- London, United Kingdom

- Thursday 04 July 2024 / 00:24

The Role of Finance in Business Continuity

- Francois Lacas, Deputy Chief Operating Officer at Yooz

- 15.10.2020 10:00 am

COVID-19 has shifted the role of the internal finance function.

From “work from home” mandates and furloughs to downsizing and outright business closures, every department found themselves forced into change. Finance departments have been particularly impacted due to the crucial role they play when it comes to businesses navigating through crises.

A business’ first challenge is to maintain continuity while working remotely; as time does not stop, financial obligations must be respected. More than ever during difficult times, businesses need to find a way to keep going.

Covid: the driving force behind digital transformation

COVID-19 has arguably been one of the biggest drivers of digital transformation, forcing a lot of people’s hand to look at solutions to overcome problems such as working from home, ensuring remote IT security or paying suppliers to keep production and sales going. The crisis acted as a wake-up call for all finance departments that had not yet started their digital transformation.

The finance departments’ second challenge has been managing cash pressures to ride out the crisis, which means streamlining processes to cut costs, save time, and gain visibility on inflows and outflows. To do so, implementing the right digital tools and technologies is no longer optional.

The crisis has also highlighted the strategic role of the CFO in guiding every crucial business decision. During this sensitive time, CEOs and management teams count more than ever on the analysis and advice of their finance departments. Digital transformation and automation are helping finance teams free up time from manual tedious tasks to focus on more value-added work such as data analysis that clarifies and facilitates decision making.

How has the responsibility of the finance department evolved?

As the pandemic hit, finance departments’ main priorities shifted to ensuring business continuity, carefully managing their increasingly tighter cash flow, while guiding their management team’s decision making.

Finance teams found themselves having to become more agile to make better, faster decisions while maintaining control over financial processes and minimise risk to the business.

In the context of an economic slowdown, finance departments also need to be especially efficient, optimising their tedious processes through automation, to save time and money. Digital transformation is helping finance departments achieve these goals.

For example, finance departments that implement cloud P2P Automation software have reduced their costs by up to 80% and cut processing cycle time to hours. AP Automation also helps businesses prevent risks such as late payments of invoices, erroneous or double payments, fraud attempts, or not being compliant.

Continuity, risk management and the foundations for growth and recovery

The continuity of the finance function is crucial to avoid cashflow problems and help support suppliers, clients and, ultimately, the economy.

It’s important to keep paying providers, big or small, as the knock-on effects for their own business and customers could be significant. Paying suppliers is a simple yet effective way to keep continuity of service as well as a way to keep people employed, motivated and prepared for after the crisis.

Simply put, there are two main ways to help with business continuity: by allowing suppliers to be paid, fast, as when everyone pays suppliers on time it will be easier to face the crisis for many others down the chain.

Secondly, because businesses have streamlined the financial processes, it makes everyone more productive while providing full visibility on key decision-making information.

What role do finance, and accounting technologies play in crisis management, continuity planning and performance observation?

The COVID-19 crisis is the first in modern economic history which has prevented employees to work even while business was alive and when new project investments were not frozen. Why? Because it stopped processes remaining mainly on physical exchanges – paper-based to be clear.

Conversely, the processes which are digitised continued to run because they allow their stakeholders to continue working remotely: issue an electronic order, receive an invoice by email, validate it via the web on their computers, their tablet or mobile, approve payment and settle it.

Indeed, technology-based processes allow businesses to switch to remote working mode overnight. We can argue that COVID-19 is the proof-of-concept for cloud technology, notably accounts payable automation and a wake-up call for any finance departments which did not have a business continuity plan including digital technologies.

Furthermore, we expect that companies that have been partially or strongly been impacted by the cash crisis will want to control and cut their internal costs even more. In the coming month, cutting costs and fighting invoice fraud will become critical, therefore using technology will be essential to achieve these goals.

A wise man once said, “Life isn't about waiting for the storm to pass; it's about learning how to dance under the rain.” This describes perfectly the current mindset of financial decision makers who have quickly realised, if they didn’t know it already, that digital transformation is not just essential, but inevitable.

Related Blogs

The Inspiration Behind Uncapped

- 2 years 11 months ago 09:00 am

The Digital Tipping Point in Financial Services

- 3 years 1 month ago 02:00 am

The Future of Work in Financial Technology

- 3 years 1 month ago 05:00 am

How Finance as a Service Is Shaping the Future of...

- 3 years 2 months ago 02:00 am

Post-Vaccine: Rethinking the Agile Working Strategy in...

- 3 years 2 months ago 07:00 am

Other Blogs

Embedded Banking is Simply the Next Step of Banking at...

- 13 hours 24 min ago 02:00 am

Utilising ERP-Supplemented Payments to Gain a...

- 14 hours 24 min ago 09:00 am

How Financial Services Organisations Should Deal with...

- 14 hours 24 min ago 06:00 am

SaaS Providers Risk Being Left Behind on Embedded...

- 1 week 2 days ago 03:00 am

Unlocking the Future: Traditional Banks' UK...

- 1 week 5 days ago 04:00 am

Why Speed Is Paramount in Payments: How Adyen...

- 1 week 5 days ago 06:00 am

Banking & Finance: Winning the Data Race in...

- 1 week 5 days ago 07:00 am

Banking's Data-Driven Makeover: Delivering...

- 2 weeks 1 day ago 07:00 am

A Legacy of Innovation: How Financial Institutions Can...

- 2 weeks 6 days ago 05:00 am

How Payments Can Support the Travel Industry

- 1 month 3 days ago 07:00 am

How to Determine the Right Payment Solutions for Your...

- 1 month 3 days ago 09:00 am

Navigating Cybersecurity Regulations Across Financial...

Latest issue.

FinTech List

Popular Tags

- Create new account

- Request new password

Download our new app

Get FinTech news headlines, videos, stories and product reviews on your mobile device. Download Financial IT App for Free

For the Public

FINRA Data provides non-commercial use of data, specifically the ability to save data views and create and manage a Bond Watchlist.

For Industry Professionals

Registered representatives can fulfill Continuing Education requirements, view their industry CRD record and perform other compliance tasks.

- FINRA Gateway

For Member Firms

Firm compliance professionals can access filings and requests, run reports and submit support tickets.

For Case Participants

Arbitration and mediation case participants and FINRA neutrals can view case information and submit documents through this Dispute Resolution Portal.

Need Help? | Check Systems Status

Log In to other FINRA systems

- Frequently Asked Questions

- Interpretive Questions

- Rule Filings

- Rule Filing Status Report

- Requests for Comments

- Rulebook Consolidation

- National Adjudicatory Council (NAC)

- Office of Hearing Officers (OHO)

- Disciplinary Actions Online

- Monthly Disciplinary Actions

- Sanction Guidelines

- Individuals Barred by FINRA

- Broker Dealers

- Capital Acquisition Brokers

- Funding Portals

- Individuals

- Securities Industry Essentials Exam (SIE)

- Continuing Education (CE)

- Classic CRD

- Financial Professional Gateway (FinPro)

- Financial Industry Networking Directory (FIND)

- Conferences & Events

- FINRA Institute at Georgetown

- Financial Learning Experience (FLEX)

- Small Firm Conference Call

- Systems Status

- Entitlement Program

- Market Transparency Reporting Tools

- Regulatory Filing Systems

- Data Transfer Tools

- Cybersecurity Checklist

- Compliance Calendar

- Weekly Update Email Archive

- Peer-2-Peer Compliance Library

- Investor Insights

- Tools & Calculators

- Credit Scores

- Emergency Funds

- Investing Basics

- Investment Products

- Investment Accounts

- Working With an Investment Professional

- Investor Alerts

- Ask and Check

- Avoid Fraud

- Protect Your Identity

- For the Military

- File a Complaint

- FINRA Securities Helpline for Seniors

- Dispute Resolution

- Avenues for Recovery of Losses

Business Continuity Planning (BCP)

Frequently asked questions related to regulatory relief due to the coronavirus pandemic.

MARCH 18, 2020 Due to the coronavirus pandemic (COVID-19) , FINRA is providing temporary relief for member firms from rules and requirements in the Frequently Asked Questions below. The relief provided does not extend beyond the identified rules and requirements. As coronavirus-related risks decrease, member firms should expect to return to meeting any regulatory obligations for which relief has been provided. When appropriate, FINRA will publish a Regulatory Notice announcing a termination date for the regulatory relief that will provide member firms with time to make necessary operational adjustments.

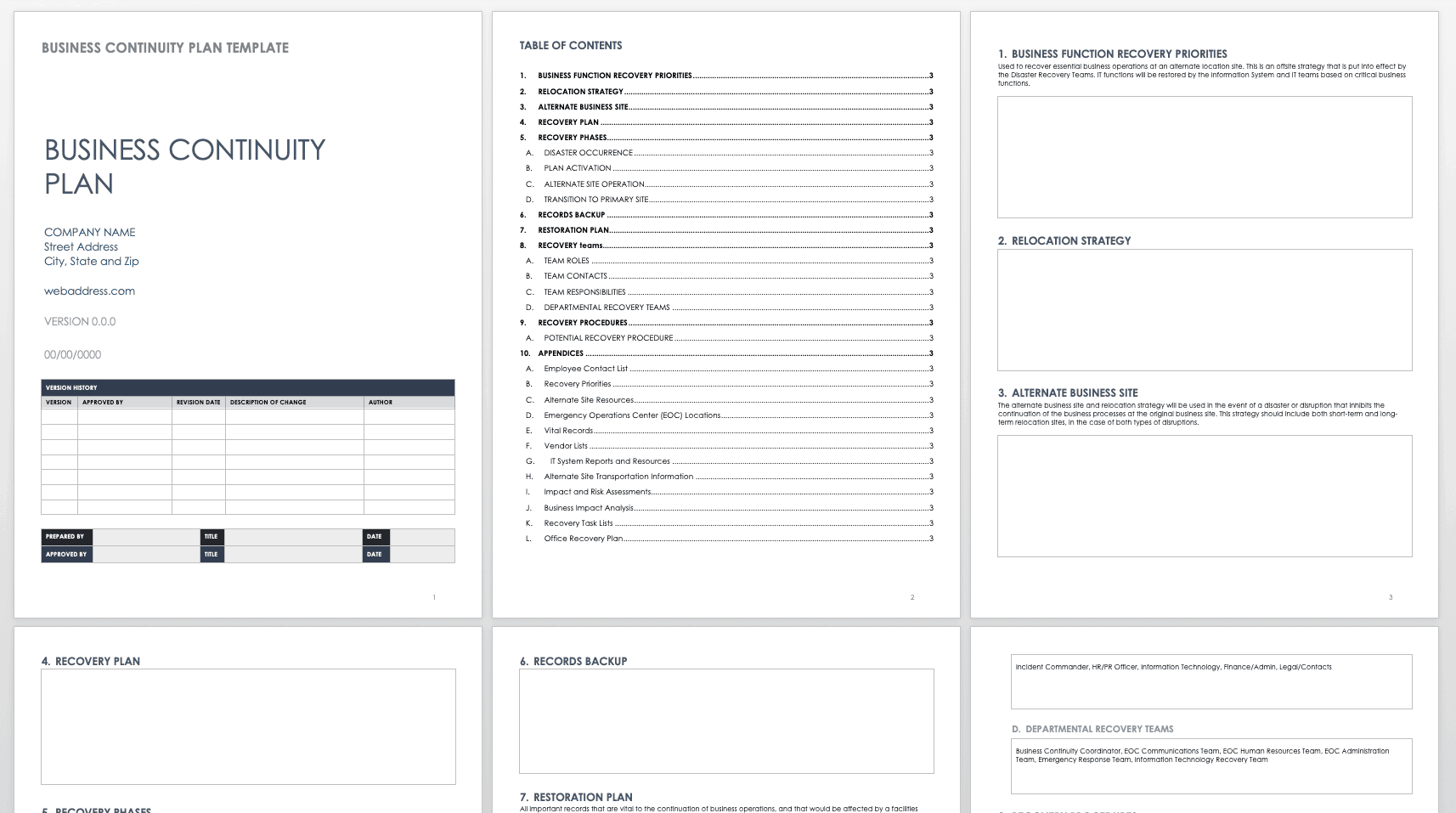

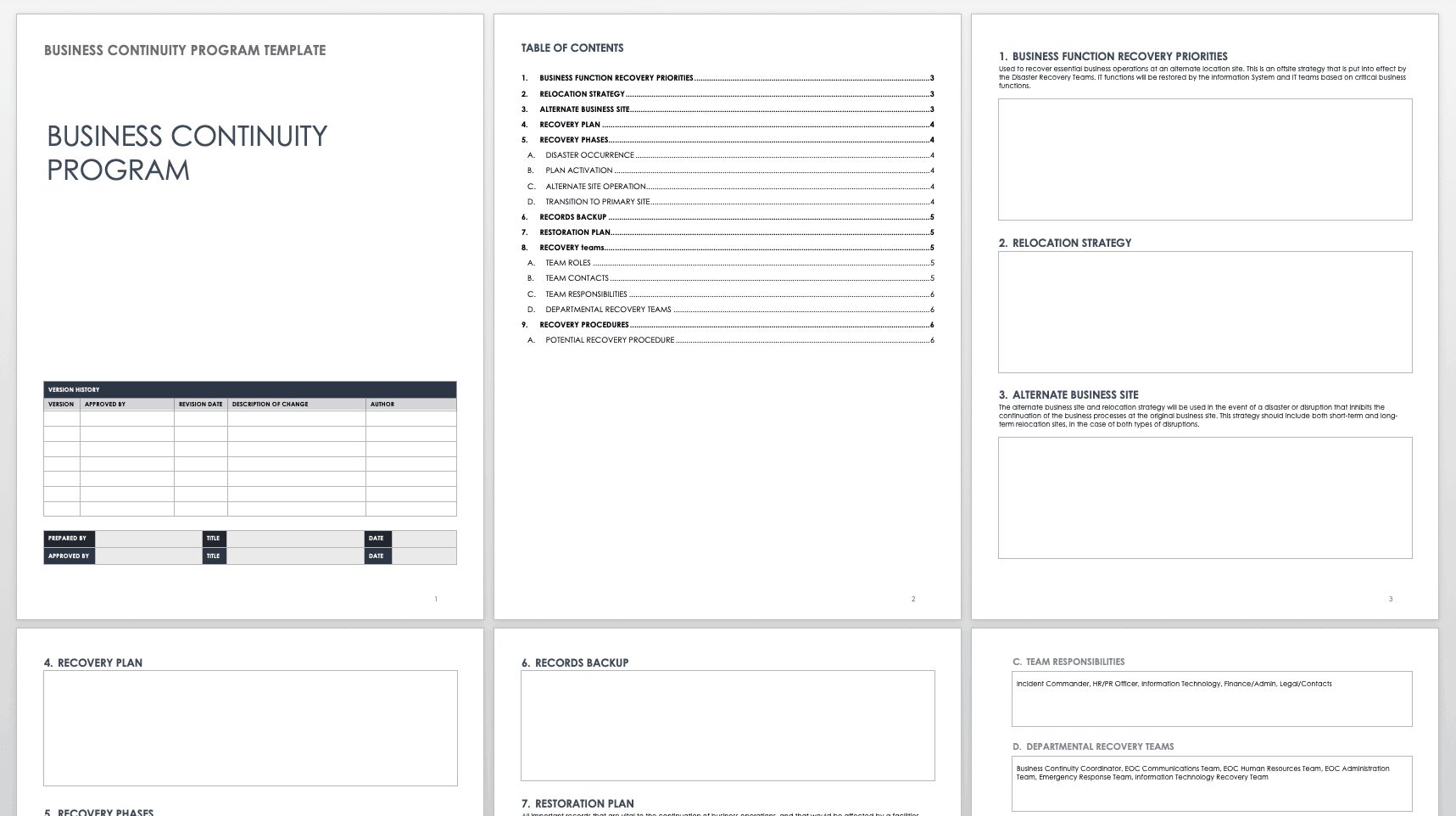

FINRA requires firms to create and maintain written business continuity plans (BCPs) relating to an emergency or significant business disruption. Rule 4370 —FINRA's emergency preparedness rule — spells out the required BCP procedures. A firm's BCP must be appropriate to the scale and scope of its business.

BCP procedures must be reasonably designed so the firm can meet its existing obligations to customers. A firm must disclose to its customers how its BCP addresses the possibility of a significant business disruption and how the firms plan to respond to events of varying scope. This BCP disclosure must be made in writing to customers when they open their account, posted on the firm's website if they maintain one and mailed to customers upon request. The BCP also must be made available promptly to FINRA staff if requested.

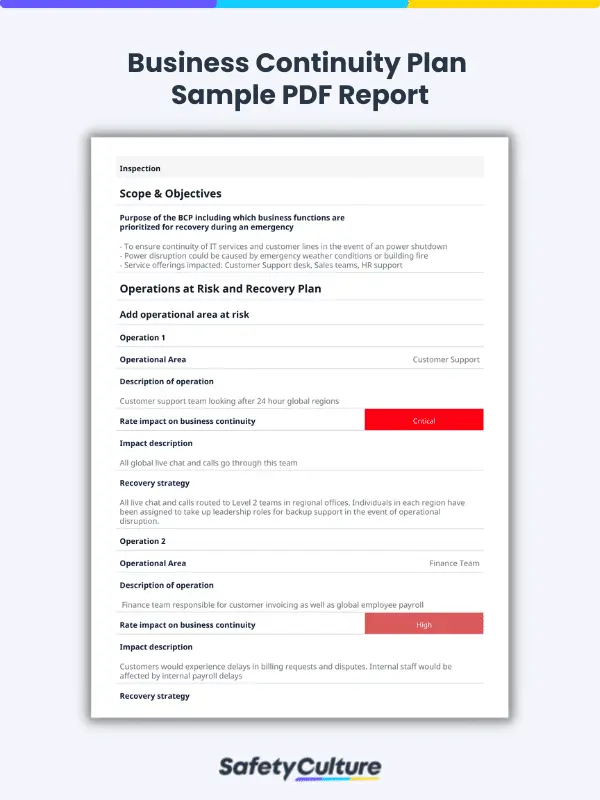

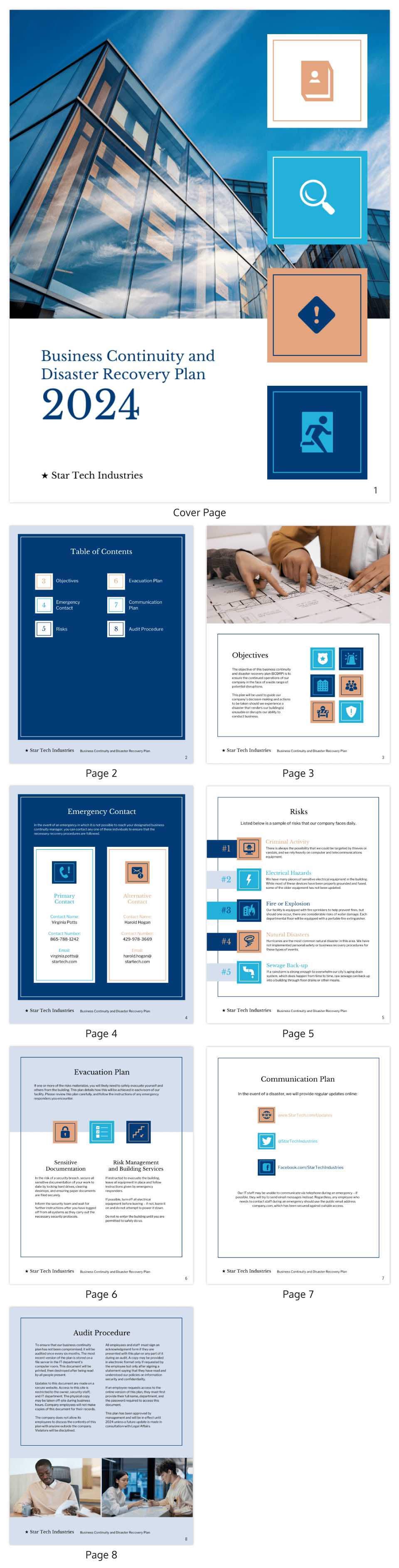

What to Include in a Business Continuity Plan

FINRA Rule 4370 gives a firm flexibility in designing a BCP. It may be tailored to the size and needs of the firm, but at a minimum it must include the following elements:

- Data backup and recovery (hard copy and electronic);

- All mission critical systems;

- Financial and operational assessments;

- Alternate communications between customers and the firm, and between the firm and employees;

- Alternate physical location of employees;

- Critical business constituent, bank, and counterparty impact;

- Regulatory reporting;

- Communications with regulators; and

- How the firm will assure customers' prompt access to their funds and securities in the event that the firm determines that it is unable to continue its business.

A firm must address the elements to the extent applicable and necessary. If any of the elements is not applicable, the firm's BCP must document the rationale for not including the element in its plan. If a firm relies on another entity for any one of the elements or any mission critical system, the firm's BCP must address this relationship.

FINRA provides the following optional tools to assist firms in in fulfilling their need to create and maintain business continuity plans (BCPs) and emergency contact person lists under FINRA Rule 4370.

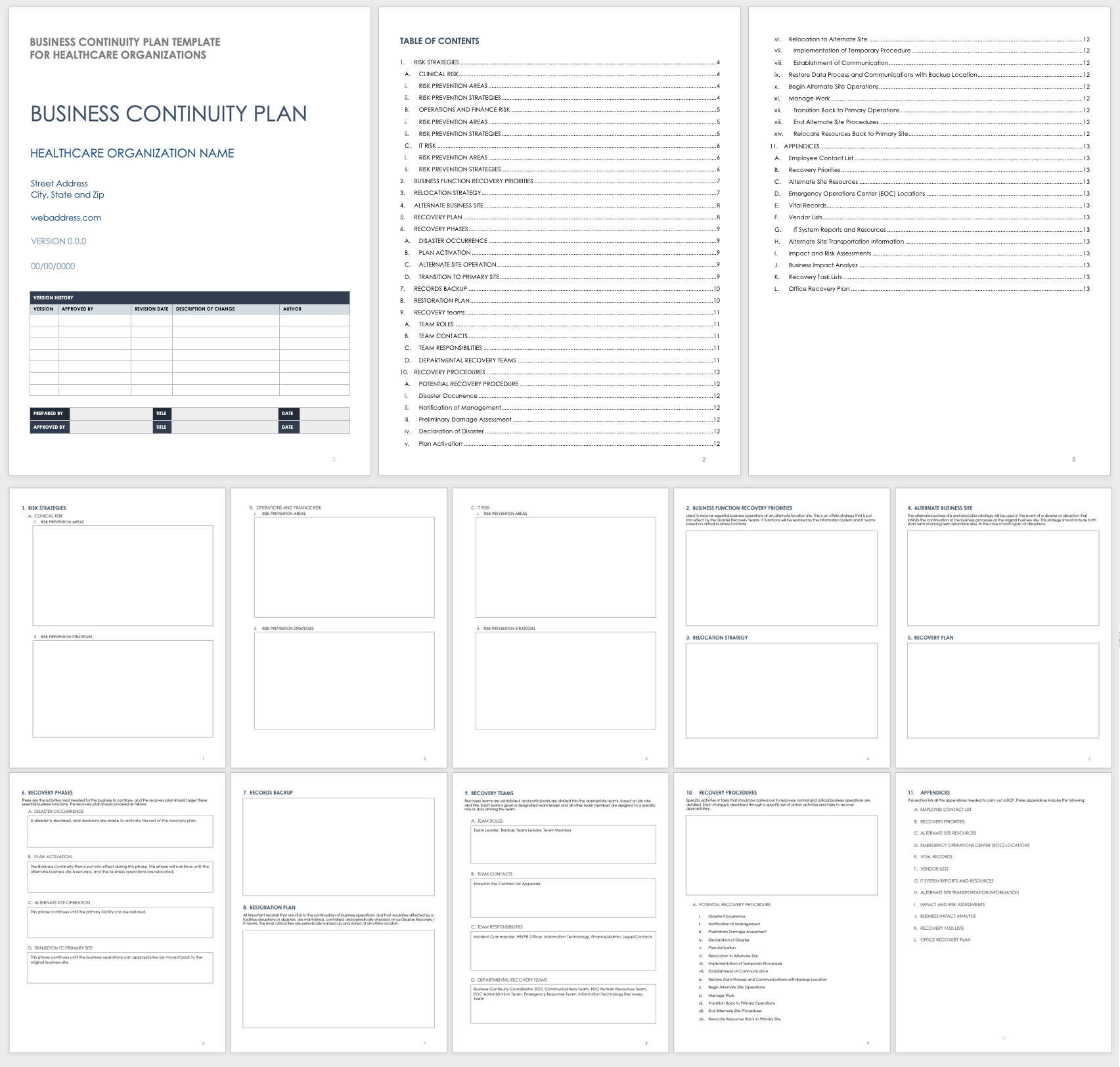

- Small Firm Business Continuity Plan Template

- Business Continuity Planning Case Study

- 2009 Pandemic Preparedness Survey Results

Communicating with FINRA

Firms must provide FINRA with emergency contact information. In addition, if a firm is unable to contact FINRA during a significant business disruption through its usual contact, such as the District Office or direct dial number, please call the FINRA Support Center at (301) 590-6500. This number will be rerouted in the event of a business disruption at FINRA's primary call center, so that the firm will be able to reach an operator or receive recorded instructions. This information also will be posted on www.finra.org.

In instances when data communications are disrupted, firms are responsible for retaining data until it can be transmitted to FINRA.

FINRA's Business Continuity Plan

FINRA's BCP specifies how we will respond to events that significantly disrupt our business and addresses safeguarding our employees and property; insuring data back up and recovery; restoring mission-critical systems as well as critical regulatory and operational activities; alternative communications with investors, member firms, associated persons, and other regulators; and assuring all of our constituents a prompt response to their needs. We plan to continue in business, transfer operations to alternate sites as needed, and maintain as much transparency to our constituents as possible during a disruption. FINRA's business continuity plan is updated and tested regularly, and it is provided to the SEC as part of its oversight of FINRA.

Contact OGC

FINRA's Office of General Counsel (OGC) staff provides broker-dealers, attorneys, registered representatives, investors and other interested parties with interpretative guidance relating to FINRA’s rules. Please see Interpreting the Rules for more information.

OGC staff contacts: Kosha Dalal and Jeanette Wingler FINRA, OGC 1700 K Street, NW Washington, DC 20006 (202) 728-8000

- Regulatory Notice 21-44 Business Continuity Planning and Lessons From the COVID-19 Pandemic 12/23/2021

- Regulatory Notice 21-29 FINRA Reminds Firms of their Supervisory Obligations Related to Outsourcing to Third-Party Vendors 08/13/2021

- Regulatory Notice 20-42 FINRA Seeks Comment on Lessons From the COVID-19 Pandemic 12/16/2020

- Information Notice – 3/26/20 Cybersecurity Alert: Measures to Consider as Firms Respond to the Coronavirus Pandemic (COVID-19) 03/26/2020

- Regulatory Notice 20-08 Pandemic-Related Business Continuity Planning, Guidance and Regulatory Relief 03/09/2020

- Regulatory Notice 19-06 FINRA Requests Comment on the Effectiveness and Efficiency of Its Rule on Business Continuity Plans and Emergency Contact Information 02/25/2019

- Regulatory Notice 18-09 FINRA Updates Designation Criteria to Require Firms Reporting U.S. Treasury Securities to TRACE to Participate in FINRA's Business Continuity/Disaster Recovery Testing 03/07/2018

- Regulatory Notice 17-27 Guidance to Members Affected by Hurricane Harvey 08/30/2017

- Regulatory Notice 13-25 FINRA, the SEC and CFTC Issue Joint Advisory on Business Continuity Planning 08/16/2013

- Regulatory Notice 12-53 FINRA Waives Certain Trade Reporting and Compliance Engine (TRACE) Late Trade Reporting Fees in Connection With Hurricane Sandy 12/03/2012

- Regulatory Notice 12-45 Guidance to Members Affected by Hurricane Sandy 10/30/2012

- Information Notice - 8/28/12 Guidance for Firms Potentially Affected by Hurricane Isaac 08/28/2012

- Regulatory Notice 09-60 SEC Approval and Effective Dates for New Consolidated FINRA Rules 10/15/2009

- Regulatory Notice 09-59 FINRA Provides Guidance on Pandemic Preparedness 10/12/2009

- Regulatory Notice 07-49 Guidance for Firms Affected by the California Wildfires 10/25/2007

- Notice to Members 06-74 Member Business Continuity Experiences regarding Hurricanes Katrina and Rita 12/29/2006

- Notice to Members 06-31 NASD Requests Comment on Regulatory Relief that Should Be Granted in Response to a Possible Pandemic or Other Major Business Disruption 06/28/2006

- Notice to Members 05-57 Guidance to Members Affected by Hurricane Katrina 09/02/2005

- Notice to Members 04-37 SEC Approves Rules Requiring Members to Create Business Continuity Plans and Provide Emergency Contact Information 05/05/2004

- Notice to Members 02-23 The NASD Seeks Comment On Proposed Rules Relating To Member Firm Business Continuity Plans And Emergency Contact Information 04/10/2002

- Guidance Cybersecurity and Technology Management The Cybersecurity and Technology Management topic of the 2024 FINRA Annual Regulatory Oversight Report (the Report) informs member firms’ compliance programs by providing annual insights from FINRA’s ongoing regulatory operations, including (1) regulatory obligations and related considerations, (2) findings and effective practices, and (3) additional resources. January 09, 2024

- Media Center Preparing for the Unexpected: The Ins and Outs and the Value of Succession Planning Succession planning is important not just for customers and representatives but can even be a matter of life or death when it comes to the continued existence of a firm. On this episode, we hear how and why firms should plan for the expected and unexpected in life. January 24, 2023

- Podcast Business in the Time of COVID-19: BCPs, Regulatory Relief & More The new coronavirus that causes COVID-19 has rapidly changed the way U.S. broker-dealers must conduct business as states implement various shelter-in-place and stay-at-home orders, forcing workers remote. On this episode, we talk to FINRA’s Chief Legal Officer and Head of Member Supervision to learn how FINRA is adapting its operations and providing important regulatory relief. March 31, 2020

Due to the coronavirus pandemic (COVID-19) , FINRA is providing temporary relief for member firms from rules and requirements in the Frequently Asked Questions below. The relief provided does not extend beyond the identified rules and requirements. FINRA will continue to monitor the situation to determine whether additional guidance and relief may be appropriate. As coronavirus-related risks decrease, member firms should expect to return to meeting any regulatory obligations for which relief has been provided.

- Targeted Examination Letter Targeted Examination Letter on Business Continuity Plans In coordination with the SEC and the CFTC, we are conducting a review of the impact of Hurricane Sandy on firms’ operations and their ability to conduct business at a time when business continuity plans were enacted. November 01, 2012

- Report / Study Pandemic Preparedness Survey Results In 2009 FINRA conducted a voluntary firm survey to determine preparedness for a pandemic in light of current events involving influenza A (H1N1). This survey continues FINRA's efforts to assist firms with business continuity planning by facilitating the exchange of information. October 26, 2009

- FAQ Business Continuity Planning FAQ Frequently asked questions regarding Business Continuity Planning (BCP) and FINRA Rule 4370.

- Compliance Tools Small Firm Business Continuity Plan Template FINRA is providing a template as an optional tool to assist small introducing firms in fulfilling their obligations under FINRA Rule 4370 (Business Continuity Plans and Emergency Contact Information).

- FINRA Issues Alert Warning Investors of Stock Fraud Following Hurricane Harvey August 31, 2017

- FINRA Announces Small Firm Emergency Partner Program October 11, 2007

- Search Search Please fill out this field.

- Business Continuity Plan Basics

- Understanding BCPs

- Benefits of BCPs

- How to Create a BCP

- BCP & Impact Analysis

- BCP vs. Disaster Recovery Plan

Frequently Asked Questions

- Business Continuity Plan FAQs

The Bottom Line

What is a business continuity plan (bcp), and how does it work.

:max_bytes(150000):strip_icc():format(webp)/wk_headshot_aug_2018_02__william_kenton-5bfc261446e0fb005118afc9.jpg)

Investopedia / Ryan Oakley

What Is a Business Continuity Plan (BCP)?

A business continuity plan (BCP) is a system of prevention and recovery from potential threats to a company. The plan ensures that personnel and assets are protected and are able to function quickly in the event of a disaster.

Key Takeaways

- Business continuity plans (BCPs) are prevention and recovery systems for potential threats, such as natural disasters or cyber-attacks.

- BCP is designed to protect personnel and assets and make sure they can function quickly when disaster strikes.

- BCPs should be tested to ensure there are no weaknesses, which can be identified and corrected.

Understanding Business Continuity Plans (BCPs)

BCP involves defining any and all risks that can affect the company's operations, making it an important part of the organization's risk management strategy. Risks may include natural disasters—fire, flood, or weather-related events—and cyber-attacks . Once the risks are identified, the plan should also include:

- Determining how those risks will affect operations

- Implementing safeguards and procedures to mitigate the risks

- Testing procedures to ensure they work

- Reviewing the process to make sure that it is up to date

BCPs are an important part of any business. Threats and disruptions mean a loss of revenue and higher costs, which leads to a drop in profitability. And businesses can't rely on insurance alone because it doesn't cover all the costs and the customers who move to the competition. It is generally conceived in advance and involves input from key stakeholders and personnel.

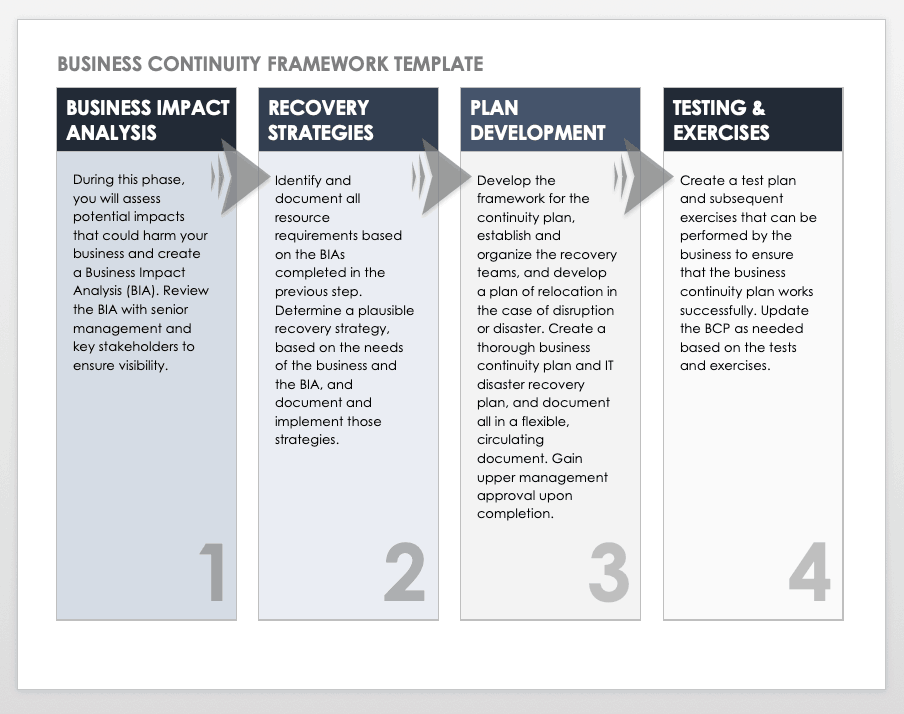

Business impact analysis, recovery, organization, and training are all steps corporations need to follow when creating a Business Continuity Plan.

Benefits of a Business Continuity Plan

Businesses are prone to a host of disasters that vary in degree from minor to catastrophic. Business continuity planning is typically meant to help a company continue operating in the event of major disasters such as fires. BCPs are different from a disaster recovery plan, which focuses on the recovery of a company's information technology system after a crisis.

Consider a finance company based in a major city. It may put a BCP in place by taking steps including backing up its computer and client files offsite. If something were to happen to the company's corporate office, its satellite offices would still have access to important information.

An important point to note is that BCP may not be as effective if a large portion of the population is affected, as in the case of a disease outbreak. Nonetheless, BCPs can improve risk management—preventing disruptions from spreading. They can also help mitigate downtime of networks or technology, saving the company money.

How To Create a Business Continuity Plan

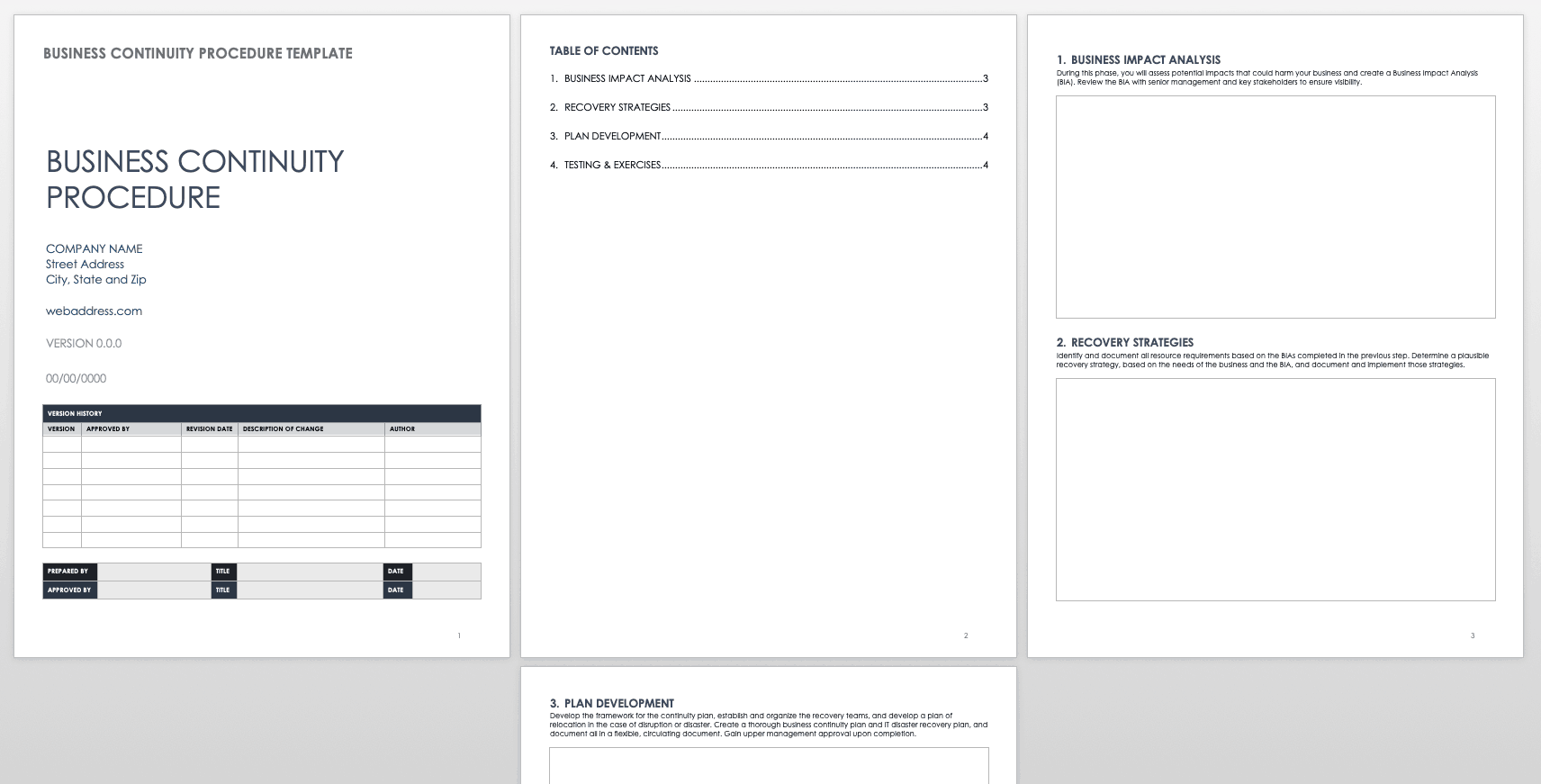

There are several steps many companies must follow to develop a solid BCP. They include:

- Business Impact Analysis : Here, the business will identify functions and related resources that are time-sensitive. (More on this below.)

- Recovery : In this portion, the business must identify and implement steps to recover critical business functions.

- Organization : A continuity team must be created. This team will devise a plan to manage the disruption.

- Training : The continuity team must be trained and tested. Members of the team should also complete exercises that go over the plan and strategies.

Companies may also find it useful to come up with a checklist that includes key details such as emergency contact information, a list of resources the continuity team may need, where backup data and other required information are housed or stored, and other important personnel.

Along with testing the continuity team, the company should also test the BCP itself. It should be tested several times to ensure it can be applied to many different risk scenarios . This will help identify any weaknesses in the plan which can then be corrected.

In order for a business continuity plan to be successful, all employees—even those who aren't on the continuity team—must be aware of the plan.

Business Continuity Impact Analysis

An important part of developing a BCP is a business continuity impact analysis. It identifies the effects of disruption of business functions and processes. It also uses the information to make decisions about recovery priorities and strategies.

FEMA provides an operational and financial impact worksheet to help run a business continuity analysis. The worksheet should be completed by business function and process managers who are well acquainted with the business. These worksheets will summarize the following:

- The impacts—both financial and operational—that stem from the loss of individual business functions and process

- Identifying when the loss of a function or process would result in the identified business impacts

Completing the analysis can help companies identify and prioritize the processes that have the most impact on the business's financial and operational functions. The point at which they must be recovered is generally known as the “recovery time objective.”

Business Continuity Plan vs. Disaster Recovery Plan

BCPs and disaster recovery plans are similar in nature, the latter focuses on technology and information technology (IT) infrastructure. BCPs are more encompassing—focusing on the entire organization, such as customer service and supply chain.

BCPs focus on reducing overall costs or losses, while disaster recovery plans look only at technology downtimes and related costs. Disaster recovery plans tend to involve only IT personnel—which create and manage the policy. However, BCPs tend to have more personnel trained on the potential processes.

Why Is Business Continuity Plan (BCP) Important?

Businesses are prone to a host of disasters that vary in degree from minor to catastrophic and business continuity plans (BCPs) are an important part of any business. BCP is typically meant to help a company continue operating in the event of threats and disruptions. This could result in a loss of revenue and higher costs, which leads to a drop in profitability. And businesses can't rely on insurance alone because it doesn't cover all the costs and the customers who move to the competition.

What Should a Business Continuity Plan (BCP) Include?

Business continuity plans involve identifying any and all risks that can affect the company's operations. The plan should also determine how those risks will affect operations and implement safeguards and procedures to mitigate the risks. There should also be testing procedures to ensure these safeguards and procedures work. Finally, there should be a review process to make sure that the plan is up to date.

What Is Business Continuity Impact Analysis?

An important part of developing a BCP is a business continuity impact analysis which identifies the effects of disruption of business functions and processes. It also uses the information to make decisions about recovery priorities and strategies.

FEMA provides an operational and financial impact worksheet to help run a business continuity analysis.

These worksheets summarize the impacts—both financial and operational—that stem from the loss of individual business functions and processes. They also identify when the loss of a function or process would result in the identified business impacts.

Business continuity plans (BCPs) are created to help speed up the recovery of an organization filling a threat or disaster. The plan puts in place mechanisms and functions to allow personnel and assets to minimize company downtime. BCPs cover all organizational risks should a disaster happen, such as flood or fire.

Federal Emergency Management Agency. " Business Process Analysis and Business Impact Analysis User Guide ." Pages 15 - 17.

Ready. “ IT Disaster Recovery Plan .”

Federal Emergency Management Agency. " Business Process Analysis and Business Impact Analysis User Guide ." Pages 15-17.

:max_bytes(150000):strip_icc():format(webp)/BusinessPlanMeeting-570270145f9b5861953a6732.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

What Is A Business Continuity Plan? [+ Template & Examples]

Published: December 30, 2022

When a business crisis occurs, the last thing you want to do is panic.

The second-to-last thing you want to do is be unprepared. Crises typically arise without warning. While you shouldn't start every day expecting the worst, you should be relatively prepared for anything to happen.

A business crisis can cost your company a lot of money and ruin your reputation if you don't have a business continuity plan in place. Customers aren't very forgiving, especially when a crisis is influenced by accidents within the company or other preventable mistakes. If you want your company to be able to maintain its business continuity in the face of a crisis, then you'll need to come up with this type of plan to uphold its essential functions.

In this post, we'll explain what a business continuity plan is, give examples of scenarios that would require a business continuity plan, and provide a template that you can use to create a well-rounded program for your business.

Table of Contents:

What is a business continuity plan?

- Business Continuity Types

- Business Continuity vs Disaster Recovery

Business Continuity Plan Template

How to write a business continuity plan.

- Business Continuity Examples

A business continuity plan outlines directions and procedures that your company will follow when faced with a crisis. These plans include business procedures, names of assets and partners, human resource functions, and other helpful information that can help maintain your brand's relationships with relevant stakeholders. The goal of a business continuity plan is to handle anything from minor disruptions to full-blown threats.

For example, one crisis that your business may have to respond to is a severe snowstorm. Your team may be wondering, "If a snowstorm disrupted our supply chain, how would we resume business?" Planning contingencies ahead of time for situations like these can help your business stay afloat when you're faced with an unavoidable crisis.

When you think about business continuity in terms of the essential functions your business requires to operate, you can begin to mitigate and plan for specific risks within those functions.

.png)

Crisis Communication and Management Kit

Manage, plan for, and communicate during your corporate crises with these crisis management plan templates.

- Free Crisis Management Plan Template

- 12 Crisis Communication Templates

- Post-Crisis Performance Grading Template

- Additional Crisis Best Management Practices

Download Free

All fields are required.

You're all set!

Click this link to access this resource at any time.

Business Continuity Planning

Business continuity planning is the process of creating a plan to address a crisis. When writing out a business continuity plan, it's important to consider the variety of crises that could potentially affect the company and prepare a resolution for each.

Don't forget to share this post!

Related articles.

How to Navigate Customer Service During a Business Closure

10 Crisis Communication Plan Examples (and How to Write Your Own)

I Tried 7 Crisis Management Software to See if They’re Worth It (Results & Recommendations)

20 Crisis Management Quotes Every PR Team Should Live By

![business continuity plan finance department Social Media Crisis Management: Your Complete Guide [Free Template]](https://www.hubspot.com/hubfs/social-media-crisis-management_11.webp)

Social Media Crisis Management: Your Complete Guide [Free Template]

![business continuity plan finance department De-Escalation Techniques: 19 Best Ways to De-Escalate [Top Tips + Data]](https://www.hubspot.com/hubfs/de-escalation-techniques_2.webp)

De-Escalation Techniques: 19 Best Ways to De-Escalate [Top Tips + Data]

Situational Crisis Communication Theory and How It Helps a Business

What Southwest’s Travel Disruption Taught Us About Customer Service

Showcasing Your Crisis Management Skills on Your Resume

![business continuity plan finance department What Is Contingency Planning? [+ Examples]](https://www.hubspot.com/hubfs/contingency-planning.jpg)

What Is Contingency Planning? [+ Examples]

Manage, plan for, and communicate during a corporate crisis.

Service Hub provides everything you need to delight and retain customers while supporting the success of your whole front office

More From Forbes

How and why to create a business continuity plan.

- Share to Facebook

- Share to Twitter

- Share to Linkedin

Recently, a few companies have asked me to help them navigate this tumultuous time for entrepreneurs. Candidly, no one understands the challenges of keeping a company afloat but a business owner who has skin in the game. Of course, that's not to say that other people have zero input in keeping a business afloat. But entrepreneurs are typically the only ones who sweat every detail in the moment, such as in this current business environment. And what this has reinforced for me is how crucial business continuity planning is for any entrepreneur.

The Questions That Matter In Challenging Business Climates

I am unpacking the fact that there is a new normal evolving — every day — with other business owners. First, I'm not convinced that soon business will be like it was in prior months or even like the year before the novel coronavirus pandemic. Therefore, the messaging for marketing should be to reframe a company's strategy to focus on the mentality of survival, caring for the consumer and creating business resilience.

For business continuity planning, operational resilience is also essential. I'm focusing on it within my brands and even as I consult. Operational resilience boils down to location and team resilience. It means asking what and who on the team is essential. And how can a business owner keep teams productive, with continuous measurements in place? Financial resilience is critical for working through the dynamics of engaging suppliers, credit and cash reserves. In moments like these, entrepreneurs should understand their cash flow plan fully, the amount of fuel in the tank and when the business could run low on money.

Further, what I'm also focusing on is cost resilience, which is also critical in business continuity planning. It starts with the question: What can you prune down? Can you downsize to a smaller space? What external services should you review and adjust? Of course, payroll cuts are tough but often necessary to keep costs in line with the new normal. In other words, to keep a company afloat, everyone — including workers — has to make sacrifices.

Finally, revenue resilience comes from sharpening the focus on being customer-centric. Entrepreneurs need customers to be healthy and engaged. Now is the time to stay close to your clients. In the process, you should pay attention to risk reversal because closing the sale before the current climate was different than doing it in the ever-evolving new normal. That means strategic consultation-based sales are the key — without an ask.

What Is Business Continuity Planning?

Business continuity planning (BCP) is a must-do, especially at present. It is an opportunity to manage strategic resilience and understand how to become a mile deep and an inch wide — versus the opposite. Business continuity planning is a process whereby leaders develop systems to prevent and recover from threats that exist. In other words, this is risk management in the middle of a changing and fluid environment.

Business continuity planning includes having a plan for all threats, which can range from economic to cyber-security threats. None of us know what the future holds, but as business development leaders explained in a recent article , planning is vital and essential for any successful business. Trust me: Knowing that we're executing our BCP strategy eases the pressure, and that's what every entrepreneur needs to be doing now. If they don't have a BCP, they need to develop one as crises like the pandemic unfold.

Steps To Plan For Business Continuity

Once you complete it, you should evaluate your business continuity plan several times during the fiscal year of the company. As we know, the business environment shifts very fast in today's world, and it's vital to develop a plan, but also make sure it's not outdated — especially as it relates to finance, technology and sales, for example.

• Assessment Of Risk And Impact Analysis

During this initial phase, you want to understand all the exposure risks for your company. This means you have to think of every possible kind of risk for your business. By doing a business impact analysis (BIA), you can gain clarity about every potential threat to your business.

The BIA will provide you with critical information, such as who your stakeholders are, your supply chain gaps, and your levels of resilience. It will also inform you about the core team that you should keep in place in the face of potential catastrophe.

• Business Continuity Plan Development

Once the team that is working with you on the creation of the business continuity plan has the information from the BIA and any gap analyses, it's time to get started on the creation of the BCP. Initially, the team should create a draft document, and then they can present it to the senior executives who have to sign off on it.

The business continuity plan is essentially the answer to questions about how your business can continue with operations should there be any crisis or disaster. This plan should encompass every area of your business from the macro to the micro levels. Consideration and review should move through the entire company, including every division and into each department, role and function.

• Testing And Maintenance Of The BCP

As I mentioned earlier in this article, and as one CIO article explained , you should review and evaluate the business continuation plan regularly — and even more so now. For finance, operations, marketing and sales, my team and I continually work to understand what our minimum metrics must be for our businesses to continue.

I can't emphasize this enough — preparation is critical, and at moments like the present, planning is happening daily. Ultimately, it's all about coming out on top. Building relationships, having strategic discussions and developing clear messaging are key. It's also important to reframe and refocus your operations, marketing and sales strategy to fuel your revenue generation and cash flow during difficult times. For more information about business continuity planning, you can visit the Small Business Administration website or even SCORE's small business disaster preparedness resources .

- Editorial Standards

- Reprints & Permissions

Business Continuity Planning: Ensuring the Resilience of Your Organization

Let’s explore the intricacies of business continuity planning, from understanding its importance to implementing a robust strategy that safeguards your enterprise.

Published by Orgvue November 20, 2023

Home > Resources > article > Business Continuity Planning: Ensuring the Resilience of Your Organization

In an unpredictable world, the ability to sustain your business’s essential functions and operations, even in the face of disruptions, is paramount.

Business continuity planning is the framework that ensures your organization can weather storms, both literal and metaphorical.

What is Business Continuity Planning?

At its core, business continuity planning is the process of developing a proactive strategy to ensure an organization’s critical functions and operations can continue in the face of unforeseen disruptions.

It encompasses a range of activities, from risk assessment to the creation of detailed recovery plans, with the ultimate goal of minimizing downtime and ensuring the organization’s resilience.

The Importance of Business Continuity Planning

The importance of being prepared for various external and internal factors cannot be overstated. While many businesses have a standard business plan, not all of them consider the potential disruptions caused by natural calamities, economic downturns, or other unexpected events. Business continuity planning is the key to ensuring a company’s sustained operation, regardless of the challenges it may face.

Business continuity planning goes beyond the traditional business plan. While a business plan outlines goals and strategies for growth, a continuity plan focuses on how the organization will continue to function in the face of adversity. It involves identifying potential risks and developing strategies to mitigate and recover from them. Whether it’s a natural disaster, a cyberattack or an economic recession, having a well-thought-out strategic plan is essential for business survival.

One of the most significant threats to businesses is an economic downturn, such as a recession. During these challenging times, consumer spending often decreases, and businesses may face financial instability. A recession can have a ripple effect on companies of all sizes, causing decreased revenue, layoffs, and even closures.

For a detailed look at the impact of recessions on businesses, read how to prepare for a recession , which delves into strategies for navigating these challenging economic conditions.

Business strategy planning is not just about surviving during tough times; it’s also crucial for capitalizing on periods of growth. When businesses experience an upturn, they often need to scale rapidly to meet increased demand. Having a continuity plan in place allows for a smoother transition during periods of growth, ensuring that the infrastructure, resources and workforce can adapt effectively.

The financial consequences of not having a business continuity plan can be devastating. Without a plan in place, businesses are more vulnerable to unexpected disruptions, which can result in significant financial losses. These losses may come from increased downtime, lost revenue, legal liabilities, reputational damage and the costs associated with recovery efforts.

Considerations for Business Continuity Planning

Creating a robust business continuity plan is a complex task that involves a multitude of factors. Among these considerations, three key aspects stand out: cultural differences, limited resources and alignment with business objectives. A successful business strategy plan takes these factors into account to ensure that an organization can effectively respond to disruptions while maintaining its core values and strategic direction.

1. Cultural Differences

Cultural diversity is a significant consideration in business strategy planning, especially for multinational companies or organizations with a diverse workforce. Cultural differences can influence how employees perceive and respond to crises. When developing a business continuity plan, it is important to consider the following aspects:

- Communication Styles : Different cultures have varying communication norms and hierarchies. Understanding how employees from various cultural backgrounds communicate during a crisis can help in crafting effective crisis communication strategies.

- Decision-Making Processes : Some cultures prioritize consensus-driven decision-making, while others lean towards hierarchical authority. A business continuity plan should acknowledge these differences and provide flexibility in decision-making approaches during disruptions.

- Crisis Response Expectations : Cultural expectations can shape how employees expect the organization to respond to a crisis. Your business strategy plan should be sensitive to these expectations and ensure that response strategies align with cultural norms.

2. Limited Resources

For many businesses, resource constraints are a reality. When developing a business continuity plan, it’s crucial to consider the organization’s resource limitations, such as budget, personnel and technology. Here are some key considerations:

- Resource Allocation : Prioritize critical functions and allocate resources accordingly. Not all business processes are equally important, and a business continuity plan should identify and protect the most essential ones first.

- Efficiency and Scalability : Develop strategies that focus on efficiency and scalability. Efficient resource use is critical, and a business strategy plan should outline how to adapt to changing resource constraints during a crisis.

- Collaboration : Collaboration with external partners, such as suppliers, can be a resource-saving strategy. Establishing relationships with partners who can provide support during disruptions is a valuable aspect.

3. Business Objectives

A business continuity plan should align with the broader business objectives to ensure that it doesn’t hinder growth or innovation. Consider the following aspects:

- Market Expansion: If the organization’s objective is to expand into new markets, the business strategy plan should accommodate this goal. It should address the challenges and opportunities that come with market expansion, including regulatory compliance and logistical considerations.

- Relocation or Migration : If there are plans to relocate or migrate operations, the business continuity plan should include strategies for a seamless transition. This may involve considerations such as data migration, employee relocation and continuity of customer service.

- Competitive Landscape : Changes in the competitive landscape, such as the emergence of new competitors, can impact the organization’s continuity. The business strategy plan should be flexible enough to adapt to shifts in the competitive environment.

- The COVID-19 pandemic forced companies to adapt rapidly, with remote work becoming the norm for many, reshaping entire industries like healthcare and e-commerce.

- The global recession of 2008 had long-lasting effects on financial institutions and prompted regulatory changes that influenced business operations.

- The rise of the internet transformed countless businesses, from retail to media, and required adaptation to online platforms.

- Looking ahead, emerging technologies like artificial intelligence have the potential to disrupt industries in unprecedented ways, with automation and data-driven decision-making reshaping the future of work. These events emphasize the critical importance of adaptable and comprehensive business continuity planning to navigate the unpredictable landscape of our ever-evolving world.

Developing a Strategic Business Plan

A well structured business plan serves as a roadmap for your organization, guiding actions and decisions while enabling effective response to a dynamic business environment.

- Conduct a comprehensive assessment of the current state of the business.

- Review financial statements, market positioning and operational performance.

- Identify strengths, weaknesses, opportunities and threats.

- Evaluate the company’s internal resources and capabilities.

- Analyze micro-environment factors such as competitors, customers, suppliers and regulatory changes.

- Examine macro-environment factors like economic trends, technological advancements and political factors.

- Use tools like PESTEL analysis and Porter’s Five Forces to assess the external business environment.

- Clearly define short-term and long-term business objectives.

- Make objectives specific, measurable, achievable, relevant and time-bound (SMART).

- Align objectives with the company’s mission and vision.

- Identify key operational processes that drive business success.

- Evaluate the efficiency and effectiveness of these processes.

- Prioritize improvements in critical areas to align with strategic objectives.

- Plan for potential risks and uncertainties that could impact the business.

- Create contingency and crisis management strategies.

- Establish a risk management framework to mitigate and respond to unforeseen events.

- Implement key performance indicators (KPIs) to track progress.

- Regularly review and revise the business plan based on changing market conditions.

- Adapt to emerging opportunities and challenges.

- Ensure that the strategic plan is communicated effectively throughout the organization.

- Secure buy-in and commitment from employees at all levels.

- Ensure that all team members understand their roles in achieving the plan’s objectives.

- Allocate resources, including finances and manpower, in alignment with the strategic priorities.

- Develop a budget that reflects the financial requirements of the plan.

- Monitor spending and adjust budgets as needed.

- Develop a timeline and action plan for the execution of the strategic initiatives.

- Assign responsibilities to specific teams or individuals.

- Regularly review progress and make adjustments to stay on track.

- Periodically evaluate the effectiveness of the strategic plan.

- Solicit feedback from employees, customers and stakeholders.

- Use feedback to make continuous improvements and refine the plan.

- Establish a system for measuring and reporting progress.

- Create dashboards or reports to communicate key metrics to stakeholders.

- Ensure that performance data aligns with the defined objectives.

- Incorporate sustainability and responsible growth practices into the plan.

- Address social and environmental impacts as part of corporate responsibility.

- Seek opportunities for sustainable growth and innovation.

- Develop scenarios that explore alternative future situations.

- Consider various outcomes and their implications on the business.

- Prepare for different scenarios to enhance adaptability.

- Leverage technology for data analytics, automation, and efficiency.

- Stay updated on emerging technologies that can support the strategic plan.

- Integrate technology solutions to enhance business processes.

Implementing a Business Continuity Plan

Importance of Training and Awareness:

- Awareness: Create awareness about the business continuity plan across the organization to foster a culture of preparedness. This includes educating employees on the potential risks and the importance of the plan.

Consistent Review of the Plan:

- Conduct post-incident reviews to assess the BCP’s performance after a real event and make necessary adjustments.

Address Cultural and Technological Issues:

- Technological Challenges: Recognize and mitigate technological hurdles that can hinder the plan’s execution, such as infrastructure limitations or cybersecurity threats. Ensure that IT systems are resilient and can support the plan.

Software Integration:

- Organizational design software like Orgvue can assist in visualizing and optimizing the organizational structure, enabling efficient allocation of resources and responsibilities during a disruption.

Business continuity planning is not merely a precaution but a strategic imperative for any organization. It provides a structured approach to safeguarding business operations in the face of unforeseen disruptions, thereby minimizing downtime and potential financial losses.

By fostering a culture of preparedness, training employees, regularly reviewing and adapting the plan, addressing cultural and technological issues, and leveraging software solutions like Orgvue for organizational design, businesses can ensure their resilience and adaptability in an ever-changing landscape.

For businesses with specific 1-5 year plans, the integration of business strategy planning is paramount. It aligns seamlessly with forward-looking strategies by fortifying the organization’s ability to execute those plans in the face of unexpected events.

By weaving business continuity considerations into your strategic framework, you not only protect your investments but also demonstrate your commitment to long-term success, customer trust and stakeholder confidence. The benefits of such foresight extend far beyond mitigating risk; they empower your business to thrive in an increasingly unpredictable world. Therefore, it is recommended that businesses of all sizes prioritize and integrate business continuity planning as an integral part of their strategic vision and ongoing operations.

Business Continuity Plan FAQs

● where does business continuity planning belong in an organization.

Depending on the organization’s culture, the department your business continuity plan falls under varies. IT is usually one of the most vital components of any business strategy plan, in which case it could belong under the IT department. Or, if financial impacts are your organization’s main concern, the finance department may need to run the plan.

● Who Is Responsible For the Business Continuity Plan?

The business continuity plan usually falls under the responsibility of a dedicated role or department, often led by a Business Continuity Manager, who reports to senior leadership. This individual or team is responsible for creating, implementing, and regularly updating the plan to ensure the organization’s resilience in the face of disruptions.

● Is Business Continuity Planning a Legal Requirement?

It is not always a legal requirement, but certain industries and jurisdictions may have regulations or standards that mandate organizations to have such plans in place to ensure operational resilience and preparedness for emergencies.

● What Role Can Business Continuity Planning Play In Recovering From an Incident?

It plays a crucial role in helping organizations recover from incidents by providing a structured framework to assess, respond to and mitigate the impact of disruptions, minimizing downtime and financial losses. It outlines clear procedures and responsibilities, ensuring that essential operations can resume swiftly and efficiently, thus safeguarding the organization’s reputation and maintaining stakeholder trust.

● When Should a Business Continuity Plan Be Activated?

A business continuity plan should be activated as a preventative measure in the event a disruptive incident occurs. Triggers may include natural disasters, cyberattacks, supply chain disruptions or any event that threatens the continuity of critical business functions.

Accelerate workforce transformation

Use Orgvue to streamline your organization.

- Business Continuity Planning (BCP)

Written by True Tamplin, BSc, CEPF®

Reviewed by subject matter experts.

Updated on February 29, 2024

Are You Retirement Ready?

Table of contents, what is business continuity planning (bcp).

Business Continuity Planning refers to the process of creating and implementing strategies and measures that ensure an organization can continue its essential operations and deliver critical services in the event of a disruptive incident.

BCP aims to minimize the impact of potential threats, such as natural disasters, cyberattacks, or operational failures, on the organization's ability to function.

The primary objective of BCP is to establish resilient systems and procedures that allow businesses to recover quickly and efficiently from any significant disruption.

This involves identifying potential risks, assessing their potential impact, and developing strategies to mitigate those risks.

BCP typically includes measures like creating backup systems, implementing data recovery processes, establishing alternate work locations, and developing communication plans.

By developing a robust BCP, organizations can ensure the safety of their employees, maintain customer trust and satisfaction, minimize financial losses, and comply with regulatory requirements.

It is an ongoing process that requires regular review, testing, and updates to adapt to changing circumstances and emerging threats.

Read Taylor's Story

Taylor Kovar, CFP®

CEO & Founder

(936) 899 - 5629

[email protected]

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning.

In the wake of a major flood, a small bakery I advised was on the brink of permanent closure. However, their forward-thinking BCP, which included a comprehensive insurance plan and a digital sales strategy, became their lifeline. Within weeks, they were selling online, keeping their community fed and spirits high. This strategy not only saved their business but doubled their reach. Don't wait for disaster to strike. Let's craft a robust Business Continuity Plan for your business today. Let's ensure your wealth fosters responsibility, not dependency.

Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives.

WHY WE RECOMMEND:

Fee-Only Financial Advisor Show explanation

Certified financial planner™, 3x investopedia top 100 advisor, author of the 5 money personalities & keynote speaker.

IDEAL CLIENTS:

Business Owners, Executives & Medical Professionals

Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation

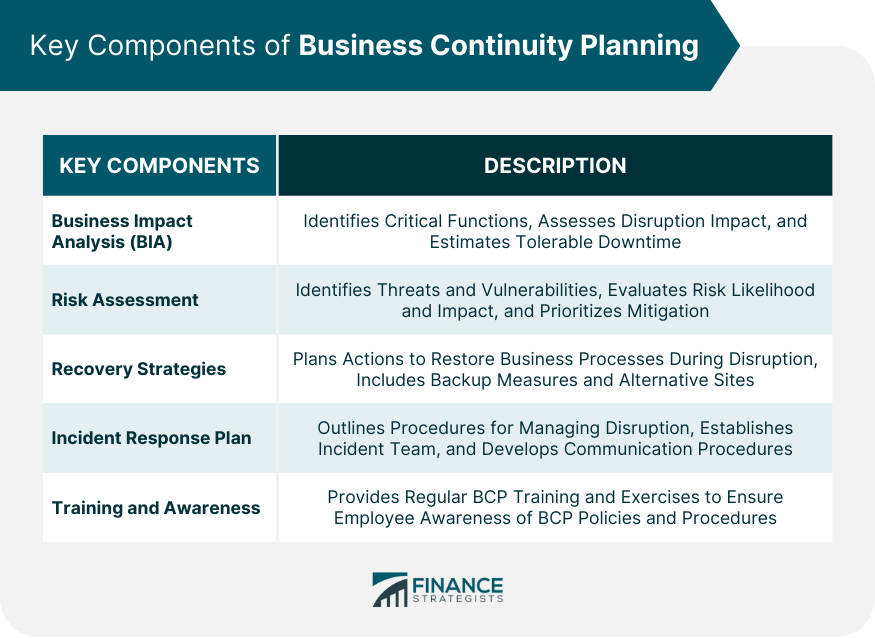

Key Components of Business Continuity Planning

Business impact analysis (bia).

A Business Impact Analysis involves identifying critical business functions and processes, assessing the potential impact of disruptions, and estimating the maximum tolerable downtime for each process.

This helps organizations prioritize their resources and determine appropriate recovery strategies.

The BIA process often includes interviews with key personnel, surveys, and data analysis to gather information about the organization's business processes, dependencies, and potential consequences of disruptions.

This information forms the foundation for developing risk mitigation strategies and allocating resources to protect critical business functions.

Risk Assessment

Risk Assessment is the process of identifying potential threats and vulnerabilities, evaluating the likelihood and impact of risks, and prioritizing them for mitigation and response.

This information is crucial for developing effective recovery strategies and allocating resources efficiently.

A comprehensive risk assessment involves analyzing potential risks from various sources, such as natural disasters, human-made incidents, and technological failures.

By understanding these risks' likelihood and potential impact, organizations can make informed decisions about where to invest in prevention, response, and recovery measures.

Recovery Strategies

Recovery strategies are the plans and actions taken to restore business processes during a disruption. This includes developing strategies for business process recovery, implementing backup and redundancy measures, and establishing alternative operational sites if necessary.

Organizations can choose from various recovery strategies, such as redundancy, backup systems, alternative locations, and remote work arrangements.

The choice of recovery strategies depends on factors such as the organization's size, industry, regulatory requirements, and available resources.

Incident Response Plan

An Incident Response Plan outlines the procedures and responsibilities for managing a disruption. This includes establishing an incident management team, defining roles and responsibilities, and developing communication and notification procedures.

The Incident Response Plan should be detailed, outlining clear steps for responding to various types of incidents.

It is essential to include procedures for coordinating with external stakeholders, such as first responders, suppliers, and customers, and internal communication processes to keep employees informed and engaged during a disruption.

Training and Awareness

Regular BCP training and exercises are essential to ensure employees know BCP policies and procedures. This helps to incorporate BCP into the organization's culture, making it more resilient and adaptable in the face of disruptions.

Training and awareness programs may include workshops, simulations, and e-learning courses that cover topics such as emergency procedures, communication protocols, and the roles and responsibilities of employees during an incident.

By fostering a culture of preparedness, organizations can improve their ability to respond effectively to disruptions and maintain business continuity.

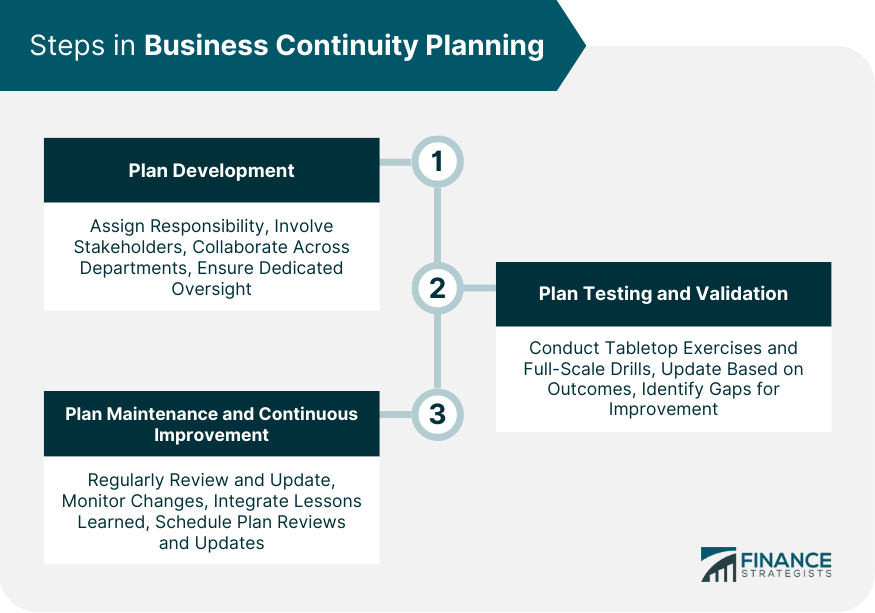

Steps in Business Continuity Planning

Plan development.

Conducting BCP involves assigning responsibility for plan development and management, establishing a project timeline and milestones, and involving key stakeholders in the planning process.

A successful BCP development process requires collaboration across departments and functions, ensuring that all perspectives and concerns are considered.

Additionally, assigning a dedicated team or individual to oversee BCP development and implementation can help ensure that the plan remains on track and meets the organization's needs.

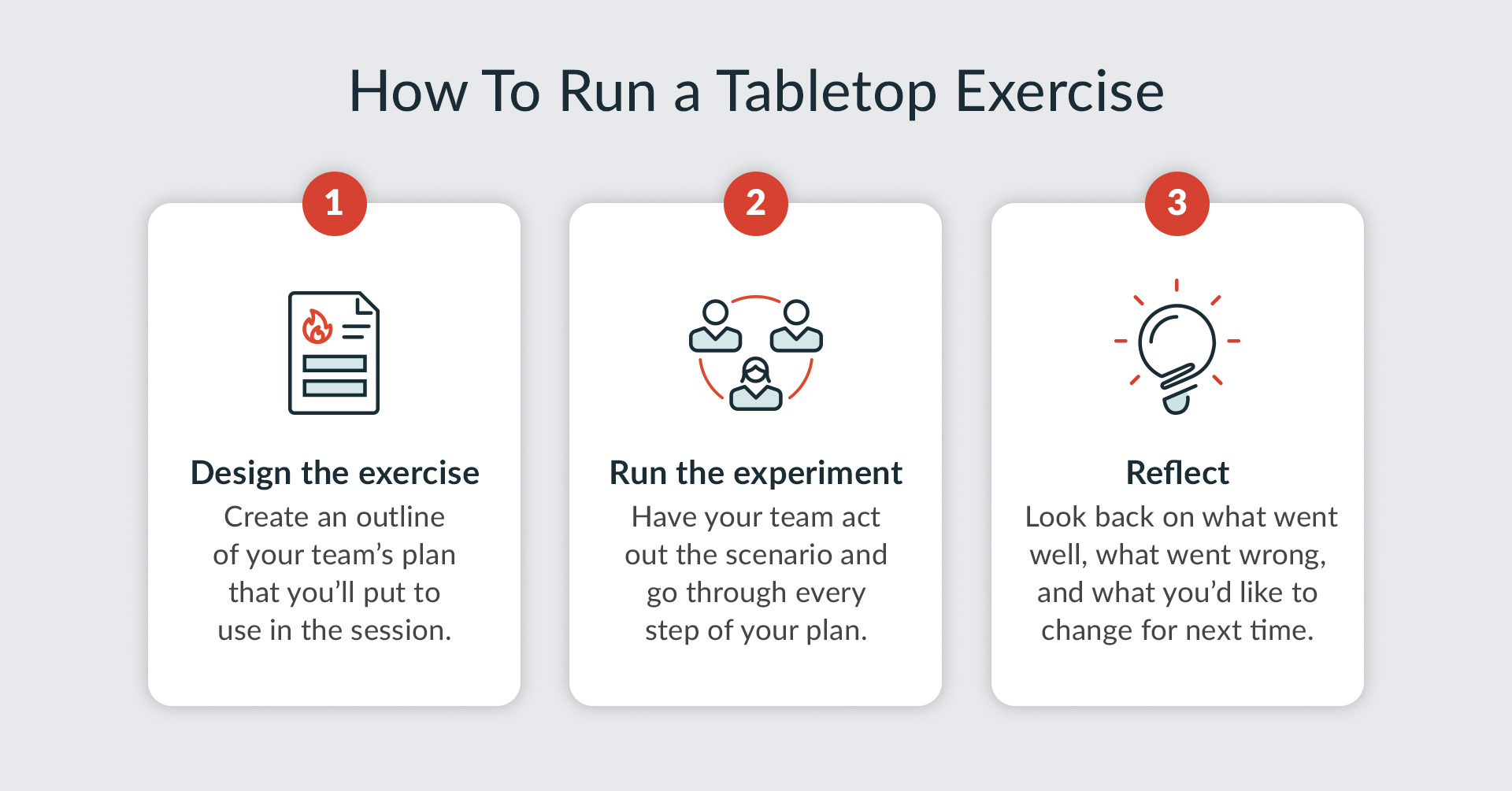

Plan Testing and Validation

This can be done through tabletop exercises and full-scale drills helps to evaluate its effectiveness and identify areas for improvement. Updating the plan based on test outcomes ensures that it remains relevant and functional.

Tabletop exercises are discussion-based simulations that allow participants to walk through various scenarios and evaluate the effectiveness of the BCP.

On the other hand, full-scale drills are live simulations that test the organization's ability to execute the BCP under realistic conditions. Both types of exercises provide valuable insights and help identify gaps or areas for improvement in the plan.

Plan Maintenance and Continuous Improvement

Regularly reviewing and updating the BCP, monitoring changes in the business environment, and integrating lessons learned from tests and real-world incidents contribute to continuous improvement and ensure that the plan remains effective.

To maintain an effective BCP, organizations should establish a schedule for regular plan reviews and updates, considering changes in business operations, technology, and regulatory requirements.

Additionally, after-action reviews following tests and real-world incidents can provide valuable insights for improving the plan and strengthening the organization's resilience.

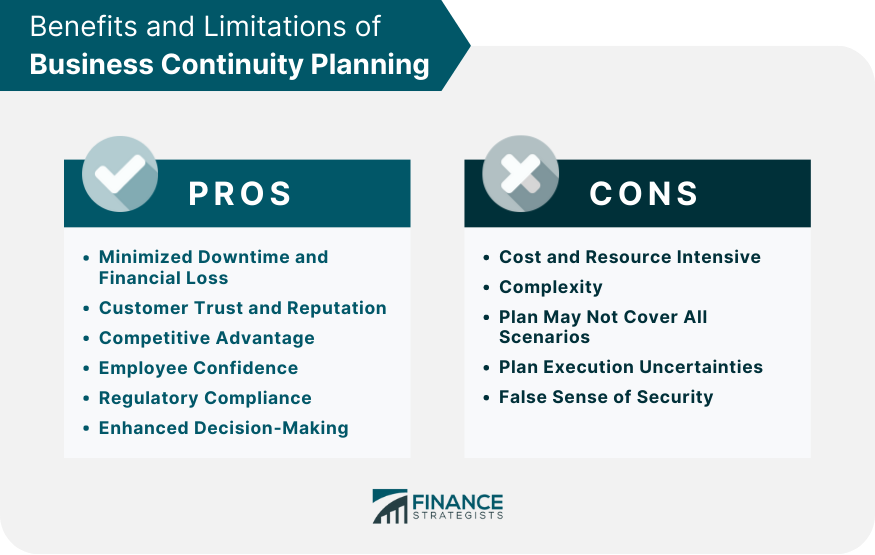

Benefits of Business Continuity Planning

Minimized downtime and financial loss.

For businesses, downtime can have severe financial implications - from loss of revenue to additional costs related to recovery and rebuilding.

A well-conceived BCP outlines the strategies and measures necessary to keep critical functions running or to quickly resume them after a disruptive event.

It helps organizations maintain their cash flow, protect financial stability, and avoid the potential loss of market share to competitors .

Customer Trust and Reputation

Customers expect reliable and uninterrupted services and even a minor disruption can lead to dissatisfaction, damaging the company's reputation.

A robust BCP allows a company to maintain or quickly resume its services during a crisis, which is essential for customer retention and long-term loyalty.

This continued service reliability fosters trust among clients and maintains the company's reputation, which can be a critical differentiating factor in the marketplace.

Competitive Advantage

When disruptions occur, organizations with a comprehensive BCP in place can maintain operations and continue providing services, while competitors may struggle.

This readiness positions a company as reliable and resilient, which can attract new customers and strengthen relationships with existing ones.

Employee Confidence

An effective BCP demonstrates to employees that their organization is well-prepared for potential disruptions. This transparency can reduce panic and confusion, thereby increasing employee confidence and productivity in stressful situations.

It also signals the company's commitment to employee welfare and job security, which can contribute to increased job satisfaction and retention.

Regulatory Compliance

In many industries, such as finance, healthcare, and energy, regulatory bodies mandate business continuity planning to protect consumers and maintain industry stability.

A comprehensive BCP ensures that organizations meet these regulatory requirements, preventing potential penalties, sanctions, or legal actions.

It also demonstrates the organization's commitment to best practices, which can foster trust among clients and stakeholders .

Enhanced Decision-Making

A well-structured BCP includes clear protocols and procedures for various disruptive scenarios, reducing ambiguity and confusion.

This clarity allows the management team to quickly understand the situation, make informed decisions, and take appropriate actions without delay.

By enhancing response time and efficiency, a BCP minimizes the negative impacts of a crisis and hastens recovery.

Limitations of Business Continuity Planning

Cost and resource intensive.

Conducting thorough risk assessments and business impact analyses, creating the plan, ensuring its alignment with the organization's goals, and training employees can all be resource-intensive activities.

Regular testing, maintenance, and updating of the plan can also incur substantial costs over time. For small to medium enterprises (SMEs) with limited resources, these expenses can be significant and may impede the implementation of a comprehensive BCP.

This complexity stems from the need to deeply understand various business processes, operational dependencies, and potential risks. Ensuring that every department, function, or operation is adequately represented in the BCP can be challenging.

It also necessitates collaboration and coordination across different teams and levels of the organization, adding to the overall complexity.

Plan May Not Cover All Scenarios

While a well-constructed BCP is developed based on an extensive risk assessment, it's virtually impossible to predict and plan for all potential disruptions.

Organizations are susceptible to unforeseen disruptions due to the uncertain and ever-changing nature of risks. This is particularly evident in our interconnected world, where new threats can arise that were not originally considered during the planning stage.

Plan Execution Uncertainties

Even with a robust BCP in place, uncertainties during its execution in a real-world crisis can pose challenges.

Despite training and preparation, human error, stress-induced mistakes, miscommunication, or unforeseen complications can impede the successful execution of the plan.

These uncertainties underline the need for regular testing and revision of the plan and its procedures.

False Sense of Security

This is a potential psychological drawback of having a BCP. There's a risk that the existence of the plan could lead to complacency, with individuals assuming they are entirely protected from disruptions.

This mindset can reduce alertness to new threats and hamper the organization's agility and responsiveness.

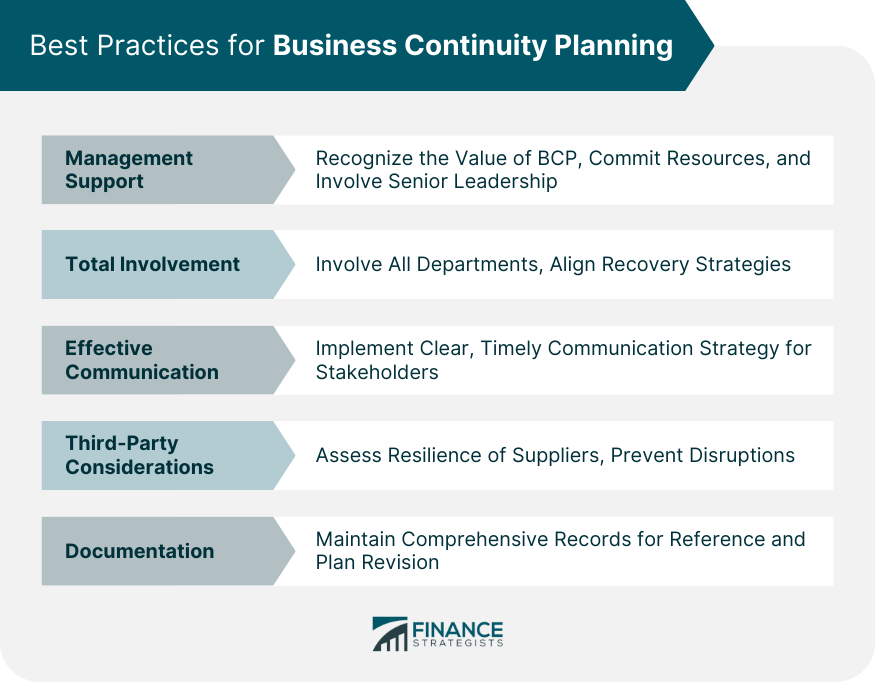

Best Practices for Business Continuity Planning

Management support.

Management must recognize the value of BCP and commit to its implementation, ensuring that the necessary resources, both human and financial, are dedicated to the planning process.

Moreover, the involvement of the senior leadership team demonstrates the importance of the plan to the entire organization, reinforcing commitment across all levels.

Total Involvement

BCP should encompass all departments and functions within the organization. Representatives from every department, including operations, HR, finance, and IT, should be involved in the planning process.

This comprehensive approach ensures that the plan covers all critical functions and that recovery strategies are aligned across the entire business.

Effective Communication

A comprehensive communication strategy should be in place, detailing how and when information will be communicated to employees, customers, suppliers, stakeholders, and potentially the media.

Clear, timely, and accurate communication can help to minimize confusion and misinformation and maintain trust during a disruption.

Third-Party Considerations

The continuity planning of your suppliers, service providers, and partners can have a significant impact on your organization. Therefore, part of your BCP should involve understanding and evaluating the resilience of key third parties.

This will help to ensure that their potential weaknesses or failures do not disrupt your operations.

Documentation

This includes records of risk assessments and BIAs, continuity strategies, training materials, and records of updates and changes to the plan. Comprehensive documentation serves as a valuable reference guide during a crisis and aids in the training, testing, and revision of the plan.

Final Thoughts

Business Continuity Planning is a critical process that organizations must undertake to ensure the continuity of their operations and the delivery of vital services during disruptive incidents.

By implementing strategies and measures to minimize potential threats, organizations can recover quickly and efficiently from significant disruptions.

BCP encompasses components such as business impact analysis, risk assessment, recovery strategies, incident response planning, and training programs.

It offers numerous benefits, including minimizing downtime and financial losses, maintaining customer trust and reputation, gaining a competitive advantage, boosting employee confidence, ensuring regulatory compliance, and enhancing decision-making.

Despite potential drawbacks such as costs and complexities, organizations can overcome them through management support, total involvement from all departments, effective communication strategies, considerations for third-party resilience, and comprehensive documentation.

By prioritizing BCP and incorporating it into their organizational culture, businesses can effectively respond to crises, protect their reputation, and thrive in a dynamic business environment.

Business Continuity Planning (BCP) FAQs

What is business continuity planning (bcp).

Business Continuity Planning is an organization's proactive process to identify potential threats and impacts to its operations. It provides a framework for building resilience and the capacity for an effective response that safeguards the interests of key stakeholders, reputation, brand, and value-creating activities.

Why is Business Continuity Planning (BCP) important?

BCP is crucial because it enhances an organization's ability to continue operations during or after a disruption or disaster. It minimizes downtime, reduces the scope of disruption, and provides a planned recovery path, thus protecting the organization from significant financial loss and reputational damage.

What are the key components of Business Continuity Planning (BCP)?

Key components of BCP include Business Impact Analysis (identifying critical functions and their dependencies), Recovery Strategies (defining how to recover critical functions), Plan Development (writing the plan), and Testing and Exercises (evaluating the plan's effectiveness and making necessary adjustments).

How often should a Business Continuity Plan (BCP) be updated?

A BCP should be reviewed and updated regularly to ensure its effectiveness. The frequency can depend on the organization's operations, technology, personnel, or physical location changes. However, as a best practice, reviewing and updating the BCP at least annually or whenever significant changes occur is recommended.

Who is responsible for Business Continuity Planning (BCP) in an organization?

While the responsibility can vary depending on the size and structure of the organization, typically, a designated Business Continuity Manager or a team is responsible for BCP. However, it's important to note that successful business continuity planning requires support and involvement from top management and participation across all levels of the organization.

About the Author

True Tamplin, BSc, CEPF®

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide , a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University , where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon , Nasdaq and Forbes .

Related Topics

- Business Exit Strategies

- Business-to-Business (B2B)

- Business-to-Consumer (B2C)

- Capital Planning

- Change-In-Control Agreements

- Corporate Giving Programs

- Corporate Philanthropy

- Cross-Purchase Agreements

- Crowdfunding Platforms

- Employee Retention and Compensation Planning

- Employee Volunteer Programs (EVPs)

- Endorsement & Sponsorship Management

- Enterprise Resource Planning (ERP)

- Entity-Purchase Agreements

- Equity Crowdfunding

- Family Business Continuity

- Family Business Governance

- Family Business Transition Planning

- Family Limited Partnerships (FLPs) and Buy-Sell Agreements

- Human Resource Planning (HRP)

- Jumpstart Our Business Startups (JOBS) Act

- Request for Information (RFI)

- Request for Proposal (RFP)

- Revenue Sharing

- SEC Regulation D

- Sale of Business Contract

- Security Token Offerings (STOs)

- Shareholder Engagement and Proxy Voting

- Social Engagements

Ask a Financial Professional Any Question

Meet top certified financial advisors near you, our recommended advisors.

Claudia Valladares

Bilingual in english / spanish, founder of wisedollarmom.com, quoted in gobanking rates, yahoo finance & forbes.

Retirees, Immigrants & Sudden Wealth / Inheritance

Retirement Planning, Personal finance, Goals-based Planning & Community Impact

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.

Fact Checked

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content.

Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

They regularly contribute to top tier financial publications, such as The Wall Street Journal, U.S. News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, Marketwatch, Investopedia, TheStreet.com, Motley Fool, CNBC, and many others.

This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

Why You Can Trust Finance Strategists

Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year.

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs.

How It Works

Step 1 of 3, ask any financial question.

Ask a question about your financial situation providing as much detail as possible. Your information is kept secure and not shared unless you specify.

Step 2 of 3

Our team will connect you with a vetted, trusted professional.

Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise.

Step 3 of 3

Get your questions answered and book a free call if necessary.

A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand your situation.

Where Should We Send Your Answer?