- Innovative Prompts

- Strategies Packs

- Skills Packs

- SOPs Toolkits

- Business Ideas

- Super Guides

- Innovation Report

- Canvas Examples

- Presentations

- Spreadsheets

- Discounted Bundles

- Search for:

No products in the cart.

Return to shop

Microsoft Business Model

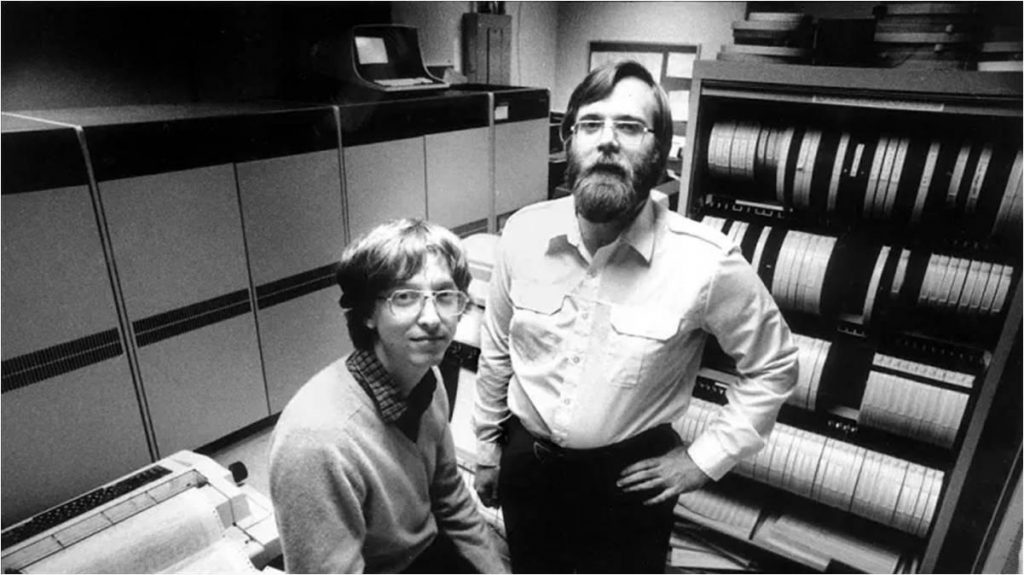

Microsoft is one of the most famous and successful tech companies worldwide — just as well-known as its founder Bill Gates. However, since its foundation, more than 45 years ago, the Microsoft business model has changed over the years. Let’s understand how the business has grown for the third-largest company in the United States.

A brief history of Microsoft

Microsoft was created in 1975, by Bill Gates and his friend Paul Allen. The computer was nothing like what we know today, and the internet was a strange network limited basically to academic institutions. But Gates and Allen decided to produce something like an operating system for the Altair 8800, the first “personal computer” . Some years later, MS-DOS would become the regular operating system for computers. But the turning point would come when Windows was launched in the market, with its innovative interface.

In 1986, Microsoft got into the stock market, thus making money to build its empire of PC operating systems. Nowadays, besides those, the Microsoft line includes Microsoft Office, Azure (cloud and AI), Xbox Games, LinkedIn, GitHub, productivity applications, management tools, browsers, and more. Bill Gates still owns some shares in Microsoft, but he sold or gave away most of them. He also dropped out of the board in 2020, in order to have more time for philanthropy projects.

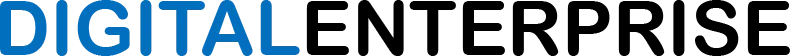

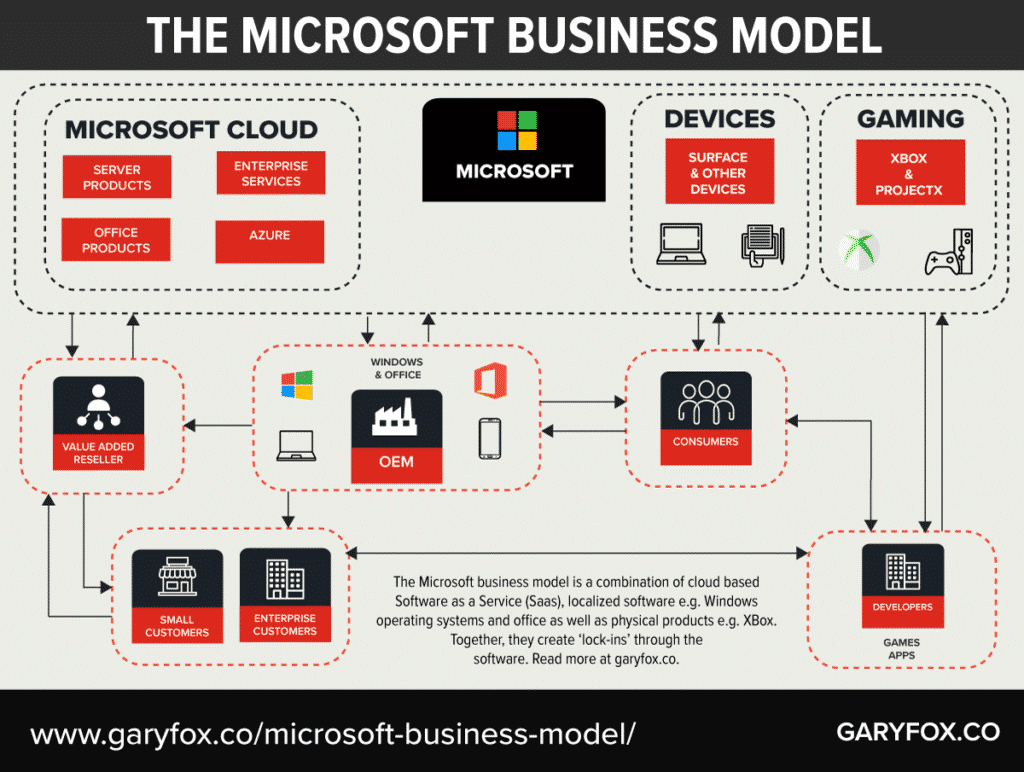

What is the Microsoft Business Model?

Since Microsoft provides systems and software for both entertainment and business, its core operations involve sale, distribution, and support for those solutions. But its business model actually encompasses a few types, in order to sustain all products and services, which include:

- Razor and Blade : Apps, software, and Xbox games work specifically for each operating system, and they don’t run in different ones;

- Lock-in : Due to high switching costs, customers keep using Microsoft software and apps;

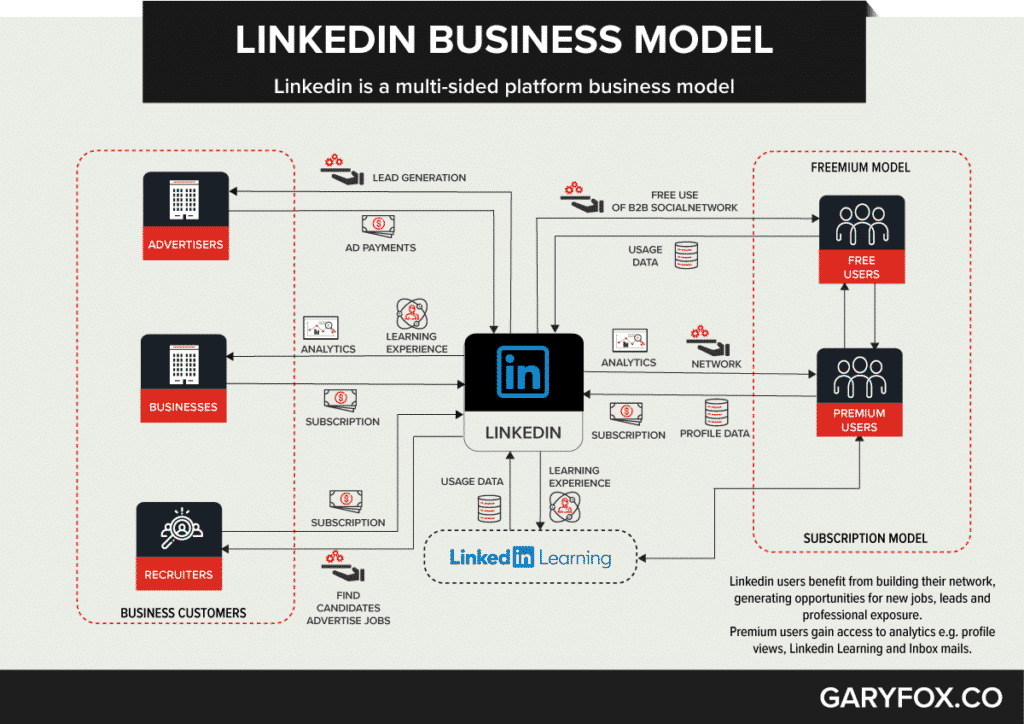

- Freemium : LinkedIn, for example, is a free business social network, but some resources are only available for premium subscribers;

- Subscription : Besides LinkedIn, Microsoft applies this business model to Office 365 and cloud services, to mention a few;

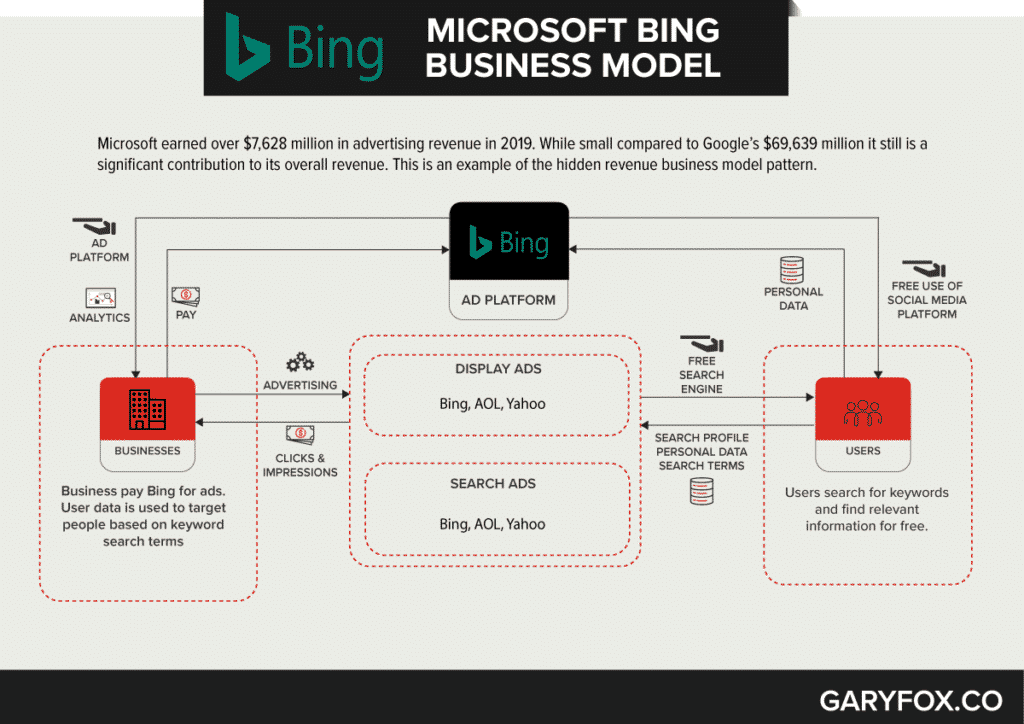

- Hidden Revenue : For instance, both LinkedIn and Bing (Microsoft search engine) show the users ads on their platforms;

- Ingredient Branding : Despite being just built into computers, Microsoft brands are flagrantly shown in the products.

Who Owns Microsoft

Microsoft is still owned today by Bill Gates . While Satya Nadella is the current Chairman and CEO and Brad Smith is the current President (plus, Vice-Chairman), Gates holds the position as the company’s Technical Adviser.

Microsoft’s Mission Statement

Microsoft’s mission statement is “ To empower every person and every organization on the planet to achieve more “.

How Microsoft makes money

Microsoft makes money through three core business segments:

Productivity and business processes

The segment consists of products and services developed for productivity and information, and represents about one-third of Microsoft’s revenue. Its flagship is the Microsoft Office software suite. Besides, there are LinkedIn, the professional social network, and Dynamics, the cloud-based solutions for business apps, such as ERP or CRM.

- Intelligent Cloud

The other third of Microsoft’s revenue is made up of its public, private, and hybrid cloud services, such as Microsoft SQL Server, Windows Server, and Azure. Besides, there are enterprise services, like Microsoft Consulting, to help customers plan and implement Microsoft products.

- Personal Computing

The final third comprises the products and services created to improve users’ experience. The main example is, of course, Windows, with the licenses in devices. Other solutions include Xbox games and consoles, advertising in Bing (the search engine), and sales of devices and PCs.

Risks in Microsoft business model

- Competition : Microsoft faces some strong competitors, with a great variety of business models. Some of them provide users with free apps and/or content and make money from advertising. Others distribute open-source software at little or no cost, and these products are very similar to Microsoft’s;

- Cloud computing: Microsoft has to afford high costs in building and maintaining the whole infrastructure to support its cloud computing services, and seeks a sufficient market share in order to achieve a profitable scale. All of that against brands like Amazon and Google .

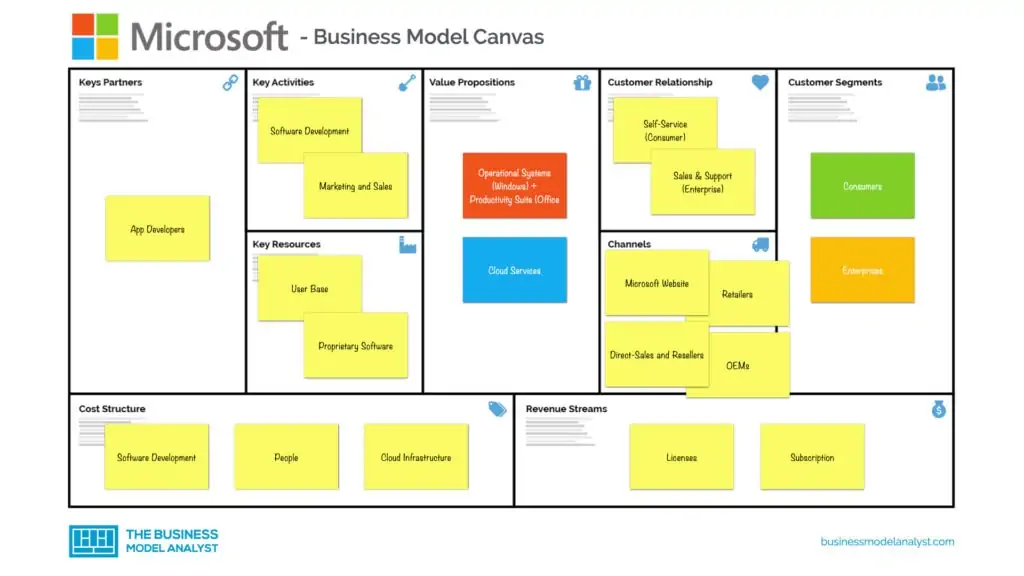

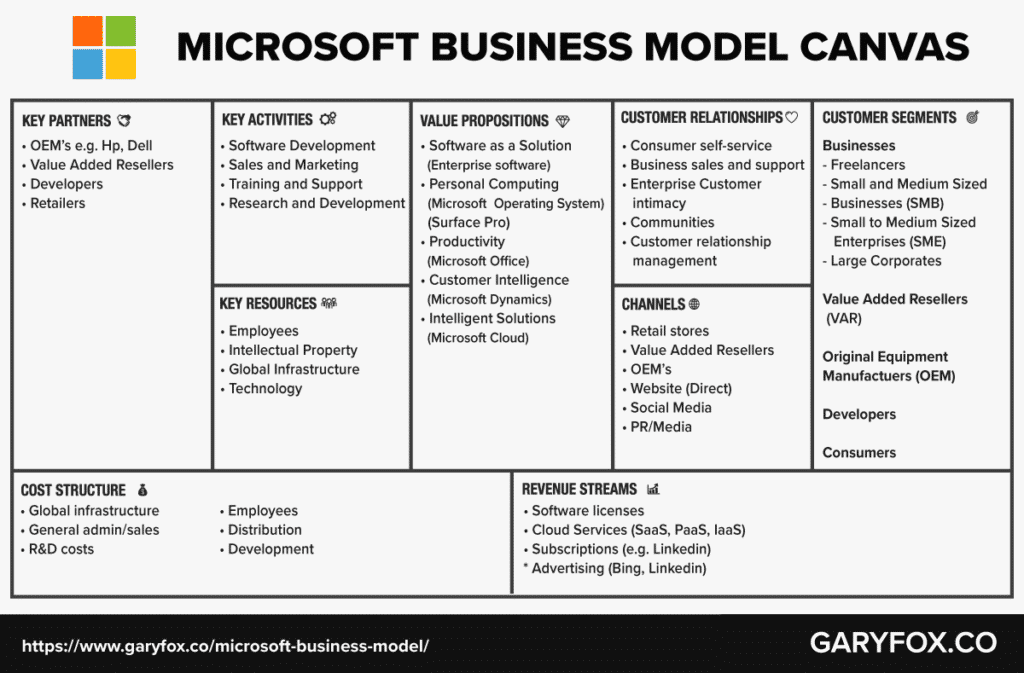

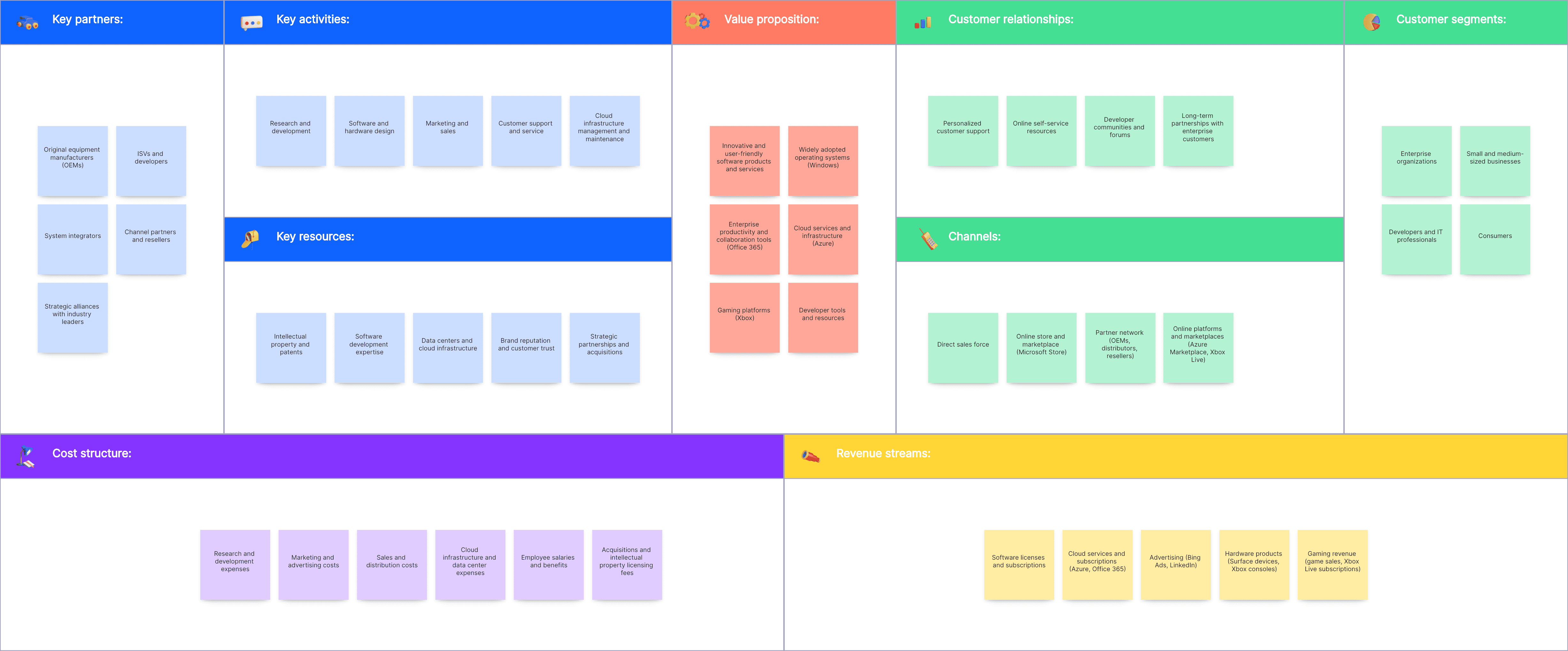

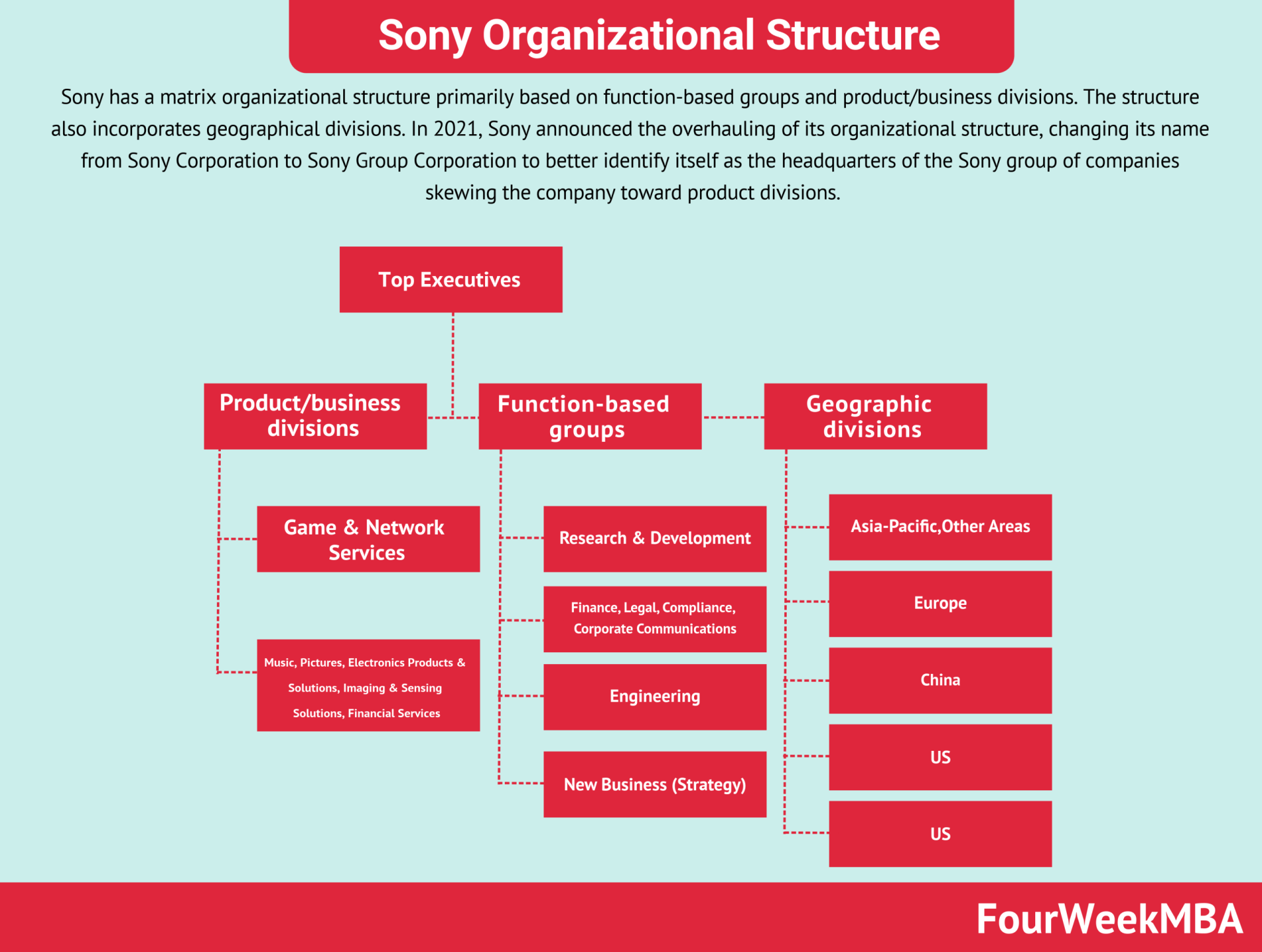

Microsoft’s Business Model Canvas

Let’s take a look at the Microsoft Business Model Canvas below:

Download FREE!

To download Microsoft Business Model Canvas today just enter your email address!

Microsoft’s Customer Segments

Microsoft’s customer segments consist of:

- Commercial and corporate clients : Server management, IT support, and consulting services, for example, besides the regular tools and solutions, such as cloud computing, Office, and Skype;

- General customers : All the common solutions (Office, Outlook, Skype, cloud, etc.) and mobile phone and video game platforms;

- Advertising agencies and big brands : Ads at MSN portal and Bing search engine.

- Server developers: a suite of development tools.

Microsoft’s Value Propositions

Microsoft’s value propositions consist of:

- A reliable market leader that provides software solutions, many of them for free;

- Compatible apps and software on many platforms, from phones to computers;

- A trusted source of expertise for consulting and a large user base for advertisers.

Microsoft’s Channels

Microsoft’s channels consist of:

- Desktop, iOS, and Google Play apps

- Sales and marketing team

Microsoft’s Customer Relationships

Microsoft’s customer relationships consist of:

- Software and hardware products are self-service, so, they don’t need much personal interaction with staff;

- Corporate products and services, consulting, support, and advertising require personal assistance from the Microsoft team and representatives;

- Social networking profiles are used to interact directly with end customers (e.g. Facebook and Twitter).

Microsoft’s Revenue Streams

Microsoft’s revenue streams consist of:

- Productivity and Business Processes

Microsoft’s Key Resources

Microsoft’s key resources consist of:

- Intellectual property

- Proprietary technology

- Data centers

- Human resources

Microsoft’s Key Activities

Microsoft’s key activities consist of:

- Developing, licensing, and supporting software products and services;

- Designing and selling hardware products;

- Delivering online advertising solutions;

- Providing IT consulting and support services.

Microsoft’s Key Partners

Microsoft’s key partners consist of:

- Companies that provide app development, data analytics, data management, digital advertising, distribution, internet hosting services, manufacturing, marketing, system integration, telecommunications, etc.;

- Resellers and independent software vendors.

Microsoft’s Cost Structure

Microsoft’s cost structure consists of:

- Research and development

- Maintenance and security of data centers and servers

- Office and general expenses

Microsoft’s Competitors

- Apple: Steve Jobs’ gigantic company competes with Microsoft since the good old days. They not just contend with hardware — such as computers, tablets, and smartphones —, but also with software, or their operating systems: It’s the eternal rivalry between Windows and macOS;

- Google: Alphabet’s major company also competes with Microsoft with hardware — as their Chromebooks contend with Dell, Acer, Lenovo, LG, Sony, and other many computer manufacturers that produce notebooks — and software in the way that Google Chrome has beaten Internet Explorer since day zero. Now, with Microsoft Edge, it’s been a whole new combat;

- IBM: The competition with IBM, a multinational technology corporation, comes from the fact that they both produce and sell computer hardware and software. Although many partnerships have come and gone throughout the years, making IBM an indirect competitor, it is, officially, the very same market that they both walk in;

- Oracle: Oracle Corporation though is a computer technology corporation focused exclusively on software development — which includes cloud-engineered systems, customer relationship management (CRM) software, and more —, which makes it another indirect competitor of Microsoft.

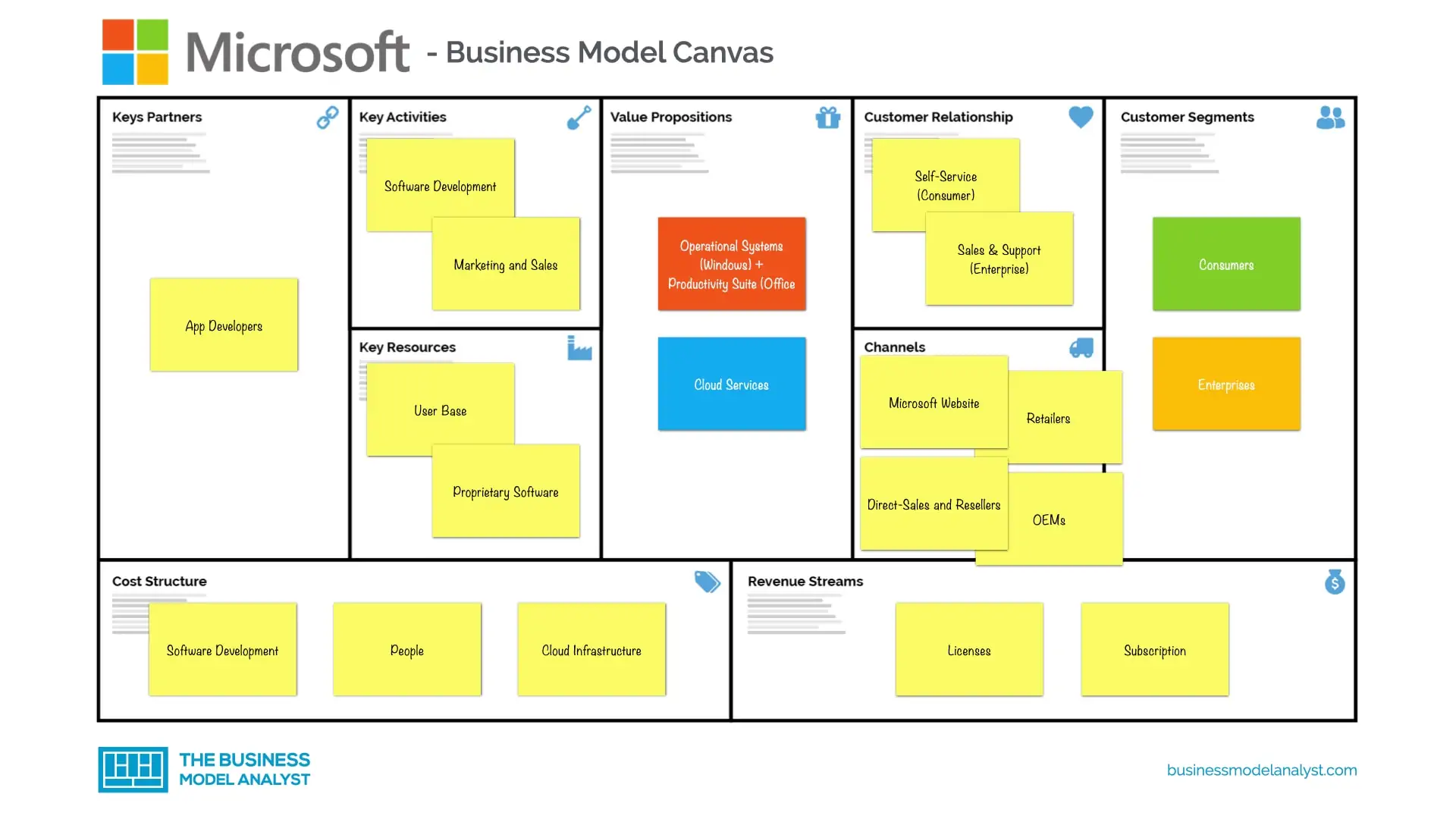

Microsoft’s SWOT Analysis

Below, there is a detailed swot analysis of Microsoft:

Microsoft’s Strengths

- Office 365: Definitely, the most famous productivity software on the market, Microsoft Office’s tools and services are one of Microsoft’s flagships;

- Windows: Another Microsoft flagship, Windows is simply the most used operating system on the planet, with a vast majority of computers using it globally.

Microsoft’s Weaknesses

- Need for a license: Life is not a bed of roses. Microsoft Office’s applications require a license to be used, especially when it comes to companies using them for their employees to collaborate. Plus, it is a relatively high price;

- Non-modifying features: Most features cannot be modified, which forces the user to look for new alternatives for their needs;

- Incompatibility: Often, Microsoft Office’s tools become incompatible with previous versions of software, including not only older Windows’ versions but macOS’ as well.

Microsoft’s Opportunities

- Professional qualification: As big as it is, Microsoft can always offer specialization courses and professional qualifications, based on its own software and applications, to clients anywhere in the world;

- Promotional packages: For both its software applications and operating system, Microsoft can come up with trials and promotional packages, especially for enterprises and large companies.

Microsoft’s Threats

- Competition: It faces strong competition in several areas of technology, with other major companies in the industry, such as Google, Apple, IBM, and Oracle, suffering from competitive pressure;

- Free similar apps: The competition is also with small developers, that often create similar applications to Microsoft Word or OneNote, for example, and offers them for free in stores for platforms such as iOS, Android, macOS, and Windows itself.

-> Read More About Microsoft’s SWOT Analysis .

The next steps of Microsoft can be seen through its acquisition plan. Some of the most important and recent ones have been LinkedIn and GitHub , just to mention some.

Daniel Pereira

Related posts.

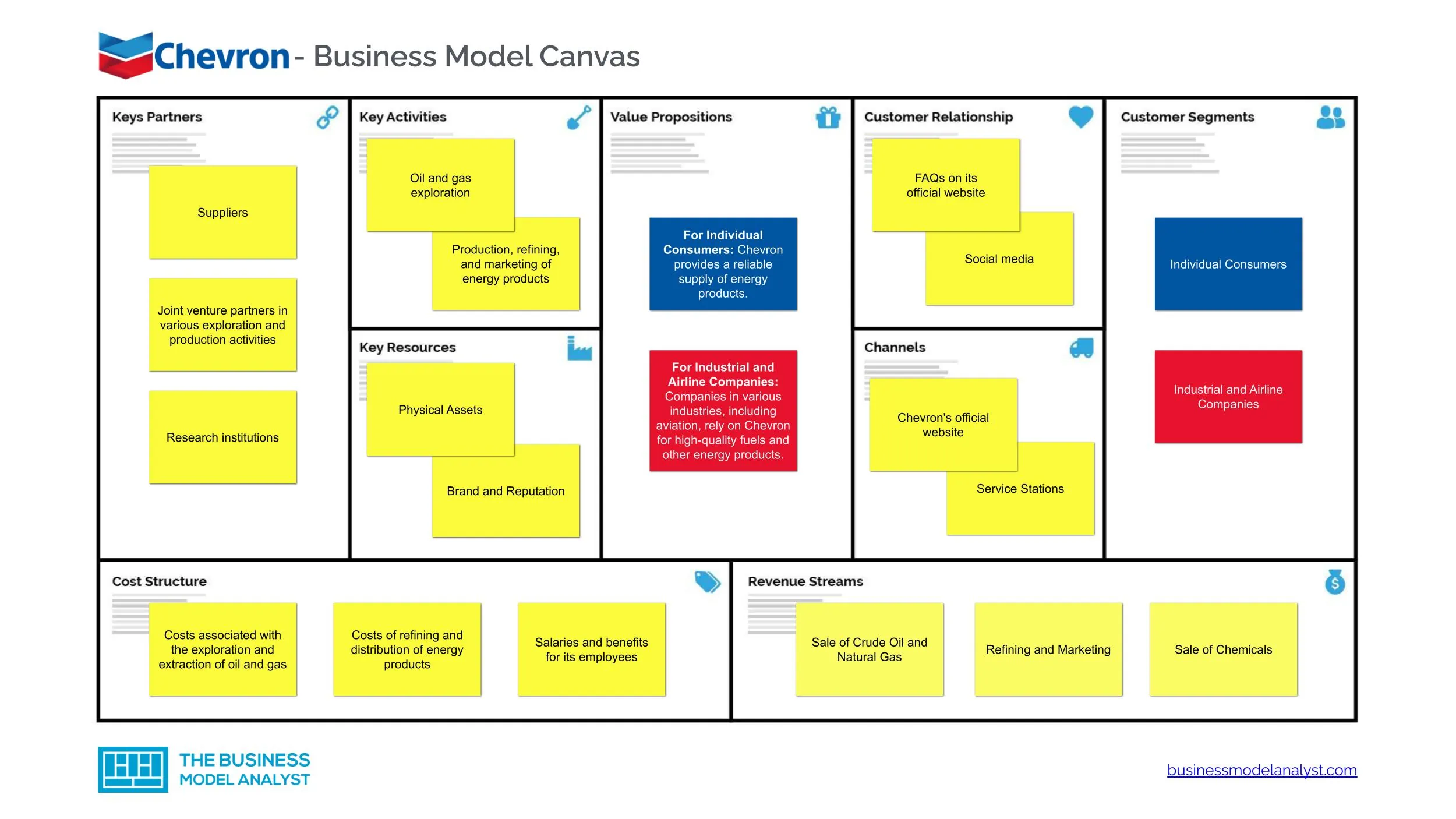

Chevron Business Model

The Chevron business model has become a cornerstone example in the oil and gas industry, [...]

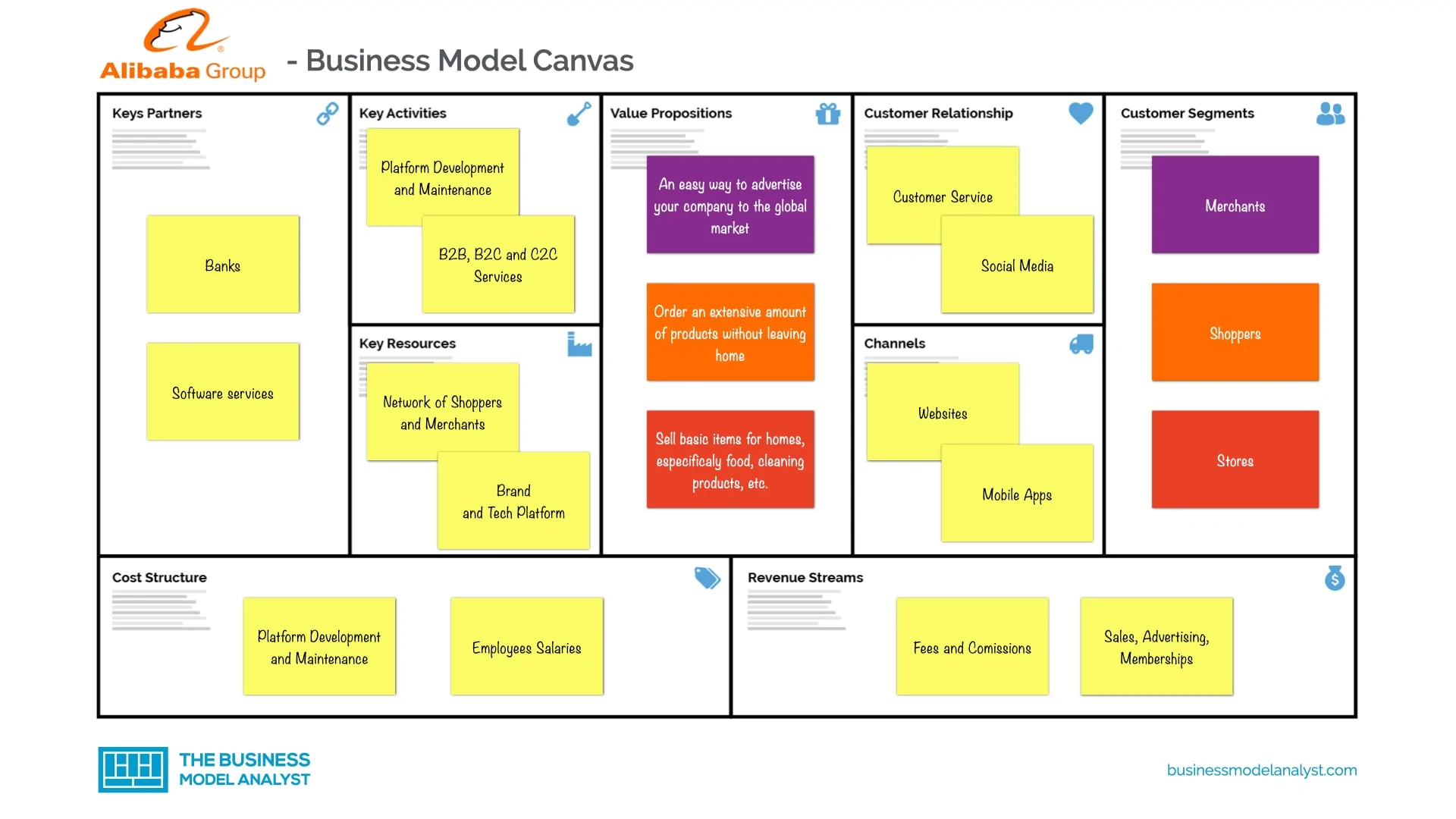

Alibaba Business Model

The idea behind the creation of the Alibaba business model was to rewrite the way [...]

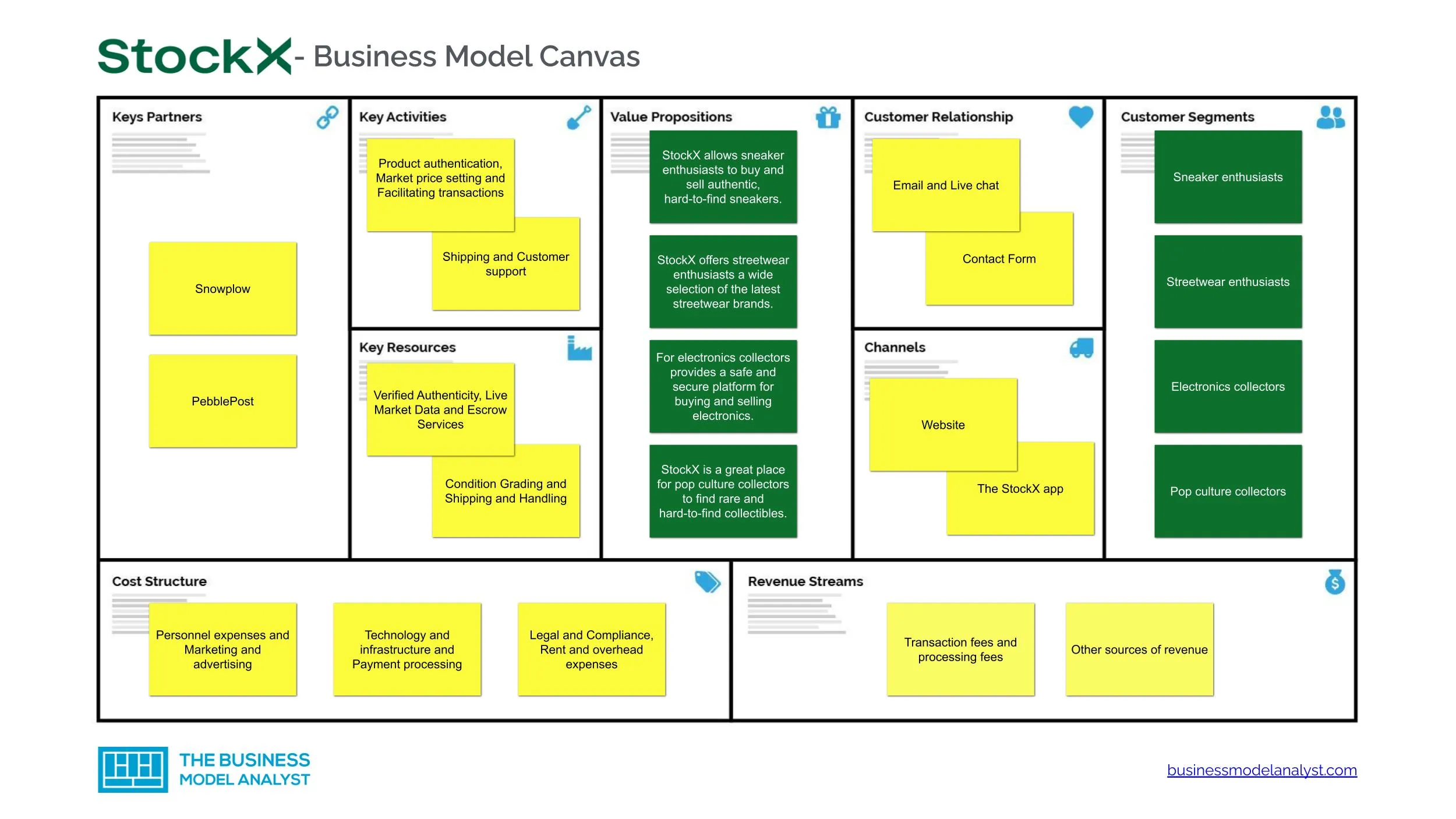

StockX Business Model

The StockX business model is centered around selling and verifying apparel and rare collectibles. The [...]

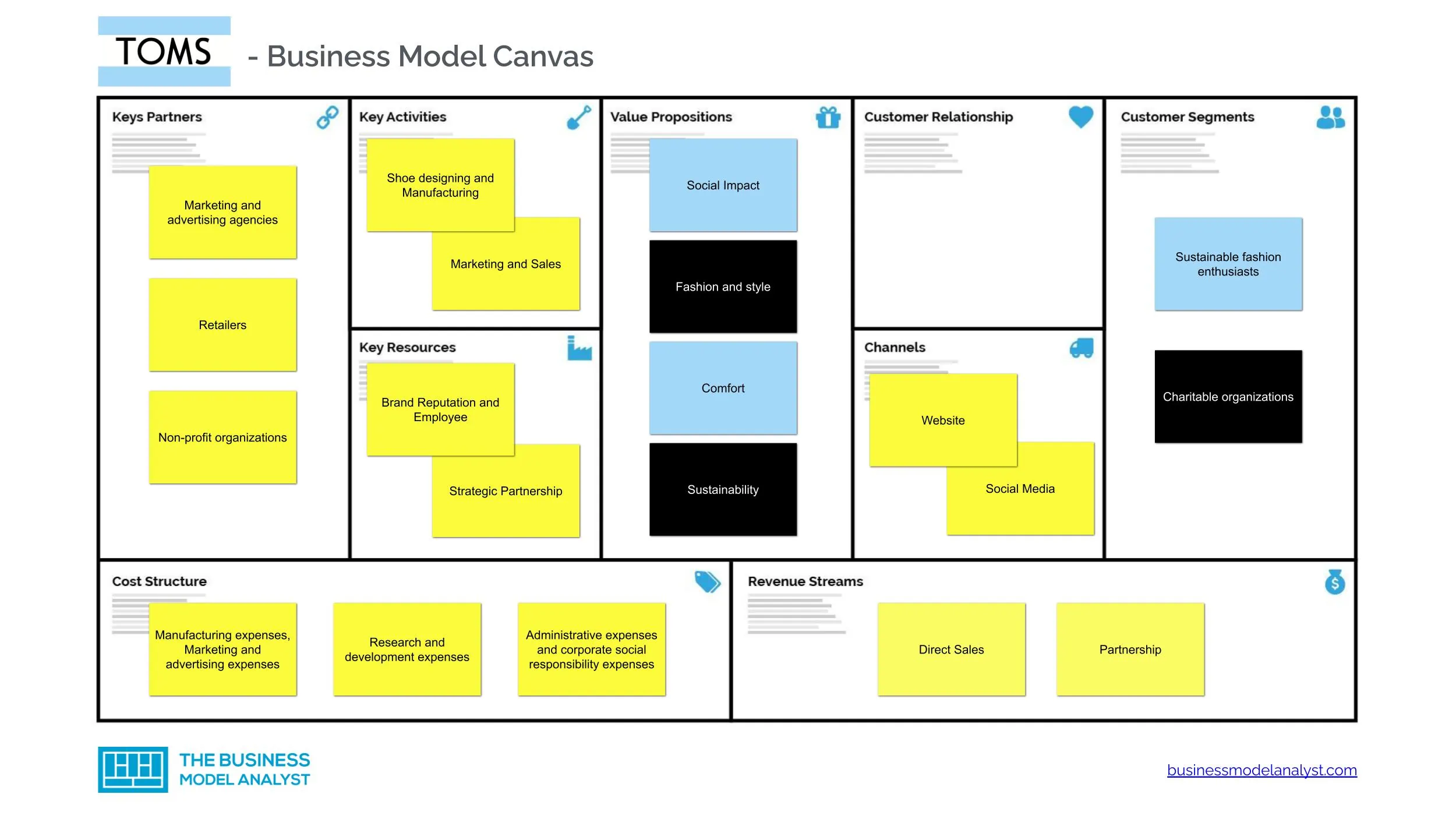

Toms Shoes Business Model

The Toms Shoes Business model is one-for-one. The one-for-one business model means the company donates [...]

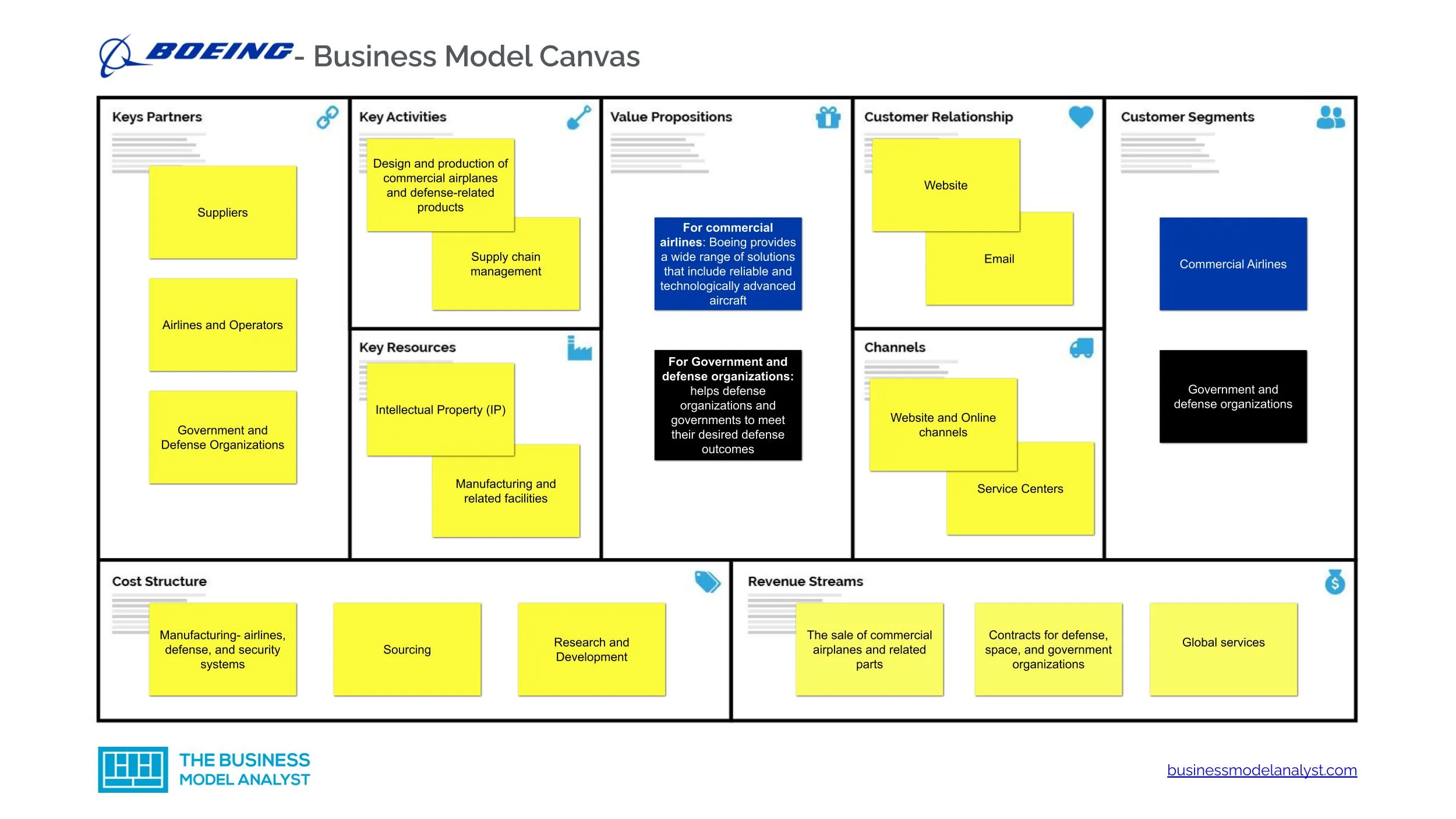

Boeing Business Model

The Boeing Business model is based on designing, manufacturing, and selling airplanes and defense-related products. [...]

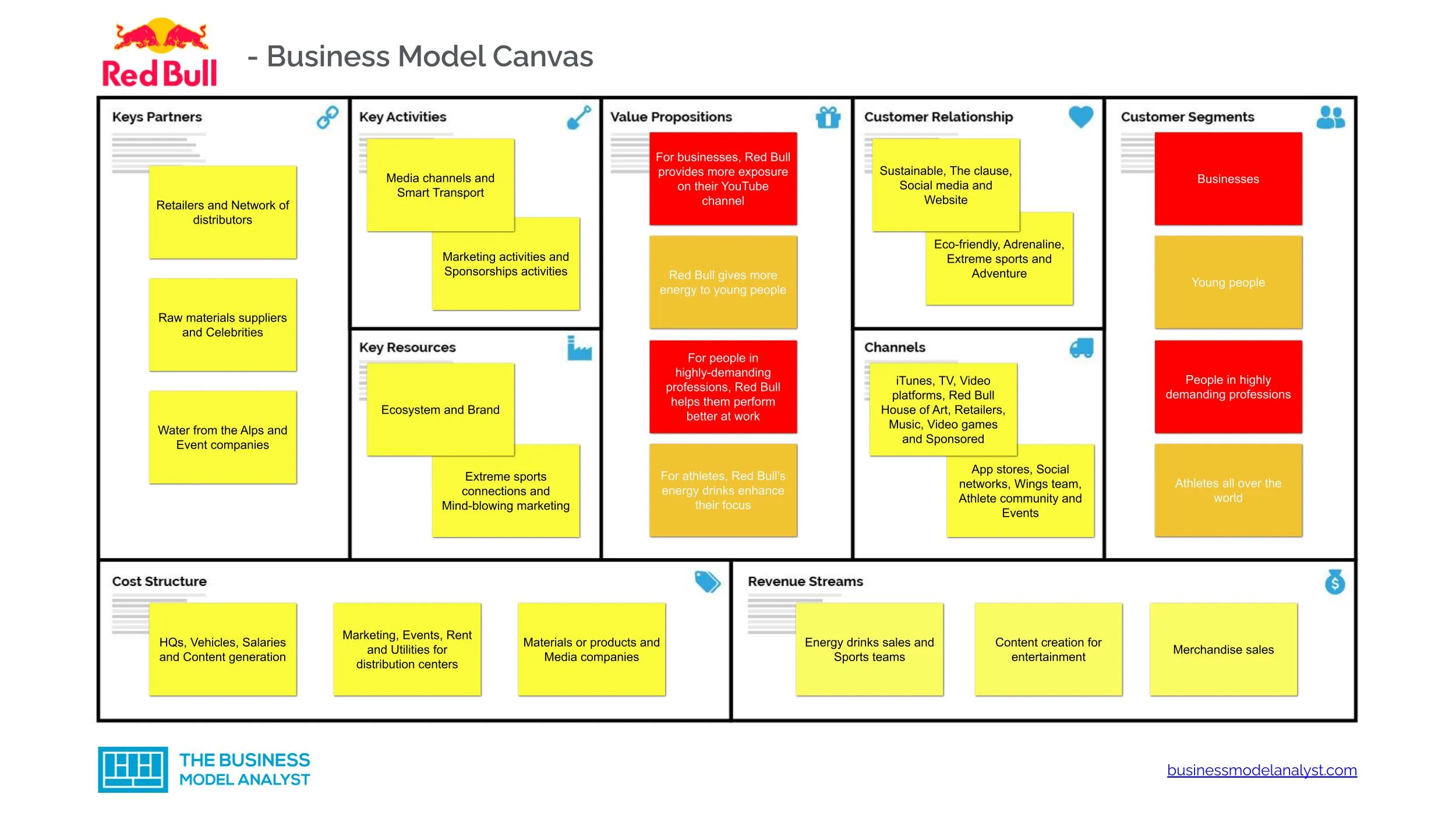

Red Bull Business Model

The Red Bull business model focused on attracting consumers to buy its energy drink using [...]

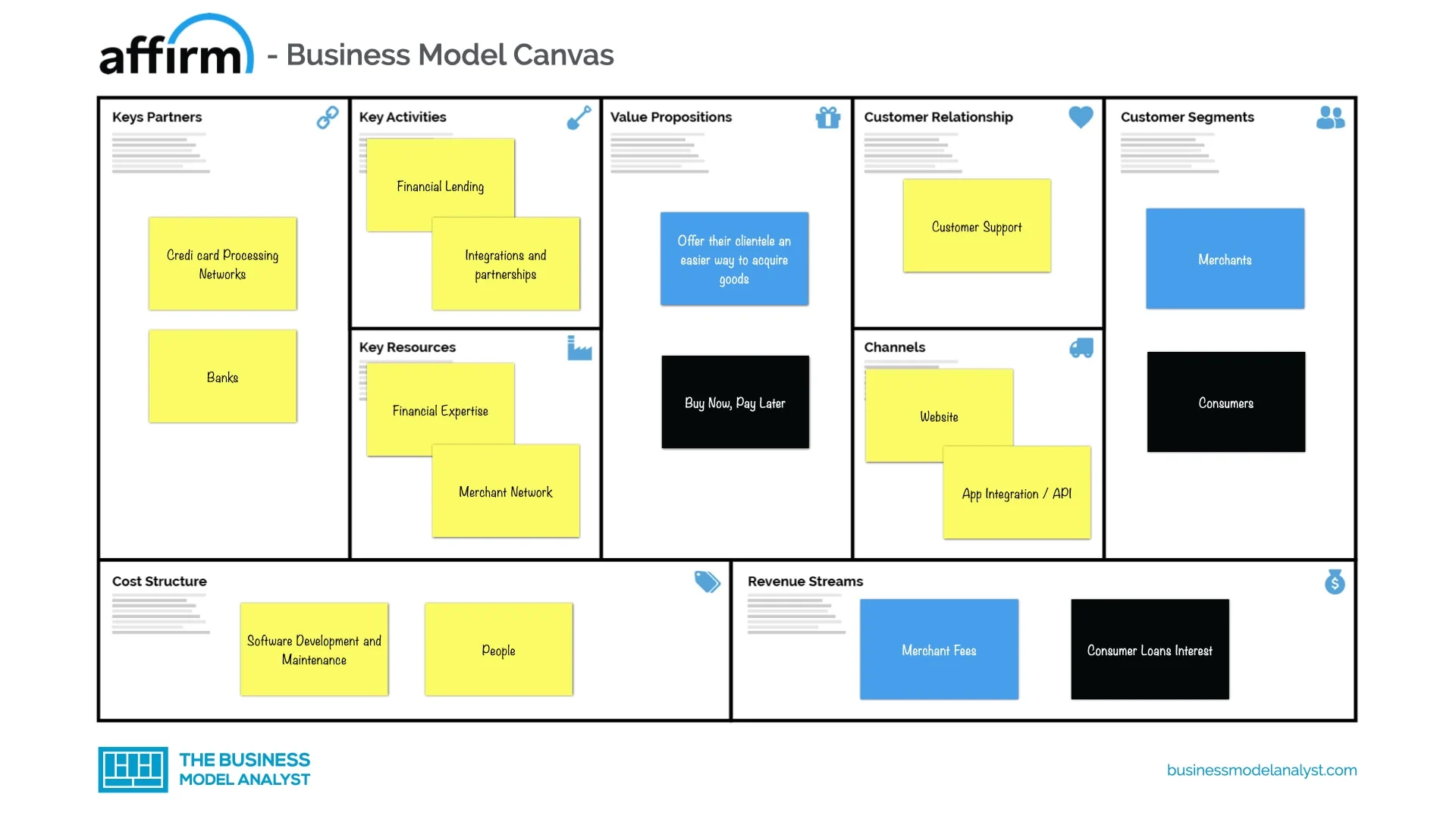

Affirm Business Model

The Affirm business model is the result of its founder’s perception, that in the future, [...]

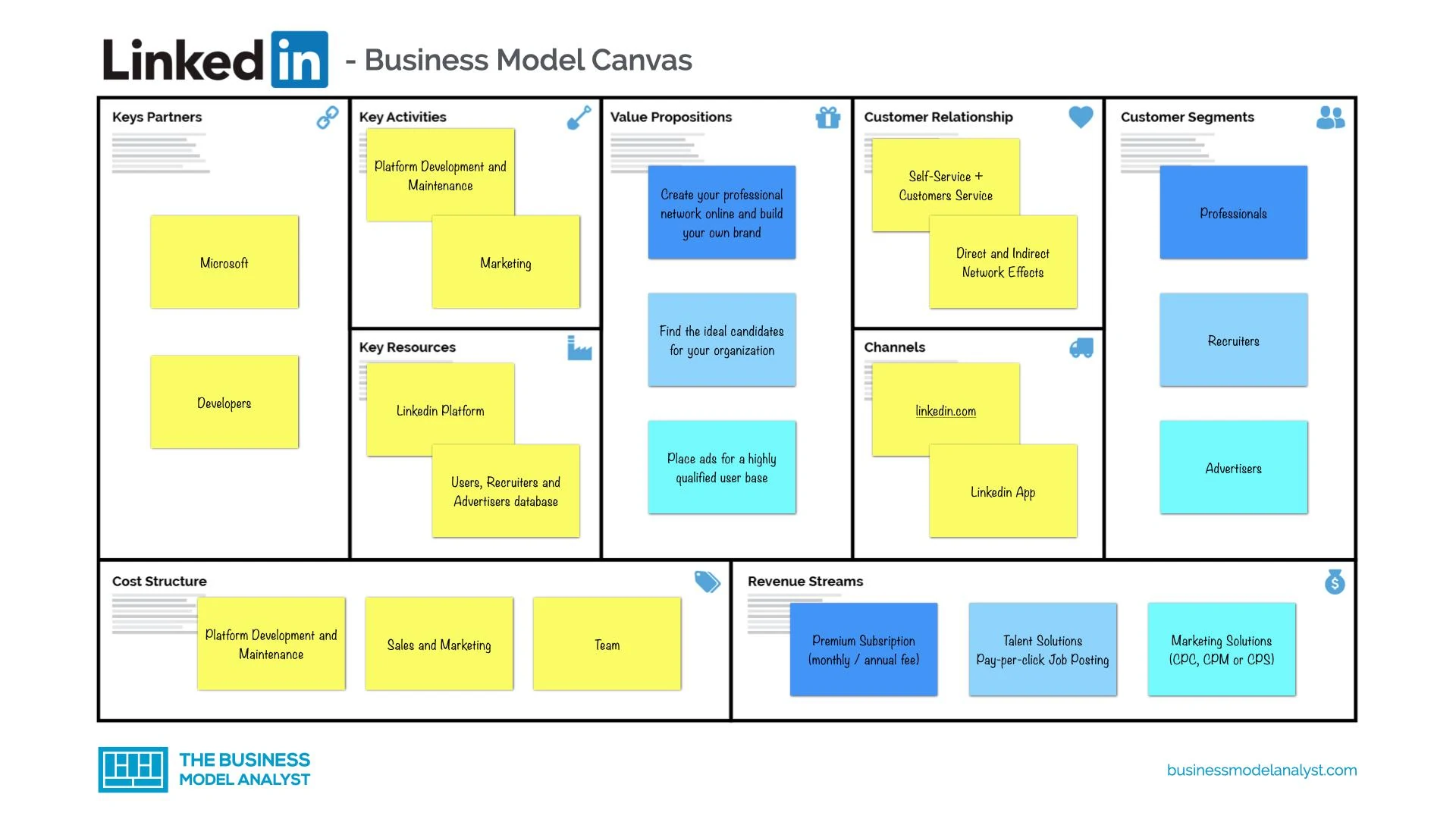

LinkedIn Business Model

The LinkedIn business model is a multisided platform that connects professional users that want to [...]

1 thoughts on “ Microsoft Business Model ”

I appreciate you providing such a thorough critique of the Microsoft Business Model. I sincerely appreciate everything you did.

Leave a Reply

Your email address will not be published. Required fields are marked *

RECEIVE OUR UPDATES

Username or email address *

Password *

Remember me Log in

Lost your password?

Microsoft’s business model: How Microsoft makes money

It’s safe to say that you have heard of Microsoft and used many of its products. Indeed, Microsoft is one of the most successful technology companies worldwide since it was founded 45 years ago by the legendary Bill Gates. It is also the third largest company listed in the U.S. (as of 2 September 2020).

Microsoft’s success intrigues me, so I proceeded to dig up more about the company’s business performance from an investor’s perspective. In this article, I’ll also cover the company’s economic moats, growth drivers, and some of the business risks it faces. Through this, I hope to give you a good overview of Microsoft’s business model and how it generates its revenues.

Business model

Microsoft is a technology company that provides software products and services to its consumers. It reports three business segments:

1. Productivity and Business Processes

This segment comprised 33% of Microsoft’s revenue in 2019. It consists of products and services in Microsoft’s portfolio of productivity and information services which include:

- Office Commercial/Consumer — Revenue is derived from users subscribing to Microsoft’s Office software suite. Services in this segment are intended to enhance personal and organisational productivities. This segment is a key driver of revenue in this business segment of Microsoft.

- LinkedIn — The professional social network makes money by offering three categories of monetised solutions : Talent solutions, marketing solutions, and premium subscriptions.

- Dynamics — This business provides cloud-based and on-premises business solutions for business applications like enterprise resource planning (ERP) and customer relationship management (CRM). Dynamics revenue is driven by the number of users licensed, expansion of average revenue per user. and the shift to Dynamics 365 — the cloud component of Dynamics.

2. Intelligent Cloud

This segment comprised 31% of Microsoft’s revenue in 2019. It consists of Microsoft’s public, private, and hybrid server products and cloud services that power modern businesses:

- Server Products and Cloud Services — Microsoft’s server software provides integrated server infrastructure and middleware designed to support software apps built on Windows. Server products include Microsoft’s SQL Server and Windows Server . Server products revenue is driven through volume licensing programs, licenses sold to original equipment manufacturers, and retail packaged products. Microsoft also provides a comprehensive set of cloud services through Microsoft Azure. This is in line with the secular growth of cloud computing as opposed to managing on-premises hardware and software. Azure makes money through users subscribing to its service.

- Enterprise Services like Microsoft Consulting Services are project-based engagements to help customers plan and implement Microsoft products so they can reap as much value from Microsoft’s products as possible.

3. More Personal Computing

This segment comprised 36% of Microsoft’s revenue in 2019. It consists of products and services mainly catered to improving the user experience:

- Windows – the operating system is still the most used desktop operating system in the world. Windows original equipment manufacturers’ (OEMs) revenue is derived from the purchase of Windows licenses by OEMs, which they pre-install on the devices they sell.

- Devices — including Surface, PC, and other Microsoft intelligent devices. Revenue is derived from this segment from the sale of these devices.

- Gaming — Microsoft’s generates gaming revenue from the sale of Xbox consoles and games.

- Search – Microsoft’s search engine, Bing, generates advertising revenue.

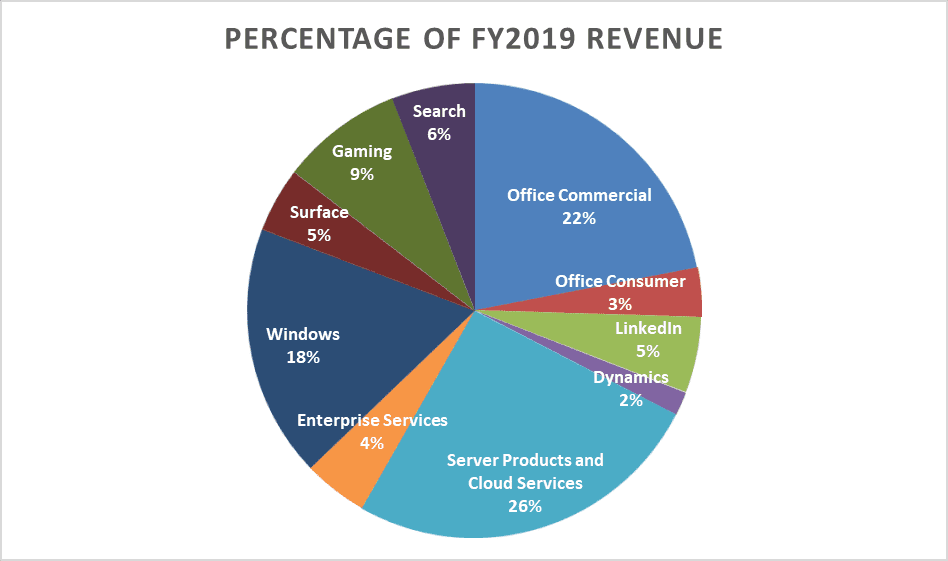

Here’s a breakdown of Microsoft’s segmental revenue for FY2019:

As you see from the chart above, Microsoft’s server products, Office, and Windows comprised more than 69% of Microsoft’s revenue in FY2019. Microsoft’s success lies in its ability to form economic moats around its key business segments/products.

Economic moats

Let’s examine some of the economic moats Microsoft has established.

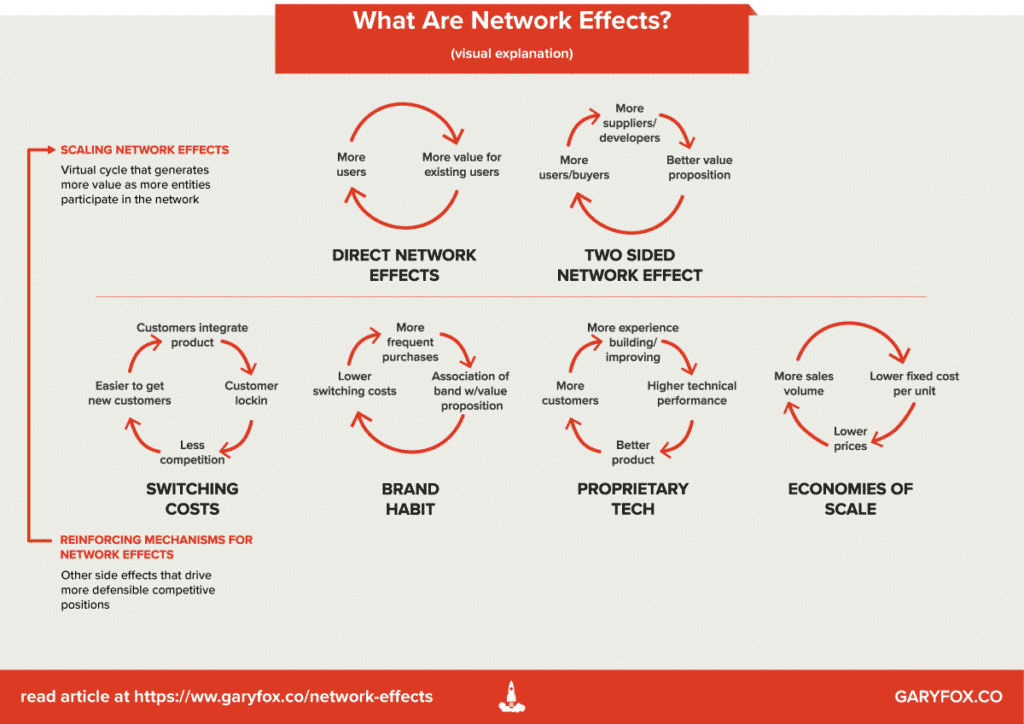

High switching costs

This is due to the industry standard Microsoft has created with its Microsoft Office software. Business functions like accounting procedures are often centered around Microsoft Excel. Thus, it would take a lot of work for users to transfer their financial spreadsheets to another platform and get used to the unfamiliar tools on the new platform (even if there were a superior alternative to Excel in the first place). Thus, it makes economic and psychological sense for companies to continue using Microsoft Office.

Microsoft’s Windows Server also forms the IT backbone of many of the world’s largest companies today. Given that it would be extremely costly for any company to replace any part of an enterprise’s IT environment, we can expect many companies to continue using Windows Server. Microsoft’s high switching costs lock customers into its unique ecosystem of Microsoft software.

Network effect

For starters, Microsoft’s network effect is established with the increased number of participants of Microsoft products, which improves the value of Microsoft’s platforms for users.

For example, with an estimated 750 million people in the world using Excel , it gives software developers the financial incentives and economies of scale when they create a variety of add-ins for Excel – such as integrating popular finance platforms like Bloomberg and Capital IQ into Excel. When the financial community wants to analyse financial figures via Bloomberg or Capital IQ, they would have an easier time doing so with Excel.

Moreover, Microsoft’s ability to move clients from an on-premises Microsoft environment to a cloud Microsoft environment via Azure has led to a wide variety of developers joining the ecosystem with applications and development tools. This has led Microsoft Server to become very attractive for CIOs and IT managers with a large installed base of users, which attracts developers which in turn attracts more users.

Growth drivers

Cloud computing.

The secular growth in cloud computing presents growth opportunities for Microsoft’s cloud business, Azure. With benefits like cost savings on hardware and automatic software integration, many companies are moving to the cloud. According to Gartner , the global cloud computing market size is expected to grow at a CAGR of 15.9% from 2018 to 2022, making it a US$354 billion industry by then. Gartner added that, by 2022, up to 60% of organizations will use an external service provider’s cloud-managed service, double that of 2018.

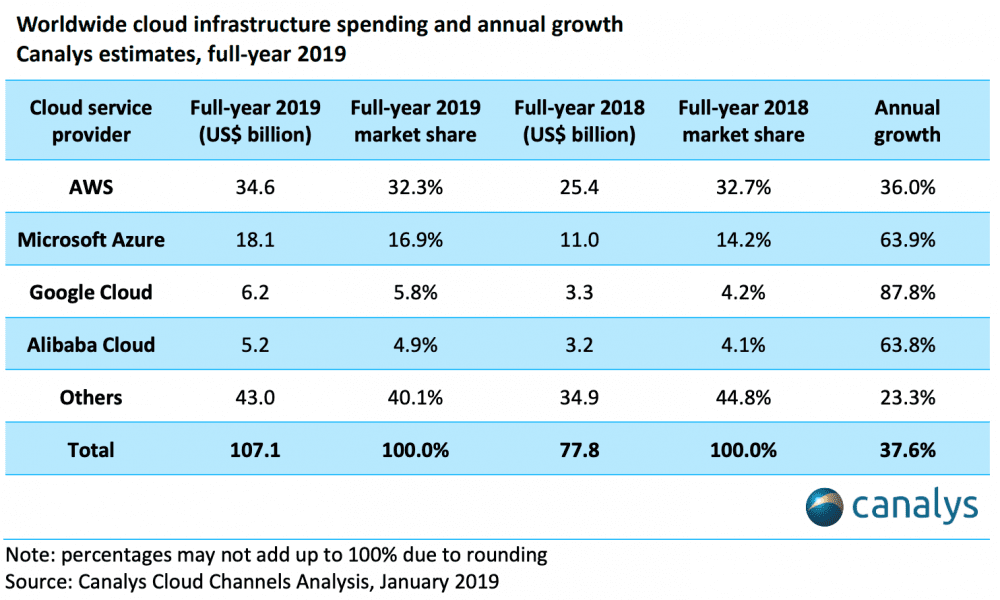

Seizing on the cloud computing trend, Azure’s revenue grew at an astounding year-on-year rate of 91% and 72% for FY2018 and FY2019 respectively. However, as Amazon entered the cloud computing space much earlier than Microsoft did, Amazon Web Services (AWS) still dominates the industry with 32.3% of market share in 2019. Azure is just behind AWS at second place with 16.9% of market share.

However, Microsoft is slowly closing on the gap. Just late last year, Azure pulled off a stunning upset to win a US$10 billion Pentagon technology contract , beating AWS. This underscores Azure’s growing reputation in the industry.

The top three cloud providers today — Google Cloud, Azure, and AWS — will be competing fiercely to capture market share in the cloud computing industry in the years to come. The cloud business is very technical, so here is an article to help you understand the competition in the cloud industry better.

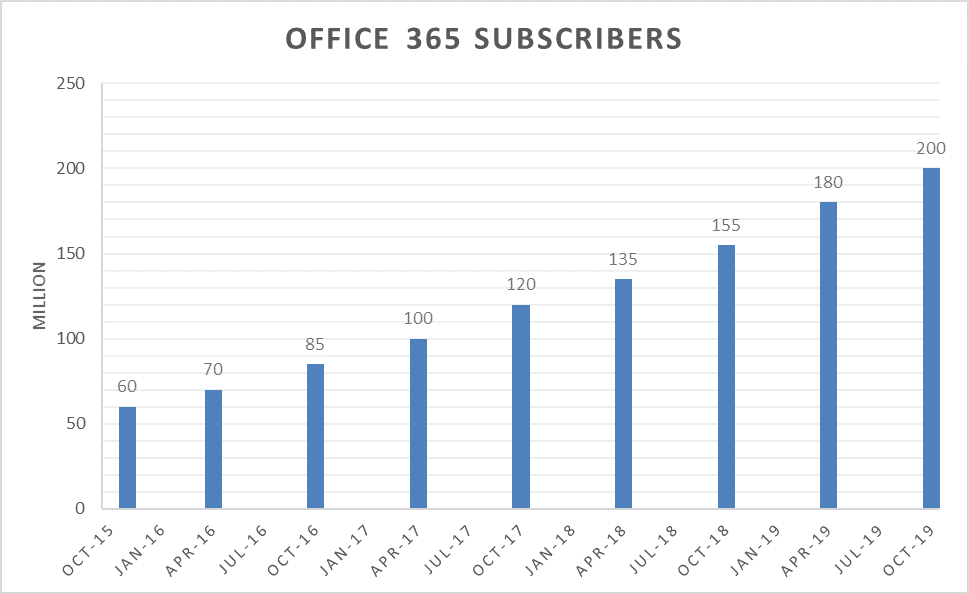

Microsoft is the pioneer in office-related products and Microsoft Office 365 is part of CEO Satya Nadella’s vision for remaking Microsoft into a company where customers rent rather than buy software. Customers benefit as they no longer have to manage software on their own computer or data centers. Rather, Office 365 ensures that users are always on the latest Microsoft versions without having to upgrade anything.

The steadily increasing number of monthly active users on Office 365 indicates that Microsoft have been successful in convincing enterprise customers to upgrade to the subscription-based Office 365 licenses.

Financial performance

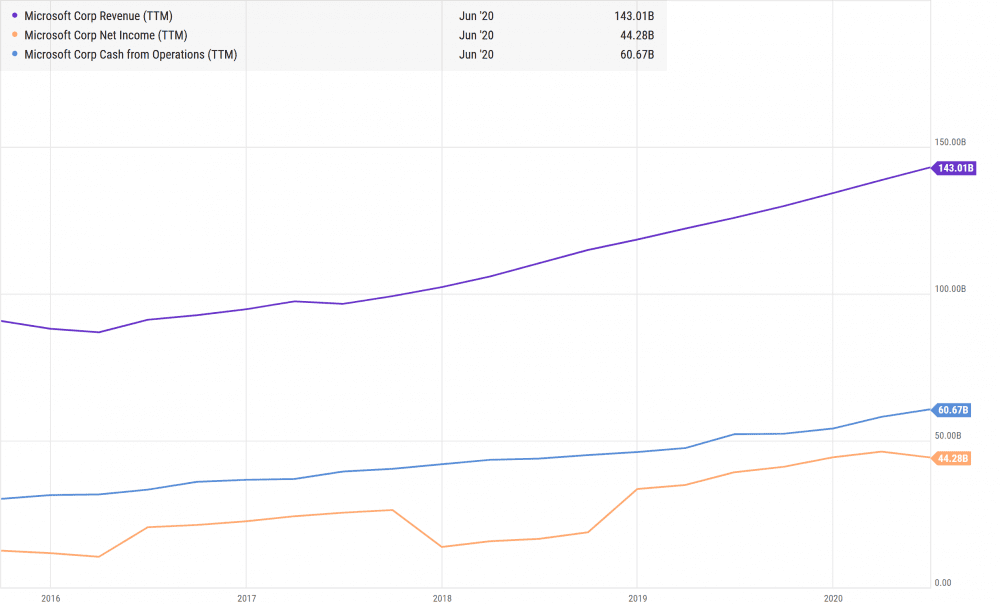

Microsoft is a very profitable company with steady revenue and net income growth over the past five financial years. This displays Microsoft’s ability to expand its user base and increase its average revenue per user.

Microsoft’s net income fell in FY2018 due to the Tax Cuts and Jobs Act which was enacted in December 2017. This required Microsoft to incur a one-time net charge of $13.7 billion on the repatriation of deferred foreign income not previously subject to U.S. income tax.

Microsoft also displays good earnings quality with its operating cash flow comfortable trending above its net income over the past five years. In FY2020, Microsoft generated $1.37 in cash for every dollar of profit.

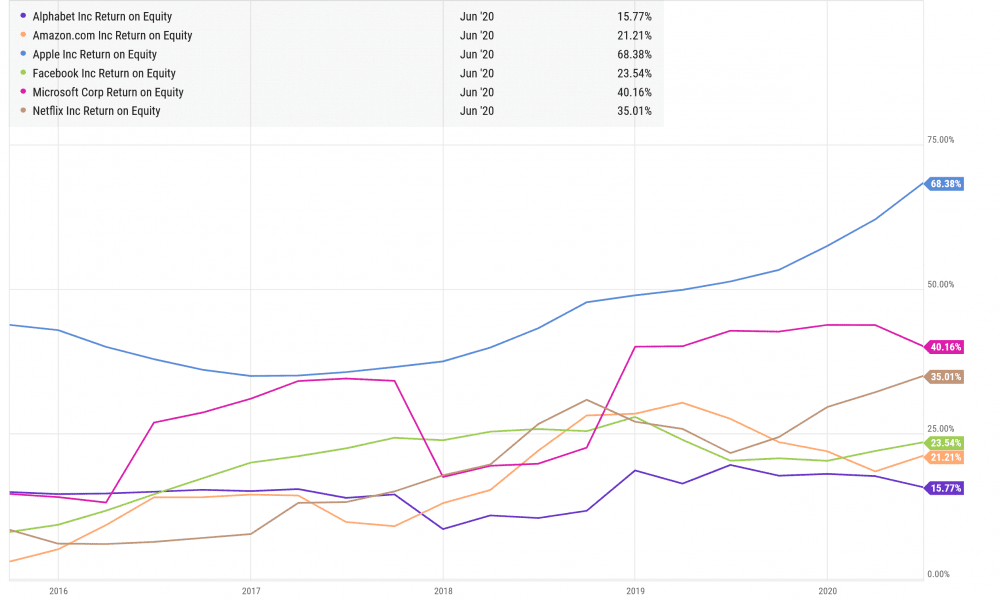

Microsoft has also generates a high return on equity (ROE) relative to its peers.

Microsoft’s ROE of 40.16% as of June 2020 is higher than the FAANG stocks bar Amazon. Microsoft is also able to achieve this with a reasonable amount of debt – its debt/equity ratio in FY2020 is just 0.54.

Business model competition

Microsoft competes with companies with a growing variety of business models. Some of Microsoft’s competitors offer free applications and content by making money from selling third-party advertising. Hence, the products of Microsoft’s competitors are provided to its users at no cost, competing directly with Microsoft’s revenue-generating products.

Competitors also compete by modifying and then distributing open source software at little cost to users without having to bear the full R&D costs for the open source software. These products are very similar to the functionality and features of Microsoft’s products.

Cloud computing risks

Microsoft’s increasing focus on cloud-based services also presents execution and competitive risks. Microsoft incurs costs in building and maintaining infrastructure to support its cloud computing services. It needs to establish sufficient market share to achieve scale necessary to reap profits from its cloud business. This depends on its execution in several areas.

For example, making its suite of cloud-based services platform-agnostic, available on a wide range of devices; and ensuring its cloud services are secure and reliable for its customers. Not to mention Microsoft’s ability to distinguish itself from the fiercely competitive cloud computing market, notably Amazon and Google.

The fifth perspective

Microsoft is clearly a high-quality company. It scores highly on profitability, has wide economic moats and is venturing into new growth areas. Yet, Microsoft is a company that is heavily involved in the software space with technical concepts that can be hard to understand for the layman.

The technology sector is also a hugely competitive one, so an investor needs to conduct deeper-than-usual analysis of Microsoft’s competition, and assess whether Microsoft can remain relevant and profitable in the many years to come.

Are You 'New' To Stock Investing?

Get up to speed with this INVEST Manual that'll show you how to be profitable in the stock market - Written in simple English that's extremely easy to understand, yet packs plenty of valuable profit strategies every investor must know...

Check Your Email To Download

Enter your email to access.

Get up to speed with this Quick-Start Manual that shows you how to profit in the stock market. Written in simple, easy-to-understand English, it’s packed with valuable strategies every investor must know to achieve success.

Your Manual Has Been Sent To Your Inbox!

Enter your email to get instant access.

Select Your Region

To ensure you get the most relevant and useful information from the Invest Manual, please select the region that best matches your current citizenship. This will help tailor the content to your specific needs and provide you with the most applicable strategies.

May I know how do we evaluate intrinsic value of Microsoft? If one decide to enter a position in this counter, what should be the fair value price? Thank You

One way is to compare Microsoft’s current P/E ratio against its long-term historical average. All things equal, a stock that’s trading below its historical valuation average can be consider undervalued.

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Notify me of follow-up comments by email.

Almost done! Please Select Your Region To Receive Customized Content

Your information is safe and secure with us

Almost done! Please complete this form and click the button below to subscribe

Enter your email address to receive FREE weekly investment insights, stock analysis, case studies & more!

How does Microsoft make money: Business Model & Strategy

Founded in 1975, Microsoft develops and supports software, services, devices, and solutions. Microsoft offers an array of services, including cloud-based solutions that provide customers with software, services, platforms, and content. Microsoft also provides solution support and consulting services. Microsoft also delivers relevant online advertising to a global audience.

Microsoft’s products include operating systems, cross-device productivity and collaboration applications, server applications, business solution applications, desktop and server management tools, software development tools, and video games. Microsoft also designs and sells devices, including PCs, tablets, gaming and entertainment consoles, other intelligent devices, and related accessories.

Microsoft is innovating and expanding its entire portfolio to help people and organizations overcome today’s challenges and emerge stronger. Microsoft combines technology and products into experiences and solutions that unlock value for its customers.

In a dynamic environment, digital technology is the key input that powers the world’s economic output. Organizations of all sizes have digitized business-critical functions, redefining what they can expect from their business applications. Customers are looking to unlock value while simplifying security and management.

Microsoft is building a distributed computing fabric – across the cloud and the edge – to help every organization build, run, and manage mission-critical workloads anywhere. Artificial intelligence (“AI”) capabilities are rapidly advancing in the next phase of innovation, fueled by data and knowledge of the world.

Microsoft is enabling metaverse experiences at all layers of Microsoft’s stack, so customers can more effectively model, automate, simulate, and predict changes within their industrial environments, feel a greater sense of presence in the new world of hybrid work, and create custom immersive worlds to enable new opportunities for connection and experimentation.

In this strategy story, we analyzed the business model and strategy of Microsoft while learning how does Microsoft make money.

What is the Business Strategy of Microsoft?

The business strategy and hence the business model of Microsoft is based on three pillars:

Reinvent Productivity and Business Processes : Microsoft provides technology and resources to help its customers create a secure hybrid work environment. Microsoft’s family of products plays a key role in how the world works, learns and connects. Microsoft’s growth depends on securely delivering continuous innovation and advancing Microsoft’s leading productivity and collaboration tools and services, including Office 365, Dynamics 365, and LinkedIn.

Build the Intelligent Cloud and Intelligent Edge Platform : For enterprises, digital technology empowers employees, optimizes operations, engages customers, and in some cases, changes the very core of products and services. As part of its business strategy, Microsoft continues to invest in high-performance and sustainable computing to meet the growing demand for fast access to Microsoft services provided by Microsoft’s network of cloud computing infrastructure and data centers.

Microsoft’s cloud business benefits from three economies of scale: datacenters that deploy computational resources at a significantly lower cost per unit than smaller ones; datacenters that coordinate and aggregate diverse customer, geographic, and application demand patterns, improving the utilization of computing, storage, and network resources; and multi-tenancy locations that lower application maintenance labor costs.

Create More Personal Computing : The business strategy of Microsoft in cloud computing is to make computing more personal by putting people at the core of the experience, enabling them to interact with technology in more intuitive, engaging, and dynamic ways.

How does Google make money? What is Google’s Business Model?

How does Microsoft make money? What is the business model of Microsoft?

Microsoft made $212 billion in 2023 . The business model of Microsoft operates in three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The segments enable the alignment of strategies and objectives across the development, sales, marketing, and services organizations. They provide a framework for the timely and rational allocation of resources within businesses.

Productivity and Business Processes

Microsoft’s Productivity and Business Processes segment consists of products and services in Microsoft’s portfolio of productivity, communication, and information services, spanning a variety of devices and platforms. Productivity and Business Processes contributed $69.2 billion to Microsoft’s revenue in 2023. This segment primarily comprises:

- Office Commercial (Office 365 subscriptions, the Office 365 portion of Microsoft 365 Commercial subscriptions, and Office licensed on-premises), comprising Office, Exchange, SharePoint, Microsoft Teams, Office 365 Security and Compliance, and Microsoft Viva. Office Commercial revenue is mainly affected by a combination of continued installed base growth and average revenue per user expansion, as well as the continued shift from Office licensed on-premises to Office 365.

- Office Consumer, including Microsoft 365 Consumer subscriptions, Office licensed on-premises and other Office services. Office Consumer Services revenue is mainly affected by the demand for communication and storage through Skype, Outlook.com, and OneDrive, largely driven by subscriptions, advertising, and the sale of minutes.

- LinkedIn, including Talent Solutions, Marketing Solutions, Premium Subscriptions, and Sales Solutions. LinkedIn revenue is mainly affected by demand from enterprises and professional organizations for subscriptions to Talent Solutions, Sales Solutions, and Premium Subscriptions offerings, as well as member engagement and the quality of the sponsored content delivered to those members to drive Marketing Solutions.

- Dynamics business solutions, including Dynamics 365, comprising a set of intelligent, cloud-based applications across ERP, CRM, Customer Insights, Power Apps, and Power Automate; and on-premises ERP and CRM applications. Dynamics revenue is driven by the number of users licensed and applications consumed, expansion of average revenue per user, and the continued shift to Dynamics 365, a unified set of cloud-based intelligent business applications, including Power Apps and Power Automate.

Intelligent Cloud

Microsoft’s Intelligent Cloud segment consists of Microsoft’s public, private, and hybrid server products and cloud services that can power modern businesses and developers. Intelligent cloud contributed $87.9 billion to Microsoft’s revenue in 2023. This segment primarily comprises:

- Server products and cloud services, including Azure and other cloud services; SQL Server, Windows Server, Visual Studio, System Center, and related Client Access Licenses (“CALs”); and Nuance and GitHub. Azure revenue is mainly affected by infrastructure-as-a-service and platform-as-a-service consumption-based services and per-user-based services such as Enterprise Mobility + Security.

- Enterprise Services, including Enterprise Support Services, Microsoft Consulting Services, and Nuance professional services.

More Personal Computing

Microsoft’s More Personal Computing segment comprises products and services that put customers at the center of the experience with Microsoft’s technology. More Personal Computing contributed $54.7 billion to Microsoft’s revenue in 2023. This segment primarily comprises:

- Windows, including Windows OEM licensing (“Windows OEM”) and other non-volume licensing of the Windows operating system; Windows Commercial, comprising volume licensing of the Windows operating system, Windows cloud services, and other Windows commercial offerings; patent licensing; and Windows Internet of Things. Windows Commercial revenue, which includes volume licensing of the Windows operating system and Windows cloud services such as Microsoft Defender for Endpoint, is affected mainly by the demand from commercial customers for volume licensing and Software Assurance (“SA”) as advanced security offerings.

- Devices, including Surface and PC accessories.

- Gaming, including Xbox hardware and Xbox content and services, comprises first- and third-party content (including games and in-game content), Xbox Game Pass and other subscriptions, Xbox Cloud Gaming, third-party disc royalties, advertising, and other cloud services. Xbox revenue is mainly affected by subscriptions and first- and third-party content and advertising sales.

- Search and news advertising that delivers relevant search, native, and display advertising to a global audience.

Microsoft also classifieds its revenue into products and services.

- Product revenue includes sales from operating systems, cross-device productivity applications, server applications, business solution applications, desktop and server management tools, software development tools, video games, and hardware such as PCs, tablets, gaming and entertainment consoles, other intelligent devices, and related accessories. Product contributed $64.7 billion to Microsoft’s revenue in 2023.

- Service and other revenue include sales from cloud-based solutions that provide customers with software, services, platforms, and content such as Office 365, Azure, Dynamics 365, and Xbox; solution support; and consulting services. Service and other revenue also include sales from online advertising and LinkedIn. Service and others contributed $147.2 billion to Microsoft’s revenue in 2023.

How Microsoft became cool by making others cool

Microsoft Financials

As per Microsoft’s 2021 Annual Report,

A passionate writer and a business enthusiast having 6 years of industry experience in a variety of industries and functions. I just love telling stories and share my learning. Connect with me on LinkedIn. Let's chat...

Related Posts

How does Instacart work and make money: Business Model

What does Zscaler do | How does Zscaler work | Business Model

What does Chegg do | How does Chegg work | Business Model

What does Bill.com do | How does Bill.com work | Business Model

What does Cricut do | How does Cricut work | Business Model

What does DexCom do? How does DexCom business work?

What does CarMax do? How does CarMax business work?

What does Paycom do? How does Paycom work?

What does FedEx do | How does FedEx work | Business Model

How does Rumble work and make money: Business Model

Dollar General Business Model & Supply Chain Explained

What does C3 AI do | Business Model Explained

What does Aflac do| How does Aflac work| Business Model

How does Booking.com work and make money: Business Model

What does Okta do | How does Okta work | Business Model

What does Alteryx do | How does Alteryx work | Business Model

Write a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

- Advanced Strategies

- Brand Marketing

- Digital Marketing

- Luxury Business

- Startup Strategies

- 1 Minute Strategy Stories

- Business Or Revenue Model

- Forward Thinking Strategies

- Infographics

- Publish & Promote Your Article

- Write Article

- Testimonials

- TSS Programs

- Fight Against Covid

- Privacy Policy

- Terms and condition

- Refund/Cancellation Policy

- Master Sessions

- Live Courses

- Playbook & Guides

Type above and press Enter to search. Press Esc to cancel.

Microsoft’s Business Model

For decades, Microsoft has reigned as an industry titan, continually adapting to the ever-changing technological landscape while solidifying its global market dominance.

As we delve into the intricacies of Microsoft’s business model, a clear picture emerges: the company’s success rests upon a profound comprehension of market trends, an unwavering commitment to innovation, and a remarkable ability to deliver seamless user experiences through an extensive portfolio of products and services.

In this blog post, we embark on a journey to explore the diverse components that constitute Microsoft’s winning formula, conducting an in-depth analysis of the key drivers that propel this dynamic organization toward long-term prosperity.

Microsoft: Tracing the Evolution of Technological Innovation

Empowering progress: microsoft’s vision and mission, decoding the microsoft business model, reinvent productivity and business processes, build the intelligent cloud and intelligent edge platform, microsoft’s cloud: three economies of scale, create more personal computing, unveiling microsoft’s revenue generation methods, microsoft’s business model overview, a swot analysis, risks in microsoft’s business model, competitors.

Microsoft traces its roots back to 1975 when Bill Gates and his friend Paul Allen embarked on a journey to create something revolutionary. In those early days, computers were vastly different from what we know today, and the Internet was a nascent network mainly confined to academic institutions.

Undeterred by the limitations of the time, Gates and Allen set out to develop an operating system for the Altair 8800, considered the first “personal computer.” This endeavor laid the foundation for what would later become Microsoft’s groundbreaking legacy.

Fast forward a few years, and MS-DOS emerged as the go-to operating system for computers, establishing Microsoft’s presence in the technology landscape. However, the true turning point came with the introduction of Windows, a game-changing operating system that revolutionized the industry with its innovative interface.

Windows catapulted Microsoft to new heights, setting the stage for its future endeavors.

In 1986, Microsoft made a momentous decision to go public, offering shares on the stock market. This strategic move allowed the company to amass the financial resources needed to build its empire of PC operating systems. Over time, Microsoft’s product line expanded to encompass much more than operating systems.

Today, it encompasses Microsoft Office, Azure (cloud and AI services), Xbox Games, LinkedIn, GitHub, productivity applications, management tools, browsers, and an array of other cutting-edge technologies.

While Bill Gates still retains some ownership in Microsoft, he has divested much of his stake through sales and philanthropic efforts. In 2020, he stepped down from the board to dedicate more time to his philanthropy projects, furthering his commitment to making a positive impact on the world.

Microsoft’s journey from its humble beginnings to its current position as a technological powerhouse showcases a remarkable evolution marked by groundbreaking innovations and a relentless pursuit of excellence.

At the heart of Microsoft’s purpose lies a powerful mission statement: “to empower every person and every organization on the planet to achieve more.” This succinct declaration embodies Microsoft’s unwavering commitment to leveraging technology as a catalyst for transformation and improvement across the globe.

Microsoft envisions a future where innovative and accessible technology serves as the driving force behind seamless collaboration, enhanced productivity, and impactful problem-solving.

By creating cutting-edge software, hardware, and services, Microsoft aims to equip individuals, communities, and businesses with the tools they need to unlock their full potential.

Through their comprehensive portfolio of offerings, Microsoft seeks to drive human progress and facilitate lasting, positive change on a global scale.

Their mission goes beyond technological advancement; it is rooted in the belief that technology can be a powerful force for good, enabling individuals and organizations to achieve more, innovate, and address complex challenges.

With their relentless pursuit of innovation and their commitment to empowering individuals and organizations, Microsoft continues to shape the future of technology and make a meaningful difference in the lives of people around the world.

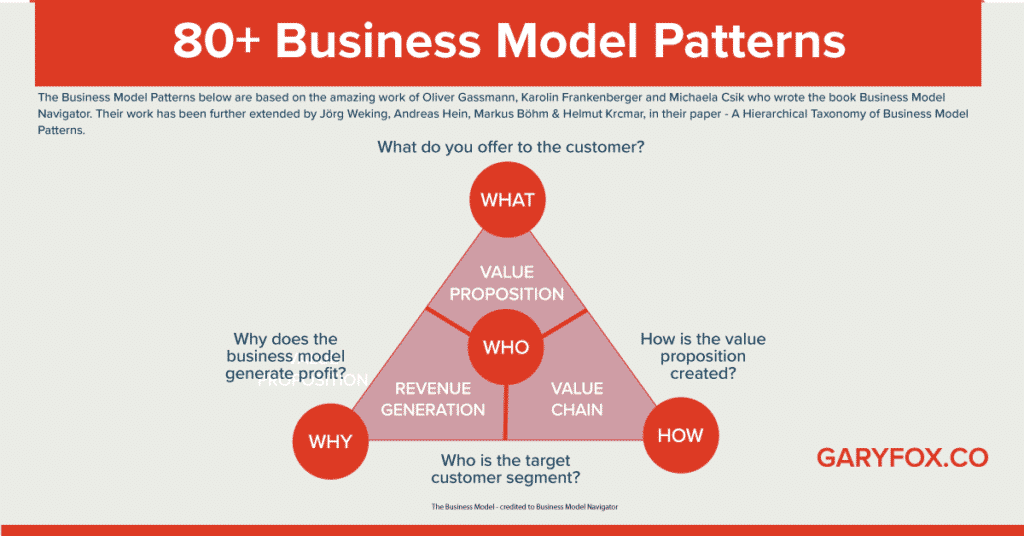

The Microsoft business model encompasses a diverse range of strategies to support its extensive portfolio of systems, software, and services. While the company operates in both the entertainment and business sectors, its core operations revolve around the sale, distribution, and support of these solutions.

Let’s explore the various components that make up Microsoft’s multifaceted business model:

- Razor and Blade: Microsoft develops apps, software, and Xbox games that are specifically designed for its operating systems, ensuring optimal performance and compatibility;

- Lock-in: Microsoft has established high switching costs for customers, making it more likely for them to continue using Microsoft software and apps due to the investment in familiarity and integration;

- Freemium: Certain Microsoft offerings, such as LinkedIn, follow a freemium model. While the platform is free to use, additional resources and features are available exclusively to premium subscribers;

- Subscription: Microsoft has successfully implemented a subscription-based model for various products and services, including Office 365 and cloud services. This model allows customers to access Microsoft’s offerings through recurring payments;

- Hidden Revenue: Platforms like LinkedIn and Bing generate revenue through advertising, displaying targeted ads to users while they engage with these platforms;

- Ingredient Branding: Microsoft’s branding is prominently displayed on products, even if they are just built into computers. This ingredient branding strategy ensures that Microsoft’s presence is readily visible to consumers.

Microsoft’s Business Strategy

The business strategy of Microsoft revolves around three fundamental pillars that underpin its success and shape its business model. Let’s delve into each of these pillars to gain a deeper understanding of Microsoft’s strategic focus:

Microsoft is dedicated to empowering its customers by providing them with the technology and resources needed to create secure and efficient hybrid work environments.

Microsoft’s diverse portfolio of products, including Office 365, Dynamics 365, and LinkedIn, plays a vital role in transforming the way the world works, learns, and connects.

Continuous innovation and advancement in productivity and collaboration tools and services are at the core of Microsoft’s growth strategy.

Microsoft recognizes the immense power of digital technology in empowering employees, optimizing operations, and engaging customers, sometimes even reshaping the very core of products and services in the enterprise landscape.

To cater to the increasing demand for fast and reliable access to its services, Microsoft continues to invest in high-performance and sustainable computing infrastructure.

By leveraging its extensive network of cloud computing infrastructure and data centers, Microsoft delivers the intelligent cloud and intelligent edge platform, providing the foundation for digital transformation.

Cost-efficient data centers that deploy computational resources at a significantly lower cost per unit, data centers that coordinate and aggregate diverse customer demands and usage patterns to optimize resource utilization, and multi-tenancy locations that reduce application maintenance labor costs.

Microsoft’s business strategy in cloud computing extends to making computing more personal and user-centric. By placing people at the core of the computing experience, Microsoft aims to enable users to interact with technology in intuitive, engaging, and dynamic ways.

This includes developing user-friendly interfaces, intuitive interactions, and personalized experiences that empower individuals to harness the full potential of technology and enhance their productivity.

Through these strategic pillars, Microsoft is committed to driving continuous innovation, delivering secure and cutting-edge solutions, and enhancing the productivity and experiences of individuals, organizations, and communities worldwide.

With a focus on productivity, intelligent cloud solutions, and user-centric computing, Microsoft continues to shape the future of technology and drive positive change in the digital era.

Microsoft’s revenue is derived from three fundamental business segments:

- Transforming Productivity and Business Processes

This segment encompasses a wide range of products and services designed to enhance productivity and information management, representing approximately one-third of Microsoft’s revenue. At the forefront is the renowned Microsoft Office software suite, which remains a flagship product.

Additionally, this segment includes LinkedIn, the prominent professional social network, and Dynamics, a suite of cloud-based solutions for business applications like ERP and CRM.

- Empowering with Intelligent Cloud Services

Comprising another significant one-third of Microsoft’s revenue, this segment focuses on the delivery of public, private, and hybrid cloud services. Microsoft SQL Server, Windows Server, and Azure are among the notable offerings. Furthermore, enterprise services such as Microsoft Consulting play a crucial role in assisting customers with planning and implementing Microsoft products effectively.

- Enhancing Personal Computing Experience

The remaining one-third of Microsoft’s revenue is derived from products and services aimed at enriching users’ overall experience. The cornerstone of this segment is undoubtedly Windows, with licenses for devices serving as a primary revenue source. In addition, Microsoft offers a diverse range of solutions, including Xbox games and consoles, advertising through Bing (their search engine), and the sales of devices and PCs.

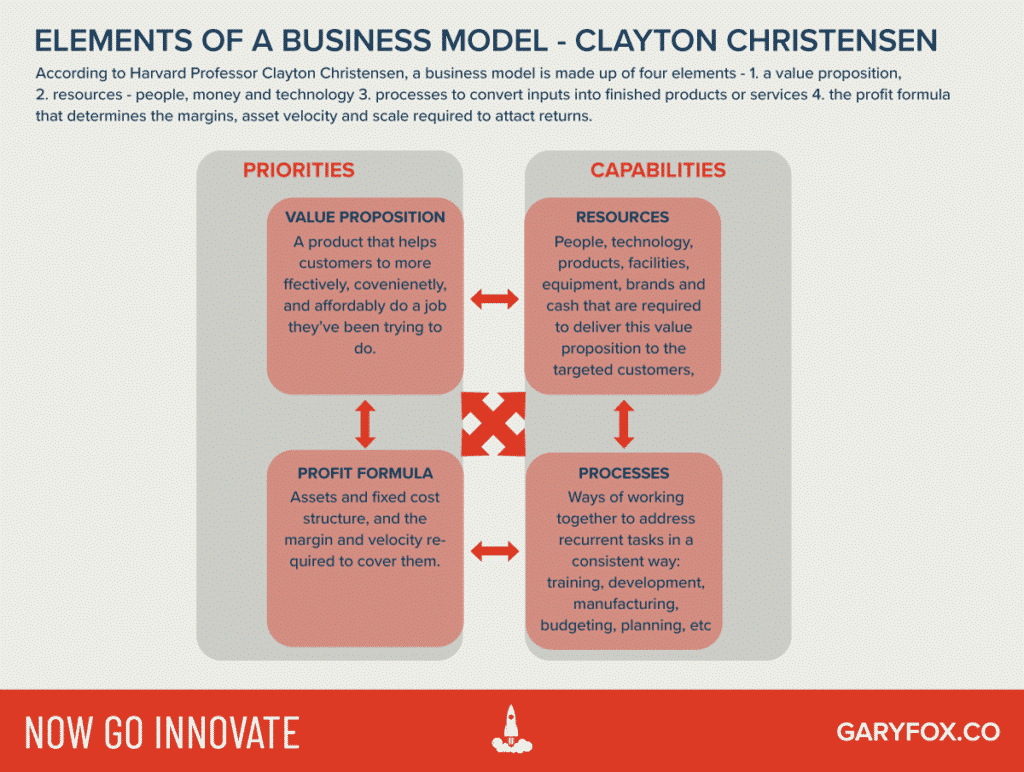

Let’s examine Microsoft’s business model using the Business Model Canvas framework. The different components of Microsoft’s business model are outlined below:

Customer Segments:

- Commercial and corporate clients: Offering server management, IT support, consulting services, as well as cloud computing, Office, and Skype solutions;

- General customers: Providing common solutions like Office, Outlook, Skype, cloud services, and mobile phone and video game platforms;

- Advertising agencies and big brands: Offering advertising opportunities on the MSN portal and Bing search engine;

- Server developers: Providing a suite of development tools.

Value Propositions:

- Reliability as a market leader offering software solutions, including some free offerings;

- Compatibility of apps and software across multiple platforms;

- Trusted source of expertise for consulting services and a large user base for advertisers.

- MSN portal;

- Desktop, iOS, and Google Play apps;

- Sales and marketing team.

Customer Relationships:

- Self-service for software and hardware products, requiring minimal personal interaction;

- Personal assistance for corporate products, consulting, support, and advertising;

- Direct interaction with end customers through social networking profiles (e.g., Facebook and Twitter).

Revenue Streams:

- Productivity and Business Processes;

- Intelligent Cloud;

- Personal Computing.

Key Resources:

- Intellectual property;

- Proprietary technology;

- Data centers;

- Human resources;

- Bill Gates (as a notable figure).

Key Activities:

- Developing, licensing, and supporting software products and services;

- Designing and selling hardware products;

- Delivering online advertising solutions;

- Providing IT consulting and support services.

Key Partners:

- Companies providing various services such as app development, data analytics, distribution, marketing, system integration, telecommunications, and more;

- Resellers and independent software vendors.

Cost Structure:

- Research and development;

- Maintenance and security of data centers and servers;

- Marketing and sales;

- Office and general expenses.

Microsoft, a renowned technology leader, can be effectively evaluated through a SWOT analysis, shedding light on its strengths, weaknesses, opportunities, and threats from a business perspective.

- Wide range of technology products, including Windows OS, Office Suite, Azure, and Xbox gaming platform;

- Strong market presence and established brand recognition;

- Vast R&D budget and diverse income sources;

- Strong reputation for innovation and technological expertise.

Weaknesses:

- Delays in product launches and challenges in addressing all customer segments with premium pricing;

- Over-dependence on Windows OS;

- Previous antitrust issues affecting its reputation and legal challenges.

Opportunities:

- Growth potential in the hybrid-cloud market and leveraging strength in cloud computing services;

- Development of advanced security features to address increasing cybersecurity concerns;

- Strategic collaborations to enhance offerings in gaming, artificial intelligence, and quantum computing.

- Intense competition from tech giants like Google, Apple, and Amazon;

- The need for continuous adaptation to rapidly evolving technological advancements;

- Challenges arising from global economic and regulatory changes.

Microsoft’s business model faces several risks that need to be considered. Two key areas of concern are competition and cloud computing.

| Competition | Cloud Computing |

|---|---|

| Microsoft encounters strong competition from various companies with diverse business models. Some competitors offer free apps and content, generating revenue through advertising. Others distribute open-source software at little or no cost, providing products similar to Microsoft’s offerings. This intense competition poses challenges to Microsoft’s market position and profitability. | Microsoft invests significant resources in building and maintaining its infrastructure to support its cloud computing services. The company aims to attain a substantial market share to achieve economies of scale and profitability. However, this objective comes with high costs and formidable competition from established brands like Amazon and Google. Microsoft must navigate these challenges to succeed in the competitive cloud computing market. |

Microsoft faces competition from several key players in the technology industry. Let’s take a closer look at some of its major competitors:

- Apple: Apple, led by Steve Jobs, has been a long-standing rival of Microsoft. The competition between the two companies extends beyond hardware, encompassing computers, tablets, and smartphones. They also compete in the realm of operating systems, with the perpetual rivalry between Windows and macOS;

- Google: Google, a prominent subsidiary of Alphabet Inc., competes with Microsoft in both hardware and software. Google’s Chromebooks directly compete with computer manufacturers like Dell, Acer, Lenovo, LG, and Sony. Additionally, Google Chrome has surpassed Internet Explorer in the web browser market. The introduction of Microsoft Edge has sparked a new wave of competition between the two companies;

- IBM: IBM, a multinational technology corporation, presents competition to Microsoft due to its involvement in computer hardware and software. While there have been partnerships between IBM and Microsoft in the past, they operate in the same market and are considered competitors;

- Oracle: Oracle Corporation primarily focuses on software development, including cloud-engineered systems and customer relationship management (CRM) software. Although Oracle’s offerings differ from Microsoft’s broader product range, they still represent an indirect competitor in the software development space.

Microsoft’s business model plays a crucial role in the company’s ongoing success and growth. Through diversification, innovation, and a customer-centric approach, Microsoft has established a strong presence in the highly competitive technology market.

Their strategic partnerships and effective monetization strategies exemplify a resilient and adaptable business model that positions them for long-term success.

By cultivating a comprehensive ecosystem of hardware, software, and cloud services, Microsoft has demonstrated its ability to navigate the ever-changing technological landscape.

As the company continues to evolve and expand its offerings, one thing remains evident: Microsoft’s business model serves as a shining example for those aspiring to build thriving and sustainable enterprises in a fiercely competitive market.

Presentations made painless

- Get Premium

Microsoft: Business Model, SWOT Analysis, and Competitors 2023

Inside This Article

Microsoft is one of the biggest tech giants in the world, with a business model that has transformed over the years. From its early days as a software development company, it has expanded to include hardware, cloud computing, and other innovative products. In this blog series, we will conduct a SWOT analysis of Microsoft and its competitors, and explore what the tech giant's business model might look like in 2023.

In this blog post, you will learn:

Who owns microsoft and the history behind the company's ownership..

- The mission statement of Microsoft and how it guides the company's decisions and actions.

- How Microsoft generates revenue and profits through its various business segments and product offerings. Additionally, we will explore the Microsoft Business Model Canvas and how it helps the company maintain a sustainable competitive advantage.

- The top competitors of Microsoft in the technology industry and how they stack up against the company's offerings.

- A detailed SWOT analysis of Microsoft, highlighting the company's strengths, weaknesses, opportunities, and threats. This analysis will provide insights into the factors that influence Microsoft's success and help readers understand the challenges and risks that the company faces in the market.

Who owns Microsoft?

Microsoft is one of the biggest names in the tech industry, and it's natural for people to wonder ## Who owns the company. The answer is not straightforward, as Microsoft has gone through several changes of ownership over the years.

The company was founded by Bill Gates and Paul Allen in 1975, with Gates holding a 64% stake and Allen owning 36%. Over the years, the company grew and went public in 1986, with Gates becoming the youngest self-made billionaire at the time.

In 2000, Gates stepped down as CEO and was replaced by Steve Ballmer. Gates remained as the chairman of the board and the largest individual shareholder, with a 12.5% stake in the company. However, Gates gradually sold his shares over the years, and as of 2021, he owns less than 1% of Microsoft.

Today, the largest shareholders in Microsoft are institutional investors, including Vanguard Group, BlackRock, and State Street Corporation. These investors hold a significant portion of the company's shares, but none of them own a controlling stake.

The current CEO of Microsoft is Satya Nadella, who has held the position since 2014. Nadella owns a relatively small number of shares in the company, but his leadership has been instrumental in driving the company's growth and success in recent years.

In conclusion, while Bill Gates was the original founder and largest shareholder of Microsoft, the company is now owned by a diverse group of institutional investors. Satya Nadella is the current CEO, and his leadership has been vital in the company's continued success.

What is the mission statement of Microsoft?

Microsoft is a company that has been around for over four decades. It has evolved from a small start-up to one of the world's largest technology companies. Despite this evolution, Microsoft's mission statement has remained relatively consistent throughout the years. The company's mission statement is to "empower every person and every organization on the planet to achieve more." This mission statement emphasizes the company's commitment to creating technology that helps people achieve their goals and improve their lives.

At its core, Microsoft's mission statement is about empowering people. The company believes that technology can be a powerful tool for improving people's lives, and it is committed to creating products and services that help people achieve more. This mission statement is reflected in the company's products, such as Windows, Office, and Microsoft Teams. These products are designed to make it easier for people to communicate, collaborate, and get work done.

Microsoft's mission statement is also reflected in its corporate culture. The company is known for its focus on employee development and empowerment. Microsoft encourages its employees to take risks, innovate, and push the boundaries of what is possible. This focus on employee empowerment has helped the company attract and retain some of the best talent in the industry.

In conclusion, Microsoft's mission statement is to empower every person and every organization on the planet to achieve more. This mission statement reflects the company's commitment to creating technology that helps people improve their lives and achieve their goals. It is a powerful statement that guides the company's products, services, and corporate culture.

How does Microsoft make money?

Microsoft is one of the biggest tech companies in the world, and it has a diverse range of revenue streams that it utilizes to generate income. Here are some of the main ways that Microsoft makes money:

Product Sales: Microsoft sells a variety of products such as Windows operating system, Microsoft Office suite, Surface devices, and Xbox gaming consoles. These products are sold through retail stores, online stores, and original equipment manufacturers (OEMs).

Cloud Services: Microsoft's cloud computing services, Azure and Office 365, have been a major source of revenue growth. Azure is a platform for building and deploying applications on Microsoft's cloud infrastructure, while Office 365 is a subscription-based service for Microsoft Office applications such as Word, Excel, and PowerPoint.

Advertising: Microsoft's search engine, Bing, generates advertising revenue through search ads and display ads on its website. Microsoft also has a digital advertising agency, Microsoft Advertising, that provides ad solutions to businesses.

Gaming: Microsoft's gaming division, Xbox, generates revenue through the sale of gaming consoles, games, and subscriptions to Xbox Live, a service that allows gamers to play online with each other.

Enterprise Services: Microsoft offers a range of services to businesses, including consulting, support, and training. These services generate revenue from enterprise customers who need assistance with deploying and managing Microsoft products and services.

In conclusion, Microsoft's revenue streams are diverse and varied, ranging from product sales to cloud services, advertising, gaming, and enterprise services. This allows the company to remain profitable and continue to innovate in the tech industry.

Microsoft Business Model Canvas Explained

The Business Model Canvas is a tool that helps businesses to map out their strategy and create a visual representation of their business model. Microsoft, being one of the biggest tech companies in the world, has a well-defined business model canvas that has contributed to its success. Here's an in-depth explanation of Microsoft's business model canvas:

Value Proposition - Microsoft's value proposition revolves around creating products and services that improve the lives of individuals and businesses through technology. The company offers a wide range of software, devices, and services that cater to different customer needs.

Key Partnerships - Microsoft has partnerships with various companies and organizations to enhance its product offerings. For example, it partners with hardware manufacturers to create devices that run on its software.

Key Activities - Microsoft's key activities include research and development, marketing, sales, and customer support. The company invests heavily in research and development to create innovative products and services.

Key Resources - Microsoft's key resources include its talented workforce, intellectual property, and brand reputation. The company's brand is globally recognized and trusted, which helps it to attract customers and partners.

Customer Segments - Microsoft caters to several customer segments, including individuals, small businesses, and large enterprises. The company tailors its products and services to meet the specific needs of each customer segment.

Channels - Microsoft's products are sold through various channels, including its online store, physical retail stores, and partnerships with other retailers.

Cost Structure - Microsoft's cost structure includes research and development expenses, marketing and advertising expenses, and the cost of goods sold. The company also invests heavily in data centers to support its cloud services.

Revenue Streams - Microsoft generates revenue from the sale of its software, devices, and services. The company also generates revenue from subscriptions to its cloud services, such as Microsoft 365 and Azure.

In conclusion, Microsoft's Business Model Canvas is a well-designed strategy that has enabled the company to remain competitive in the tech industry. By focusing on creating innovative products and services that cater to different customer needs, investing in research and development, and building strong partnerships, Microsoft has continued to grow and expand its business.

Which companies are the competitors of Microsoft?

When it comes to technology, Microsoft is a household name. However, it's not the only giant in the industry. Here are some of the biggest competitors of Microsoft:

Apple Inc. - Apple is Microsoft's biggest competitor, especially in the consumer electronics market. Apple's products, such as the iPhone, iPad, and MacBook, compete with Microsoft's Surface, Windows, and other software products.

Google - Google is a major competitor of Microsoft in the search engine and productivity software markets. Google's search engine and Chrome browser compete with Microsoft's Bing and Edge, while Google's G Suite productivity suite competes with Microsoft Office.

Amazon - Amazon is a competitor of Microsoft in the cloud computing market. Amazon Web Services (AWS) competes with Microsoft's Azure cloud computing platform.

Oracle - Oracle is a competitor of Microsoft in the enterprise software market. Oracle's databases and enterprise software solutions compete with Microsoft's SQL Server and other enterprise software products.

IBM - IBM is also a competitor of Microsoft in the enterprise software market. IBM's enterprise software solutions, such as its Watson platform, compete with Microsoft's enterprise software products.

Overall, Microsoft faces stiff competition from some of the biggest names in the tech industry. However, Microsoft's diverse product offerings and strong brand reputation have helped it remain a dominant player in the market.

Microsoft SWOT Analysis

Microsoft is one of the largest and most successful technology companies in the world. However, like any company, it has its strengths, weaknesses, opportunities, and threats. A SWOT analysis can be a useful tool to evaluate a company's overall position in the market. Here is a breakdown of Microsoft's SWOT analysis:

Strong brand recognition: Microsoft is a well-known brand that has been around for over four decades.

Diverse product portfolio: Microsoft offers a wide range of products such as Windows, Office, Xbox, and Surface, which helps it cater to various customer segments.

Strong financial position: Microsoft has a healthy financial position, with a revenue of over $110 billion in 2018, making it one of the most valuable companies in the world.

Large customer base: Microsoft has a massive customer base that includes individuals, small businesses, and large enterprises.

Weaknesses:

Dependence on Windows and Office: Microsoft's revenue heavily relies on the sales of Windows and Office, making it vulnerable to market changes and competition.

Limited presence in mobile: Despite its efforts, Microsoft's mobile presence is limited, with only a small market share.

High entry barriers: Microsoft's products require significant investment, which can be a barrier for small businesses and individuals.

Opportunities:

Cloud computing: Microsoft's Azure cloud platform is growing rapidly, offering significant opportunities for the company.

Emerging technologies: Microsoft is investing heavily in emerging technologies such as AI, VR, and IoT, providing it with opportunities to innovate and create new products.

Diversification: Microsoft can explore new business areas and diversify its product offerings to reduce dependence on Windows and Office.

Intense competition: Microsoft faces intense competition from companies such as Google, Apple, and Amazon, which can limit its market share and revenue growth.

Cybersecurity threats: Cybersecurity threats are increasing, making it essential for Microsoft to invest heavily in security measures.

Changing market trends: Technology trends are continuously changing, and Microsoft must stay ahead of the curve to remain relevant and competitive.

Overall, Microsoft's SWOT analysis highlights its strengths, weaknesses, opportunities, and threats, providing valuable insights into the company's position in the market. By evaluating these factors, Microsoft can make informed decisions to address its weaknesses, capitalize on opportunities and mitigate threats.

Key Takeaways

Key takeaways:

- Microsoft is a publicly traded company, meaning it is owned by shareholders who can buy and sell its stock.

- The mission statement of Microsoft is to "empower every person and every organization on the planet to achieve more."

- Microsoft primarily makes money through selling software and cloud services, as well as hardware such as the Xbox gaming console and Surface line of computers.

- The Microsoft Business Model Canvas breaks down the company's key activities, resources, and partnerships that enable it to deliver value to customers and generate revenue.

- Some of Microsoft's main competitors include tech giants like Apple, Google, and Amazon, as well as companies focused specifically on software and cloud services like Oracle and Salesforce.

- A SWOT analysis of Microsoft reveals strengths such as its strong brand and market position, weaknesses such as its reliance on a few key products, opportunities such as expanding its cloud services offerings, and threats such as increasing competition and cybersecurity risks.

In conclusion, Microsoft is owned by its shareholders, and its mission statement is to empower every person and organization on the planet to achieve more. Microsoft makes money through various business segments, including productivity and business processes, intelligent cloud, and more personal computing. Through its business model canvas, Microsoft has been able to optimize its resources and create value for its customers. However, it faces stiff competition from companies such as Apple, Amazon, and Google. Despite this, Microsoft's strong brand, innovative products, and extensive resources position it well to continue dominating the technology industry. A SWOT analysis of Microsoft reveals its strengths, weaknesses, opportunities, and threats, which the company continues to leverage to remain relevant and competitive.

What are the strength and weaknesses of Microsoft?

Strengths: • Microsoft is a leader in the software and technology industry. • It has a strong brand name and customer base. • It has a large library of software and hardware solutions. • Microsoft has a strong presence in the cloud computing market. • Microsoft has a large and varied selection of products and services. • Microsoft offers a wide range of support and training options.

Weaknesses: • Microsoft is heavily reliant on its Windows operating system and Office suite of applications. • Microsoft’s products are often expensive and require significant upfront investments. • Microsoft is vulnerable to competition from other software and technology companies. • Microsoft’s products can be difficult to use and require significant training. • Microsoft’s products are vulnerable to security threats and malware.

Does Microsoft have a SWOT analysis template?

Yes, Microsoft does have a SWOT analysis template. It is available as part of Microsoft Word, Excel, and PowerPoint, and can be accessed via the Office.com template library. The template helps users create a comprehensive analysis of their organization's strengths, weaknesses, opportunities, and threats.

What is Microsoft main weakness?

Microsoft's main weakness is its slow adoption of new technologies and services. Microsoft often takes a long time to incorporate newer technologies into its products and services, which can lead to a slower response time to customer needs. Additionally, Microsoft has been known to be slow to react to changing market trends, which can also hinder its growth and development.

What are the 5 elements of SWOT analysis?

- Strengths: Identify the internal strengths that can be used to help reach strategic goals.

- Weaknesses: Identify the internal weaknesses that might hinder progress towards strategic objectives.

- Opportunities: Identify external opportunities that can be taken advantage of to help reach strategic goals.

- Threats: Identify external threats that could impede progress towards strategic objectives.

- Outcomes: Identify the desired outcomes of the SWOT analysis and how these can be achieved.

Want to create a presentation now?

Instantly Create A Deck

Let PitchGrade do this for me

Hassle Free

We will create your text and designs for you. Sit back and relax while we do the work.

Explore More Content

- Privacy Policy

- Terms of Service

© 2023 Pitchgrade

- Search Search Please fill out this field.

The Apple Business Model

The microsoft business model.

- Special Considerations: Google

- Tech Stocks

Apple vs. Microsoft Business Model: What's the Difference?

:max_bytes(150000):strip_icc():format(webp)/picture-53893-1440688982-5bfc2a88c9e77c005143c705.png)

Katrina Ávila Munichiello is an experienced editor, writer, fact-checker, and proofreader with more than fourteen years of experience working with print and online publications.

:max_bytes(150000):strip_icc():format(webp)/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

Apple Business Model vs. Microsoft Business Model: An Overview

More than any other American companies, Apple, Inc. (NASDAQ: AAPL ) and Microsoft Corporation (NASDAQ: MSFT ) dominate the intersection of technology and consumer access. Even though they compete across a huge range of sub-industries, such as computing software, hardware, operating systems, mobile devices, advertising, applications, and web browsing, each firm takes a different approach from an organizational and philosophical perspective.

As of Jan. 2022, AAPL had a market cap of around $2.61 trillion. Microsoft briefly edged out Apple as the largest company in the world riding on the strength in the growth of its cloud computing business, but MSFT has now fallen to second at $2.17 trillion.

Key Takeaways

- As of 2021, Apple and Microsoft are two of the biggest companies in the world, alternating the title of the world's most valuable company.

- Both companies have boasted a market cap of over $2 trillion.

- Apple's business model is based on innovation and consumer-centric devices. They are able to keep their base due to easy-to-use designs and data migration to new product lines.

- Microsoft built its success on the licensing of software such as Windows and Office Suite. Their business model has shifted, and they are releasing their own devices to compete with Apple's.

- Both companies are run differently with different end purposes. They are both extremely successful and have revolutionized their respective industries.

It is difficult to recall a modern American business so thoroughly dominated by the ideas and personality of one individual as Apple was under the tutelage of Steve Jobs . Jobs' remarkable innovations propelled Apple to unprecedented heights until his passing from cancer in 2011.

During Steve Jobs' second reign—he was fired in 1985, returning in 1997—Apple returned to relevancy and revolutionized multiple subindustries. In 2001, the company released the iPod, a pocket-sized device that could hold 1,000 songs, and it soon took over the Sony Walkman. A few years later, Apple completely redefined mobile phones when the iPhone was released in 2007.

Apple easily bests its competitors in terms of hardware sales and high-end gadgets. Thanks to the company's early 2000s reputation as a nonconformist response to Microsoft, millennials grew up using Macs in large numbers. This is buoyed by the company's brilliant insistence on integrating its products, making it easier to keep using new Apple products and thus more difficult to switch to a competitor's interface; this is sometimes referred to as the "Apple Ecosystem Lock."

The weakness in the Apple's business model lies in the historic success of the company's golden invention: the iPhone. Nearly half of all Apple revenue comes from iPhone sales, and no new, comparable innovation has taken off since its former CEO died and was replaced by Tim Cook. However, Cook has done a good job of preserving Jobs' legacy and has propelled Apple stock to all-time highs.

For years, Microsoft dominated the computer industry with its Windows software; Apple was an afterthought for more than a generation of operating products. Before Google Web browsing began to dominate the market, Microsoft gave away Internet Explorer for free, driving Netscape and other similar companies out of business.

The Microsoft revenue model historically relied on just a few key strengths. The first, and most important, is the licensing fees charged for use of the Windows operating system and the Microsoft Office suite. After a few years of increasing irrelevance in the race against Google and Apple, Microsoft unveiled a new vision in April 2014, instantly shifting focus to make Windows software more compatible with competitor products, such as the iPad. Microsoft also has a few successful products, highlighted by the Microsoft Surface and Surface Pro, that battle Apple devices such as the iPad.

Moving forward, however, Microsoft realized that paid software is a more difficult sell in an age of low-cost alternatives. Additionally, tablets and phones are replacing PCs. A newer Microsoft business model has been telegraphed by CEO Satya Nadella, one that emphasizes product integration, a "freemium" software package, and a concentration on its cloud computing business.

For example, Microsoft wants customers to be more engaged and fixated on its products.

Special Consideration: Google's Business Model

Unsurprisingly, the heart and soul of the Google revenue stream is its search engine and web advertisements. While Google is not the only company to give away free services and bundle them with other goods, few do it as well or as successfully.

Google services did not originally cost the user anything. Google would lure in users and collect their data, and then sell access to eager buyers across the planet. Every marketing firm in the world wants the kind of information and repeat usage Google enjoys. Moreover, the company keeps getting better and more sophisticated at targeting consumers and businesses, syncing preferences and playing economic matchmaker. In recent years, some fees have been added for storage and other services.