- Search Search Please fill out this field.

What Is Break-Even Analysis?

Break-even point formula.

- Calculating BEP and Contribution Margin

Who Calculates the BEP?

Why break-even analysis matters, the bottom line.

- Investing Basics

Break-Even Analysis: Formula and Calculation

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master's in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

:max_bytes(150000):strip_icc():format(webp)/adam_hayes-5bfc262a46e0fb005118b414.jpg)

Gordon Scott has been an active investor and technical analyst or 20+ years. He is a Chartered Market Technician (CMT).

:max_bytes(150000):strip_icc():format(webp)/gordonscottphoto-5bfc26c446e0fb00265b0ed4.jpg)

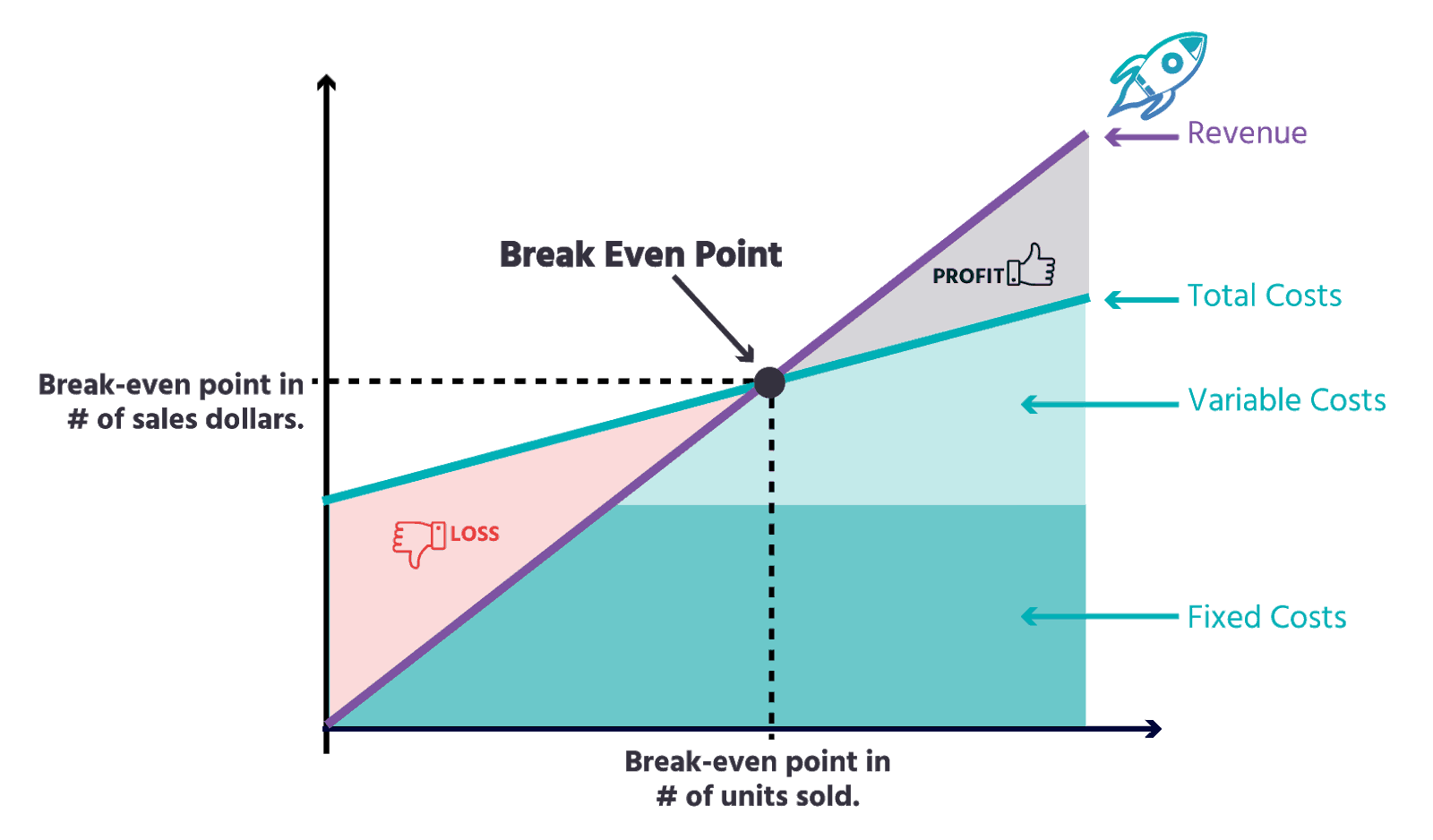

Break-even analysis compares income from sales to the fixed costs of doing business. Five components of break-even analysis include fixed costs, variable costs, revenue, contribution margin, and break-even point (BEP). When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs to begin generating a profit. The break-even point formula can help find the BEP in units or sales dollars.

Key Takeaways:

- Using the break-even point formula, businesses can determine how many units or dollars of sales cover the fixed and variable production costs.

- The break-even point (BEP) is considered a measure of the margin of safety.

- Break-even analysis is used broadly, from stock and options trading to corporate budgeting for various projects.

Investopedia / Paige McLaughlin

Break-even analysis involves a calculation of the break-even point (BEP) . The break-even point formula divides the total fixed production costs by the price per individual unit, less the variable cost per unit.

BEP = Fixed Costs / (Price Per Unit - Variable Cost Per Unit)

Break-even analysis looks at the fixed costs relative to the profit earned by each additional unit produced and sold. A firm with lower fixed costs will have a lower break-even point of sale and $0 of fixed costs will automatically have broken even with the sale of the first product, assuming variable costs do not exceed sales revenue. Fixed costs remain the same regardless of how many units are sold. Examples of fixed and variable costs include:

| Rent | Raw material costs |

| Taxes | Production Supplies |

| Insurance | Utilities |

| Wages or Salaries | Packaging |

Calculating the Break-Even Point and Contribution Margin

Break-even analysis and the BEP formula can provide firms with a product's contribution margin. The contribution margin is the difference between the selling price of the product and its variable costs. For example, if an item sells for $100, with fixed costs of $25 per unit, and variable costs of $60 per unit, the contribution margin is $40 ($100 - $60). This $40 reflects the revenue collected to cover the remaining fixed costs, which are excluded when figuring the contribution margin.

Contribution Margin = Item Price - Variable Cost Per Unit

To find the total units required to break even, divide the total fixed costs by the unit contribution margin. Assume total fixed costs are $20,000. With a contribution margin of $40 above, the break-even point is 500 units ($20,000 divided by $40). Upon selling 500 units, the payment of all fixed costs is complete, and the company will report a net profit or loss of $0.

BEP (Units) = Total Fixed Costs / Contribution Margin

To calculate the break-even point in sales dollars, divide the total fixed costs by the contribution margin ratio. The contribution margin ratio is the contribution margin per unit divided by the sale price.

Contribution Margin Ratio = Contribution Margin Per Unit / Item Price

BEP (Sales Dollars) = Total Fixed Costs / Contribution Margin Ratio

The contribution margin ratio is 40% ($40 contribution margin per item divided by $100 sale price per item). The break-even point in sales dollars is $50,000 ($20,000 total fixed costs divided by 40%).

In accounting, the margin of safety is the difference between actual sales and break-even sales. Managers utilize the margin of safety to know how much sales can decrease before the company or project becomes unprofitable.

- Entrepreneurs

- Financial Analysts

- Stock and Option Traders

- Government Agencies

Although investors are not interested in an individual company's break-even analysis on their production, they may use the calculation to determine at what price they will break even on a trade or investment. The calculation is useful when trading in or creating a strategy to buy options or a fixed-income security product.

- Pricing : Businesses get a comprehensible perspective on their cost structure with a break-even analysis, setting prices for their products that cover their fixed and variable costs and provide a reasonable profit margin.

- Decision-Making : When it comes to new products and services, operational expansion, or increased production, businesses can chart their profit to sales volume and use break-even analysis to help them make informed decisions surrounding those activities.

- Cost Reduction : Break-even analysis helps businesses find areas to reduce costs to increase profitability.

- Performance Metric: Break-even analysis is a financial performance tool that helps businesses ascertain where they are in achieving their goals.

What Are Some Limitations of Break-Even Analysis?

Break-even analysis assumes that the fixed and variable costs remain constant over time. Costs may change due to factors such as inflation, changes in technology, or changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

What Are the Components of Break-Even Analysis?

There are five components of break-even analysis including fixed costs, variable costs, revenue, contribution margin, and the break-even point (BEP).

Why Is the Contribution Margin Important in Break-Even Analysis?

The contribution margin represents the revenue required to cover a business' fixed costs and contribute to its profit. Through the contribution margin calculation, a business can determine the break-even point and where it can begin earning a profit.

How Do Businesses Use the Break-Even Point in Break-Even Analysis?

The break-even point (BEP) helps businesses with pricing decisions, sales forecasting, cost management, and growth strategies. A business would not use break-even to measure its repayment of debt or how long that repayment will take to complete.

Break-even analysis is a tool used by businesses and stock and option traders. Break-even analysis is essential in determining the minimum sales volume required to cover total costs and break even. It helps businesses choose pricing strategies, and manage costs and operations. In stock and options trading, break-even analysis helps find the minimum price movements required to cover trading costs and make a profit. Traders can use break-even analysis to set realistic profit targets, manage risk, and make informed trading decisions.

U.S. Small Business Administration. " Break-Even Point ."

Professor Rosemary Nurre, College of San Mateo. " Accounting 131: Chapter 6, Cost-Volume-Profit Relationships ."

:max_bytes(150000):strip_icc():format(webp)/VariableCost-c90b9744910b4c2db18fafc5e4957465.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- HR & Payroll

Break-Even Analysis Explained - Full Guide With Examples

Did you know that 30% of operating small businesses are losing money? Running your own business is trickier than it sounds. You have to plan ahead carefully to break-even or be profitable in the long run.

Building your own small business is one of the most exciting, challenging, and fun things you can do in this generation.

To start and sustain a small business it is important to know financial terms and metrics like net sales, income statement and most importantly break-even point .

Performing break-even analysis is a crucial activity for making important business decisions and to be profitable in business.

So how do you do it? That is what we will go through in this article. Some of the key takeaways for you when you finish this guide would be:

- Understand what break-even point is

- Know why it is important

- Learn how to calculate break-even point

- Know how to do break-even analysis

- Understand the limitations of break-even analysis

So, if you are tired of your nine-to-five and want to start your own business, or are already living your dream, read on.

What is Break-Even Point?

Small businesses that succeeds are the ones that focus on business planning to cross the break-even point, and turn profitable .

In a small business, a break-even point is a point at which total revenue equals total costs or expenses. At this point, there is no profit or loss — in other words, you 'break-even'.

Break-even as a term is used widely, from stock and options trading to corporate budgeting as a margin of safety measure.

On the other hand, break-even analysis lets you predict, or forecast your break-even point. This allows you to course your chart towards profitability.

Managers typically use break-even analysis to set a price to understand the economic impact of various price and sales volume calculations.

The total profit at the break-even point is zero. It is only possible for a small business to pass the break-even point when the dollar value of sales is greater than the fixed + variable cost per unit.

Every business must develop a break-even point calculation for their company. This will give visibility into the number of units to sell, or the sales revenue they need, to cover their variable and fixed costs.

Importance of Break-Even Analysis for Your Small Business

A business could be bringing in a lot of money; however, it could still be making a loss. Knowing the break-even point helps decide prices, set sales targets, and prepare a business plan.

The break-even point calculation is an essential tool to analyze critical profit drivers of your business, including sales volume, average production costs, and, as mentioned earlier, the average sales price. Using and understanding the break-even point, you can measure

- how profitable is your present product line

- how far sales drop before you start to make a loss

- how many units you need to sell before you make a profit

- how decreasing or increasing price and volume of product will affect profits

- how much of an increase in price or volume of sales you will need to meet the rise in fixed cost

How to Calculate Break-Even Point

There are multiple ways to calculate your break-even point.

Calculate Break-even Point based on Units

One way to calculate the break-even point is to determine the number of units to be produced for transitioning from loss to profit.

For this method, simply use the formula below:

Break-Even Point (Units) = Fixed Costs ÷ (Revenue per Unit – Variable Cost per Unit)

Fixed costs are those that do not change no matter how many units are sold. Don't worry, we will explain with examples below. Revenue is the income, or dollars made by selling one unit.

Variable costs include cost of goods sold, or the acquisition cost. This may include the purchase cost and other additional costs like labor and freight costs.

Calculate Break-Even Point by Sales Dollar - Contribution Margin Method

Divide the fixed costs by the contribution margin. The contribution margin is determined by subtracting the variable costs from the price of a product. This amount is then used to cover the fixed costs.

Break-Even Point (sales dollars) = Fixed Costs ÷ Contribution Margin

Contribution Margin = Price of Product – Variable Costs

Let’s take a deeper look at the some common terms we have encountered so far:

- Fixed costs: Fixed costs are not affected by the number of items sold, such as rent paid for storefronts or production facilities, office furniture, computer units, and software. Fixed costs also include payment for services like design, marketing, public relations, and advertising.

- Contribution margin: Is calculated by subtracting the unit variable costs from its selling price. So if you’re selling a unit for $100 and the cost of materials is $30, then the contribution margin is $70. This $70 is then used to cover the fixed costs, and if there is any money left after that, it’s your net profit.

- Contribution margin ratio: is calculated by dividing your fixed costs from your contribution margin. It is expressed as a percentage. Using the contribution margin, you can determine what you need to do to break-even, like cutting fixed costs or raising your prices.

- Profit earned following your break-even: When your sales equal your fixed and variable costs, you have reached the break-even point. At this point, the company will report a net profit or loss of $0. The sales beyond this point contribute to your net profit.

Small Business Example for Calculating Break-even Point

To show how break-even works, let’s take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress.

These costs might cover the software and materials needed to design the dress and be sure it meets the requirement of the brand, the fee paid to a designer to design the look and feel of the dress, and the development of promotional materials used to advertise the dress.

These costs are fixed as they do not change per the number of dresses sold.

The variable costs would include the materials used to make each dress — embellishment’s for $30, the fabric for the body for $20, inner lining for $10 — and the labor required to assemble the dress, which amounted to one and a half hours for a worker earning $50 per hour.

Thus, the unit variable costs to make a single dress is $110 ($60 in materials and $50 in labor). If she sells the dress for $150, she’ll make a unit margin of $40.

Given the $40 unit margin she’ll receive for each dress sold, she will cover her $45,500 total fixed cost will be covered if she sells:

Break-Even Point (Units) = $45,000 ÷ $40 = 1,125 Units

You can see per the formula , on the right-hand side, that the Break-even is 1,125 dresses or units

In other words, if this dressmaker sells 1,125 units of this particular dress, then she will fully recover the $45,000 in fixed costs she invested in production and selling. If she sells fewer than 1,125 units, she will lose money. And if she sells more than 1,125 units, she will turn a profit. That’s the break-even point.

What if we change the price?

Suppose our dressmaker is worried about the current demand for dresses and has concerns about her firm’s sales and marketing capabilities, calling into question her ability to sell 1,125 units at a price of $150. What would be the effect of increasing the price to $200?

This would increase the unit margin to $90.Then the number of units to be sold would decline to 500 units. With this information, the dressmaker could assess whether she was better off trying to sell 1,125 dresses at $150 or 500 dresses at $200, and priced accordingly.

What if we want to make an investment and increase the fixed costs?

Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments. For instance, consider the possibility of keeping the price at $150, but having a celebrity endorse the dress (think Madonna!) for a fee of $20,000.

This would be worthwhile if the dressmaker believed that the endorsement would result in total sales of $66,000 (the original fixed cost plus the $20,000 for Ms. Madonna).

With the Fixed Costs at $66,000 we see, it would only be worthwhile if the dressmaker believed that the endorsement would result in total sales of 1,650 units.

In other words, if the endorsement led to incremental sales of 525 dress units, the endorsement would break-even. If it led to incremental sales of greater than 525 dresses, it would increase profits.

What if we change the variable cost of producing a good?

Break-even also can be used to examine the impact of a potential change to the variable cost of producing a good.

Imagine that our dressmaker could switch from using a rather plain $20 fabric for the dress to a higher-end $40 fabric, thereby increasing the variable cost of the dress from $110 to $130 and decreasing the unit margin from $40 to $20. How much would your sales need to increase to compensate for the extra cost?

Suppose the Variable Cost is $130 (and the Fixed Cost is $45,000 – our dressmaker can’t afford to have nice fabric plus get Ms. Madonna). It would make better sense to switch to the nicer fabric if the dressmaker thought it would result in sales of 2,250 units, an additional 1125 dresses, which is double the number of initial sale numbers.

You likely aren’t a dressmaker or able to get a celebrity endorsement from Ms. Madonna, but you can use break-even analysis to understand how the various changes of your product, from revenue, costs, sales, impact your small business’s profitability .

What Are the Benefits of Doing a Break-even Analysis?

Smart Pricing : Finding your break-even point will help you price your products better. A lot of effort and understanding goes into effective pricing, but knowing how it will affect your profitability is just as important. You need to make sure you can pay all your bills.

Cover Fixed Costs : When most people think about pricing, they think about how much their product costs to create. Those are considered variable costs. You will still need to cover your fixed costs like insurance or web development fees. Doing a break-even analysis helps you do that.

Avoid Missing Expenses : When you do a break-even analysis, you have to lay out all your financial commitments to figure out your break-even point. It’s easy to forget about expenses when you’re thinking through a business idea. This will limit the number of surprises down the road.

Setting Revenue Targets : After completing a break-even analysis, you know exactly how much you need to sell to be profitable. This will help you set better sales goals for you and your team.

Decision Making : Usually, business decisions are based on emotion. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to decide when you’ve put in the work and have useful data in front of you.

Manage Financial Strain : Doing a break-even analysis will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes by being aware of the risks and knowing when to avoid a business idea.

Business Funding : For any funding or investment, a break-even analysis is a key component of any business plan. You have to prove your plan is viable. It’s usually a requirement if you want to take on investors or other debt to fund your business.

When to Use Break-even Analysis

Starting a new business.

If you’re thinking about a small online business or e-commerce, a break-even analysis is a must. Not only does it help you decide if your business idea is viable, but it makes you research and be realistic about costs, as well as think through your pricing strategy.

Creating a new product

Especially for a small business, you should still do a break-even analysis before starting or adding on a new product in case that product is going to add to your expenses. There will be a need to work out the variable costs related to your new product and set prices before you start selling.

Adding a new sales channel

If you add a new sales channel, your costs will change. Let's say you have been selling online, and you’re thinking about opening an offline store; you’ll want to make sure you at least break-even with the brick and mortar costs added in. Adding additional marketing channels or expanding social media spends usually increases daily expenses. These costs need to be part of your break-even analysis.

Changing the business model

Let's say you are thinking about changing your business model; for example, switching from buying inventory to doing drop shipping or vice-versa, you should do a break-even analysis. Your costs might vary significantly, and this will help you figure out if your prices need to change too.

Limitations of Break-even Analysis

- The Break-even analysis focuses mostly on the supply-side (i.e., costs only) analysis. It doesn't tell us what sales are actually likely to be for the product at various prices.

- It assumes that fixed costs are constant. However, an increase in the scale of production is likely to lead to an increase in fixed costs.

- It assumes average variable costs are constant per unit of output, per the range of the number of sales

- It assumes that the number of goods produced is equal to the number of goods sold. It believes that there is no change in the number of goods held in inventory at the beginning of the period and the number of goods held in inventory at the end of the period

- In multi-product companies, the relative proportions of each product sold and produced are fixed or constant.

So that's a wrap. Hope you found this article interesting and informative. Feel free to subscribe to our blog to get updates on awesome new content we publish for small business owners.

Key Takeaways

Break-even analysis is infinitely valuable as it sets the framework for pricing structures, operations, hiring employees, and obtaining future financial support.

- You can identify how much, or how many, you have to sell to be profitable.

- Identify costs inside your business that should be alleviated or eliminated.

Remember, any break-even analysis is only as strong as its underlying assumptions.

Like many forecasting metrics, break-even point is subject to it's limitations; however it can be a powerful and simple tool to provide a small business owner with an idea of what their sales need to be in order to start being profitable as quickly as possible.

Lastly, please understand that break-even analysis is not a predictor of demand .

If you go to market with the wrong product or the wrong price, it may be tough to ever hit the break-even point. To avoid this, make sure you have done the groundwork before setting up your business.

Head over to our small business guide on setting up a new business if you want to know more.

Want to calculate break even point quickly? Use our handy break-even point calculator.

Hey! Try Deskera Now!

Everything to Run Your Business

Get Accounting, CRM & Payroll in one integrated package with Deskera All-in-One .

What is Break-Even Analysis?

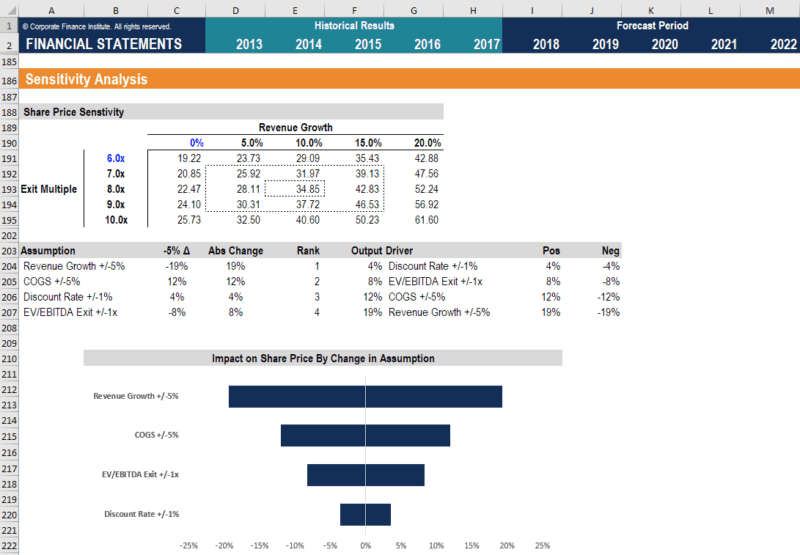

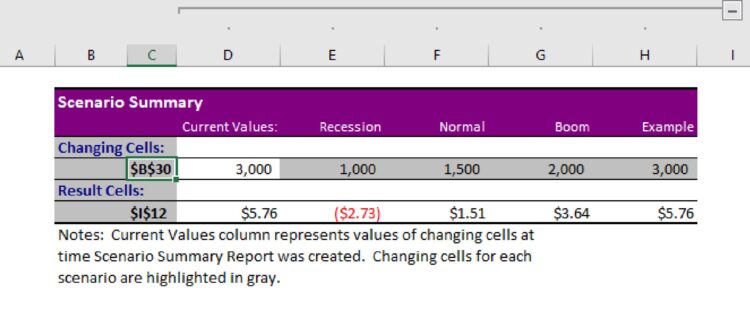

What is the break-even analysis formula, break-even analysis example, graphically representing the break-even point, free cost-volume-profit analysis template, download the free template, interpretation of break-even analysis, sensitivity analysis.

- Factors that Increase a Company’s Break-Even Point

How to reduce the break-even point

Additional resources, break even analysis.

The point in which total cost and total revenue are equal

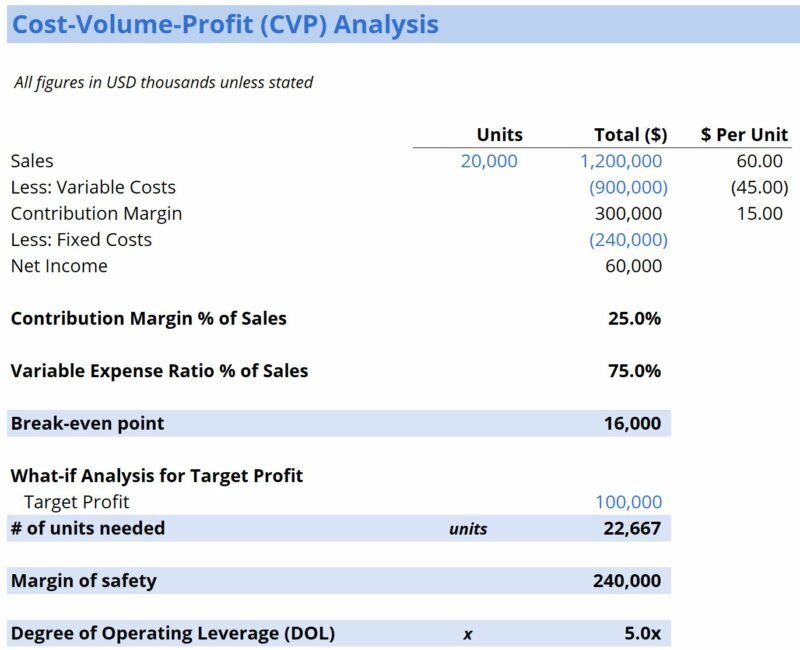

Break-even analysis in economics, business, and cost accounting refers to the point at which total costs and total revenue are equal. A break-even point analysis is used to determine the number of units or dollars of revenue needed to cover total costs ( fixed and variable costs ).

Key Highlights

- Break-even analysis refers to the point at which total costs and total revenue are equal.

- A break-even point analysis is used to determine the number of units or dollars of revenue needed to cover total costs.

- Break-even analysis is important to business owners and managers in determining how many units (or revenues) are needed to cover fixed and variable expenses of the business.

The formula for break-even analysis is as follows:

Break-Even Quantity = Fixed Costs / (Sales Price per Unit – Variable Cost Per Unit)

- Fixed Costs are costs that do not change with varying output (e.g., salary, rent, building machinery)

- Sales Price per Unit is the selling price per unit

- Variable Cost per Unit is the variable cost incurred to create a unit

It is also helpful to note that the sales price per unit minus variable cost per unit is the contribution margin per unit. For example, if a book’s selling price is $100 and its variable costs are $5 to make the book, $95 is the contribution margin per unit and contributes to offsetting the fixed costs.

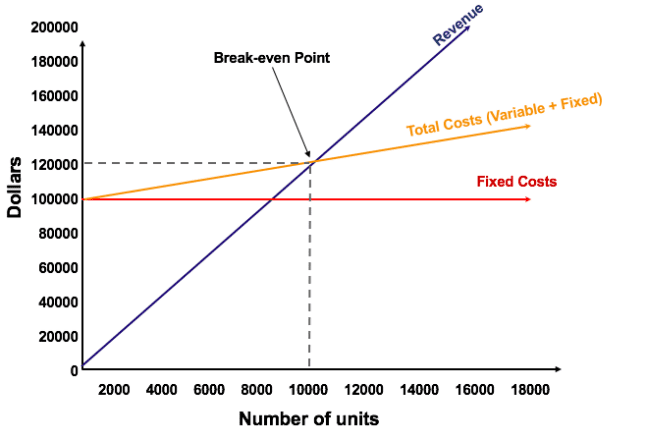

Colin is the managerial accountant in charge of Company A, which sells water bottles. He previously determined that the fixed costs of Company A consist of property taxes, a lease, and executive salaries, which add up to $100,000. The variable cost associated with producing one water bottle is $2 per unit. The water bottle is sold at a premium price of $12. To determine the break-even point of Company A’s premium water bottle:

Break Even Quantity = $100,000 / ($12 – $2) = 10,000

Therefore, given the fixed costs, variable costs, and selling price of the water bottles, Company A would need to sell 10,000 units of water bottles to break even.

For more information about variable costs, check out the following video:

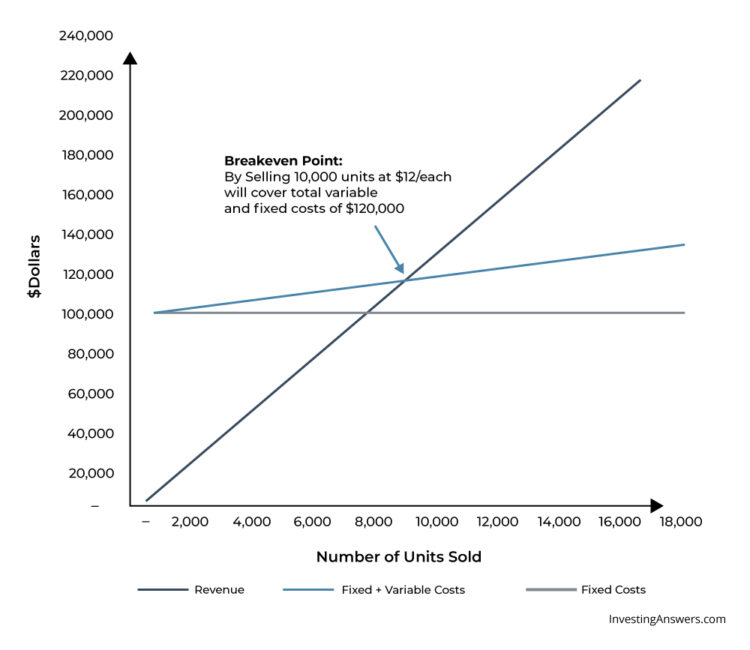

The graphical representation of unit sales and dollar sales needed to break even is referred to as the break-even chart or cost-volume-profit (CVP) graph. Below is the CVP graph of the example above:

Explanation:

- The number of units is on the X-axis (horizontal) and the dollar amount is on the Y-axis (vertical).

- The red line represents the total fixed costs of $100,000.

- The blue line represents revenue per unit sold. For example, selling 10,000 units would generate 10,000 x $12 = $120,000 in revenue.

- The yellow line represents total costs (fixed and variable costs). For example, if the company sells 0 units, then the company would incur $0 in variable costs but $100,000 in fixed costs for total costs of $100,000. If the company sells 10,000 units, the company would incur 10,000 x $2 = $20,000 in variable costs and $100,000 in fixed costs for total costs of $120,000.

- The break even point is at 10,000 units. At this point, revenue would be 10,000 x $12 = $120,000 and costs would be 10,000 x 2 = $20,000 in variable costs and $100,000 in fixed costs.

- When the number of units exceeds 10,000, the company would be making a profit on the units sold. Note that the blue revenue line is greater than the yellow total costs line after 10,000 units are produced. Likewise, if the number of units is below 10,000, the company would be incurring a loss. From 0-9,999 units, the total costs line is above the revenue line.

Enter your name and email in the form below and download the free template now!

As illustrated in the graph above, the point at which total fixed and variable costs are equal to total revenues is known as the break-even point. At the break-even point, a business does not make a profit or loss. Therefore, the break-even point is often referred to as the “no-profit” or “no-loss point.”

The break-even analysis is important to business owners and managers in determining how many units (or revenues) are needed to cover fixed and variable expenses of the business.

Therefore, the concept of break-even point is as follows:

- Profit when Revenue > Total Variable Cost + Total Fixed Cost

- Break-even point when Revenue = Total Variable Cost + Total Fixed Cost

- Loss when Revenue < Total Variable Cost + Total Fixed Cost

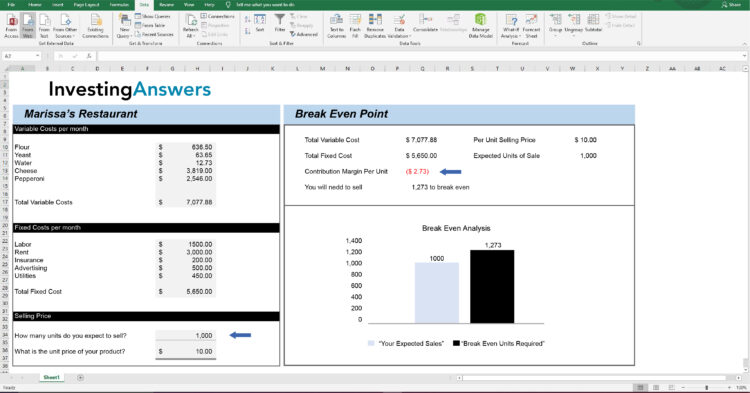

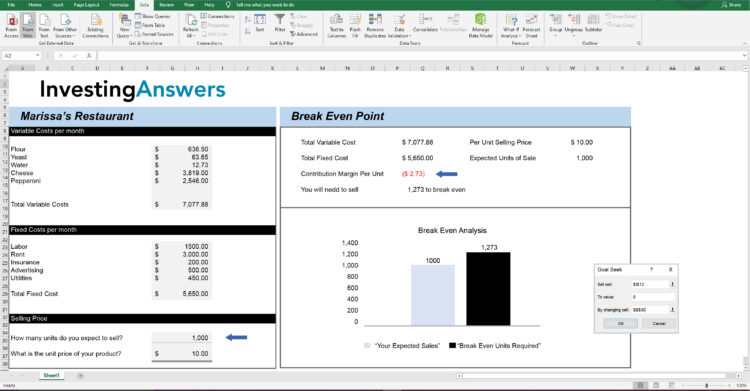

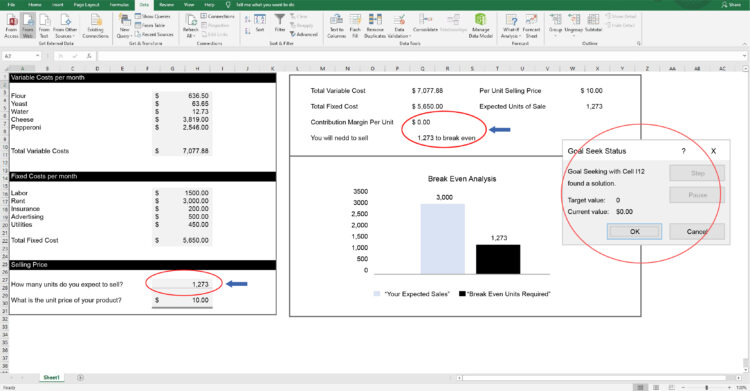

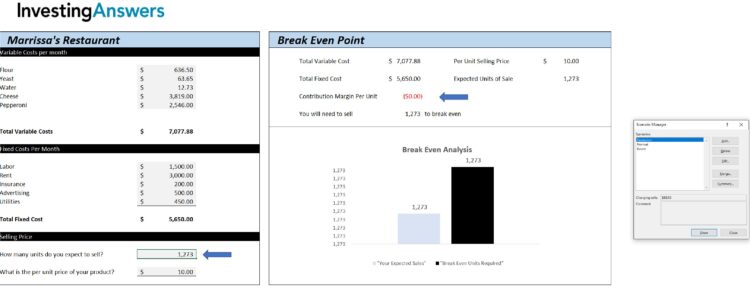

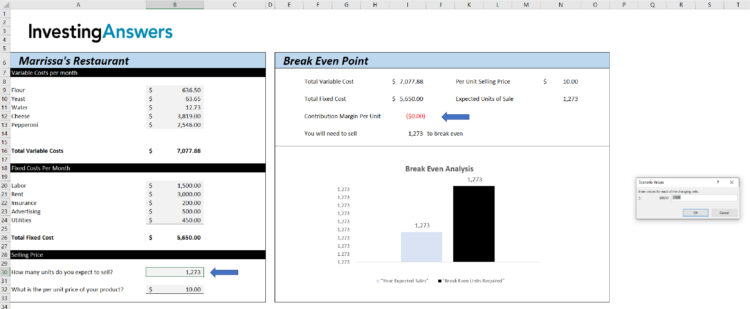

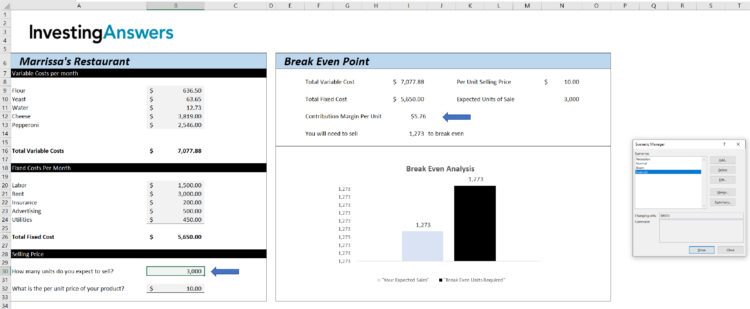

Break-even analysis is often a component of sensitivity analysis and scenario analysis performed in financial modeling . Using Goal Seek in Excel, an analyst can backsolve how many units need to be sold, at what price, and at what cost to break even.

Factors that Increase a Company’s Break-Even Point

It is important to calculate a company’s break-even point in order to know the minimum target to cover production expenses. However, there are times when the break-even point increases or decreases, depending on certain of the following factors:

1. Increase in customer sales

When there is an increase in customer sales, it means that there is higher demand. A company then needs to produce more of its products to meet this new demand which, in turn, raises the break-even point in order to cover the extra expenses.

2. Increase in production costs

The hard part of running a business is when customer sales or product demand remains the same while the price of variable costs increases, such as the price of raw materials. When that happens, the break-even point also goes up because of the additional expense. Aside from production costs, other costs that may increase include rent for a warehouse, increases in salaries for employees, or higher utility rates.

3. Equipment repair

In cases where the production line falters, or a part of the assembly line breaks down, the break-even point increases since the target number of units is not produced within the desired time frame. Equipment failures also mean higher operational costs and, therefore, a higher break-even.

In order for a business to generate higher profits, the break-even point must be lowered. Here are common ways of reducing it:

1. Raise product prices

This is something that not all business owners want to do without hesitation, fearful that it may make them lose some customers.

2. Outsourcing

Profitability may be increased when a business opts for outsourcing , which can help reduce manufacturing costs when production volume increases.

Every company is in business to make some type of profit. However, understanding the break-even number of units is critical because it enables a company to determine the number of units it needs to sell to cover all of the expenses it’s accrued during the process of creating and selling goods or services.

Once the break-even number of units is determined, the company then knows what sales target it needs to set in order to generate profit and reach the company’s financial goals.

How the 3 Financial Statements are Linked

Cost Behavior Analysis

Analysis of Financial Statements

Shutdown Point

See all accounting resources

- Share this article

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in

July 4th Sale: 60% off LivePlan Premium

0 results have been found for “”

Return to blog home

Break-Even Analysis Explained—How to Find the Break-Even Point

Posted november 2, 2022 by kiara taylor.

Conducting a break-even analysis is a crucial tool for small business owners. If you’re planning on launching a business, writing a business plan , or just exploring a new product, knowing your break-even point can tell you whether or not a product or service is a good idea.

In this guide, we’ll cover what a break-even point is, why it’s critical to calculate, how to calculate it, and additional factors you should consider.

What is the break-even point?

The break-even point is where an asset’s market price equals its original cost. Put another way; the break-even point is when the total revenues of a certain production level equal the total expenses of producing that product. For small business owners, it’s essentially the amount that you need to earn in order to cover your costs.

Why you should know your break-even point

So, why is knowing your break-even point so important? Here are a few important reasons to consider.

Minimize risk

Risk comes in various forms , but break-even points can help you understand the viability of certain products before they’re even launched.

For example, before even sending an order to a factory, you can already know how many units you need to sell and what expenses will go into making that product. Understanding this is key whether you’re launching a business for the first time or starting a new product line.

Identify unseen expenses

Running a break-even analysis forces you to outline all potential expenses associated with an initiative. Expenses that you’d otherwise miss without it. Usually, these expenses come from the fixed and variable costs of production. In this process, you can often identify unexpected expenses that you may not have considered before.

Appropriately price your products/services

Because your break-even point concerns the price relationship to your expenses, you can calculate different break-even points based on sold units or different pricing schemes. For example, you may find that your product is unprofitable at a certain price point except at extremely large scales.

If that’s the case, you can explore higher price points. However, it’s important that you do not do this in isolation. Instead, use this exercise to understand potential pricing options and begin testing them with your target customers .

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Prepare for funding

If you’re seeking funding for your business, this information is often expected or required by lenders and investors . It helps them gauge the viability of your idea and determine what level of funding is appropriate. For you as a business owner, it can help you determine how much funding you think you’ll need and even identify how you’ll use those funds.

How to calculate the break-even point

To calculate your break-even point, you’ll need to know the following:

- Fixed costs: Expenses that remain consistent no matter your sales volume.

- Variable costs: Expenses that change depending on your sales/production volume.

- Sales price: The price that you intend to sell the product/service for.

Break-even point formula

The break-even point is calculated using your fixed costs and your contribution margin. The contribution margin is the selling price of the product minus the total variable costs. Your selling price is usually the amount you place on any customer invoices.

The contribution margin formula is:

Contribution Margin = Selling Price – Total Variable Costs

Once you have the contribution margin, you then take the total fixed costs per unit and divide those costs by the contribution margin. This will give you the break-even number of units required to offset your costs.

The break-even point formula is:

Break-Even Point = Fixed Costs / Contribution Margin

Break-even point example

Now that you know the formula for calculating your break-even point let’s put it into practice.

Imagine you are the owner of a small paper company and considering adding a new line of paper to your available products. You expect to sell a ream of paper for $5.00.

The variable costs of the ream of the paper include:

- $1.00 for the paper itself

- $0.50 for the packaging of the ream

- $0.50 of costs to package each ream

According to this information, you have $2.00 in variable costs. Using the formula mentioned above, we can calculate the contribution margin for your paper ream:

$5.00 – $2.00 = $3.00

Next, we’ll incorporate fixed costs to determine how many units need to be sold. After holding an office meeting in the conference room, you determine that the following fixed costs are associated with producing reams of paper:

- $50.00 in salaries

- $50.00 in office rent

- $50.00 for monthly shipments from the paper factory

Your total fixed costs come to: $50.00 + $50.00 + $50.00 = $150.00.

Lastly, we’ll calculate the break-even point: $150.00 / $3.00 = 50 units. To break even, you would need to sell 50 reams of paper.

Maximizing your break-even point formulas

You can also utilize this calculation to figure out your break-even point in dollars. This is done by dividing the total fixed costs by the contribution margin ratio. You can figure out your contribution margin ratio by taking the contribution margin per unit and dividing it by the sales price.

Your contribution margin ratio using the data from the above example is:

$3.00 (your contribution margin) / $5.00 (price per one ream of paper) = 60%.

Finally, divide your total fixed costs ($150.00) by your contribution margin ratio (60%) to calculate the break-even point in dollars:

$150.00 / 60% = $250.00 in sales

You can confirm your findings by multiplying your break-even point in units (50) by the sales price ($5.00):

50 x $5.00 = $250.00

What is a standard break-even time period?

The standard break-even period is hard to predict and fully depends on your business. However, once you know your break-even point, you can gauge the time it will take to break even more accurately.

Your break-even period is the amount of time it takes you to sell enough units to break even. This means that the only thing holding back your ability to break even is how fast you sell your units.

The formula to calculate your break-even time period is:

Break-Even Time Period = Break-Even Units / Amount Sold per Period (Period)

If we return to the paper company example, we can estimate what the break-even period is. After reviewing your financials, you learn that the average number of reams you expect to sell daily is 5. Now, take your number of break-even units (50) and divide them by the amount sold in a given period (5):

50 / 5 = 10. Under this analysis, you would break even in approximately 10 days.

However, it’s important to remember that fixed costs, which are an important part of calculating your break-even point, may accumulate faster than you can sell your product. In that case, you’ll need to factor this into your analysis.

How to lower your break-even point

Everyone wants to lower their break-even point because it typically leads to greater profitability at a faster rate. But how do you lower your break-even point? The key thing to remember is that it’s a ratio of your fixed and variable costs. To reduce your break-even point, you’ll need to lower one or both.

One of the most efficient ways to reduce your break-even point is to start by reducing variable costs. Keep in mind that variable costs are associated with each unit. Other fixed costs, those that exist regardless, like the $20-$80 you pay for your employees’ no medical life insurance every month, can be more difficult to eliminate because they are essential.

What you can do with a break-even analysis

Conducting an initial break-even analysis is incredibly useful when starting a business. But, did you know that you can use it on an ongoing basis as part of your management process ? Here are a few key uses you can leverage.

Determine if your prices are correct

A break-even analysis can be used to continuously audit and fine-tune your pricing strategy. If you find sales are missing expectations, you can reference this calculation to easily understand what quantities must be sold if you decide to adjust the price.

Explore current fixed and variable costs

You can also explore how different costs impact your bottom line. At the end of the day, your business needs to know what costs are impacting its ability to generate revenue. A break-even analysis can help you understand whether some products may be costing you more money than their worth. For example, products with low contribution margins or ratios might be too expensive to keep in production.

Narrow down financial scenarios

Finally, you can use your break-even analyses as part of any forecast scenarios that you explore. By changing numbers in your formula, you can test different types of prices and quantities based on perceived consumer interest. This can help inform a larger analysis of your sales, cash, and expenses based on how reasonable your price and volume adjustments are.

Other metrics to consider

Now that you understand break-even points and break-even analysis, you’ll be able to put them to work for your business. Remember, this is just a piece of measuring business performance and there are other valuable metrics you should be tracking. You can do this manually with spreadsheets, leverage budgeting and accounting software, or better explore future performance with LivePlan’s performance tracking and forecasting features .

Whatever option you choose, the important thing is that you are aware of these metrics and actively using them. It will help you better understand the health of your business, make more strategic decisions, and ultimately grow your business.

Like this post? Share with a friend!

Kiara Taylor

Posted in growth & metrics, join over 1 million entrepreneurs who found success with liveplan, like this content sign up to receive more.

Subscribe for tips and guidance to help you grow a better, smarter business.

You're all set!

Exciting business insights and growth strategies will be coming your way each month.

We care about your privacy. See our privacy policy .

What Is a Break-Even Analysis?

3 min. read

Updated October 27, 2023

The break-even analysis lets you determine what you need to sell, monthly or annually, to cover your costs of doing business—your break-even point.

- Understanding break-even analysis

The break-even analysis is not our favorite analysis because:

- It is frequently mistaken for the payback period, the time it takes to recover an investment. There are variations on break even that make some people think we have it wrong. The one we do use is the most common, the most universally accepted, but not the only one possible.

- It depends on the concept of fixed costs, a hard idea to swallow. Technically, a break-even analysis defines fixed costs as those costs that would continue even if you went broke. Instead, you may want to use your regular running fixed costs, including payroll and normal expenses. This will give you a better insight on financial realities. We call that “burn rate” these post-Internet days.

- It depends on averaging your per-unit variable cost and per-unit revenue over the whole business.

Over the past few years, the break-even analysis has fallen out of favor with financial analysts. It is okay when done right, can be useful, but not for all businesses and not for all situations. And, to add to the confusion, the term “break-even” is often used to refer to “payback” or “payback period.” And there are several ways to do the analysis. But what is shown here is the most common.

- Three assumptions of the break-even analysis

The break-even analysis depends on three key assumptions:

1. Average per-unit sales price (per-unit revenue):

This is the price that you receive per unit of sales. Take into account sales discounts and special offers. Get this number from your sales forecast.

For non-unit based businesses, make the per-unit revenue one dollar and enter your costs as a percent of a dollar. The most common questions about this input relate to averaging many different products into a single estimate.

The analysis requires a single number, and if you build your sales forecast first, then you will have this number. You are not alone in this, the vast majority of businesses sell more than one item, and have to average for their break-even analysis.

2. Average per-unit cost:

This is the incremental cost, or variable cost, of each unit of sales. If you buy goods for resale, this is what you paid, on average, for the goods you sell. If you sell a service, this is what it costs you, per dollar of revenue or unit of service delivered, to deliver that service.

If you are using a units-based sales forecast table (for manufacturing and mixed business types), you can project unit costs from the sales forecast table. If you are using the basic sales forecast table for retail, service and distribution businesses, use a percentage estimate, e.g., a retail store running a 50 percent margin would have a per-unit cost of .5, and a per-unit revenue of 1.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. Monthly fixed costs:

Technically, a break-even analysis defines fixed costs as costs that would continue even if you went broke. Instead, we recommend that you use your regular running fixed costs, including payroll and normal expenses (total monthly operating expenses). This will give you a better insight on financial realities.

If averaging and estimating is difficult, use your profit and loss table to calculate a working fixed cost estimate—it will be a rough estimate, but it will provide a useful input for a conservative break-even analysis. As sales increase, the profit line passes through the zero or break-even line at the break-even point. This is a classic business chart that helps you consider your bottom-line financial realities. Can you sell enough to make your break-even volume?

The break-even analysis depends on assumptions made for average per-unit revenue, average per-unit cost, and fixed costs. These are rarely exact. We recommend that you do the break-even table twice; first, with educated guesses for assumptions, as part of the initial assessment, and later on, using your detailed sales forecast and profit and loss numbers. Both are valid uses.

Do you have any questions about running a break-even analysis?

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

Related Articles

1 Min. Read

How to Calculate Return on Investment (ROI)

6 Min. Read

How to Create a Profit and Loss Forecast

11 Min. Read

How to Create a Sales Forecast

7 Min. Read

7 Financial Terms Small Business Owners Need to Know

The Bplans Newsletter

The Bplans Weekly

Subscribe now for weekly advice and free downloadable resources to help start and grow your business.

We care about your privacy. See our privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

Break-Even Analysis: What It Is and How to Calculate

Priyanka Prakash is a former Fundera.com staff writer and a freelancer specializing in small-business finance, credit, law and insurance, helping business owners navigate complicated concepts and decisions.

Christine Aebischer is an assistant assigning editor on the small-business team at NerdWallet who has covered business and personal finance for nearly a decade. Previously, she was an editor at Fundera, where she developed service-driven content on topics such as business lending, software and insurance. She has also held editing roles at LearnVest, a personal finance startup, and its parent company, Northwestern Mutual. She is based in Santa Monica, California.

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

A break-even analysis helps business owners find the point at which their total costs and total revenue are equal, also known as the break-even point in accounting . This lets them know how much product they need to sell to cover the cost of doing business.

At the break-even point, you’ve made no profit, but you also haven’t incurred any losses. This metric is important for new businesses to determine if their ideas are viable, as well as for seasoned businesses to identify operational weaknesses.

advertisement

QuickBooks Online

What is the break-even analysis formula?

The break-even analysis formula requires three main pieces of information:

Fixed costs per month: Fixed costs are what your business has to pay no matter how many units you sell. This could include rent, business insurance , business loan payments, accounting and legal services and utilities.

Sales price per unit: This is the amount of money you will charge the customer for every single unit of product or service you sell. Make sure to include any discounts or special offers you give customers. If you sell multiple products or services, figure out the average selling price for everything combined.

Variable costs per unit: These are the costs you incur for each unit you sell. They may include labor, the price of raw materials or sales commissions, and they are subject to change as sales fluctuate. To calculate, multiply the number of units produced by the costs of producing just one unit.

From there, the break-even point can be calculated in units.

Break-even point in units = fixed costs / (sales price per unit – variable costs per unit)

This gives you the number of units you need to sell to cover your costs per month. Anything you sell above this number is profit. Anything below this number means your business is losing money.

Once you’re above the break-even point, every additional unit you sell increases profit by the amount of the unit contribution margin. This is the amount each unit contributes to paying off fixed costs and increasing profits, and it’s the denominator of the break-even analysis formula. To find it, subtract variable costs per unit from sales price per unit.

» MORE: Best apps for small businesses

Break-even analysis example

Let's say you're thinking about starting a furniture manufacturing business. The first unit you're going to sell is a table. How many tables would you need to sell in order to break even?

If it costs $50 to make a table and you have fixed costs of $1,000, the number of tables you must sell to break even varies depending on price. Here are two scenarios:

If you sell a table at $100: $1,000 / ($100 — $50) = 20 tables

If you sell a table at $200: $1,000 / ($200 — $50) = 6.7 tables

This is a great example of how selling a product for a higher price allows you to reach the break-even point significantly faster. However, you need to think about whether your customers would pay $200 for a table, given what your competitors are charging.

» MORE: NerdWallet’s picks for the best small-business accounting software

When to use break-even analysis

Break-even analysis formulas can help you compare different pricing strategies.

For example, if you raise the price of a product, you’d have to sell fewer items, but it might be harder to attract buyers. You can lower the price, but would then need to sell more of a product to break even. It can also hint at whether it’s worth using less expensive materials to keep the cost down, or taking out a longer-term business loan to decrease monthly fixed costs.

Here are a few specific situations where a break-even analysis is especially useful:

Starting a new business: When starting a business , break-even analysis can help you figure out the viability of your product or service. If you do this analysis along with writing a business plan, you can spot weak points in your company's financial strategy and develop a plan to address them.

Launching a new product or service: Whenever you launch a new product or service, you'll need to determine its sale price and how much it costs to produce it. Using a break-even analysis, you can see how both of these factors affect your profitability. Eventually, you can choose a price that's fair to customers and realistic for your company.

Adding a new sales channel: If your business model changes to incorporate a new sales channel, that's a good opportunity to do a break-even analysis. For example, if you have a brick-and-mortar store but want to start an e-commerce business, your costs and pricing might change. You should make sure you at least break even so that you don't put too much financial strain on your business.

This article originally appeared on Fundera, a subsidiary of NerdWallet.

| Product | Starting at | Promotion | Learn more |

|---|---|---|---|

| QuickBooks Online 5.0 on QuickBooks' website | $30/month | 50% off | on QuickBooks' website |

| Xero 5.0 on Xero's website | $15/month | 30-day free trial | on Xero's website |

| Zoho Books 4.5 on Zoho Books' website | $0 | 14-day free trial | on Zoho Books' website |

| FreshBooks 4.5 on FreshBooks' website | $19/month | 30-day free trial | on FreshBooks' website |

- SUGGESTED TOPICS

- The Magazine

- Newsletters

- Managing Yourself

- Managing Teams

- Work-life Balance

- The Big Idea

- Data & Visuals

- Reading Lists

- Case Selections

- HBR Learning

- Topic Feeds

- Account Settings

- Email Preferences

A Quick Guide to Breakeven Analysis

It’s a simple calculation, but do you know how to use it?

In a world of Excel spreadsheets and online tools, we take a lot of calculations for granted. Take breakeven analysis. You’ve probably heard of it. Maybe even used the term before, or said: “At what point do we break even?” But because you may not entirely understand the math — and because understanding the formula can only deepen your understanding of the concept — here’s a closer look at how the concept works in reality.

- Amy Gallo is a contributing editor at Harvard Business Review, cohost of the Women at Work podcast , and the author of two books: Getting Along: How to Work with Anyone (Even Difficult People) and the HBR Guide to Dealing with Conflict . She writes and speaks about workplace dynamics. Watch her TEDx talk on conflict and follow her on LinkedIn . amyegallo

Partner Center

Original text

What is a break-even analysis? The break-even point is the point when your business’s total revenues equal its total expenses.

Your business is “breaking even”—not making a profit but not losing money, either.

After the break-even point, any additional sales will generate profits.

To use this break-even analysis template, gather information about your business’s fixed and variable costs, as well as your 12-month sales forecast .

When should you use a break-even analysis.

A break-even analysis is a critical part of the financial projections in the business plan for a new business. Financing sources will want to see when you expect to break even so they know when your business will become profitable.

But even if you’re not seeking outside financing, you should know when your business is going to break even. This will help you plan the amount of startup capital you’ll need and determine how long that capital will need to last.

In general, you should aim to break even in six to 18 months after launching your business. If your break-even analysis shows that it will take longer, you need to revisit your costs and pricing strategy so you can increase your margins and break even in a reasonable amount of time.

Existing businesses can benefit from a break-even analysis, too.

In this situation, a break-even analysis can help you calculate how different scenarios might play out financially. For instance, if you add another employee to the payroll, how many extra sales dollars will be needed to recoup that additional expense? If you borrow money, how much will be needed to cover the monthly principal and interest payments?

A break-even analysis can also be used as a motivational tool. For instance, you can calculate a monthly, weekly, or even daily break-even analysis to give your sales team a goal to aim for.

Do you need help completing your break-even analysis? Connect with a SCORE mentor online or in your community today.

Business Planning & Financial Statements Template Gallery Download SCORE’s templates to help you plan for a new business startup or grow your existing business.

Sales Forecast (12 months) The sales forecast is the key to the whole financial plan, so it is important to use realistic estimates. Download SCORE's Sales Forecast template.

Copyright © 2024 SCORE Association, SCORE.org

Funded, in part, through a Cooperative Agreement with the U.S. Small Business Administration. All opinions, and/or recommendations expressed herein are those of the author(s) and do not necessarily reflect the views of the SBA.

- Start free trial

Start selling with Shopify today

Start your free trial with Shopify today—then use these resources to guide you through every step of the process.

Master the Break Even Analysis: The Ultimate Guide

A break-even point tells you exactly how much product you need to sell to become profitable. Learn how to calculate your break-even points, with examples and a free downloadable template in this guide.

If you’re a business owner, or thinking about becoming one, you should know how to do a break-even analysis. It’s a crucial activity for making important business decisions and financial planning .

A break-even analysis will tell you exactly what you need to do in order to make back your initial investment and begin turning a profit.

Table of contents

What is break-even analysis?

Benefits of a break-even analysis, how to calculate break-even point, break-even analysis examples: when to use it, break-even analysis limitations, tips to lower your break-even point, download your free break-even analysis template, break-even analysis faq.

Break-even analysis is a small-business accounting process for determining at what point a company, or a new product or service, will be profitable. It’s a financial calculation used to determine the number of products or services you must sell to at least cover your production costs.

The break-even theory is based on the fact that there is a minimum product level at which a venture neither makes profit nor loss. M.B. Ndaliman, An Economic Model for Break-even Analysis

For example, a break-even analysis could help you determine how many cellphone cases you need to sell to cover your warehousing costs, or how many hours of service you’ll have to bill to pay for your office space. Anything you sell beyond your break-even point will add profit.

To fully understand break-even analysis for your business, you should be aware of your fixed and variable costs.

- Fixed costs: expenses that stay the same no matter how much you sell.

- Variable costs: expenses that fluctuate up and down with production or sales volume.

Learn more: Small Business Accounting 101: How To Set Up and Manage Your Books

Many small and medium-sized businesses never perform any meaningful financial analysis. They don’t know how many units they have to sell to see a return on their capital.

Break-even analysis is a way to find out the minimum sales volume so that a business does not suffer losses. Lis Sintha, Importance of Break-Even

A break-even point analysis is a powerful tool for planning and decision making, and for highlighting critical information like costs, quantities sold, prices, and so much more.

Price smarter

Finding your break-even point will help you understand how to price your products better. A lot of psychology goes into effective pricing, but knowing how it will affect your gross profit margins is just as important. You need to make sure you can pay your bills.

Cover fixed costs

When most people think about pricing, they think about variable cost—that is, how much their product costs to make. But in addition to variable costs, you also need to cover your fixed costs, like insurance or web development fees. Performing a break-even analysis helps you do that.

Catch missing expenses

It’s easy to forget about expenses when you’re thinking through a small business idea. When you do a break-even analysis you have to lay out all your financial commitments to figure out your break-even point. This will limit the number of surprises down the road.

Set sales revenue targets

After completing a break-even analysis, you know exactly how many sales you need to make to be profitable. This will help you set more concrete sales goals for you and your team. When you have a clear number in mind, it will be much easier to follow through.

Make smarter decisions

Entrepreneurs often make business decisions based on emotion. If they feel good about a new venture, they go for it. How you feel is important, but it’s not enough. Successful entrepreneurs make their decisions based on facts. It will be a lot easier to make decisions when you’ve put in the work and have useful data in front of you.

Limit financial strain

Doing a break-even analysis helps mitigate risk by showing you when to avoid a business idea. It will help you avoid failures and limit the financial toll that bad decisions can have on your business. Instead, you can be realistic about the potential outcomes.

Fund your business

A break-even analysis is a key component of any business plan . It’s usually a requirement if you want to take on investors or borrow money to fund your business. You have to prove your plan is viable. More than that, if the analysis looks good, you will be more comfortable taking on the burden of financing.

Your break-even point is equal to your fixed costs, divided by your average selling price, minus variable costs. It is the point at which revenue is equal to costs and anything beyond that makes the business profitable.

Formula: break-even point = fixed cost / (average selling price - variable costs)

Before we calculate the break-even point, let’s discuss how the break-even analysis formula works. Understanding the framework of the following formula will help determine profitability and future earnings potential.

Basically, you need to figure out what your net profit per unit sold is and divide your fixed costs by that number. This will tell you how many units you need to sell before you start earning a profit.

As you now know, your product sales need to pay for more than just the costs of producing them. The remaining profit is known as the contribution margin ratio because it contributes sales dollars to the fixed costs.

Now that you know what it is, how it works, and why it matters, let's break down how to calculate your break-even point.

Before we get started, download your free copy of the break-even analysis template . You can make a copy, edit the template, and do your own calculations.

Step 1: Gather your data

The first step is to list all the costs of doing business—everything including the cost of your product, rent, and bank fees. Think through everything you have to pay for and write it down.

The next step is to divide your costs into fixed costs and variable costs.

Fixed costs

Fixed costs are any costs that stay the same, regardless of how much product you sell. This could include things like rent, software subscriptions, insurance, and labor.

Make a list of everything you have to pay for, no matter what. In most cases, you can list total expenses as monthly amounts, unless you’re considering an event with a shorter timeframe, such as a three-day festival. Add everything up. If you’re using the break-even analysis spreadsheet, it will do the math for you automatically.

Variable costs

Variable costs are costs that fluctuate based on the amount of product you sell. This could include things like materials, commissions, payment processing, and labor.

Some costs can go in either category, depending on your business. If you have salaried staff, they will go under fixed costs. But if you pay part-time hourly employees who only work when it's busy, they will be considered variable costs.

Make a list of all your costs that fluctuate depending on how much you sell. List the price per unit sold and add up all the costs.

Average price

Finally, decide on a price. Don’t worry if you’re not ready to commit to a final price yet. You can change this later. Keep in mind, this is the average price. If you offer some customers bulk discounts, it will lower the average price.

Step 2: Plug in your data

Now it’s time to plug in your data. The spreadsheet will pull your fixed cost total and variable cost total up into the break-even calculation. All you need to do is to fill in your average price in the appropriate cell. After that, the math will happen automatically. The number that gets calculated in the top right cell under Break-Even Units is the number of units you need to sell to break even.

In the break-even analysis example above, the break-even point is 92.5 units.

Step 3: Make adjustments

Feel free to experiment with different numbers. See what happens if you lower your fixed or variable costs or try changing the price. You may not get it right the first time, so make adjustments as you go.

Warning: Don’t forget any expenses

The most common pitfall of break-even-point analysis is forgetting things—especially variable costs. Break-even analyses are an important step toward making important business decisions. That’s why you need to make sure your data is as accurate as possible.

To make sure you don’t miss any costs, think through your entire operations from start to finish. If you think through your ecommerce packaging experience, you might remember that you need to order branded tissue paper, and that one order lasts you 200 shipments.

If you’re thinking through your event setup, you might remember that you’ll need to provide napkins along with the food you’re selling. These are variable costs that need to be included.

If you need further help, use a break-even calculator to help you determine your financial analysis.

There are four common scenarios for when it helps to do a break-even analysis.

1. Starting a new business

If you’re thinking about starting a new business , a break-even analysis is a must. Not only will it help you decide if your business idea is viable, it will force you to do research and be realistic about costs, and make you think through your pricing strategy.

2. Creating a new product

If you already have a business, you should still do a break-even analysis before committing to a new product —especially if that product is going to add significant expense. Even if your fixed costs, like an office lease, stay the same, you’ll need to work out the variable costs related to your new product and set prices before you start selling.

3. Adding a new sales channel

Any time you add a new sales channel, your costs will change—even if your prices don’t. For example, if you’ve been selling online and you’re thinking about doing a pop-up shop , you’ll want to make sure you at least break even. Otherwise, the financial strain could put the rest of your business at risk.

This applies equally to adding new online sales channels , like shoppable posts on Instagram . Will you be planning any additional costs to promote the channel, like Instagram ads? Those costs need to be part of your break-even analysis.

4. Changing your business model

If you’re thinking about changing your business model, for example, switching from dropshipping products to carrying inventory, you should do a break-even analysis. Your startup costs could change significantly, and this will help you figure out if your prices need to change too.

Learn more: 7 Ways Small Businesses Can Save Money In Their First Year

Break-even analysis plays an important role in bookkeeping and making business decisions, but it’s limited in the type of information it can provide.

Not a predictor of demand

It’s important to note that a break-even analysis is not a predictor of demand. It won’t tell you what your sales are going to be, or how many people will want what you’re selling. It will only tell you the amount of sales you need to make to operate profitably.

Dependent on reliable data

Sometimes costs fall into both fixed and variable categories. This can make calculations complicated and you’ll likely need to wedge them into one or the other. For example, you may have a baseline labor cost no matter what, as well as an additional labor cost that could fluctuate based on how much product you sell.

The accuracy of your break-even point depends on accurate data. If you don’t feed good data into a break-even formula, you won’t get a reliable result.

Many businesses have multiple products with multiple prices. Unfortunately, the break-even point formula doesn’t reflect this kind of nuance. You’ll likely need to work with one product at a time, or estimate an average price based on all the products you might sell. If this is the case, it’s best to run a few different scenarios to be better prepared.

As prices fluctuate, so do costs. This model assumes that only one thing changes at a time. Instead, if you lower your price and sell more, your variable costs might decrease because you have more buying power or are able to work more efficiently. Ultimately, it’s only an estimate.

Ignores time

The break-even analysis ignores fluctuations over time. Your timeframe will be dependent on the period you use to calculate fixed costs (monthly is most common). Although you’ll see how many units you need to sell over the course of the month, you won’t see how things change if your sales fluctuate week to week, or seasonally over the course of a year. For this, you’ll need to rely on good cash flow management and possibly a solid sales forecast .

In addition, break-even analysis doesn’t take the future into account. If your raw material costs double next year, your break-even point will be a lot higher, unless you raise your prices. If you raise your prices, you could lose customers. This delicate balance is always in flux.

Ignores competitors

As a new entrant to the market, you’re going to affect competitors and vice versa. They could change their prices, which could affect demand for your product, causing you to change your prices too. If they grow quickly and a raw material you both use becomes more scarce, the cost could go up.

Ultimately, a break-even analysis will give you a very solid understanding of the baseline conditions for being successful. It is a must. But it’s not the only research you need to do before starting or making changes to a business.

What if you complete your break-even analysis and find out that the number of units you need to sell seems unrealistic or unattainable? Don’t panic: you may be able to make some adjustments to lower your break-even point.

1. Lower fixed costs

See if there’s an opportunity to lower your fixed costs. The lower you can get them, the fewer units you’ll need to sell in order to break even. For example, if you’re thinking about opening a retail store and numbers aren’t working out, consider selling online instead. How does that affect your fixed costs?

2. Raise your prices

If you raise your prices, you won’t need to sell as many units to break even. The marginal contribution per unit sold will be higher. When thinking about raising your prices, be mindful of what the market is willing to pay and of the expectations that come with a price. You won’t need to sell as many units, but you’ll still need to sell enough—and if you charge more, buyers may expect a better product or better customer service.

3. Lower variable costs

Lowering your variable costs is often the most difficult option, especially if you’re just going into business. But the more you scale, the easier it will be to reduce variable costs. It’s worth trying to lower your costs by negotiating with your suppliers, changing suppliers, or changing your process. For example, maybe you’ll find that packing peanuts are cheaper than bubble wrap for shipping fragile products .

If you haven't already, remember to download your free break-even analysis template .

Doing a break-even analysis is essential for making smart business decisions. The next time you’re thinking about starting a new business, or making changes to your existing business, do a break-even analysis so you’ll be better prepared.

- How to Price Your Products in 3 Simple Steps

- Free Business Plan Template- A Practical Framework for Creating Your Business Plan

- The Ultimate Guide To Dropshipping (2024)

- How To Source Products To Sell Online

- 30 Best Price Comparison Websites and Apps To Use (2024)

- Product Research in 2024 - How to Find Product Ideas

- How to Start a Dropshipping Business- A Complete Playbook for 2024

- What Makes a Great Business Idea?

- Shipping Delays and the Holiday Rush- How to Set Your Business Up for Success

- Understanding PSD2 and Strong Customer Authentication

What is a break-even point (BEP)?

What are the three methods to calculate your break-even point.

- Fixed costs: Expenses your business has to pay regardless of how many units you make or sell.

- Variable costs: Expenses that increase or decrease depending on your level of production or sales volume.

- Average sales price: The amount you will charge customers per unit of your product, averaged to include any bulk discounts you may offer.

What’s a good margin of safety?

What’s the difference between break-even analysis and break-even point.

Break-even point refers to a measure of the margin of safety. A break-even analysis tells you how many sales you must make to cover the total costs of production.

Keep up with the latest from Shopify

Get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

By entering your email, you agree to receive marketing emails from Shopify.

popular posts

The most intuitive, powerful

Shopify yet

Shopify Editions Summer ’24

Subscribe to our blog and get free ecommerce tips, inspiration, and resources delivered directly to your inbox.

Unsubscribe anytime. By entering your email, you agree to receive marketing emails from Shopify.

Latest from Shopify

Jul 6, 2024

Jul 5, 2024

Jul 4, 2024

Learn on the go. Try Shopify for free, and explore all the tools you need to start, run, and grow your business.

Try Shopify for free, no credit card required.

- Search Search Please fill out this field.

- Building Your Business

- Operations & Success

5 Easy Steps to Creating a Break-Even Analysis

- What Break-Even is Used For

Gathering Information for Analysis

- Steps to Break-Even Analysis

Analyzing a Break-Even Chart

Break-even is one of those vital numbers that can mean success or failure to a small business. If you are breaking even your income is are equal to your costs. You have no profit or loss at this point. But, above the break-even point, every dollar of sales is pure profit.

How to Use a Break-Even Analysis in Financial Planning

A break-even analysis is important in several different situations:

- As your business plans new products, knowing the break-even point helps you price more efficiently.