting more and more and importing less and less. The difference between exports and imports, which must be always in favour of the nation, would be settled by an inflow of gold and other precious metals. The more gold the nation had, richer and more powerful it would be. All this could be guaranteed by foreign trade that is in favour of the country. The mercantilists, as great “nation builders” advocated that the government should adopt policies which are designed to restrict imports and stimulate exports; because we lose gold by importing and earn gold by exporting. The theory of mercantilism aims at creating trade surplus, which in turn contributes to the accumulation of a nation’s wealth. Between the 16 th and 19 th centuries, European colonial powers actively pursued international trade to increase their treasury of goods, which were in turn invested to build a powerful army and infrastructure.

Mercantilism was implemented by active government interventions, which focused on maintaining trade surplus and expansion of colonization. National governments imposed restrictions on imports through tariffs and quotas and promoted exports by subsidizing production. The colonies served as cheap sources for primary commodities, such as raw cotton, grains, spices, herbs and medicinal plants, tea, coffee, and fruits, both for consumption and also as raw material for industries. Thus, the policy of mercantilism greatly assisted and benefited the colonial powers in accumulating wealth.

The main limitation of this theory is, accumulation of wealth takes place at the cost of another trading partner. If one nation has to gain from international trade the partner country must lose. Therefore, international trade is treated as a win-lose game resulting virtually in no contribution of global wealth. Thus, international trade becomes zero-sum game.

A number of national governments still seem to cling to the mercantilist theory, and exports rather than imports are actively promoted. This also explains the reason behind the ‘import substitution strategy’ adopted by a large number of countries prior to economic liberalization. This strategy was guided by their keenness to contain imports and promote domestic production even at the cost of efficiency and higher production costs. It has resulted in the creation of a large number of export promotion organizations that look after the promotion of exports from the country. However, import promotion agencies are uncommon in most nations. Presently, the terminology used under this trade theory is neo-mercantilism, which aims at creating favourable trade balance and has been employed by a number of countries to create trade surplus.

37.3 THEORY OF ABSOLUTE ADVANTAGE

In 1776, Adam Smith published his famous book The Wealth of Nations, in which he attacked the mercantilist view and showed that it was all wrong and illogical, for one thing, not all nations can have an export surplus simultaneously. Mercantilist policy, therefore, cannot be considered as international economic policy. Their policy was highly nationalistic and biased heavily against the other countries. It was Adam Smith who first developed a model of international trade and showed convincingly that all countries could gain form trade. Mercantilists had measured the wealth of nation by the stock of precious metals that the nation possessed. Adam Smith rejected all this and argued instead, that the wealth of a nation is measured by the amount of goods and services that a nation produced, or by what is today called Gross National Product (GNP). He developed the comparative advantage model, where he showed that international trade could bring gains to all trading nations, thereby improving the wealth and standards of living of all the participating nations. In his model of trade, unlike the mercantilist’s model, a nation need not gain only at the expense of other nations; here all nations gain together and simultaneously.

An absolute advantage refers to the ability of a country to produce a good more efficiently and cost-effectively than any other country. Smith elucidated the concept of ‘absolute advantage’ leading to gains from specialization with the day-to-day illustrations as follows:

“It is the maxim of every prudent master of a family, never to make at home what is will cost him more to make than to buy. The taylor does not attempt to make his own shoes, but buys them from shoemaker. The shoemaker does not attempt to make his own clothes, but employs a taylor. The farmer attempts to make neither…”

What is true in the conduct of a family may also be applied for the nations. If a foreign country can supply us with a commodity cheaper than we ourselves can make it, better buy it from them with some part of the produce of our own industry. Thus he advocated, instead of producing all products, each country should specialize in producing those goods that it can produce more efficiently. A country’s advantage may be either natural or acquired.

2.3.1 Natural Advantage

Natural factors, such as a country’s geographical and agro-climatic conditions, mineral or other natural resources, or specialized manpower contribute to a country’s natural advantage in certain products. For instance, the agro-climatic condition in India is an important factor for sizeable export of agro-produce, such as spices, cotton, tea and mangoes etc. The availability of relatively cheap labour contributes to India’s edge in export of labour-intensive products. The production of wheat and maize in US, petroleum in Saudi Arabia, citrus fruits in Israel, lumber in Canada, and aluminum ore in Jamaica are illustrations of natural advantages.

2.3.2 Acquired Advantage

The acquired advantage in either a product of its process technology plays an important role in creating such as shift. The ability to differentiate or produce a different product is termed as an advantage in product technology, while the ability to produce a homogenous product more efficiently is termed as an advantage in process technology. Development of software products in India, production of consumer electronics and automobiles in Japan, watches in Switzerland and shipbuilding in South Korea may be attributed to acquired advantage. Export centers in for precious and semi-precious stones in Jaipur, Surat, Navasari and Mumbai have come up not just because of their raw material resources but the skills they have developed in processing imported raw stones.

To appreciate the theory of absolute advantage, consider an example of two countries and two commodities model. Let Malaysia and India be the two such countries and Rubber and Textiles be the commodities. Assume that in the production of these commodities in two countries, there are constant returns to scale conditions i.e. there are constant marginal opportunity opportunity cost conditions in both countries in both commodities. Assume further production possibilities are such that both countries can produce both the goods if they wish. Finally assume that both countries have X amount of factors of production such that,

a. With X factors of production, Malaysia can produce either 100 units of rubber or 50 units of textiles, or mix of rubber and textiles in the opportunity cost ratio of 2:1 (i.e. to produce 1 more unit of textiles, it has to give up the opportunity of producing 2 units of rubber). b. With X factors of production India can produce either 50 units of rubber or 100 units of textiles. Or some other combination of rubber and textiles subject to the opportunity cost ratio of 1:2 (This means that India has to give up producing 1 unit of rubber in order to produce 2 units of textiles or alternatively, India has to give up the opportunity of producing 2 units of textiles in order to product 1 more unit of rubber).

From the above supply conditions it is quite clear that Malaysia has an absolute advantage in the production of rubber and India has the absolute advantage in the production of textiles. This shows there is scope for specialization in production and also of establishing mutually beneficial trade between the two countries. Now let us see how it happens.

First in a situation of autarky or no trade, each country can produce and consume independent of other country, a combination of rubber and textile as shown in table 37.1. Malaysia produces and consumes 50 units of rubber plus 25 units of textiles (total 75 units). India produces 25 units of rubber plus 50 units of textiles (total 75 units). Therefore, in absence of any trade, the total units produced in the world are 150 units.

Table 37.1. Production and consumption levels with no trade

| Countries | Commodities | Total output (units) | |

| Rubber (units) | Textiles (units) | ||

| Malaysia | 50 | 25 | 75 |

| India | 25 | 50 | 75 |

| World | 75 | 75 | 150 |

Let us now examine what happens if they trade with each other. This is shown in the table 37.2. Malaysia would specialize in production of rubber and India in production of textiles with 100 units of rubber and textiles respectively by utilizing all the resources. Thus the total production in the world would be 200 units. Thus opening up trade resulted in higher production in both the countries. Both the countries became richer after trade in terms of production. This is production gain from international trade.

Table 37.2. Production levels after international trade

| Countries | Commodities | Total output (units) | |

| Rubber (units) | Textiles (units) | ||

| Malaysia | 100 | 0 | 100 |

| India | 0 | 100 | 100 |

| World | 100 | 100 | 200 |

What about the consumption gain? This depends on how the gains from the production are distributed between the two countries. In other words, it depends on the terms of trade, i.e., how many units of rubber exchange for one unit of textiles between India and Malaysia.

Suppose terms of trade are fixed at 1:1 i.e., Malaysia and India agree to exchange 1 unit of rubber for 1 unit of textiles. Then depending on the taste pattern in the two countries and upon how much they want to trade each other’s goods, the consumption gains can be determined. Supposing that the consumers in both countries want to consume some mix of both the goods; then Malaysia could export say 40 units of rubber in exchange for 40 units of textile imports from India. The resulting situation will be like that is presented in table 37.3. Malaysia after trade has produced 100 units of rubber. Consumers wish to consume 60 units of rubber to India. Malaysia exports 40 units of rubber to India in exchange for 40 units of textile imports from India. Similarly for India, it imports 40 units of rubber and exports 40 units of textiles. India’s post trade consumption of rubber and textile is 40 and 60. Clearly consumers in both the countries have gained from the trade.

The same analogy can be applied what happens if the terms of trade are different.

Table 37.3. Consumption shares after international trade

| Countries | Commodities | Total output (units) | |

| Rubber (units) | Textiles (units) | ||

| Malaysia | 60 | 40 | 100 |

| India | 40 | 60 | 100 |

| World | 100 | 100 | 200 |

Current course

Module 1. Management Concepts & Principle

Module 2. Management Functions

Module 3. Marketing Management

Module 4. Concepts and application of management p...

Module 5. Production, Consumption, Processing and ...

Module 6. Meaning & Theories of International ...

Module 7. WTO provisions for trade in agricultural...

Advantages and Disadvantages of Assumptions Of Absolute Advantage Theory

Looking for advantages and disadvantages of Assumptions Of Absolute Advantage Theory?

We have collected some solid points that will help you understand the pros and cons of Assumptions Of Absolute Advantage Theory in detail.

But first, let’s understand the topic:

What is Assumptions Of Absolute Advantage Theory?

Absolute Advantage Theory assumes that each country can make certain goods better and cheaper than others. It suggests countries should focus on producing these goods to trade and everyone will benefit.

What are the advantages and disadvantages of Assumptions Of Absolute Advantage Theory

The following are the advantages and disadvantages of Assumptions Of Absolute Advantage Theory:

| Advantages | Disadvantages |

|---|---|

| Promotes efficient resource use | Ignores transport costs |

| Encourages global trade | Overlooks product quality differences |

| Enhances economic growth | Doesn’t consider labor mobility |

| Boosts product variety | Assumes unlimited resources |

| Fosters international cooperation | Neglects technological progress |

Advantages of Assumptions Of Absolute Advantage Theory

Disadvantages of assumptions of absolute advantage theory.

You can view other “advantages and disadvantages of…” posts by clicking here .

If you have a related query, feel free to let us know in the comments below.

Also, kindly share the information with your friends who you think might be interested in reading it.

Leave a Reply Cancel reply

Registration Successful

Registration failed.

- Economics Assignment Help

Absolute Advantage Theory

Absolute advantage theory assignment help | absolute advantage theory homework help.

The criticism of the mercantilism led to the birth of the absolute advantage theory. Economist claimed that with the mercantilism school of thought, countries would never perpetually increase their wealth through international trade but rather they will revolve around being bullion deficits and bullion surpluses. Adam Smith came up with a solution to this hitch in the international trade; the absolute advantage theory. This theory’s major implication is that it encourages wealth creation in foreign markets. When countries can easily import goods that they do not produce efficiently and produce only those they are great at, more wealth will be created since they are not limited by what they can produce hence allowing an opportunity for growth. Moreover, the absence of trade barriers allows increased specialization, mutual benefits from countries and increase in the market size which all translate to wealth creation.