Top 21 Financial Advisor Interview Questions (with Sample Answers)

Home » Interview Questions » Top 21 Financial Advisor Interview Questions (with Sample Answers)

So you’ve set your sights on a career as a Financial Advisor, a role that is both intellectually stimulating and personally rewarding. With the increasing focus on personal finance and wealth management, Financial Advisors have become the cornerstone for helping individuals achieve their financial goals. But to carve your niche in this competitive field, acing the interview is the first major hurdle you need to cross. This article is a treasure trove of the most relevant interview questions you may face, complete with insights and sample answers to ensure you walk into your interview brimming with confidence.

Before diving into the questions, it’s essential to understand what the role entails. Financial Advisors wear multiple hats; they are planners, strategists, and educators rolled into one. Their work involves not just asset allocation but also tax planning, estate planning, and more. By the end of this guide, you’ll be better prepared to tackle any question thrown your way, so let’s get started!

1. Can you describe your experience with portfolio management?

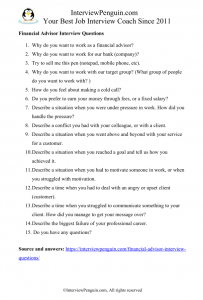

2. how do you approach financial planning for a new client, 3. explain a complex financial concept in simple terms., 4. how do you handle clients who are averse to taking risks, 5. how do you stay updated on financial markets and trends, 6. can you discuss a time you helped a client achieve their financial goal, 7. what financial software are you familiar with, 8. describe your experience with retirement planning., 9. how do you gain the trust of a new client, 10. explain the difference between active and passive investment strategies., 11. how do you handle conflicts of interest, 12. what are your career goals as a financial advisor, 13. how would you react if a client wants to invest in a scheme you don’t recommend, 14. how do you handle stressful situations, 15. how would you advise a client looking for quick returns, 16. how do you evaluate investment opportunities, 17. what’s your approach to asset allocation, 18. can you explain the concept of tax loss harvesting, 19. how do you prioritize tasks, 20. what is your biggest professional achievement, 21. how do you manage client expectations, top 21 financial advisor interview questions and answers.

Your future employer will likely probe into a variety of topics, ranging from technical know-how to soft skills like communication and problem-solving. Here’s a curated list of the top 21 questions to prepare for.

In this question, the interviewer is seeking to understand your hands-on experience with managing investment portfolios, which is a critical part of being a financial advisor.

Sample Answer

“In my previous role at XYZ Financial, I managed portfolios for over 50 clients with diverse financial goals. By implementing a mix of long-term and short-term investment strategies, I successfully generated an average annual return of 8% over three years.”

This question aims to assess your methodology for building financial plans, which often serve as the roadmap for your client’s financial future.

“My approach is holistic and starts with a thorough understanding of the client’s financial situation, goals, and risk tolerance. I then craft a personalized financial plan that includes not just investment strategies but also tax planning, estate planning, and other elements.”

Build your resume in just 5 minutes with AI.

The ability to simplify complex information is crucial for a Financial Advisor, as you’ll need to explain intricate financial concepts to clients who may not have a financial background.

“Compound interest is like a snowball effect for your money. Imagine rolling a small snowball down a snowy hill; it gathers more snow and grows larger as it rolls. Similarly, compound interest helps your money grow faster over time as the interest earns interest on itself.”

Risk tolerance varies among clients. This question aims to gauge your ability to deal with clients who are risk-averse and how you’d tailor your advice accordingly.

“For risk-averse clients, I typically focus on more conservative investment options like bonds or dividend-paying stocks. I also emphasize the importance of a diversified portfolio to mitigate risk and educate them on how a balanced approach can achieve their financial goals with minimal risk.”

Being up-to-date on market trends is essential for any Financial Advisor. The question seeks to know how you keep your knowledge current.

“I follow several financial news outlets and subscribe to relevant publications. I also participate in webinars and workshops, and network with other professionals to gain diverse perspectives on market trends.”

This question serves as an avenue for you to discuss your practical experience and your ability to deliver results.

“One of my clients wanted to buy a home within five years but had no proper savings strategy. I helped them set up a diversified investment portfolio and a monthly saving plan. Within four years, they had saved enough for a down payment.”

In this digital age, proficiency in financial software is a must. This question assesses your technical skills.

“I have hands-on experience with financial planning software like MoneyGuidePro and risk assessment tools like Riskalyze. I’m also proficient in using Excel for financial modeling.”

Retirement planning is often a key concern for clients, and this question tests your expertise in this particular area.

“I have extensive experience in creating customized retirement plans. These plans take into account various income sources, like pensions and investments, and are designed to provide a stable income for clients during their retirement years.”

Trust is a cornerstone of the Financial Advisor-client relationship. This question aims to assess your interpersonal skills.

“I believe in full transparency and open communication. During initial meetings, I take time to understand the client’s needs and provide a clear roadmap. I also provide regular updates and reviews to maintain transparency.”

Understanding

different investment approaches is crucial for a Financial Advisor. This question tests your technical expertise.

“Active investment involves frequent buying and selling with the aim to outperform the market. Passive investment, on the other hand, aims to mimic a market index and generally involves less trading and lower costs.”

This question probes into your ethical standing, a critical trait for any financial advisor.

“Ethical conduct is non-negotiable for me. If a conflict of interest arises, I disclose it to the concerned parties and recuse myself from the situation if needed.”

Your interviewer wants to assess your long-term vision and gauge whether you’ll be a fit for the company in the long run.

“In the short term, I aim to broaden my client base and gain expertise in specialized financial products. In the long run, I aspire to take up leadership roles, possibly heading a team of Financial Advisors.”

This question aims to test your client management skills, particularly when clients do not agree with your professional recommendations.

“I would lay out the pros and cons of the investment and explain why I don’t recommend it. Ultimately, it’s the client’s decision, but I believe in providing all necessary information for them to make an informed choice.”

The role of a Financial Advisor can be stressful at times, especially during market downturns. This question tests your stress management skills.

“I prioritize tasks and keep a level head, focusing on what can be controlled. I also take short breaks to clear my mind, ensuring that stress doesn’t affect my decision-making.”

Quick returns often come with high risks, and this question assesses how you’d counsel a client seeking rapid gains.

“I would caution the client about the risks involved in investments that promise quick returns. While I can suggest higher-risk options, I make sure they are aware of the potential downsides.”

Evaluating investments is a core responsibility, and this question aims to test your analytical abilities and decision-making skills.

“I use a mix of quantitative and qualitative methods, such as financial ratios and management competency, to evaluate investment opportunities. I also assess how the investment aligns with the client’s goals and risk tolerance.”

Asset allocation is a critical aspect of financial planning, and your answer should reflect your understanding and strategy regarding the same.

“I believe in a diversified approach, spreading assets across various classes like equities, bonds, and alternative investments. The allocation is primarily driven by the client’s financial goals, time horizon, and risk tolerance.”

Tax considerations are an important part of financial planning. This question aims to gauge your understanding of tax-saving strategies.

“Tax Loss Harvesting involves selling off underperforming assets to realize losses, which can offset gains in other parts of the portfolio. It’s a strategic way to lower the tax burden.”

Time management and prioritization are vital skills for a Financial Advisor, given the multifaceted nature of the role.

“I prioritize tasks based on urgency and importance. Client meetings and time-sensitive investment decisions take precedence. I also allocate specific times for research and professional development.”

This question provides an opportunity to discuss a career highlight that you are particularly proud of.

“My biggest professional achievement was recovering a client’s portfolio from a 20% loss to a 10% gain within a year through strategic asset reallocation and timely investments.”

Managing client expectations is pivotal in a service-oriented profession like this. Your answer should reflect your skills in communication and relationship management.

“I manage client expectations through transparent and regular communication. I provide realistic projections and keep them informed about the potential risks and rewards of their financial choices.”

You’re now equipped with the top 21 Financial Advisor interview questions and their expert-crafted answers. Remember, apart from technical proficiency, interpersonal skills, ethical conduct, and a thorough understanding of financial markets are the hallmarks of a successful Financial Advisor. Good luck with your interview, and may you forge a rewarding career in this exciting field!

Remember to utilize resources like AI Resume Builder , Resume Design , Resume Samples , Resume Examples , Resume Skills , Resume Help , Resume Synonyms , and Job Responsibilities to create a standout application and prepare for the interview.

Build your resume in 5 minutes

Our resume builder is easy to use and will help you create a resume that is ATS-friendly and will stand out from the crowd.

Published by Sarah Samson

Sarah Samson is a professional career advisor and resume expert. She specializes in helping recent college graduates and mid-career professionals improve their resumes and format them for the modern job market. In addition, she has also been a contributor to several online publications.

Create a job winning resume in minutes with our AI-powered resume builder

Privacy Overview

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Interview Questions

Comprehensive Interview Guide: 60+ Professions Explored in Detail

15 Most Common Financial Advisor Interview Questions and Answers

By Pete Martin

Published: March 20, 2024

Preparing for a financial advisor interview can be both exciting and nerve-wracking. As an aspiring financial advisor, you want to showcase your knowledge, skills, and passion for helping clients meet their financial goals. To help you make a great impression, we’ve compiled a list of the 15 most common Financial Advisor interview questions and answers.

In this article, we will walk you through each question, providing examples of well-crafted responses that will impress your interviewer. From discussing your decision-making process to showcasing your problem-solving skills, these tips will help you articulate your expertise and present yourself as a strong candidate for the job.

Qualities and Skills Hiring Managers Look for in a Financial Advisor

As a financial advisor, it is essential to possess a diverse range of qualities and skills that hiring managers are seeking. Here, we will discuss six key aspects that can make you stand out as a strong candidate for a financial advisor position.

- Strong Communication Skills

Effective communication skills are critical for financial advisors. You must be able to clearly and confidently explain complex financial concepts and strategies to clients, both in writing and verbally. When working with clients, listening skills are equally important, as understanding their needs and goals will help you provide tailored advice.

- Education and Certification

Hiring managers often look for financial advisors with a solid educational background in areas such as finance, economics, and investment. Holding a Certified Financial Planner (CFP) certification can be a significant advantage, as it demonstrates your commitment to the profession and adherence to ethical standards.

- Relevant Experience

Having relevant experience in the financial industry, such as previous roles in banking or investment management, can showcase your knowledge and familiarity with the field. Be sure to highlight any specific achievements during your past experiences, such as business development or portfolio optimization results.

- Exceptional Soft Skills

Financial advisors need a range of soft skills to succeed in their role, such as empathy, adaptability, and time management. These skills help you connect with clients and provide personalized financial advice while managing multiple tasks and priorities effectively.

- Work Ethic and Problem-Solving

A strong work ethic is essential for financial advisors, as they need to consistently update their knowledge, track industry trends, and cultivate relationships with clients. Furthermore, having a keen problem-solving ability and critical-thinking skills can help you creatively address client concerns and develop effective financial strategies.

- Customer Service Skills

Last but not least, outstanding customer service skills are crucial for building and maintaining long-lasting relationships with clients. Demonstrating your ability to respond promptly, provide accurate information, and cater to clients’ needs in a respectful and considerate manner can be a valuable asset while interviewing for a financial advisor role.

General Interview Questions

In this section, we will discuss some general interview questions that are commonly asked during financial advisor interviews. By understanding the reasoning behind these questions, learning the do’s and don’ts associated with each, and using sample answers, you will be better prepared for your interview and able to alleviate any interview anxiety.

1. Can you tell me a little about yourself and your professional background?

This is often asked at the beginning of an interview to break the ice and give the interviewer a brief overview of your professional history.

- Be concise and focus on your relevant professional experience.

- Highlight your achievements.

- Link your background to the financial advisor role.

Don’ts

- Do not delve into personal life unrelated to work.

- Avoid speaking negatively about previous employers.

- Do not ramble or go off on tangents.

Sample answer :

“As a finance graduate, I have accumulated over 6 years of experience in the financial industry, working for a reputable wealth management firm. During my time there, I achieved a consistent track record of helping clients grow their portfolios while minimizing risk. My expertise lies in portfolio management, financial planning, and strategic investment advice. I am passionate about helping clients achieve their financial goals and I believe my experience aligns well with the role of a financial advisor at your company.”

2. What do you know about our company?

This is designed to evaluate if you have done your homework and researched the company before the interview. Demonstrating an understanding of the company’s values, products, and services will show the interviewer that you are genuinely interested in joining the team.

- Mention the company’s services, mission, and history.

- Explain how your skills and experience align with the firm’s goals.

- Refer to recent news, projects, or initiatives the company has undertaken.

- Do not claim to know everything about the company.

- Avoid stating incorrect information.

- Do not focus solely on the company’s financial performance.

“I am fully aware that your company is recognized as one of the leading wealth management firms in the country, with a reputation for delivering tailored, high-quality financial advice to clients. Your mission to empower clients through comprehensive financial planning and superior customer service resonates with me. I’ve read about your recent initiatives in sustainable investment options and believe my strong background in portfolio management and ethical investing makes me an ideal fit.”

3. How do you make important decisions?

This aims to assess your risk management and decision-making skills , as financial advisors need to make decisions that benefit their clients’ financial well-being.

- Describe your process of analyzing and evaluating options.

- Provide specific examples from your professional experience.

- Emphasize your communication and collaboration skills when working with a team.

- Do not suggest you make decisions impulsively.

- Avoid discussing personal decisions unrelated to work.

- Do not come across as inflexible or unable to adapt.

“When making important decisions, I start by gathering all relevant information and assessing the potential risks and rewards associated with each option. Once the data is collected, I use various quantitative and qualitative methods to analyze the options and have discussions with colleagues if necessary. This helps ensure I reach well-informed decisions that align with the client’s best interests, risk tolerance, and financial objectives.”

4. What is your greatest achievement?

This behavioral question seeks insight into your professional accomplishments and how they relate to the role of a financial advisor.

- Choose a significant professional achievement that can be linked to the requirements of the financial advisor role.

- Emphasize the actions you took and the resulting positive outcomes.

- Highlight your problem-solving, analytical, and interpersonal skills.

- Refrain from mentioning achievements that lack relevancy to the role.

- Do not exaggerate or falsify your accomplishments.

“My greatest achievement would be when I helped an elderly client design and implement a long-term financial plan that protected her assets during a market downturn, while still generating substantial growth over time. This required extensive research, collaboration with the client, and flexible adjustments to the plan as market conditions changed. As a result, the client was immensely grateful and satisfied, and I was recognized within my firm for my dedication and excellent client service.”

5. Where do you see yourself in five years?

This question is used to understand your long-term professional goals and assess if they align with the company’s objectives.

- Outline your career aspirations and professional development plans.

- Express your motivation for growth within the company.

- Demonstrate commitment and dedication to your field of work.

- Avoid being too vague or unrealistic in your future plans.

- Do not mention unrelated career goals outside the realm of financial advising.

- Refrain from appearing disinterested in a long-term commitment to the company.

“In the next five years, I envision myself advancing to a senior financial advisor role within your company, helping a wider range of clients reach their financial goals and serving as an expert resource for my colleagues. I also plan to pursue relevant certifications to enhance my skills and broaden my industry knowledge. I am committed to continuous growth and believe joining your firm would offer the ideal environment to reach my full professional potential.”

Role-Specific Interview Questions

As a financial advisor, you need to be able to answer role-specific questions that demonstrate your competency and experience in the financial industry. These questions are designed to help employers gain insight into how you approach various aspects of financial planning, client communication, and managing challenging situations.

6. Can you explain your approach to creating a financial plan for a new client?

This allows the interviewer to understand your ability to create personalized financial plans that cater to clients’ unique needs and objectives.

- Do showcase your financial planning process step-by-step.

- Do explain how you gather and analyze relevant information.

- Don’t forget to mention the ways you adjust financial plans as client’s needs change.

- Don’t give a one-size-fits-all answer.

Sample Answer:

“When creating a financial plan for a new client, I start by conducting a thorough assessment of their current financial situation, including assets, liabilities, income, expenses, and financial goals. I spend time with the client to understand their risk tolerance and time horizon for various objectives. With this information, I develop a comprehensive financial plan that addresses their specific needs, such as retirement, education funding, or estate planning. I ensure that the plan incorporates appropriate asset allocation strategies and investment products that align with the client’s risk tolerance and objectives. Regularly, I review and update this plan with the client to ensure it remains on track to meet their goals.”

7. How do you stay updated on financial markets and trends?

This question gauges your commitment to staying current with industry developments and your ability to adapt your services accordingly.

- Do mention reliable sources like industry publications , newsletters, and webinars.

- Do emphasize your participation in professional organizations or continuing education.

- Don’t underestimate the importance of networking with industry professionals.

- Don’t give a generic answer.

“I believe staying current with financial markets and trends is crucial for providing sound advice to my clients. I regularly read industry publications, such as the Wall Street Journal and Financial Planning Magazine, and subscribe to various online newsletters to stay informed of market developments and new investment opportunities. I also participate in webinars and attend industry conferences to gain insights from expert speakers and colleagues. Additionally, I maintain an active membership in professional organizations, which offers me access to resources and networking opportunities with other financial professionals.”

8. Describe a time when you had to deal with a client who was unhappy with their portfolio performance. How did you manage the situation?

Addressing concerns about portfolio performance is an essential part of being a financial advisor. This question evaluates your problem-solving and customer relations skills.

- Do show empathy and understanding.

- Do illustrate your ability to analyze the situation and provide solutions.

- Don’t blame the client or external factors.

- Don’t give a vague or impersonal response.

“There was a time when one of my clients was disappointed with their portfolio’s returns, which had underperformed relative to the market. I empathized with their frustration and assured them that I would closely review the portfolio to identify the causes. After analyzing the investments, I found that some of the riskier assets had suffered due to market volatility. I discussed this issue with the client and presented several options to rebalance the portfolio to better align with their risk tolerance and financial goals. Ultimately, we decided on a revised investment strategy, which not only addressed the underperformance but also restored the client’s confidence in my services.”

9. How would you handle a risk-averse client who needs higher returns for their financial goals?

Your ability to balance clients’ risk tolerances with their financial objectives is a vital part of the job. This demonstrates your skill in creating tailored investment strategies necessary for a successful financial advisor.

- Do explain the importance of managing risk and return trade-offs.

- Do suggest alternative methods for achieving higher returns.

- Don’t recommend high-risk investments that disregard client’s concerns.

- Don’t downplay the challenges of helping risk-averse clients achieve higher returns.

“When working with a risk-averse client who needs higher returns, I begin by educating them about the relationship between risk and return, emphasizing the need for a balance that caters to their comfort level. I may propose alternative methods to generate higher returns while mitigating risks, such as diversifying their portfolio or considering investments with a higher potential for income, like dividend-paying stocks or real estate investment trusts (REITs). Additionally, I would explore tax-efficient investment strategies and ways to optimize their cash flow, allowing them to contribute more towards their financial goals without jeopardizing their risk tolerance.”

10. How do you approach explaining complex financial concepts to clients who are not financially savvy?

Effective communication skills are crucial for ensuring clients understand and trust your financial advice. This question assesses your ability to break down complex financial concepts for those with limited financial knowledge.

- Do emphasize the use of clear, concise language and relatable examples.

- Do showcase your patience and willingness to answer questions.

- Don’t assume clients will automatically understand concepts because they are simple to you.

- Don’t underestimate the importance of building trust through communication.

“When explaining complex financial concepts to clients who are not financially savvy, I prioritize using clear and concise language to break down the information into digestible segments. I often utilize analogies or real-life examples to help clients visualize and relate to the concepts. I also encourage open communication, inviting clients to ask questions, and actively listen to ensure they genuinely understand the information being presented. By fostering a supportive and educational environment, clients can build trust in my expertise and feel more confident in the financial decisions we make together.”

11. Can you discuss your experience with financial software and tools? Which ones are you most comfortable using?

This question examines your familiarity with the tools necessary for your role as a financial advisor, as well as your ability to stay up-to-date with industry advances.

- Mention specific software and tools.

- Highlight any certifications or training.

- Discuss your experience using these tools in real-life situations.

Don’t

- Be vague or give a generic answer.

- Claim expertise in a tool you aren’t familiar with.

Sample answer:

“I have extensive experience using financial software such as QuickBooks, Excel, and Morningstar Direct. I regularly attend workshops and conferences to stay updated on new tools and features in these applications. I’m most comfortable using Excel for financial modeling and cash flow projections, as well as Morningstar Direct for investment analysis.”

12. If a client was considering a high-risk investment, how would you advise them?

This addresses your ability to manage risk when helping clients with their financial planning.

- Explain your process for analyzing risks and rewards.

- Discuss how you consider the client’s personal financial goals and risk tolerance.

- Share specific, professional advice you would offer in this scenario.

Don’t:

- Give a one-size-fits-all answer.

- Completely discourage high-risk investments.

“If a client was considering a high-risk investment, I would first assess their overall financial situation and risk tolerance. I would closely analyze the investment opportunity, considering both the potential rewards and risks involved. I’d explain the possible outcomes and make sure the client understands the implications of their decision. If the investment aligns with their goals and risk tolerance, I would support their decision while ensuring they have a balanced, diversified portfolio.”

13. Can you share an example where your financial advice had a significant impact on a client’s financial situation?

This allows you to showcase your expertise and demonstrate how you’ve made a tangible difference in a client’s life.

- Provide a detailed, real-life example.

- Explain the situation, your advice, and the positive outcome for the client.

- Highlight your skills and knowledge that contributed to the result.

- Share confidential information about the client.

- Exaggerate or fabricate details.

“I once had a client who was struggling with student loan debt and saving for retirement. I helped them restructure their debt repayment plan, optimizing their payments to reduce interest expenses. I also advised them on an investment strategy that aligned with their risk tolerance, emphasizing the importance of long-term financial planning. As a result, the client significantly reduced their debt and increased their retirement savings, all while staying within their budget.”

14. How do you build trust with your clients, especially when dealing with their personal finances?

Establishing trust is crucial in a financial advisor role, as you are responsible for managing clients’ hard-earned money and helping them achieve their financial goals.

- Explain your approach to building trust and rapport.

- Highlight any certifications or professional affiliations that demonstrate your credibility.

- Show empathy and understanding toward client concerns.

- Don’t only on technical skills.

- Neglect the importance of communication and listening.

“Building trust with clients is essential, and I do this by demonstrating transparency, professionalism, and empathy. I am a Certified Financial Planner and adhere to a strict code of ethics. Communication is key – I make sure to listen to clients’ needs, answer their questions clearly, and keep them informed about their finances. By providing consistent, sound advice and prioritizing their financial goals, I build long-lasting relationships with my clients.”

15. Describe a time when you had to adhere to strict rules and regulations while providing financial advice. How did you ensure compliance?

Compliance is critical in the financial industry, and this question tests your ability to balance client needs with regulatory requirements.

- Share a specific example showing your experience with compliance.

- Explain the importance of adhering to rules and regulations.

- Describe how you stay updated on industry standards.

- Downplay the importance of compliance.

- Give an answer lacking a clear approach to compliance.

“In my previous role as a financial advisor at XYZ Bank, I advised clients on investment opportunities. When a new investment product was introduced, I had to comply with strict regulations regarding the product’s marketing and sales. To ensure compliance, I thoroughly studied the documentation provided, attended training sessions, and consulted with the compliance department when needed. This diligent approach allowed me to effectively adhere to regulations while meeting my clients’ financial needs.”

Takeaways and Next Steps

Moving ahead, make sure you have a detailed understanding of the Form ADV as this document is crucial in the world of finance and will likely come up during your interviews. It contains essential information about your potential employer’s business, making it an invaluable resource for interview preparedness.

Invest time in researching the company, its training programs, and industry practices. This will not only demonstrate your commitment to the role but will also enable you to speak more confidently about their specific approach and how it aligns with your own professional goals. Consider reviewing the company’s website, as well as any recent news or developments that may pertain to their work in the financial sector.

To help you in preparing, here are some important points to focus on:

- Familiarize yourself with the company’s products and services

- Research their approach to client management and financial planning

- Understand their company culture and mission

- Brush up on what unique questions to ask during the interview

- After the interview is done, make sure to send a follow-up email to validate your interest in the position

By investing time in research, practice and understanding the needs of the hiring managers, you will be well-prepared to ace your Financial Advisor interview and take the next step in your career.

Q&A with Brenton Harrison, Financial Advisor and Host of ‘New Money New Problems’ Podcast

About the Author

Read more articles by Pete Martin

Continue Reading

12 Expert-Approved Responses to ‘What Makes You Unique?’ in Job Interviews

15 most common pharmacist interview questions and answers, 15 most common paralegal interview questions and answers, top 30+ funny interview questions and answers, 60 hardest interview questions and answers, 100+ best ice breaker questions to ask candidates, top 20 situational interview questions (& sample answers), 15 most common physical therapist interview questions and answers.

Need to start saving with a new ATS? Learn how to calculate the return on investment of your ATS Calculate ROI now

- HR Toolkit |

- HR Templates |

- Interview questions |

Financial Adviser interview questions and answers

These sample Financial Adviser interview questions will help you assess candidates’ finance and accounting skills. Feel free to adjust these sample interview questions to suit your company’s needs.

An experienced recruiter and HR professional who has transferred her expertise to insightful content to support others in HR.

Jump to section:

- Introduction

Operational and Situational questions

Role-specific questions, behavioral questions, financial adviser interview questions.

Financial Advisers guide their clients’ investments and cash management. They develop financial plans to meet companies’ needs and create profits.

When hiring for this role, focus on candidates who have previous experience in financial management positions. Candidates who are knowledgeable about your industry will stand out. Potential hires should also hold a degree in Finance, Accounting or Economics. Additional qualifications, like Chartered Financial Analyst (CFA), are a plus.

During your interviews, assess candidates’ soft skills . Focus on their critical thinking and ability to analyze and present large amounts of financial data. Attention to detail is equally essential. Use situational and behavioral questions to test how candidates use their knowledge in various job-related scenarios.

- What visual aids would you use to deliver a presentation on a new financial plan to senior managers? Why?

- If you want to prevent a manager from making an investment, how do you ensure they understand the risks?

- We are planning to open a new store in the next two years. When does your role in this project begin and what do you think are your main responsibilities?

- How would you help employees shift from a “this is how it’s always done” approach to embracing new processes you implement?

- What are the first questions you ask about a new client or project?

- What is your client portfolio?

- Walk me through the process of assessing our current financial status.

- How do you check your work for accuracy? (e.g. ensuring correct data entry in large spreadsheets)

- What methods/metrics do you use to evaluate a company’s performance?

- What is a cash flow statement? Is this enough to tell whether a company is profitable?

- What financial management software do you have experience working with?

- In your opinion, what are the biggest untapped markets and most challenging financial regulations in our industry?

- How do you stay up-to-date with changes to tax and investment regulations?

- Tell me about a time your advice to senior managers resulted in higher revenues.

- Describe a time you used analytical skills to explain the risks of a potential investment.

- Have you ever made a bad financial decision? If so, what happened and what did you learn from that experience?

- Do you prefer giving presentations or preparing written reports? Why?

Ready to fine-tune this interview kit?

Related job descriptions.

- Financial Adviser job description

- Financial Controller job description

- Financial Specialist job description

Related Interview Questions

- Analytical interview questions and answers

- Communication interview questions and answers

- Attention to detail interview questions and answers

Related Topics

- 5 qualities of a good employee and candidate and how to evaluate them in an interview

- Diversity in the workplace: why it matters and how to increase inclusion

- The recruitment process: 10 steps necessary for success

Jump to section

Let's grow together.

Explore our full platform with a 15-day free trial. Post jobs, get candidates and onboard employees all in one place.

Share on Mastodon

10 Key Financial Advisor Interview Questions and Answers

Andre Mendes

June 20, 2024

Getting ready for a financial advisor interview? You can anticipate a range of questions targeting your financial knowledge, client handling skills, and ethical understanding. To help you succeed, we’ve compiled the top 10 interview questions you might encounter, along with examples of effective responses.

| A Financial Advisor assists clients in managing their finances. They provide financial planning and investment advice, help with retirement planning, and provide strategies for saving, investing, and building wealth. They also sell insurance, investments, and various financial products. | |

| Excellent communication skills, Financial knowledge, Analytical skills, Sales skills, Customer service skills, Problem-solving skills, Attention to detail, Ethical conduct, Ability to explain complex financial concepts in simple terms | |

| Finance, Insurance, Banking, Investment | |

| Entry to mid-level. Some positions may require several years of experience in financial advising or a related field. | |

| Bachelor’s degree in Finance, Economics, Business, or a related field. Some positions may require a master’s degree in business administration (MBA) or a similar qualification. Certification as a Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA) may also be required. | |

| Financial Advisors typically work in office environments, either in banks, financial advisory firms, or insurance companies. They often have to meet with clients in their homes or businesses. Some travel may be required. | |

| $50,000 to $120,000 annually, depending on experience and location. Financial advisors often earn a substantial portion of their income through commissions on the products they sell. | |

| Financial Advisors often start as junior advisors or analysts. With experience and further education, they can progress to senior advisory roles, management positions, or become independent financial advisors. They may also choose to specialize in a particular area such as retirement planning or wealth management. | |

| Merrill Lynch, Morgan Stanley, Goldman Sachs, Edward Jones, UBS, Charles Schwab, Fidelity Investments |

Financial Advisor Interview Questions

Can you describe a time when you had to explain a complex financial concept to a client who had little to no financial knowledge how did you handle it.

How to Answer : When answering this question, focus on your communication skills and your ability to simplify complex information. Give a specific example of a time you had to explain a complex financial concept and explain the strategies you used to help the client understand. Show your patience, empathy, and commitment to ensuring your client’s understanding and comfort.

Example : In my previous role as a financial advisor, I had a client who was completely new to investing. She had recently inherited a substantial sum and wanted to invest it but had no understanding of how the stock market works. I started by explaining the basics of stocks and bonds, using simple analogies. For instance, I compared investing in a company’s stock to buying a small piece of the company. I also made sure to check in with her frequently to gauge her understanding and comfort level. Over time, we were able to create a diversified portfolio that fit her risk tolerance and financial goals. This experience reinforced the importance of clear communication and patience in my role as a financial advisor.

Describe a situation where you had to deal with a client who was unhappy with their financial portfolio. How did you resolve the situation?

How to Answer : This question is designed to assess your problem-solving skills and client service abilities. The interviewer wants to know that you can handle difficult situations with clients and work towards a satisfactory solution. When answering this question, use the STAR method: Situation, Task, Action, Result. Start by describing the conflict or problem, then discuss your responsibilities in the situation. Explain the actions you took to resolve the problem and end with the result or outcome.

Example : In my previous role, I dealt with a client who was unhappy with the performance of their portfolio. They had expected higher returns and were considering changing advisors. The first thing I did was to calmly listen to their concerns and empathize with their situation. I then explained that investing always involves some degree of risk and that returns can’t be guaranteed. However, I reassured them that I would review their portfolio and adjust their investment strategy if necessary. I spent the next few days conducting an in-depth analysis of their portfolio and identified some areas where we could potentially improve returns. I presented these findings to the client and proposed a new investment strategy which they agreed to. Over the next several months, their portfolio began to perform better and they were satisfied with the changes. This situation taught me the importance of effective communication and being proactive in managing client expectations.

How do you keep yourself updated on new investment opportunities and financial market trends?

How to Answer : The interviewer is interested in understanding your commitment to continuous learning and staying updated in the field. Discuss the resources you use to stay informed, such as financial news outlets, industry reports, webinars, and professional networks. Also, highlight how this knowledge helps you advise clients better.

Example : I am committed to continuous learning in order to provide the best advice to my clients. I start my day by reading financial news from trusted sources like Bloomberg and the Wall Street Journal. I also subscribe to several industry reports and attend webinars to understand emerging trends. Moreover, I am part of a professional network where we discuss new investment opportunities. This constant learning not only keeps me updated but also helps me in advising my clients based on the latest trends and opportunities.

Tell me about a time when you had to adjust your communication style to successfully work with a client. What was the situation and what was the outcome?

How to Answer : This question assesses your ability to adapt to different client personalities and needs, a key skill for a Financial Advisor. Start by outlining the situation, then describe the client’s communication style or needs and how they differed from your own. Explain the steps you took to adjust your style and the positive outcome this led to. Make sure to highlight what you learned from the experience.

Example : In my previous role, I had a client who was a successful entrepreneur but had little knowledge about investing and found financial jargon intimidating. I realized that my usual approach of using technical terms to explain investment strategies was not working. So, I adjusted my communication style to use simpler language and real-world examples to explain different investment options. I also provided her with easy-to-understand written materials. Over time, she gained confidence and became actively involved in managing her portfolio. This experience taught me the importance of flexibility in communication and meeting clients where they are in terms of financial literacy.

Get Ready to Nail Your Next Job Interview!

Feeling nervous about your upcoming interview? We’ve got you covered! Our special interview guide for Financial Advisor is here to help you shine and land that job.

What’s Inside:

- Proven Tips : Easy-to-follow strategies for common interview questions

- Expert Advice : Insider tips to help you craft memorable responses

- Real Examples : Inspiration from successful interviews

- Essential Do’s and Don’ts : Avoid common pitfalls and stand out

All for only $5! Take the stress out of interview prep and boost your confidence.

Get it now! Just $5

How do you handle risk management when advising clients on investment options?

How to Answer : When answering this question, highlight your understanding of risk management and its importance in financial advising. Discuss your process for assessing risk and how you use this in advising clients. You should also mention your ability to explain risk to clients and how you help them make informed decisions based on their risk tolerance.

Example : Risk management is a critical component of financial advising. When considering investment options for a client, I always start by assessing the risk associated with each option. For instance, I look at market trends, the stability of the investment, and any potential factors that could affect its performance. I then balance this with the client’s risk tolerance, financial goals, and investment timeline. It’s also important to me to ensure that the client fully understands the risk involved. I explain it in clear, simple terms and help them consider how it fits with their overall financial strategy.

In your opinion, what are the most important qualities for a Financial Advisor to possess, and how do you exhibit these qualities in your professional life?

How to Answer : To answer this question, you should highlight the key skills and qualities required for a financial advisor such as strong analytical skills, excellent communication, integrity, empathy, and good understanding of financial markets. Then, provide specific examples from your previous experiences or your personal life that demonstrate how you embody these qualities.

Example : I believe the most important qualities that a Financial Advisor should possess are strong analytical skills, excellent communication, and high integrity. In my previous role as a Financial Analyst, I often had to analyze complex financial data and make recommendations based on my findings. This honed my analytical skills. Furthermore, I was required to present my findings to non-financial stakeholders, which helped me improve my ability to communicate complex financial information in a simple, easy-to-understand manner. As for integrity, I believe it is fundamental to this role. I always strive to be honest and transparent with my clients, as I understand the importance of trust in this relationship.

How would you handle a potential client who is hesitant to invest due to volatile market conditions?

How to Answer : The interviewer wants to see your ability to reassure clients in times of uncertainty. Your response should demonstrate your knowledge of the market, your ability to educate the client about the nature of investing, and your skills in building trust and confidence. Discuss how you would explain the importance of diversifying investments, long-term planning, and the potential risks and rewards of investing. Also, mention how you would keep the client informed and involved in decision-making.

Example : When dealing with a client who is hesitant to invest due to volatile market conditions, I would first ensure that I fully understand their concerns and investment goals. I would explain that while markets can be unpredictable in the short term, history has shown that they tend to increase in value over the long term. I would educate them about the concept of diversification and how it can help to mitigate risk. I would also reassure them that we would work closely together to monitor their portfolio and make adjustments as necessary. I believe that by being transparent about the risks and potential rewards of investing, and by keeping them involved in the decision-making process, I can help them to feel more confident and comfortable with investing.

Describe a time when you had to deal with a client’s unrealistic financial goals. How did you manage their expectations?

How to Answer : The answer to this question would require showcasing your communication skills and emotional intelligence. Highlight how you used your expertise to provide a realistic outlook, how you communicated this to your client, and how you managed to keep them engaged and satisfied despite having to alter their initial expectations.

Example : I once had a client who wanted a 20% return on their investments within a year. After analyzing their portfolio and market conditions, I realized that this was unrealistic. I arranged a meeting with the client and explained the situation by showing them historical data and market projections. I also laid out a modified plan that was more realistic but still aimed at maximizing their returns. The client was initially disappointed, but appreciated my honesty and decided to stick with the modified plan. Eventually, they were satisfied with the returns we achieved.

Can you tell me about a time when you had to go above and beyond to get a customer to trust you? What was the situation and how did you handle it?

How to Answer : The interviewer is trying to gauge both your interpersonal skills and your commitment to providing exceptional service. When answering this question, it’s important to tell a story that demonstrates your ability to cultivate relationships, earn trust, and exceed client expectations. It’s also beneficial to highlight your knowledge on financial matters, showing how you used it to help the client understand and trust your advice.

Example : In my previous role, I had a new client who was skeptical about investing in stocks due to past negative experiences. I understood his concerns and took extra time to educate him about the nature of investing, risk management, and the potential rewards. I also shared success stories of clients in similar situations, provided him with reading materials, and invited him to a seminar on investment basics. Over the next few weeks, I followed up with him regularly to address his questions. Gradually, he gained confidence and decided to proceed with a moderate risk portfolio. This experience taught me the importance of patience, effective communication, and the value of trust in building strong client relationships.

Can you describe a time when you disagreed with a client’s financial decisions? How did you handle the situation?

How to Answer : The interviewer wants to know how you handle difficult situations, where you might have to oppose a client’s decision for their best interest. In your response, you should focus on your communication skills and your ability to maintain professional relationships even when disagreements arise. Explain the situation, your approach, and the final outcome.

Example : In my previous role, I worked with a client who wanted to invest heavily in a single sector. I disagreed with this strategy because it lacked diversification, increasing the risk. I explained my concerns to the client, using data and projections to support my argument. Although the client was initially resistant, they eventually understood my perspective and agreed to diversify their investments. This situation reinforced the importance of clear communication and the ability to articulate financial strategies effectively.

Related Posts

10 essential teller interview questions and answers, top 10 treasurer interview questions and answers, top 10 tax preparer interview questions and answers, top 10 senior accountant interview questions and answers, top 10 staff accountant interview questions and answers, 10 essential payroll clerk interview questions and answers, 10 essential payroll manager interview questions and sample responses, 10 essential payroll specialist interview questions and answers, top 10 internal auditor interview questions and answers, top 10 junior accountant interview questions and answers, leave a comment cancel reply.

Save my name, email, and website in this browser for the next time I comment.

© 2023 Mock Interview Pro

- https://www.facebook.com/mockinterviewpro

15 Financial Advisor Interview Questions (With Example Answers)

It's important to prepare for an interview in order to improve your chances of getting the job. Researching questions beforehand can help you give better answers during the interview. Most interviews will include questions about your personality, qualifications, experience and how well you would fit the job. In this article, we review examples of various financial advisor interview questions and sample answers to some of the most common questions.

or download as PDF

Common Financial Advisor Interview Questions

How do you keep abreast of changes in the financial world, what is your experience with investment planning and portfolio management, what is your investment philosophy, what experience do you have with retirement planning, what would you say are the biggest financial concerns of people your clients' ages, do you have experience with estate planning, what do you think is the best way to save for retirement, what do you think is the biggest mistake people make when it comes to their finances, what do you think is the biggest financial mistake a person can make, what are some tips you can give someone who is trying to get their finances in order, how do you think someone can best prepare for retirement, what are some common financial goals that people have, what are some common mistakes people make when trying to achieve their financial goals, what are some common financial concerns that people have, what are some tips you can give someone who is trying to improve their financial situation.

An interviewer would ask "How do you keep abreast of changes in the financial world?" to a/an Financial Advisor because it is important for Financial Advisors to be up-to-date on changes in the financial world in order to give the best advice to their clients.

Example: “ I keep abreast of changes in the financial world by reading industry publications, attending industry conferences, and networking with other financial advisors. I also stay up to date on changes in tax and estate planning laws and regulations. ”

There are a few reasons why an interviewer might ask about an individual's experience with investment planning and portfolio management. For one, it can give the interviewer a sense of the individual's financial literacy and their ability to understand and navigate complex financial concepts. Additionally, it can provide insight into the individual's investment strategy and risk tolerance. Finally, it can give the interviewer a sense of the individual's ability to provide sound financial advice to clients.

Investment planning and portfolio management are important skills for financial advisors because they help to ensure that clients' assets are allocated in a way that meets their financial goals and objectives. Additionally, these skills help advisors to manage risk and protect against losses.

Example: “ I have experience working with investment planning and portfolio management. I have worked with clients to create and implement investment plans that are tailored to their individual goals and risk tolerance. I have also managed portfolios for clients, making sure to stay within their desired risk level and ensuring that their investments are performing well. ”

The interviewer wants to know what investment philosophy the financial advisor follows because it will give them insight into how the advisor makes decisions about where to invest their clients' money. It is important for the interviewer to know this because they need to be sure that the financial advisor's philosophy is compatible with their own investment goals and objectives.

Example: “ My investment philosophy is based on three key principles: diversification, risk management, and disciplined investing. Diversification is important because it helps to mitigate risk by spreading your investments across a variety of asset classes and sectors. By diversifying your portfolio, you are less likely to experience large losses if one particular asset class or sector performs poorly. Risk management is another critical element of my investment philosophy. I believe that it is important to carefully assess the risks associated with any investment before making a commitment. I also believe that it is important to have a clear exit strategy in place in case an investment does not perform as expected. Disciplined investing is the third key principle of my investment philosophy. I believe that successful investing requires sticking to a well-defined plan and staying disciplined throughout the process. This means buying assets when they are undervalued and selling them when they are overvalued. It also means avoiding emotional decisions and sticking to your long-term goals. ”

An interviewer would ask a financial advisor about their experience with retirement planning in order to gauge their ability to provide advice and assistance to clients who are nearing retirement age. It is important for financial advisors to have a strong understanding of retirement planning in order to help their clients make the best decisions for their future.

Example: “ I have been working as a financial advisor for the past 10 years and have helped many clients with their retirement planning. I have a deep understanding of the various retirement options available and can help my clients choose the best option for their needs. I also have experience in investment planning and can help my clients grow their retirement savings. ”

The interviewer is trying to understand what the financial concerns of the advisor's clients are in order to better assess how the advisor can help them. This is important because it allows the interviewer to gauge whether or not the advisor is able to understand and address the needs of their clients.

Example: “ The biggest financial concerns of people in their 20s are job security and student loan debt. People in their 30s are worried about saving for retirement and paying off mortgages or other debts. Those in their 40s are focused on sending their children to college and preparing for retirement. And people in their 50s and 60s are primarily concerned with retirement planning and estate planning. ”

An interviewer would ask "Do you have experience with estate planning?" to a/an Financial Advisor because it is an important part of financial planning. Estate planning is the process of designing a plan to manage your assets and property after your death. It is important to have a financial advisor who is experienced in estate planning so that they can help you create a plan that will protect your assets and property and ensure that your loved ones are taken care of after your death.

Example: “ I have experience with estate planning and can provide comprehensive services to my clients. I have worked with clients to develop and implement estate plans that are designed to protect their assets and minimize taxes. I have also assisted clients in probate and estate administration. ”

The interviewer is asking the financial advisor for their professional opinion on the best way to save for retirement. It is important to know the financial advisor's opinion on this topic because it will help the interviewer determine if the financial advisor is knowledgeable and can provide helpful advice on saving for retirement.

Example: “ There is no one-size-fits-all answer to this question, as the best way to save for retirement will vary depending on your individual circumstances. However, some general tips that may be helpful include: -Start saving as early as possible: The earlier you start saving for retirement, the more time your money has to grow. -Contribute to a retirement savings account: Contributing to a retirement savings account such as a 401(k) or IRA can help you save money for retirement and may offer tax benefits. -Save regularly: Try to make saving for retirement a regular habit by setting up automatic transfers from your checking account to your retirement account. -Invest wisely: Consider investing in a mix of stocks, bonds, and other investments to help maximize your returns while minimizing your risk. ”

There are a few possible reasons why an interviewer would ask this question to a financial advisor. One reason could be to gauge the financial advisor's level of experience and expertise. By understanding the biggest mistake that people make when it comes to their finances, the financial advisor can better help their clients avoid making that mistake. Additionally, this question could be used to start a conversation about financial literacy and education. It is important for people to be financially literate so that they can make sound decisions about their money. Financial advisors play a key role in helping people become more financially literate.

Example: “ There are a few different mistakes that people make when it comes to their finances, but one of the biggest is not having a budget. A budget can help you keep track of your spending and make sure that you are not overspending. Without a budget, it is easy to spend more money than you have and get into debt. Another mistake people make is not saving for retirement. It is important to start saving for retirement as early as possible so that you can have enough money to live on when you retire. ”

The interviewer is trying to gauge the financial advisor's level of expertise and understanding of financial planning. It is important to know the biggest financial mistake a person can make in order to avoid it.

Example: “ There are a few different types of financial mistakes a person can make, but some of the most common and costly include: 1. Not saving enough for retirement: This is one of the biggest financial mistakes a person can make. Without adequate savings, you may be forced to rely on Social Security benefits or other sources of income that may not be sufficient to cover your costs in retirement. 2. Not investing early enough: Another big mistake is not investing early enough in life. The earlier you start investing, the more time your money has to grow. If you wait too long to start investing, you may miss out on years of potential growth and end up with less money than you could have had. 3. Not diversifying your investments: Diversification is key when it comes to investing. By spreading your money across different asset classes, you can minimize your risk and maximize your potential for returns. However, many people fail to diversify their investments, which can lead to losses if one asset class performs poorly. 4. Taking on too much debt: Debt can be a useful tool when used wisely, but it can also be a major financial burden if not managed properly. Taking on too much debt can lead to financial problems down the ”

The interviewer is trying to gauge the financial advisor's knowledge and ability to provide helpful advice. It is important to know if the financial advisor is able to provide tips and advice that can help people get their finances in order because this is one of the main services that financial advisors provide. If the financial advisor is not able to provide helpful tips and advice, then the interviewer may question whether or not the financial advisor is qualified to do their job.

Example: “ There are a few key things that anyone can do to get their finances in order. First, it is important to create a budget and track all spending. This will help you to identify areas where you may be spending too much money and help you to make adjustments accordingly. Second, it is important to save money regularly. This can be done by setting aside a fixed amount of money each month into savings or investing in a longer-term goal such as retirement. Finally, it is important to stay disciplined with your finances. This means making smart choices with your money and not letting impulse purchases or other financial temptations get in the way of your financial goals. ”

There are a few reasons why an interviewer would ask this question to a financial advisor. First, it allows the interviewer to gauge the financial advisor's level of expertise on the topic of retirement planning. Second, it allows the interviewer to see if the financial advisor is able to provide concrete advice on how to prepare for retirement. Finally, this question allows the interviewer to get a sense of the financial advisor's personal views on retirement planning.

It is important for interviewers to ask this question because retirement planning is a complex topic that requires a great deal of knowledge and experience to properly advise on. By asking this question, the interviewer can get a better sense of whether or not the financial advisor is qualified to provide advice on this topic.

Example: “ There are a few things that someone can do to best prepare for retirement. First, they should start saving early on in their career. The sooner they start saving, the more time their money will have to grow. They should also try to save as much as possible each month. Even if they can only save a small amount, it will add up over time. Another thing they can do is invest their money wisely. They should diversify their investments and not put all of their eggs in one basket. This will help to minimize risk and maximize returns. Finally, they should develop a retirement plan that outlines how much money they will need to have saved in order to live comfortably in retirement. This plan should be reviewed and updated regularly to ensure that it is still on track. ”

There are a few reasons why an interviewer would ask this question to a financial advisor. First, it allows the interviewer to gauge the financial advisor's understanding of common financial goals. It is important for a financial advisor to be aware of common financial goals so that they can better advise their clients. Second, it allows the interviewer to gauge the financial advisor's ability to communicate with clients about their financial goals. It is important for a financial advisor to be able to communicate effectively so that they can help their clients reach their financial goals.

Example: “ Some common financial goals that people have are to save for retirement, pay off debt, and build up an emergency fund. Other goals might include saving for a specific purchase, such as a house or a car, or investing for long-term growth. ”

There are a few reasons why an interviewer might ask this question to a financial advisor. First, it allows the interviewer to gauge the advisor's knowledge of financial planning and goal setting. Second, it allows the interviewer to see how the advisor would handle a situation where a client has made a mistake in their financial planning. Finally, it gives the interviewer insight into the advisor's problem-solving skills.

Asking this question also allows the interviewer to see if the financial advisor is able to identify common mistakes that people make when trying to achieve their financial goals. This is important because it shows that the advisor is able to help their clients avoid making these mistakes. It also shows that the advisor is knowledgeable about financial planning and goal setting.

Example: “ Some common mistakes people make when trying to achieve their financial goals include: -Not having a clear plan or goal: Without a clear plan or goal, it can be difficult to stay motivated and on track. People may start off with good intentions, but without a specific goal in mind, it is easy to get sidetracked or give up altogether. -Not budgeting: A budget is a crucial tool for achieving financial goals. Without a budget, it is difficult to track expenses and know where your money is going. This can lead to overspending and putting yourself in debt. -Investing without doing research: Many people make the mistake of investing without doing any research first. This can be a risky proposition and can often lead to losses. It is important to understand what you are investing in and why before putting any money down. -Not diversifying: Diversifying your investments is important in order to minimize risk. Putting all of your eggs in one basket can be very dangerous if that investment goes sour. By diversifying, you spread out the risk and increase the chances of seeing positive returns. -Trying to time the market: Many people try to time the stock market, buying when they think prices ”

Some common financial concerns that people have are:

1. How to save money

2. How to invest money

3. How to manage debt

4. How to plan for retirement

It is important for financial advisors to know these concerns so that they can address them and provide solutions for their clients. By understanding the financial concerns of their clients, financial advisors can develop a plan that will help them reach their financial goals.

Example: “ Some common financial concerns that people have include: 1. How to save money: Many people are concerned about how to save money effectively. This may include finding ways to reduce expenses, setting up a budget, and investing in long-term savings vehicles such as retirement accounts. 2. How to make money: For many people, making more money is a top financial priority. This may involve earning more income through promotions or raises at work, starting a side hustle, or investing in income-producing assets such as real estate or stocks. 3. How to pay off debt: Debt can be a major financial burden for many people. Some may be concerned about how to make their monthly payments, while others may be trying to figure out the best way to pay off their debt (such as through debt consolidation or a debt repayment plan). 4. How to plan for retirement: Retirement planning can be complex, and there are many factors to consider such as saving enough money, choosing the right retirement account, and figuring out how much income you will need in retirement. 5. How to protect your finances: Many people are worried about financial risks such as identity theft, investment losses, and unexpected medical bills. Taking steps to protect your ”

There are a few reasons why an interviewer would ask this question to a financial advisor. Firstly, it allows the interviewer to gauge the financial advisor's level of financial literacy and knowledge. Secondly, it allows the interviewer to understand the financial advisor's approach to financial planning and advice. Finally, it allows the interviewer to get a sense of the financial advisor's philosophy and values around money.

It is important for the interviewer to ask this question because it will give them a better understanding of the financial advisor's ability to help people improve their financial situation. It will also allow the interviewer to get a sense of the financial advisor's personality and how they may be able to work with clients.

Example: “ There are a few key things that anyone can do to improve their financial situation. First, it is important to create and stick to a budget. This will help you to track your spending and ensure that you are not overspending. Second, it is important to save money each month. Even if it is just a small amount, putting money into savings will help you in the long run. Finally, it is important to make smart financial decisions. This means being mindful of your spending, investing in yourself, and planning for the future. ”

Related Interview Questions

- Financial Advisor Trainee

- Personal Financial Advisor

- Financial Aid Advisor

- Financial Systems Analyst

- Financial Project Manager

- Financial Aid Counselor

Advancing Knowledge in Financial Planning

- Close Search

- Live Webinars

- Financial Planning Value Summit

- Digital Marketing Summit

- Business Solutions

- Advicer Manifesto

- AdvisorTech

- FinTech Map

- AdvisorTech Directory

- Master Conference List

- Best Of Posts

- CFP Scholarships

- FAS Resources

- How To Contribute

- Financial Advisor Success

- Kitces & Carl

- Apply/Recommend Guest

- Client Trust & Communication

- Conferences

- Debt & Liabilities

- Estate Planning

- General Planning

- Human Capital

- Industry News

- Investments

- Personal/Career Development

- Planning Profession

- Practice Management

- Regulation & Compliance

- Retirement Planning

- Technology & Advisor FinTech

- Weekend Reading

- CE Eligible

- Nerd’s Eye View

Please contact your Firm's Group Admin

IAR CE is only available if your organization contracts with Kitces.com for the credit. Please contact your firm's group administrator to enable this feature. If you do not know who your group administrator is you may contact [email protected]

Kitces Webinar

An in-depth look at optimal rebalancing strategies, presented by michael kitces, chief financial planning nerd, kitces.com.

Tuesday, July 2, 3-4:30 PM ET

Want CE Credit for reading articles like this?

Essential requirements in crafting a one-page financial advisor business plan.

August 17, 2015 07:01 am 21 Comments CATEGORY: Practice Management

Executive Summary

In a world where most advisory firms are relatively small businesses, having a formal business plan is a remarkably rare occurrence. For most advisors, they can “keep track” of the business in their head, making the process of creating a formal business plan on paper to seem unnecessary.

Yet the reality is that crafting a business plan is about more than just setting some business goals to pursue. Like financial planning, the process of thinking through the plan is still valuable, regardless of whether the final document at the end gets put to use. In fact, for many advisory firms, a simple “one-page” financial advisor business plan may be the best output of the business planning process – a single-page document with concrete goals to which the advisor can hold himself/herself accountable.

So what should the (one-page) financial advisor business plan actually cover? As the included sample template shows, there are six key areas to define for the business: who will it serve, what will you do for them, how will you reach them, how will you know if it’s working, where will you focus your time, and what must you do to strengthen (or build) the foundation to make it possible? Ideally, this should be accompanied by a second page to the business plan, which includes a budget or financial projection of the key revenue and expense areas of the business, to affirm that it is a financially viable plan (and what the financial goals really are!).